Top of the Pops

It is, alas, paywalled but it’s leaked that the EU is now considering only applying regulatory restrictions on methane emissions for gas producers in Europe by 2025, a concession to Equinor, Gazprom, and SOCAR in particular given attempts to apply territorial mandates within the EU onto firms exporting into the EU. That suggests a longer runway and, frankly, a regulatory approach not radically different from what you see in the US at the state level building off of EPA requirements. Everyone’s an environmentalist till they see the heating and electricity bills (and lobbyist cash).

What's going on?

Rosatom’s dreams of being Russia’s supercomputer monopolist are in tatters for now, as the Ministry of Digital Development refuses to support the creation of such a monopoly after polling market participants who all gave Rosatom low marks. Though the company’s system “Logos” lacks an analog in Russia and is already used by the firm, the IT sector recognizes the danger of centralizing power over the relevant tech in one firm. But unless other firms are able to invest into their own systems, the built in legal preference to allow for a single source of tech procurement if there aren’t competing systems may eventually give Rosatom the upper hand.

Deputy Prime Minister has ordered MinEnergo to undergo a review of the adequacy of current capital expenditure plans to modernize the country’s thermal power plants and transition them all to combined cycle turbines. The review is to take place by November 1. Current rules effectively impose limits on Capex for new turbines by fixing costs where companies have requested that prices be indexed in order to better align them with the specific installation.

Russia saw a record 13,868 new cases of COVID-19 yesterday. The underlying trends are clear and there is, as of yet, no clear government policy or plan to react.

Green = recoveries (new cases) Black = deaths (new cases)

But it’s important to contextualize the clear rise in cases against earlier this year. H/T to Tatiana Evdokimova:

United Russia deputy Vyacheslav Lysakov is being run out of the party and not going to be on the ballot as a candidate in next year’s elections because of his critical comments regarding politics and his colleagues on his personal Telegram channel. Lysakov is the first deputy chairman for the committee on legislation. By no means an earthquake politically, it’s indicative of a growing problem for the Kremlin: systemic political actors can make use of social media and messaging services to build a popular base of support, even if it’s of limited use.

Check my (In)flow

China’s driving a small bit of bullish sentiment when it comes to oil, commodities markets, and global recovery. The question, as always, is what exactly is going on? Good news for one country is often bad news for others when you have mass confusion and disorder over economic recovery plans. But it’s a big deal that the RMB has strengthened (and an important test of whether the ruble bounces back with better commodity news, how much the COVID story domestically is playing a role, and how much the vague geopolitics angle actually matters). Capital inflows are as important as the current account surplus China has been running this year:

Total equity on Chinese exchanges has surged past $10 trillion for the first time in 5 years. The growing attractiveness of Chinese equities and debt markets for foreign investors has helped push the RMB to 6.74 on the USD. The People’s Bank of China is trying to prevent further rapid appreciation by removing risk reserve ratio requirements for traders speculating on exchange rates, effectively making it easier to short the RMB and strengthen the link between its exchange rate, market sentiment, and macroeconomic indicators. Capital inflows have been accompanied by a surprising rise in imports, including oil. Note that the following figures pulled from S&P in turn pulling Chinese customs data are all in millions of metric tons:

Crude imports rose, product imports fell and product exports fell more, which suggests that Chinese refiners are realizing better margins on the domestic market due to underlying demand. It’s probably not enough to push three-month forward contracts for Brent above $45 a barrel for long, if at all. What’s interesting, though, is that other commodities, including copper and iron have seen import increases. Here’s a good snapshot of the overall trade current account from Brad Setser:

The question then is what happens to those commodity imports? If its minerals, metals, and electronic components that are going to exporting industries, what we’re really seeing is a surge of spending with the aim of meeting foreign demand. The question is then where the money’s actually flowing, and whether it can sustain itself since domestic consumption is still not recovering as fast as production. Retail sales were only up 0.5% year-on-year for August, and online sales growth has declined every month since June. This caught my eye a few days ago:

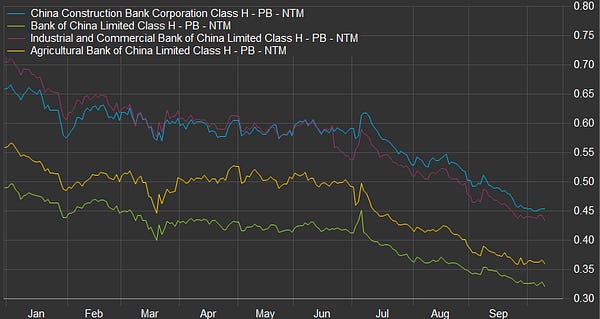

High Price-Book ratios tend to signal that investors are bullish on a company’s future earnings performance from its assets on the books whereas a low ratio tends to mean that a company’s price is backed up by tangible assets (though both can signal something is fundamentally wrong with a company). There are a lot of other factors that come into play, but it’s interesting to note that the downward pressure on Chinese banks’ p/b ratios aligns with an increase in commodity exports, since in the past, Chinese banks have been known to hold tangible assets in the form of orders of a commodity as collateral for loans. In effect, we could be seeing excess consumption to support the financial sector at the same time as consumer demand has picked up a bit. Clearly construction is taking place, new inflows of capital are coming, and more. Those accounts for much more of it on the whole. But if commodity imports are converted into exports, the question is who’s buying:

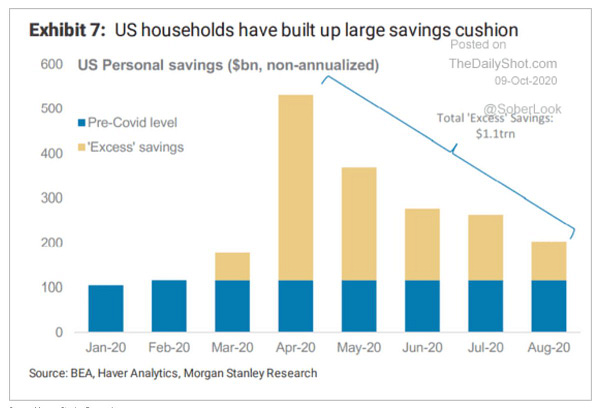

US demand is about to nosedive as people run out of money thanks to the stimulus talks getting scuttled and the EU is still not stimulating demand at adequate levels. Either way, Russia’s in for a bumpy ride if it’s betting big on China saving the day. Oil and gas revenues are basically at 2004 levels for the year. A stronger RMB should help lift oil prices in the shorter-term, but don’t expect it to stick.

Made ya Lukoil

Yesterday, Lukoil announced that it was cutting its investment program by 450-500 billion rubles ($34.7-38.5 billion) and moving a large part of its central office staff into regional offices (presumably to save on Moscow rent and some salary adjustments). However, the company left its projects in Iraq out of the cuts. Lower production costs make investments in Iraq far more attractive. The question, however, is what Lukoil expects in terms of oil prices since, unlike Rosneft, it operates with predictable financial discipline, prioritizes stable reserve management over growth at all costs, and maintains the lowest tax burden of any Russian oil major. The IEA is now setting a longer-term price equilibrium around $70 a barrel after the current market chaos subsides. But it’s important to check that against inflation terms (even if with a minor adjustment). Assuming a real price of $70 a barrel by 2025, an end year price in 2020 of about $45 a barrel, and annual inflation returning to an average close to 2% for the next 5 years, the real price of $45 a barrel is almost $50 a barrel come 2025. So a swing towards $70, while more bullish than I’d probably wager, isn’t actually that large an increase. They’re probably assuming the US shale is dead in the water to pick up the slack.

The IEA’s demand scenario is more interesting to consider against the price and Russian firms’ plans:

Their status quo trajectory pre-crisis still showed lower aggregate oil demand than OPEC’s COVID-adjusted forecast and a delayed recovery scenario, what I expect is likely at the current rate given global imbalances, shows growth is over. But it’s essential to note that the IEA points out that SUVs account for over 40% of global car sales at the moment against 2.5% for electric vehicles. There’s plenty of room to run for road fuel demand, the question is how much spending power will people actually have, how efficient will engines be, and what impact will public spending on infrastructure have on future road vehicle use and demand. Large infrastructure plans can increase aggregate oil demand, as the stated policies scenario reflects (and is something important to remember since state policies are very, very bad at predicting individual behavioral responses to something like COVID).

To that end, the IMF has come out guns blazing for public investment:

Estimates from the Higher School of Economics in Moscow show that every ruble spent on infrastructure yields a 7x return on investment for national GDP, which speaks to just how underdeveloped the country’s infrastructure is in relation to its size and wealth. This again ties back to the huge percentage of GDP wrapped up in energy subsidies. Russia has an opportunity to massively improve its energy efficiency, and thus reduce the financial burden of subsidizing the oil & gas sector. A sketchy demand outlook, however, should have businesspeople thinking more creatively than just how to make money selling the same stuff in a slightly different way.

Last week, Lukoil announced it would construct a solar plant in the Krasnodar region come 2022. Small in size, the project still builds on past intentions to build solar capacity in Kazakhstan from 2018 and earlier forays into the sector purchasing wind farms and dipping a toe into green energy before the other Russian majors. In this DW roundup on how Rosneft and Gazprom are skeptical that Big Oil can pivot to green energy and want to find ways to profit off of what they see as Europe’s foolishness, Lukoil was notably missing. The company already powers its own refineries using hydropower and solar where possible. Though renewables account for a tiny fraction of the national grid’s generating capacity and company’s portfolio, Lukoil is unique among the Russian majors for its willingness to at least entertain renewable energy plays going back to 2010.

The current fights over how to best modernize Russia’s power grid are going to dictate a lot of policy terms companies need clarity on for project planning purposes. The Market Council wants to promote green energy, but fears that the current slate of policy proposals from MinEnergo impose escalating costs on companies failing to localize production and export production, which effectively stunts innovation and smaller firms while discouraging larger ones from taking risks. Historically, the “oil men” of Russia have been their own distinct interest group and power bloc. If Lukoil wants to survive, and thrive where Rosneft and state-owned competitors refuse to, it probably needs to start thinking hard about how to get in on the modernization of the country’s power grid and to shift its own position within the country’s political landscape. With the market being what it is and US skepticism of Russian deals abroad, Lukoil is never going to be Chevron or the like. But it may pay to start thinking more like a NextraEnergy and other diversified energy companies to build up its bottom line. Even $70 a barrel by 2025 won’t save it if demand plateaus quickly and Moscow tries to increase its tax burden. Both seem likely at the moment.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).