Top of the Pops

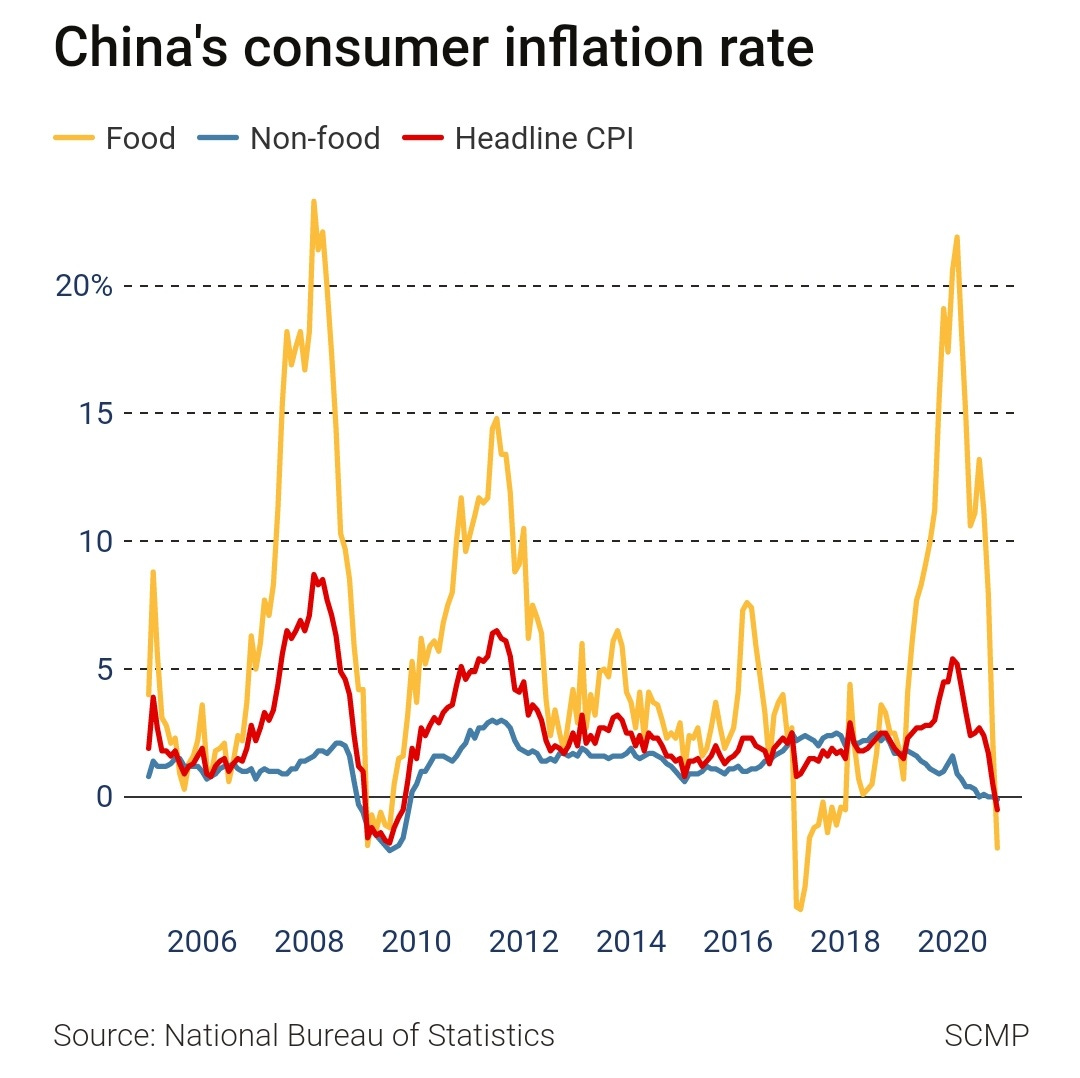

The People’s Bank of China is rolling out new measures to support green finance and proactively take part in cooperation and norm-setting around green finance to drive China’s decarbonization agenda and shift environmental requirements for financing provided to international projects. I still have loads of questions. If it’s really true that China has $1.7 trillion in outstanding green loans provided, how much of that activity is linked to efficient investments that create value over time and how much of that activity is trickling out into emissions from rising commodity extraction? It’s the latter point we really have to worry about in the short-term, which is why gold miners and other extractives are trying to establish roadmaps to decarbonize production as fast as financially feasible given their business models and margins. Here’s the other thing. China’s consumer recovery is not showing signs of strength compared to its export-supply side recovery:

Factory gate inflation is back on an upward path while CPI is net negative. That could portend stronger domestic inflation to come, but would seem to be export-sector led for outputs that face rising costs (think anything with copper, for one). The green announcement may well fit into that story in the years to come as well. If China doesn’t get its act together better managing its transformation from an exporter to a consumer-led economy — it is there in net terms, but as Russia shows us, sectors with a relatively small share of national GDP can still massively distort the political economy of the rest — green finance is going to be an instrument to sustain its export prowess and increase its investment income abroad.

What’s going on?

Russia’s budget spending next year is expected to fall by 9% (excluding costs of debt servicing payments). The ratings agency National Credit Ratings is arguing that the current fiscal policy is too conservative and undoubtedly going to hinder recovery. The following are revenues (green) vs. expenditures excluding debt payments (blue) in trillions of rubles:

Economic recovery estimates vary significantly for 2021, but seem to generally fall into the range of 2.5-3.3%. In other words, Russia won’t recover the ground it’s lost till 2022, and given the composition of the GDP, it seems quite likely national real incomes will take longer to recover from the fallout. There’s a noticeable turn going on, and while not well articulated, it does seem that the policy logic of austerity is finally being prodded more aggressively in public and behind closed doors.

Ready or not, the beginning of vaccinations in the UK and looming distribution in the US has pushed forward (some) renewed optimism about economic recoveries. Fitch has the following estimates for 2020-2022 — top to bottom, the US, the Euro Zone, China, and Russia:

As we can see, Europe is yet again the ‘loser’ of this global shock while Russia still seems set to default back to its stagnant trend of annual GDP growth at 1-2%, lagging considerably behind annual inflation. Global growth is expected to hit 5.3% for Fitch’s forecast, which suggests something else too — China could well start falling closer to the global average as the inefficiency of its debt-driven growth model increases and there’s likely to be a very strong emerging market rebound driven by the new commodities cycle and shift towards globalized supply chains to export to China. Russia isn’t going to partake, and, as if by gravity, seems like it’s following Europe’s trajectory, though with a much shallower trough from the shock this year.

Sergei Katyrin from the Trade and Industrial Chamber (TPP) has reportedly written a letter to Mikhail Mishustin explaining that the existing law restricting migrant labor due to COVID that took effect on March 20 now risks businesses struggling without adequate labor. TPP wants the government to clarify the procedure by which migrant labor can be invited/hired by Russian businesses with overall migration levels coordinated at the regional level via inter-agency commission, to have leading businesses pass on the names and info of key hires to the FSB and Ministry of the Interior, and to allow highly-skilled workers who were forced to leave Russia because of the pandemic to resettle their families in Russia upon their return to retain more labor. Businesses are lobbying to only allow specialists to move to Russia while keeping cheap labor from Central Asia and the Caucasus out, basically. It reflects changes in hiring. Russians are now more desperate for jobs because of the economic shock and migrants are likelier to be staying home due to the ripple effects of the COVID shock. Using less illegal labor is going to trigger some price inflation from higher salaries and legal protections, so what to see how Mishustin responds.

Deputy head from MinEkonomiki Andrei Ivanov has written to the Russian Union of Industrialists and Entrepreneurs about a potential support package for business investment that would include regulatory and financial measures. It comes down to a new “investment codex,” which is polite spin for yet more regulatory chaos by creating instruments that will be awarded to specific firms and sectors through informal and formal agreements, setting aside new money that’ll be contested by MinFin, and more. The challenge for MinEkonomiki is raising the level of investment in the economy by 70% in 2030 compared to 2020. What’s all the more pathetic is that 2020 would be taken as a baseline year given the large drag that oil production cuts place on national investment figures. The most promising idea that’s relatively simple to implement is putting projects/their backing firms negotiating SPIK contracts onto a so-called Lombard list at the CBR which presumably would lend while securing collateral from the company. Once on the list, they’d have preferential access to credit at a reduced cost. It makes use of fiscal conservatism to aid with a credit expansion for business. There’s a lot more here from the Vtimes reporting and features in today’s column.

COVID Status Report

Cases hung just north of 26,000 again with the death toll at 562 for the last 24 hours with Moscow still ping-ponging, but the regions continuing to stabilize on net. Based on the number of cases per 1,000 the last 30 days, there’s a visible shift towards risks in the northeastern part of European Russia compared to the earlier evidence that places like the Kuban’ and Eastern Siberia were really what we should worry about:

Top to bottom: Karelia, St. Petersburg, Moscow, Republic of Altai, Murmansk oblast’, Yamal-Nenets, Komi, Arkhangelsk oblast’, Khakasiya, Pskov oblast’

The vaccine rollout charges on. I think the story about doctors refusing vaccines is noteworthy, but probably not indicative of the broader direction of travel for the public health response. Telling people not to drink for 56 days after getting the shot, however, is a big haul when the country’s headed into New Year’s and then Christmas. But it does seem that some semblance of stability is emerging nationally despite the countless local and regional shortfalls of necessary equipment, bonus payments, and more. I wouldn’t count on foot traffic data for retail recovering a bit till January-February though.

Money printer in winter go brrrrr

The biggest shift from MinEkonomiki’s raft of proposals to get levels of investment up in the Russian economy comes in a shift of overall economic mentality. Policymakers seem to finally have cottoned out to the fact that they need to shove a lot more money out the door into productive investments to return to growth, get real incomes rising again, and break through some of the bottlenecks that recurrently trigger consumer inflation. The CBR hasn’t magicked inflation under control. Real incomes have fallen since 2013 with weak investment levels, and that entails deflation. MinEkonomiki and the “Stolpyin Club” are pushing for a large expansion of loans, bond issuances, the creation of capital companies expressly to invest, and direct money emissions from the CBR. The direct emission policy idea is predicated on an exhaustion of other possible policy choices to reduce borrowing costs as well as the use of the key rate and discount window to keep bank operations from facing liquidity shocks and borrowers from facing a surge in interest rates due to the poor economic climate. As we can see from the CBR data in hand (this is in US$ mlns), direct investments now make up around one-third of Russia’s financial assets and it’s a net lender (in line with the current account surplus) i.e. Russia has a net positive investment rating meaning it, on net, is owed money from liabilities rather than holding more liabilities than assets. Note that the net international position follows the left axis, but was broken out as a line for ease:

But the direct investment data underscores a broader problem. Net investment as a share of GDP in Russia has run in the realm of 2ish% for most of the last two decades, which beats out developed economies like the US and Germany, but given high inflation rates depreciating assets, the amount of investments needed to break past supply constraints from the 2013 wall the economy hit after it exhausted soviet-era surplus supply, and its systemic underinvestment in infrastructure, that rate is too low. Thing is that Russia’s not in any position to accept large flows of foreign investment for institutional reasons — foreign investors may be interested, but the weakness of legal institutions and constantly shifting policy landscape undermine long-term planning for returns and estimates of profitability — and its private sector is constrained in borrowing from abroad due to sanctions and reputational risks as well as currency risks. The ruble doesn’t follow the oil price as directly any longer, but still weakens because of the link between the oil price, Russian business cycle, and impact of price shocks on the cost and availability of credit. That means that it has to generate more financial resources domestically, which means monetary/credit expansions and also goes to show that the % share of direct investments in the country’s assets reflects the extent to which fixed asset investments from the extractives sector or supporting it i.e. pipelines and more can considerably skew the net valuation of assets held, particularly since in market terms, their value actually changes a fair bit with commodity prices and cycles.

The shift in thinking at MinEkonomiki is interesting because it acknowledges that the biggest resource constraint facing the Russian economy at the moment is capital. Creating more of it to finance productive investment requires adequate bank sector liquidity, which in Russia’s case is provided via earnings from commodity exports. Russia’s banking crises lag oil price shocks slightly, but the link is clear. As dollar, Euro, and now CNY earnings drop and stop filtering into bank reserves via corporate accounts, the banks are forced to turn to CBR currency swaps and repo operations to cover liabilities/maintain their reserve base. Enough banks do it at the same time, suddenly the costs start going up as CBR reserves are threatened. A large reason why the CBR floated the ruble in late 2014 wasn’t that it literally lacked dollars in hand, but rather that Russian firms owed over a hundred billion USD for external liabilities on a short-time horizon and a run on that liquidity would massively raise borrowing costs across the economy while also leading to massive devaluation of the ruble in real terms that could not be warded off as currency reserves dwindled.

The MinEkonomiki proposal pointedly includes the aim of creating a reliable framework and stable of green and perpetual bond/long-term financing instruments. Looking deeply at tax preferences and tweaks is comforting in the Russian context since it’s always central to lobbying efforts, but it’s really the cost of long-term credit and being able to sustain long-term investment planning on financial grounds that matters more to get the ball rolling. Look at the US case:

Yields on bonds for companies below investment grade in the US level out in the 3.5-4.5% range over the last few years once policy interventions settle. That’s effectively junk debt, the kind that shale and other sectors struggling to generate cash flow feast on. Ruble-bonds issued domestically by Rosneft and Gazprom — literally borrowing from the market with the backing of a sovereign government — frequently run in the 5-7% at what would ostensibly be the highest or almost highest investment grade in Russia since they effectively can’t default. MinEkonomiki is staking a bet that if it can create low-cost long-term financing options, investment levels will naturally rise. If lending increases, that should in theory bring more inflation.

Since the CBR supplies foreign currency to the private banking sector, the balance of banking operations managing liquidity and reserves to underpin credit is the lynchpin of what MinEkonomiki is proposing and could create a vicious cycle. The yield curve for OFZs now is fairly stable and not too worrying — about 4.25% for bonds you’d hold for just one quarter up to 6.93ish% for 30-year bond maturities. Expanding borrowing in ruble-denominated bonds to finance the deficit is, in my view, totally right. But with the key rate as low as it is vs. inflation and these attempts to expand borrowing, you’ll then get a monetary expansion through credit creation that may well fail to trickle into Russians’ incomes initially. That then threatens to increase inflation in the economy without growth, which then puts more pressure on the CBR to return to orthodoxy and begin to raise the rate to do what it would prefer to do anyway because a higher inflation rate hurts the growing Russian population reliant on fixed-income support from the state and can encourage SOEs and parastatals to look more seriously at foreign-denominated liabilities to finance long-term projects because domestic banks would theoretically look to raise interest rates to avoid borrowers inflating away what they owe if their earnings are in foreign currencies anyway. I’m making a few leaps and skipping over details, not because they don’t matter, but because they aren’t really crucial to the larger point here: Russia’s economic plans are going to require a monetary expansion to be realized, but that expansion poses significant risks because the newer, domestic sectors that have to develop will be earning in rubles whereas Russia’s financial and fiscal backbone remains exporters earnings in foreign scrip. Currency devaluations help those exporting firms that aren’t credit-constrained, but would hurt most others as well as significantly raise the costs of imports for industries still reliant on them.

This is where Russia’s slow and tortured macroeconomic evolution is interesting, and fits into broadly observable changes in the country’s political economy as a result of what will be 8 years of fiscal consolidation by the time 2023 rolls around. One of the broadly observable phenomena in Russian politics is that whenever the budget retreats from a spending obligation, it’s common to see SOEs and parastatals fill the gap out of their own pockets. RZhD is a great example. The company began issuing perpetual bonds in June at rates in the 6.5-7% range that aren’t secured by anything. At the same time, the company turns around and uses debt raises to finance social spending and straight up tells investors in the prospectus (apologies, couldn’t find the link I stumbled on awhile back digging around but will try and include it the next few days) that the entirety of the raise was devoted to social spending. The same goes for Rosneft historically paying a higher level of social contributions compared to its net tax rate. Company balance sheets replace the budget in sorting out how to avoid the worst effects of fiscal austerity.

This becomes simultaneously more useful for the regime and also a bigger systemic risk when you shift into a lower-inflation, lower-interest rate regime by Russian standards. There’s significant empirical evidence that lower interest rates tend to encourage market consolidation and weaken market entry (and exit) for firms, empowering incumbents with relatively advantages to double down and exploit their scale to invest more to dominate a market. As showcased by Russia’s stimulus plans offering lines of credit (the US too…), smaller firms don’t benefit as much from these attempts to ease conditions for credit. Existing institutional arrangements, a poor business climate broadly, and a lack of legal protections strengthen the largest firms. All this goes to say that the model MinEkonomiki is proposing to adopt could well end up further weakening the power of SMEs while posing as a means to strengthen them because of differential levels of access to credit and, most importantly, the role large firms have in redistributing rents and resources no longer flowing directly into the budget. If markets further consolidate, then consumers lose as the rents created by market concentration accrue to the company and its political power to lobby the state.

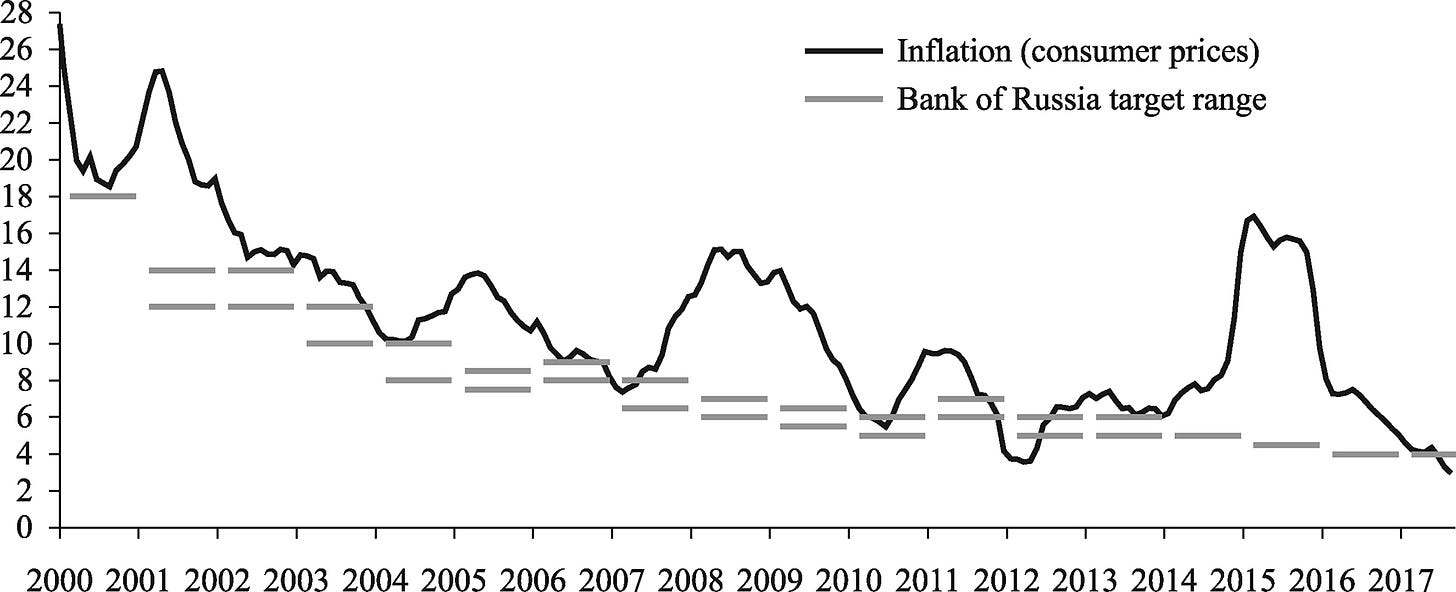

At present, investors are banking on a ruble rally in 2021, which tends to mean an increase in capital inflows and, one would presume, commodity export earnings. MinEkonomiki’s hunt for 13 trillion rubles’ worth ($176.54 billion) of investment can’t be driven by external demand and factors, however. Commodity bull markets benefit the SOEs that already have it easiest, and don’t provide a large amount of growth in most cases. The CBR’s evolution has been gradual, but falls in line with the latest change in MinEkonomiki’s thinking. This from a great 2017 paper by Iikka Korhonen and Riikka Nuutilainen on breaks in Russian monetary policy:

Monetary expansions underlying these cycles have always been steady. The shifts have come from increasing commodity prices and foreign currency earnings, devaluation effects, largely other sources of inflation. What I’m positing here is that the long-term slope downwards in inflation from 2000 to 2013 corresponds to the use of Soviet surplus capacity as domestic demand rose again to control inflationary pressures, and that 2013 onwards — excluding the 2015-2016 spike — deflationary factors for real incomes have reined in inflation. As long as the inflation target is kept at 4%, Russian policy will have to leap at some point and shift into running the economy hot. MinEkonomiki’s proposals are flawed, but a step in that direction. The question will be whether or not such a shift in regime for macro policy as it happens — I don’t assume it’ll happen in full, but there is a shift identifiably taking place — creates broad growth or just strengthens state firms. My money’s on the latter because of Russia’s institutional failings since companies can’t print their own money and really let a rip on infrastructure investment. At least not yet.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).