There's no KPI in Team

Putin's latest decree is a recipe for political strife, just not on the streets

Top of the Pops

In response to the uproar over Navalny’s sentencing — and also a tactical move likely taking into account the opposition’s decision to call off further protests and focus organizing activity on the September elections — Putin signed a new decree that reframes the key performance indicators for regional governors and governments to include the polled public trust of regional authorities and the president. It’s a move that shoves the pressure to resolve the current decline in Putin’s ratings onto governors and the regions despite Moscow’s continual tightening of control over the purse strings. From what I can tell, it’s a gamble that seems likely to open the floodgates to a new wave of fiscal policy aimed at shutting people up. By making the regions’ explicitly liable to improve the image of the president with the public, Putin has effectively mandated that they come up with excuses to act instead of not act. From The Bell’s reporting, it looks like Sber head German Gref and Inter RAO’s Boris Kovalchuk are driving a “change and disrupt” approach with Mikhail Mishustin to advance the realization of national goals. The question remains how exactly those goals are possible without a fundamental shift in fiscal policy and macro orthodoxy since there isn’t enough private capital that can protect its investments at present to do the heavy-lifting without being crowded in through state spending.

Most interesting from the new developments under Mishustin is that his team explicitly worked out a plan referring to a “new social contract” with the intention of providing universal family benefits, but only to those who ‘need it’. Two birds, one stone. Try to drive up birth rates and marriages, you create a new social transfer underpinned by sound money and budgetary politics. It’s a massive fig leaf for having no intention of fixing the structural deflationary pressure on real incomes that isn’t resolved by significant nominal wage increases and any other number of associated problems from lack of investment. It’s also hilarious to say it’s universal and then means-test it. Seems like Mishustin’s copying Democrats in the US . . .

The other thing to follow with this shift in KPIs and explicit pressure on governors and regional governments to make Putin look good is how it’ll play out handling SOEs and the largest companies. Take Nornickel’s 148 billion ruble ($1.97 billion) fine for last year’s spill. The government has farmed out debt increases and a growing list of social spending needs to SOEs and large companies in an attempt to avoid putting any pressure on the budget, but these same firms have proven atrocious at responding to the public’s demands about ecological protections and, increasingly, the competitive pressures of accelerating decarbonization initiatives globally. Regional governments will have every incentive to make the companies look bad if things go wrong locally, particularly if they aren’t given adequate financial resources from the center. That’s only going to create yet more instances where corrupt practices and governance failures can be pointed out by organizers who remain persistent, especially ahead of the September elections. The system isn’t collapsing, but it’s moved on from eating its young to eating its middle managers.

What’s going on?

The energy sector’s Market Council is proposing a 600 billion ruble ($8 billion) support program for new waste burning facilities to be built by Rostec to be doled out and coordinated at the regional level. The proposal, however, would force Rostec to negotiate with each regional government individually over terms and it could end up costing the company 1.5 trillion rubles ($20 billion) in guaranteed wholesale energy sale earnings as a result. Rostec obviously hates the change in support mechanism, but is happy to take a guaranteed 100 billion rubles ($1.33 billion) annually in wholesale energy auctions for 15 years if the financing mechanism is changed. Basically, the current schema allows companies to set a long-term tariff rate charged to consumers for new projects with agreements the company provide a certain amount of power guaranteed to be bought by consumers on the market at a fixed, (slightly) elevated price above whatever the spot price for power is on a given day. Energy companies then buy the distributers who act as the midstream between power generation and the end user to compensate for losses depending on the financial conditions of the project. If this sounds confusing and stupid, it is because it is, in fact, confusing and stupid. Setting longer-term agreements for power is normal — it’s how renewables hop to the front of the queue for power sales, despite frequently not setting the marginal price wholesale. But here, the web of state subsidies, price agreements and caps, and conflicts of interest fly so thick and fast that the sector ends up being underinvested to everyone’s loss.

Prices on food commodities globally have reached six-year highs, reminiscent somewhat of the spike in food costs that hit in 2007-8 and 2010-20113 though not as extreme overall (yet). January saw a bit of a surge in prices:

Title: Dynamics of food prices (2014-2016 = 100)

Yellow = meat Red = wheat Seafoam = sugar Black = general index

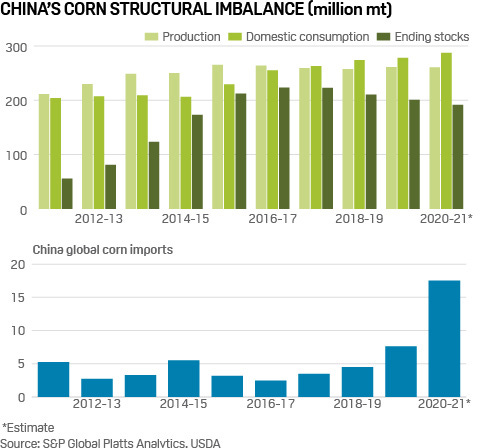

The obvious distinction here for Russian consumers is the oil price. During the 2007-8 rally, Brent crude briefly hit $140+ a barrel mid-summer before financial contagion struck in September and in 2011-2013, oil prices were consistently around $110 a barrel. There’s no equivalent external impulse supporting wages through windfall budget revenues. Corn prices notably trended upwards because China picked up the pace of purchases from the US — over 11 million tons bought but undelivered for 2021 as of January 14 vs. a measly 60,000 tons ordered for 2019-2020 — responding to a huge domestic imbalance:

As we can see, the government’s price measures are having very little effect so long as these goods are either still imported in quantities significant enough to have to manage price differentials or exported with the same problem. Turns out that it’s really expensive to try to have your cake and eat it too because, as even the Soviet Union learned the hard way, the inflationary pressures from the points at which you depend on exports or imports can’t be contained through central planning measures so long as exports are crucial to revenues and macroeconomic stability.

MinEkonomiki held its first expert council/working group with leading firms — think Rosatom, Sber, Rusal, Alrosa, and Gazprom Neft (but not Lukoil or Rosneft) — about the impact and risks of carbon adjustment and carbon taxes from the EU. Fosagro general director Andrei Guriev noted that the introduction of a carbon taxation scheme at the national and corporate level is at a serious stage of talks with its competitor firms and buyers on European markets. Rusal is content that it already emits less CO2 per ton of aluminum produced than most of its European competitors, but what’s missing is just how low relative production levels are in most EU member states and that Norway — reliant on emissions-free hydropower for 98% of its needs — is actually Russia’s biggest export competitor in Europe, followed by Iceland. Germany, Spain, and France all follow after. Sber is reportedly stress-testing its portfolio in response to changing investor requirements and potential legal changes regarding carbon taxation in preparation for whatever comes next. It seems the main aims now are to try and create fiscally neutral offsets for Russian firms’ tax levels that account for the carbon emitted, and thus the external tax levied. This is a tall order without some parallel regulatory structure accelerating harmonization of regulations with the EU.

MinFin is hoping to introduce a new legal proposal concerning voluntary contributions to pension funds — a policy agenda began in late 2019 but completely railroaded by COVID — in December as a means of raising more capital to finance state spending using the resources of non-banking institutional capital. Of course, a December fiscal proposal means it’s being tagged into the development plan through 2023, so it’s likely 3 years away from implementation if that’s the timeline for when it’s proposed and likely rubber-stamped. The social and economic blocs seem skeptical that it’ll pass through the Duma quickly, though. September elections mean no one wants to touch pensions till afterwards with a thirty-foot pole, and any attempt to push through another pension reform after the elections risks appearing like the last attempted reform effort. No one will care that they might have more freedom to stick their money away for retirement when the demographics who need this change most are the most fed up with the regime and have seen the greatest relative income losses over the last 7 years given costs of living where the highest-paying jobs not in the extractive sector are clustered. Tinkering may take place, but the regime has seriously undermined its ability to generate a larger pool of safe “long money” outside of the banks to build things.

COVID Status Report

Yesterday saw 16,688 new cases and deaths came in at 527. The week has seen the number stabilize after an initial small drop, though the underlying trend shows no signs of changing:

Red = Russia Black = Moscow Blue = Russia w/o Moscow

The Constitutional Court is hearing a case on April 14 regarding a legal challenge to COVID’s status as a disease that poses public health risks to those around the infected because of its declining numbers compared to other illnesses, which would legally invalidate restrictive measures used to protect the public. The challenge is absurd, and it seems most likely that the court intends to use the decision to set a precedent for future pandemics more than anything else. 5 million doses of Sputnik-V have reportedly been shipped to Iran as the two governments negotiate potential local production. A slim majority of the Russian public now supports getting vaccinated — 12% report having been vaccinated in polling, 40% say they will — but 38% still aren’t sold. The decision to ship vaccines abroad suggests Moscow is confident, but weirdly, the public’s continued reticence actually might make it easier to ship doses abroad despite potential production bottlenecks because of that gap. Hard to say, but something to consider regarding Russia’s vaccine diplomacy.

Dying (and Living) of Consumption

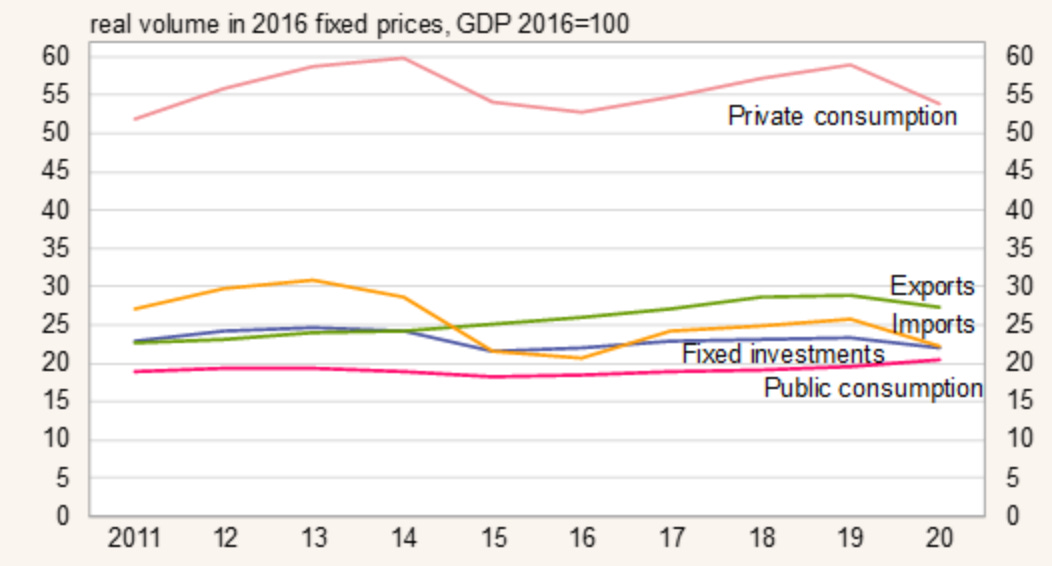

BOFIT’s weekly monitoring pulled out a handy breakdown of the structure of Russia’s economic performance in 2020 that says just about everything you’d expect. Imports fell and private consumption fell more, exports fell but not too strongly, fixed investments fell, public consumption picked up a little slack:

The contraction in private consumption was about 8.5% vs. a 3-3.1% GDP contraction. I’d argue that the fall in consumption is a much better barometer of Russia’s growth prospects and performance from 2020 through 2021. First, I’d like to go back to the theme of the ruble’s performance during last years, in particular the point made that geopolitical risks drove further devaluations after May as the ruble decoupled from oil price movements:

Losses in export earnings were offset by the CBR’s management of gold reserves and steeper import compression. The example here about Navalny is clear, but the lower interest rate regime creates persistent depreciation pressure, weaker private consumption in Russia creates deflationary pressure across the economy (yet aggregate inflation remained around 4.9% for the year) which doesn’t exactly excite investors, and there are delayed financial effects from current account compression that you see through banking sector money flows. The ruble’s decline over summer corresponded to the banking sector running down foreign currency reserves as external debts denominated in foreign currencies were paid off where possible until there was a foreign currency crunch in 3-4Q and, by October, a massive increase in CBR claims on the banking sector i.e. banks suddenly accumulated a large number of obligations owed to the CBR. This pressure eased only after oil prices had stabilized for a few months and with a lagged effect. Geopolitical risks are always at play, but I don’t think they explain the phenomenon adequately because of how weak domestic consumption was and the imbalanced effect of 2020 on firms’ indebtedness given that non-oil & gas resource exporters made out alright but simply couldn’t generate the same currency inflows. The reason I return to this theme is that there’s zero evidence private consumption will recover on track even if Russia reopens faster than most economies because its underlying demand was already suppressed, incomes weren’t supported through the crisis, and, simply put, this isn't China.

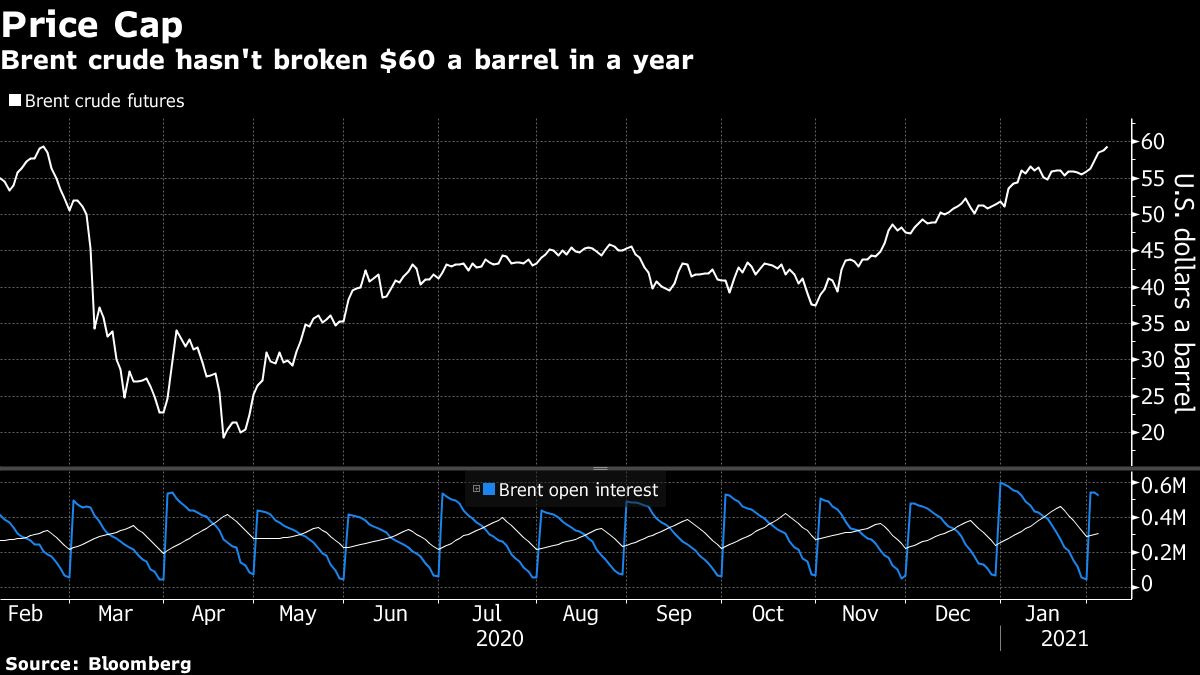

There’s also reason to think that the macro picture with oil is mixed, even if prices now appear to be trending upwards. Commodities trader Gunvor thinks that oil price gains are capped at $60 a barrel because if they go any higher, there’ll be a flood of new crude on the market:

It gets worse. The daily shipping rates for Very Large Crude Carriers (VLCC are crude tankers with capacity between 200,000 and 400,000 tons) have gone negative because of the surplus of empty boats on the market thanks to the longer-run impacts of OPEC+ cuts. The following graph isn’t too important by category, but just shows you how profound the long-term low rates trough has been since some unwinding of the supply overhang last summer:

So not only is $60 a barrel a sort of psychological breaking point that would drive shale drillers and others to open the taps, but the economics of booking shipping capacity on tankers are insanely attractive right now. Russia’s rebound in oil export earnings may take a hefty hit if prices rise further. That suggests more leverage to get OPEC+ to ramp up production faster, but hold on. There’s still more. This note from Nordea, admittedly just one view but still interesting, flags the following:

Much stronger growth expectations in the US are corresponding to an expectation based of Federal Reserve guidance that the amount of money parked in the Treasury General Account (TGA) — the general checking account of the US Treasury from which the US Government withdraws money to make payments — is being pulled back, and therefore more dollar liquidity is going into the banking system instead of it being parked aside. Nordea estimates an expansion of USD liquidity worth $1.6-1.8 trillion, which will drive the dollar down against the Euro. But that’s a bit of a problem for the Eurozone. The recent spike in inflation was taken by many as a welcome sign of life, but given how poorly the vaccine rollout has gone, it’s important to note that a surge to 1.4% for January is likely a one-off (and also supported by rising food prices). A weakening USD means Americans are going to have a harder time buying European exports — some of that might be offset by the strengthening of the CNY. It’s still bad news for Europe’s recovery since US consumers keep buying made in China.

Russia would benefit from a sustained stronger Euro in terms of its reserves and the value of its earnings in rubles, but without a new round of fiscal packages in Europe, demand for oil (not gas) will slump more on European export markets, which of course hurts Russia disproportionately since much of its export infrastructure is Europe-facing. The ruble’s decoupling from oil is evident during troughs, but not sustained during higher prices because of its impact on the business cycle and last year’s production restraint. The CBR assures us the banking sector can handle more instability now. But the dynamics for Russian oil aren’t great, and with that comes persistent financial instability risks in 2021 even as it recovers.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).