Top of the Pops

Andrei Belousov, economy minister Maxim Reshetnikov, and the windfall hounds finally got their way. Metallurgical firms are now bracing for a government overhaul of their fiscal approach to the sector. Belousov specifically has supported an increase in export duties as a way to compensate for rising construction and input costs for state-funded projects. Before a larger overhaul, the decision has been taken to raise export duties on copper, nickel, aluminum, and related products from August 1 till the end of December in order to cap some of the effects of price increases on state spending. The duty hike is expected to raise 160 billion rubles ($2.21 billion) in additional revenues using the maneuver at the expense of the competitiveness of Russian exports. Rusal just lost 8% of its share value listed in Hong Kong. The larger reform concerns potentially raising severance taxes for extraction and offsetting some of the pain using a ‘reverse’ excise tax system that would allow for some of the increase to be written off. Likelier it seems per Vedomosti and my own gut sense of constructing an easier system to administer and negotiate would be an increase in taxes on profits and other less complex approaches. Metallurgical firms face a far lower average tax burden than other workhorse resource exporters in the Russian economy. The reasoning is obvious — the state wants to seize and recycle the rents from the new commodity cycle in an environment where high oil prices no longer provide real growth:

If they can’t capture more resource rents for metals, the rise in input costs will filter through the economy raising inflation without a politically manipulable lever to offset it. Since they don’t want to increase borrowing, they have to increase taxes to find the revenues. But increases in the tax rate have the obvious effect of reducing the supply of earnings to be reinvested into production during what will likely be a lengthy period of elevated metals prices, strengthened by any aggregate increases in green investment led by private or public spending as well as what finally appears to be a slowly coalescing political strategy around infrastructure in the United States. Now comes the nitty-gritty of updating the rentier model in what will become long-term measures creating new domestic market distortions and politically pressures to extract rents.

What’s going on?

Vegetable growers are complaining that the current subsidy scheme to ship produce to the Far East is inadequate to meet the region’s nutritional needs. Shipments take too long to arrive, disrupting supply chains and sometimes allowing the produce to spoil en route. The Far East only produces about 28% of its greenhouse vegetable needs at present, which leaves it reliant on shipments from far away within Russia. What’s interesting to my mind here is that demand can’t explain the current bottleneck — it’s not like people are suddenly eating loads more regardless of what we’re talking about in terms of foodstuffs, except perhaps a significant increase in ice cream consumption more recently. But these growers are struggling to book capacity in refrigerated rail wagons. Rolling stock frequently shifts into deficits, almost annually it seems, due to the underutilization of existing productive capacity and lack of adequate demand to nudge manufacturers to make large capacity additions. Starting next year, the policy is to provide subsidies for up to 20% of the capital expenditures for greenhouse growers based on 2016 investment levels — 230 million rubles ($3.19 million) per hectare — while the greenhouse growers’ union is pushing for 396.2 million rubles ($5.49 million) per hectare to help offset higher costs for energy and natural gas farther north. The ministries haven’t looked at the proposal yet. “In-sourcing” to the Far East has long been the easiest way of avoiding logistical strains for the Trans-Siberian and Baikal-Amur Mainlines. I wouldn’t take arguments that a set of 3-5 megacomplexes. now being proposed willl transform the region from a vegetable importer to an exporter, but it’s vital and productive use of budget resources to redistribute rents to improve food security. The question, as always, is who benefits and whether it ends up doing much to bring prices down.

A new Deloitte consumer survey shows that Russians are beginning to factor in the environment into what they’re looking for when they shop. Online shopping, rise of prepared food delivery services, and the increasingly open acknowledgement of the problem of climate change politically are the likely causes. As e-commerce keeps growing, it’ll become easier for consumers with a conscience to try and do the basic background research into what they’re buying rather than wandering into a store without much thought. The following are % of respondents who pay attention to details on food packaging:

Descending — country of origin, contents, ecological aspects of the product

The new level of awareness is clustered towards food, which makes sense. Russia’s ban on GMOs and adamant rejection of European and US standards allowing for them — and the money western corporates reap by selling designer seeds for their own fertilizers and pesticides — also makes the exercise theoretically a bit easier. Deloitte also found that 70% of Russian consumers are trying to save money when they shop. Something tells me that’s not a promising sign regarding income and earnings expectations for households in the year ahead.

The continuing mortgage boom is now raising fears of a sub-prime mortgage crisis hitting Russian banks. Deteriorating real incomes and wealth losses from the last year have worsened the average creditworthiness of borrowers and, by default, pushed banks to lend to riskier borrowers looking to buy a home. In May, banks lent 435 billion rubles ($6.02 billion) to 145,000 individuals to buy property. For January-May, the number of loans issued rose 45% and their combined monetary value 25%. We’re at the point where people at the cusp of being able to handle the payments are borrowing to try and buy while they can. At the end of April, the total mortgage portfolio held by banks exceeded 10 trillion rubles ($138.55 billion) for the first time ever and the indications that the recovery is uneven and surges in consumption uneven, it seems like property investment is still seen as as a safe store of value given rising inflation, the mortgage subsidy program’s extension, and the understandable desire to want to own your own home. Costs per square meter in Moscow are up 11% so far this year, a slowed rate of increase than last year but still big. Central Bank data shows that almost half of the people borrowing to buy can’t cover more than 20% of the value of the apartment/house they’re buying. 45% of the loans issued don’t require principal payments upfront of 20% now, up from 24% a year ago. Banks expect housing prices to fall about 5.7% from current levels in the second half of the year, but it’s safe to say that the mortgage response taken without adequate income support measures has created a massive systemic risk for the economy if they can’t get incomes rising again. The 3rd wave of the pandemic is only going to intensify the stress on household finances since some of the gains from reopening are going to be lost. This is a logical consequence of the myopia of policymakers’ austerity and sovereignty mindset — if the state won’t borrow, households have to and unlike a state, they can’t set interest rates and face much more stringent borrowing constraints.

The Russian home construction market is now short about 2-2.5 million cubic meters of lumber, the equivalent of 30-40% of annual demand. The squeeze is immense. Prices for lumber have risen 30% for June alone. They’ve tripled since the start of 2020. Lumber-frame homes have risen 40% in price since October as a result. Export bans on roundwood remain the easiest fix and those steps are already being taken. A wide range of measures are still on the table — cutting logistical subsidies for exporters, subsidizing end consumption, using state aid to increase output, and so on. I still find it rather odd that for a government so obsessed with supply side policy measures, there isn’t yet talk about directly investing state money into forestry. That could be done through private-public partnerships, it could be grants to firms with stipulations about use that then trigger some sort of punishment if they fail to invest into output, or else accelerating talk of creating a state timber export monopolist and standing up a firm quickly. The surge in prices is ultimately a result of global forces — housing demand is up in the US, China may be investing less into construction this year but is expected to kick back in next year to manufacture its growth figures, Europe is now recovering slightly more strongly (though it may not last), and the wealthy across the globe like buying property. Nabiullina is correct that inflation won’t be as transitory as a 1-3 month surge, but now it’s just a matter of adjusting expectations for how long it’ll take supply to react to bottlenecks. In other words, it’ll be transitory over something more like 8 months. I fear, however, that prices will be stuck higher in Russia for longer until they realize they can actually do more to directly invest into production and supply.

COVID Status Report

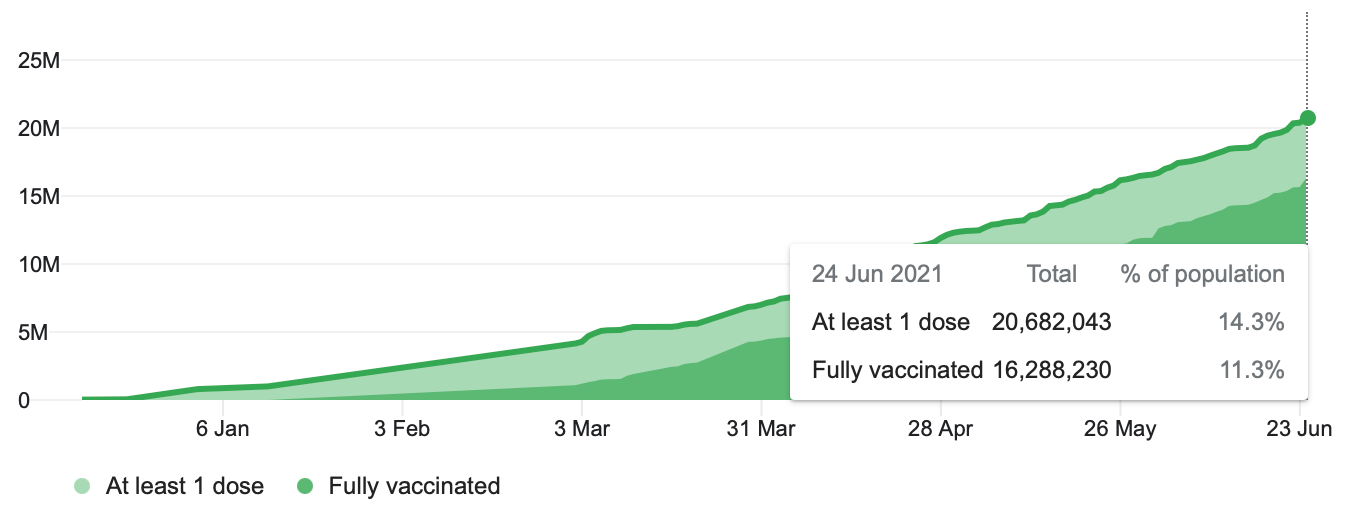

The Operational Staff recorded 20,393 new cases and 601 deaths in the last day. According to health minister Mikhail Murashko, no more than 0.5% of those who’ve been vaccinated are getting infected. The race is on now that researchers have discovered a “Delta Plus” version of the Indian variant that’s reportedly even more infectious. We’re seeing a slow expansion of mandatory vaccination requirements for employees and those at risk across the regions, but the more eye-catching announcement came out of Moscow today. From June 28, Moscow’s reinstating the remote work requirement that businesses send 30% of their employees to work from home targeting elderly employees. In Khabarovsk krai, there are now 3 villages under quarantine as locally directed efforts pick up in areas that have worse access to healthcare facilities. Rosturism is calling on Russians to get vaccinated for the sake of saving the tourism sector . . . and their own holidays. The demographic impacts are going to be much more visible next year. Apparently death rates among pregnant women have risen 24.4% since the start of the pandemic. The vaccination rate has doubled in Moscow. Unclear yet the degree to which the same is happening elsewhere. Even a doubling of the rate will leave a long time before vaccines bring down infection and death rates. We’re now seeing closer to 0.3% daily increases for the one dose category, up from 0.2%. Gaining a 0.9% point every 3 days would leave us about 3.5-4 months till approaching the 60% threshold where cases start to drop precipitously. They’ll need to accelerate further to avoid a terrible summer:

Infrastructure Groundhog Day

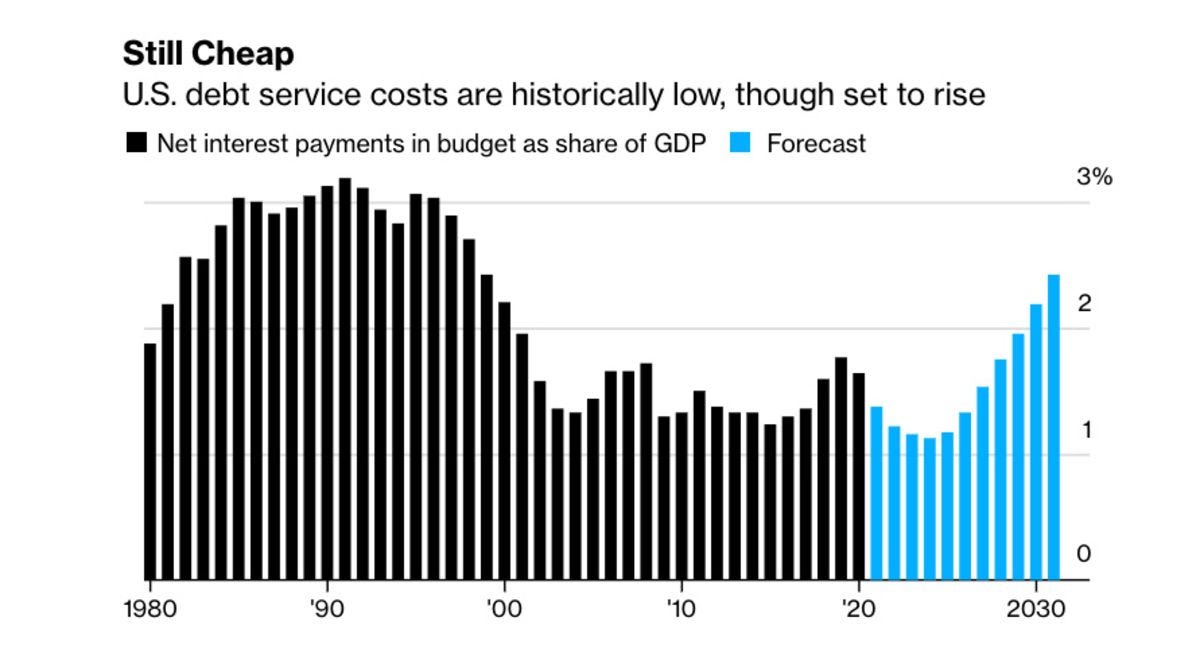

I’m going to go back to Eurasia on Monday. I’d like to quickly flag this new report on China’s transnational repression of Uighurs for anyone curious, the first of its kind and co-authored by my good friend Natalie Hall with Edward Lemon and Bradley Jardine. But this week, political developments in the US probably matter more for the economic arc of events in Eurasia in the months and year or 2 years ahead than we might otherwise expect, especially with the ongoing debates about the optics of France and Germany’s mishandled attempt to setup an EU-Russia summit. The latest gamble on a bipartisan infrastructure deal alongside a reconciliation bill to be passed by Senate Democrats is incredibly important for markets, even given the relatively paltry sums of money involved assuming it passes. Infrastructure has been a handy totem since 2017 in Washington. Everybody knows Mitch McConnell has no intention of doing a damn thing to help anyone but his donors, everyone knows it’s absolutely crucial, everyone knows it’s an opportunity for pork barrel politics, and everyone knows they can attack the other side for being fiscally irresponsible. At least that used to be the logic. Today’s pay-for politics do not correspond to any fiscal constraint on US policy. The US Treasury’s forecasts for the cost of servicing US debt — far more important than the volume of debt borrowed — shows that in % GDP terms, the US has an historically large amount of room to borrow and spend compared to its post-Bretton Woods past:

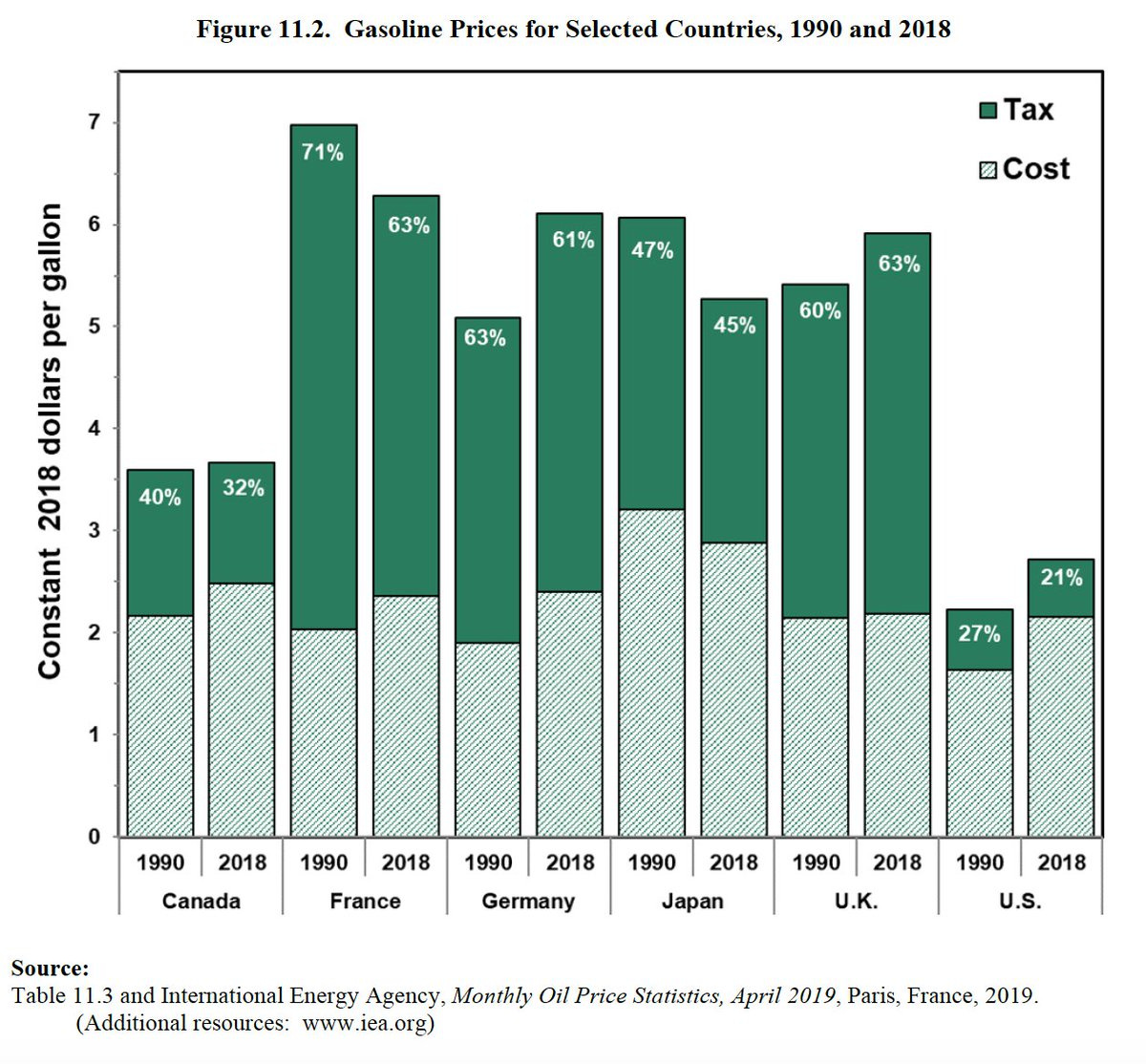

The increase is only because of assumptions about rising rates on bonds, which are immaterial and may be overstated if enough growth is created via spending. The debates over taxes and the means to pay for any big infrastructure push are ultimately about fostering the illusion of bipartisanship — it allows Biden to claim he made a deal that Trump failed to get done ahead of the midterms — and then allows a parallel vote on a massive spending bill via the reconciliation process in the US Senate that covers a bevy of social spending initiatives including healthcare and elderly care, more on climate initiatives and infrastructure, and other items sneaking in more industrial policy and moves to pursue full employment. Debates about raising gas taxes are always a political hot potato and not going to happen. As a relevant aside, we can see that the US taxes gasoline at exceedingly low levels compared to developed market peers:

So what does the play for the bipartisan deal mean? Well, it authorizes $579 billion in new spending over 8 years. Just $7.5 billion of that is going into electric vehicle charging stations. A much weightier $66 billion is going into passenger and freight rail projects. $49 billion has been allocated for public transit. There’s a lot more here, but it’s a small bump of spending that’ll help at the margins with US growth in the years ahead. All of these projects will help add a bit more momentum for a range of commodities since there’s huge onus on the White House to find ways to get private capital investing into infrastructure and charging the public user fees we all hate to profit off of it. What’s crazier is that the US spends in the ballpark of $400 billion annually on infrastructure annually, falling short of its repair and maintenance needs on top of underinvestment into non-road transport. This bill really doesn’t change that dynamic though it will address specific needs.

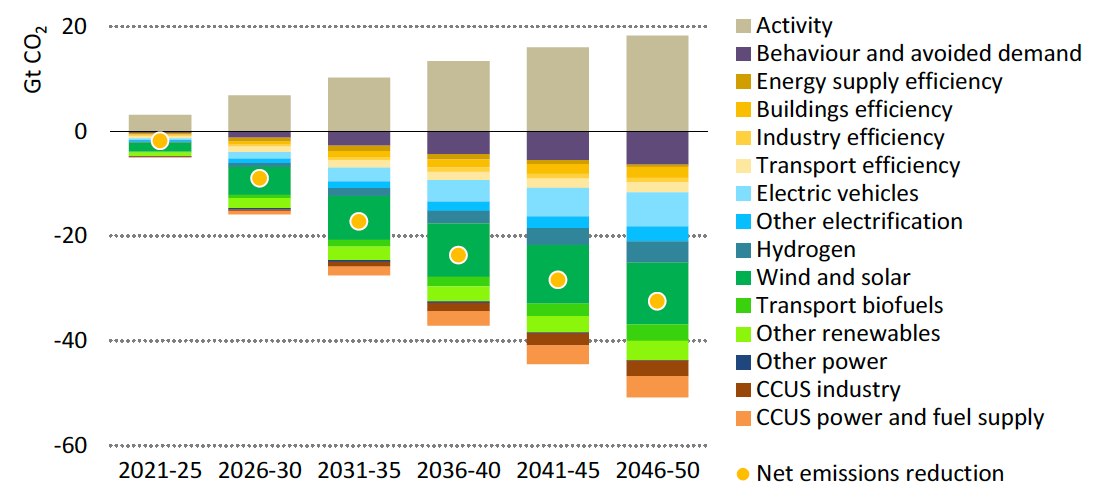

The hard part comes next. What’s going to be in the reconciliation bill that would be passed using only Democratic votes? Majority leader Chuck Schumer and Budget Committee Chair Bernie Sanders pegged their initial reconciliation bill covering an expansive definition of ‘infrastructure’ at $6 trillion over the next decade (to my understanding). They know it’ll get hacked apart by moderates, but the more they start from a huge ask, the likelier the final product will end up at a reasonable spending level. We need more time to see details leak, party members counter-brief, and news cycles wring hands over nothing. But one thing is now quite clear — there’s no other major economy in the world right now doing anything at scale to stimulate demand. That means that in the years to come, US firms seem likelier to retain their pricing power for lots of commodities, especially those used in infrastructure development. Citibank now predicts China will no longer lead the global investment cycle for business. From 2010-2019, 47% of global investment growth on average came from China as well as 33% of global GDP growth. Advanced economies’ contribution to GDP growth will surpass that of emerging markets this year for the first time since 2006, led by the US. Russia’s bet on China’s growth could start to unravel. Emissions reduction strategies are going to create really odd intersections of old school energy security concerns about natural resources and industrial policy:

The more the US spends and builds, the more relative power to determine growth, regulatory transmission, and marginal changes in demand for commodities shifts to the US, followed by Europe, Japan, and South Korea benefiting from US stimulus. Geopolitical chattering heads have been buying the narrative of China’s rise across Eurasia. Some of it has been true and understandable, much of it more about threat inflation and the promise of book deals and column inches to opine freely. Yet the ongoing fiscal debate in Washington and distribution of the post-COVID recovery is upending the logic that all roads lead to Beijing. They do in many respects, but China’s losing its power to set the pace within the global economy at the same time it has to manage the challenge of financial instability from rising inflows of capital. We’re a step closer to knowing what Biden’s infrastructure fate will be. Most signs suggest we’re closer to another spate of spending with global macroeconomic implications than I’d have expected after weeks of uncertainty. A greener, more equal world requires a lot of materials. Pretty soon a fair bit more of Eurasia’s marginal output might be flowing West again instead of East. So much for China bailing Russia out and lifting Central Asia.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).