Stay in your grain

China's imbalanced recovery dovetails with Russian protectionism in a bad way

Top of the Pops

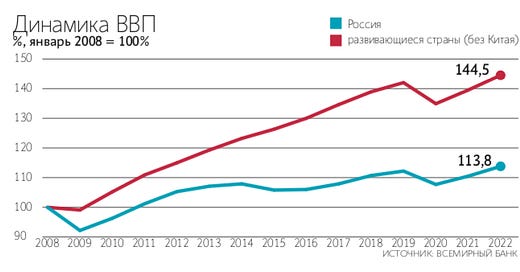

World Bank warnings of a slow-growing decade ahead were big enough to catch Vedomosti’s eye last night and should raise some questions for those utterly confident in oil’s recovery and, to some extent, just what the bull market for other commodities will look like in practice. The base scenario offered up by Franziska Ohnsorge and Naotaka Sugawara without reforms and political changes mitigating the worst structural domestic and international economic imbalances and challenges posits annual growth of 1.9% globally. That’s just under 18.5% over 10 years compared to something more in the range of 33% in the last decade (I’m spitballing, but using a 3.3% reference point yields that). Note as well that Russia’s growth model left it lagging other emerging markets terribly in the aggregate over the last 12 years:

Title: GDP dynamics, %, January 2008 = 100%

Cyan = Russia Red = developing countries (excluding China)

Russia grew at a rate less than 1.9% annually the last decade, and that came with 3 years of oil prices at an average near $110 a barrel in the early going. Only a fool would contend that the oil industry isn’t in serious need of investment (though the extent to which that number is captured in absolute constant $ comparisons is unclear given cost reductions since 2014 and now a declining cost for labor given this shock). But a consensus assumption from oil industry insiders that demand will plateau at 108-100 million bpd seems absurd if the global GDP growth rate isn’t much more than half what it was pre-crisis without big changes, advanced economies are better equipped to minimize output gaps from the economic scarring that’s happening, and export-led growth sustained by permanent current account surpluses in the Asia-Pacific is a much bigger problem in a world of securitizing supply chains and changing growth composition. The supply squeeze on metals & minerals is going to lead to huge price increases, but that’s also because those commodities benefit from input substitution into economic activity and attempts to improve productivity (that have, as yet, not aided labor’s share of national incomes). Oil & gas lose from that substitution process, particularly oil. Persistent weak global growth expectations should really cause more of a rethink of potential future demand increases, especially since the post-financial crisis growth slowdown contributed significantly to the 2014-2015 oil shock when demand growth slowed.

What’s going on?

Edaurd Khudainatov’s been gifted a large share of two Rosneft subsidiaries — Nizhnevartovskoye and Var’eganneftegaz, which produced a total of more than 100,000 barrels per day while operating with the latest OPEC+ cuts. It’s a win for Khudainatov’s Neftegazholding and part of Rosneft’s payment for Vostok Oil after he was out front in the early days trying to develop it. Neftegazholding is set to become Russia’s sixth-largest oil producer and, more importantly, give Khudainatov new revenue streams to pay down the roughly $4 billion in debt he took out in 2014 amidst an oil shock to start his own oil business. The question its what game Rosneft thinks it’s playing. The assets it offered aren’t particularly profitable and they’ve signaled their intentions to shed assets that are aging or don’t generate great returns from their core portfolio in order to double down on Arctic oil. No one seems to know how to properly value Vostok Oil. Goldman Sachs’ estimates run from $45-75 billion depending on where oil falls in the $45-65 per barrel range. Of course, oil price uncertainty, cost inflation, higher capital costs from operating in the Arctic, and more could significantly alter those valuations over the lifetime of the field’s operation. Humans are less productive laborers once temperatures fall below zero (Fahrenheit or celsius) and it gets worse the colder it gets. The deal smells like a favor to keep Khudainatov happy without giving him anything particularly valuable.

The relaunch of MinFin’s currency purchases has (finally) prompted a proper visualization of purchases over the last year that sheds some light on the timing of these policy decisions. The following is volume per day for each time period in billions of rubles:

The budget rule is to blame. Once oil rises above $42 a barrel, MinFin launches currency purchases in order to try and sterilize the effect of oil revenues on the ruble’s exchange rate while, when it falls below $40 a barrel, MinFin is prompted to do the opposite by selling currency in support of macroeconomic stability. The fear now is that if the Central Bank and MinFin aren’t aligned in their monetary policies, foreign currency purchases from MinFin will weaken the ruble’s exchange rate. There’s little reason to see that happening just yet, and the CBR has noted the program won’t strongly affect the ruble exchange rate. Bank of America is forecasting a 68 ruble to 1 US$ exchange rate average for 2021, but the math’s always fuzzy. The ruble is the most exposed (semi)major currency to political risk because of the sanctions regime and while many point out it doesn’t trade per its fundamentals, it’s not surprising that markets are more skittish because they’ve lost (some) faith in Russian policymakers, though not in the credibility of its Central Bank or Ministry of Finance.

Gazprom has reopened talks with Saudi Arabia’s SABIC to invest into the Bobanenkovskoye natural gas cluster on the Yamal peninsula in order to launch a gas refining and petrochemical complex. The two facilities would combine to produce 37.8 bcm of purified methane, 2.3 million tons of ethane, and 0.8 million tons of liquefied petroleum gas. Investment is expected to cost $15 billion in total, with $9.9 billion financed using debt. I’m curious to see if Novak uses his new cabinet post to try and push for more progress. He’s noted in the past that Russia only accounts for 2.5% of global refined products output and Russia needs to ensure it retains value higher up the value chain, especially since Saudi firms are way out front compared to their Russian counterparts investing into downstream capacity abroad. In the end, though, it’ll probably take Russian state guarantees to convince SABIC that investing into Yamal and the Northern Sea Route makes more sense than similar project proposals elsewhere, including Ust-Luga on the Baltic. It’s a classically Russian problem for economic development: the subsidies and incentives used to try and achieve one aim, generally political in nature, end up destroying most of the net value that would be created through the investment in the first place and actually deepening cross-subsidy requirements between sectors, destroying yet more wealth and creating less growth. C’est la vie.

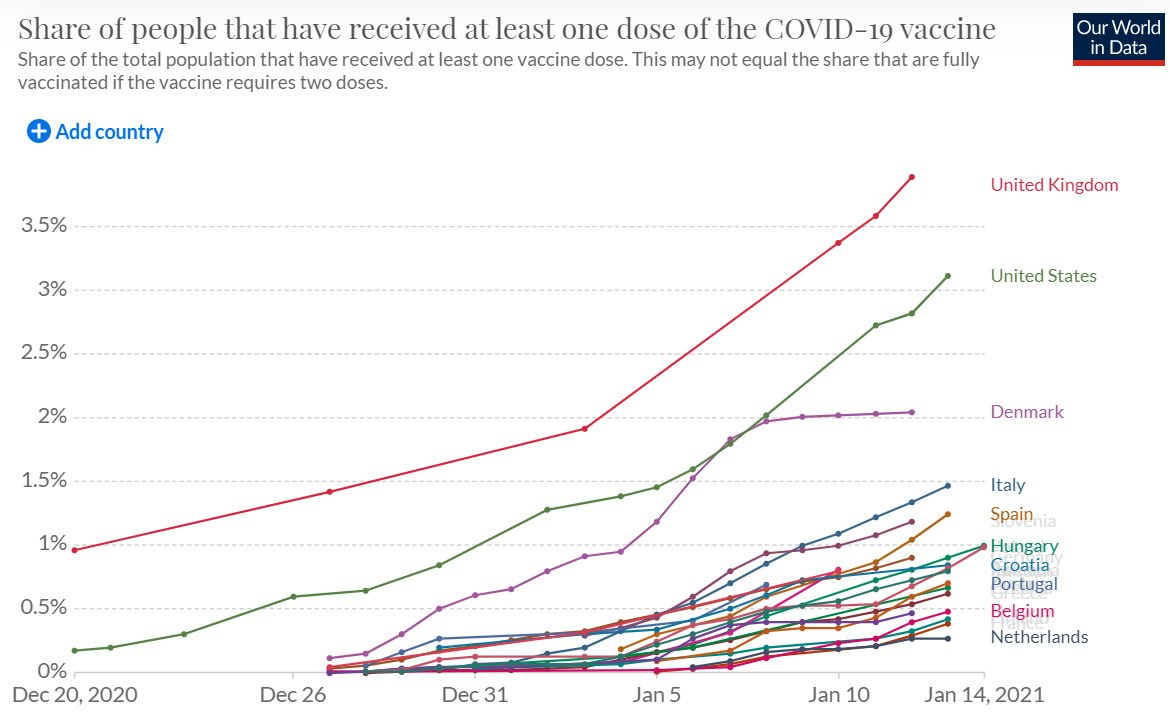

Mishustin gave an address at the Gaidar Forum calling the present moment a “turning point” in the COVID crisis for Russia because its efforts to produce a vaccine would lead to a speedier economic recovery than in most of the rest of the world. Bragging that Russia was the first to produce a vaccine and begin to distribute it, Mishustin’s confidence game was boosted by word from deputy minister Tatiana Golikova that mass vaccinations are expected to begin on January 18. On the one hand, yes, mass vaccinations would be an economic boon. Yet not only is a huge portion of the public unwilling to get vaccinated at the moment, but regional logistical disparities for distribution remain a huge impediment. What’s more, Russia’s economy depends heavily on external demand, which would suggest that even if things go off without too much of a hitch, growth will be anemic this year and ‘recovery’ will look like prior ones across Eurasia — financial and commodity shocks that dovetail with broader global economic crises or trends lead to steadily diminishing post-crisis growth rates, something broadly observable across emerging markets but particularly salient for Eurasia’s commodity export-dependent economies. The regime has a line it’s going to sell as long as it has to. I just don’t think it’s going to fool many people.

COVID Status Report

Recorded infections rose to 24,763 and deaths reached 570 over the last 24 hours led by an infection uptick in Moscow. To make matters worse, St. Petersburg is weakening its theater restrictions from 25% capacity to 50% capacity despite being the worst hit city/region in the country on a per capita basis. The good news is that the cases per 100,000 figures do seem to be falling consistently in Moscow and other leading regions compared to December:

Nearly 70% of hospital beds across Russia are now occupied by COVID patients. No matter how the government wants to spin the vaccine rollout, the health system is still operating at its limits trying to handle the case load, and that doesn’t factor in recent findings from Russian doctors of 18 mutations from the original COVID strain in a Russian lymphoma patient. Some of said mutations overlapped with the British variant, though not all. It seems likely that the accelerated mass vaccination timeline and Mishustin’s Gaidar Forum speech are aimed at the reality that the best way to head off further mutations is to reduce the case load as fast as possible. Yet they still refuse to order a new lockdown federally or do anything at that level to reduce the case load while rolling out the vaccines for mass use. It makes very little practical sense, particularly since the oil price recovery as improved budgetary stability, the stability of the ruble, and bank sector solvency. They’re worried and stuck doubling down.

Imbalancing Act

Trade data out of China shows a concerning problem for global recovery — China’s December trade surplus hit a record high of $78.2 billion. Here’s what that looks like:

As Michael Pettis notes, that monthly surplus is equivalent to 6% of China’s December GDP and a whopping 1.2% of global GDP for December. Exports were up 18.1% in year-on-year terms for December, and as you can see from the graph, the good news about China’s consumption recovery is significantly overstated. Until the current account surplus falls closer to 0, we have little reason to believe Chinese consumers are going to do much to help boost global growth, which of course then spills over into putting a drag on growth elsewhere that could export more competitively or else consumes what China exports. In 2008-2009, China’s contribution to global stimulus via the size of its economy was smaller in relative terms (though not its fiscal policy) and the imbalances in the Chinese economy have weighed on global growth since. The problem isn’t just the classic concern about rising trade protectionism in response to massive exogenous (and endogenous) economic shocks, but also that said protectionism doesn’t resolve and can often worsen the underlying imbalances of financial flows, savings, and spending power that constrain global demand. China is, at this point, suppressing the demand needed for a more complete global recovery.

But protectionism is on the policy menu for Russia, in this case primarily focused on price protection. The agricultural ministry is considering raising the export tax on wheat from mid-March to keep domestic price increases under control, which raises concerns for importers given Russian exports accounts for a large share of global wheat imports. Egypt, one of the world’s leading importers and heavily dependent on bread subsidies for domestic food security, is now facing market turbulence for tenders issued for future wheat supplies from Russia, often its leading source of grain imports. Prices spike up yet further as the export tax rises, which effectively means Russia is trying to export price inflation abroad to avoid it at home. But by doing it with a good that’s so basic and necessary for survival in so many countries, Moscow is worsening global inflation risks for food, and by extension worsening any prospective consumer demand recovery globally which you’d think they wouldn’t want to do given Russia’s dependence on external demand for growth and employment. The agricultural equipment manufacturer Rosspetsmash has written to Mishustin warning the imposition of new quota levels used to determine the volumes of output at which export taxes are levied or else physically restricting output are now undermining investment and spending on plant needed to maintain agricultural sector growth. In other words, these quota restrictions and rising export taxes may control prices, but they reduce the profits realized by corollary businesses such as tractor manufacturers. So Russia’s choking investment and growth in a sector it’s heavily subsidized and protected in order to increase its export competitiveness, reduce food imports, and reduce Russia’s dependence on foreign markets for domestic food security. November wheat prices had risen 50% year-on-year, prompting significant inflationary pressure and a policy response for prices. Shortfalls of investment today, however, become tomorrow’s inflationary pressure as demand outstrips supply.

Russia’s two-fold obsession with price stability via monetarist orthodoxy and price stability via policy fiat poses limited risks in general given most countries don’t trade for much with Russia, at least when it comes to value-added goods. But it produces weird outcomes domestically, some of which are also influenced by seasonality. For example, RZhD hauled a record level of wheat in 2020 — 27.9 million tons, a 2.9% increase over the then record in 2018. Normally you’d assume that record transport levels suggest a great harvest and lower prices domestically. Not this year given the pressure to export because of better earnings, and that doesn’t touch on recurrent logistical logjams created by the investment cycle into new railwagons. Over reliance on state-contracts, price controls, and tariff regimes on the national rail system that end up lowering the profits realized by firms leasing out wagon capacity hinder the adequate provision of new wagons creating a stop-start dynamic where one year things are fine, and then suddenly one comes into winter or another year and shortages emerge. The knock-on effects of an export tax increase or quota reductions for wheat exporters have many unintended consequences.

That wouldn’t matter as much if China was doing what it should be doing and trying to consume and import more in the coming year to help rebalance global trade and investment flows since demand for Russia’s primary exports — oil, gas, metals, minerals, and (to a lesser extent for this) agricultural goods — would more evenly recover and prices would likely rise more quickly due to a more equitable distribution of demand. In fact, the case for continued oil demand growth would appear much stronger in this instance and probably buy Moscow a longer runway for its economic policymaking to escape stagnation. It could more readily redistribute oil & gas rents to try and address price inflation through measures like income support instead of controlling price and export levels directly, thus kneecapping investment. That’s not the case, and some shifts flagged from the World Bank’s December report on China are interesting to consider for how different factors connect for an imbalanced recovery and how Russia’s attempts to insulate itself from world prices and markets make precious little sense for an economy geared towards external demand that takes great pains to suppress domestic consumption in practice. First, there’s evidence that investments into rail and road transport capacity across Russia, Central Asia, and the Caucasus have paralleled a change in the geography of China’s export value chains:

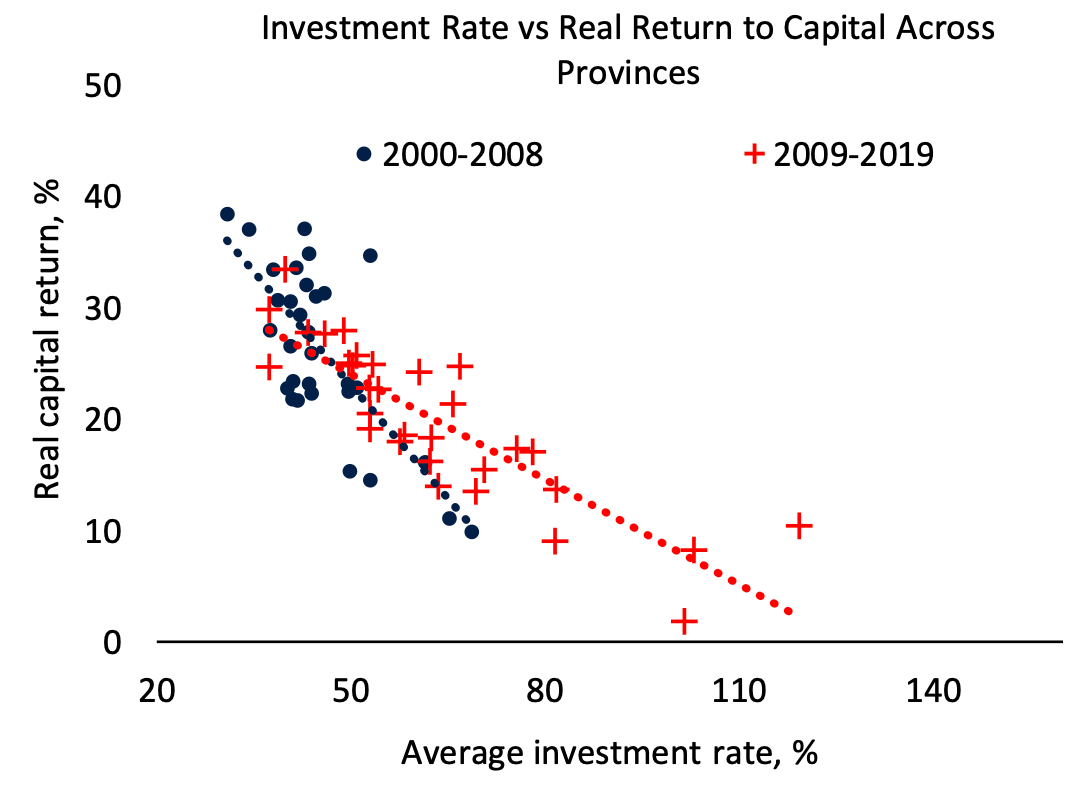

About 15% of exports are being produced in central and western China now, not a groundbreaking shift from over 20 years ago but still notable. By extension, those exports are more exposed to trade policies and logistical limitations between Kazakhstan, Russia, and Belarus, and therefore the Eurasian Economic Union. But trade facilitation efforts cannot be as credibly negotiated if member states apply trade restrictions on an ad hoc basis to insulate their home market from price inflation that is witnessed internationally. Worse, some of this capacity shift exporting into Eurasian markets is really just replacing stuff that used to be imported from Europe and currency risks could become a problem. As the CNY strengthens against the US dollar, it makes exports to Russia less competitive and to Europe as well, which is the main end consumer market for any change in China’s export value chains. And while Russian exports to China grow more competitive as the CNY strengthens, it needs a robust trade agreement expanding market access to capitalize. That’s unlikely to happen given that even if they’re expensive, Chinese firms have the edge over Russian counterparts for a wide range of consumer goods that beat Russian competition. Even if those firms invested into production in Russia, Moscow’s loss of corporate control over output would make it much more difficult to strike the kind of arrangements often preferred to manage the country’s failure to lift incomes. Investment is the other problem:

Rates of return on investment in China continue to drop because it’s been inundated with inefficient capital aided mightily by the suppression of wages and labor’s share of the national income. An investment boom can’t get China back to robust growth or save the global commodities market this time. Only boosting domestic demand can do that. Russia’s enjoyed being able to ‘free-ride’ on China’s rise as a logical complementary economic partner because of what it exports and China imports, but the partnership is not just lopsided, but increasingly unable to give Russia what it needs. China’s economic model is exhausting itself fast just as Europe is struggling with recovery. The latest political crisis in Italy — Italian prime minister Guiseppe Conte just lost his ruling majority in the senate and Italy’s austerity politics could lead to renewed financial crisis — and the slow rollout of vaccines in Europe aren’t offering any relief from China’s imbalanced recovery:

Russia’s best bets now entail deepening its trade integration with key partners, not just in market share terms, but in terms of the flow of capital, market access for foreign goods to compete for market share, reducing quota controls on things like wheat, basically freeing up investment levels to correspond to real demand signals and realizing that some inflationary pressure is needed to better align inflation in the economy with supply and demand balances and politically enable constituencies to empower labor and higher levels of investment. Domestic protectionism ends up hurting growth and the ability of Russians to increase their consumption at the same time that global coordination between the world’s two traditional “consumption centers” — first the US, then the EU — and the world’s rising one — China — is absent and killing the economic recovery’s health. Moscow better pray that Democrats in the Senate pass stimulus bills with much bigger cash relief on a recurrent basis if it wants to ride out 2021 with a healthier commodity market. As of now, it’s shooting itself in the foot. China’s export data suggests we’re in for a slow, painful recovery, one that drags on growth in the midst of a commodity bull market. Wait till those rising prices for iron, nickel, copper, and others feedback into the Russian economy and see how today’s price controls help.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).