The Bill is Gone

Putin's not paying the price for stagnation cause much of his base prefers deflation

Top of the Pops

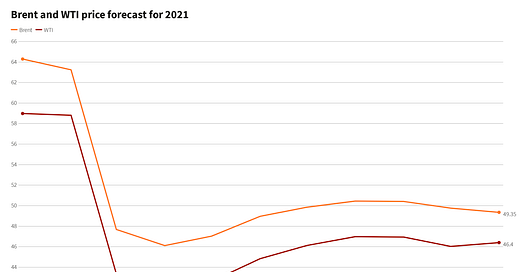

The new emerging 2021 Brent crude price consensus seems to be settling around or just below $50 a barrel:

The WTI spread is way down given the collapse in the US rig count earlier this year, but it’s back up to 241, its highest level since May (if a massive ways down from the start of the year). Copper hit an 8-year high in Shanghai and a 4-year high in London, which reflects a mix of strong demand expectations for 2021 and lower levels of inventory. Silver and gold can’t quite make up their minds, but investors are shifting back into a risk averse mindset for now. Commodities markets are telling us different stories about recovery ranging from robust growth to relatively flat, slower recovery. I’d argue that these divergences are going to reflect the uneven nature of recoveries post-COVID. Developed economies with more fiscal capacity and larger spending plans pertaining to the energy transition are going to boost prices for metals & minerals, as will major exporters of consumer goods well positioned right now (like China) to take advantage of having the virus under control. Oil is going to struggle more since non-OECD economies aren’t going to return to growth evenly and many OECD economies are going to see renewed policy pressure to invest into public transport and, arguably more importantly, make working from home easier post-pandemic for higher wage jobs on an increasingly stratified income distribution that is actually sapping some potential demand growth for petroleum products and other commodities by concentrating too much wealth in the hands of people who’ve basically reached the limit of what they can physically consume. The commodity super cycle still exists, even if oil no longer reliably has a medium-term price cycle, but economic effects of commodity cycles may be much more striated and uneven.

What’s going on?

The truth comes out. It’s starting to look like the heads and networks at RZhD, Transneft, and Rosset’ took out Artyemov from the Federal Anti-Monopoly Service as they’ve now lodged a complaint with Mikhail Mishustin about the proposed new law “on natural monopolies” now under consideration in the Duma. Artyomev had lobbied for a decade to improve the regulatory system to encourage competition. The proposed changes to the regulation of monopolies include an end to the consideration of amortization, dividends, and capital investments to set tariff schedules, establishing reference tariffs all market participants have to adhere to, and breaking up ownership of infrastructure from operating deliveries using that infrastructure (this would have to be adjusted for Transneft specifically). Every state monopoly or quasi-monopoly is a snowflake, and they’d rather that FAS had no regulatory or oversight power to begin with. Specialists know that rejecting the law as is and is being reviewed would lead to regulatory chaos. Then again, it’s regulatory chaos half the time with the law in place as is.

As one might expect in the middle of a simultaneous oil shock and pandemic-induced demand shock, Russian consumer expectations and assessment of current conditions are showing an extremely narrow gap right now. There hasn’t been much positive news of late. Taking a peek at extractives vs. consumer indices on MOEX really shows the gap in investor positions that would exacerbate sectoral ‘imbalances’ for the financial markets between a consumer/demand rally and an external one:

In terms of capitalization, consumers lag insanely behind the extractives even though the initial closing price from month opens and the end of November shows they’re tracking closer to metals & mining than oil & gas, though the Santa Rally has had more of a positive impact for oil & gas in % terms. It’s a long-shot and a very long-term trend to follow, but following consumers’ share of MOEX indices rise would be a strong indicator that investors, not just people struggling to get by day-to-day, are buying domestic demand recovery.

Deputy minister Tatiana Golikova, long the person running the policy file for pensions, non-budgetary financial sources covering social spending initiatives, and social/family policy is now leading a push to consolidate family policy in the hands of MinTrud towards 2024. In fitting with Mishustin’s broader aim to optimize different ministries and agencies’ responsibilities and functions, centralizing policymaking and lobbying at the labor ministry is probably the best way to strengthen the relative bargaining power of the ‘social bloc’ in Moscow.

MinFin is desperate enough to increase investment into Russia’s regions that it’s now reviewing further reducing the legal requirements around state procurements, a move that would increase the number of uncompetitive tenders and single-source contracts. But there’s a catch: MinFin wants to make better use of the “offset” provisions in these contracts to mandate a certain amount of investment into that region from the supplier should they win it. As of now, the entry threshold for investors bidding on these contracts is 1 billion rubles ($13.12 million) and plans call to reduce that threshold to 400 million rubles ($5.25 million). By doing so, investors can lock in rents via procurements having won uncompetitive bids with even lower reqs to invest in productive capacity. That may well generate more investment activity, but it’s going to worsen the inefficiency of how procurement money is allocated, and I wager will not appreciably help advance import substitution measures.

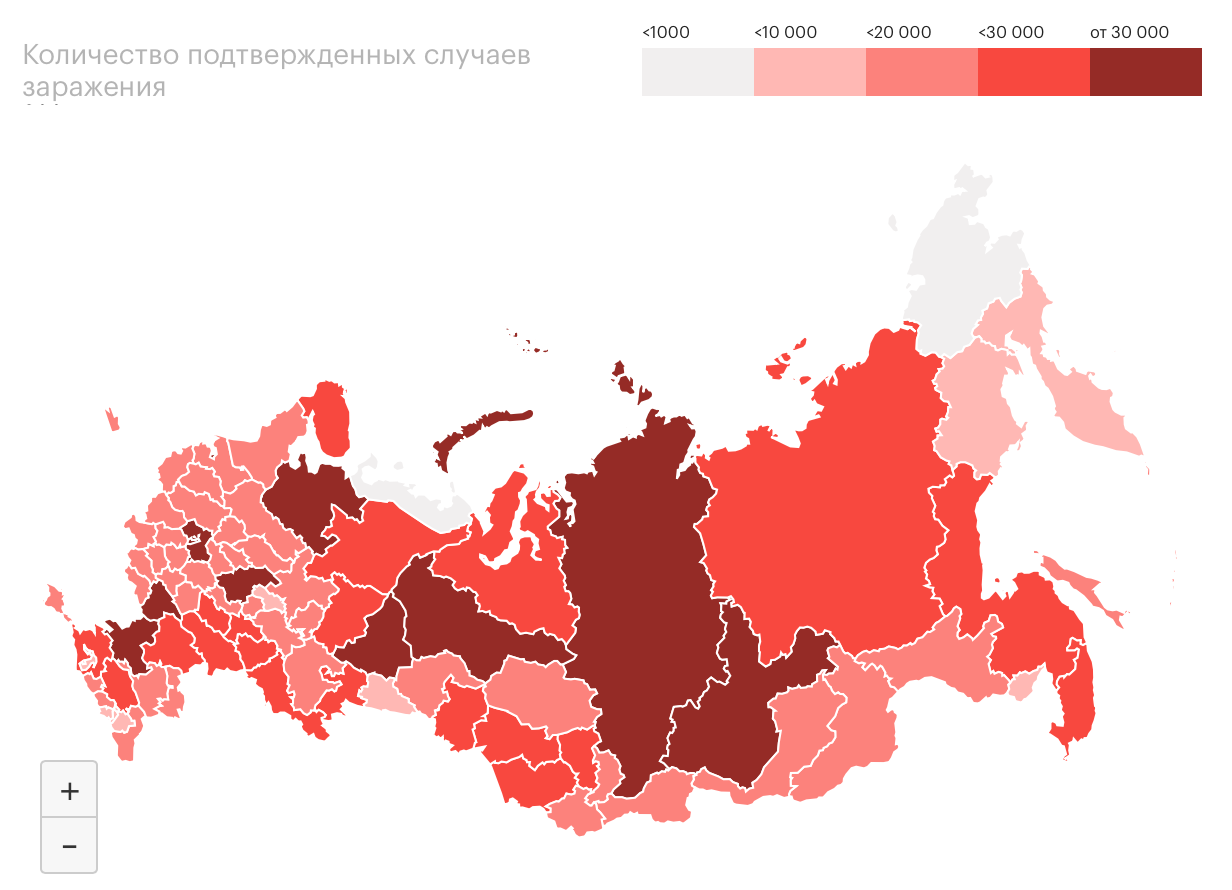

COVID Status Report

As regional cases show more signs of leveling off and the caseload hanging above 26,000, the bigger problem is the death toll — a record 569 the last day — ticking up from the infections over the last few weeks. As of now, here’s how the regions look according to the Operational Staff data:

This might be where things stay for awhile unless there’s a resurgence of the spread headed into New Year’s. Barnaul authorities are now giving medications to ambulatory patients diagnosed with COVID or those suspected of having COVID for free from clinics. If someone calls in thinking they have it, medical personnel come to their home with proper protective gear and equipment to test them to be sure and provide the initial medicine needed. That’s a great example of the power of local and regional governments to fill gaps when absolutely necessary. The question is how many can pull it off, what deals had to be cut to make it feasible (if they were necessary), and can the regions model the delivery of medical services for the future of medical care in Russia. Volgograd has launched ambulance COVID-centers to improve mobility and delivery of services. For however bad the Federal response has been, it’s clear that some people are lucky enough to have decent local public health officials doing their jobs. It’s depressing that deliveries of basic items needed to care for diabetics, for those with other kinds of infections, or else with COVID make the news so regularly in the Russian press, though.

Faculties of decline

In a piece responding to Putin’s late September UN speech for The Moscow Times, Mark Galeotti noted that for all the achievements and bluster, it appeared that Putin was preparing a defense for a nation in decline. It’s a theme that I’ve been taken with since 2018, so much so that I’ve even attempted haltingly to start writing a book on the basis of my own take on Russian decline. If I make even half-decent progress, I’ll likely share drafts or excerpts either here or posted on the site rather than in an email. What’s fascinating to me now is that the available strategies to manage such a decline are now exhausting themselves due to the severity of the nature of the pandemic. That doesn’t mean I believe Russia’s heading towards a revolutionary overthrow of the regime or even that most people necessarily want to see the regime vanish, but rather that politics ceases to appear to be a means by which real problems are solved. That doesn’t necessarily mean everyone turns on the state, however, and it suggests some residual successes, including clamping down on inflation (even if by deflationary measures). Look at the latest Levada-Center polling from a piece by Alexei Levinson the VTimes ran today:

Title: How has your family’s material situation changed in the last year?, % polled

Top to Bottom: All, Moscow, Cities over 500,000 people, Cities from 100-500,000 people, Cities up to 100,000 people, Villages

Left to Right: Overall improved, Overall worsened, Stayed the same, Hard to answer

To add more, Levada data shows that 45% of respondents expect things to get even worse in the coming months. Yet somehow, things seem to look most up (in relative terms) in mid-sized cities and villages, which corresponds very roughly to electoral base the regime shifted to after 2012 seeking to firm up support across the regions to make up for shortfalls with more liberal, large urban centers — namely Moscow and St. Petersburg, but a few other cities as well. Yet despite this, presidential approval ratings resist generally resist gravity, and even Mishustin has a significantly higher approval rating than most of the political establishment (Putin is purple and Mishustin light blue):

Title: Trust in politicians (sum of ‘unconditional trust’ and ‘generally trust’)

Many people have riddled over how to explain the persistence of support for the regime and Putin among the public. Some prefer to reject the validity of the data collected by citing the broad apathy of the public and lack of alternatives. Others take the data to heart. I fall more towards the former in practice with a major caveat: the regime has built a sturdy system to cover its flaws and, more crucially, to distribute rents as needed. But the latter part of the equation began to fall apart in 2013 and has since entered profound stagnation since 2014 with the imposition of constant austerity. So the question then becomes how the hell do these numbers stay so high when they aren’t even giving people as much in the way of the rents they collect?

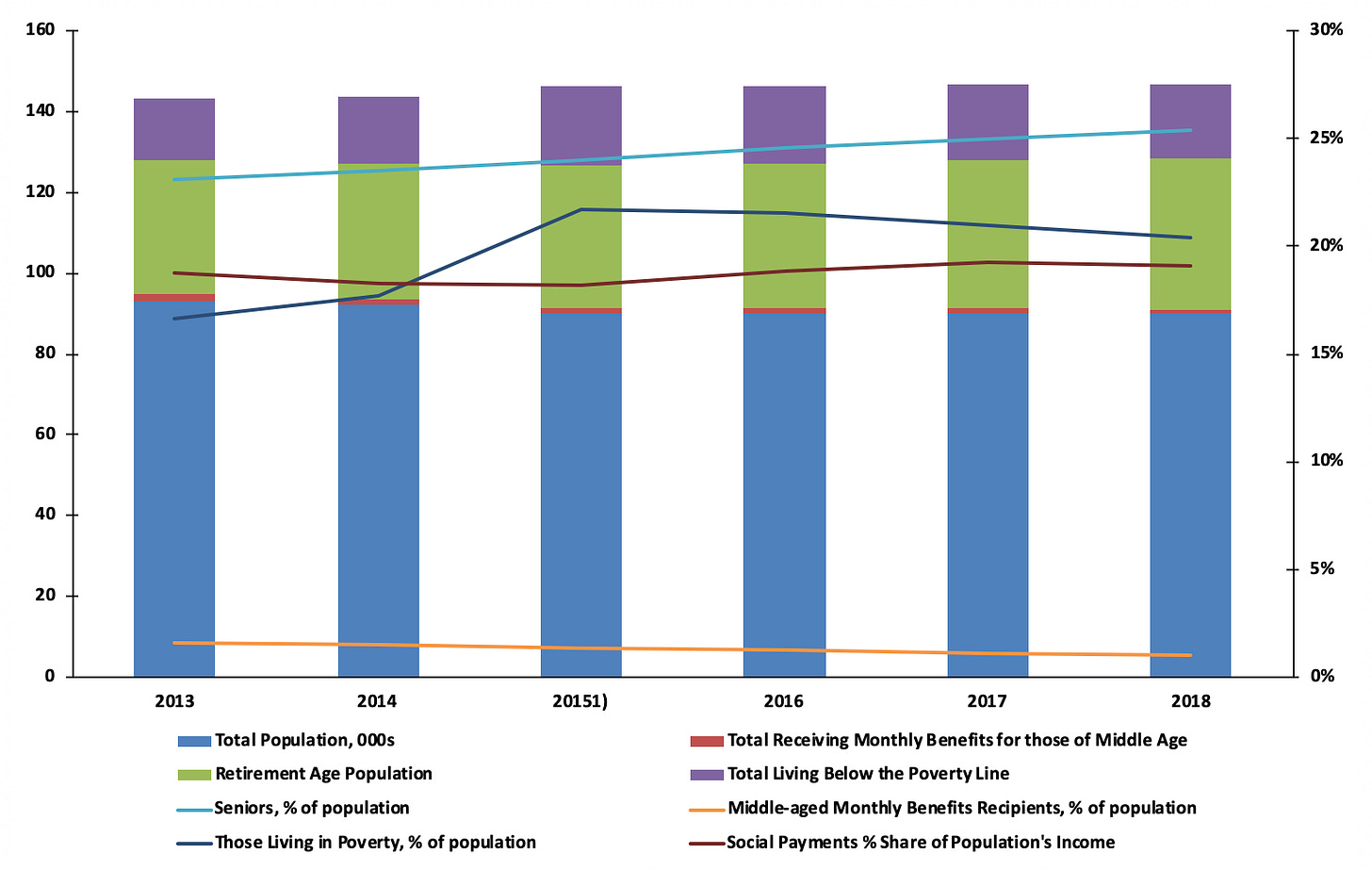

This is where I think the Central Bank and MinFin’s obsession with avoiding excessive spending and running the economy hot comes into play. I pulled the following from demographic data from Rosstat:

Despite austerity, the % share that social payments account for among the population’s net revenues/earnings has actually risen past its 2013 level since 2014. Further, seniors now account for about a quarter of the population, and about one-fifth of the country — some of them seniors too — live below the poverty line. I included some benefits recipients who are middle-aged, but they make up a relatively small population from the whole of the country. The larger point is that as the country’s senior population grows and poverty levels seem relatively stagnant, though they have declined since 2014, the share of individuals and families reliant on fixed social transfers is growing at the same time that Russia’s income inequality has worsened — note that I haven’t dug into things like maternity payments meant to encourage births and family support. As Bloomberg’s Anna Andrianova noted in a piece yesterday, wealth inequality has exploded between regions:

I bring it up because that % share of social payments for the population’s earnings understates the distribution and salience of those payments for people living outside of Moscow or in regions with the highest wage coefficients (a relic from the Soviet era) to adjust for costs of living with everyday costs under control. For tens of millions, therefore, those fixed payments once they’ve retired, been injured, or else face new caretaking responsibilities and costs with one’s parents or children are a lifeline in a chaotic economy. Fixed expenditures like food and rent matter most for the effects of inflation on their wellbeing. Take the CBR’s inflation breakdown for staple foodstuffs:

Inflation adds up fast, but compared to inflation for services and other goods, these are relatively low figures. The broader point I’m trying to raise is that people’s continued support for the regime can simply be explained by the continued necessity of these social transfers and mechanisms meant to control costs of living for a huge portion of the country. At the same time, the importance of fixed payments to sustain quality of life and living standards mean that macroeconomic policy is pressured into a de facto deflationary approach in line with the regime’s bases of public political support. Yet doing so robs the young of potential earnings, wealth accumulation opportunities, and more as they enter and navigate the workforce, frequently stuck trying to find jobs in the country’s biggest urban centers where wages are higher but inflation for rents and services is more intense. The result is that Putin’s not just messaging decline to rein in foreign policy tendencies or defend his track record. He’s actually built a political base of support that probably prefers deflationary pressures to inflationary pressure, which can only last so long. Russia is not a diversified developed economy like most of its western counterparts. Growth at 1-2.5% is inadequate considering the structural sources of inflationary pressure in the Russian economy. The political economy of decline may be how he preserves his power.

Sneaky Joe

Word of Mohsen Fakhrizadeh’s assassination in Iran has prompted a new wave of obnoxious and tedious punditry about the significance of what appears to be Israeli action. Bruce Riedel, a former NSC staffer with a background with the CIA and the Pentagon, said the obvious part out loud when quoted in a New Yorker writeup: killing one scientist is irrelevant to hindering Iran’s nuclear program. The move is just the latest of an endless string of provocations, small to more brazen, pushed by Israeli prime minister Netanyahu, his Gulf partners — namely Mohammed bin Salman — and the United States to try and force Iran to effectively cross an otherwise invisible red line so convincingly that the American public see no problem with taking action and European capitals have sufficient political cover to do what they wanted to do anyway given they’ve tried to put Iran’s missile program on the table as a negotiating point for years and years.

The problem with the narrative that this is Trump trying to rat**** Biden coming into office is that we actually have scant evidence Biden disagrees with his Iran policy. For one, Biden’s issued no public statement on the assassination despite it being a marquee international event bound to significantly impact diplomatic efforts. For another, Biden’s language on the Iran deal is evasive. He keeps insisting he wants to return to the deal so long as Iran comes back into strict compliance. That sounds pretty, but means something very different once you factor in that the Democratic Party leadership is not actually in lockstep behind any effort to return to the deal as it was. Sullivan let slip that the administration seems like it’s considering negotiating follow-on agreements, which is really just code for re-litigating Trump’s approach of using pressure to get a better deal because, theoretically, the US has more leverage now.

Iran is a much more bipartisan issue than Democratic waifs like Chris Murphy would have you believe. Opposition has largely been about short-term political gain or making home state electorates happy, not particularly principled policy stands. If that were the case, then Democrats would be able to link why the Iran deal was a necessary condition for a potential withdrawal from Afghanistan to work. Democrats, of course, now seem to oppose doing so. That means that sanctions relief for the oil market is much less likely to come from Iran looking closely at it. It more worryingly means that Israel and Saudi Arabia have pretty successfully boxed in US policy, most recently evidenced by the decision to deploy the carrier Nimitz to the Gulf under cover of helping Iraq and Afghanistan despite zero need for further air support capacity from a naval asset given the numerous airbases across the region and in Afghanistan the US has in place. Escalation risks are structural, not idiosyncratic.

It’s comforting to think that Gulf states like the UAE now urging caution and condemning the assassination is evidence that Israel’s normalization campaign constrains its behavior. Only the most naive optimist takes state language at face value when these leaders know that they’re in the line of fire if a conflict erupts and would rather maintain plausible deniability and distance. A press release is cheap. Actually enabling the sustained campaign of escalation and lobbying for it in Washington, Riyadh, and with Tel Aviv is politically expensive. Which do you think proves their priorities more? The oil market has been able to forget about supply risks for a long time now. Unfortunately, we’re not out of the woods yet. We’re just about to get a more competent crew into power already making contingency plans to pursue what they actually believe rather than what they campaigned on.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).