Top of the Pops

How has the oil market taken to the OPEC+ fallout? Not great. Prices have actually fallen this week back under $75 a barrel for Brent as market participants realize that a refusal to agree to gradual output increases from August increases the odds of much sharper increases ahead of demand. The ICE Brent August contracts are now trading just under $73 a barrel:

It’d be falling faster if it weren’t for the fact that about 1/3 of US oil production is being sold at just $55 a barrel. US shale drillers had to hedge their bets and lock in prices amid uncertainty for their credit covenants when borrowing that saddles them with mounting (relative) losses the higher prices rise. The longer that OPEC+ members refuse to increase output per the original deal, the greater the pressure for shale drillers to increase their investment into output, even if at a more moderate pace than years past. The US oil rig count has risen 3 of the last 4 weeks and 212 units for the year thus far. If free cashflow from prices in the second half of the year matches gains made in the first, there’ll be $60 billion to give to investors, bump up salaries, and spend on output among shale drillers. Other firms within OPEC+ aren’t scared they’ll lose market share to shale because the market’s growing. They have to be worried about ceding market share if demand enters decline in the next few years since shale drillers now realize the benefit in cash flow terms from sitting back. Igor Sechin never likes the prospect of American oil power…

What’s going on?

For Jan.-May, pharmaceutical production fell 9.2% to 1.7 billion ‘packs’ according to RNC Pharma. That figure includes all COVID vaccines produced and puts output back around 2018 levels. But the decline in physical production came with a 25.9% increase in earnings — 239.1 billion rubles ($3.18 billion). Non-prescription medication output fell about 16% whereas prescription drugs fell just 1%, so we can see pharmaceutical firms prioritized medications for heavier conditions. Some of this fall has been consumer-driven. The shift to consume more expensive, more trustworthy brands took out sales for the lowest price segment of the market. Sales of anything worth around 50 rubles have fallen off with a countervailing 27% increase in demand for medications that cost 300-400 rubles. State procurements are another important component of the surge in earnings vs. fallen output. When Russian producers bid on state contracts to supply medications, they generally win cause they’re cheaper. But their cheaper production is still marked up relative to prices for what they sell wholesale to pharmacies:

Cyan = blns rubles Red = blns packs

Medical import substitution measures haven’t been terribly successful so far in terms of net output though changing consumer preferences from COVID may help. Curious to see how the recently signed law allowing firms to legally manufacture pirated medications plays into this and obvious efforts to encourage industrial espionage or else just take drugs licensed from foreign firms and steal the IP.

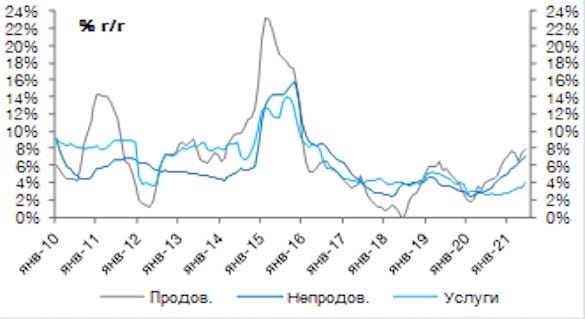

Inflation keeps picking up pace, hitting 5-year highs and finally reaching 6.5% in annualized terms. In the last month, the consumer “basket” inflation levels rose a post-2012 record 0.69%. The arc of the inflationary increase reconfirms that rising commodity prices, the new commodity cycle, and supply disruptions from COVID and faster-than-expected surges in demand globally, not as much in Russia, are to blame. Monetary tightening can only achieve so much to fix that problem:

Grey = food Dark Blue = non-food goods Light Blue = services

The government’s adding on as it has to. From July 1, electricity tariffs rose 4.3%, waste disposal rates rose 3.4%, and water supply rates rose 3-3.2%. The Central Bank and markets are still on course for a 1% rate hike and now seem to be expecting an end-of-year rate around 7.25%. That some are optimistic inflation is peaking says more about the health of the recovery in Russia (and elsewhere) than anything else. Seasonally-adjusted, TsMAKL shows that bankruptcies are only up 1.3% — I noticed the coverage quite elegantly side-stepped the bigger problem. Restructuring at lower rates will undoubtedly have saved a lot of businesses, but if earnings don’t fully recover, that situation can’t last. The overall decline in bankruptcies since 2016 probably has a lot more to do with interest rates falling than things going particularly well, sector depending of course. No one expects it yet, but if inflation keeps spiraling upwards, the rate correction will probably have to head closer to where it was in 2019 pre-COVID past 7.25%. The impact of rising credit costs will be felt quickly by any company looking at investments or barely staying afloat.

MinEkonomiki has finally sent the law establishing a carbon quota and trading scheme for Sakhalin to the government. The idealized goal is to achieve carbon neutrality by 2025 by setting emissions quotas for the largest firms and allowing firms that reduce their emissions to then trade their remaining cap space to other firms. Kaliningrad and Khanty-Mansiysk okrug want in on a quota system as well. The quota system initially only applies to firms responsible for at least 50,000 tons of carbon emissions or equivalents annually, with failure to meet quotas costing anywhere from $2 (global average price for greenhouse gas emissions) to €25 a ton (the latter is a long-term average of EU ETS prices). These numbers make it clear the law is not going to achieve carbon neutrality unless they get creative accounting for trees and other offsets. Finance minister Anton Siluanov is finally sounding the alarm that a stress test for energy transition scenarios revealed Russia would lose a ton of revenues and export earnings, prompting a new push to reform the tax system to make the transition as 'painless’ as possible. If you’re doing well, expect windfall taxes. If you’re a household, expect direct and indirect ways to tax you at a higher rate or else tax businesses at a higher rate without providing them adequate demand via fiscal stimulus to sustain investment and growth. Carbon quotas will introduce a new problem for graft and institutional governance — the politically connected will lobby for exemptions or subsidy/financial support for investments to meet said quotas. If the quota system ends up being successful, that’ll be welcome news and it must be acknowledged how politically significant the shift taking place is. Now comes the fun part of seeing how it translates into (mis)governance.

Russian Railways is now pushing to build a separate railway from Yakutia parallel to the Baikal-Amur Mainline (BAM) and Trans-Siberian to carry coal. A route to the Udskaya bay on the Sea of Okhotsk is one of the main possibilities being discussed. The intention is clear — avoid overloading the capacity of the “eastern polygon” — but the logic less so. Why can’t RZhD expand BAM and the Trans-Siberians’ respective capacities to avoid congestion? Plans to increase coal exports from Yakutia despite the global turn against emissions will bring foreign currency earnings, but further strain the balance of the national rolling stock fleet given differential tariff rates and the physical volume of coal. The parallel line is estimated to cost between 350-700 billion rubles ($4.65-9.3 billion), effectively the same price range as each stage of the BAM modernization project. The government’s apparently now hoping to fund the last stage of BAM works using the National Welfare Fund. If these plans are serious, then labor’s going to be an issue. Aside from prisoners and Putin’s own remarks about the need to mobilize military engineers to avoid further delays for BAM, there’s renewed pressure on Marat Khusnullin and the Ministry of Labor to attract more Belarusian, Uzbek, and Kyrgyz workers for railway construction needs. The gambit seems stupid, frankly. The returns and efficacy of the new route will hinge entirely on commodity market prices for a resource that may spike in price for the duration of the construction of said line, but may then face perpetual falling demand. At least BAM and the Trans-Siberian serve a more diverse set of goods markets. That’s not to say they shouldn’t necessarily build more rail capacity for export, rather that doing so in this manner will only deepen the economy’s resource export dependence. Instead of talking about oil windfalls or taxation, however, it becomes a matter of aligning global price levels and market share with how individual projects are paid for and maintained or the latest poorly-designed attempt to manage domestic inflation levels through export duties or curbs.

COVID Status Report

24,818 new cases and 734 deaths were recorded in the last day. Regional cases keep climbing even as Moscow appears to have stabilized. The EU has approached MinZdrav about the potential inclusion of Russian vaccination certificates into the EU’s COVID passport system to enable more travel, though France is adamant that Russian and Chinese vaccines not be recognized. I checked the latest Eurasianet update with JHU data since Moscow’s now scrambling to attract more migrant labor and I wanted a sense check of how cases are rising in the neighborhood, acknowledging differences in testing capacity. Worth noting also that both Azerbaijan and Kazakhstan have over 20% of their population with a single dose, outpacing Russia for rollout thus far:

Tajikistan has always been suspect due to capacity constraints and the refusal of state authorities to openly engage with how bad things were. Now it’s a concerning vector because more Russian troops (who’ve been vaccinated at least) are deploying and the increase in border crossings from Taliban seizures of territory and action in Afghanistan should be cause for public health concerns. I’m sure Uzbek authorities are already pondering what they can do if they get hit with an influx of refugees. Labor migration and really any migration within Eurasia or between member states of the EAEU is going to be politically fraught even if accepted or else not blocked for a long time.

It’s getting hot in here

A rather tedious Twitter exchange yesterday on Russia’s ability to ‘win’ or else benefit from climate change left a bitter taste in my mouth. Whenever the claim appears in headlines or policy puffery, the basic contention is that a warming climate will unlock huge tracts of newly arable land for Russia to exploit while others suffer. Never explicitly stated, proponents of the thesis seem to buy into a notional “fortress Russia” capable of insulating itself from the negative effects of climate change while reaping its benefits in basically one sector, though admittedly one that will be increasingly salient for security as the effects of climate change escalate. To stretch that a bit further, the implication is that Russia is a huge land power rich in resources and able to pull up the drawbridge on a host of global problems when it comes to domestic matters. It may be strictly true more arable land opens up — the findings are a bit contested in their significance and there are tradeoffs — but these assertions are comical. They seem to assume climate change has discrete, distinct effects that are somehow outside deeply and expansively embedded systems of interdependence within one economy, political system, or society and culture and between economies, systems, and states.

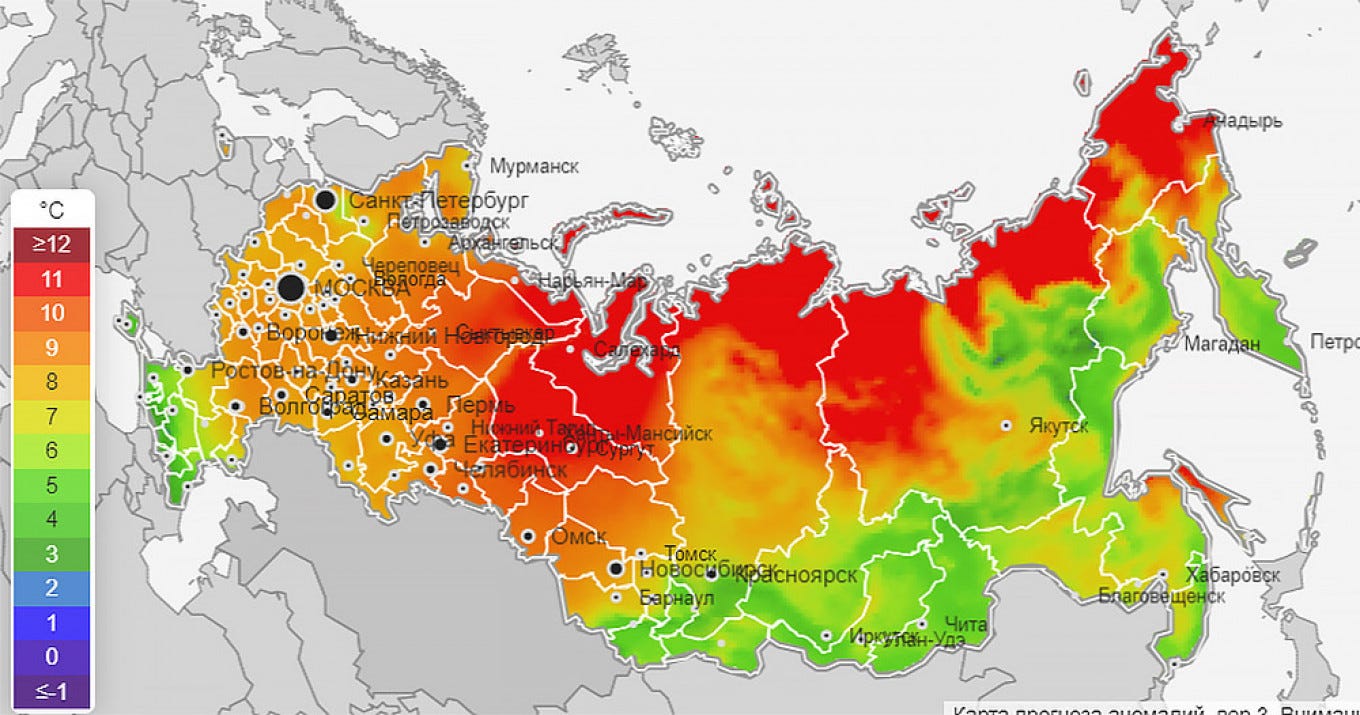

Today, Kommersant ran a piece on how abnormally high and drier weather has led to a 15% decrease in the procurement of livestock feed. Breeders are therefore budgeting for increased feed costs which could then lead to an 18% increase in costs of production for milk. To take the example used in this article, yields in Tiumen’ oblast’ dropped 40-50% because of the weather, which then has immediate knock-on effects for local producers who not only have to source feed from further away and manage the logistics, but are also potentially competing against foreign importers (probably not in this case, though) who will pay more. And it’s not like Tiumen’ is exactly far south. In theory, regions like it just north of Kazakhstan should benefit from the changing climate in the scenario painted by the climate “optimists”. Yet differential changes in climate and the increasing occurrence of abnormal weather would naturally lead to episodes like this one. It just so happens to be taking place in the middle of an inflationary wave as global commodity prices keep rising. The following was an extreme projection for a high temperature increase scenario 2090-2099 from the Voeikov Observatory in St. Petersburg:

We shouldn’t expect these to necessarily pan out, but more broadly, the relative increase in temperatures from current levels rises the further north and east you go except for that belt just above Kazakhstan/China and closer to the Sea of Okhotsk and the Pacific. With these disruptions, it’s certainly likely new land opens up for use — it should be noted, however, that new land opening up climactically does not mean the soil is going to be great quality. Black Earth is Black Earth. Russia may have a huge share of the world’s black soil area, but it’s clustered in southern Russia. Since the late 20th century, Southern Russia and Siberia — presumably the big ‘winner’ from climate change — have seen higher incidence rates for higher temperature anomalies. The risk is that southern agricultural breadbaskets begin to see a decline in rainfall during harvest seasons and an increase in winter or else a net decline. You might be able to open up lands further north, but none have the same qualities as chernozem. If dry spells become more common, then we’d expect to see bursts of price inflation for food become more common. How exactly does the existing inflation policy framework now trying to build a system of reactive export duties, taxes, subsidies, and other mechanisms function to address climate problems? Agriculture has been a resounding success story for growth in Russia, particularly since 2013. Right now, we’re seeing producers complain about rising fertilizer costs because commodity price cycles feed into sectors between each other altering production costs.

There’s another problem modeling tradeoffs from a changing climate — the later an economy waits to start investing into mitigation measures and newer infrastructure to handle changes as they come, the more expensive said investments become as the timelines get condensed, businesses and states have to react to increasingly extreme dislocations, and new land that hasn’t been utilized at all becomes more valuable and has to be unlocked. In other words, you need an investment boom to manage climate change just about everywhere. That means commodity prices — and related inflation — stay higher and everyone’s got to get building. Neither of those work well for the Russian economy or the regime as it’s currently constructed. Further, the size of the workforce is structurally declining. If agriculture keeps growing in an economy that’s got a relatively low ceiling for services since incomes keep falling, that will draw in labor that is deployed elsewhere. Of course, part of these labor shortfalls might be managed by increased labor migration and refugee flight from Central Asia or the South Caucasus, but then you have to consider social friction and the institutional challenge of incorporating arrivals into existing tax and welfare systems. The EAEU helps in that regard a bit, but it’s not a panacea. Oh, and they’ll have to build more than a pathetic 2,000 kilometers of new roads annually to plus up logistical access to rural areas where newer lands are meant to be exploited.

Climate change creates a host of systemic risks and shifts that Russia and other macroeconomically orthodox political systems are not designed to handle. Economies have to be run hotter to ward off the worst possible temperature increases and climate disruptions. It’s as yet speculative, but one can imagine that Russia’s defense manufacturers would try to cash in on any of these emergent projects as a means of off-setting export losses or budget restraint. New tech, new equipment, and the pressure to mobilize labor will all matter more. The correlation of domestic forces suggests climate change will become yet another rentier goldmine at the expense of the deflation forced upon other groups in society.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).