Top of the Pops

Today will be a slightly different format, as will tomorrow. Given that the entire world is holding its breath over the US elections tomorrow, I figured a dive into how a potential Biden presidency means for Russia. Tomorrow, I’ll zoom it out to cover a Biden presidency’s impact across Eurasia, not just Russia. First, a few odds and sods from Russia:

Experts are expecting COVID-19 cases to peak in Moscow by December 14. While the growth rate for new infections has declined considerably, the Operational Staff figures are underreporting the caseload. Transmissions are likely lower due to seasonality around travel, the national mask regime having its intended effect, and better measures in big cities.

More retailers in search of warehouse space in the regions, with the share of regions seeing leasing or purchase deals rising from 26% to 31% year-on-year and doubled in total space. Lower prices from COVID, growth for e-commerce, and focus on the distribution of essentials are driving investment, which may well end up reducing inflationary risks for the CPI given systemic weakness for corporate infrastructure investments since 2015.

The ruble hit 80 to the US dollar on oil price weakness — European lockdowns and US election uncertainty are slamming crude forward contracts — and returned to its record low against the Euro at over 92 rubles. European deflation is driving up the Euro’s value while things keep getting worse for oil.

IT import substitution has been delayed once more, with Russian software to replace imports as of Jan. 1 2024 and Russian hardware as of Jan 1. 2025. This is the song that never ends. The rents go on and on my friends.

Chessboard, Shchmessboard

There’s a tendency in some of the current generation of US-Russia relations analysis to privilege words, symbols, the feelings of participants, even the emotional tenor of policy debates or quotes from sources over deeper scrutiny of the underlying forces, trends, or impulses at play. It’s understandable. The bleakly comic nature of Moscow and Washington’s ever-worsening relationship lends itself to analysis in a bubble that, inspired by punditry, fails to account for political economy or the myriad competing pressures on US and Russian policy that don’t concern the bilateral relationship. So I find the initial impression that Biden offers greater stability for Moscow and a potential partner to negotiate arms control quite lacking, even if true. Talking heads, established research fellows, and other fonts of quotes for foreign policy fodder only tell us what their agendas are or what they care about, not the actual likely arc of relations or relevant policies to follow based on strict scrutiny. Stable doesn’t actually mean better since much of the stability Biden may provide entails a steady worsening of Russia’s strategic position because of its own choices and political economy, which creates a permanent pressure to use antagonistic measures to try and create policy leverage.

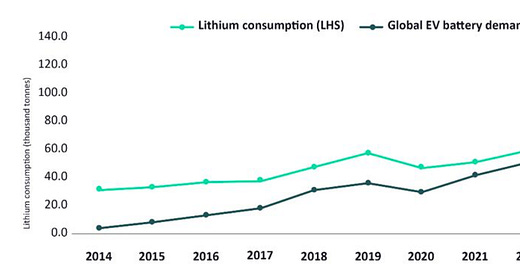

First, we can look at the domestic side and then zoom it out into international affairs, including how Biden might affect energy markets, security affairs, and the like. Any analysis of a potential Biden presidency’s impact on Moscow, assuming Democrats win control of the senate, without even mentioning energy policy and climate change is misleading as to how US policymakers will frame great power competition. Barebones it may be, his own platform calls for $1.7 trillion in federal spending on clean energy over the next decade with an additional $5 trillion of local and private sector funding raised. It sets a net-zero emissions target for 2050, accelerating timelines for the electrification of light and medium vehicle fleets, mandating companies report on carbon risks for their own operations and supply chains (scopes 1 and 2), and decarbonize the nation’s electricity grid by 2035. I'm most interested in how a Biden presidency can shift corporate preferences and financial markets alongside federal spending commitments like 500,000 charging stations for electric vehicles. The last point is more important in the shorter-term for market expectations given the bull market for lithium and Russia’s absence from its production — Rosatom doesn’t have anything of note I’ve seen out the last few weeks following up on its September announcements — and how it’ll start to drag on road fuel demand and likely worsen refining imbalances for margins earned on each refined barrel between gasoline and middle distillates in the medium to long-term. This demand projection from Global Data:

A Biden administration is undoubtedly going to try and at least make a feint towards nudging Detroit along in the scramble for EV market share.

Biden makes a big deal of using federal procurements to accelerate the energy transition and market development. He cites a $500 billion figure, but clearly his team isn’t thinking outside the box on how much leverage the Federal government has as a consumer to nudge market developments. Consider first a major problem with the growth of green financing to stimulate ecologically sustainable economic development and growth: the firms issuing green bonds frequently see their net carbon intensity increase after issuance because the bonds are used to finance a project, not measure a firm’s overall carbon sustainability. From the Bank of International Settlements:

In other words, a project may be green, but the firm’s net footprint still worsens. Biden’s own commitment to using the executive branch to mandate regulatory changes requiring companies to report their scope 1 and 2 emissions and emissions risks makes it that much easier to make the shift that the BIS recommends — issuing green bonds on the basis of entire firms’ climate performance, not the merits of a single project. This creates a credit incentive to be greener by building in carbon externalities into borrowing costs. Europe has led the way, but dollar-denominated issuances could take off under Biden given that the investment grade credit market in the US is 2.5 times larger than that in Europe. Consider the size of the Federal government and potential knock-on effects from shifts in procurement and contracting requirements, especially since contractors with the US government may have to report their emissions and emissions risks, thus allowing for public audit of how “green” USG spending is. Pulling from usaspending.gov, here are a few proxies for the pots of money that can be spent in a manner, which could entail commitments regarding emissions reporting and management for scope 1 and 2 emissions:

This spending power is equivalent to about 5-6% of the EU’s pre-COVID nominal GDP on an annualized basis with the added impact of nudging the US financial market to catch up to Europe on green finance. The relatively simple act of ordering corporate accounting for direct and supply chain emissions risks also helps state and local governments build in similar requirements if they choose to as a force multiplier for federal programs (and remember that it would be possible with democratic control of the senate or even executive order in many instances to attach similar federal procurement requirements to pass-through grants spent at the local level for procured services). Link here:

Leaving aside arguments about the efficacy of his energy plan, the potential impacts for lenders, financial markets, corporate board and shareholder incentives, and executive branches across the country are huge. On net, these are terrible for Russia’s economic outlook as the incentives to improve energy efficiency and reduce hydrocarbon use will no longer be driven first by the price of oil or other commodities, but increasingly by the cost of credit, investor pressure, and governments’ role as consumers. In the US, for example, European companies that are greener could bid for US contracts to deliver best value for American taxpayers, which then forces America Inc. to up its game. This is a serious problem for Russia, even if sanctions policies and arms control are conducted on a more even keel. But it gets worse…

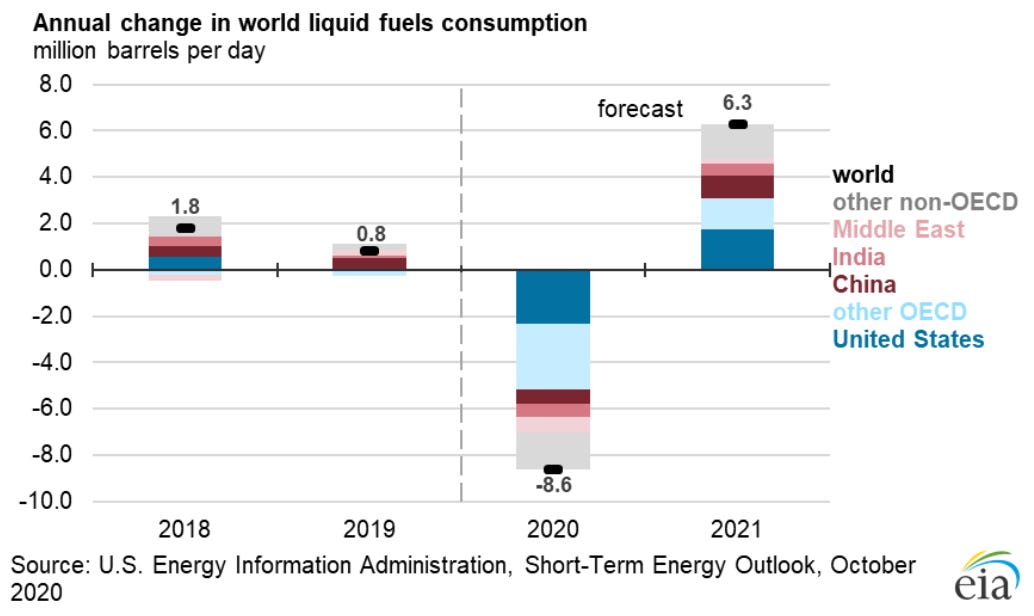

The Man Without a Face

Despite people’s best assurances, there is very little evidence that we actually know what a Biden foreign policy concretely looks like in practice due not only to domestic political factors and his stable of rather hawkish advisors, but also the constraints diplomacy faces when your counterparts don’t trust you. One leg of diplomacy he and his team have put out concerns talks with Iran and Venezuela. Any Biden-led diplomatic process would be slow-moving, but easing sanctions restrictions on oil exports from both countries is going to have to happen if he’s serious as a sign of trust and good faith while getting some kind of commitment and verification depending on the issue — Venezuela lacks the same dramatic stakes of non-proliferation diplomacy with Iran. Doing so would tank oil prices again at the same time Libyan crude volumes are now surging at 800,000 barrels per day with a political target of a further 500,000 barrels of daily output for early 2021 in direct contravention of the OPEC+ cuts. Russia’s going to be forced to comply more deeply with cuts or risk another disastrous price war hoping (foolishly) to destroy US shale once and for all. The economic pain Moscow’s facing is not going to be ignored by hawks like Blinken or Mike Carpenter, especially since many are hoping to sell Biden’s own cred as a values-based foreign policy leader. They’ll lean into the same sense of opportunity that Reagan’s national security team identified in 1980 when they discovered that the Soviet economy was in trouble. The EIA’s demand outlook from October, likely to be revised down given the new lockdowns, says it all for Russia’s budget, the ruble, Russia’s recovery prospects, and the basic data inputs for national security briefings on the topic:

Net demand destruction + new supplies to market + a likely backdoor bailout for some shale players = prices stuck at $40 a barrel, if not lower for much of that time.

Then onto other the bigger picture.

If someone like Samantha Power is given Secretary of State, she’s going to use her advocacy to advance policy agendas. Those agendas include fixing a tarnished legacy in Syria, where Power was a vocal critic of the UN and Russia’s role in the conflict. Carpenter is the type of Russia-watcher to talk about Russia creating a conflict in Belarus in order to annex it and to panic about completely innocuous flight rights with the Open Skies Treaty. This idea that dialogue will be a priority is not wrong, but it misses what that dialogue is going to be about. Biden has stayed silent on the matter of the US presence in Syria, and for all his good intentions, there is no reason to believe that Iran would agree to re-enter a deal with the US, especially since a democratic senate would hand more power to senators like the likely Foreign Relations committee head Bob Menendez who cosponsored a bill with Lindsey Graham to support Secretary of State Mike Pompeo’s efforts to replace the JCPOA with a new, tougher deal that bans Iran from enrichment but provides them nuclear fuel as well as said fuel to other Middle Eastern governments for power generation while denying them the right to enrichment. Incoming Democratic majority leader Chuck Schumer opposed the Iran Deal in the first place. Biden, barring a shift on oil exports which I frankly think isn’t necessarily that likely once hawks start dragging him over Iran’s escalating enrichment levels to inflate the threat, is much likelier to represent continuity in the Middle East than most seem willing to admit. It gets crazier looking at what might happen with the Department of Defense.

Based on past media reports, Michele Fluornoy is at the top of Biden’s shortlist for SecDef. Flournoy is a staunch believer than the erosion of our deterrence capability with China is a massive security risk and is basically bought into the idea that the US has to maintain a massive military edge to be able to deliver a devastating first strike. That means that she’ll talk about cost savings but push aggressively for yet further defense spending increases since there’s simply no other way to maintain that type of edge against a competitor like China. In practical terms, both democrats and republicans are already sold on Trump’s general line that China is the biggest competitor and challenge the United States faces. From trade to tech to military affairs, that train has left the station. Russia is increasingly an afterthought, a domestic political football that’s used to fight the last political war at home in order to secure budgets for the future one. Its ties to Beijing are going to be hurled about to death in Washington, especially since Russia’s now lost influence in European capitals because of energy market policies and trends, natural gas prices, green new deals, the Navalny poisoning, and the declining costs of taking a tougher line. If Biden intends to fix trans-Atlantic ties — not something I believe is truly achievable given divergent interests — then Germany’s slight shift on Russia is going to matter a great deal.

Biden does not have an actual foreign policy identity as a candidate beyond the platitudes of bringing us back to yesteryear and restoring American leadership. He does have a base understanding that climate change requires a full blown international effort and, in pursuing progress on that front, will end up undermining Russian national interests. Similarly, any commitment to values in foreign policy is likely to be reflected in attempts to use what many policymakers will see as growing US leverage to push for preferable outcomes. It’s better to see Biden as a sort of obverse mirror to Putin in this policy area: no one can actually pin anything on him and thus everyone projects everything they prefer onto him.

For this cycle, he’s become the face of normality despite the bevy of indicators that normality can’t be restored and COVID is changing the game for good. Endless commitments to stay in Afghanistan are already now being messaged on the basis of protecting women’s rights. That same rhetoric is going to be picked up, amplified, exploited by his team to justify their own policy preferences. It’s hard to imagine that they won’t push for more in Syria or Libya or else demand a more visible role for US diplomacy in Ukraine, Belarus, Nagorno-Karabakh, and Central Asia. The last one will become particularly more salient the more that US policymakers frame the region in terms of China. Any talk of him being more measured on sanctions is, frankly, irrelevant. Most targets have already been hit. Investors, markets, and the Kremlin can’t rest easy about the ruble, reputational risks, and the like even with a saner sanctions approach in Washington.

Anyone expecting things to get better is doing so on the basis that a president alone can actually alter the course of US foreign policy. Trump has shown us that this is, in fact, not true. Congress, public opinion, advisors, other nations’ policies all get a vote. A Biden presidency is ultimately about continuity disguised as change on most policy areas in order to secure big policy wins on a few that matter a great deal like climate change, economic recovery, and healthcare. Expanding the National Security Council tends to default towards privileging the Washington status quo as lobbies and friends push their favorites into positions of power and authority. There’s only so much bandwidth a White House has. When it runs out, other interests and actors pounce. Even with stability, Russia’s bound to lose out.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).