Top of the Pops

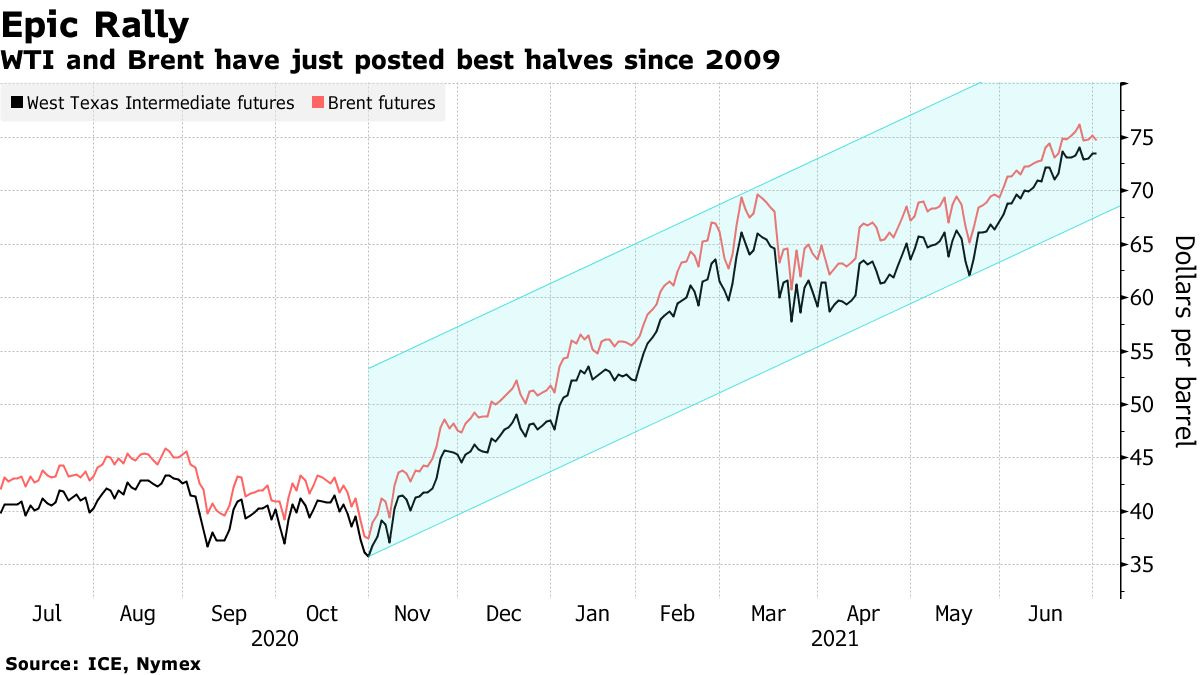

The oil market’s interesting again as it resumes the monthly cycle of ‘what’s happening next!?’ coverage. Moscow’s OPEC negotiators, led by deputy minister Aleksandr Novak, are lobbying the Saudis hard to quickly ramp up output come August while the Saudis are sticking to their preference for a tighter market. Kuwait, Algeria, and Iraq are on Saudi Arabia’s side. The uncertainties at the moment are quite complicated — progress on nuclear talks with Iran has stalled again raising doubts about Iranian supply increases, the pandemic threatens to rage on wherever vaccines have not yet arrived or made enough of a dent, and the reality that this may be oil’s last bull market also discourage opening the taps. Brent crude is hanging above $75 a barrel at the moment and we can see from the trends for oil futures that there are two camps within OPEC+ now fighting it out:

Moscow has little faith that US shale drillers will remain disciplined if prices rise to or past $80 a barrel and Riyadh is not yet convinced that price increases will get away from the bloc or else that Wall Street will suddenly forget the endless headaches it faces with shale whenever drilling is prioritized over cashflow to return to investors. If the bloc ramps up now, they pre-empt that risk while Russia can boost domestic demand for goods and services, offering a bit more respite from what’s becoming yet another blow to recovery during the current wave of COVID infections and deaths. OPEC’s forecasts place the supply deficit at 2.2 million barrels per day by 4Q. The question is when to hike. My money’s on holding pat till August followed by a gradual increase, especially since Riyadh is well aware of the domestic political limitations facing their Russian counterparts and that Igor Sechin and co. learned their lesson from the last price war.

What’s going on?

Aluminum prices in Europe, the US, and Japan began to rise after the announcement that Russia would be placing an export tariff on its aluminum production starting August 1. Nickel and copper haven’t risen yet, but traders expect them to follow suit. Aluminum is the main story right now — prices rose 4.5% in just a week to $2,553 per ton. The export tariffs are going to be pretty terrible for Russia’s export competitiveness. They’re set at a base of 15% of the value per ton and then adjusted based on the type of metal or degree of processing in relation to world prices over the last 5 months. Not only is that an unwieldy system, it risks Russian exporters losing their market share to competitors able to crowd out their production. The only consolation is that the current rise in prices reacting to the expected trade disruption the export tariff poses will increase metallurgical sector earnings before it takes effect. Regional ‘premiums’ for deliveries to Rusal’s non-China customers have skyrocketed 130-150% because of the shortage of containers and shipping capacity amid rapid demand increases driven by US stimulus. Rusal’s the biggest loser from the export duty — it could lose 24% of its EBITDA while Russia’s other large metallurgical firms face loses from 4-15%. Rusal’s really hoping that the short-run price increase for aluminum — 3% on the Moscow Exchange yesterday alone — offsets enough for 3-4Q. Since June 24, the company’s stocks have lost 10% of their value. Once again, the decision to use a complicated set of interventionist measures that are really about raising revenues for the state and punishing businesses rather than using state resources to form strategic reserves will end up hurting the sector’s ability to invest into new production and ‘exporting’ price inflation to other markets where competitors, able to realize how higher profits, may end up benefiting.

The housing market continued to see positive growth in May with a 31.3% increase year-on-year in works started on new builds. That’s partially due to a low base effect since housing construction had dropped off 18% YoY last May but also a result of the political pressure to build more before prices rise further. Construction figures beat the 2018 May Decree targets for housing. The following comparisons are for completions of housing in millions of square meters:

The indicator for apartment buildings also surpassed 2019 levels — 12.5 million square meters for January-May over 11.2 million in 2019. Industrial construction’s up to. But the underlying common denominator is the mortgage program. By subsidizing credit, the state did a great job of saving demand for buildings and space since lower rates brought forward a ton of investment activity that would have otherwise required a lot more savings. It did so without accounting for the social effects and price sensitivities to labor and raw materials, which have created a situation now that’s a) good insofar as a lot more has to be built b) bad insofar as rapid price increases are politically problematic. Admittedly they had no idea what the conditions were when they started the program, nor could they have fully grasped how pandemic stimulus efforts would coincide with a new commodity cycle. That they extended it knowing the Central Bank is trying to hike rates is the more interesting aspect of their thinking, something that may help meet May Decree targets but at the cost of deepening economic inequality in visible fashion.

Inflation and key rate expectations seem to have finally hit Russian sovereign debt issuance. From an auction placing 50 billion rubles ($686 million) of bonds, only 8.5 billion rubles' ($116.62 million) were taken up by investors. Sanctions are the other quiet (in my view lesser) part of the equation. MinFin has been consciously testing the waters since the sanctions were announced and demand, particularly from non-resident investors, has fallen. Rate hikes will flatten the yield curve for bonds — for those less economically-minded, there’s an escalating ‘curve’ for yields on bonds bought with different maturities and the further in the future the maturity, the higher the interest rate to offset higher levels of risk since your capital is sunk into the asset for longer, might lose value from inflation, or else not be repaid due to default. We’re not entering this territory yet, but if the key rate shoots up quickly and the curve goes from flattening to inverting — shorter-term yields rising above longer-term ones — than we’d expect another recession to hit Russia. That’s pretty unlikely, but the market’s expecting a tougher and tougher response as each week goes by. Central Bank governor Elvira Nabiullina has announced a new review of the inflation targets the bank has set out, hinting at the possibility that said targets could be adjusted in aim and form next year. The last review took place in the fall of 2014, so it’s high time to rethink the hard 4% inflation target they’ve stuck to since at considerable cost to the Russian economy when things were ‘quieter’. They might go for a 3-5% corridor sort of mirroring some of the evolution we’ve seen at the Federal Reserve. It’s inevitably going to affect MinFin’s ability to get investors to buy debt or else harangue state banks to buy them a longer runway since it wants to avoid high rates. It seems they’ve backed off of the latter approach, likely because of their fears that it’s worsened inflation by monetizing the national debt.

The latest Rosstat data shows that private consumption stopped growing in May, a development that confirms my suspicions about the strength of the consumer recovery during the re-opening period. Demand for labor was healthy, but that was when firms were expecting more growth and all the indicators we have for June suggest incomes and spending would have resume their decline due to rising inflation and the resurgence of the virus will also have a negative effect on business and demand. There’s another factoid in there that suggests things aren’t great — spending on services for January-May 2021 was only up 11.5% year-on-year accounting for early lockdown style restrictions last year and while it’s hard to parse from the data cited here, there is the implication that people are trying to buy goods that’ll last a long time before they get even more expensive. June is expected to show a further slowdown as borrowing continues to rise. The average mortgage maturity is now over 20 years for the first time in Russia’s post-Soviet history. Central Bank rhetoric of fighting an inflation spiral means credit conditions have to tighten a lot more, which then also means households are about to face a much steeper bill to maintain their standards of living. Post-pandemic growth isn’t on the horizon. What’s likelier is a restructuring of consumption at current levels if not a bit lower. Russian e-commerce giant Ozon just closed the largest warehouse and logistics real estate deal in Russian history with the PNK Group for 400,000 sq. meters of space at 3 facilities built at 2 of PNK’s industrial parks. The ease of borrowing for property investment makes the expected 13.8-14.6 billion ruble ($189.06-200 million) bill very palatable. If incomes decline further, e-retailers able to shave down costs using scale and better delivery logistics who stand to benefit as brick and mortar locations try to keep up.

COVID Status Report

New cases jumped to 23,543 and another record for deaths — 672 — was set in the last day. The vaccination effort can’t ramp up realistically given vaccine shortages and currently about 13.6% of the population has had at least one dose according to RBK (lower than the official data scraped by World in Data weirdly). Putin’s off the cuff remark about the problems experienced by people who’ve gotten AstraZeneca or Pfizer beautifully undercut his attempt to promote vaccinations at the Direct Line conference. Even if Russians only trust Russian vaccines, there have to be enough vaccines and people willing to get them for them to have sufficient effect. It’s not heartening to see the current rate of case increase against past spikes given what we know about the Delta variant:

Red = Russia Blue = Russia w/o Moscow Black = Moscow

Logistical challenges rolling out the United Automatic Medical Information System (EMIAS) have led to problems for FSB and FSO members using QR-code data to digitally certify their vaccinations wherever they go in Moscow. Apparently it’ll be resolved by next week as the city’s data portal sorts out the gaps. These problems aren’t unique to Russia. The EU only just launched its own certification system and as we’ve learned from track and trace efforts in the UK, the bedlam across the US for much of the pandemic, and elsewhere, it takes time to make these measures work. What’s more concerning is the shift in position from MinZdrav on repeat vaccination ‘booster’ shots 6 months after getting fully vaccinated. There has to be a significant expansion of manufacturing capacity and it’s never great when security organs serving political interests are tasked with managing medical data…

Last Tango in Moscow

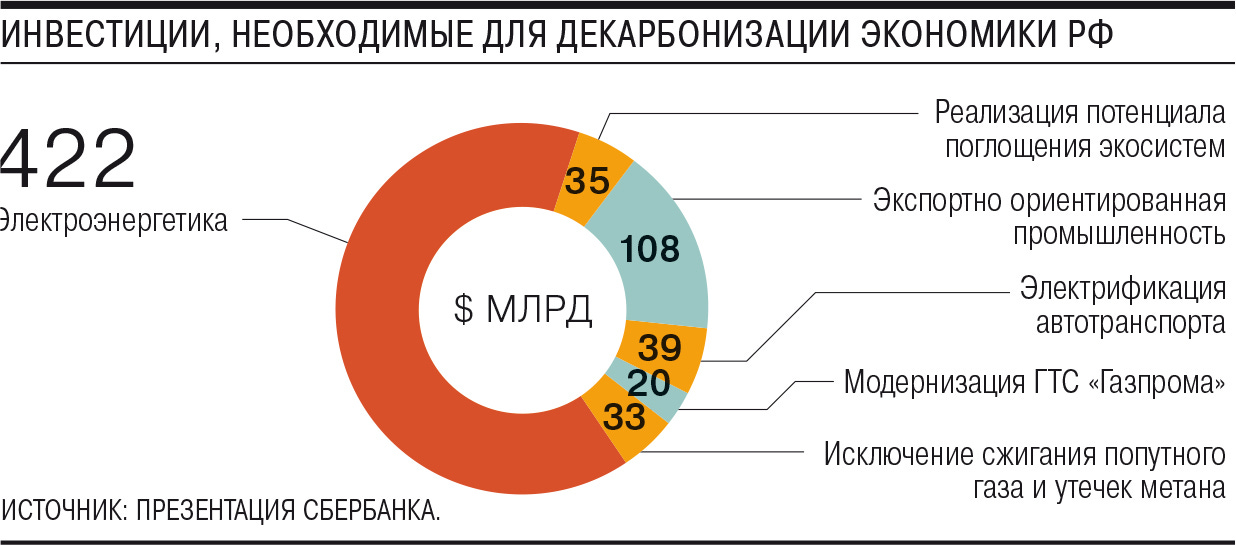

I started watching the Direct Line on the off chance there was morsel here or there worth digging into. I got about halfway through and just gave up. Performing power in such a lifeless way only offers so much potential room for insight. It did, however, indicate a few things about the behind-the-scenes discussions and debates that I think are worth touching on, particularly because of something entirely unrelated — German Gref has just had Sberbank put out a forecast for the effects of decarbonization on the Russian economy and Russia’s investment needs in response to decarbonization in a net zero scenario. The topline figures are huge. Sberbank estimates the Russian economy will lose out on $4.4 trillion over the next 30 years — that’s $146 billion annually but clearly backloaded to when hydrocarbon demand collapses. In response, Gref is proposing $1 trillion worth of investments, half of which could be paid for trading carbon quotas and similar pricing instruments. A sampling of his proposed investments from the Kommersant writeup:

In descending monetary value order: Power generation/infrastructure, export-oriented industries, electrification of auto transport, realization of ‘ecosystem’ potential, stopping flaring and methane leaks, and modernizing Gazprom’s transmission systems

Here are some more alarming data points from Gref’s scenario: Russian revenues from hydrocarbon exports will fall 59%, the Urals blend will trade around $26 a barrel towards 2050 (in nominal, non-inflation adjusted terms), and the Russian budget will be short $97 billion by 2035. I have questions about that last point since it’s difficult to dynamically assess but given their assumption that oil output will fall by two-thirds, it passes the “eyeball test.”

This report comes just as Putin openly acknowledged the economic and human consequences of climate change could have dramatically negative effects on Russia. He didn’t offer a full-throated defense of Russia’s oil & gas producers or else commit to anything significant policy wise, but it’s telling nonetheless that people concerned about the matter have gotten through to him. It’s hard to confirm, but since SPIEF, it seems that there’s talk of giving Anatoly Chubais a role leading an SOE that would be tasked with ‘greening’ the economy and otherwise managing the national carbon trading system. That would make him a natural ally of Ruslan Edelgeriev who’s been running the early trials with Sakhalin via his post with the presidential administration. I’m skeptical Chubais will end up happily in the role — something tells me the siloviki that hate his guts will undercut him if he’s named to anything — but there does seem to have been a shift whereby the ‘systemic’ liberals and those concerned about climate have managed to alter the terms of the policy debate. The real problems are fiscal and macroeconomic. There’s no way to replicate oil rents or oil’s role for the balance of payments and foreign currency reserves by going green. By extension, that means there’s no good way to create a sustainable “community of rentiers” who can agree to a status quo with rules of the game as to how the pie is divided. Medvedev’s obsession with the innovation economy from 2008-2012 reflected the persistent challenge of delivering results while delivering rents. Skolkovo couldn’t do it, which is retrospectively somewhat funny since tech has been able to swallow growth from other sectors in the US, for instance, but that’s a much larger and more diffuse conversation for another time. Putin is now comfortable acknowledging the state has to do something beyond the Paris agreements when it comes to climate. That’s important. So was the tack he took responding to a few questions about inflation and the economy writ large.

He asserted that inflation levels will be down to about 5% in annualized terms by the end of the year. This is where the deflationary politics the regime has relied on since 2012 are crucial. The Central Bank’s inflation June expectations survey tells the story in a useful way:

Red (solid) = expected inflation (w/ savings) Beige = expected inflation (w/o savings) Red (dotted) = observed inflation (w/ savings) Beige (dotted) = observed inflation (w/o savings)

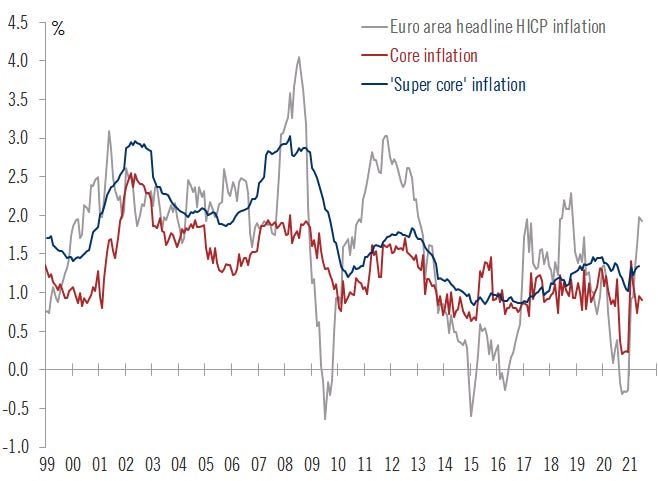

The implication is pretty clear. Inflation levels are observably lower, thought far above the inflation target, when savings are factored in. That means that inflation expectations and observed inflation drop as Russians’ savings rates rise. On the one hand, you want higher key rates for the yield on deposits to rise so Russians save more. On the other, they’re likely to stop spending and cutting off demand — that means real incomes will fall again as business slows down and wage pressures ease and, to boot, the sources of inflation linked to global price levels and supply bottlenecks for things like the chips used in car manufacturing will remain in place. I’m not saying 5% is unachievable, but it’s highly contingent on external factors cutting Russia’s way and a further decline in purchasing power for most households. He was right to say price increases are happening everywhere, but inflation is ultimately a political phenomenon and one that is distributed unevenly at the national and global level. Europe’s recovery is looking decent thus far, but inflation levels are still under the traditional 2% target:

Things have picked up in the US and it’s seeing larger price increases, but amid a much stronger overall recovery. Look at Americans’ attitudes towards the labor market:

The Federal Reserve and the ECB want inflation higher and, with varying degrees of effectiveness, will keep pushing. Putin and his economic team don’t because they’re panicked about people living on fixed incomes or working in sectors that manage wages using formal and informal agreements because of the broad system of price management across the economy. But price stability comes at the cost of investment and labor’s income. It expressly contradicts the calls for investment mobilization also at play. Stability is the pet psychological obsession of Russian policy today. Sadly it’s far more costly in the longer run than higher inflation, especially if decarbonization investments are ever to materialize.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).