Top of the Pops

Word’s leaked that the EU draft rules for its green deal and sustainable finance taxonomy will not consider natural gas power plants a “transition” fuel towards emissions-neutral renewable sources. It’s a huge deal for countries like Poland with a lot of legacy coal assets and plans to cut emissions from those plants by half using natural gas. The narrative of natural gas as a “bridge fuel” is dead. At the same time, though, falling renewable power generation costs in Europe haven’t led to lower prices because fossil fuels are still setting the marginal cost on wholesale power markets (for now). These pressures are undoubtedly going to lead to more fights over EU spending plans and regulatory approaches that Gazprom and co. will be watching closely.

What’s going on?

Businesses are increasingly taking on all proper tax and social contribution obligations for their employees as stats from MinTrud show that 66% of those polled collected so-called “white wages” — wages that legally comply with all requirements — rather than partial or full payment handed over in an envelope. The primary story here is one of administrative success, helped no doubt by Mishustin’s efforts to modernize tax collection but also by the pandemic. As employees shifted towards work from home, companies had to adapt and make sure that they both kept paying people, but also had all of their paperwork in a row to maximize their access to pandemic support programs. The increase in with wages is on the order of 12% per the same poll from 2018, a net decline from 2016. COVID might end up making those gains more permanent.

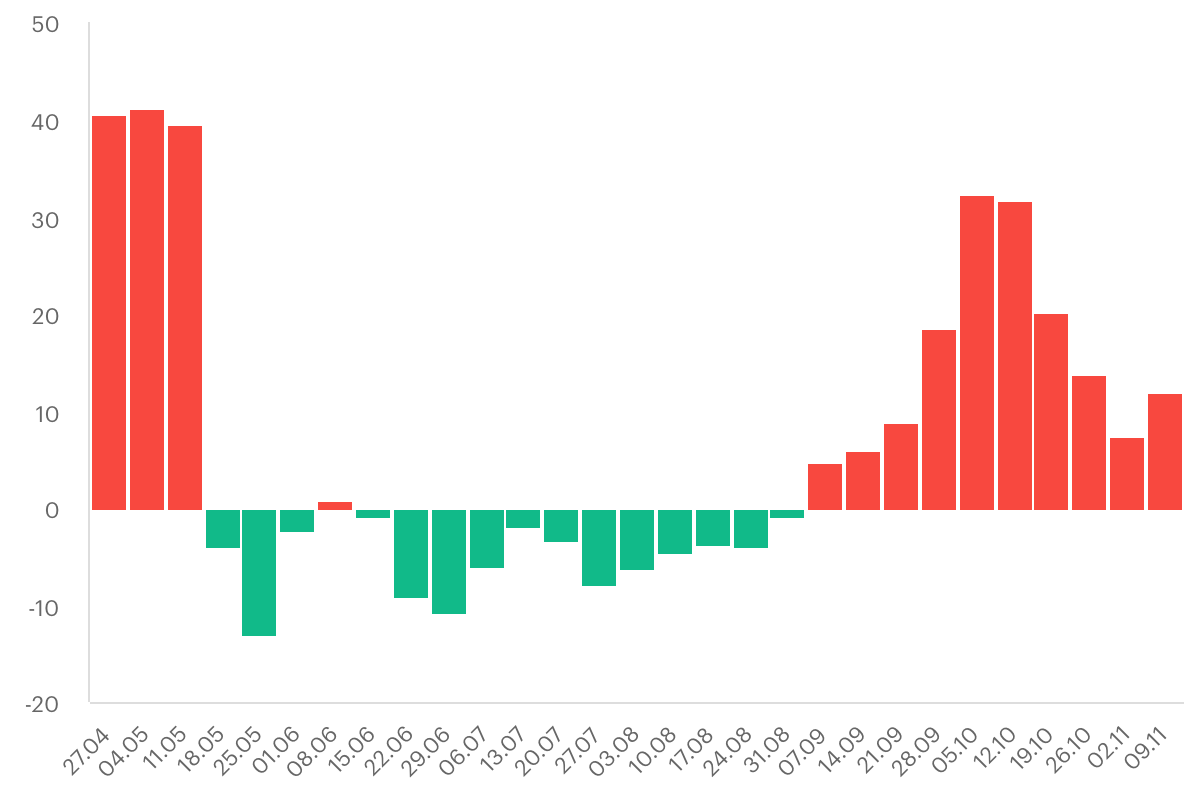

Small and medium-sized businesses borrowed a record 1.05 trillion rubles ($13.64 billion) in 3Q as businesses struggling to survive took advantage of historically low interest rates — they’ve reached an average of 6.1%, down nearly 4% from last year thanks to Central Bank policy and loan subsidy programs. The following shows year-on-year growth of indebtedness per quarter:

Gold = microbusiness Red = small business Cyan = medium-sized business

The question is to what extent the lending boom — spruced up earlier this year with 0-2% interest rates for firms affected by COVID — is merely delaying the financial risks these firms face without strong consumer confidence and economic indicators. For now, the low rates and offers to restructure are saving loads of businesses that would otherwise have already gone bankrupt. It just might avoid the worst of the fallout, but given the virus’ spread and lack of willingness to use stricter public interventions to manage it, it’s hard to see service-based businesses getting out from under a rising debt load without a lot of pain in the next 2 years given incomes aren’t yet recovering.

As the dust settles on Artyomev’s exit from FAS, it seems that his replacement — Maxim Shashkol’skiy — is going to pivot the oversight body from fights with Russia’s numerous cartels to focus on tariff regulation. Artyomev was forced out because of the threat of legal investigations into cartel behavior, generally driven by SOEs and parastatal firms that frequently have ties to the security services. Mishustin’s signaled he wants tariff regulations at the fore, which is really another way of saying “please resolve this permanent headache for me since most supply chains shift around these things.” The hope appears to be a new face whose bothered far fewer people can make headway unifying the country’s patchwork tariff system.

The government is beginning to work out a plan to unify electricity tariffs merging 9 regions with neighboring jurisdictions, thus allowing increases in some regions to offset decreases in others as per a proposal put forward by Rosset’. The proposal was put forward to Putin by Yuri Borisov and would touch on about 25% of electricity transmission in regional networks. It’s a neat and useful way of consolidating cross-subsidization for electricity prices and reconfiguring existing legal jurisdictions for power markets to better harmonize prices and reduce complexity. It could also help lower consumer costs, which would save face for power providers worried that investment plans are inadequate to keep prices from rising significantly past inflation in the latter half of the next decade. All in all, an administrative fix requiring little money spent that probably should have been tried a long time ago.

COVID Status Report

Daily cases shot back up past 21,600 with an uptick in Moscow as well. RBK tweaked its regional map to contradict what it was showing earlier this week as Russia recorded 439 COVID deaths yesterday, setting the new record that was itself just set yesterday. The growth rate % comparisons week-on-week highlights just how bad things are for the containment effort:

The growth rate is ticking back up in % terms off of a much larger absolute base since the infection caseloads started rising again in early September. The increase across the regions is still a steep and straight line up, while Moscow’s reined in the virus somewhat but not gotten ahead of it to lower the R enough as of yet.

Moscow is now telling governors to look at restrictions to fight COVID if needed, but to do so without harming the economy significantly. The real move was to make governors personally responsible for the provision of medications and cots for hospitals while drafting the legal framework to extend emergency powers over public. health into 2021. This is essentially what happened with the Trump administration earlier this year: the president is the Joker snapping a cue stick into pieces and tossing them onto the floor while governors scramble to make the cut and keep their jobs, inevitably at points competing with each other for the same finite resources to take care of their own people.

Point Enough

French Total just bought Charging Solutions, a German firm operating 2000 charging stations for electric vehicles across Germany. The acquisition is just the first step in Total’s quest to own 150,000 charging points in Europe by 2025. This is where the manner in which the EU defines natural gas for its sustainable financing framework matters. Total’s current business plan aims to sell 50mt of LNG by 2025 and use the cashflow from its oil & gas earnings to finance an expansion into the electricity sector. It’s just about the only business strategy a self-respecting European major has at this point. The biggest thing stopping investors from rushing into the sector in even larger numbers despite evidence of higher returns than traditional fossil fuels is a lack of market liquidity. It’s too new. The majors out front on this now have a chance to steer investor opinions, but thus far, investors seem skeptical the giants of the energy world can deliver. That means that funds and active managers acquiring stakes in assets and trying to standup capital are going to have to do more of the heavy lifting.

Take examples from the US, where the regulatory approaches diverge more at the state level and the Trump administration has even gone as far as to try and make it harder to use green ESG criteria for investments in the US this year. In the last week, Ecofin announced it was raising $250 million for an investment trust (a REIT) targeting renewable energy with an expected annual return of 7-7.5%. Those assets are largely going to be in states with favorable regimes and will hold fixed long-term contracts, thus guaranteeing returns. Ecofin estimates at present show that renewables will account for 67% of all power capital expenditures in the US over the next decade. Note that this likely has to assume as a base case that Biden’s not launching a massive green spending plan given hurdles in the senate. Investors are all going through a crash course in how to make sense of value in this new world.

The oil industry responded to the last price crash in 2014-2015 by finally finding some discipline with its cash. High prices often beget bad investment decisions and poor project management. That means that firms have shifted towards smaller projects that tend to have shorter investment horizons to realize return and frequently entail less capital expenditure than a greenfield project with the aim of hitting internal rates of return from, say, 15-20%. When realized, that’s a ways ahead of what anyone trying to buy power-generating infrastructure that’s green is likely to bank on. But it’s going to get a bit more complicated to translate project returns to broader equity performance for companies as those IRRs are likelier to look more stable for natural gas than oil over the long term (so long as shale drillers exist in the US). The cost savings and efficiency gains were more readily apparent in 2014-2015 after a decade of profligacy from higher prices.

One of the ways firms try to capture more value out of the sale of refined products is to diversify into the very end of the downstream by buying up filling stations and brands for convenience stores and related chains that operate through them. BP’s aiming to do this, which in places like the UK will be a fascinating study of rates of adoption. Many mature products markets in developed economies have seen a steady concentration of sales in fewer and fewer hands among filling stations, a result of weaker product margins, variable overhead costs, and shifts in demand (not the case in the US as in Europe). That means that rural consumers tend to have to drive farther to fill up, and are also already likelier to have to drive farther to access basic amenities. Higher EV costs are likely to delay adoption in rural communities, but EVs are going to slowly squeeze fuel margins worsening the problem. Just a thought about spatial inequality baked into the energy transition.

However, once filling stations are converted and have charging points, that also means that drivers are going to have to spend longer waiting and, thus, are likelier to spend their money on food, entertainment, whatever it is a station has to offer. These marginal returns in the future will be minuscule compared to what one expects with a disciplined oil & gas project extracting the resource, but they matter a great deal. The industry is going to keep innovating to improve recovery factors and maximize earnings from existing assets — again, a net win for shale — but it’s going to go through an “equity trough” as investors slowly cotton on to how those cashflows can be reoriented and invested to generate less spectacular, but far more stable returns and develop new models of horizontal and vertical integration.

Compared to the devastation to oil & gas equities, diversified players and renewables on solid footing are beating them out by a landslide. Nextra is massively into natural gas and nuclear, despite its green rep, but is one of the best exemplar cases for how extractive firms can diversify:

Brookfield’s renewables fund is similarly performing well for the last year, even though it fell victim to the Nasdaq tech bubble sucking equity in to Tesla and other long bets and thus sucking capital out of others with much more sustainable fundamentals, if not the same value upside:

These are quick snapshots, but indicative of the continued direction of travel for the market. The problem for Russian firms is that they’re effectively locked out of participating in these types of transactions for charging stations and more on foreign markets, but will have to play catch up if they own downstream distributors and filling stations on foreign markets making the leap. That kind of “learning” abroad can be brought back onto the Russian market. Still, it’s more often the case that large firms embedded in their own national systems export aspects of their domestic models and approaches. The energy transition is going to shift a lot of these traditional observations for firms reliant on external markets to realize most of their earnings.

Leverage (without a pivot)

We’re still in the early days of financially modeling economic exposure to climate change and carbon prices. Building on the above column, marginal returns on investment can be narrower when the effective costs of borrowing and operating costs are manageable. The Interest Coverage Ratio (ICR) is a good, basic tool to assess the financial health of a company. The ICR is as follows:

ICR = Earnings before interest and taxes (EBIT)/annual interest expenses

If the ratio is 1, a company is only able to meet its interest payments (and would technically still have taxes outstanding). The higher the ratio, the safer a borrower that company is to a bank and the less exposed a company is to any increase in interest rates.

Potential increases in carbon taxes are going to significantly impact margins for a wide array of industries, not just oil & gas, if they rise from a relatively pedestrian $35 a ton — a cost that oil firms had already prepped for internally in recent years — to a more drastic $70 a ton or a sky-high $150 a ton. The IMF thought to run a stress test for the impact on firms’ ICR in Norway, fairly green as economies go, with these higher taxes hiked in parallel and assuming all firms within a sector have the same emissions intensity:

Each letter stands for a sector. Notably agriculture, water supply, accommodation and food, and transportation and storage are all significantly affected. Even an increase of 10% of firms falling below an ICR of 1 has huge ramifications for competitiveness, market concentration, marginal costs, and more. In practical terms, central banks can’t raise interest rates until these systems pricing in carbon and related externalities have been in place for some time, otherwise there’ll be a cascade of zombie firms and bankruptcies leading to unemployment, reduced consumer demand, and social and political unrest.

It’s a conundrum no one has an answer to. The current monetary policy regime explicitly punishes savers and forces people who have any savings to speak of to constantly seek return on equities and bonds to realize any savings growth while the growing number of people locked out of effective means of accumulating wealth, particularly acquiring property, take a punt on apps and the like. Savings accounts delivered annual rates of around 5% twenty years ago before Greenspan’s cuts to escape the Dot Com Bubble bursting. Now, we’re lucky to find anything above 0.5%, and thus trail broad measures of inflation. Unsurprisingly, developed economies are trapped in an endless cycle of easing, not just because of fiscal policy failures, but also the political ramifications of any significant rate hike being utterly unpalatable while trying to push through green policy measures.

I bring up these factors because Russia’s going to be in an interesting no man’s land when it comes to the inevitable transition to come. As more economies introduce higher carbon tax rates — I don’t have a timeline but do think it’s inevitable since politically it can now be sold even to diehard doubters as a means of managing debts accumulated from the COVID shock — and those taxes are going to involve trade protections and rules of some kind, Russian firms are going to be forced to lobby that Moscow find some manner of internalizing the cost of carbon into its tax system tp maintain their competitiveness. In practice, that will end up burdening SMEs more because the cost of credit is going to rise again within the Central Bank’s orthodox policy framework. Quickly? No. But there’s considerable pressure to make sure that banks retain reserves so as to not rely so heavily on central bank operations to maintain liquidity and there’s also not visible support to improve consumer spending power, a necessary step to prevent the current credit expansion from dragging on future growth and earnings as ICRs increase.

This isn’t an argument about running the economy hot or MMT jeremiads about a jobs guarantee to ensure full employment (an idea that I find laughably shallow, but I admit I’m quite biased). It’s an issue of differential climate impacts on central bank policies at the national level, and a case where any further pressure on future export earnings in foreign currencies for the current account really matter. Keeping a massive pile of reserves around to reduce borrowing costs makes a lot of sense for the energy transition, but it won’t save smaller firms when carbon prices enter the picture.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).