Top of the Pops

The fallout from Alexei Navalny’s arrest and video release chronicling corruption about Putin’s palace, a direct attack on the president also calling him out for ordering Navalny’s poisoning, continues. VTimes is referring to it as the worst crisis Putin’s faced. That’s a bit farfetched, but in political terms, a fair assessment given the combination of economic, political, and foreign policy factors at play all at once. Even German chancellor Angela Merkel is openly calling for Navalny’s release. It’s not just a domestic matter, it’s yet another nail in the coffin of improved EU-Russia ties and a blow against Moscow’s totemic multipolarity as an underlying justification for treating domestic politics as somehow insulated and distinct from foreign relations.

Much more importantly, however, Navalny has blown the lid off of the extensive and expanding efforts to deny the public access to information about those in the security services and positions of ‘hard’ power while ensuring that risks of exposure remain for technocrats and others who are politically expendable. By going after Putin directly, it creates a new space for public criticism that will be difficult to control and, further, makes any further attempt on Navalny’s life or further retribution from the state look a lot worse. Granted, Navalny’s public support is frequently exaggerated by those who live in hope for a democratic revolution of affairs in Russia. He still has poked at something bigger here than ever before. Now, Putin’s polling numbers are always stronger than the rest of his government. Levada confirms that the public is pretty divided on the government’s actions. As of November, COVID measures had won back some trust:

Black = approve Blue = don’t approve

By targeting Putin directly, however, it becomes much more difficult to distinguish him personally from the actions of the government and broader state that frequently receive more scrutiny. I highly doubt polling figures are going to show much of a change, at least yet. But the stakes of the national COVID response and recovery are now much higher, as are the stakes if the public starts trusting figures like Mishustin too much compared to Putin. It’s getting more and more difficult to separate rhetoric from action, and that puts all the more pressure on the latest optimization drive for state services and policy.

What’s going on?

The Duma has launched floor debate on a law (still being amended) that would mandate that all manufacturers and importers of goods be required to use 100% of the waste from packaging (in some way). It could take effect from January 1, 2022. Transparently, the Duma is hoping that the proposal will jumpstart the development of a national recycling ecosystem to help manage the endless waste management crisis across the regions. The Audit Chamber estimates that existing landfill capacity could be exhausted by 2024, and by next year at 17 major sites. Existing federal subsidies to regions to buy containers for waste are frequently pointless because there aren’t even local manufacturers to buy containers from and imposed tariff schedules to pay for the sorting of waste from recycling are usually unpopular locally. The Audit Chamber estimates that the current generation of recycling projects won’t return capital invested for 15-18 years without state support. This bill is a step forward, but mandating recycling without actually having an adequate business ecosystem supporting it is just inventing a new way to punish operators and regional governments from the center. The federal government is going to have to bear more budget costs for the first wave of investment if it wants to make real progress, and it’s going to need better enforcement mechanisms that are more responsive to market, and not political signals.

Ipsos global polling (on a country-by-country basis) regarding consumer sentiment and expectations about what recovery looks like for one’s affairs shows that Russian respondents track close to global averages — and also the psychological divergence one can see based on different structures of economies and policy responses. The poll covered the 5 main categories relevant for what was needed for one’s job, business, etc. to ‘open up’:

Blue = financing Beige-Green = interest Purple = the economy Yellow = knowledge Grey = other Descending = World, Russia, China, US, Germany

Financing is the biggest problem unlocking consumption and activity for Russian correspondents . . . and Chinese correspondents despite the fact that Russia’s national index scored at less than half of that in China — a lowly 34.9 against a world-leading 74.1. Germany’s an outlier since its economy depends on foreign demand for roughly half of its output — they’re waiting for the US and China to buy more. The financing problem and divergence between Russia and China is the thing to watch. For Russia, the link between the commodity cycle and banking sector is the problem; 522 billion rubles ($7 billion) have been withdrawn since the last CBR update, banks have to offset those losses with CBR help, and demand is still very weak. The low key rate, in other words, is probably not unlocking enough consumer financing except where lending is subsidized through fiscal policy. In China, however, the story would be that industrials mostly benefited from the credit expansion since China’s macro policy generally destroys household savings via zero or real negative rates on deposits and transfers them to exporting firms that have rebounded much faster. But this year’s ‘de-risking’ in China is going to slowdown the rate of credit expansion and possibly consumer recovery. That’s bad for oil and Russian consumers.

Research out from the Center for Macroeconomic Analysis and Short-term Forecasting shows that while corporate bankruptcies in 2020 were down 19.8% compared to 2019, business creation rates were alarmingly bad. First, lower bankruptcies reflect moratoria and some support schema, and its expected that net bankruptcy levels return to 2019 levels once support and moratoria end. But it’s damning that for every business that opened in 2020, 2.3 businesses closed. This supports my thesis about the creeping consolidating in the economy picking up pace, save in areas like the lower-end of the service industry — restaurants and similar consumer services that don’t benefit from scale that much. HSE estimates shows that 32% of companies are loss-making and 20% are on the verge of bankruptcy, so why not spin creative destruction into a positive!? Well, creative destruction is highly overrated since its not about efficiency as much as it is about the ability of a business or business model to sustain debt (and enjoy continued demand) during a shock like COVID. Uncertainty kills business creation, and it was already slowing pre-COVID. I’d expect it to look weaker structurally even with a successful vaccination campaign.

Investment banks operating on Russia’s securities and debt markets increased their commissions by 3% year-on-year in 2020 to $416.7 million. Lucky for Moscow, VTB Capital came out on top as the country’s biggest earner instead of American banks Morgan Stanley and Goldman Sachs, but the net market share is still skewed: VTB took 22% of those commissions vs. 18% and 17% respectively. The issuance of Russian securities rose 131% year-on-year to $7.7 billion, 60% of which were repeat emissions. $38 billion of debt was issued, a much less impressive 16% increase. Deleveraging on foreign obligations obviously undercut some domestic debt growth, but I think the other cause is that SOEs could take out far more debt far more easily than privately-held firms. VTB likely took the top spot cause it’s a state bank, and state firms have won out for borrowing and state support in the last year, making it the natural banking partner for those deals. Still, it’s interesting that the Kremlin — otherwise obsessed with economic security — has not yet found a way to close the investment banking gap with foreign banks that effectively, knowing that if it denied them market access, foreign capital markets would not react well.

COVID Status Report

Daily cases stood at 21,887 with deaths rising to 612. For now, it does seem to be a new, lower plateau. Moscow is following St. Petersburg and allowing public venues like libraries and museums to operate at 50% capacity while also opening sports schools and colleges. Sobyanin is projecting confidence despite the highly uneven spread of capacity to handle existing infection rates:

Despite lower net cases, the death toll was the first time more than 600 people have been recorded as dying of COVID in a single day in Russia, led by 79 deaths recorded in St. Petersburg. Hungary has reportedly accepted delivery of Sputnik-V in its vaccine rollout plan, as much a reflection of the EU’s lackluster collective efforts thus far to increase vaccination rates as anything else (though that will change in the coming weeks I expect). MinZdrav has also authorized a modified Sputnik-V vaccine that can be safely stored at temperatures of 2-8 degrees celsius rather than -18, which should ease some of the logistical burden for the rollout and, more importantly, future vaccine exports to countries with worse infrastructure. Here’s Novaya Gazeta’s roundup on COVID in the regions if you’re curious. I remain skeptical Russia can curry any significant kind of ‘soft power’ from COVID diplomacy, but I’d expect that will come into play as Russia’s vaccination rate rises.

MOEX Money, Mo’ Problems

Yesterday, MOEX hit a milestone. For the first time in its history, there were more than 1 trillion rubles’ ($13.54 billion) worth of open positions of standardized derivatives on the exchange. The volume marks a nearly 150% increase over 2019 figures. Though less than a pittance in international terms — data from the Bank of International Settlements shows that net global futures and options derivative markets were worth a combined $72.6 trillion as of last September — it’s part of an important evolution for the Russian economy, and a broader problem of political economy that, I think, Russia actually shares with much more highly financialized, developed (or developing) economies it criticizes in its own economic security policy guidance.

If you look at the performance of MOEX — Russia’s primary domestically-focused exchange — against that of the RTS — the exchange normally preferred by foreign investors — the “tale of two Russias” since the economy entered stagnation in 2013 are quite evident. Forgive the Finnish, I assume no translation is needed here (BOFIT will shortly translate its weekly update if you’re interested):

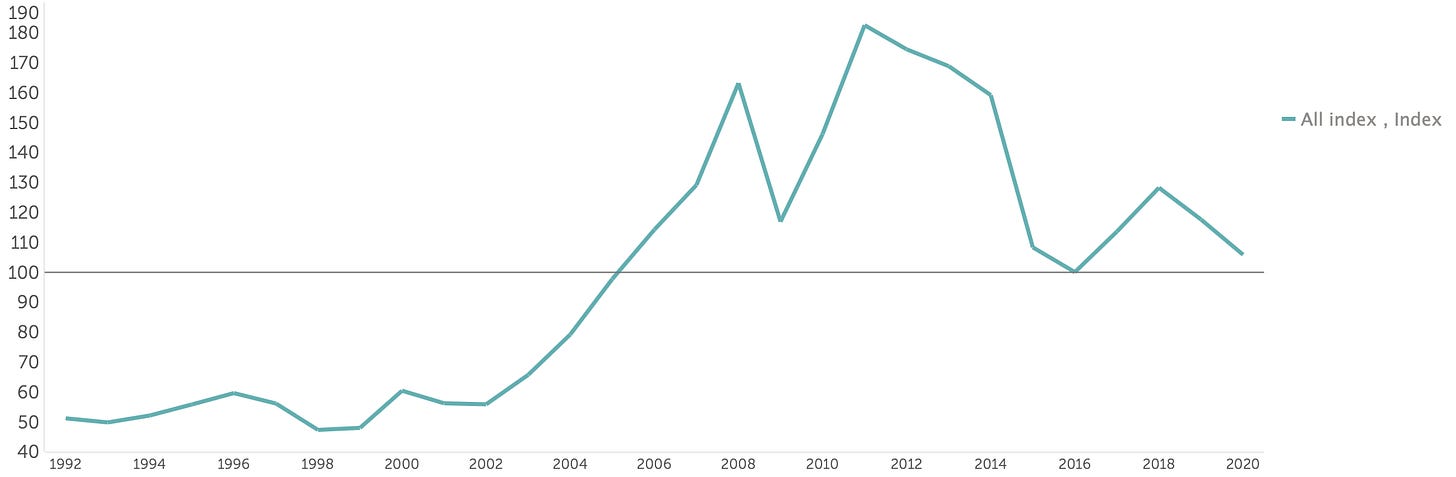

The RTS is still below 2013 highs and as you can see from the drop in 2020 vs. that observed in MOEX, it’s more exposed to the commodity price cycle because foreign investors want to hold stock in Russia’s exporting, more internationalized firms and they tend to be more clustered towards extractives. MOEX holds a broader basket of firms in areas of the Russian economy that aren’t as cyclical, or else benefit from the adoption of newer tech, import substitution policies, and market consolidation. Juxtapose these indices with the following taken from the IMFs cumulative commodity price index:

As we can see, net commodity prices — oil is most important, but this factors in the broadest possible range of commodities, many of which contribute to and have played a larger role in Russia’s current account surplus for 2020 — reached a peak in 2010-2011 right when Russian economic growth began to slow. By 2013, they were on a downward slope. The RTS performance much more closely reflects the commodity price cycle than MOEX. I have a pet theory as to why, one that I think is crucial for making sense of the next stage of the regime’s negotiation with political interest groups and one that exposes just why the current struggle with consumer price inflation is so important.

As we know, pre-crisis economic growth in Russia from 2013-2019 was incredibly weak. In constant terms, setting aside exchange rate fluctuations and related measures affecting purchasing power parity, the Russian economy only grew about 5.1% cumulatively over that time. The value of the assets held on MOEX more than doubled. One of the side effects of the constraints facing investment into productive economic activity in the Russian economy — excessive fiscal conservativism, institutional constraints creating a poor business climate, foreign sanctions, and the steadily expanding role of the state — is that savings that are invested don’t necessarily help produce much more growth. In fact, private pension funds have regularly under-performed state-run funds for returns since 2015. This is a crucial dynamic to consider since most funds, much like the insurance companies growing their asset base, are predicated on a promised rate of return and adjust their portfolios accordingly. As the key rate comes down over time from the CBR, the bonds offer less and less reward and investors tend to seek out riskier assets. By the time the key rate is just above inflation, most are happy to buy OFZ but want to find better yields for clients and customers. The rising value of assets on the MOEX reflects the problems of asset price inflation in places like the US, UK, and many EU economies: asset price inflation — higher costs for property, financial securities, bonds, etc. — correspond to disinflationary pressures in the real economy.

Given that real wage growth has been stagnant to negative and nominal wages have risen significantly, there is probably an underreporting problem for inflation. When you consider the slowly expanding array of production subsidy arrangements for import substitution programs, state policy is weakening the price signal between actual supply and demand constraints, and more inflationary pressure might then be appearing in the shadow economy than in the formal economy. If inflation eats into your savings, deposit rates aren’t that attractive, you can’t access credit at interest rates you can afford, and you can’t find adequate domestic replacements for imported goods whose cost has risen due to a devalued ruble, well, you might as well take bigger investment risks. The growth of non-financial institutions’ pile of capital — think pension funds, insurers, and retail investors using brokerages — corresponds to poor macroeconomic conditions that fail to generate adequate returns on savings elsewhere. The current property boom in Russia is a direct result of mortgage subsidies unlocking pent up demand for safe assets (and more space!) among households.

The strength of MOEX reflects the underlying structural weaknesses of the Russian economy. That’s not at all the entire story. M&A activity, performance and profitability gains for some sectors, and competitive Russian firms that are publicly-listed do exist and do provide some growth for the index. But oil prices still drive a huge share of the country’s business cycle and there is no way the last 7 years have seen a business cycle that suggests equity value should double. And take the RTS and Russia’s traditional equity workhorses in energy. Equity valuations should correspond to some degree to valuations and flows of capital. But in the case of a company like Rosneft, its equity valuation is really about the state’s allocation of value and assumption of equity risk. Look at Vostok Oil. Some equity analysts predict that the realization of Vostok Oil would increase Rosneft’s equity valuation by 26% in a year. The project is going to require subsidy support, and Rosneft’s profitability directly reflects its success in negotiating for tax relief, such as its current effort fighting with MinFin over the Eastern Petrochemical Company to make up for its inefficient deployment of capital in general by lowering tax overhead costs. Without more tax breaks, RTS would sag even lower. Much of the current bull rally for Rosneft and parts of the RTS comes from bullish oil market expectations. However, as a rule, Rosneft is worse at executing projects profitably than IOCs. It’s still about policy support and politics.

Rosneft sold 10% of the project to Trafigura to avoid taking on too much debt, yet the CBR literally can’t find where the reported $7.7 billion raised from the sale have gone. They definitely didn’t come in as an inflow per the available statistics. So what’s happening here is that the state is taking on a greater burden to inflate the equity value of firms that used to drive financial market performance and not even realizing capital inflows from deals it cuts as Rosneft is likely parking the money offshore beyond the reach of either the Russian state while hoping to dodge any oversight from the US Treasury. At the same time rents are being redistributed to those owning hydrocarbon assets, the country’s tepid to terrible economic performance has driven up the value of other financial assets in a reflection of the lack of return available for savings on top of negative real income growth that is pressuring more Russians to cut consumption and find return for money or else to stash money they’d rather spend on themselves. To be sure, the oil & gas sector are underpinning their share of the current fiscal consolidation as they’ve lost a bunch of tax exemptions per the current MinFin plan.

Putin has staked a great deal of his credibility on protecting pensioners, pensions, and retirement savings. In 2008, he made a huge deal of preventing a collapse in the value of savings akin to what happened in 1998. He’s had to negotiate that problem since the COVID crisis started. Indexing pensions using state funds is a useful means to redistribute state resources. It doesn’t fix things structurally, though. Consumer price inflation is once more a huge, systemic problem for the regime. No one who survived the crisis of the Gorbachev years is happy about it. Prices for pasta in the first two weeks of January alone rose 8%, prompting pressure from MinSel’khoz on regional governments to take further measures to control price increases. Unless they intend to allow prices to affect production and investment levels, this could become a cyclical struggle if a bull market for grain export prices holds. Here’s the World Bank pink sheet for reference if anyone’s interested.

I’ve written previously that much of this pressure stems from the regime’s political reliance on voters who live off of fixed-incomes that are more at risk from higher consumer inflation. Thinking further, it’s also about the lack of real economy growth delivering value and flight to equity in search of yield. That increases financial risks, and it also leaves Russia in the perilous position of trying to unwind the unequal effects of greater levels of financialization, which are sadly needed to finance future growth in many respects. It also points to the emerging “politics of equity” in a country like Russia where its financial institutions are closely knit to the fate of hydrocarbon industries. The problem isn’t what happens to pensioners so much as what happens to those now who want their savings to accumulate but face a bifurcating economy caught between no real income growth and rising asset prices accelerated by stimulus measures taken in response to COVID. De-risking one’s equity portfolio from climate change is one thing. De-risking an entire economy’s is quite another, especially when that portfolio is performing better the worst things are for the key drivers of the real economy underlying it.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).