The Emperor's New Close

China and Asia's current account surpluses may spur financial risks across Eurasia

Top of the Pops

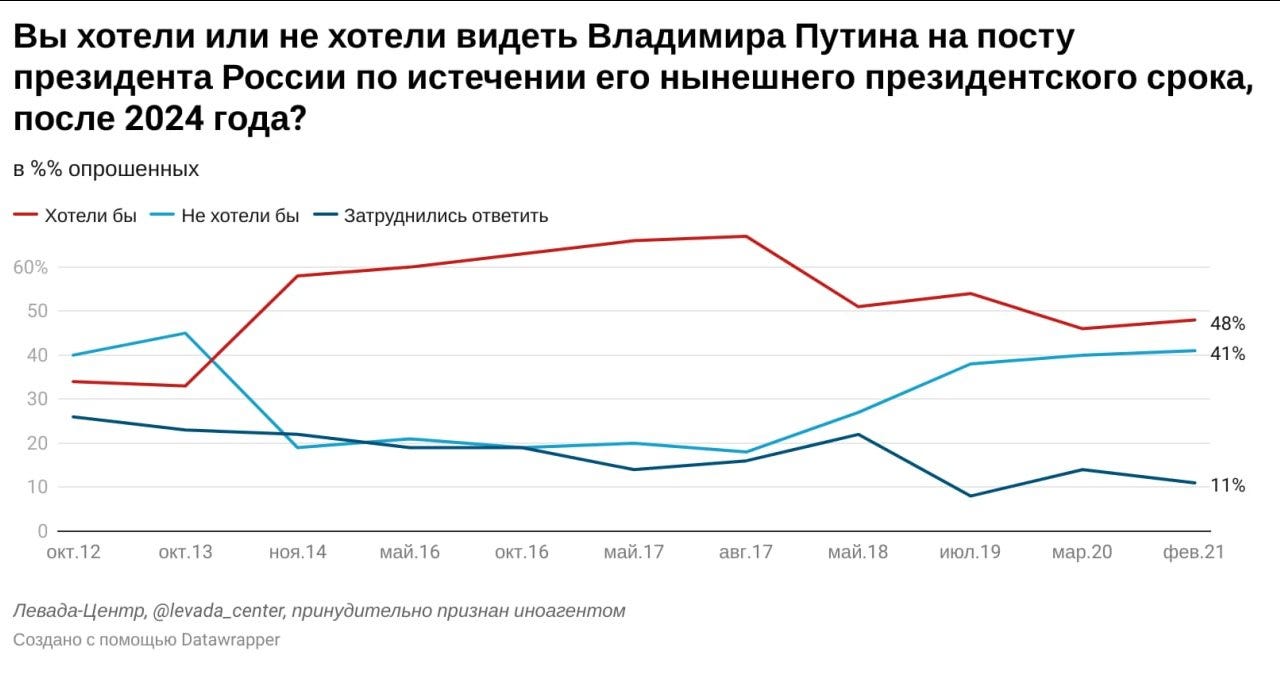

Despite the apparent slight rise in trust ratings for Putin from other Levada data, it looks like people are starting to sour on Putin staying in power past 2024:

Red = I’d want him to Cyan = I don’t want him to Darker Blue = hard to say

The gap’s down to 7% in favor of him staying on with an underlying, slow step trend downwards that risks seeing these levels return to 2011-2012 figures when the regime had to crackdown hard on protesters as Putin returned to the presidency. And what’s more, COVID has no appreciable impact on the path of the data. What that suggests to me is that there is an economic story here that’s longer, structural, and lacks an easy timeline by which to judge the regime’s performance. Clearly the COVID response has little effect on Putin if the regime’s done all it could to make the government at the local, regional, and federal level look responsible without him. Building off this change, I figured I’d pull the latest Rosstat update on average home prices given that real incomes haven’t risen, though wages have nominally. The following is 000s rubles per sq. meter where purple = first homes and maroon = second homes:

There’s clearly far more going on with the Putin polling data, but housing is a useful indicator because it’s a capital asset, owners don’t want it to depreciate in value, and once you own something you want to preserve, your incentives to think long-term politically shift somewhat (even if you don’t necessarily realize it or articulate it that way). Thus the more people own their homes or landlords are earning off of the ownership of property that’s rented out, the more their political incentives are to advocate for policies that are deflationary or else panic over things like a surge in CPI fearing it augurs a coming depreciation for their assets. They also benefit mightily from the current state subsidy policy. But Russia’s economic woes are a result of its pre-existing deflationary bias and the way that political interest groups close to Putin and the regime maneuver to exploit said bias. As more people grow fatigued and want to see new blood in leadership positions, rising housing costs are going to affect home ownership rates for younger Russians more and more without real income increases, further feeding the underlying discontent that the protests around Navalny tapped into. There aren’t any viable alternatives to Putin, clearly. But shared misery can build new political alliances and blocs where we don’t necessarily expect them. Every deflationary political bloc has an opposite inflationary one, especially for dyed-in-the-wool younger communists seeking a new lease on political life.

What’s going on?

One side effect of the supply side response adopted by the state last year was that the banking sector proved to get through COVID better off than any other sector of the economy, citing minimal losses of a mere 0.3% of earnings for April-May when things were at their worst. According to Otkrytiye rep Mikhail Zadornov, the sector actually grew 3-3.5% for the year and saw earning rise 8% despite the overall economic contraction. What’s interesting here is more that the current account shock that led to the recession in 2015 from oil prices collapsing didn’t replicate itself in 2020 at all — the banking sector entered crisis then after years of financing expansion and money creation post-global financial crisis in an economy that was stalling and piling up bad bets since oil prices were high. Banks at risk only account for 3.5% of sector assets, down from 6% in 2018, and the Central Bank’s efforts to clean up the sector and support measures clearly contained any systemic risks swiftly and effectively. What’s worrisome, however, is that the only reason banks didn’t lose much profit off of bad debts and reduced credit-worthiness for most consumer and many commercial loans was the state subsidy for mortgages and massive growth in mortgage applications. What that suggests is that the health of banking sector growth is basically down to a policy-induced housing bubble. Hopefully wages and real incomes keep it up.

As expected, the Russian press is doing a subtle game of gloating about external debt. Kommersant ran a brief column with the latest updates on just how much debt OECD economies took on in response to COVID:

Title: Debt provision of developed countries

Blue (lhs) = total volume of debt issued, US$ trlns

Red (rhs) = net volume placed (US$ trlns) Black = total budget deficit

OECD debt expanded by $18 trillion in 2020, a $6.8 trillion increase over 2019 worth the equivalent of 29% of OECD GDP. Net debt increased $8.6 trillion. Of course, Kommersant’s coverage notes that it’s ‘interesting’ that the expansion of debt decreased the actual cost of debt servicing rather than increased it. Essentially, the Russian macroeconomic model that filters through its coverage makes clear they still believe that ‘bond vigilantes’ are lurking and that private markets determine interest rates and the value of bonds. But the last financial crisis disproved this when central banks swung into action and showed they can effectively suppress the yield curve over time and determine the price action for debt given their massive firepower compared to private investors. The piece, of course, ends with a brief note on inflation rising (despite the complete lack of evidence that what are, for now, short-run inflationary pressures will last). This isn’t a big news story, but it’s another brief peek into how these debates are still framed in Moscow — and legitimizing its own obsessive avoidance of further debt expansions, even if managed by central bank policy and held by domestic investors. I wonder how that’ll look when the US economy roars back this year.

At the same time the banking sector was going gangbusters, the shadow economy took the biggest hit last year — logical given the nature of a pandemic-induced demand shock. The shadow economy accounts for as much as 40% of employment and 30% of workforce earnings. The growth in nominal wages for formal sector employment might well reflect people being forced out of the shadow sector because of the constraints imposed by COVID. What makes it so odd is that shadow employment and economic activity almost always grows during crises as people try to find ways to make money however they can to get by. One working theory is that the reductions for social tax obligations that small and medium-sized businesses received from the state made it easier for them to hire and that the expansion of the newer tax regime allowing self-employed individuals to easily register as well as tax breaks offered in last year’s support package helped with topline employment data as well. These measures undoubtedly helped hiring given that the economy never actually shut down for any significant period of time, but rather demand fell as the oil sector was squeezed, intermediate demand fell, interruptions occurred from various ad hoc health measures, and a massive spike of uncertainty reduced business investment and spending in a vicious cycle. So the supply side ain’t all bad. The question is how long those cuts will stay in place. Moscow always refrains from running the economy hot, but wants to maintain employment to avoid unrest. It’s a tricky balance.

Highland Fund, a Chinese venture that owns a share of the gold-copper Bystrinskiy project — metals are generally found and mined together, hence the overlap — has been given the right to sell its 13.3% share via put option to Norilsk Nickel, the majority owner. HF bought in at $100 million and is selling out at $428 million just as commodity prices kick off into a new price cycle. What’s more interesting is that the sale conforms to an agreement HF had reached conditional on the joint venture running the project not attempting an IPO. Bystrinsky is a large greenfield project that’s cost a combined 90 billion rubles ($1.2 billion) thus far, a relatively piddling sum compared to the implicit valuation from the sale ($3.2 billion) and expected valuation gains from higher prices. That makes HF the second company to leave as a result of disagreements over an IPO. It’s not a political story. This is clearly about business. But Norilsk Nickel really shouldn’t be scaring off Chinese capital with its rep as tarnished as it is in the West at the beginning of a commodity super cycle. These types of disagreements happen everywhere, it’s just important to keep an eye on Chinese capital into resource extraction, particularly since metals & minerals aren’t yet sanctioned by the West.

COVID Status Report

Rates keep falling, with just over 11,000 new cases recorded against 428 deaths. The topline numbers are no longer that ‘interesting’ per se, so when appropriate, I’ll try and pull other related data since the horse race to get infections under control — even assuming that the reporting undersells it from how many people may have mild cases and not get tested — is calming down. The one area that’s truly lagging, however, is vaccinations for those above the age of 60. Health minister Mikhail Murashko is telling regional governments to get it together. Apparently as many as 80% of Russians were worried about losing their job during the pandemic, which helps explain why decisions to avoid serious public health measures were taken in stride, it would seem. Through November, Rosstat’s nominal wage data shows 2020 looks like a normal year:

The question will be whether there was really a spike at the end from the 4Q budget and orders rush. The veneer of normalcy doesn’t seem to make much sense given that unemployment rates did rise, but anti-crisis measures supporting businesses would have filtered through to wages and the shortage of labor from the loss of migrant laborers in some sectors would have created counter-balancing rises in wages isn 3-4Q. Something to ponder building off of the story today on the shadow sector. Lastly, if you haven’t and can, worth reading the latest scoop from FT Moscow team showing that the African Union is paying 3 times what it pays for the Oxford/AstraZeneca and Novavax vaccines for Sputnik-V, a case of Russia hoping to leverage its ‘soft power’ to make a buck. Given the rate of production increases in the West, that may well blow back in Moscow’s face.

Eastbound and Down

BOFIT’s weekly monitoring releases are always a handy snapshot for Russia and China, and today they released the compiled data on China’s current and financial accounts for 2020. I’ve pulled them because of what they indicate in the year ahead for Eurasia:

China’s current account surplus reached 2% of GDP, roughly $300 billion by year’s end. As the current account surplus returned to levels last seen in 2015 when China faced a financial crisis on its equities market linked to a massive spike in capital outflows, we can see that China’s outflows of capital have resumed. Taking the 30,000 ft. view, that means that Chinese capital managers, private equity, and corporates are looking for assets to acquire abroad and that the surplus of production vs. domestic consumption will, at least in the shorter-term, probably contribute to deflationary headwinds in places like Kazakhstan, Uzbekistan, or else Russia trying to get domestic manufacturing back to growth and, more importantly, trying to export more production for the sake of economic diversification and strategic planning.

If we think of the global economy in terms of poles of power, there’s a (relatively) bifurcated structure: the United States holds up the global financial system, the global reserve currency, and acts as the consumer of all excess finished products not consumed elsewhere while China soaks up demand for commodities and, increasingly, consumer products that are finished domestically, but tie into supply chains elsewhere, including the US but more so the European Union led by Germany. Historically, the US has been responsible for providing safe assets for foreign investors, and the semi-liberalization of China’s financial markets seems likely to bring on a rush of speculative foreign investment seeking return. The US is risk-off, China is risk-on. The problem for Russia and post-Soviet Eurasia is that the relative growth of commodities demand to come isn’t going to just flow to China and its not in position to maintain its growth rates. As BOFIT notes, the regional growth targets in China — for those less familiar, the state’s mandated GDP growth target is managed at the regional level and via lending to SOEs rather than through federal spending or credit plans — suggest that higher GDP growth above 6% to return to pre-COVID trends this year may not actually be what Beijing’s expecting:

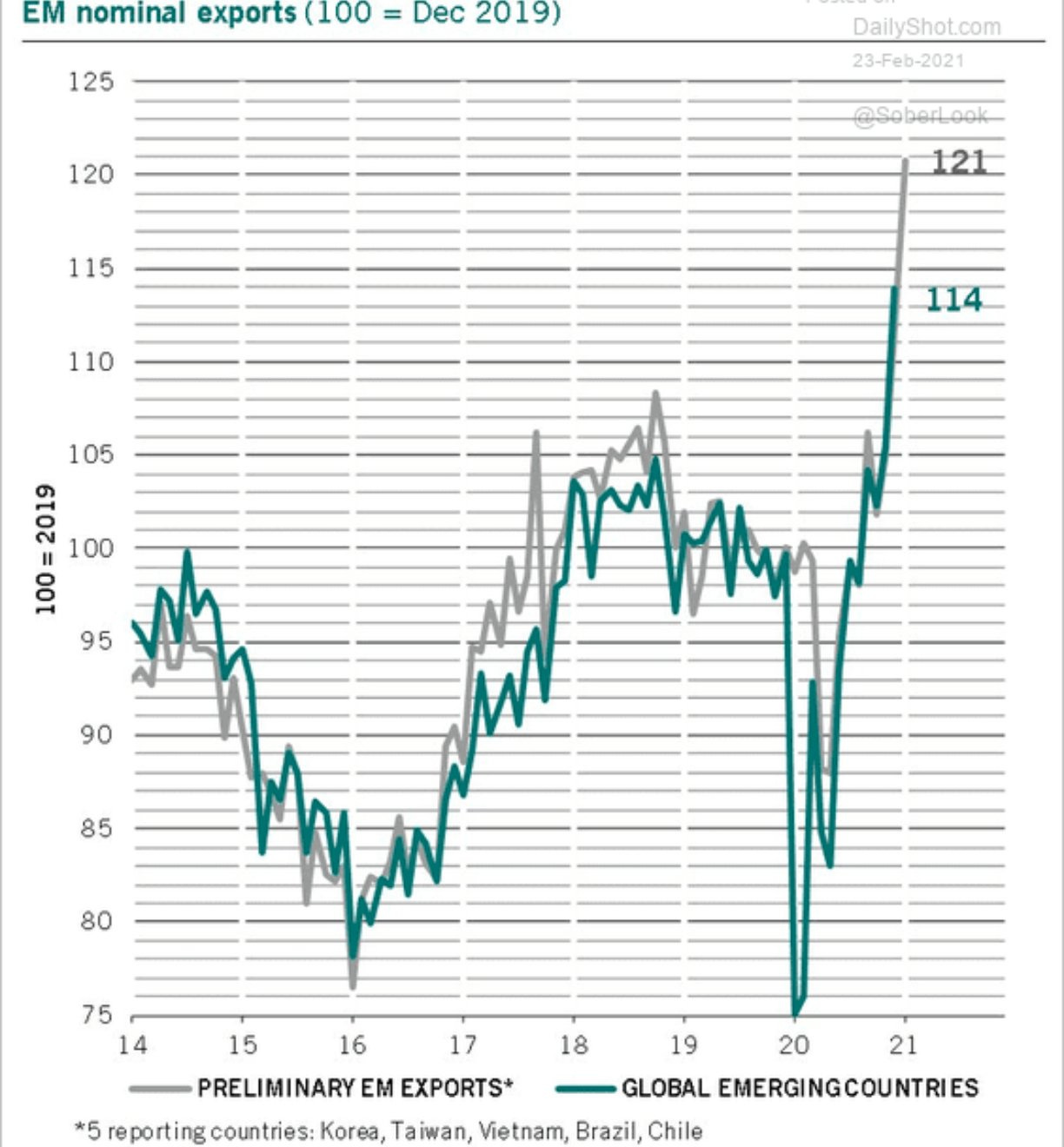

If 6-6.5% is still the topline target instead of, say, 8%, that represents a net decline from pre-COVID trends and underscores that the recovery in motion will be structurally slower and drag down the rest of developing Eurasia without domestic policy interventions. Russia’s Central Bank is still projecting calm. Per Nabiullina’s own words: “per our base scenario, we see this as a recovery year and existing positive tendencies — the recovery of the economy — will continue.” Russian Railways, however, sees that the current pace of recovery won’t be enough to return freight transport volumes to growth and instead expects a further decline in volume of 1% vs. a 2.7% decline in 2020, virtually all of which can be chalked up to the oil production cuts and lower consumer demand. Commodity exports may find relief in the year ahead, but won’t do enough for demand in the rest of the economy to boost matters. This is where Russia’s failure to try and integrate into manufacturing value chains makes a big difference. By the looks of it, emerging market exports appear to be rebounding very strongly:

Russia is going to be left behind since it’s only part of the commodity supply chain and incremental supply growth for most metals & minerals is taking place elsewhere, made all the worse by the fact that Chinese investors now hunting for bargains and sources of foreign income broadly don’t trust their Russian counterparts unless it’s a strategic project of high political salience to both Moscow and Beijing. Put another way, even though its growth began to slow after the last financial crisis, the Chinese market played an integral role in allowing Putinism to survive the 2011-2012 political cycle by keeping oil prices higher until US supply swamped the market. There is no equivalent external stimulus this time because of the economy’s autarkic turn and the effect of sanctions. As noted at the top today, the housing price bubble now in full swing is part of this dynamic — the state has to inflate the value of certain assets held by the population to boost incomes to make up for the wage stagnation brought about by Putinist economic policy, but in so doing, makes the net effect of a compressed current account and real income stagnation worse since debt disproportionately finances newer consumption when the price of goods and assets inflates faster than nominal wage increases can reasonably keep pace. MinFin has also increased its take of yen and yuan in its reserve basket to maintain macro stability because of the expectation that the US dollar will depreciate by 7% or more this year. Effectively, Russia’s macroeconomic stability increasingly correlates to the current account surpluses the Asia-Pacific is running that are actually dogging recovery, including commodity demand. Growth in APAC doesn’t mean it’s leading the global recovery. Rather the region is producing products with relatively inelastic demand despite COVID that are being consumed elsewhere. Look at the gap between savings and investment in the Asia-Pacific vs. the rest of the world:

Unless these savings are channeled into productive investment in the real economy in Russia, they’re likelier to end up negatively weighing on its recovery. And there’s nothing substantive that current policy can do to attract foreign investment unless domestic demand was boosted via state spending to make it more attractive for foreign manufacturers otherwise concerned about legal risks on a weak market. The more that Russia turns to Asia to manage the ruble and its future growth, the worse the domestic deflationary bias for policy becomes since the Asia-Pacific is the world’s worst offender at a macro level when it comes to suppressing its own demand. Outside Russia, expect a new rash of Chinese entrepreneurs trying to nab assets in Central Asia and the Caucasus where they can. Those savings have to go somewhere, and weaker growth outlooks give them even more leverage if investment from elsewhere is lacking and risks on investment are high.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).