The Tylenol PM

Mishustin's facing serious heat over inflation and all he can do is scream about greed

Top of the Pops

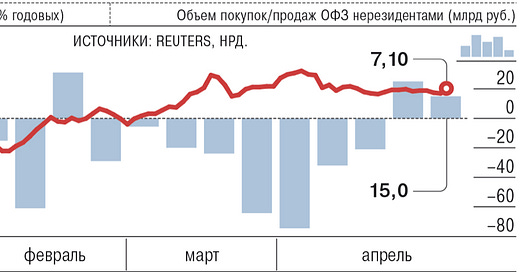

Now that the additional softer sanctions put in place by the Biden administration on Russia have settled, non-residents are more comfortable buying OFZs again. For the 2nd week in a row, the net USD position for foreign investors in OFZs rose — $500 million in total. This marks a reversal of the net outflow we first saw. The reduction in political risks, more attractive yields, and ongoing rate corrections globally as markets sort out what to make of the current inflation panic for financiers grown far too comfortable with a deflationary policy regime and global economic environment drags on:

Red = OFZ annual rates for 10-year bonds Blue = volume of puchases/sales to non-residents (blns rubles)

We don’t know how many of these purchases are still state banks or else Russians buying from offshore — I suspect that’s still going strong — but it’s clear that foreign investors have calmed down enough to buy back in overall. Some of that might have also dovetailed with the Rosstat data that inflation in monthly terms had slowed to 0.58% in April vs. 0.66% in March, which steadied yields a bit. But that’s contingent and subject to change and since we lack good data on gross flows at the moment for the latest influx of capital rather than net flows, I wouldn’t read too much into it just yet. Positions are still net down significantly since mid-January overall and Otkrytiye, for instance, is saying the market’s near balance. Still a net down shift with more potential volatility to come since inflation is a much bigger problem for Russia than DMs — it lacks the same capacity to bust through supply constraints when they appear and is far more at the mercy of the commodity price environment.

What’s going on?

A new report from the Center for Future Management Solutions argues that the best fix to improve the motivation and quality of civil servants and state employees is to — gasp — raise their salaries. Managerial salaries for mid-level employees are higher in the commercial sector and low starting salaries scare off young specialists from taking state jobs. There’s also the need to link pay to performance indicators of some kind, preferring a 70-30 split between a fixed salary with the rest comprised of bonuses. Finally, the authors propose using more project-specific contracts. All of these proposals correspond to Mishustin’s push to reduce the size of regional and federal staffs where possible. Shift that money around to increase salaries since increases to budget spending are constantly kneecapped by the fiscal policy framework from MinFin. The optimization campaign for state structures, within these parameters, is also about improving the quality and attractiveness of state jobs — upping the ‘loyalty buy’ using budget and administrative resources. The problem, of course, is that in a system where the state is supposed to drive investment and carries so much pricing power, whether through cost interventions, trade protections, the direct regulation of wages, and size of the state and SOE workforces, upward wage pressure for state jobs that’ll be highly sought will inevitably affect local labor markets where the private sector is weakest.

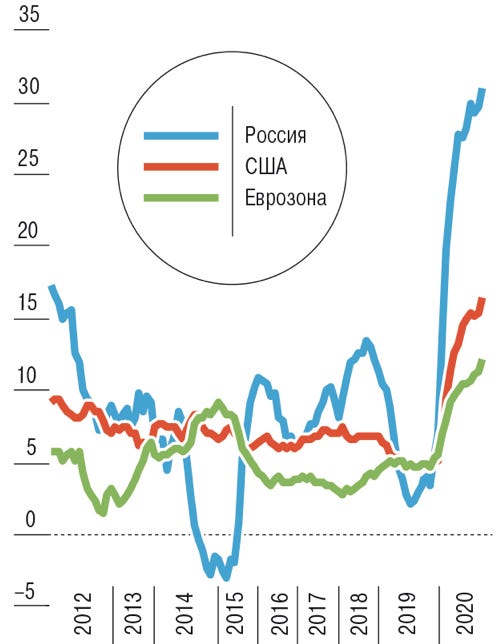

The “13 theses about the economy” — a regular report from the Center for Macroeconomic and Short-term Forecasting — confirms that the implicit monetary theory of inflation doesn’t really map onto the current crisis. The increase in Russians’ holdings of rubles in cash roughly matches the draw down of currency deposits, so there hasn’t so much been an increase in demand for cash to enter circulation as a change in the composition of how households hold it. Declining incomes and uncertainty due to economic policy have reduced the incentives to make long-term investments and force households to spend a higher proportion of their earnings:

Title: Trends for cash in circulation, % growth YoY

Blue = Russia Red = US Green = Eurozone

On the one hand, lower rates and higher inflation push most of the withdrawal of cash into consumption rather than deposits. On the other, that cash can buy less and less for a majority of the population given the distribution of consumer price inflation. Banks have already begun raising rates for deposits to keep more cash in banks. The report openly admits that the recovery is a mess without saying it out loud — demand can only recover to pre-crisis levels if SMEs, individual entrepreneurs, and the self-employed are feeling safe and confident in the business environment. We’ve got no evidence (for now) that this is happening. So the expansion of cash in circulation wasn’t about drawing more into the economy from an expanding money supply led by sovereign and private sector debt expansions and the value of cash under the mattress is at risk so long as inflation remains persistently higher. The April slowdown, if it becomes a trend, would likelier herald weakening demand.

Boris Titov, the Kremlin’s business ombudsman, has prepared a report for Putin arguing that regional courts exploit the statute of limitations — or else ignore them — in order to facilitate the expropriation of business’ assets. Theoretically, the civil codex sets a 3 three statute of limitations from the date at which the legal party found out about the violation of their rights to initiate a case. The latest appeal comes from a long line of annual reviews of attempts to game the cadastral registry system in Russia to manipulate balance sheets for acquisitions or else assets held by individuals and firms. Bizarrely, courts don’t have a unified legal stance on the inclusion of VAT in valuations for property. That compounds the regional variation in tax rates since regions are allowed to set rates and tax benefits (within fairly strict bounds). Don’t sweat the details of the letter or even the significance of the policy questions. The bigger problem is that Putin, more than ever, needs businesses to sink their money into productive projects since the state’s tied its own hands. That makes these personal appeals all the more important as we build up to what should be an economic policy program announcement from Mishustin and the cabinet in the weeks ahead. But business here is asking that he intervene to actually improve the capacity of state institutions, effectively by unifying them at the federal level, in a manner that is evidently impossible since the courts, unlike the governorships, can’t be ‘captured’ quite as easily by the center so long as local interests shape the fights over assets Titov is concerned about.

There’s a new push from government to tighten the enforcement mechanisms for quota requirements mandating the procurement of domestic goods and services by SOEs, government agencies, and departments. SOEs continue to dodge reqs where they can as a matter of quality and cost control. Some of that is outright purchases ignoring the rules, sometimes it’s applying an incorrect code for the procurement to mask the problem. By measures in the government, procurements fell 20-30% short of targets in many cases based on FZ-223 vs. FZ-44, different regs establishing quotas. Once more, the government is at work crafting a ‘normative legal basis’ for an amended system. MinFin is particularly annoyed at a loophole allowing firms to dodge scrutiny by buying imports via intermediaries so it appears to be a Russian acquisition. This never-ending saga shows the limits of the state’s capacity to achieve these targets because of the weakness of its legal authority — laws are crafted by competing institutions with competing power bases and lobbying interests involved in the policy process — and constant need to strengthen its means of disciplining SOEs that otherwise operate as semi-independent fiefdoms within the purview of their respective ‘briefs’ handed out or seized by the regime. The stricter the enforcement aspect becomes, the harder it is to find good faith contractors since the incentives are to make things appear correct on paper and not reality so long as the costs of Russian output remain higher due to inefficiency, shortfalls of domestic output, or outright graft.

COVID Status Report

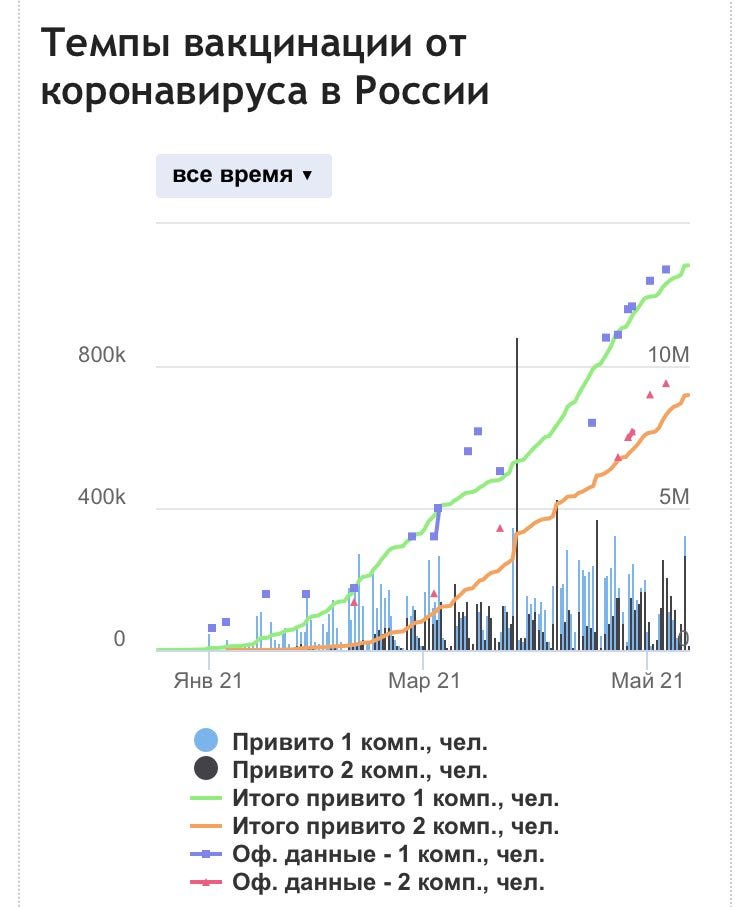

8,217 new cases and 355 deaths were reported for the last day. After some confusion earlier, Tatiana Golikova clarified that Putin and Mishustin have been referring to total doses of vaccines used rather than the % of the population fully vaccinated. That’s 24 million doses total. H/T to Jake Cordell for the following graphic:

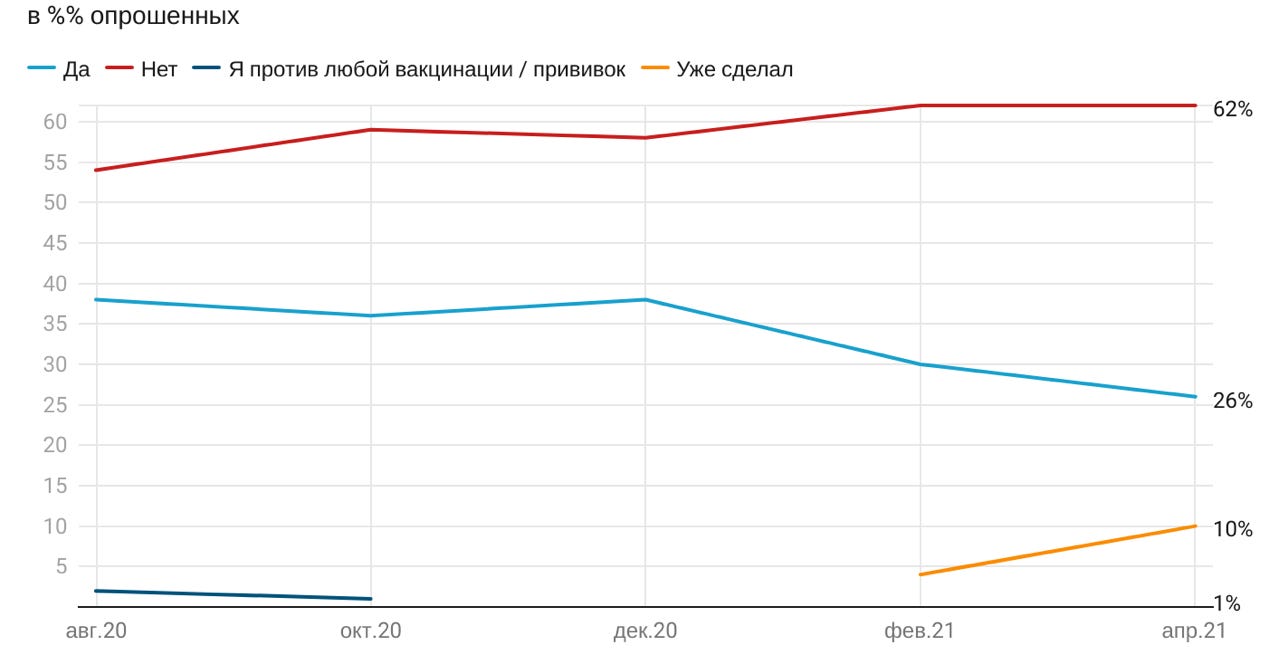

As of yesterday, the caseload in St. Petersburg was up 17.7% week-on-week. The concern is that the longer higher levels remain in Moscow or Piter (or other large ‘hub’ cities though the regional rates have declined), the greater the risk that normalization in the economy ends up spreading infections again via travel and logistical networks. The national figures showed a roughly 6.1% week-on-week decline as of Monday this week, which is still positive per the Operational Staff — I trust the direction of travel still, just not the absolute numbers — but as I’ve noted, that indicator would lag due to the holiday in early May. Putin’s still technically in an isolation regime alongside his more visible efforts to get Russians to get tested and vaccinated. I’m wondering when they announce he’s leaving it since they’re now stuck using even small public signals. Levada polling damningly shows that fewer Russians are ready to get vaccinated with Sputnik than back in August:

Light Blue = yes Red = no Dark Blue = I’m against vaccinations Orange = already done

At this rate, the vaccinated population would top out at about 36% of the public, far from enough for herd immunity and a persistent tail-risk for the pandemic. Just great.

The Irreality of the Russian 'Economy’

Mikhail Mishustin confirmed my worst fears today speaking to the Duma about the state of the economy. Not only did he default to the exhaustingly uninformed line that low interest rates, monetary expansion, and risky money have led to a massive increase in global inflation — one wonders where the hell this inflation was in 2010-2011 or how Russian leaders explain the commodity cycle of the 2010s. He blamed the greed of businessmen for domestic price increases on foodstuffs and basic goods. More precisely, he said the following:

“And here it’s important to speak about another single cause as to why prices are rising. It’s greed. The greed of individual producers and retail chains. And here I want to remind you: the government has enough instruments to curb the appetites of those profiting off of the frenzied demand in all spheres.”

Despite his own admission that producers and retailers have marked up prices in response to global commodity price increases — he left out rising transport costs for containers, 475% year-on-year in North Europe for instance — he singled out greed. From what I gather, Mishustin’s efforts at price manipulation have been a complete failure and this is what it’s come to politically. He has to generate a political logic for the state to intervene in new ways, to excuse its failure, and most importantly to change the ‘contract’ between business and the state. In line with Putin’s thinly veiled threats against firms retaining dividends rather than investing, Mishustin is using this new theme of ‘greed’ to justify calls to increase the tax burden on business and richer Russians to provide more non-oil & gas revenues for the budget:

“The very same greed we talked about today, it can exist in a person, however you need to pay for greed with additional taxes and revenues for the use of the benefit of the budget of the country where these firms works, where these people work.”

Prices can’t be fixed with the current methods, but they’ve setup an increase for the tax burden on businesses since the regime can’t reasonably ask households to pay more. What was perhaps crazier coming with this new ‘greed’ theme was the claim that real incomes actually increased 3% in 2020. This makes no sense unless they’re there’s some methodological wizardry counting extra savings accumulated without concern for costs that have just been deferred and ignoring the composition of savings i.e. most people’s incomes most certainly fell. Based off Rosstat data, Mishustin and Putin are really flailing here with the pivot to try and increase the tax obligations of firms and individuals raking in cash without giving enough back:

The tax share of GDP has fallen since 2012 based on the topline metrics Rosstat uses despite the shifting construction of the tax system — note that taxes here are ‘net’ taxes. The value of the current price ruble categories from different datasets are probably somewhat off, but the trend is the important thing from corporate turnover. It doesn’t really correspond to big shift for profits. In fact, the opposite has happened — households’ share of the national income have increased the last few years and profits’ share of GDP declined. So firms aren’t actually increasing profits overall, setting aside specific sectors, and demand keeps falling from households. Corporates are doing more and not profiting — I suspect some of this expansion is SOE-led and includes social obligation spending and filling regional budgetary gaps for physical and social infrastructure. What exactly does Mishustin expect will happen if they ‘pay for their greed’ when the state itself is engaged in constant efforts to generate rents for itself?

Economic policy is finally entering the realm of irreality. Material concerns and hard data don’t actually matter for Mishustin’s supposed data-crunching operation in the Coordination Center. They just need to know what to head off politically, but then go on to deny the reality of the inflationary crisis, incomes crisis, and investment crisis resorting to increasingly detached administrative measures. The real income increase is a dead giveaway that Mishustin has nothing to offer — he can’t spend more money after all. He just ran with Reshetnikov’s plan to push paper. But the measures that are palatable, ironically, are all the purview of fiscal policy. The threat of higher taxes, of failing to protect the wealth of those who aren’t patriotic, and so on are basically all that’s left for the regime to try and escape the dead end its set for itself since 2013. If the mobilization state is designed to get the right individuals, institutions, and firms to act for the good of the country when needed, then now it’s task will be to take more money under its own control to then be able to control how it is used, dispersed, and leveraged without addressing the underlying problem that provides the political logic for these changes: inflation.

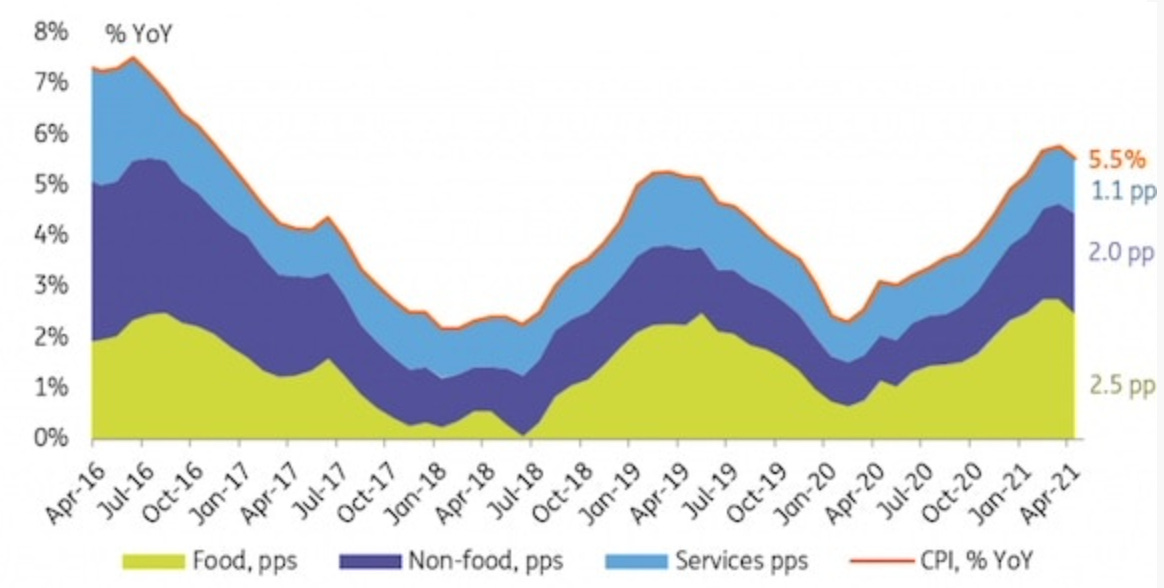

It’s a straightforward gamble. The public is suffering, so we’ll make businesses suffer a bit more. They aren’t just punishing greed, however. They’re opening up pandora’s box so that the Duma, regional officials, everyone in power can call for the “speculators” driving up prices to be punished. It’s a return to Soviet form that instead of acknowledging the systemic failings of the construction of the economic system the regime relies upon, it blames the avarice of individuals failing to act with any decency. The groundwork for this approach was laid by Putin’s 2020 marathon press conference when he expressly distinguished between inflation that is objective and not objective. Worse, we have to also consider how much the goalposts have moved on what constitutes dangerous inflation:

In effect, anything above 3% starts to generate political risks despite the official 4% target because of the composition of inflationary factors, geopolitical risks for the ruble, and regulatory rents that raise domestic prices (or demand without adequate profits sustaining investment). So long as real incomes keep falling or stagnating, even low levels of inflation are a big problem. The most pernicious aspect of the new strategy is that it’s so obviously an attempt to replace economic policymaking with narrative control. By creating some sort of vaguely shared ‘enemy’ that can be blamed, it creates an insular discourse anchored somehow by Milton Friedman, bad boyars, and Putin. The increased tax burden is unlikely to be paired with any significant increase in spending. No one in the government or MinFin is suggesting that a higher tax burden will, say, better fund the National Projects or allow a more ambitious infrastructure initiative to take shape. Taxes serve as a punishment, a disciplining mechanism without clear economic benefit and a means of ‘sharing the misery.’

There are much larger questions of when ‘the economy’ became a topic, assuming a discrete discursive form organizing how philosophers, political economists, and politicians attempted to articulate the relationship between ‘the state’ and ‘markets’ as global, interconnected, and interdependent capitalism became a reality. What’s happening now in Russia is, to my mind, the construction of ‘the economy’ as an irreality — the sort of thing you’d read in a Borges footnote palimpsestically parading a fiction handed down by unknown figures as a fact to further the narrator’s ends. Mishustin’s turn at the Duma sets up a new normal for economic discourse. Not only can he do nothing to fix these problems, but he’ll simultaneously deny they exist (people’s incomes rose!) and blame undefined forces of human nature — greed — for the failings of a resource-dependent economy and political system that depend on the power to extract value, not create it. The late Soviet economic crisis exploded as interest groups captured and derailed policy processes and decisions made in a system that was trapped over-investing into industrial capacity and by the extraction of diminishing value while hoarding an excess amount of state resources for its ability to resource and mobilize its military and security apparatus. Now the same is happening in reverse in a system wedded to under-investment in order to preserve state solvency. The economy is now just a thing to wish away and find guilty parties for, not a dynamic system to be managed with the considerable fiscal tools available to the state. A new wave of mobilization is underway and I doubt it’s going to go smoothly. Inflation is a headache Mishustin won’t be able to shake.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).