The Lead-off

Biden’s done well to position climate change and the American middle class at the heart of his as yet ineffable foreign policy coming into office. On that front, he’s got some decent market tailwinds to thank for making his job a little less daunting with or without Democratic control of the Senate. From S&P, there’s an expected 172.5 GW of solar and wind power generation on track to built in the US through 2024:

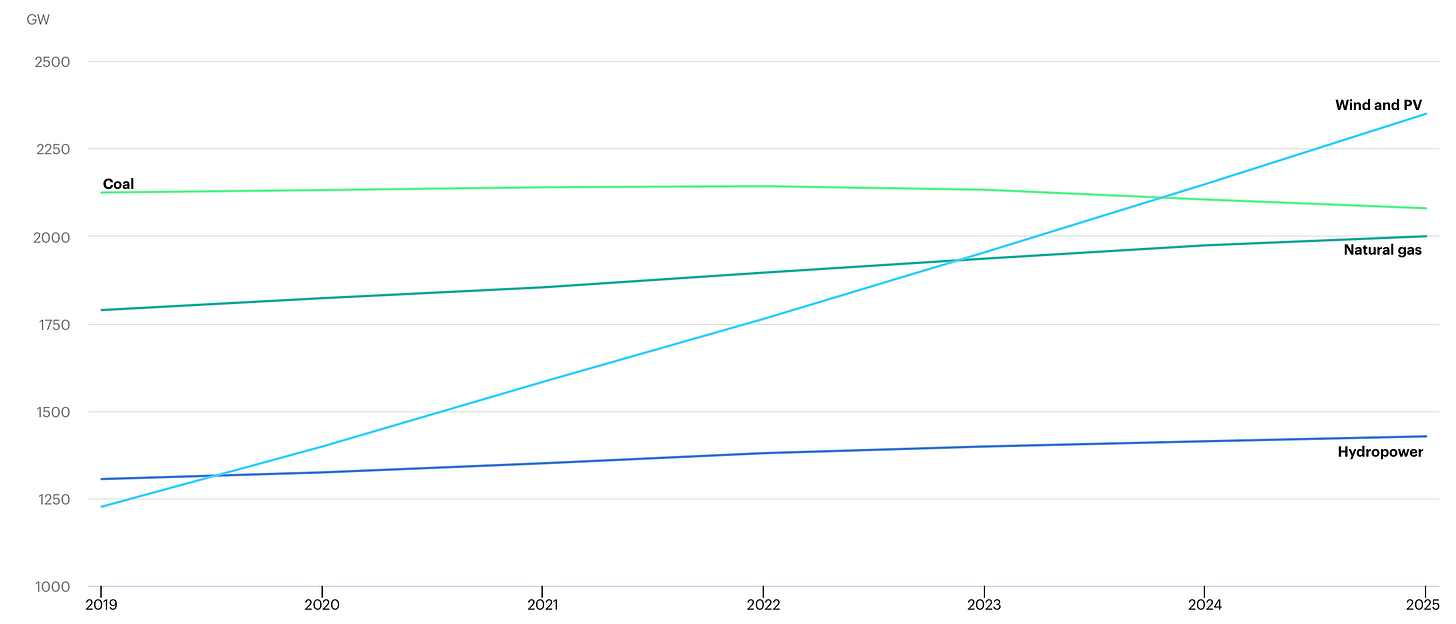

That figure is only likely to grow more now given how much of the current outlay for green energy capacity additions are still in development stages. Relatively marginal changes in federal regulatory posture from the EPA as well as the new focus on the Department of Energy — bit nuts that $40 billion from post-financial crisis programs is just lying around unspent to back clean energy loan guarantees — will undoubtedly push utilities companies already in the space as well as latecomers and infrastructure equity groups to play catchup and diversify their portfolios into the space. The global trend line from IEA projections shows a very strong growth path for renewables, but one that undoubtedly is geographically uneven with the persistence of coal in energy mixes within parts of and outside the OECD:

Exports are the lingering question. Saving US automakers to meet domestic demand is one thing, and still a big step if Granholm’s posting to DoE ends up steering an influx of federal R&D and business support into commercializing green automative tech as fast as possible. It’s another to consider the broader implications for competitively selling abroad, or more importantly, trying to re-shore intermediate stages of supply chains into the US to promote more manufacturing jobs. Something tells me Biden’s got nothing substantive to offer on resolving issues like the effects of US dollar hegemony on export competitiveness. However, the attempt to juice the adoption of newer tech will help greatly when it comes to maintaining a qualitative edge on relevant tech thanks to the depth of the United States’ financial markets, ability to monetize new ideas quickly, and existing public-private research ecosystem. One area he’d do well to direct attention to in Washington would be increasing service exports for data.

Tech firms declaring net zero targets are drawn to Scandinavia in search of places with abundant land, emissions-free energy on hand, and attractive market access and data regulatory structures in place for expansions in data center capacity. It’s the type of development that states within the US are undoubtedly going to end up bidding over, but one that the Biden administration would do well to proactively encourage in the US. The trouble there is that Scandinavia follows the EU’s GDPR, whereas the US as a jurisdiction does not. But that angle’s gotten all the more interesting with Brexit. Facebook has led the way shifting UK users onto US privacy legal regimes in place of the GDPR lacking a UK replacement for the time being. That arbitrage between legal schema for data is a pressure point for future UK-US trade talks, and while there are plenty of reasons to believe Biden’s team won’t prioritize Westminster, the doom and gloom is exaggerated given just how adroit Johnson’s cabinet has been at executing a foreign policy in lockstep with Washington’s consensus preferences despite its pathetic dysfunction on all domestic matters. Per data from the US Chamber of Commerce, a large data center creates somewhere in the realm of 150 local jobs vs. the over 1,600 jobs created during construction. But when you look at a snapshot of the trends for where it’s being built, it’s blindingly obvious that the combined security and defense budgets of the US government and Washington’s sprawling intelligence infrastructure are leading domestic expansion, a trend that suggests the US is losing out on the chance to host more data using a better, transparent and enforceable privacy regime, with negative consequences for some jobs and potentially the nation’s ability to gather intelligence:

Watch Texas be the biggest beneficiary in coming years as tax refugees flee California for friendlier business climates. Chicago is likely edging out other metro areas because of city programs providing free community college to any public school graduate with a B average and better access to public research universities and institutions, plus Argonne and Fermilab — 2 of the 5 national quantum computing research centers — are a drive away. These jobs aren’t glamorous, but like the warehouse work that Amazon is creating, they’re what’s on offer as the e-economy beats out brick and mortar and more disposable income is spent on apps and more time is spent online in some form. The energy transition has a host of implications for power politics only now being teased out as people realize the breadth of what’s to come.

“We never took him seriously”

I just finished reading Andrew Scott Cooper’s The Oil Kings, a great book if you enjoy seeing Nixon and Kissinger taken down a peg or two and the maddening set of palace intrigues, clashing personalities, policy myopia, and existential panic in Washington that led the US to first throw in completely with Saudi Arabia as its preferred regional partner. Cooper does a fantastic job of capturing the constant panic about oil prices, whether from US banks leveraging up to the hilt to loan money to desperate European firms and banks to rationing at filling stations to the broader realization that escalating economic pain from high inflation, high unemployment, falling wages, and potentially worse things to come could deliver communist parties in key NATO member states governing majorities. But the peculiarities of that historical moment seem very, very unlikely to repeat, both because political forces lost control of oil market dynamics in many respects by 1987 — Iranian and Saudi gamesmanship over price and production increases and decreases not only made oil from the North Sea, Alaska, and Gulf of Mexico competitive, but forced rising volumes of spot crude onto the market and encouraged buyers, with recourse to these volumes in growing amounts, to hedge against the new normal of price instability by trading crude oil futures (it took off in 1983 as supply constraints were slowly replaced with a glut).

Biden has elevated climate change as a national security issue, especially by handing John Kerry a role on the National Security Council tasked with handling matters pertaining to it. Bringing in a diplomatic heavy like Kerry entails large institutional risks. It’s hard to imagine Kerry, a former Secretary of State, being comfortable with Tony Blinken or others at cabinet level or else on the NSC overruling him if there isn’t a clear delineation of responsibilities. That’s what made The Oil Kings such a compelling read in light of the current moment. If under Nixon and Ford, it was the likes of Henry Kissinger, Richard Helms, Bill Simon, and Alan Greenspan fighting to stop or slow oil price increases, salvage American grand strategy, and pull off a post-Vietnam retrenchment unpopular with a growing chorus of Republican and Democratic congressmen and senators through their own briefs, memos, and respective staffs, this crew will face a similar task, if one with different attendant risks. The first oil shock, a moment that shaped much of the public consciousness and most political assumptions in the West about energy security until the 2014-2015 oil supply shock, coincided with a tectonic shift in perceptions about American power abroad, the collapse of the international monetary regime, debt crises, and the sudden deep and profound interlinkage of commodities with financial flows and default risks. The current moment lacks the same through line economically — green energy depends heavily on countless commodities but none have the same force as oil to shape inflation or financial flows — but the mix of COVID-19, the disorder left by the Trump administration, and the urgency of deepening international cooperation to accelerate the energy transition are going to lead to new security and political dilemmas fast and plenty of internal fights over policy priorities.

Cooper’s book ends with a disgraced Richard Helms waving away the folly of the strategy pursued by Nixon and Kissinger of empowering the Shah of Iran as a ‘regional gladiator’ to secure US interests in OPEC, protect Gulf oilfields, as well as shore up US interests in Afghanistan and Pakistan. “We never took him seriously,” Helms lies some years after his part in the affair as a former CIA director turned ambassador in Tehran. It encapsulates what usually happens in Washington, from Kissinger stashing away his own recordings and notes on his role as National Security Advisor and Secretary of State with Nelson Rockefeller to avoid post-Watergate prosecution and hamstring the Carter administration to the internal contradictions of trying to find a way to reduce US defense commitments by elevating partners. History is rewritten by those who didn’t take the fall. Worse, they hide how apparent their folly was from the start.

In the case of the first oil shock, Nixon and Ford were over a barrel. Oil scarcity was real, OPEC held a market share large enough to do more than just react to marginal demand and market sentiment, and the political dominoes were scary as hell. As just one example, Gulf oil firms were some of the biggest foreign buyers of American steel. Every price increase initiated to increase oil rents meant steel production costs went up, raising the costs of oil & gas equipment. Gulf producers had an excuse to bully for more price hikes on top of an escalating arms race, a massive influx of Americans into Iran to help sustain all of the Shah’s insane procurement contracts, and correlated inflation and economic mayhem from mismanagement in Iran proper. Yet Nixon, being it seems a terrible negotiator one-on-one, and Kissinger, being someone too smart to accept he was too stupid on key matters of macroeconomics at the time, offered Tehran carte blanche on US defense systems knowing full well that his spending habits threatened the economic stability of Iran, forcing it to push for price hikes. They actually established a US policy that preferred higher oil prices in pursuit of what was evidently a misguided attempt at rebalancing US strategy in fear of the Soviets gaining access to the Gulf. At precisely the moment the US needed to break OPEC, it had committed itself to becoming a Hessian for hire in the region.

Today, what’s interesting to consider is what green recovery entails when trying to imagine what a “Biden doctrine” that, thus far, seems mostly concerned with rebuilding credibility and focusing on America’s own economically looks like. Nickel, copper, cobalt, lithium, and other metals and minerals don’t provide the same financial leverage oil once did. Tax receipts are lower, the sums of money involved with investment are lower, many of them are found together in any given seam being mined, and mining companies take on considerably different (sometimes higher) risk profiles in many countries, but mines generate a great deal of political interest locally. The trouble is that in most cases, there’s nothing like Kissinger’s shuttle diplomacy that could resolve any major issues that might arise. Chinese firms buying mineral rights, shortages of rare earth metals, or a sudden squeeze on nickel won’t create the same spillover effects as an oil supply shock. Whereas Nixon and Kissinger inhabited a political moment still dominated by nation-states, the fights over commodities production for green tech are about companies, frequently knowing either no loyalty or else enlisted into a national corporate system that cannot be beaten with traditional diplomatic sticks and carrots. That dynamic was at play in the early 70s, but firms were negotiating the terms of their obsolescence in the Middle East as governments wanted to take ownership of their own oil wealth directly. Governments could dictate terms in a manner far different from now.

It’s very good news that Austin has become the default Defense Secretary pic, Colin Kahl was given defense undersecretary for policy, and Kathleen Hicks was given the deputy job. The Department of Defense will be led by more restraint oriented thinkers in the mould of Obama’s foreign policy calculus. The reason is this: the declining security importance of oil wealth and economic strain on Middle Eastern governments creates a paradoxical pressure point for a foreign policy predicated on restoring US credibility and accelerating the energy transition. In order to do the former, Biden has to dance on a pinhead and somehow re-enter the Iran deal, which will be seen as a loss of credibility in Israel, Saudi Arabia, and the UAE, all of which have ample room to escalate tensions if they so wish. And to boot, if it becomes clearer still that oil demand has peaked in the coming months, Saudi Arabia — dealing with an aggressive production expansion plan from the UAE within OPEC, a new US president and his team, including Kerry who negotiated the Iran deal and Jake Sullivan who was there at its earlier stages — has all the more reason to lock in its gains before its oil wealth and lobbying access don’t buy as much.

It’s the same calculus the Shah faced heading into the first oil shock, but reversed since his view of peak oil — that we’d run out of it — has been replaced with peak demand and the replacement of oil as a key fuel source (but not as a feedstock for non-fuel products). Arguably, it’s the same calculus Russia now faces, though it presents a different case. We no longer live in an order with oil kings. Not even OPEC+ can move the market without some divine intervention from the invisible hand nudging demand and consumer preferences in the right direction. But the powers Biden has to navigate and nudge face a stark reality. The edifice of oil rents underpinning a social contract of sorts is finally reaching the end of its viability, not that it will cease entirely but rather cease to deliver growth or create enough wealth on its own to paper over its flaws. Worse, Europe will still demand the US be involved in the Middle East fearing that renewed instability might lead to newer waves of migration, yet the continued military presence of the US and its European allies in the region reliably contributes to that instability as much as it wards it off, at least in its current configuration. Biden better be taking these leaders seriously. Trump was their best hand to play. With him gone, all they can do is bluff until the US calls their bet. It’ll be a monumental task avoiding that trap while trying to accelerate the energy transition, one that requires an overarching vision or set of principles that go beyond a remix of Making America Great Again. The new kings are all bound to be gamblers at a time of rising disorder and costs for US leadership.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).