Top of the Pops

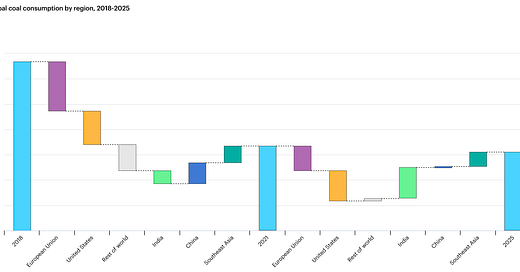

Kommersant put out a story today about the effect of declining coal demand on the government’s approach to Russian Railways’ role supporting coal exports. The government wants RZhD to sign long-term supply contracts with producers to lock in transport prices at affordable levels, avoid price volatility, and help maintain the sector as global demand peaks and coal begins to lose out from fuel substitution globally. The IEA forecasts demand decline after this year running through 2025:

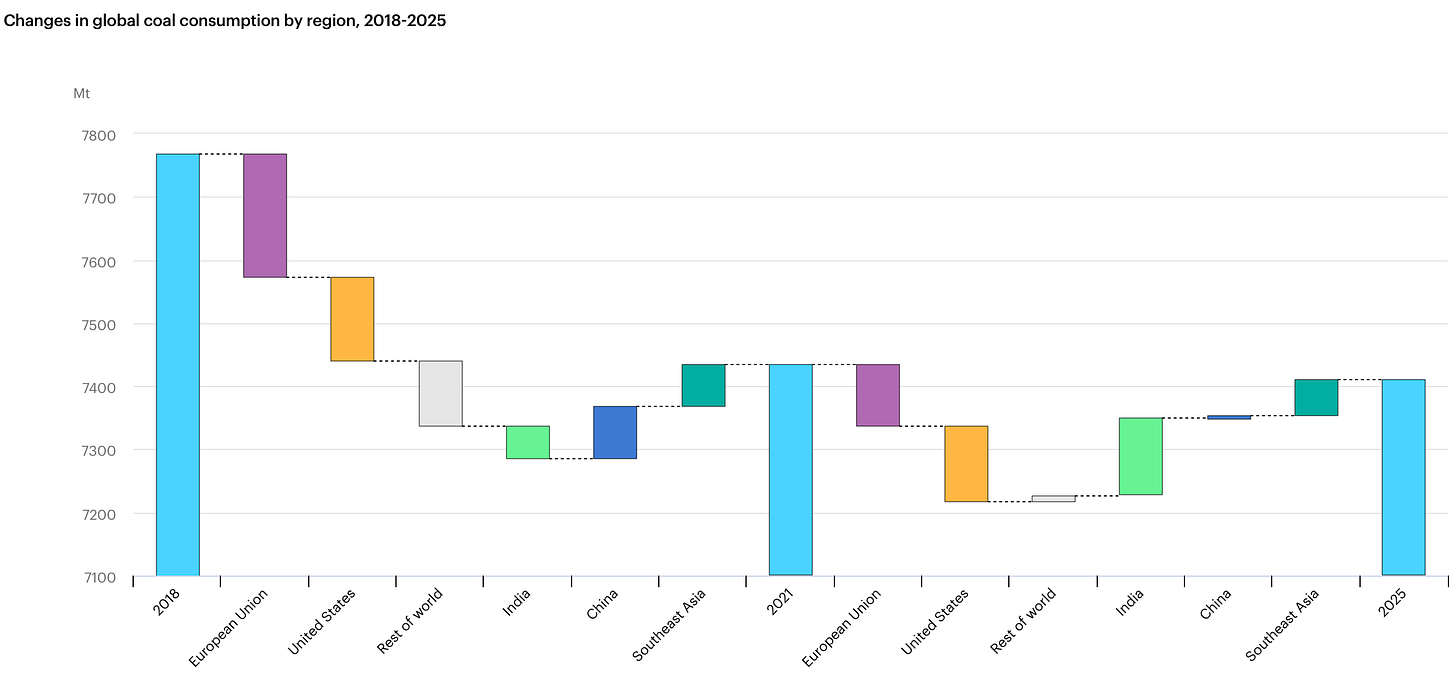

It has to accelerate a lot faster than that to meet aggressive carbon reduction targets, but it’s also reality that the energy transition is going to need a lot of steel, about 70% of which is produced currently using coal. The long-term supply contract model is something that, as of now for RZhD, only happens with oil. It makes a great deal of sense to lock in long-term supply contracts since they’re competing against pipelines for exports and often take the marginal capacity i.e. the volumes above what pipeline infrastructure to neighboring countries and to Russian ports can handle. That increases the relative profits they can realize since producers are looking for ways of getting that production to market domestically or abroad as fast as possible given capacity constraints and pipelines’ larger share of the midstream. Coal is different, and therefore producers’ ability to meet long-term contracts hinge on export prices. That’s a massive source of uncertainty at the moment, even with a broader commodity supercycle starting. We should also not lose sight of the effect that the turn in US monetary and fiscal policy is having on the investment environment for fuel in the US that we know the Biden administration wants to leverage into climate leadership and engagement elsewhere:

The US is actually putting itself on a higher growth path because of its policies than pre-pandemic, which, yes, suggests a larger draw on commodities assuming a lot of that growth trickles to poorer families. More importantly, the Federal Reserve and US financial sector are hustling to include climate risks in more of their macroprudential regulation for banks, which will then spillover into how the banks underwriting energy investments start to assess their exposure. Hedge funds and non-financial institutions face different considerations, but even if we accept the premise that green energy is now a growing equity bubble, it’s still a sector with a lot more organic growth to come compared to oil, gas, or coal. The long-term supply contract question is going to come up regarding natural gas, however, and the story on RZhD, despite having Russian characteristics, is part of a broader chain reaction to shifts on energy markets mandating suppliers find ways of sustainably backstopping grids increasingly powered by sources suffering from intermittent interruptions and extreme climate events while in need of a sustainable backstop. There’s reason to believe gas markets’ slow move towards price and mid-term contracting pre-COVID may shift back to focus on long-term contracts with marginal volumes sold at spot prices.

What’s going on?

Rusland Edel’geriev’s interview with Kommersant on the big shift in Russian politics towards, finally, taking climate change seriously reveals a bit about how his appointment to the presidential administration (PA) has evolved. Ede'l’geriev was elevated to the PA in 2018 and handed the climate change portfolio, something no one took seriously at that political moment as oil & gas still seemed safe long-term bets and seemed more like a fig leaf since he was a Chechen taken onboard as part of the balancing politics between interest groups of who makes it into the PA. He notes immediately, with a slight sense of exhaustion, that all of the climate skeptics in Russia have been proven wrong: the Paris Agreement strengthened without the US, the US is now looking to lead within it, China’s accelerating its own carbon trading system, the world has moved on. Edel’geriev was behind efforts in Moscow to launch the Sakhalin carbon trading scheme. His current fight is with the host of firms (and the Russian Union of Industrialists and Entrepreneurs) that offer to voluntarily undertake climate-friendly projects, but then immediately fight hard against any regulatory requirements. What’s clear is that while climate change is already affecting the shape of Moscow lobbying blocs, it’s quite telling that a figure in the presidential administration is out front compared to Russia’s leading business lobbies. Putin’s absence from the resolution of key economic agendas is acutely felt, and likely a big part of why progress has been so halting.

Boris Titov, presidential commissioner for entrepreneur’s rights and the head of the Party of Growth, and the Stolypin Institute of Economic Growth have been tracking regional business education initiatives regarding municipal waste disposal and the tariff regimes put into place to finance it. Based on their work, awareness and understanding of federally-led schema has risen, but still needs a lot of work. The following are the number of regions with sectors of business polled that scored 25% higher than the national average regarding their working knowledge of norms — there are 85 Federal subjects:

Descending: Grocers, supermarkets, food markets, auto (and tire) repair, movie theaters, cafes, restaurants, bars, snack bars, and cafeterias, and hairdressers, cosmetic salons, and beauty salons

One of the widespread practices the reporting shows is that waste operators are exploiting the lack of clarity on regs and awareness among businesses to charge rates above those set into law at the regional level. The absence of clear federal law coordinating these activities is acting as a shadow tax on Russian businesses, especially those that are more waste-intensive. It also speaks to constant challenge facing Moscow — any fiscal legislative power delegated to the local or regional level can end up benefiting local lobbies poised to exploit the law, while a federal law may be ironclad and easier to propagate for businesses, but much costlier to enforce in practice (and still risks the same types of predatory behavior). Worst of all, it’s a salient political issue for local political organizers not concerned with overturning the system, but just with resolving basic day-to-day problems like clean air, clean water, and clean nature for their kids.

Putin has reportedly introduced a bill to the Duma that would make way for Russia’s accession to the International Organization for Migration. The proposal is caveated to ensure that Russia maintains space to ensure the ‘sovereignty’ of its migration policy. Overall, it seems like a transparent effort to exert more influence within an international body that ultimately only has the power to recommend. More interestingly, the reportage from Vedomosti stresses that Russia should have joined a decade earlier, but the pretensions of elites who refused to believe that immigrants to Russia settle there for the long-term rather than just showing up as ‘gastarbeiter’ migrant laborers killed it. COVID — and labor shortages in key sectors leading to rising wages and price inflation — have reminded them that in reality, Russia needs to ensure migrant flows from Central Asia and, to a much lesser extent, the Caucasus are maintained. Russia’s the world’s 4th largest migrant destination per UN data. Moscow appears ready to accept that fact. One wonders how this will look in Tajikistan, which continues to resist Eurasian Economic Union membership despite the potential benefits to accepting an agreed multilateral framework for its many migrant laborers remitting earnings back from Russia.

Izvestia reports that a new set of anti-crisis support measures is now being worked out by the government (read: Mishustin) including: extension of the credit support program for SMEs with an additional rate cut of 2-3% with any bank losses covered by the federal budget, writing off tax and insurance debts for small businesses in the hardest hit sectors, resetting cadastral property values to 2020 levels, and a transitional tax program to ease the burden on companies that have already taken support and recovered somewhat but aren’t 100% back. The proposals should be scored by MinFin, the Central Bank, and all other relevant agencies by March 1. This is where the real action is taking place regarding Navalny and September as VTimes reports that those inside the presidential administration and the ‘curators’ running domestic and regional policy can’t commit to any course of action till they know what the support program looks like. One of the biggest concerns is that the more administrative, legal, and security resources are brought to bear to ensure the result, the more the net turnout will fall despite returning a good % for United Russia, strengthening Navalny’s basic contention that the system doesn’t respond to the public or serve it. But UR’s also in trouble since any further decline in its ratings will threaten its dominance across a wider swathe of regions and seats. Show me your budget, I’ll show you what you value. We’ll find out more about how the regime will backstop UR once Putin announces the spending plan.

COVID Status Report

14,207 new cases were reported in the last 24 hours along with 394 deaths, the latter showing what are probably the first signs of mortality rates catching up with declining infection rates. Moscow is no longer in the top ten Russian cities and regions on an infections per 1,000 basis, and Karelia has overtaken St. Petersburg just slightly in the lead.

These decline rates all look good set against several weeks ago, but the question now is how much more can they actually fall if restrictions are being eased and the available data we have on vaccinations suggests a slower rollout than the authorities indicate with their own rhetoric and policy actions. Rostov is now easing restrictions with rates falling, the latest as municipal governments now look to ease the burden on the population and also try and get tax receipts up. But if the vaccination rate isn’t as fast as advertised, most of the declines have been from restrictions. Russian specialists seem relatively unconcerned about mutations or newer strains affecting vaccine efficacy since they apparently could work up a new vaccine in a few days without any significant testing needed. I’m optimistic that the Operational Staff data reflects the overall situation, but the cavalier attitudes about the vaccination program and lack of transparency regarding the data around the vaccine are a big worry since the most dangerous moment is when restrictions are lifted if vaccines haven’t accelerated significantly.

Élan Musk

The current cold snap in the US has completely overwhelmed the Texas power grid’s ability to handle the demand load and forced the Permian basin to shut the taps on production. For a snapshot of how badly short the ERCOT grid in Texas is vs. power needs, it’s short by 8.46%:

The wells that aren’t producing have pushed Brent crude north of $63 a barrel — back into Russia’s comfortably stagnant sweet spot price-wise post-2014 — and, what’s more, West Texas Intermediate futures have now broken the psychological barrier of $60 a barrel (since its relative discount to Brent has declined from greater carrying capacity and OPEC+ production cuts):

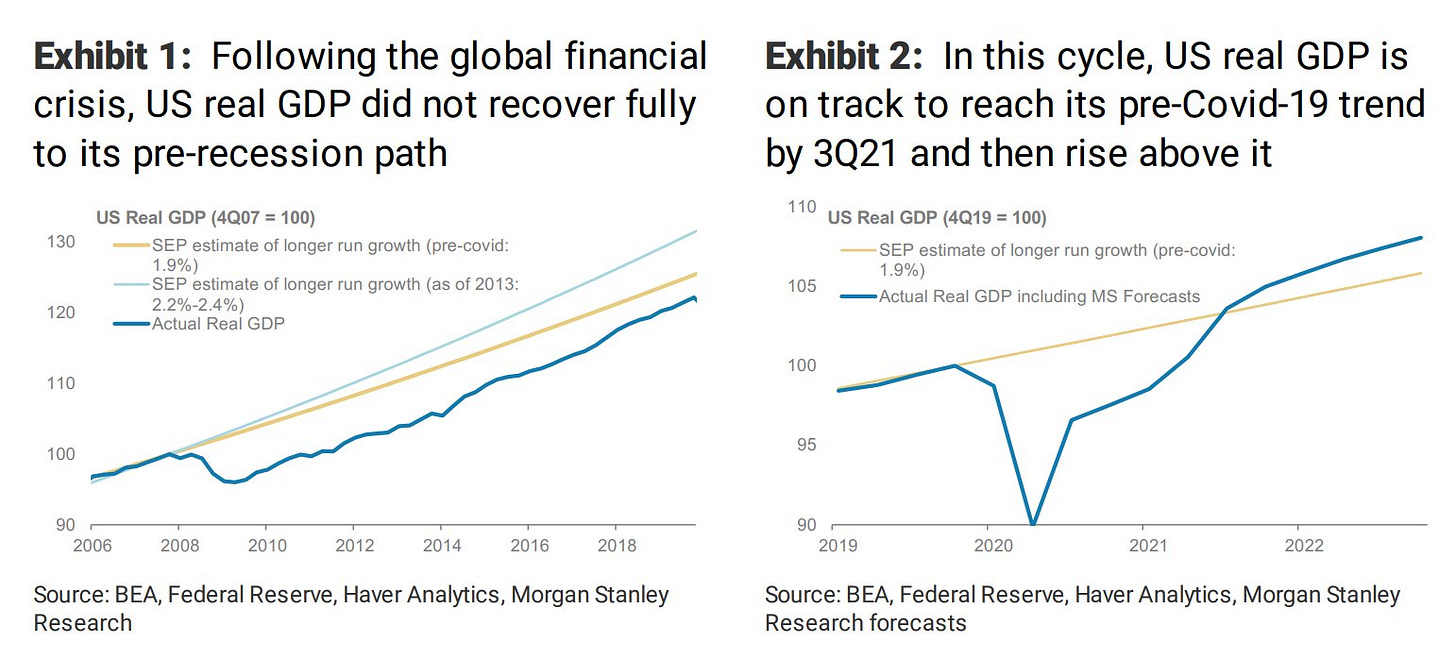

Though US shale drillers are restrained and trying to avoid scaring off Wall Street by pumping at all costs, if prices hang any longer above $60 a barrel after the current cold snap ends, output will start growing again. This cold snap has been a reminder of the value of natural gas as a baseload in times of serious need. Rolling blackouts in Texas and historically cold weather will undoubtedly shift some attitudes about the risks of transitioning an energy grid without nuclear power or sufficient redundancies in place to cover during periods like this. I’m not sold, though, that this somehow resurrects natural gas’ prospects substantially. If we take a quick peak at the duration of cold snaps across the US, net demand for natural gas will shift across the country and domestic connections between state markets and the potential creation of shared storage and federally-directed efforts to cover shortfalls may actually be sufficient over time in many instances. Cold snaps are defined as days below winter average temperature (1970 vs. 2019 here):

As average temperatures rise, it gets easier to store more away for longer. That’s not enough on its own for a cold snap like what we’re seeing now, but it’s a structural reality of the grid. What’s more interesting to consider is how Tesla and like-minded, smaller companies have positioned themselves for what will probably be a big part of the next wave of energy investment, if one unevenly distributed based on socioeconomic class, federal, state and local regulatory requirements, and national level support and legislation in the US and abroad as the energy transition copes with the problems created by green energy.

Germany is a great example of the risks of shifting to weather-dependent renewables at the expense of baseload capacity (though Germany could have just stuck with nuclear like an adult…): bad weather comes, you see shortfalls. Great weather comes for too long, you get surpluses that force retailers selling to consumers to sell at negative prices, effectively paying people to take electricity off their hands. If you’ve foregone baseload, you need to be able to store up any excess power to then release it into the grid during periods of deficit. Basically, you need an array of batteries and a contractual mechanism for a business owning that array to pay for today’s volumes (often at negative prices) and store them to sell in the future during a shortfall at spot prices. That’s obviously a problem requiring some level of market intervention via regulation or the state more directly as well as a technological one. But Tesla has been eyeing this business for several years and is expanding rapidly (from a minuscule base of course).

Powerwall is the piece of Tesla tech only energy hands and tech nerds have probably paid any attention to, but to sum it up, it’s part of a suite of things Tesla’s rolled out trying to offer homeowners a battery that either stores excess power from the grid or else from the solar roof that Tesla sold you or you’ve installed with another supplier so that whenever there’s an outage, you have power on hand without interruption, or, per its Virtual Power Plant (VPP) scheme it’s begun to roll out in the UK, you can sell your excess production back onto the grid. That last point has been a matter of great regulatory concern at the state level in the US, with utilities providers waging effective lobby campaigns to convince voters they’re voting to free up the market and green their homes when actually they’re locked into conditions that privilege the wholesalers and large utilities while limiting space to sell back onto the grid. The scale of the shortages seen in Texas in the US could well be diminished significantly if more homes are able to operate off-grid for longer. Tesla’s VPP scheme is also an attempt to allow for the grid to manage imbalances from all the participants selling and buying in decentralized fashion. There’s little doubt you still need a big utility, even perhaps state-owned, as a sort of ‘consumer of last resort’ and central dispatcher during periods of extreme stress, but the reality is that cold snaps are getting shorter and the O&G patch’s experience of power failure with renewables is going to prompt interest in battery tech as investors and Wall Street start demanding more emissions reduction and mitigation as part of their financing agreements for the energy sector.

Cost is obviously a huge concern. Powerwall is pricey, in the range of $10-15,000 (comparable prices in the UK), but there are a plethora of means by which local, state, or federal governments can construct funding schemes to underwrite the tech. After all, that’s core to Tesla’s business model. Musk himself said back in 2019 that this business would grow faster than EVs. There’s also logistics. Batteries lose effectiveness over time, Powerwall has a 90% effectiveness rate i.e. 90% of what is stored as input is available as output, and you have to scale it to get benefits for a sustained outage (Tesla says you can chain up to 10 batteries). Tesla offers 10-year warranties and guarantees 70% charge retention over that decade and will undoubtedly have to also figure out plans to offer upgrades etc. There’s also the fact that the batteries have heat and cold limits (as of now) that would likely require some of the power stored to be spent on AC or heating in the event of an extreme run of weather. But investments into R&D mean that cost deflation is still happening and the quality of the batteries is, over time, improving. Funny enough, oil & gas operators able to maintain production in the cold, but lacking power from a systemic problem are likely to show more interest in this stuff in the next year or two. Oil companies were already bidding on startups in the space back in 2019. Having been beaten to market at scale, they’ll likely have to sign deals with Tesla soon enough if they want to find ways to profit off of sector growth, Musk’s self-declared war with oil & gas be damned.

The reason I flagged this story today is not so much to argue that the tech is where it needs to be at this moment or that the costs can be borne by a lot of consumers. Neither is necessarily the case. Rather Tesla has been trying to solve a problem that emerges from the rapid rise of renewables’ power-generation share, and has made some progress moving towards an improvement, if not a solution. Improvements in battery tech matter for cars, sure, but they’re actually much more significant for the companies able to commercialize them for home power needs. These types of disruptions to the structure of contracts, reconfiguration of market structures to handle surpluses and deficits, and price discovery for electricity all bode ill in the longer-term for natural gas. When that tipping point happens is still completely unclear. It will, though, and without a national champion in Russia to play a competitive role in the space, it’ll further rewrite the politics of energy security and strategic sovereignty into one defined much more by one’s access to and ownership of strategic global value chains rather than ownership of natural resources. The rents to be extracted are going to change, and fast.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).