Top of the Pops

The global crude supply overhang seems to be unwinding some as the volume of crude stored at sea has now fallen below 100 million barrels, less than half their May-June peak:

This ‘great unwinding’ of the glut at sea is an important reference point for why OPEC+ would opt for gradual production increases. Even though there are other drivers, including the UAE going hell for leather to increase its output potential in the future (some of that, of course, is just on paper), this does suggest the cuts are slowly working to achieve market balance. US oil majors are now finally setting aggressive emissions cutting targets to keep pace with European competitors as large investors like BlackRock are now demanding action as much as the traditional pressure groups and activist investors. That could involve some level of supply constraint for new investments, at least initially, but given that firms like Exxon have internally priced $35 a ton for carbon for years, I don’t expect emissions cutting programs to meaningfully impact upstream investment with the rates at which firms can borrow. As the market rebalances, IOCs and midsized drillers whose business models aren’t vertically-integrated will likely jump into projects before OPEC+ can build in their market share. Cost-cutting remains king.

What’s going on?

Analysis from Expert RA and the Center for Macroeconomic Analysis and Short-term Forecasting show that Russia’s banks lost interest in financing the real sector of the economy by mid-2018. Despite some nominal lending growth in 2019, the overall level of lending stabilized between 2015 and 2019 in the range of 52-58 trillion rubles ($699-780 billion). In 2016, loans to non-financial organizations were worth 40.1% of GDP, falling all the way to 30.7% at the start of 2020. It turns out that falling interest rates in Russia haven’t actually spurred business activity, at least per Anton Tabakh’s analysis, because the regulatory system in place and measures taken to contain the last banking crisis have made it more difficult for banks to lend to anyone but the largest companies. Companies’ own authorized capital now accounts for 55% of their investment financing, up from 45%. Deregulation or the use of state-guarantees to encourage riskier lending are needed, else many smaller firms are stuck relying on falling profits to finance future investments. Rather than spark growth, Russia’s current institutional arrangement is shifting into a world of easy(ier) money for the strongest SOEs, parastatals, and leading firms to consolidate their market positions.

Opinion polling from the Higher School of Economics tells an interesting story — it seems that more Russians in 2020 believe that they themselves are able to change their material circumstances than in 2016. Similarly, now 26% of respondents say they don’t owe the state anything because of how little it gives them compared to 31% four years ago:

Title: Citizens’ assessment of their ability to change their life for the better, %

Top to bottom: Of course, yes, yes, more than not, hard to answer, no more than yes, of course not

It’s easy to over-analyze individual poll results in Russia given how hard it can sometimes be to come by relatively unbiased and useful poll data, but these results speak to a few trends (noting that 65% of all respondents accepted state policies and responses to the pandemic). On the one hand, that suggests some level of hope has risen that merit, hard work, and luck still exist and the worst of the post-2014 economic crisis has passed mentally. That more people feel they owe the state something speaks to a slight increase in the state’s share of the national income and relevant support programs since 2014 as well. But increased hopes about advancement are actually what generate political reform pressures, at least in the economy, if they aren’t met with an improvement in wages among many other things. So it could just as much be a leading signal that local politics are about to get more intense. We need more data, but this is worth following closely.

1 in 10 economically active Russians now invests in equities. Citizens’ investments were worth an estimated 4.7 trillion rubles ($63.2 billion) in 3Q, a 16% increase over 2Q and a 45% increase year-on-year. Retail investors, for comparison, moved a total of 420 billion rubles ($5.65 billion) into the market in 3Q vs. an inflow of 237 billion rubles ($3.18 billion) in 2Q. Since March, investors of all stripes have been buying shares in Russian and debt obligations held by foreign firms, it looks like. So long as the key rate is held just above the inflation target, there’s little incentive for people to leave savings in bank deposits so the money’s flowing into riskier assets. What strikes me here is that a rise in equities ownership for some of those investing is undoubtedly going to contribute to their real incomes over time via sales for gains and dividends depending on how they run their accounts. The more Russians are invested in stocks, the larger the constituency that benefits from a lower interest rate regime becomes at the same time we have evidence that said regime has not spurred bank lending to SMEs. It’s a perfect storm — Russian macroeconomic policy has to evolve to adapt to higher levels of financialization while microeconomic reality and banking sector governance undermine the growth that could be realized from a larger credit impulse.

The Netherlands has reportedly refused to reach a deal with MinFin to revise the existing tax agreement with Russia by raising taxes on dividends and interest while demanding that the two countries maintain a “separate channel to withdraw money.” Whereas Malta, Cyprus, and Luxembourg all signed up, the Netherlands are holding firm. Russia’s deal was to raise the rates on dividends and interest to 15% with a 5% rate offered if a company was 15% publicly-traded in a free float and at least 15% of company shares pay dividends. That amounts to a tax break for the biggest firms registered in the country investing into Russia. Rates on royalties, dividends, and interest could shoot up from 0% to 20% without a deal along with a host of other roadblocks for investors. It’s a huge problem given the Netherlands is the preferred EU jurisdiction for many Russian firms operating between Russia and the EU and international firms doing the same. Though firms could move within the EU, doing so will raise costs and open up new political headaches with national governments and Brussels. Pressure’s on for business lobbies demanding Siluanov deliver.

COVID Status Report

Good news! For the first time the last few months, there was a daily dip for both regional cases and Moscow, with the national total still coming in high above 28,100 with 465 deaths recorded. More importantly, though, the weekly growth rate of the infection caseload is clearly falling. It was 10.1% as of November 30, down to 6.4% as of today:

The falling growth rate will eventually become a net decline in absolute cases, and we’ll see if the death rate declines slightly faster than the caseload rate. Mass vaccination for teachers and doctors is beginning as of today, though experts are still worried about logistical difficulties with distribution of the vaccine to the regions because of the temperatures needed for storage in transport. Turns out that even without Pfizer’s methods, things weren’t all perfect for delivery after all. Vaccinations are undoubtedly going to help manage caseloads, particularly if frontline workers aren’t at risk which will make it a bit easier for hospitals to stretch capacity in some instances. Russia’s infection peak was estimated by Moscow experts to hit the next week or two, and that looks about right so far.

Kingdom Come a Copper

A few days ago, in a fit of hair-trigger Twittering, I tagged into a conversation briefly and made a terrible mistake: I linked the hypothecation thesis for commodities and China — that debtors in China pledge collateral in the form of volumes of commodities to secure debts — to the copper price rally this year. I was drawing on historical assumptions that pertain broadly to commodities across class and made a loot more sense as of June-July than now. Turns out I was (stupidly) wrong and not thinking through what was going on with the copper market. Thanks to Neil Hume posting a screengrab from a Glencore report on copper:

We’ve got ourselves a lack of supply coming on stream at precisely the moment that demand for electronics, wiring more broadly, and electric vehicles is set to take off. The sector globally was banking on a longer runway for price recovery, so it slashed its budgets prematurely in 2020 for investment into new production. As we can see here, there was a lingering effect from the massive bull run on commodities markets before the global financial crisis that led to steadily investment trough the last decade as global growth slowed and the first systemic signs of trouble emerged for China’s growth model. So to get this out of the way, I was wrong to jump to conclusions about the correlation between China’s credit growth and copper prices. It’s broadly true across commodity classes from the summer, but doesn’t explain the current situation well. As I was kindly corrected, stocks of copper are falling:

China’s copper imports may have fallen the last two months, but demand is still rising at a healthy clip. Imports fell off of an arbitrage window closing — the price differential between London and Shanghai ceased to provide an opening buy low and sell high between markets. Historically, London’s cash copper spot price correlates very, very strongly with Shanghai’s front month contract i.e. the nearest expiration date for a futures contract:

I tried pulling together data for this year, but it’s most readily accessible with expensive subscriptions I can’t (yet) afford. As we can see, however, the market seems set for a large bull run that would return price levels in inflation-adjusted terms towards where they were at their peaks in 2006-2007 and 2011 if not even higher. This chart also emphasizes why the USD-CNY exchange rate is increasingly important to assess commodity flows for inputs like copper, which are going to be larger drivers of consumer price inflation than oil in the near to medium-term. As the CNY strengthens and USD weakens, the arbitrage window changes (as well as responding to differences in regional demand and the intensity of trading action on a given commodity exchange). China alone accounts for 50% of global copper consumption, and the arbitrage trade was briefly worth around $580 a ton between London and Shanghai at the beginning of this year:

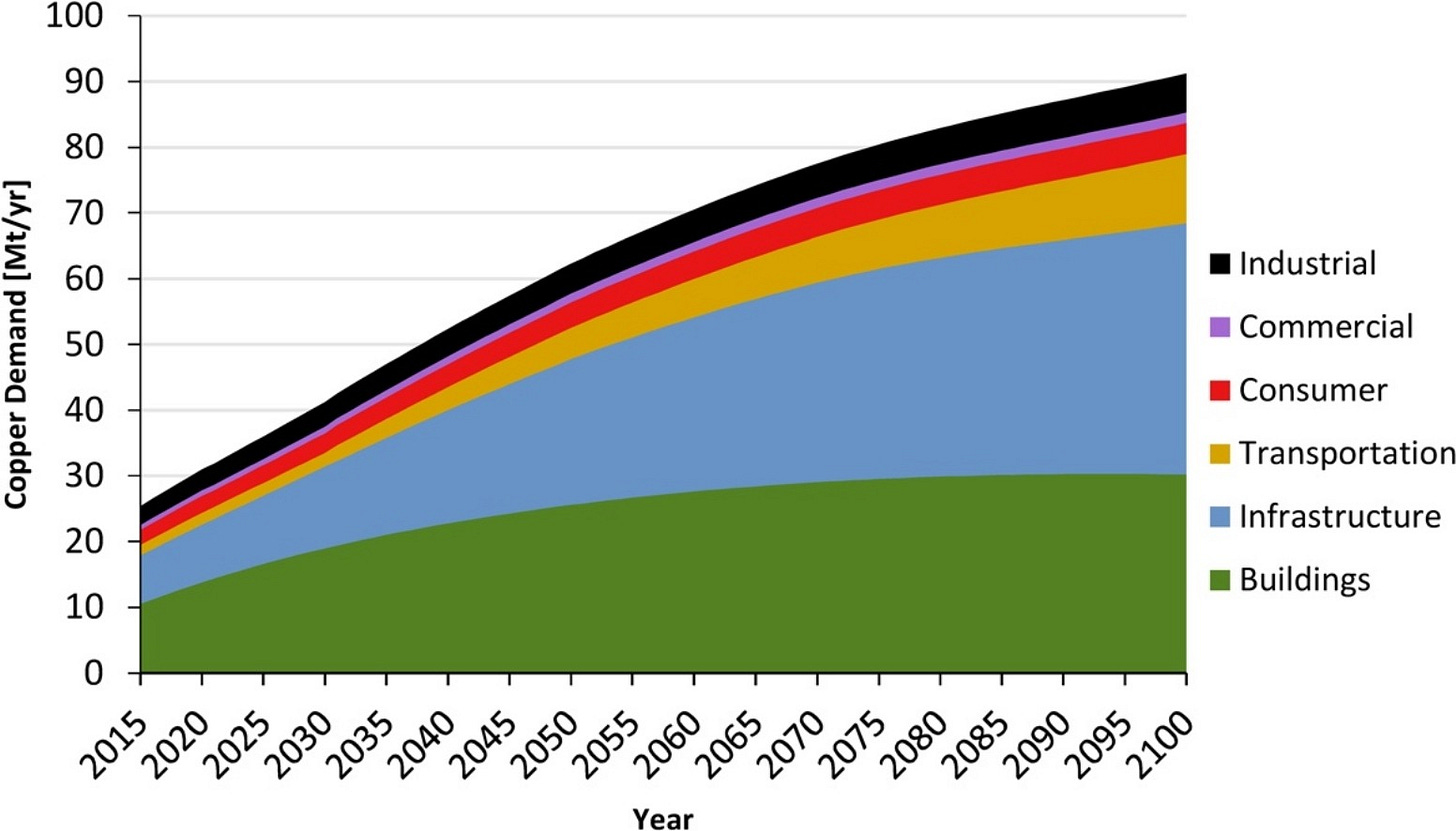

That’s an insane arbitrage trade to pull off, though now gone (partially because commodities traders in London are likely rolling back their exposure since many will be taking a fair amount of time off around Christmas and New Year’s). The bull market for copper is a much more important story for the fundamentals of the energy transition than an oil market recover. In fact, it poses a potential structural risk for EV adoption if inputs for batteries become more expensive compared to perpetually cheap oil. I side with those arguing that there’s a secular shift in the costs of energy taking place, originally by policy intervention but increasingly due to market factors. But a new bull run for copper is going to make a lot of electronic and green tech more expensive to manufacture and buy and faces a greater supply squeeze than anything happening with oil. This is an academic stab at estimating future demand from 2018 worth a look:

Compare that to oil since 1970:

Copper today is closer to where oil was around WWII in terms of its growth trajectory for demand if we’re using relatively optimistic assumptions about the energy transition, the ever-expanding technological inundation of our daily lives, new gadgets and wiring requirements, and more. Much of this future demand is going to have to come from recycling existing resources in order to better manage emissions as well as head off supply constraints until we find a physical replacement for copper that can scale and we have adequate supplies of. In Russia’s case, the current bull run is going to do more to sustain a fair number of Arctic investments than anything from the oil market. The problem will be the financial terms under which companies operate to extract copper in Russia, not supply (which is plentiful, if frequently in remote areas requiring a lot of infrastructure investment).

Russia’s largest copper find — Udokan — launched production in August, which is surely going to raise output considerably. Mishustin touted figures in August that production would rise 15-20% after the GOK project in Chukotka launched. But Udokan is a very remote investment it took 70 years to launch from discovery as is anything built in Chukotka, which inevitably is going to require state support, whether via direct investment, grants, subsidized loans, or what’s likeliest — continued subsidies and price controls for tariffs on transport. The should be no doubt that Russia’s well-positioned to increase its market share for copper in the years to come, especially since Russian firms have recourse to government help to invest counter-cyclically. However, I expect the bull market to provide the presidential administration and MinFin a rationale to maintain the current temporary tax increases for extractive industries and the metallurgical sector — a fixation for Andrei Belousov before COVID hit.

If metals replace oil as the inputs to watch for inflationary pressures with large demand increases globally, Russia’s system is designed to try and retain as much as possible in the way of rents from the sector while leaving it to squeak out investments into productive capacity. This time, a lower interest rate regime and growing comfort using ruble-bond issuances domestically will provide more financial cushion. No one in the sector is going to rest easy knowing that, though. Oil & gas have always borne the brunt of the worst when the country needs revenues. The energy transition and tailwinds for copper and other metals are going to shift the some of the thinking in the next year or two, especially if Novak intends to use his new post in the cabinet to lobby on behalf of the oil & gas companies in need of more effective tax systems. New rents are going to be created and existing rents increased in many cases. Watch out.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).