Callooh, Callay, oh frabjous day, the $1.9 trillion stimulus pushed through by Biden’s White House and House and Senate Democrats finally passed. The following is a snapshot of what’s in it and its significance — I won’t linger too long cause this stuff is inundating press coverage:

$1400 checks directly sent out (but per 2019 tax data). Individual earning under $80,000 a year are eligible, as are couples earning under $160,000

$300 a week boosting unemployment benefits through early September (again complicated by accounting categories)

Child tax credits are expanded to $3600 for children under 6 and $3000 for 6-17 for 2021. Low-income people ineligible for the full benefit are set to receive it as well with advanced payments sent in H2 to effectively act as guaranteed income. Other credits for dependent care were also expanded for 2021, EITC was expanded, and student debt loan forgiveness was exempt from income taxes through 2025

$350 billion for state, local, and tribal governments — greater than their net deficit — $130 billion for schools and more plugging deficits for transit agencies, housing aid, food assistance, and more

An increase in ACA subsidies to lower healthcare premiums across the income spectrum for anyone using the exchanges as well as help for anyone unemployed who otherwise wouldn’t be able to access their healthcare plans

Funding for COVID vaccine distribution and related miscellany

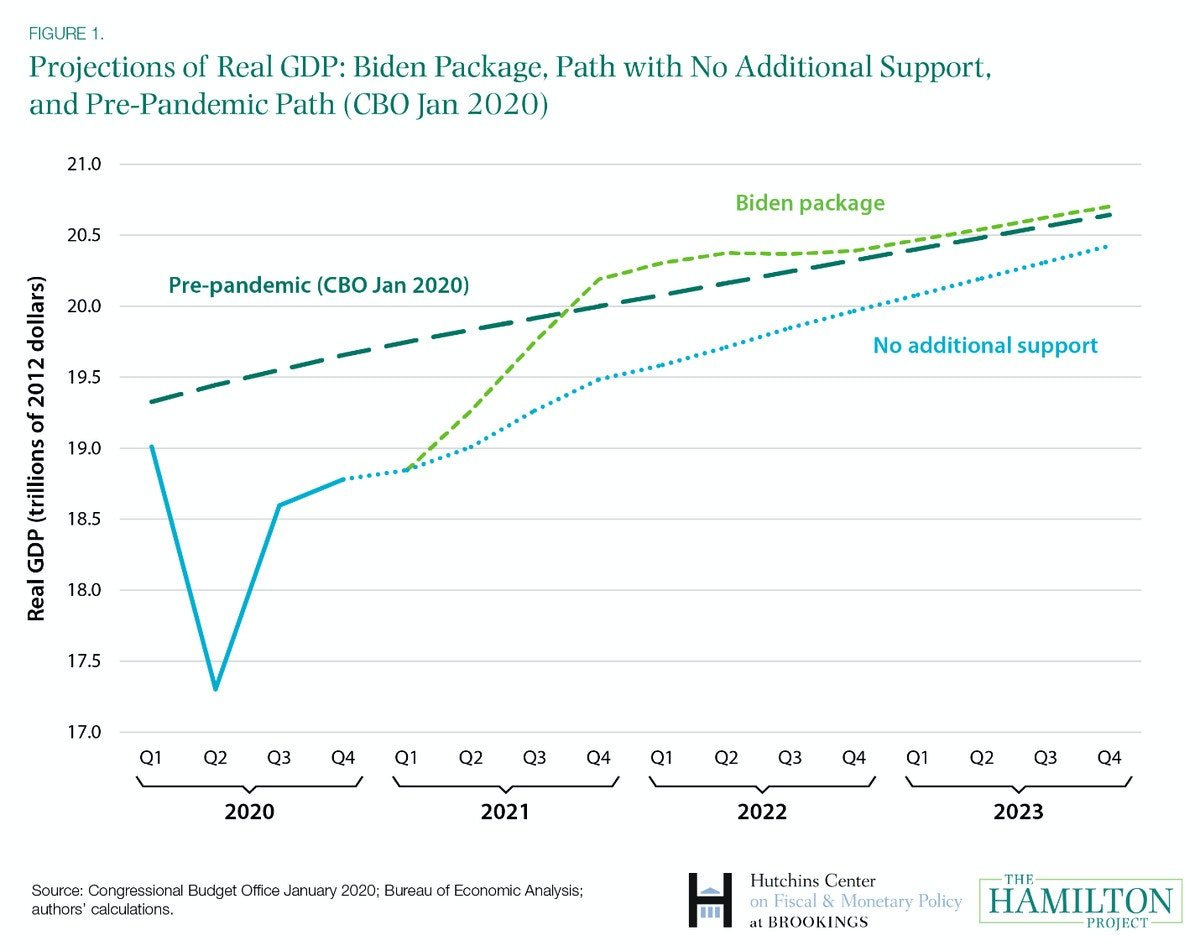

Despite its flaws — the means-testing is still going to catch a lot of people out, campaigning on $2000 checks for Georgia will cost Warnock (and others) support in 2022, and the refusal to use near universal, recurring cash relief is maddening given the willingness to spend — it’s going to have a hugely positive economic impact:

But bumping GDP growth slightly above the pre-pandemic path isn’t enough to truly run the economy hot until lots of people who’ve fallen out of the workforce but are still able to work come back into it. As Fed chair Jerome Powell has stated at his Feb. 23rd testimony before the Senate:

“Regarding our employment goal, we emphasized that maximum employment is a broad and inclusive goal. This change reflects our appreciation for the benefits of a strong labor market, particularly for low and moderate-income communities. In addition, we state that our policy decisions will be informed by our assessments of shortfalls of employment from its maximum level, rather than by deviations from its maximum level. This change means that we will not tighten monetary policy solely in response to a strong labor market.”

As clarified with more questioning and since, the Fed is focused on the actual number of people working from the entire population, not measures of unemployment that understate the scale of unemployment/underemployment, and is really focused on everyone who can work working instead of accepting a higher “natural rate” of unemployment. They want the labor market running hot as possible. Here’s why that really, really matters compared to the last recovery, which showed little positive effect on real wages and incomes until after Trump came into office. Look at US firms’ investment into IT equipment from 2000-2015 (h/t to Employ America):

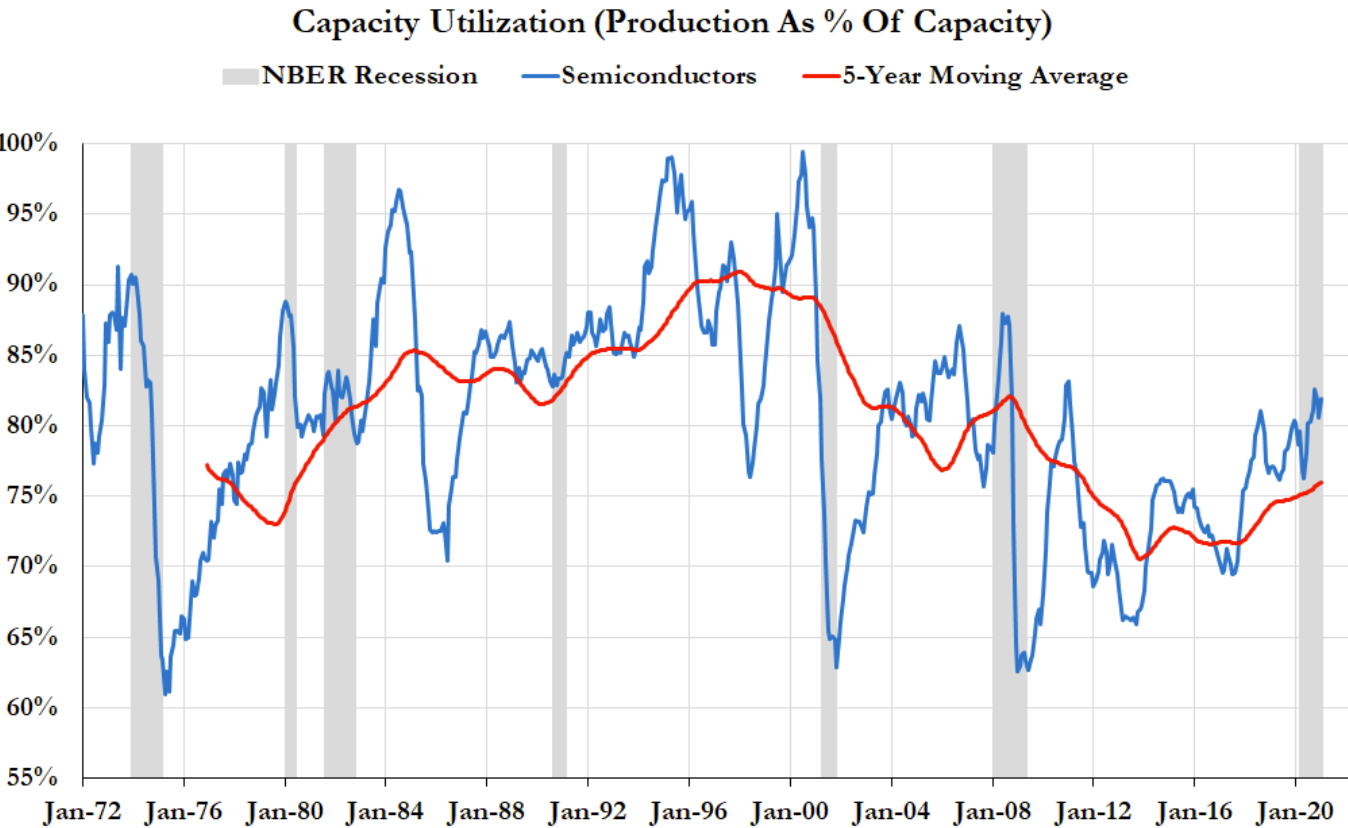

This datapoint alone captures the problem of stagnation for productivity — and wages — across the US economy. The challenge of technological innovation displacing jobs isn’t a myth despite this. Technological innovation and adoption disproportionately affects people over the age of 40-45 whose functions for businesses are replaceable and cognitively-oriented innovation is fundamentally different than, say, mechanizing extractive labor or manufacturing. But it augments labor more than replaces it (at least initially) and requires a different type of safety net, at least for those most negatively affected. There’s also the issue of speed of displacement vs. available other jobs to allow those who lose out to maintain their earnings levels and so on. Skanda Amarnath and Alex Williams’ calculations for capacity utilization in the US economy nail the systemic problem of deflationary pressures in the US economy sapping it of growth potential and making non-asset owners poorer:

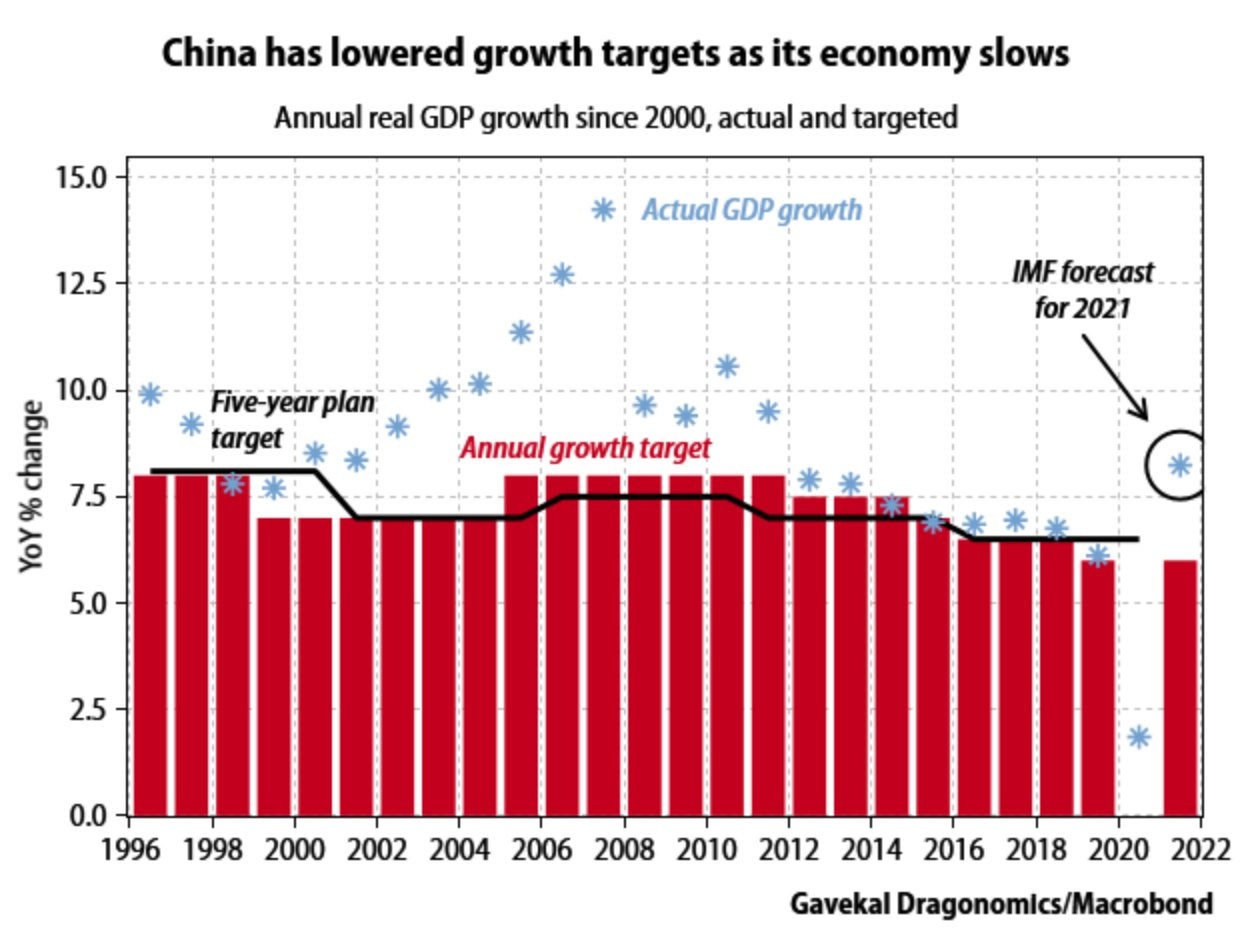

There’s a pretty obvious relationship between the tech bubble in equities and this chart — by depriving the real economy of enough demand from an overly skimpy monetary and fiscal policy framework and refusal to run the economy hot, firms betting on future cash flows offering up stock as a speculative product rise in value vs. firms actually producing profits, boosting the real economy broadly, and passing off some profit as dividends. This stimulus bill doesn’t suddenly fix this dynamic, but it’s a huge first step towards changing the framework in which policy is set alongside the Federal Reserve’s evolution on inflation and the labor market. In effect, the Fed and congress have setup a policy environment much more concerned with increasing labor’s share of national income and distributing more downward driven by a much tighter labor market, higher levels of business investment into productivity and capacity, and the return of demand-driven economic policymaking. And this comes as China has to react with its own policy changes:

The growth rate has been maintained via debt and capital allocation driven by regional governments and SOEs for decades, not organic growth. The result is that the efficiency of investment has steadily declined in many respects, while demand has been constrained. That last bit appears to be changing slightly as plans were announced to reform the Hukou residency system that has been used to exploit rural labor moving into cities by denying them legal protections. It’s too early to tell what kind of impact it’ll have, though, but there’s a renewed sense of urgency to the economic competition between the US and China.

This shift in growth politics in the US has been hailed as evidence that the Left has cracked open the door to power by seizing the ‘ideas agenda’ for a new era of policymaking. I’m sympathetic to this view, though it probably ignores the extent to which the far right agrees with this shift in economic consensus — I remain amazed the extent to which the Left has memory-holed Richard Spencer and other ethnonationalists part of the Trump sphere who openly supported Sanders and have supported AOC on social media and in fora where they communicate with themselves. The issue for them isn’t the state’s power to redistribute or the need to break out of a deflationary spiral, it’s denying minorities the fruits of those gains over time. There’s no core ‘conservatism’ on economic matters from that portion of the Republican electorate, but they also weren’t the ones who powered Trump to victory in 2016. But even accepting this, this shift fits into an as yet unclear political landscape for the midterms and 2024 that could fracture over foreign policy.

The Biden administration has ripped up the peace process in Afghanistan Trump started by chaotically rolling out a new negotiating forum to be hosted by Turkey — a dig at Moscow — and there’s stuff leaking out that Ghani’s team wasn’t properly coordinated with. The latter isn’t really avoidable insofar as any US withdrawal is terrible for Ghani, his government, and the rents they’ve secured from the US presence. The manner in which this is happening, however, suggests that Blinken is trying a soft landing to rollback US deployments so we don’t withdraw before May 1 since NATO partners would still be in country. Inviting every regional stakeholder or power to the table isn’t a strategy at this point, it’s a Hail Mary that other partners can somehow be leveraged to help deal with the Taliban. It’s probably too late, and it certainly won’t have the support of the government in Kabul. Then consider the latest symbolic B-52 overflight aimed at Iran escorted by Israeli fighters following word Turkey was building out its capacity to provide electricity to the opposition-held cities of Ras al-ain and Tell Abyad just over the Turkish border in Syria — a move to reduce the Syrian regime’s role in the region since they currently have power agreements used as a political bargaining chip. Oil refineries in the north in al-Bab and Jarablus were hit with missiles just a few days ago. Syria’s heating up at the same time Secretary of State Blinken is messaging Iran is going the wrong direction on its nuclear program while inviting Tehran to multilateral talks about Afghanistan. Oh, and Secretary of Defense Austin — tasked with somehow really pivoting to Asia while not drawing down in the Middle East — is assuring us that the latest rocket attacks in Iraq will be dealt with in a ‘thoughtful’ and ‘appropriate’ manner. Israeli Defense Minister Benny Gantz recently informed the US government of updated strike plans against Iran should attempts at diplomacy fail. A great deal is in motion, and little of it encouraging.

While Biden is asking Congress to revise and limit his scope for action under the existing AUMF that covers most action in the Middle East (and Africa), he’s really banking on the fact that most Democrats and Republicans are actually united in their willingness to use force proactively and expansively and reality that they can’t actually stop the president from acting a lot of the time. It’s a useful shell game that wins plaudits from the Left and public tired of war while the same new economic consensus implied by the stimulus bill means that deficits really don’t matter and we can afford to increase defense spending. Likely off the radar of most excited by the possibilities of the new consensus, we already have figures like Robert Levinson writing for War on the Rocks arguing we can afford to spend as much as we please on defense because of the reality of sovereign debt and China’s just announced a defense spending increase of 6.8%. The last ingredient in this increasing noxious cocktail of factors is the fact that Biden’s return to a ‘values-led’ American foreign policy vision has given new life to the coercive force behind the mask of civil society efforts that are essential in many contexts, but function as a discursive ‘get out of jail free card’ in Washington budget debates or when someone demands an airstrike. Democrats may question Biden’s authority to do what he did in Syria recently and Blinken may have disavowed ‘costly interventions’ to secure human rights. But escalation can still take place without actually pulling US troops back from the persistent, ‘low-grade’ conflict currently exhausting special forces and the US Navy with insane operational tempos and requirements to accomplish what much larger forces are meant to. There’s still no clear way the Department of Defense can focus on China without more spending so long as the current deployment level in the Middle East is maintained, and there’s every reason to expect it could rise if JCPOA negotiations fall apart.

The problem with the Left economic consensus about the irrelevance of deficits is that it naturally leads to a scenario when there is no useful economic check on the expansion of the US defense budget in domestic politics. The result is to keep investing into a hammer that makes every problem a nail and deployments that polarize the public since much of the Left now excited by the prospect of what the stimulus bill entails are insulated from the effects of a budget and foreign policy discourse that treat soldiers’ lives as an afterthought. There are enough Democrats who, emboldened by this new fiscal turn, won’t feel like they have to hold back in trying to partner with most Republicans to get a spending increase. Every victory contains the seeds of the next crisis. It’s quite possible that as more economic bills are rolled out, foreign policy becomes a dividing line that will resonate through 2022 and 2024. I’d watch out.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).