Top of the Pops

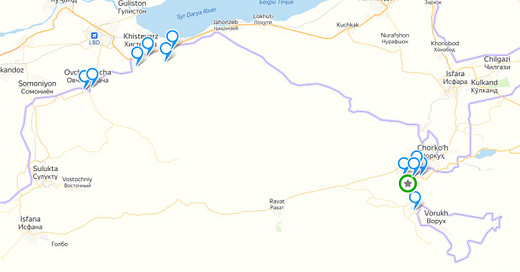

Now that a complete ceasefire has been negotiated and a few days of reporting and analysis are out there, here’s the basic story of the latest border conflict between Tajikistan and Kyrgyzstan: Tajik forces attacked Kyrgyz territory and positions around the Tajik enclave of Vorukh, Tajik territory surrounded by Kyrgyz territory due to the messy resolution of borders in the Fergana valley after the collapse of the Soviet Union. Earlier in April, Tajik president Emomali Rahmon had assured local residents that he was not entertaining any land swap deal with Kyrgyzstan as a means of resolving border conflicts that often turn violent. Instead, he opted to escalate militarily for domestic political gain — local fights over a water intake facility near Kok-Tash that initially left at least 4 dead provided a pretext to use force not only in the area, despite the lack of any threat from Kyrgyz forces on Tajik territory, but also to attack Kyrgyz villages as far as 70 km away. H/t to Bermet Talant, who you should follow if you don’t:

At the moment, Tajikistan is the current chair of the Collective Security Treaty Organization, a position it exploited in launching these attacks. As noted by Erica Marat, other international organizations completely balked at the violence:

The OSCE expressed concern — a European past-time in international affairs — and offered no help with mediation, nor did other conceivably relevant bodies. The chaos speaks to the inherent fragility of multilateral institutions nominally led by Russia, but designed to allow for a large degree of autocratic or personalist flexibility between governments in the name of sovereignty. All told, we have no idea how many people on the Tajik side were killed or injured. The last estimates released by both governments readily on hand for Western outlets was 31 dead and 154 injured on the Kyrgyz side vs. 10 dead and 90 wounded on the Tajik side. Eurasianet’s writeup from April 29 is a great overview of the initial causes and reactions to the fighting. The lesson, to my mind, is that resource conflicts haven’t gone away. The end of oil scarcity didn’t end resource scarcity. But these conflicts are rarely about resources themselves, but rather their discursive use by political institutions and leaders to generate justifications for action in response to a perceived or else politically convenient threat. Tajik authorities claimed Kyrgyzstan intended to seize the Golovnoi water intake facility crucial to Vorukh’s survival, thus justifying their excessive response. Kazakh president Kasym-Zhomart Tokaev has stepped into the breach trying to exert some sort of diplomatic influence to ensure tensions don’t reach the same levels of violence again while Moscow doesn’t seem to be actively crisis managing. I’d wait to see how the political fallout domestically in Kyrgyzstan affects Japarov. For now, the fighting’s settled. But it could set a precedent for future escalations in response to domestic political needs that’s very, very worrying.

Around the horn

In case you missed it, last week, the Constitutional Court of Moldova overturned the state of emergency declared by president Maia Sandu at the end of March to help contain COVID-19. A slim majority of 52 members of parliament out of 101 voted for the measure at the time, a sad state of affairs for a country that has been trapped in constant parliamentary and presidential gridlock for years now. The Constitutional Court’s decision forced Sandu’s hand — she’s called for new parliamentary elections on July 11 and dissolved the parliament in hopes of winning a bigger majority coalition to reduce the scope for elites to advance their own interests by exploiting the constant gridlock. Sandu’s been agitating for a snap election for months since her prime minister Ion Chicu resigned on December 23, twice proposing former finance minister Natalia Gavriliță take the post despite knowing she’d fail to win the votes because the constitution allows the president to dissolve parliament after twice failing to approve a new executive. The Constitutional Court overruled the act as unconstitutional because Sandu had refused to accept a nominee backed by 54 MPs. The leaves Igor Dodon — head of the Moldovan Socialist Party — and his coalition partners in the Democratic Party core backed by Vlad Plahotniuc’s core power base (he’s living in Turkey) and the Shor party (led by Ilhan Shor now living in Israel) to find a new way to poach seats. Sandu’s Solidarity and Action Party only has a chance to win an outright majority and break the deadlock — Moldova hasn’t had a party holding a majority of parliamentary seats in government since 2009 — if they can unite the EU and pro-reform votes that changed the political landscape in 2019. There’s more interest in Washington now with the new administration given the reprimand issued by the State Department over the parliament’s decision to pass a non-binding resolution calling for the ouster of the head of the Constitutional Court after handing Sandu that victory last week. The campaign season will be bonkers, as things always are in Moldova.

The first shipments of Sputnik vaccines arrived in Azerbaijan yesterday as authorities in Baku now look to sort out distribution logistics. It’s an important symbol as state hopes that oil prices stay higher and provide a growth cushion for the year ahead. Additional oil & gas revenues are going to be crucial to finance the inclusion of the acquired territories in Karabakh. Efforts to more deeply integrate with the EAEU to facilitate transport and logistics to that end have hit a political dead end for now. Armenia hasn’t agreed to Azerbaijan’s participation in the EAEU’s inter-governmental council. That’s not great. The ADB’s latest forecast puts Azerbaijan’s expected GDP growth at just 1.9% for 2021, and the marginal increases in oil output coordinated with OPEC+ — cumulatively just 25,000 additional barrels per day by July — won’t provide much relief. The protocol signed between Moscow and Baku is also mostly pro forma, as are most trade and investment agreements signed nationally in the region. The more interesting tidbit of economic diplomacy comes from Israel. Israeli businesses are reportedly keen to help Baku rebuild the ‘liberated’ territories in Karabakh, a handy maneuver intended to externally legitimize expanding seizures of property and investments into settlements in Palestine using the same logic and in the face of international criticism over the legal status of Karabakh. It’s interesting, if not necessarily surprising, just how silent the international community has been on the legal questions raised by the aftermath of the conflict compared to the seizure of Crimea. I tried to dig up some good reporting on inflation given that the commodity price surge globally is having an outsized effect on economies like those in former Soviet Eurasia, but alas, they’re isn’t much out there. The annual inflation target is still in the range of 4%, with the annualized inflation from March observed at 4.1% — the dollar peg is still helping manage the worst of it so far. There aren’t any “surprises” here of late.

As more labor in Central Asia is staying home this year instead of headed to Russia, national policy targets in the region have to shift. Uzbekistan is currently aiming to create just over 457,000 new jobs nationally by the end of the year. One wonders what the jobs will actually look like. GDP fell 2.6% last year — the rise in commodity export prices buoyed things as did the state’s response to the worst of the crisis — and is expected per the IMF to best Kazakhstan’s topline rate at 5%, just behind Kyrgyzstan. One thing I’m unsure of because of the lack of data — if migrant laborers stayed in Russia, they’re likely seeing some wage increases due to labor scarcity, which might offset some of the remittance losses from last year coming into this year. Food for thought. Now that Tashkent is negotiating for more Sputnik deliveries from Russia, I’d expect an increase in the pressure from MinTrud in Moscow to ease up on migration restrictions. The Uzbek and Ukrainian governments have agreed to relaunch direct flights as Uzbekistan Airways tries to cut unprofitable routes to other European and Asian capitals to re-focus routes based on domestic demand, which defaults to a more FSU-centric route map (also shorter distances, so you save on fuel). Anything that increases domestic capacity utilization, demand, and employment is a net positive now. Annualized consumer price inflation YoY has hit 13.6% vs. 2020, a significantly lower figure than the 19.1% seen for Jan.-April last year — it was lower at 11.6% for appliances, basic services, and healthcare. The lesson in Uzbekistan is that unlike Russia, inflation levels have remained persistently high because of high(er) levels of growth since Karimov’s death in 2016. High inflation in a growing economy with a growing workforce is way different than in a stagnant one with a declining workforce. Still important to keep an eye on that in the months ahead, and how the targets for jobs creation correlate to investment levels from the private sector.

Tokaev has thrown in behind plans for dredging works at the Kashagan oil & gas field despite the objections of local fishing interests and environmentalists. The $250 million dollar scheme is a result of climate change — falling water levels are forcing Kashagan operators to adjust. Just as falling water levels are affecting rivers and the physical linkages at border crossing and across western Kazakhstan, falling levels in the Caspian are going to force offshore oil & gas operators to increase investment levels to adapt. You can also see the unequal effects of the oil price recovery and slowly rising production levels vs. the non-transit, non-oil & gas economy domestically. Mangistau was the leading region nationally for home sales in March, though there are also usually local supply issues for housing markets. The current rise in prices — 7.8% on the secondary market in annualized terms — was driven by a surge of retiree purchases that’s cooling down now. Real wages appear to be up 7.4% YoY, which is good news given that inflation is currently at 7% in annualized terms with hopes that a strengthening of the tenge will reduce import costs and lower inflation to 6.5%. The pressures around price management for imports among EAEU members have led to a broad, if vague consensus that it’s in their interest to try and relocate imported production into the shared trade zone. COVID, however, has led to a stepped-up inspection regime in Russia, which undercuts the impetus between members to support these initiatives. In the longer-run, that’ll shave down some of the costs, if only the bloc can ever get its act together.

They’re not mad, they’re just adjusting

The issue of carbon adjustment is now filtering across Eurasia as a political challenge to be taken seriously, a concern all the more pressing as the Greens in Germany climb in the polls. If the Christian Democratic Union (CDU) holds on, a carbon border adjustment mechanism will still see considerable support. The Ag ministry came out for it in January, and the electoral politics are there. If the Greens actually pull it out, they not only want to see aa significant mechanism adopted by the EU but want to use a transatlantic agreement with the US as a shot at restoring the alliance. One can see the direction of travel since February with the CDU bleeding support that’s translated into a Green surge:

While everyone looks ahead to German elections in September — a huge concern for further joint stimulus efforts between Eurozone and EU members — it’s worth noting how much smaller the European fiscal response to the crisis has been than in the US. That gap will affect the relative demand for commodity resource exports from Azerbaijan and Central Asia, as well as the political context for Eurasia’s recovery. European households are in worse shape as consumers, even with the existing welfare system in place otherwise absent in the US, and the relative level of unemployment has been obscured via schemes that have saved jobs via furlough-style arrangements without counterpart stimulus via household transfers. All the same, the confidence indicators for European business are still shooting up and the improving vaccination campaign has closed some of the gap implied by the following spending comparison in % GDP terms for emergency COVID measures:

Ukraine has been the first up to react to carbon border taxes because of its DCFTA with the EU’s single market. Decades of energy inefficient production, historically subsidized with Russian gas though that dynamic changed after 2014-2015, pose a serious risk to the country’s significant steel manufacturing base among other major economic constituencies. On March 24, the cabinet created a working group to respond to emerging EU policy and elaborate a policy and political approach on the matter. Poland wants to see the tax applied in such a manner as to support metals and chemical production among EU members so long as it’s less emissions-intensive. ArcelorMittal just committed to invest $1 billion into modernization to green and expand production capacity at Kryvyi Rih. It’s a leading indicator for what other MNCs trying to make use of Ukraine’s lower labor costs to export onto European markets will have to consider as talks accelerate, as well as what regulators and the authorities tasked with attracting investment will have to bet on. But Ukraine is an exceptional case among former Soviet Eurasian exporters because of 2013-2014, even if the current agreement effectively sets quotas for key export goods onto EU markets. You see the beginnings of responses from business lobbies and policymakers elsewhere, but nothing yet approaching a coherent understanding of the challenge ahead.

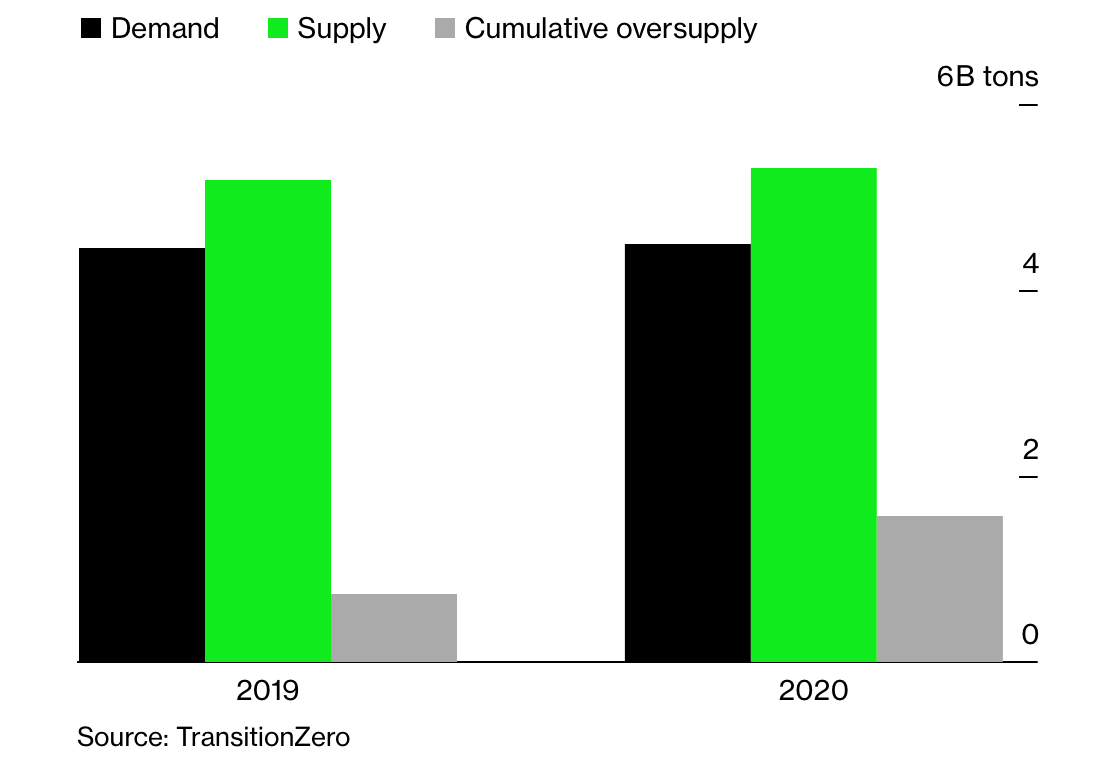

Elsewhere, the EU’s incoming policy fix matters, but the bigger question is what exactly is happening in China. After the announcement that China had launched a carbon market akin to the EU Emissions Trading System — imagine you have a finite number of ‘credits’ in circulation, companies buy them, and financial markets can then create securities linked to them — a familiar problem has emerged. Too many credits are being issued, which means the price of carbon has plummeted:

Unlike the EU, China’s not keen to see the implementation of any border adjustment because it’d rather that developed countries absorb the cost and allow its exporters to keep on trucking using just the domestic system to drive down emissions. It’s a problem near and dear to the dilemma Central Asian exporters face for metallurgical exports as the EU policy stumbles into force in the next few years. Park Tajikistan aside from the rest with its heavy dependence on aluminum for its export earnings and hard currency reserves since the country’s abundance of hydropower makes it a bit easier to fudge the emissions question. Broadly, however, you can see a two-fold hit happening over time because of China’s failure to adjust its domestic model away from export and investment-led growth managed using debt to a consumer-led economy where households have a higher share of the national income. The following is the % share of merchandise exports sold to low and middle-income countries, those that aren’t now scrambling to impose carbon taxes and adjustments per World Bank data through 2019:

China’s share for merchandise exports is rising at the same time the EU is moving to impose measures that will benefit efforts to re-shore some production. The result is that Chinese exports are going to squeeze the margins on Central Asian exports even more, especially if Chinese efforts to displace emissions-intensive activity into neighboring economies continues without a serious change of course on carbon adjustment. Former Soviet Eurasia’s about to face a competitiveness crisis for its non-resource exports on top of a push to decarbonize extraction and persistently falling consumer in Russia. And the EU and China are sealing the deal with their approaches to carbon taxation without some sort of step change in the level of green investment and trade support offered to the region. Border clashes and mobilization politics may well become all the more common as the economic fallout takes root.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).