Top of the Pops

At least in the US, there’s some cause to think that we’ve possibly hit bottom for the various supply chain bottlenecks and stresses overall and that now, with some exceptions given every sector is different, inflation pressures for finished goods and industrial supply chains will start to ease. Thanks to Joe Weisenthal for posting this from the Richmond Fed’s survey. We can see the vendor lead times and backlogs for goods starting to tick down and though finished goods are at their lowest right now, raw material inventories seem to finally be bouncing up:

This data is, on its face, worlds away from Russia and Eurasia. Russia’s Central Bank chair Elvira Nabiullina is adamant in communicating the inability of the supply side to keep pace with demand at the moment. European industry is moving again and that means higher European demand and, most likely, a bit of extra strain for Russian importers whose European counterparts are keeping more export goods for domestic use or else redirecting their subsidiaries’ production from China to European markets instead of Russia. Confidence that inflation is transitory — note that I share this view — will eventually help Russia some. As raw material inventories recover, odds are that some, not all, commodity prices will also settle downwards. The persistent sources of inflation in Russia and Eurasia will most likely come from ongoing labor market shocks and the commodities structurally benefiting from a new, decarbonization-led price cycle. The more commodity-intensive an economy’s consumption, the bigger the effect of the new price cycle on price levels. Nabiullina may be proven right about inflation in Russia, but it won’t be because of industries now finally figuring out a way forward from supply/demand imbalances.

What’s going on?

For January-June, car prices rose an average of 7% in Russia with some models rising as much as 20%. Some of that has been from the ruble weakening, but supply chain crunches are the prime culprit — imported components, particularly electronic components hit by semiconductor production backlogs, have risen in price significantly as have shipping costs for container capacity. In typically Russian fashion, Mercedes Benz have seen the smallest average price increase at just 2%. The good news is that the worst of the supply crunches are over. It’s expected price increases will settle out another 3% over the course of the rest of the year for an annual figure at 10%. The demand side looks messy. Autoloan issuances are up 80% for January-May, by itself a positive indicator that consumers want to buy. On the flip side, that means that rising costs of credit will restrain purchases later in the year. Russia’s domestic pricing dynamics are also somewhat at the whim of stimulus and recovery elsewhere. For instance, if US growth maintains its high pace for longer and/or the Eurozone recovers more strongly than expected, that’ll put more of a squeeze on imported components. Overall, it’s good news that the worst of the price increases are behind us when it comes to cars. But cars aren’t a big enough share of consumption in Russia to offer much inflation relief.

The state registry of ‘unscrupulous’ suppliers continues to swell with new firms. 2020 data lagged 2019 registries, but that likely reflects the mechanisms by which a firm is put on the list and banned from participation in procurement bids for 2 years — either they avoid fulfilling a contract or a customer unilaterally terminates it with a court stepping in to decide when the violations are major. The Federal Anti-Monopoly Service (FAS) reviews the cases that are then decided in an arbitration court. We see a sudden proliferation of these firms in 2019. The following are in 000s:

Blue = firms on the registry Purple = contested decisions from FAS Black = successfully overturned FAS decisions

The number of successful challenges to inclusion on the registry has also risen, but by very little compared to the gross number of firms being added each year now. The government is now looking at further strengthening the regulations around the registry to include contractors’ violations of specific contractually-agreed conditions, part of the ongoing effort to leverage the state’s formal powers to scare businesses into being more efficient and less wasteful with the public purse. One has to wonder who’s lobbying FAS and the arbitration courts and which firms have actually won their appeals. It’ll be interesting to see if the increase in the number of firms added to the list continues to rise this year.

According to MinSel’khoz, the government is now trying to levy an excise tax on non-alcoholic drinks to raise revenues. MinFin has two versions it’s looking at — charging tax based on the drink’s cost or on its sugar content. The Ministry is against idea for the obvious reason that it’ll immediately lead to price increases for both consumers and producers in the middle of an inflationary wave. Worse, it could hurt production and encourage more illegal production to dodge taxation, which could offset the revenue gains. As expected, the international firms operating in the space like Pepsi and Coca-Cola as well as domestic producers are lobbying hard against the policy. Beverages only account for about 2% of sugar demand in Russia, a figure you have to watch closely since there have been shortages of sugar this year as well as a result of fluctuating beet sugar production. Kazakhstan is looking at rolling out its own version of the tax starting at 7% and rising to 45% by 2025. There isn’t yet a clear list of drinks that would be affected and other technical requirements to apply said levies, but the thinking is that from 2022-2024, they can raise about 149.4 billion rubles ($2.06 billion) for the budget settling around 20 billion rubles annually after. This sounds like a proposal that will sneak through after the election. No one enjoys discovering their favorite tooth-destroying drink is about to get more expensive before heading into a voting booth. If corporations are expected to invest more to dodge higher taxes, then it looks like households will be asked to pay more in taxes with their incomes that are supposed to be rising.

The oil lobby has convinced the government to hold off on more radical price control measures for benzine, including direct price controls, export bans, or increasing the sale of fuels on exchanges. Wholesale prices are up 20% over the last 6 months and outpacing general price increases so the victory is notable. The average good in a supply chain travels 1,000(ish) kilometers in Russia before reaching its destination and it’s not like Russian drivers are generally swimming in cash they want to spend on fuel at the moment. Deputy minister Aleksandr Novak first met with the fuel retailers union. Filling stations are struggling to turn a profit at the moment as inflation eats up any of their potential profits and they were begging for price support to save their margins — for those who don’t know, downstream operations like filling stations are a viciously competitive industry because margins are thin. Margins are realized by marking up prices against retail costs and your occasional services while trying to squeeze as much profit as possible out of sales of food and drink. But the large, integrated oil companies intervened and argued that the government should give the damping mechanism that compensates refiners depending on oil prices and the difference between domestic and export prices for fuel more time to do its job and not demand large firms cut their margins selling fuel wholesale. The state budget then compensates refiners for any gap between export and domestic pricing, a maneuver that can be more easily paid for now that pensions are receiving a half trillion fewer rubles in the current 3-year budget plan. That’s a gamble given that road fuel demand always rises in summer and any shortfalls on the domestic market will lead to further price hikes. Novak’s talks led to a choice to pay out more to the integrated oil firms to subsidize production. Hard to see how they can avoid a full-on price freeze for wholesale fuel prices later this summer, though.

COVID Status Report

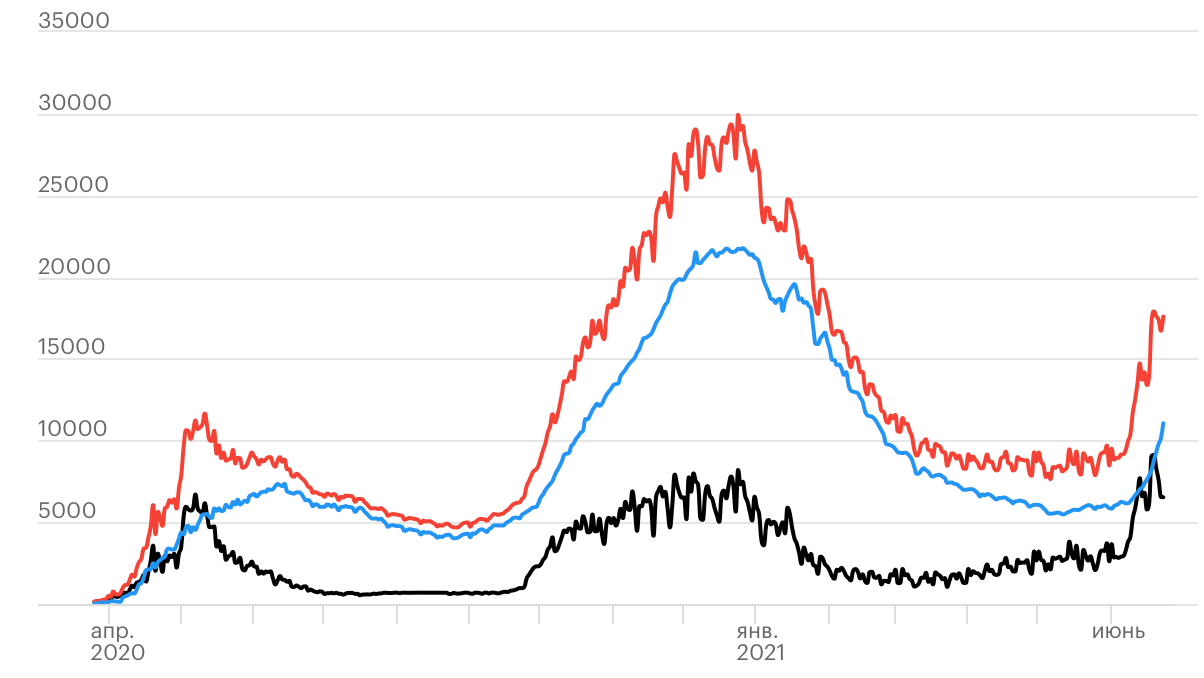

17,594 new cases and 548 deaths were recorded by the Operational Staff for the last day. We can now see divergence in the official data between Moscow and the regions that points to the scale of the problem:

Red = Russia Blue = Russia w/o Moscow Black = Moscow

No other city has the same fiscal and physical infrastructure at scale and quality to get ahead of the virus. The Kremlin has made it clear that a national lockdown isn’t on the table right now. Emerging shortfalls of vaccine supplies across the regions are, according to Dmitry Peskov, a result of rising demand. But that also suggests that production isn’t as strong as we might expect insofar as doses could be stored officially for up to 2 months before being destroyed with prior plans to extend the storage time to 6 months. As of late May, they’d exported about 12 million doses compared to about 19 million doses distributed domestically at the time that data was issued. We’re now around 24.66 million doses administered domestically. There’s clearly some sort of bottleneck. A lot of this would stem from logistical complications — the US vaccine push has faced and still faces plenty of problems reaching rural areas and dealing with less densely populated areas — but they also aren’t producing enough to ramp up vaccinations. The PR campaign around mass vaccinations was a complete dud with export volumes just taking away from what could have been a far more efficient and quick push domestically followed by a ramp up of export capacity. Politics, as always, came first.

What to worry about

Despite better news of late, Moscow can’t rest too easy about oil markets. Brent crude prices are just under $75 a barrel — a boon for the budget and wealth funds — and the recovery of upstream investment outside of OPEC+ is only now starting. Based on relative levels of investment, adjusting for cost deflation since 2015, companies like Rosneft and it’s 300,000 barrels a day of capacity it can tap (according to Renaissance Capital) are in decent shape. Final Investment Decisions (FID) for oil projects worth at least $1 billion are back at 2016 levels, the low-point of the pre-COVID market supply glut:

Iran’s presidential elections added more fuel to oil prices. Ebrahim Raise, a hardliner candidate, emerged victorious. It just became that much more unlikely the Biden administration can negotiate a return to the JCPOA.

But the good news is limited there. For one, it turns out that the share of junk debt issued by US corporates out of its total debt issuances actually declined last year, an indicator that often reflects the furious speculation of frackers borrowing to cover cash shortfalls and drill more. US frackers have financially been licking their wounds focusing on mergers & acquisitions, paying down debt, and restraining their spending on drilling in order to deliver returns for investors. As a result, US shale is actually in position to provide huge profits this year. Public exploration companies are seeing surges of cash in the door:

These profits are coming because shale drillers aren’t drilling as much, which also means they won’t be as reactive to changes in oil prices or marginal demand increases. Inventories of crude oil are now being drawn down, setting up a surge of OPEC+ output this summer. Demand this winter will be the next hurdle to clear, and we’ll see if shale drillers stay so disciplined if prices rise further for longer. Mounting political headaches for the September Duma elections require more fiscal intervention if the regime is serious about buying votes. We’re now seeing evidence that many buyers who flooded into the housing market with mortgage subsidies are beginning to struggle with interest payments, a sign that the economy is not recovering strongly. The easiest ‘fix’ is to redistribute more of the oil rents to help sustain consumer demand and solvency. That seems unlikely at the moment, but conditions may worsen enough in the next 4-6 weeks to trigger a shift in thinking as the family support payments go out the door in August.

If things are relatively positive for Russia on the oil market and in terms of its macro policy (well, if policymakers decide to act), the same can’t be said for the rapid deterioration of conditions in Afghanistan. From reports, the Talban managed to capture 21 districts in just 24 hours yesterday. They just seized the Shir Khan Bandar crossing, Tajikistan’s main border crossing into the country. They’re currently at the gates of Mazar-i-Sharif, one of the most important cities and logistical nodes in Afghanistan’s north as well as the nexus of several infrastructure initiatives to try and improve commerce between Uzbekistan, Afghanistan, and Iran. The following map tracks fights between the Afghan security forces and Taliban and emphasizes how the new offensive is everywhere:

The speed with which the situation has deteriorated is both a testament to the incompetence and corruption of the security forces supported and trained by the US and NATO members for over a decade as well as the sudden threat of instability Moscow — and Beijing — have to worry about. In May, the Taliban seized more than 50 districts among the roughly 400 nationally. Dmitry Peskov directly addressed concerns about events on the border with Tajikistan. The next logical step will be an increased border presence and coordination with Tajik authorities. Initial steps upping deployments to bases in both Tajikistan and Kyrgyzstan were well underway in May as things began to fall apart politically. What’s perhaps more interesting now to see is that 130 Afghan soldiers retreated from the Taliban into Tajik territory. By default, that entails growing participation in the management of the conflict for Moscow as it coordinates between Kabul and Dushanbe and would provide any lift capacity to help return people, assuming western militaries aren’t going to be given logistical access. We’re now seeing the initial phases of a growing burden for regional security play out. We now need to see if the US will continue air support.

The other story today was the claim by Moscow that Russia’s border and coast guard fired warning shots at the HMS Defender in the Black Sea. The UK’s Ministry of Defense promptly clarified no warning shots were fired and no such incident had taken place. The sense one gets is a creeping desperation to maintain the illusion of power projection. The buildup on the Ukrainian border ended up producing a more unified western response and new degree of political determination by Zelensky to provide the Biden administration “deliverables” to justify continued and deepening support. The Armenian elections were by no means a “loss” for Moscow, but weren’t dictated by Moscow’s influence. Afghanistan is beginning to look like a new problem. The ongoing pressure to keep providing financial and material support to Assad in Syria remains with no sign the conflict is close to winding down. By no means are Moscow elites in a panic over the state of world affairs, but there is a creeping sense of disorder when it comes to decision-making. There’s no discussion of a ‘recueillement’ to resolve domestic problems more fully, nor is there a consistent logic to these brief, percussive moments of diplomacy, gunboat or otherwise.

I wager much of this is down to the oil lobby feeling confident of its position and ability to stabilize the budget and economic situation adequately with a price rally into 4Q this year. If that’s the case, they’re living like there’s no tomorrow. A consortium between China’s Silk Road Fund and Hassana Investment Co. just acquired a 49% stake in Aramco Oil Pipelines Co., the latest sign of Saudi Arabia’s successful campaign cultivating business ties with the world’s largest importer. US shale firms are going to have a lot of gas to spend once demand ‘normalizes’. Ernst & Young now forecasts sales of electric vehicles will overtake traditional vehicles in China, the US, and Europe by 2033, earlier than prior forecasts. Change is accelerating, if unevenly and not necessarily to detriment of oil exporters yet. But the cumulative impact of these changes broadly point to a diminution of Russian market influence and ability to generate stability from its oil wealth amid an increasingly fraught geopolitical context across Eurasia.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).