Tarkin loud, sayin' nothin'

The more the Kremlin tightens its grip on prices, the more the system slips away

Top of the Pops

Just a few days into Biden’s presidency and we’ve already got an event to worry about in Syria. Russian military police are apparently in the potential line of fire around the northern Syrian town of Qamishli, which lies on the M-4 highway running to Damascus and hosts an airbase and Russian aviation group. Kurdish SDF forces as well as local Kurdish police have attempted to block access to the airbase as well as to Qamishli itself. The SDF and local Kurds are (still) receiving support from the US, putting them at odds with Russian forces trying to keep a fragile balance of power together on the ground. Biden’s only tip so far about his plans in Syria concern restarting humanitarian aid and coordinating Syria’s reconstruction. Everyone knows that’s impossible without either the defeat of the regime and its allied forces from Iran and Russia, or else via a negotiated settlement no party has any intention of reaching at this stage. The question, then, is how will Biden’s approach to Turkey affect the US relationship with Kurdish forces that have long posed as the ‘democratic alternative’ on the ground amid the exceedingly complex array of militia groups and terror factions playing external powers and each other for influence.

The SDF have reportedly requested that Russian forces hold Turkish forces in check two days ago as they’ve continued to launch attacks. Russia has deployed an additional 300 MPs near the Turkish border in the last week in response to the situation. Yesterday, foreign minister Sergei Lavrov — admittedly a very marginal policy figure at this point — announced that a new meeting of the Astana Format will take place in Sochi in February. Russia is forced to mediate the current conflict since it’s got troops on the ground, and it’s hard to imagine that the Astana announcement wasn’t partially timed in response to Biden’s inauguration and the latest fighting between Kurds and Turkish forces. Russian ambassador to the US Anatoly Antonov noted as Biden prepped for the inauguration that his government hoped regular contacts with the US military in Syria to deconflict when necessary would continue. The Syrian conflict is running on inertia, and there’s little mind being paid to it in Europe or in Washington at the moment. Turkish forces are facing new attacks in Idlib at the same time this is all going on. Inertia isn’t calm. Until Biden tips his hand, we know little of what to expect next. It’s clear, however, that Russia’s role policing the conflict is more likely to expand than not, which isn’t great news for Moscow since that leaves it in a permanently reactive posture.

What’s going on?

The United Shipbuilding Corporation (OSK) wants to require all those ordering ships on contract to register their ships with Russia’s International Ship Registry (RMRS). Apparently there’s been trouble collecting refunds of VAT as promised per production stimulus measures, incurring significant losses — the bill for the icebreaker Arktika comes out to 4.5-6 billion rubles ($59.8-79.7 million) alone. It’s a perfect case study in the inadequacy of Russia’s economic governance: you pass a half-baked stimulus measure to encourage domestic production while limiting import competition and reducing efficiency, you offer a tax break you can’t even verify with the existing legal regime, and then you have to invent new ways to keep up with the disruption the initial policy caused. Ship contractors have agreed to register future ships with the RMRS, just not the current crop. Sources cited from MinTrans say that OSK is actually just trying to increase the cost of its ships by 18-20% by raising the price to match what the VAT would be and collecting what it otherwise would have had to be paid in tax by contractors. That’s a result of direct, formal, and indirect, informal price control measures since the state doesn’t let the firms properly compete against imports. But then OSK tries to use legal means to increase them and shunt costs onto others to earn more without improving efficiency. And so we go in circles.

Despite a weaker ruble, it appears that Russia’s imports rose last year off of 2019 levels. That’s a small surprise given the means by which the budget was used to cushion COVID’s impact, but actually tracks with weaker industrial output figures:

Title: Dynamics of the composition of imports (2007 = 100)

Orange = investment goods Blue = other goods Seafoam = consumer goods

The 14.4% decline in the ruble’s value clearly hit consumer imports, though Russia still relies on foreign medical production for healthcare needs. But the rise in investment goods aligns with China’s stimulus for its exporters and Russia’s trade deficit with China in H2 last year. Other goods isn’t elaborated from underlying data, but followed investment goods’ trajectory. The real takeaway here is that Russia’s done a great deal to reduce to its import dependence since 2012-2013 when oil was at $100+ a barrel, but its current account surplus has still fallen in relation to the broader economy and, crucially, supply-side stimulus abroad in response to the crisis was probably able to grab market share faster than domestic production could react. In other words, it’s not a supply shock that shortcircuited Russian producers’ COVID response. It was demand uncertainty and a fall off of orders, followed by a decision to keep things open as much as possible that benefited Chinese (and other) exporters operating with a greater degree of certainty than domestic producers in Russia.

An amendment to the budget codex is now being taken up in the Duma that would hand legal oversight over all state capital investments carrying any level of risk, excluding those classified as ‘risk-free’ or classified by the state, to the treasury in Moscow. The government is seeking to expand the oversight provisions to cover subsidies, budget spending on state procurement contracts worth over 100 million rubles ($1.33 million), spending on the management of property, and more. The details are interesting but obscure the political thrust of the initiative: pinch every penny possible and hand Mishustin a cudgel to beat departments and officials in line during the next round of fiscal consolidation. This is basically an attempt to create a ‘meta-KPI’ for all state investment, almost as if they want to game out a fiscal multiplier for every line item of capital investment spending. It’s quite odd to pursue a campaign to reduce the size of government staffs wherever possible and expect to be able to better assess the results and impact of spending plans with fewer resources available, but that’s the pressure policymakers now face. Regional governments should be worried.

The movers and shakers of Davos laid out a crucial point for post-COVID recovery that should really worry Moscow: the acceleration of technological trends threatens to create a bigger productivity gap between developed and developing economies. To add to that, emerging markets have been forced to push themselves to the limits of what they can handle in terms of budget deficits and monetary easing. It’s helped cushion the blow of the last year, but lots of questions remain like what happens when the dollar finally leaves its current bear market and begins to appreciate in value again? Dollar-denominated emerging market debts broke $4 trillion for the first time in October, not as bad as it sounds considering their economic weight has grown significantly in the last few decades but that’s still a lot of money to owe. If the dollar strengthens, EM growth slows. This dynamic is one to watch for commodity demand in the next few years, especially as a weaker dollar should, in theory, help the US generate new manufacturing jobs and reduce its trade deficit while China struggles to embrace a consumer-led economic model for good.

COVID Status Report

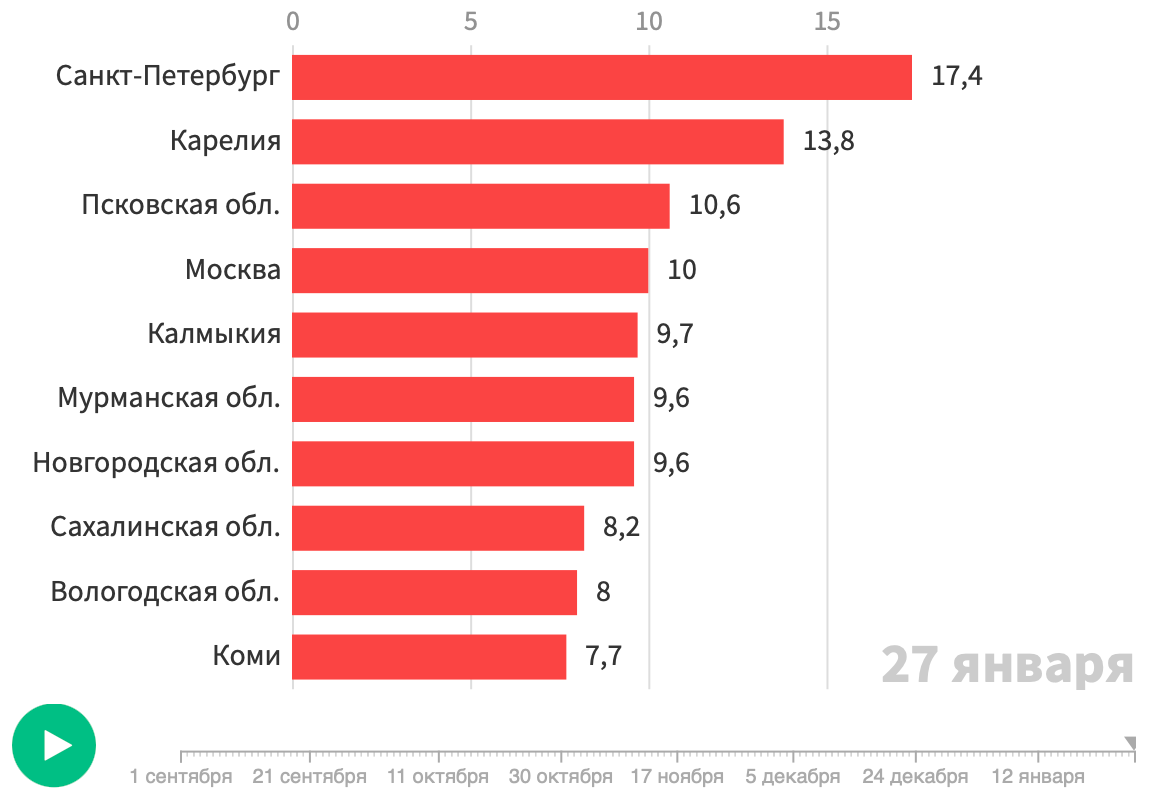

New cases are now down under 18,000, though the daily death toll was high at 594. The infection rates per 1,000 show that the problem is clearly worst in St. Petersburg and Karelia for slots 1 and 2, thus holding up the figures some while Moscow and other cities and areas have had success in steadily bringing down case totals :

Rospotrebnadzor is now briefing that the current ‘stabilization’ phase will last about another 6 weeks, after which they expect to begin to see a steady decline into summer. The media coverage links it to the vaccine rollout. We can already see that United Russia is angling its recruitment drive for new members to stand in September elections on a COVID platform i.e. the vaccine drive will be a huge part of laying the groundwork for whatever policy proposals they throw out trying to win a strong majority in the Duma. As things have improved in Moscow, mayor Sergei Sobyanin has ended the remote working advisory in the city in hopes of jumpstarting its economic recovery. They’re really gambling big on re-opening, which makes sense. They don’t have any other tricks in the bag if they refuse to spend money.

The Limits of Control

The price control story in the Russian economy and Russian politics keeps dragging on, and raising new questions about what exactly is going on with Russian governance. Writing a brief note in Kommersant, Anatoly Kostyrev exposes just how stupid the policy has proven and how systemic discontent with the policy appears to be. Kostyrev took the example of sugar producers. The assertion of ‘manual control’ — a favorite for Russian leaders — over pricing for sugar has stipulated that sugar producers sell wholesale to industrial producers at 36 rubles per kilo. But at spot rates on the free market, the price is generally 40-42 rubles per kilo. The current controls are forcing producers to slash prices depending on the good from 6-30%. But sugar beet production is down this year, and since the agreements set priority deliveries for key staples at retail chains, the prioritization of deliveries then generates inflation elsewhere at the same time that producers at different parts of the supply chain may refuse to sell at a discount depending on their own needs or how the good they produce is affected. Candy is at risk of seeing significant price increases as domestic sugar production falls due to seasonal/annual variation at the same time prices are being held down and confectioners aren’t subject to the current scheme.

All Moscow has done is rearrange the effects of inflation while trimming margins for the retailers who, despite operating in a thin-margin business, aren’t suffering at the moment given that COVID didn’t kill demand for what we need to survive. The Audit Chamber has warned that the control schema could lead to product shortages or worse price trouble if producers end up refusing to stick to price controls since the legal mechanism by which the agreement is operating is so unclearly delineated between being a formal law and informal deal with the government. The after-effects of the initial decision taken in December are beginning to reveal what I worried was the case: Russian economic policy is becoming too Soviet. We’re nowhere near centralized command economy planning, but price-setting in this instance is just a lazier way of avoiding the mobilization problem for production while effectively generating the same inflationary effects through shortages.

Price controls would not be as much of a problem if the ‘plumbing’ holding together the sectors of the economy that produce the base goods that are always in high demand i.e. foodstuffs, basic clothing, consumer goods that are essential like basic cookware and so on wasn’t subject to similar problems spilling over from various forms of economic intervention. Take Russia’s food security and production, ostensibly one of its great post-Crimea success stories driven by rising wheat exports in particular as well as higher domestic production for goods the country used to rely heavily on imports for:

As we can see here, the energy efficiency of production made huge gains between 2000 and 2014 and then, suddenly, it stopped. At the same time, the amount of energy consumed in relation to physical labor — itself a reflection of buying better machine stock that’s more productive, some automation, and related efficiency investments — keeps rising. Just as counter-sanctions hit and subsidy support for agriculture expands, it ceases to keep improving its energy efficiency while trying to increase net output to nab more export market share. Price controls on grains as well as the newer customs duties and reduced export quotas will end up harming returns, sure. What I'm more interested here, though, to use the Soviet analogy, is how the distortionary effects of subsidy, price controls, and/or protectionist support in one sector create spillages that the current policy climate can’t resolve.

Agriculture requires a rising amount of energy without adequately corresponding mechanisms to encourage energy efficiency investments. Granted, these investments have lagged globally so it’s not just a Russian phenomenon, but the point here is more about sector-specific interventions producing sector-specific effects that eventually cause broader problems. The issue I can foresee here is that the ad hoc and disjointed policy process to encourage power plant modernization could end up creating delayed inflation. Kicking the can down the road now to hold prices lower for residential and industrial consumers wards off inflation in the next few years, but then a crunch on electricity supply creates a later burst. It’s something I write about frequently and have mused on before, but I increasingly think it’s under-appreciated as a sort of unstated governing orthodoxy. The aim of policy is always to delay inflation as long as possible, or else absorb it using the state budget as the Soviet government did through its price subsidy efforts. Energy use and efficiency point to the problems of this approach, and how quasi-stability and stagnation hide how bad the underlying economic firmament likely is:

Russia’s primary energy consumption tracks directly with GDP growth, only lagging during the 2000s boom more significantly because of the composition of growth. Oil prices boomed, so one could generate a lot more GDP per unit of energy consumed extracting oil without any corresponding improvement in production for other sectors, many of which struggled because rising incomes and a then stronger ruble underpinned by petrodollar reserve accumulation enabled a consumer boom that came after decades of demand constraint due to Soviet policy and then the chaos of post-independence ‘de-growth’. But agriculture showed considerable gains between 2000 and 2012 despite limited evidence the Russian economy as a whole did. Why?

Well, it’s institutional. The privatization reform Putin signed into law in 2003 encouraged firms using agricultural land to cut costs and more efficiently use resources. That stalls once subsidy support and import bans on European production force state policy to enable less efficient production to take place in order to meet domestic needs and avoid excessive price inflation. If energy efficiency isn’t really improving significantly across the broader economy — the same institutional gains agriculture made would be inverted in other sectors where state participation has steadily expanded — then it also underscores the failure of Russian policy to create a viable industrial base for exports and successes ramping up domestic production of some consumer goods appearing to produce significant energy efficiency gains because of fuel switching to natural gas, which itself has long been subject to price control schema, forms of state support, and in the case of Gazprom, a pipeline export monopoly. The entire system is pinned together through hydrocarbon subsidies and exports. Whereas efficiency gains are discernible in developed economies since 2014-2015 despite lower hydrocarbon prices, Russia hasn’t adequately kept pace (though it’s important to note that it’s not an energy efficiency wasteland, some things have gotten better over time).

Assuming that Russia can no longer rely as consistently on oil & gas to power a beefy current account surplus, the only way it maintain the same currency reserves to backstop state-led growth is exporting intermediate parts for goods consumed elsewhere, especially in China. But in order to do so, Moscow has to let companies fail and expose its industries to ruthless competition. Domestic demand is simply too weak in the current orthodoxy to generate balanced growth, there’s no evidence that macroeconomic policy will change on that front, and the expanding web of subsidies and market controls undermine competitiveness. That’s why a carbon tax could be a boon for Russian growth in the longer-run, despite an initial burst of inflation and contraction of some economic activity (depending on how it’s phased in). At the Gaidar Forum earlier this month, Anatoly Chubais mused that the failure to apply a carbon tax was a ‘gross mistake’ for the country. I tend to agree for one simple reason: because of the structure of the Russian economy, it would force a rapid increase of investment into cost-cutting and efficiency gains that would generate domestically-sourced manufacturing and jobs that would prove more durable than an increasingly fragile balance of employment sustained through the fiscal and monetary support the country’s hydrocarbon sector can generate. At this point, I’d argue it’s a precondition to be able to export value-added goods to newer markets, especially as the trade agenda expands to cover climate issues. After all, the US seems likely to impose climate-related tariff regimes that, even if negotiated on a country-by-country basis, signal a sea change for anyone trying to shift their export basket into value-added production.

By waging war on inflation through direct price controls instead of war on inefficiency and logistical bottlenecks, Moscow has set itself up to lose out on one of the last competitive advantages it has: an educated workforce that costs less to produce a wide range of goods than elsewhere. Even its ‘success stories’ reveal an accumulating strain of inefficient capital allocation and state interventions at the sector level. One might want to remind the presidential administration of the lessons of Governor Tarkin: the more they tighten their grip, the more pricing systems slip through their fingers. It’s getting harder to isolate the effects of every policy choice as the interventions pile up with unintended consequences.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).