Top of the Pops

First, apologies for the editing mixups yesterday. Annoyed me when I realized I’d left them in, clearly I wasn’t being attentive. Today’s newsletter is short a column as I had a slew of errands to run ahead of the weekend and am readjusting some of the news gathering approaches, particularly now that VTimes is out and there seems to be slightly tighter control over news stories out there. Tomorrow the longer column will cover the latest from the US, a bit on Afghanistan, and linking them to Russia and Eurasia in the months ahead.

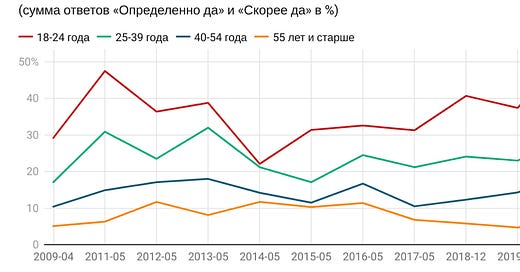

Levada polling on Russian attitudes about emigration shows that in % terms, about as many Russians are now thinking about emigrating (setting aside their ability to do so) as in 2011-2012 when Putin’s return to power kicked off protests that changed the trajectory of the state’s turn towards repression in place of carrots. The age breakdown also shows an interesting gap between the 18-24 year olds and those 25-54 aggregating the hard and soft yes and no responses:

Those 18-24 seem to have decided against it during the pandemic, which makes a lot of sense! They’ve taken a huge hit professionally, been forced to rely more on family, and don’t have professional experience or more advanced degrees to make it easier to find work. Still, young Russians are by far the likeliest to be thinking about it regularly. But everyone 25-54 has slowly seen an uptick in sentiment that most likely can only get stronger the longer the current economic crisis/higher inflation and low growth environment drags on. And these figures come as an adjusted migrant laborer legal regime has taken effect. Now laborers coming will have to pass tests that show they know Russian fluently (enough) to deal with the police, medical authorities, and colleagues in spoken and written forms as well as requirements showing one knows the history of Russia, basic constitutional and labor law, and a bit more in exchange for a certificate of legal status to work and live in Russia that lasts 3 years in place of the previous 5 year timeline. Moscow’s making it nominally more difficult to legalize migrant labor flows at the same time more Russians are thinking about leaving. Not a great indicator, especially for labor markets that may be significantly affected by COVID for longer than expected. Now that Navalny’s entire organization has been made illegal, we find out that the FSB went after Dmitry Bykov, and Dmitry Gudkov has fled, we’re entering a truly dangerous period as the coordination of state activities from above continues to weaken while the problems that require coordinated state action mount ever higher.

What’s going on?

MinEnergo is now studying what power sources and infrastructure are needed to power the third stage of the modernization and expansion of capacity on the Baikal-Amur Mainline (BAM). Current plans call for 1.16 GW of coal-power capacity (out of 1.8. GW in total) and 4,200 kilometers of electric networks. The plans also call for an expansion of generating capacity at RusHydro’s Neriungrinskiy plant adding two blocks with 430 MW. All told, the ‘Eastern Polygon’ will have a net capacity of 8.52 GW by 2030 if the current investment plans are all realized. The 2nd stage of these investment plans are currently underway and worth an estimated 309.7 billion rubles ($4.29 billion) — I’m curious to see what final cost estimates for stage 3 come out to given that materials and labor are getting more expensive right now and long-term supply contracts can’t cap it all. Attempts to build an infrastructural core for future economic development in the Far East face a basic problem — electricity costs are too low, stagnation means even small cost increases hit households particularly hard, and current tariff regulations undermine the profitability of the generation capacity expansions needed to support BAM. This is yet another case where the lack of clear policy or political willingness to change the policy framework for the power sector seems likely to create an unending debate about investments and investment costs that will increase uncertainty and delay investment plans that should theoretically be locked in since a state monopoly — RZhD — is the main consumer. If you want a leading indicator of how relatively small changes in utilities bills matter, 1 in 3 coffee purchases from Russian consumers are now made at McDonald’s. So much for the artisanal revolution. Pocketbooks trump subway tile markups after all, and it’s in those areas where most of the innovation and gains are taking place among retailers and consumer firms.

FocusEconomics changed its growth consensus for 2021-2022 to reflect a different composition of GDP growth — the topline rate of 3.2% annualized growth this year was unchanged. But consumption is set to grow faster than GDP and investment to grow slower. That’s not a great indicator despite the more positive story regarding demand for goods and services:

Black = consumption growth % in 2021 Yellow-Green = consumption growth % in 2022

Why the divergence? Well, it’s cause incomes aren’t in great shape so far. The consumption recovery this year is probably most strongly linked to the recovery of the current account via higher commodity prices, so firms are set to consume more goods and services, particularly as oil production cuts are eased. Some of that obviously does go to household earnings. But businesses aren’t banking on longer-term demand for either category domestically, which means lower overall investment levels. In short, the structure and scale of the fiscal response is leading to the expected outcome — weaker post-crisis investment papered over by a base effect increase in consumption further strengthened by a new commodity cycle.

Thanks to the mortgage subsidies and surge in interest amount consumers to buy apartments, August 2020 to May 2021 saw 30.9 million sq. meters of new housing under development. That’s a 64.3% increase year-on-year for the same period of time. 14.8 million sq. meters of new projects launched in May alone, which goes to show how backloaded that increase actually is. It’s great news insofar as there’s been no real slowdown yet in mortgage take-up for purchases, but we also have to temper the rate of builds against the rate of increased interest as well. In Nizhny Novgorod for instance, construction is up 39% but mortgage signings for purchase are up 92%. Still plenty space for demand/pricing and supply mismatches. Dom.RF and VTB are now working up a unified mortgage strategy to spur development beyond the subsidy program for Russia’s regions by the end of the year, including potential subsidies for initial down payments or interest rates as the government adopted last year. Their aim is to top up the state fund intended to back housing construction targets using the pool of money generated through subsidized offerings and other holdings it looks like. VTB estimates that mortgage issuances across Russia for the first half of the year will hit 2.7 trillion rubles ($37.368 billion). That pace will lift demand so long as incomes and savings can support the down payments/rates. Based on Vedomosti’s writeup, it seems that a large portion of the surge in building is a result of firms that delayed construction last year due to demand uncertainty. So basically, it took a year of subsidized mortgages to draw them back in. Overall, if your income didn’t take a hit the last 15 months, things are still looking decent when it comes to buying (so long as inflation isn’t crushing your spending power). The current pace can’t hold for too long without an income rise given rising input and labor prices.

Dutch banker ING Group is forecasting the ruble will hold in the 72-73 to the USD range and won’t see much more appreciation upside for a variety of factors. As indicated by the consumption vs. investment growth differential, imports have risen quite sharply — imports from the ‘far’ abroad rose 49% in April in monetary terms. Nearly $25 billion in capital has left the country from the private sector since the start of the year, limits on Russians’ travel have capped some normal capital outflows and will likely ease over time, and corporate dividend season is starting which will send a further $7 billion abroad for May-August to foreign investors. The ruble has largely tracked its currency peers against the USD so far with the usual geopolitical risk premium at play:

So long as private capital keeps leaving — hard to imagine that trend changes, especially with the more outwardly repressive political turn and new political campaign to pressure business — these dynamics won’t change too significantly even with an oil price recovery. Import prices are rising too. Up to 236 project agreements are expected to be signed with regional governors in July worth 1.2 trillion rubles ($16.62 billion) in exchange for debt restructuring measures. We’ll see if private investors see better potential for returns to leave their capital in the country. Color me skeptical.

COVID Status Report

New cases climbed higher to 11,699 along with 383 recorded deaths. The spike in the official data was observed almost entirely in Moscow and comes just after mayor Sergei Sobyanin waved off a new possible lockdown in response to rising cases. Though Russia’s vaccination efforts continue to lag terribly — Vyacheslav Volodin has shepherded a bill to include COVID vaccinations on the national annual vaccination calendar — it looks like 93% of the army has been vaccinated. Azerbaijan’s also opening up its borders to Russian tourists. For a snapshot of the global state of vaccinations per 100 people, worth noting that China’s shot up massively though it seems that its vaccines are far better at stopping major cases of COVID with potential complications than infections full stop:

Post-post Soviet Eurasia has some catching up to do….

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).