This is us

Post-pandemic growth isn't just a Russia problem. It's global.

Top of the Pops

A reminder that this will be the last week on Substack for OGs and OFZs. My reasoning and what to expect for pricing and paywalling going forward are broken down here. I’ll begin the move to Ghost at week’s end and will aim to be up and running again around August 16 after a much needed honeymoon in Chicago. If you want to get your first 3 months’ subscription discounted at Ghost, subscribe sometime this week for the monthly plan or else the annual plan, which will rollover whenever it’s renewed — I’m still working out the logistics for how those rollovers work but will provide all of the relevant promo codes, probably via Substack or else personal email (reach me at nbtrickett@gmail.com) before launching on Ghost.

A good New York Times piece on the health costs and related effects of rising temperatures offers some important food for thought on Russia and Eurasia, generally left out of the statistical overviews in these write-ups. How will medical services handle heat stress for elderly Russians as extreme weather becomes more common and what stress effects in Russia, and globally, will come about as air conditioning and climate control in homes, workplaces, and offices becomes more important?

One study by Randazzo, De Cian, and Mistry found that households using air conditioning consume 35-42% more electricity. In late June, Russia achieved a post-Soviet record for energy consumption as a result of heatwaves — 122.68 gigawatts, beating out the 2019 record by 2.3 gigawatts. As of today, power prices at auction have reached historic highs because of the heat. Rising temperatures are triggering more demand and causing price inflation for electricity. Here’s the price in rubles per megawatt-hour:

Modernizing the power grid is an urgent priority to head off more inflation and adapt as fast as possible.

What’s going on?

For the first time since September 2020, Rosstat registered consumer price deflation of 0.01%. Belousov promises and Rosstat delivers. To be fair, the Central Bank has noted that inflationary forces have peaked and food prices levels had ticked down based on commodities in recent weeks. Food price deflation came a few weeks earlier this year than usual based on annual patterns, something to ponder for both climate change and attempts to impose price controls while producer prices have climbed significantly:

Title: Dynamics of observed and expected inflation, % in annual terms

Purple = observed inflation Red = expected inflation

Surveys show much higher levels of inflation than the official data suggests — consumers thought it was at 14.9%, not 6.5% in June. And 1 in 6 respondents from the CBR’s survey think prices have risen 30% or more in the last year. We still don’t know how the high producer costs filter into consumer costs since there’s always a lag there. It’s good news that price increases have slowed. The question is how much of that is deflationary, how much of that is a matter of food production cycles, and how much of that is distributed to lower income Russians vs. higher income Russians.

Tajikistan has mobilized reserves including anyone up to the age of 55 in response to the collapse of talks between Kabul authorities and the Taliban to negotiate a ceasefire for Eid al-Adha and drills start today. Russian foreign minister Sergei Lavrov elegantly parsed words by saying Russia isn’t planning any strikes into Afghanistan, a far cry from a categorical denial that the Russian military will do so if conditions warrant it. Saying “you’re confusing us with the Americans” cause we aren’t planning anything is a decent way of buying space to respond to a border incident if need be. A few days ago, 340 ethnic Kyrgyz who fled Afghanistan into Tajikistan were returned. General Mark Milley, US chairman of the Joint Chiefs of Staff, admits that a total Taliban takeover of Afghanistan is possible, but we shouldn’t read into that yet the expectation it will come to pass. Milley made a point of telling the press that the Taliban are doing what they can to stoke the narrative of inevitable victory. They get strategic communications. The end isn’t yet written, and it’s quite possible a longer-term unstable equilibrium emerges over the next few months. Lavrov’s visit to Tashkent also included a reiteration of Russia’s interest taking part in the TAPI pipeline, a project that’s been killed countless times given the difficulties ensuring Afghan transit to link Turkmenistan to Pakistan and then convince India that it’s ok to allow Pakistan to control import infrastructure. 1,500 Russian and Uzbek troops are carrying out drills from July 30 to August 10 in Surxondaryo Region close to Termez. This is all contingency planning now and maintaining as many options as possible without signaling a clear commitment to any intervention into the civil war in Afghanistan.

Efforts are now underway to reexamine and rewrite the Belarusian constitution to line up a national referendum next year akin to what Putin and the Kremlin’s technologists did during late June and the start of July last year. The aim would be to extend his current 5-year term from the 2018 elections all the way to 2033, avoiding any potentially embarrassing campaign headaches or opposition crackdown during an electoral season and giving him free reign to plan an exit if he wants to step down at some point. The situation should draw attention to the political economy of his rule in the years ahead given the tandem stagnation of the Belarusian and Russian economies. For context on the scale of transfers from Russia to Belarus, the IMF estimates that Belarus received a combined $106 billion between 2005 and 2015. The $500 million dollar tranche Moscow offered Minsk early in the summer wasn’t intended to setup investment. It was crucial to help Belarusian firms and the Belarusian state pay off debts owed to Russian companies. We can see in the year-on-year 1Q balance of payments data taken at a high level — I broke out Russia, Ukraine, and then the rest — what the economic dynamic looks like (LHS is US$ blns):

Russia is basically the only significant source of foreign borrowing and that borrowing then helps finance the export surplus with CIS partners and European buyers. Belarus is a net creditor if you subtract the Russia data from the rest. The same maladies driving Russia into stagnation affect Belarus, with the exception that transfers have allowed the state to maintain, on paper at least, a better real wage environment and proportionally better benefits. Locking in Lukashenko’s rule will deepen this dynamic over time, thus raising the stakes for Moscow.

Exports of agricultural equipment are up 35% to the princely total of 10 billion rubles ($135.6 million), primarily to CIS states followed by the EU. Bad news is that export growth has slowed thanks to a strengthened ruble and rising input prices. Shipments of reapers are up 94%, plows are up 85%, balers are up 72%, sprayers are up 71%, agricultural tractors are up 48%, and harrows are up 37%. Rosspetsmash chalks up market dynamics to grain prices and the effectiveness of state support. The story caught my eye because of the potential impact of supply chain disruptions, pressure for supply chain resiliency during COVID, and the issue of domestic productive capacity. That exports are so low isn’t an indictment of the effectiveness of state industrial policies — domestic demand has risen dramatically for higher-end equipment over the last decade. Just look at the energy-intensity of production from the Rosstat data. But you run into other issues like branding, the durability of longer-term producer-customer relationships, and the challenge of getting your foot in the door into supply chains for repair and maintenance. It’s good to see that the sector has managed to start yielding export growth for value-added outputs that aren’t just commodities. However, the new price control regime that’s emerging domestically and efforts to create built in “inflation buffers” that automatically apply stabilizers via export duty hikes or shifts in subsidy support in relation to relative price levels ends up affecting exports. I don’t have any evidence that it’s the case right now, but I suspect that some increases in exports now or in the future can come about as a result of idiosyncratic declines in demand at the regional level within Russia due to dry weather and growing seasons, thus pushing firms to find buyers abroad whenever there’s slack. CIS importers are generally facing high(er) inflation levels right now and need cheap plant to maintain operations. That’s great for Russian industries, less good for CIS states who are trying to break from economic dependence on commodities unless Russian producers invest more into foreign production. Of course, these exports may also end up taking a hit due to climate change down the road.

COVID Status Report

24,471 new cases and 796 deaths were recorded in the last day. Regional cases finally dropped but were offset by a rise in Moscow. The biggest announcement comes from Putin — he wants vaccinations sped up so that 80% of Russians are vaccinated by November 1. Health minister Mikhail Murashko has noted the infection rates have dropped, but his own figures cite 890,000 Russians currently infected — that’s twice the level reported by the Operational Staff data. At the same time, the ministry dismissed the 29 million infections figure as “fantasy.” If that’s the case, there’s no coherent cause to believe herd immunity can be achieved without vaccinations, so. you get Putin’s call to mobilize. The dissonance between the Operational Staff and MinZdrav suggests stunning degree of internal incoherence, and also highlights how the narratives the regime has deployed at various points to please the public fold in on themselves. Older assertions that collective immunity could be achieved with infections imply cases are much higher than reported, but when cases reported rise, then you highlight the failure of vaccinations and so on. But apparently 17 regions are close to reaching 60% collective immunity according to an interview given by Tatiana Golikova. The significance of that figure is unclear, but hey, it’s happening. Oh, and even better, Brazil’s “gamma” variant has now been found in Russia. At least the caseload seems its still on a stagnant trajectory, even if total cases are twice as high as the Operational Staff wants you to believe.

The Fire This Time

We aren’t out of the woods yet from COVID by any stretch. Caseloads outside of developed markets with higher vaccine penetration rates continue to climb and we see new variants every other week, it feels like. Coming out of COVID, there are scores of as yet unanswered or else too infrequently asked questions about what global growth looks like that will shape a fair bit of the policy options Russia and other Eurasian states have available in the years to come. I don’t necessarily agree with his causal explanations, but I’m always happy to see Robin Brooks raising the point that emerging markets face a problem now similar, though not identical, to the taper tantrum crisis of 2013. His major point recently is the structural issue of emerging market growth and the link between monetary instability and attempts to stimulate domestic demand:

As we can see, growth has structurally declined since 2010 for emerging markets as the cumulative effects of European austerity, China’s domestic imbalances, unnecessary slack in the US economy, and political and monetary restraints on emerging markets’ economic policies took their tool. Russia’s in an even more fickle position since positive growth is still a function of commodity prices despite its efforts to diversify. US stimulus can drive growth in the year or 3 ahead if Biden actually pulls it off, but that’ll primarily result in US consumption lifting up foreign exporters and commodity demand rather than rebalancing. Rebalancing requires all of the world’s largest economies to take on the entrenched political coalitions that benefited from older development models we can visibly see no longer produce the same levels of growth. We tend to link these imbalances in an American or European context to deindustrialization and the financialization of economies, yet neither provide us particularly useful prisms for analysis when considering the global economy as a closed system:

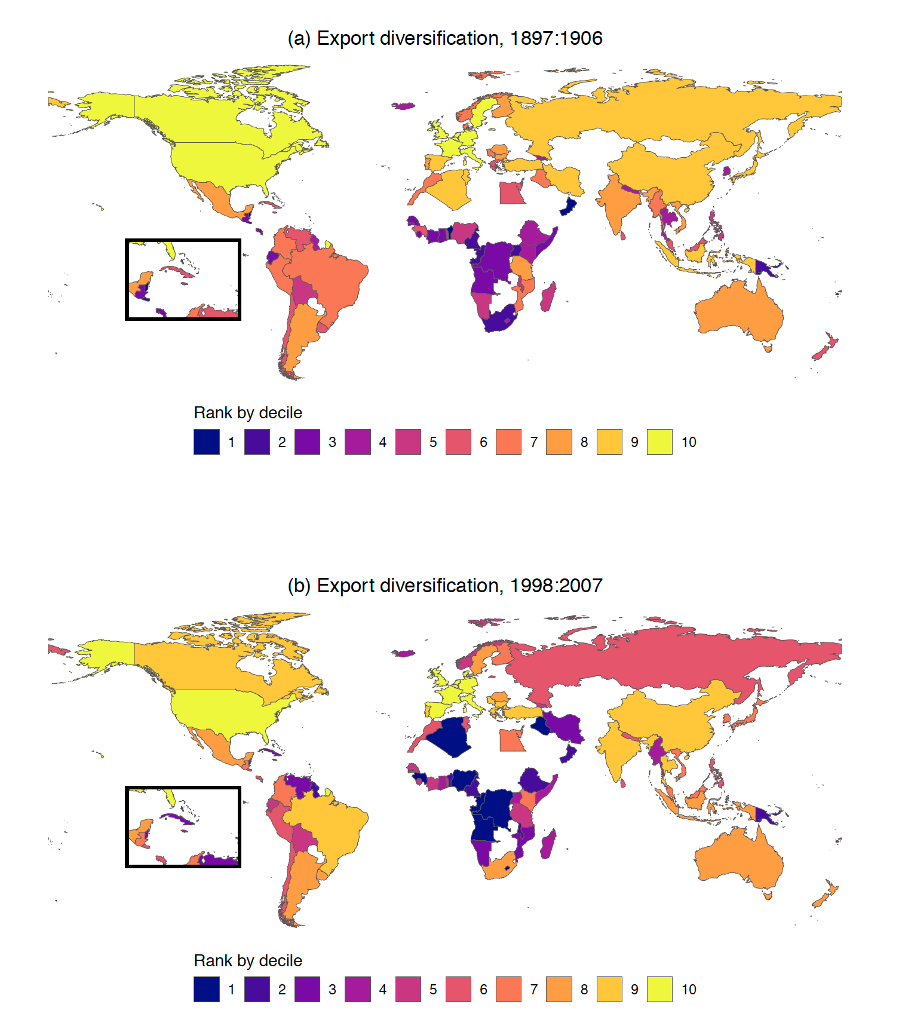

Deindustrialization and financialization are more about the changing geography of where things are made than the number of factories and factory jobs, though this will also change in the years ahead depending on advances in automation, protectionist policies aligning with the climate agenda, or else the potential for as yet unseen radical transformations of political economy as a result of conflict and climate catastrophe. Crucially, Russia and former Soviet states in Eurasia skipped out on the process entirely. Most endured some level of deindustrialization after the collapse of the USSR for a variety of reasons: the loss of planning within one market crushed demand and shattered supply chain stability, monetary pressures made commodity exports more attractive, institutions were rapidly deformed and reformed depending on which political interest groups were most powerful during the transition, and industries had never faced true import competition before or operated in countries with fully or partially liberalized capital accounts. The “lost 90s” from 1991-1998 wiped out crucial time to get involved in these processes even as western firms tried to open up capacity in Russia to serve Russian consumers, often making use of Soviet-era plant that had been privatized and repurposed rather than built anew. We can also see how long-term effects of specialization within the global economy tend to reinforce underlying specializations among less developed/developing economies. This from new work put out by Isabella Weber at al:

The global economy was in need of rebalancing pre-COVID, especially if large developmental gains are to be made at the global level. But COVID, like the last financial crisis, has reinforced divides and relative levels of specialization for states trying to manage foreign-currency debt burdens. Russia’s a peculiar case because the decisive shift in its underlying political economy was to ride the simplification of its economy in the 2000s to achieve political and monetary stability and sovereignty only to then flip a switch having joined the WTO in 2012 to utilize its commodity exports as a driver to finance import substitution for more advanced goods. Lots of developing economies have historically used forms of protectionism to climb the value ladder. None to my knowledge attempted to do so with an economy trapped in stagnation, not just lower growth, because of their own policy choices with a weakening domestic demand base and geopolitical pretensions to challenge the strongest structural power in the international system. All happy export-led success stories are similar, Russia’s failures are its own. But I think it’s important to contextualize its stagnation as part of a broader process in which the inequality between developed and developing states as well as domestically within both poses serious problems for commodity-export growth, problems that a green boom will alter considerably as demand growth for metals and minerals and goods rises to replace existing stock as often as to “grow” output capacity or consumption. Where does that leave emerging markets? In trouble unless more is done to help them expand domestic demand, something Russia’s fantastic at weakening in the furtherance of frequently short-sighted political goals.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).