Top of the Pops

Armenian Prime Minister Nikol Pashinyan clarified in an interview that only a change in Turkey’s stance would encourage Azerbaijan to deescalate military action, going as far as to say that Turkey was continuing the Armenian genocide with its Neo-Ottoman expansionist aims. The line that Pashinyan is pushing is telling: Nagorno-Karabakh could become the “new Syria.” Worth noting that last week, Fitch downgraded Armenia’s sovereign debt status to B+ with a stable outlook with the sharper than expected downturn - and surely the impact of the conflict now as well. BP reiterated yesterday that it plans to ship gas via the Trans-Adriatic Pipeline, supplied by Azerbaijan’s Shah Deniz field and transported via the Trans-Anatolian Pipeline and related infrastructure, to Italy and European markets by year end regardless of the conflict. Baku has a lot more cash lying around, and the longer this goes on, the more they’ll lean on SOFAZ and foreign currency earnings, both of which Armenia lacks.

What’s going on?

Metallurgical companies are reportedly appealing to first deputy prime minister to review price controls for train wheels and axles set by the Federal Anti-Monopoly Service. The trouble for the sector is that FAS’ price ceiling is, in their opinion, too low and doesn’t reflect costs and market demand fairly. But any increase in costs will end up raising freight rates given persistent rail wagon shortages that fluctuate seasonally, thus raising inflation because of the dominant role train haulage plays for national supply chains, particularly in more remote regions reliant on a distant railhead.

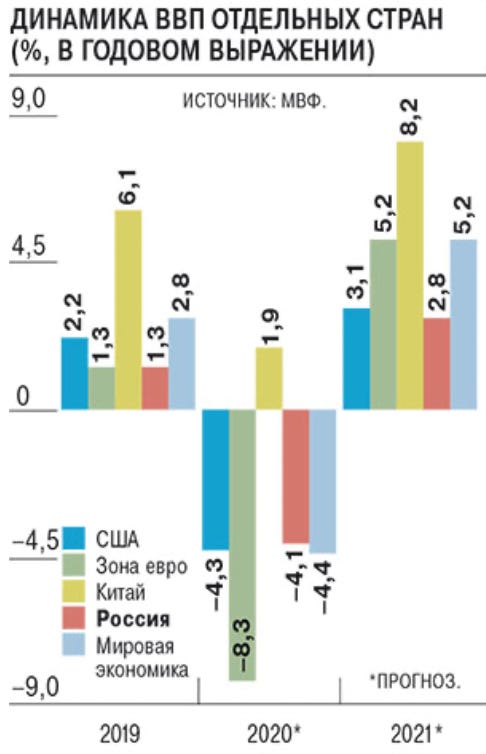

IMF estimates for economic contractions in 2020 and recoveries in 2021 show that Russia is now actually on pace to lose ground:

Title: GDP dynamics of separate countries (%, in year-on-year terms)

Blue/Cyan = USA Darker green = Eurozone Yellow-Green = China Red = Russia Light Blue = World economy

I remain a little skeptical about the strength of growth in China next year, but overall, Russia continues to lose ground in output terms to China (and Asia) while, at best, breaking even with the US and gaining only a little on the Eurozone. Put another way, the rate of external demand growth continues to outpace domestic demand in Russia by a significant gap, and that’s a huge problem for an economy that has failed to turn commodity export earnings into sustainable domestic growth. Forget being a Top 5 economy by 2030…

MinEkonomiki estimates that small and medium-sized businesses have received over 1 trillion rubles ($12.96 billion) in relief credit since April, primarily from state-owned banks Sber and VTB. The release is clearly intended to suggest that the government has taken serious action. Yet the number of business-owners living in cities with a million residents or more who now wish to sell their businesses has grown by 28%, a leading indicator for bankruptcies (noted in today’s The Bell, if you aren’t subscribed. Highly recommend it!). While firms like Gazprom benefiting from the sovereign’s credit rating test the financing waters by placing perpetual eurobonds, SMEs face a financing cliff edge if domestic demand doesn’t strengthen and better support measures are crafted for the current wave of infections.

EuroChem and PhosAgro - fertilizer producers - are tied up in knots having won agreements from relevant ministries to win mineral extraction tax exemptions for projects in the Arctic that are now roped into a push by the budget hawks in Moscow to raise MET for the chemicals sector by 350%. Local exemptions would still apply, but the current scheme calls for a 50% exemption that cannot exceed the total value of investments into infrastructure or refining and processing capacity for any given field. Yet more evidence that Moscow will try and soak producers to save the budget, despite the risks that increased taxes be passed onto agricultural sector consumers who represent an increasingly important export lobby.

COVID Status Alert

The important stuff — Red = new announced infections Black = deaths

The October 14 figures are a new record, and while nowhere near the actual infection rates seen in April-May, the rate of increase is looking worse.

OPEC on the Cheek

Saudi Crown Prince Mohammed bin Salman and President Putin spoke by phone yesterday to signal continued support for oil output coordination in the OPEC+ format and calling for other producer nations to continue to comply with negotiated cuts. The current pressures on the market make another break with the cuts highly unlikely - Russia’s at a huge disadvantage lacking significant storage capacity for its own oil, which then means that every marginal barrel produced past domestic demand and not under long-term contract immediately has to go somewhere.

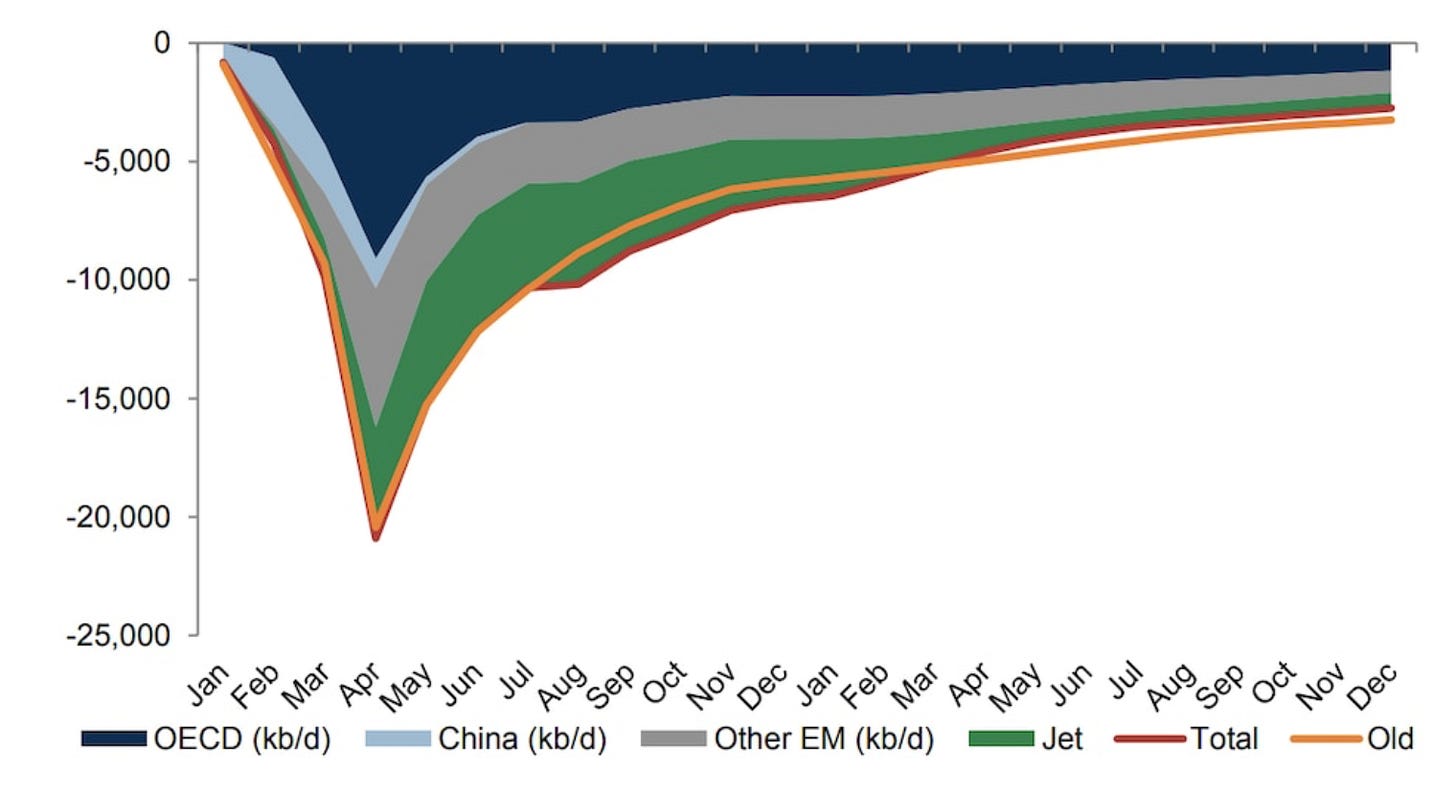

OPEC+ is, as of now, set to ease production restrictions come January from the current cumulative cuts of 7.7 million barrels per day to about 5.76 million barrels per day. Few are confident the market’s in a good place to absorb the incoming volumes. Take Goldman Sachs rather upbeat forecast from the beginning of September for 2020-2021 demand that assumes vaccinations become widely available and have a positive effect next year:

Even in their rosy scenario, demand is down 5 million barrels a day by the end of next year, which matches most of the cuts come January. The gamble, then, is that OPEC+ benefits from IOCs and private firms cutting back their investment plans into newer production and can more quickly absorb the newer market share to come to stabilize prices and retain as much control of supply side dynamics as possible. But this forecast already looks dated, at least to my eyes, and there’s every reason to believe that recoveries will be slow, inconsistent, and imbalanced due to policy responses as much as difficulties with vaccines.

Back to the problem of competing on costs when carbon emissions are internalized into oil prices. Maximizing existing petroleum revenues in the current demand environment entails a shift in operational and capital expenditures for both NOCs and IOCs. From this Oxford Energy overview of hedging strategies for exporters citing 2015 data:

This is a bit distortionary cause it likely doesn’t factor in related Scope 2 and 3 emissions - the carbon intensity of the electricity producers consume and then emissions from business travel, procurement, water and waste management etc. which would definitely up Russia’s numbers. But the point stands that international oil companies like BP, Total, Shell, and Equinor already use assumed carbon prices in the range of $30-40 per ton for planning purposes, or else have set emissions reductions targets that include scope 2 and 3 emissions and not just direct emissions from extraction. So even if in 2021, OPEC+ is able to maintain cut discipline to support the price and prevent a resurgence of upstream investment elsewhere, the international oil companies they compete with are slowly moving towards pricing in externalities into the way they do business. In effect, they’re returns on capital deployed will, in theory, be more efficient as policies shift if state-owned companies don’t keep pace.

Given gloomy demand prospects, OPEC+ faces the reality that if they don’t hang together, they’ll all hang separately. As much as I expect the cohesion of cuts to be tested, budgets and market stability are the most important consideration. The structure of recovery spelt out by the IMF’s World Economic Outlook helps put things into perspective:

If OPEC+ is trying to nab market share in the near-term and crowd out any resurgent competition from IOCs, think of national economies in recovery playing their own structural roles in a similar manner, if not by intention. China’s increased its share of world industrial output while it idles in developed economies, but its been consumers in Germany, the US, Brazil, and Japan consuming more past last year’s levels providing some semblance of balance. The reason to track this closely is that, while left out of the above graphs, exporting industries in developing economies tend to be crucial for wage growth. Wage growth, by extension, is what allows those economies to consume more domestically sustainably without over-reliance on debt that they frequently have a more difficult time affording.

Unless the recovery more equitably distributes industrial production’s return to growth, that won’t happen. For a basic sense of the problem, here’s OECD vs. non-OECD oil consumption since 2000:

The race now is on to see if demand in place like China, driven by new auto sales (including SUVs) can offset what has already been the structural decline of demand growth and, now, demand in developed economies. Putin and MbS know the geopolitical and budgetary value of doing whatever they have to in order to lift prices to $40 a barrel and higher. What comes next is figuring out how to keep investing into the industry while making sure to keep pace with another wave of innovation from small, medium-sized, and major international firms looking to cut costs and emissions, even if they’re pivoting to a diversification strategy to get by. The demand side is pretty bleak for the next few years. That means the political incentive for OPEC+ to continue aligns well with economic incentives ill at least January. If demand is still in the dumps, expect figures like Sechin to argue that Russia’s in a better fiscal position to weather the worst of it and push again for all out producer war. He, like Putin and MbS, has his eye on US shale.

Shale Rider

The initial reactions to the pandemic among industry experts regarding the future of US shale were varied. Some more traditional types like Daniel Yergin took the line that this was just another boom-bust cycle certain to cull the wheat from the chaff, and leave the surviving shale drillers more efficient and strong than ever. Others were more skeptical. At this point, the fear is that production levels will either never fully recover or else only briefly recover after several years of hardship and be trapped by semi-permanent price instability. Consider just how bad a money pit shale has been for the companies gambling that it could become a valuable part of a diversified portfolio. Equinor is a good example of just how bad it can get:

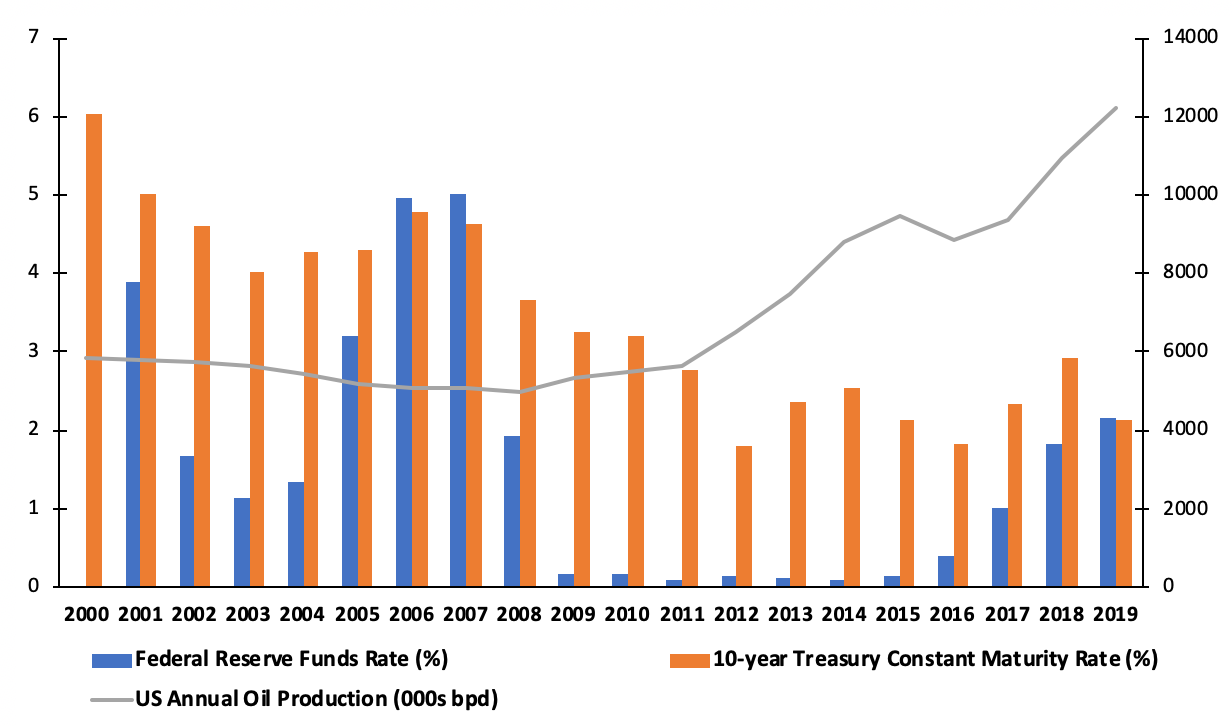

The problem for Russian producers' specifically is that shale was and is basically a massive equity bubble sustained by junk debt and high-risk investor and firm behavior. Look at its debt to cash flow ratios going into the last market shock in 2014-2015. If you trace the last two decades in US oil output, you can see a clear link between the decline in the Federal Reserve Funds Rate and 10-Year Treasury Maturities - the former lowering the cost of borrowing for banks to cover reserve requirements i.e. take risks lending and the latter offering declining yields for a very safe assets, which tends to push investors into riskier assets to maintain the returns they want. I’d have rather reversed the axes, but Excel on my Mac today was a bit of a mess:

In the last market crash, firms were forced to cut staffs and servicing costs wherever they could. Sample of the carnage in Pennsylvania around the last oil shock (gas plays, not oil, but a similar story):

Labor costs are going to be low again because of the economic devastation in the US. labor costs won’t hurt shale drillers, material costs might. But it’s really about their ability to procure financing in this climate. But production efficiency has leveled off or entered decline because of the quality of the reservoirs being drilled and a lack of technical breakthrough - companies have avoided increasing production by increasing their capital expenditures. Earlier this year, I’d have said that oil majors would start to consolidate shale plays, but now I think the situation is different. Service providers with better techniques equipment, and a willingness to sink more capital into R&D and performance improvement are going to find drillers with lower debt levels and partner up. US production is not going to come roaring back, but I don’t think it’s going to collapse either. So Russia can rest easy on that front, but its oil sector faces a longer-term problem that shale exposed:

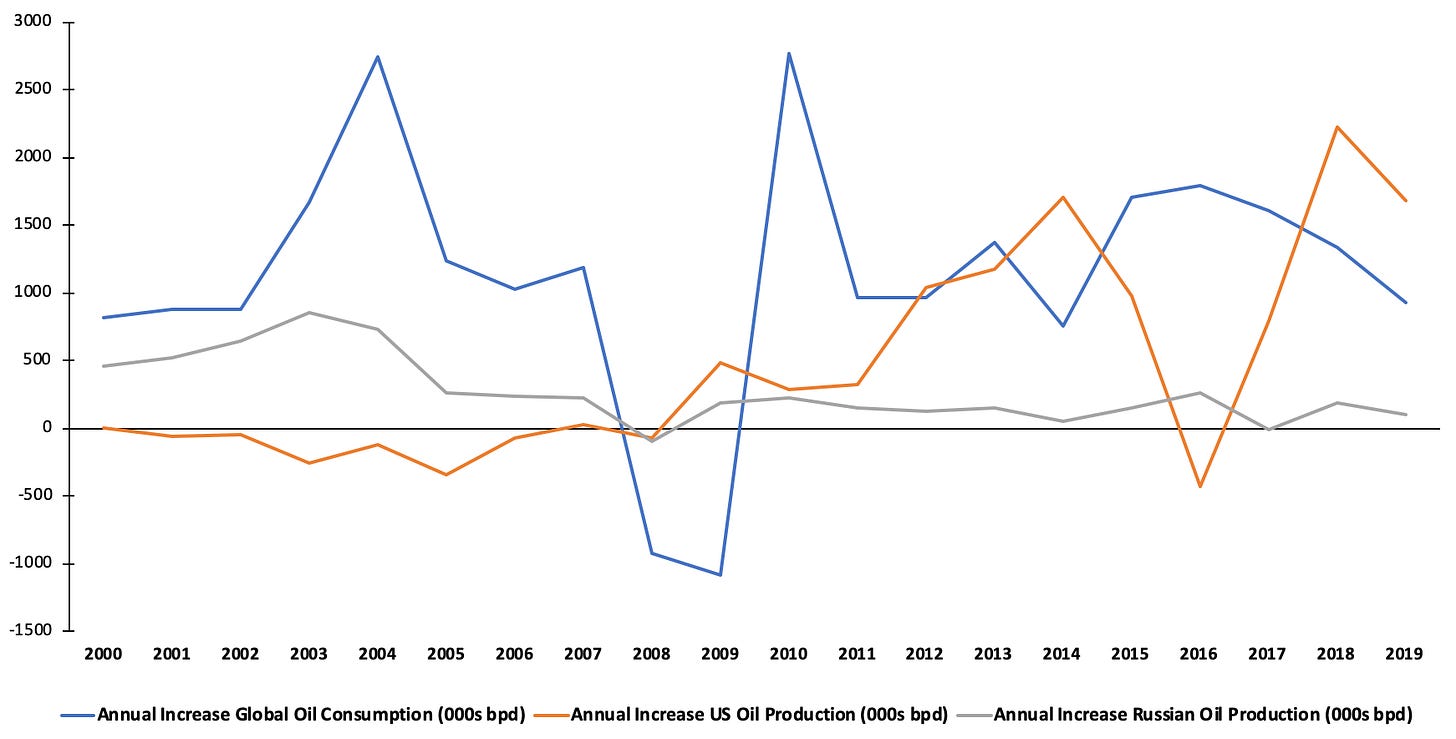

Increases in Russian output only meaningfully helped match marginal demand gains globally from 2000-2005 under Putin. Since then, a combination of the high tax burden, depletion of West Siberian and Volga-Urals basin deposits, and disincentive to invest into services R&D and new oil fields has undercut its ability to meet rising demand. Since 2016, that’s also been constrained by OPEC+ cuts, and where I would have said Russia would break the deal should demand return to growth. Russia was losing its marginal edge as a producer even before COVID. It gains nothing now from breaking cuts if can’t change that structural reality. Even if shale is dead - the jury’s still out and I suspect that persistently cheap debt is still going to keep it going - Russia Inc. isn’t in position to ramp up production significantly to meet future demand with the current policy regime. MbS knows that and intends to leverage it for all its worth.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).