The Long Goodbye

Oil's recovery is looking strong right now. It's not likely a longer-term story

Top of the Pops

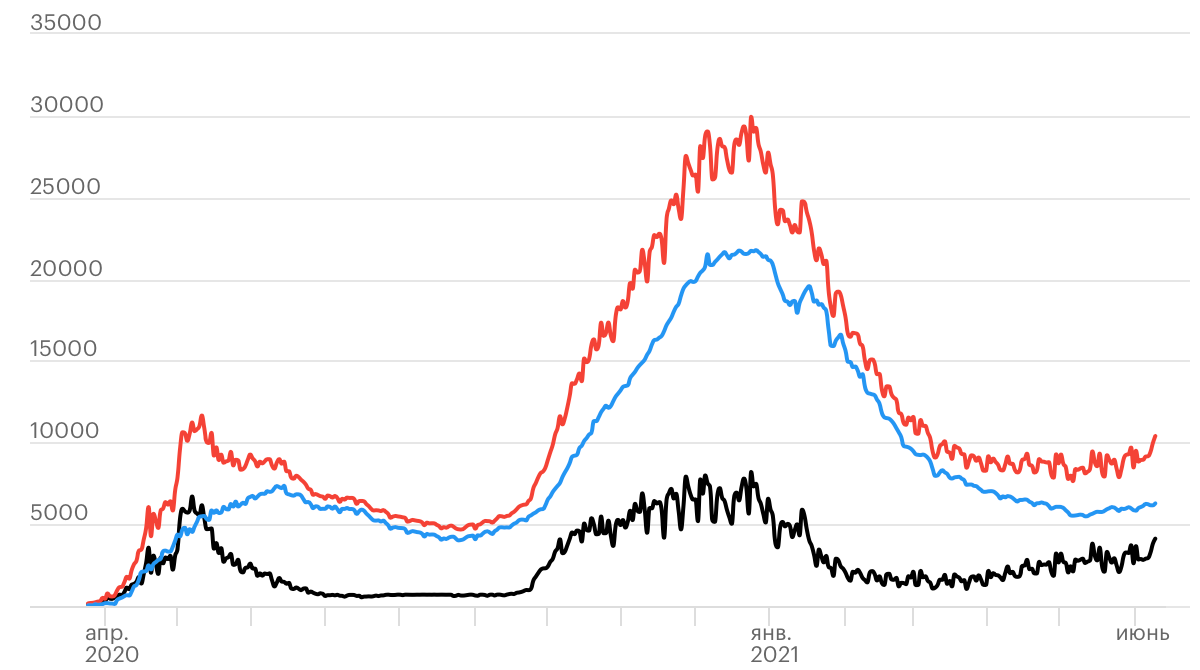

Just a thought about the politics of de-dollarization in Russia today. A bit over a month ago, I was listening to an older ChinaTalk episode with Adam Tooze and Matt Klein (if I recall correctly, may have been another. WFH has fried parts of my memory) wherein the conversation at one point turned to the position of Russian within the global dollar system prior to the Global Financial Crisis. Tooze points to the surge of anti-dollar political sentiment from 2005-2006 wherein various administrative tweaks were made to try and assert Russia’s monetary sovereignty, including mandating that all cost measurements used for official purposes be conducted in rubles to kill the urge to benchmark spending in USD. This ‘uneasy’ relationship has a decades-long history dating back even to before the influx of petrodollars in the 70s when Khruschev and other Soviet leaders were convinced they could get the Third World to conduct more transactions in rubles when negotiating debt and commercial relationships. But focusing too much on the whims of anti-western security heads, Russian monetary chauvinists, or else the political technologists exploiting an anxiety for personal or political gain is only part of the story. The dollar system evolved as it did from the personal choices made by countless elites globally as well as everyday people. The Central Bank’s most recent overview of the state of foreign currency demand and use per March data shows Russians keep running to the USD over the Euro:

Blue = USD demand Black = Euro demand

It’s exceedingly difficult to accept the premise that you have a ‘unitary’ Russian state approach to this aspect of monetary politics because of how divergent the interests of different economic and political groups are. Russia’s wealthiest barons don’t just rely on their relationship with the regime, but on an open capital account that allows them to freely send their hard-won rents and favors abroad in the form of foreign currency tucked far away from the hands of the Russian state. Households happen to have the same instinct when it comes to finding monetary safety — they still prefer to hold dollars during an economic crisis. Now that the Duma and political technologists are looking to force banks to tighten the oversight of financial transfers of money from abroad — they’re really targeting non-profits doing political work — there’s a creeping sense that these controls are intended to indirectly affect preferences, especially if they tighten their grip on flows of money from “unfriendly countries” (read: the US and anyone else they deem a problem for political gain, currently only the Czech Republic). All this is a roundabout way of saying that the anxieties of the 2000s about the need to restore the state’s sovereignty are far different than today’s challenge of de-dollarization despite sharing an intellectual continuity. Without a deeper account of interest group politics in Russia’s labyrinthine political system, it’s hard to take at face value the idea that a country talking up rubles while all of its wealthy citizens, asset owners, and even state corporations not only prefer dollars but often prefer to raise debt abroad in foreign currencies suggests that talk is cheap. Monetary sovereignty can be a lot more expensive if poorly pursued.

What’s going on?

Trade has somewhat recovered as the latest data release from the FTS shows rising turnover with all of Russia’s top 10 trade partners, but it’s not all good news for Moscow. Russia’s trade surplus is down 8.4% year-on-year even with the commodity price recovery — the current account surplus stood at $41.2 billion Jan.-April vs. $44 billion from 2020. The following includes May data for net turnover, not any trade surplus or deficit bilaterally:

There are two main factors holding back the resurgence of the current account surplus 1) oil prices haven’t been able to breach $70 a barrel for long (though they’re now surging so that may change, particularly if shale drillers stay disciplined) 2) imported goods/components and services have been shooting up in price due to global supply bottlenecks and the uneven stop-start effect of ‘turning on’ developed market economies again. Energy exports accounted for 52.1% of all trade and grew more weakly than imports — exports rose 11.3% whereas imports rose 23.7% in monetary value. Equally important to note is that the net share of trade from Asia-Pacific countries now roughly matches that of the EU. We can say in geographic terms Russia’s successfully diversified its trade. That means precious little, however, when inflation — and the MNCs producing its needed components — are global.

Pension inflation adjustments are now falling behind the pace of inflation slightly with a 5.4% year-on-year increase as of May against a 5.5% annualized inflation level. That also fails to capture the much higher relative increase in the price of most of the goods those pensions, worth an average of 15,971 rubles a month, are actually buying. Pensions have declined 0.5% in real terms since March, an indicator that should worry United Russia and the Kremlin given the important role pensioners play in delivering election results. There’s some form of relief on the way. The ruble’s now resting at a 10-month high against the USD thanks to rising expectations of a far more hawkish Central Bank policy approach. Markets are now betting on three quick 0.5% rate hikes taking key rates to 6.5% by the end of summer. Rate hikes are going to hurt the consumer recovery among anyone under the age of 60-65 who’s still working, trying to maintain their quality of life, and not necessarily seeing adequate real wage increases. There are already some indicators that the surge of consumer spending is abating, at least in specific product categories that benefited last year. For instance, demand for new TVs fell 15% year-on-year in 1Q terms of physical turnover vs. just a 3% decline because of rising prices. That suggests that a fair bit of the consumer recovery may be muted by the inequality experienced within the pandemic last year i.e. if you kept working normally and so on, you consumed more goods and some services last year compared to everyone whose incomes fell. If similar declines start to be observed across other major consumer goods categories, the consumer recovery will be returning to the pre-crisis “normal” (which was frankly quite bad) faster than might have otherwise been expected thanks to the weaker than necessary fiscal response.

Russia’s coal-based power generation capacity is struggling to adjust to a peculiar problem that’s emerged globally during the current commodity run — thermal coal prices haven’t dropped despite summer arriving. Thermal coal prices are at 9-year highs, with Australian export prices at about $107/ton even with China’s import restrictions playing havoc on Asian markets where the most intense action is right now. That means that exports are 2 times more profitable for Russian coalers in Europe and 3 times more profitable in Asia than they were a year ago. Everyone wants the profit from selling abroad, squeezing domestic supply, driving domestic power prices up, and challenging power firms to reset tariffs for energy usage. Argus expects export prices for Russian thermal coal to hang in the range of 1,400-1,500 rubles/ton vs. the domestic price of 1,100 tons with no normalization in sight till the end of the year. Kuzbass coal companies are trying to up output — the Kuzbass Fuel Company specifically wants to increase production 36% year-on-year to 12.75 million tons, for instance. There’s been no real policy response from Moscow. MinPromTorg just sticks to the usual line about signing long-term supply contracts for price stability and getting discounts for budget-financed construction projects. The recent surge was heavily influenced by China’s recovery lifting demand alongside some more idiosyncratic supply bottlenecks and logistical challenges affecting its domestic supply. It’s yet another example of Russia’s inability to shield itself from bottlenecks and inflation pressures with its commodity-export led economic model and state controls. Watch energy prices in the regions over the summer.

COVID Status Report

10,407 new cases and 399 deaths were reported as the new case count climbed north of 10,000 for the first time since March. It appears that Rosstat has finally effectively admitted that all excess mortality can be attributed to COVID with the release of the April data showing an 11.6% increase year-on-year — if you exclude the causes of death attributed to COVID-19 from last year, you get a near perfect match with the net increase. Yet another academic and research, Sergei Sedykh of the Institute of Chemical Biology and Fundamental Medicine in Novosibirsk has come out confirming a 3rd wave underway. While vaccines continue to slowly rise, the regional disparities are a huge source of concern. For instance, Dagestan is lagging the entire country — only 7.4% of its population has been vaccinated — and these carry significant risks the longer these disparities persist on top of the poor take-up rate nationally. Sources from a Krasnoyarsk news report put out by TVK cite local recognition among doctors and hospitals that the numbers of people infected and hospitalized are rising far more than the official data suggests and emergency services are struggling to keep pace.

Red = Russia Blue = Russia w/ Moscow Black = Moscow

Rospotrebnadzor is trying to assure everyone above the age of 60 that it’s safe to get vaccinated in hopes of protecting those most at-risk, similarly pushing good news that 96% of those who received shots of EpiVacCorona developed enough antibodies to fight off COVID infections. Richer Russians are surely waiting to see how the European Parliaments decision on COVID vaccination certificates unfolds too.

Oil bulls on parade

Brent crude has surged to $72.80+ a barrel as the market now expects record deficits of oil supplies vs. demand. Some traders and funds are so excited, they’re grabbing options on the off chance it surges to $100 a barrel. But there’s little reason to believe we’re going to see much of an increase past current levels because of just how much spare capacity has been idled. OPEC+ is still collectively “underproducing” by as much as 6 million barrels per day. Turn that capacity on and prices will correspondingly fall. There isn’t a shortfall of supply that can’t quickly be corrected, at least for now. China can’t as easily do the heavy-lifting now either. With prices at or above $70 a barrel, it’s no longer locking in cheap supply while other economies struggle. Going back to OPEC’s May report, we can how the demand recovery is still about recovering demand in the non-OECD but with a leading edge from the US, Europe, and China, but in a much more uneven manner with different implications than past episodes of price and demand instability. The following are in million barrels per day, with the first showing total demand by country/bloc or region:

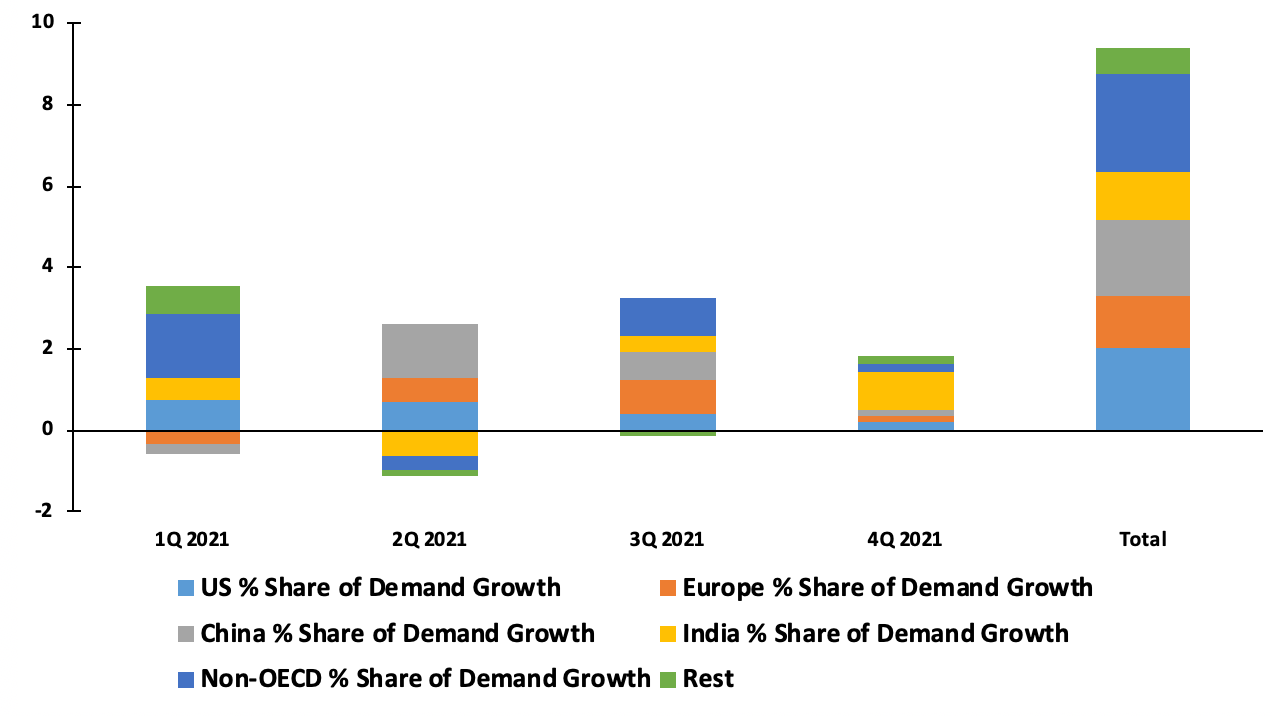

The second is the barrel share of demand increases by country or bloc of countries based on the quarterly changes in total demand per OPEC’s data:

The US and European demand recovery account for about 35% of the demand increase for 2021 taken together. China and India combine for 32.6%. Other non-OECD countries account for 25.4% and the remaining OECD countries account for 6.9%. In short, the demand recovery doesn’t reflect the pre-crisis arc of demand increases led most strongly by China and India for now, and other non-OECD countries play a huge role in OPEC’s projected return to pre-crisis demand. The post-COVID oil market may initially appear to still be lead by China, but the ‘growth gravity’ has clearly shifted. The axes aren’t perfectly aligned cause of the numbers but fairly close. I used BP’s data to capture the overall national/economy type composition of demand growth from 2000-2019 and relative demand growth rates for China, the World, and Europe where I think demand decline is likeliest to accelerate most quickly:

The bigger point we can see is that China was holding up demand growth around 5% as global demand growth in % terms halved between 2016 and 2019 and was on a consistently downwards path due to global economic imbalances, structural limitations, domestic political economies, and more. Chinese debt and GDP targets have been holding the market up for years now. In other words, the current boost to demand that might take it past 2019 levels is being led by the economies that weren’t holding up demand growth pre-COVID anyway with China supporting demand through persistent overinvestment into construction and under-consumption. Decreases in the former will hit things like diesel demand while the latter should, in theory, spur more product demand elsewhere. But the shift towards consumption, however badly supported by China’s current policy approaches, is now timed on a market where EVs are gaining steam and fiscal policies supporting more fuel substitution are politically popular, even if politicians continue to fret over debt or other ghosts of orthodoxies past. Vital to this mix is the role that Europe’s playing pushing EV market share — and potentially dragging the US market along with it over time as the Biden administration tries to get serious on industrial policy. I plan to write more on the US on Friday with a short-roundup on Eurasia as a heads up since I think it’s really where the ‘action’ for lots of systemic factors is taking place at the moment. Pew has a useful graph and piece capturing the current state of the market as the US lags on the EV front:

It takes a lot longer to change over car fleets than more optimistic green warriors probably wish was true, hence the need for forced retirements of ICE vehicles, but the market share in Europe is a huge deal as is the rate of market share increase in China. That doesn’t necessarily mean a large emissions gain so long as China’s EVs use coal power, but it does mean that oil demand’s ‘rosy’ future is a myth. There’s definitely space to grow a bit more thanks to the shift in developed markets, but the tipping point is accelerating. On the price front, US shale drillers have maintained their discipline so far and have no reason to let up now with so much slack capacity out there. They’re also now dealing with price inflation from the global raw material crunch on supply chains, which I wager will trigger further mergers and acquisitions as investors realize shale is far more attractive if firms simply reduce drilling capex. As S&P Global Platts showed a few weeks back, anyone arguing that the profit margins on shale are killing it off probably has no clue how these firms survived so long and the internal rates of return are far better than you’d get on most green utility investments:

Russia’s bet on an investment shortfall and high prices remains foolish. 2021 is going to be an anomalous year by most economic metrics. The underlying factors at play for oil aren’t pretty, even if falling demand won’t necessarily kill returns. Oil bulls are on parade for now, but long-term bets aren’t what they’re in it for.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).