Top of the Pops

The Central Bank opted to surprise everyone by hiking the key rate from 4.25% to 4.5%, the first rate increase since December 2018. It marks a decisive shift in approach from the Bank of Russia for the rest of the year, moving from easy monetary policy to an officially neutral stance that, in practice, suggests a great deal more hawkishness to come as various broken markets, sector-specific imbalances, and the current commodity cycle will sustain higher inflation rates across the economy. What’s more interesting to see is the oil market reaction to rising yields on US Treasuries. Brent oil futures were down 3.6% and WTI futures in New York down 4% as US T-bill yields rise. You’d think that oil would perform well since rising inflation expectations herald a stronger economy and, in this case, oil futures would normally act as an inflationary hedge by rising in price in response. It’s not happening. Spot prices have also taken a big step back as new demand concerns have arisen with the bull euphoria fading in the sober light of the dawn of global recovery:

The market’s no longer buoyed by good economic news, one could argue. Investors and analysts seem intent on convincing themselves the Fed is going to hike rates sooner rather than later to cut off inflationary pressures, despite the fact that the relative level of inflation in the US economy remains quite low by historical standards. The problem, at least for Russia, is how one understands inflation to function in the economy. Robin Brooks has been warning that the current spike in yields in the US is forcing emerging markets to hike rates faster to quash inflationary pressures, weakening their recoveries and recreating aspects of the 2013 taper tantrum when the Fed signaled it was willing to start unwinding quantitative easing program:

But in Russia’s case, the inflationary pressure isn’t evenly distributed — it’s mostly food and housing that are the problem — and in both cases, there are a series of domestic policy instruments and interventions that have made things considerably worse alongside a systemic lack of capacity utilization for productive output. In other words, Russia’s inflationary pressures are more like stagflation alongside a shrinking workforce and diminished current account surplus than the same problems happening elsewhere which, in many cases I wager, also reflect the trouble handling the unevenly distributed effects of the virus on production and demand. We should look to parallels for the obvious reason that what’s good for the US is not good for developing economies without more coordination from China and Europe. But there are hard limits on how far to take that comparison. Russia’s more in trouble from its continued macroeconomic dependence on oil without any growth from price increases than anything else.

What’s going on?

Savings rates from 4Q 2020 were higher than in 2Q during the worst of the pandemic, with 30% of Russians per Rabota.ru polling now saying they’re putting some of their earnings into savings vs. 28% who said they were a year ago. 64% last year said they wanted to start saving money this year. 21% of respondents are saving 30% of their earnings, 6% are saving 30-50%, and 3% are saving more than 50%. The biggest driver of this savings burst are ‘rainy day’ funds for when things go pear shaped. Data from Rossgostrakh Zhizn’ and Otkrytiye show that the share of Russians with savings rose last year fro 36% to 40%. The way the crisis has been handled has scared consumers into being thriftier, and that thrift will inevitably weaken consumer demand this year to the detriment of growth and state revenues. The state’s policy failure and gamble on vaccines is evident from the quarterly net savings data showing net savings in trillions of rubles:

Since 1Q in 2019 when the economy had already begun to slow down again, Russian households have saved a net additional 4.4 trillion rubles ($59.4 billion). That’s equivalent to about 3.4-3.5% of GDP coming into 2021 (adjusting downward slightly off of the $1.7 trillion pre-COVID figure). It’s a huge block of consumption taken out of the economy because of the requisite caution necessary when real incomes keep falling, doubling the blow to the consumer economy and not correlating to any significant increase in investment despite the availability of domestic savings since demand is absent. If households are saving more at the same time the state is trying to spend less on top of renewed doubts about the strength of oil market recovery, the recovery will drag out even longer.

Business confidence levels are showing positive signs of recovery for 1Q (though from a very low base over the course of 2020). But the signs of optimism aren’t supported by rising earnings yet — only 11% of companies polled saw an improvement in earnings for February vs. 53% who said their earnings situation got worse. Only a third expect earnings improvement in March. So what’s the deal? The following measure is like PMI surveys. 50 is the baseline so any value below is net contraction and value above is growth.

Dark Blue = services Red = goods Light Blue = production

Given that these surveys reflect dynamic changes month on month, the base effect is definitely most important to consider (though imperfect given the type of measurement this is). Overall, the best I can gather is that the decline in COVID cases, though it’s plateaued recently, has fostered more security among businesses that once spring is in full swing, there’ll be enough business to get by. What’s less clear is if businesses expect another social spending package to prop up consumption, but the opacity of the policymaking process in Moscow makes it a stretch to assume so in my view. 19% of SME respondents said they’re planning to hire more, only 10% had in the last month. The best explanation in my view is the extension of some support measures alongside the conscious effort to push COVID out as a major story or concern, nothing approaching sustained demand recovery as Russians are still tightening their belts.

2020 operating results show that 31% of Gazprom Neft’s oil production is now located in the Arctic, led by its field at Novoportovskoye on the Yamal peninsula. The expectation is that this will only grow in time. As of now, Gazprom Neft is really the only oil firm to successfully pivot to the Arctic onshore for all future production needs while Rosneft gets going with Vostok Oil. What’s more odd is that as of late last year, the company was still pursuing tax breaks to develop its offshore Arctic finds and launching tenders for further exploration and preparatory activities for a long-term investment plan (2030 was kicked around as reference date for new production). Lukoil CEO Vagit Alekperov thinks that the Arctic shelf remains the only oil in Russia it’s just not worth developing, but Gazprom Neft’s push is as much political as economic. Winning those tax breaks makes it a more important player to offset brownfield declines in West Siberia, now a much bigger problem for Rosneft’s long-term supply contracts with China than any other leading oil firm — I set aside Surgutneftegaz since it’s basically a money pile for unnamed individuals. The next thing to watch will be the National Welfare Fund spending plans. It’s reported that Putin wants the government to draw up a list of projects to be funded at a rate of about 180-200 billion rubles ($2.43-2.7 billion) a month through the back end of the year, and no doubt the ministries and business lobbies are lining up for a piece. After a year on the backburner, there’s a new push to update Arctic development plans. Worth following up in a month or two.

In a blow to German Gref and Sber, a Rostec subsidiary was handed the state contract to manufacture and distribute vaccines for the regions that a Sber subsidiary had previously held. The new subsidiary is called Natsimbio. Sber subsidiary Immunontechnologiya was registered as the sole provider back in May long before the vaccination campaign got underway, part of Sber’s pivot last year to shake up its long-running business model as a ‘bank’ and start to expand as fast as possible into tech and related services — the vaccination campaign would have been a great piece of business PR. Per the Vedomosti reporting, Sber’s firm met the contractual obligations negotiated with the government in December at the start of the mass vaccination campaign as of March 15 before the hand-off. The government’s not said a word to the press about why they changed supplier, and to the best of my knowledge, it’s basically a game of musical chairs concerning vaccine rents. Part of the switch appears to be that Immunotechnologiya didn’t want to absorb higher profit losses when the end cost of Sputnik-V was halved at the end fo February by government action — the initial supply contract appears to have stipulated an agreement to work on a fixed cost basis. So Sber might have gladly handed the contract off to Rostec knowing it was bad business. It’s a massive risk for logistical disruptions and a stupid one from what I can tell, but it seems that Moscow is content to force Rostec to swallow the profit losses by producing under price of production for the national vaccine campaign. Economic mobilization politics continue.

COVID Status Report

9,699 new cases were recorded alongside 443 deaths. With rates falling but settling into their plateau, Moscow is back in the top 10 worst hit areas using cases per 1,000 people as the metric:

Karelia and St. Petersburg still top it off. Barring a massive change in vaccination rates — less likely for the next few weeks given the change in producer for regional supplies reported on today — my concern is that these rates will linger for months with the actual case levels underreported by people staying at home and not getting tested. Rather embarrassingly, Mexican authorities seized a batch of 5,775 doses of Sputnik-V vaccines that were actually fake. The RDIF immediately sprang to action to clarify that the shipment had nothing to do with the original vaccine. The bottles apparently had spelling errors in Russian and I feel confident in saying it was a local scheme. What I wonder is what impact these types of schemes will have in countries desperate for supplies accepting these deliveries? The Philippines just approved it for use. With things getting worse in Europe, Germany is now signaling a willingness to sign for deliveries. Pakistan is reportedly buying doses of Sputnik-V at $22.50 a dose. Funny, AstraZeneca doses for South Africa and other upper-middle income countries were negotiated in Europe to cost $5.25 a dose. Russian largesse is a myth. They’re squeezing desperate countries for money. The issue for the West is the lack of production and refusal to share technology with countries that don’t protect intellectual property rights at the level pharmaceutical firms want. Both are own goals in the longer run.

Observe and Report

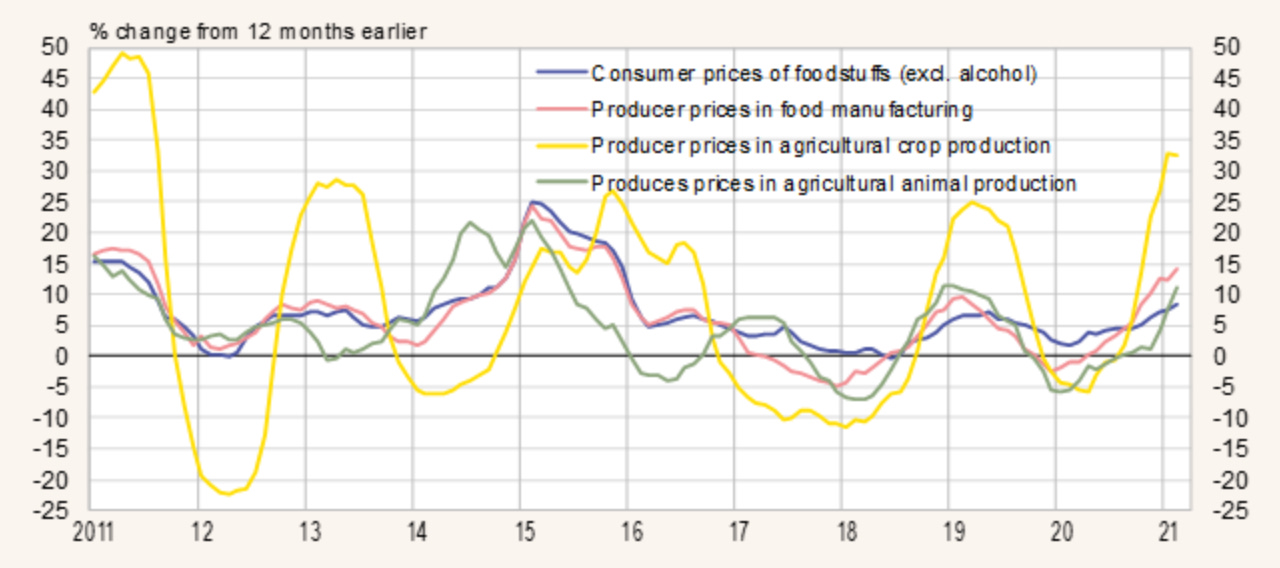

The expansion of price monitoring for crucial goods now covers 3/4 of the consumer price basket as officials keep panicking about inflation levels. Yet we can see from trends in recent years the new spike is bad, but much worse in relation to rising production costs. It really does come down to falling incomes and the design of the aid and stimulus support from the state amplifying these effects since additional deficit spending didn’t create more food demand or directly increase inflation, it simply allowed people to buy food as they normally would:

So there’s obviously more inflation to come based on the producer price inflation dynamic. I don’t want to spend yet another column hammering out inflation economics, though. The quest to observe and manage price level changes for the consumer price basket reflects a broader trend across Russian politics and economic policy. Data, surveillance, the ability to modulate policy responses quickly and reactively as needed by harnessing better “local knowledge” is the default approach Mishustin is pushing forward to save the Russian economy and Putin’s political system. None of these are new, but they’ve now infiltrated the economic policymaking machine manned by technocrats that historically Putin has only leaned on at key moments, such as the tail end of the commodity boom in the 2000s that was generating much higher levels of food price inflation as I noted in this piece for Riddle on price controls. The expansion of socioeconomic surveillance has become one of the most important parts of the regime’s current wave of capacity building to handle the years ahead.

Boris Titov is pushing for business reforms and now using the 100th anniversary of the shift to a tax regime in place of a physical procurement regime that inaugurated the New Economic Policy (NEP) years for PR via the Parliamentary Gazette. He criticizes the current approach as a “turtle strategy” that ought to be replaced with a sprint towards growth. He also noted pointedly that to secure growth, the state shouldn’t “increase the profitability of state monopolies and banks, but increase investment.” The consensus view put forth by the business ombudsman is clearly about investment needs, but unlike Putin, he doesn’t couch it with a demand from the state that business act. Yet investments under a system where surveillance matters more and more can’t operate by the same logic that Titov or other ‘normal’ businesspeople intend. It’s nothing new that Putin’s political system uses companies to ensure outcomes such as employment levels or social spending across the regions, but the direct control of price levels means that private businesses with significant scale and reach that produce socially significant goods aren’t just facing the more traditional ‘supply’ side manipulation such as increasing employment at the expense of efficiency gains for political benefit, but now face a state apparatus that can more freely demand they produce below cost or otherwise swallow profit losses. The successful reforms to the Tax Service end up becoming a sort of ‘tip of the spear’ for the resurrection of the automation lobby of Soviet economists hoping to optimize the centrally planned economy by developing a cybernetic, homeostatic regulatory instrument and mechanism to balance sectoral resource needs and consumer demand in a rough equilibrium.

But in place of directly linking physical resource allocation and investment/spending budgets to enterprises, Putinomics was historically more focused on capital allocation to firms that own the commanding heights of a sector, firms of local or regional political value, or else producers of key goods like foodstuffs. The price control element, though it appeared in the past, had never been legally incorporated into this system by the state before. Now that it’s appeared, the relative flexibility of the system to absorb the inevitable disequilibria that openly trading, mixed market systems create is weakened. The only way it can conceivably work in the longer run is to deepen the data collection capabilities of state agencies and ministries now being centralized via Mishustin’s coordination center to react as needed to social, economic, and political disruptions or shocks creating new disequilibria. Whereas Soviet economists frequently struggled to cobble together what exactly was happening from firm to sector to national level using budget sources, anecdotes, inferences from adjacent statistics and sectors, and more, today’s policymakers of Late Putinism need a more refined set of tools to calibrate policy responses. One of the biggest problems for the state and business is that the poor quality of its own statistics, constantly revised by Rosstat in particular but other agencies and organs as well, undermines strategic business planning and budget allocation. Mishustin’s optimization drive seems destined to focus on this issue.

The adhocratic mix of planned controls and market mechanisms is a nightmare for the emergent approach. The coal industry offers a useful example. Long-term supply contracts were signed to maintain export levels and production levels without any consideration for what external demand actually looks like and lock in the use of infrastructure inevitably owned by an interested party. But when those contracts end, the mines are all threatened with closure and stranded assets in regions crucial to the regime’s turnout strategy. Next thing you know, you have figures like Igor Sechin who have business interests in coal arguing in defense of market mechanisms meant to undermine the prescription that certain ports be used via these contracts to better let market prices affect where goods are delivered under the expectation that there be enough rail capacity to export rising volumes of coal on a world market shifting to other energy sources. But Russian Railways’ own investment plans for capacity expansions on the Trans-Siberian and Baikal-Amur Mainlines relies on capacity projections that are themselves linked to these long-term contracts, all the more salient since the rise in trans-eurasian rail cargo volumes from China to Europe hasn’t done much to offset any losses and coal is by far the worst source of revenues for RZhD relative to its massive share of freight capacity taken up on the rail network. The use of market mechanisms in this case is likely to end up overburdening RZhD’s capacity to haul coal in the Far East without providing enough offsetting revenues for investment or redirecting shipments to ease congestion. Everyone loses in terms of the gross wealth created and distributed, but owners, managers, and statists with interests benefit.

So bursts of inflation are often caused by a lack of capacity in one sector and over-capacity in another result from personal tiffs, sectoral rivalries, and the refusal on the part of the regime to countenance even modest increases in regional unemployment that could be absorbed and redirected with a more expansive investment program. The result is that in order to keep a lid on these problems to prevent unrest in the future, the state needs to have immediate data on transactions, on claimed losses, on costs and end prices in hand to react. There’s a massive effort on from the statistical reporting arms of the economic ministries now to gather all possible data on SMEs from 2020 by April 1 to make sure support programs are working. These aren’t problems entirely unique to Russia, but they are made far worse through the frequently distorted structure of economic institutions and incentives that end up affecting what might, for lack of a better term, be called ‘pricing politics.’ The rise of businesspeople entering Russia’s systemic political parties and governing at the local level can add to these distortions as noted in David Szakonyi’s work in Politics for Profit. More money gets spent on roads and business infrastructure wastefully, contracts are awarded on less competitive bases, and social capital and consumer spending power suffers without any federal impulse to help, eventually undermining the businesses these leaders ostensibly are inclined to help because of these mismatches between local/regional business interests, national macroeconomic orthodoxy, and business and state capture at the sector or regional level. The only ‘solution’ insofar as it is one is to surveil all this activity more closely to be able to use state sanction, coercion, price-fixing, or arrest to alter it when needed. And then the circus starts again as the next person has to be paid off. It’s a proper Gogolian mess.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).