Securitizing Climate

Russia's eventually going to need a climate strategy to handle crises in Eurasia

Top of the Pops

I’ll respond to the Direct Line with Putin tomorrow to have a more fully formed view on what’s going on and reflect on what it suggests domestically. Today there was enough other stuff to keep track of and I won’t have had a chance to digest it since it’s incredibly difficult to look up lots more content and analysis while actively listening/watching.

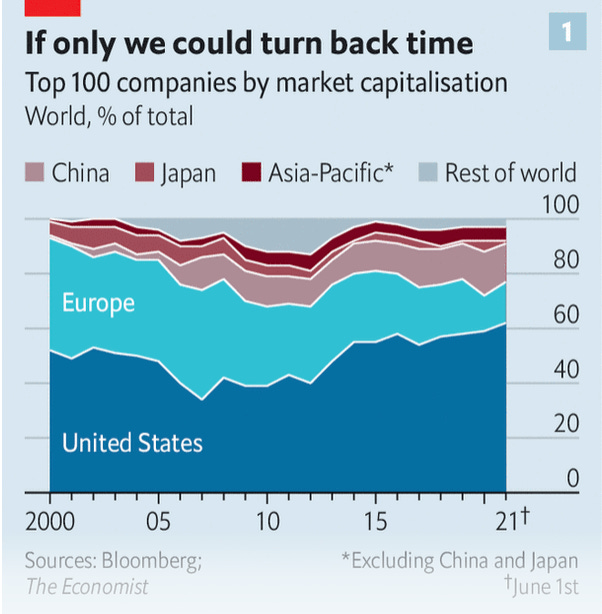

The last few days, a graphic from the Economist has been making the rounds online that caught my eye since it tells a story about “decline” and how we conceive it I think is really important to make sense of, particularly since it has a huge bearing on the geopolitics of climate change and climate policy:

We can see that after the Global Financial Crisis, the power of European firms on equity markets fell precipitously, American firms took off in terms of valuation, and China expanded its role too though not at a scale commensurate with its size. This chart directly challenges the traditionally security-centric paradigm of American decline, an incredibly important aspect of national power but one contingent upon a variety of other factors. This chart jumped out to me also because of an ongoing debate about the role of the US and US dollar in the future because foreign investors have stopped buying US sovereign debt. You’d think that augurs poorly since a hegemonic power has to provide safe assets to the world, presumably using its debt as a means of anchoring its central role and cultivating dependencies and political relationships so as to maintain the primacy of its currency. Well, I’m admittedly a dilettante on a wide range of economic matters, but it strikes me as funny to assume that foreigners begging off of US debt purchases when yields have been terrible across developed markets for a decade is a serious problem. Foreign ownership of US stocks has grown and grown for decades — foreign investors owned about 35% of the market capitalization of US stocks pre-COVID and their share was growing. If stock valuations have been buoyed by cheap credit, friendly taxes, and the massive provision of liquidity from the Federal Reserve that has made a point of heading off sharp losses of equity value for years now, why aren’t they “safe assets?” The market recovered incredibly quickly from the initial COVID shock and US monetary policy and now fiscal policy are set to generate lots of safe returns. Stocks aren’t bonds by any stretch, but safety is relative and returns matter. This is just an initial thought, but it’s meant to also reflect on how Russia and Eurasia’s incredibly lopsided integration into global markets configure some of Russia’s power politics.

What’s going on?

Putin has reportedly ordered the government and Russian Railways (RZhD) to figure out who’s to blame for the failure to keep pace with modernization projects and investments on the Baikal-Amur Mainline (BAM) in the Far East. Responsibility has been doled out accordingly — the Audit Chamber is supposed to carry out a review of the tariff regulations for the network, the security and oversight organs are going to assess the legality of the use of state resources, and RZhD head Oleg Belozerov will be tasked with finding people inside the state monopoly to blame. It appears the president gave an order that hushed up to action this on June 5 with a July 1 deadline for results. BAM and the so-called “eastern polygon” have a checkered record. For instance, the Audit Chamber found that in 2018, only 1 additional siding had been completed in place of the expected 11 per modernization plans. In 2019-2020, investment levels weren’t realized because of problems with contractors supplying the project and labor. No wonder they want prisoners laying tracks now. The first stage of modernization and expansion was estimated to cost 520.25 billion ($7.11 billion), the second stage up to 759.1 billion rubles ($10.38 billion), followed by a third stage that hasn’t been finalized yet. One of the rightful pushbacks I get on the argument that Russian fiscal policy is disastrous is that spending more won’t solve problems like this, but here’s why that’s wrong. A more proactive fiscal policy raising demand would encourage more productivity improvements and capacity from firms — fewer holdups with suppliers — and even more importantly, make it politically impossible for local and regional actors to drag their feet so much. If things are booming or at least growing steadily, systems of graft may steal outrageously but bottlenecks become a more visible political problem, ironically, compared to conditions of stagnation that can paradoxically reduce the political cost of failure. Failure hurts growth, but the lack of growth makes the appearance of delivering justice by firing and arresting someone more palatable.

Good news: international financial organizations’ share of ruble-denominated debt issuances have quadrupled since 2012. Bad News: they accounted for a measly 0.4% of the total debt market by the end of 2020, issuing just 46 billion rubles ($632.96 million) in debt for the entire of the year despite the surge in borrowing. These organizations include the Eurasian Development Bank. (EBR), the New Development Bank (NBR), International Investment Bank (MIB), the Interstate Bank (MGB), the International Bank of Economic Cooperation (MBES), and the Black Sea Trade and Development Bank (BSTDB). The following measures assets in $ billions:

Red = EBR Green = MIB Black = MGB Blue = MBES Light Red = BSTDB

As we can see, development banks have a pretty minimal presence on the Russian market, only backing targeted projects that probably aren’t worth too much. The big stuff goes through state banks in Russia instead. A European Bank of Reconstruction and Development (EBRD) rep reiterated the bank’s position yesterday that it won’t invest in Russian projects, a policy it’s taken since 2014. Though not a large financial loss, Russia’s inability to work closely with western development institutions does create a problem — it’s harder to generate legitimacy via reforms that ‘reform to the test’ using World Bank ratings or other metrics when the institutions otherwise working in numerous countries facing massive institutional challenges including corruption don’t want to touch Russian projects. That can largely be explained by funder-nation politics and the chilling effect of sanctions, but it’s an under-appreciated area for potential diplomatic engagement in the future.

Coal prices have surged to 10-year highs — $113.15 a ton for coal futures on the Rotterdam hub as of last night. Russian coalers are already scrambling to sell more to Europe instead of Asia and are looking at production capacity expansions based on what’s actually a pretty small sample size to go off of. Based on Vedomosti’s coverage, many Russian experts and businesses seem content to believe that lower costs will trump ecological concerns in Europe. But I think they’re missing a crucial part of the puzzle when understanding the data we’re seeing post-COVID, though they have a point. Surges in the utilization of industrial and consumer capacity tend to increase consumption of the dirtiest forms of energy because they work fluidly at scale, have more room to ramp up or down than solar or wind (as examples), and it’s faster to bring fossil fuel power generating capacity online. That doesn’t mean the current surges will necessarily stick. Russia has a commanding position on the market for European coal imports — 68% market share in 2020. It’s in the interest of its exporters to keep that going as long as possible. EU carbon prices are now above €55 a ton and are set to keep rising, which will add additional costs to coal operators and nullify a lot of the built-in advantages that privilege dirty energy consumption during ‘boom’ periods — note that the EU is not really booming, just normalizing/reopening and benefiting from US stimulus at the moment. Coal prices will drop with demand, which should then make it more competitive again. But carbon prices are spreading and going to be part of the policy arsenal to divest from coal. The question is how national and regional approaches mesh and whether it becomes a decision foisted on states by the EU, shifts in US policy, or else even in China, not whether or not it’ll happen in my view.

A funny thing happened last year — Russia became a net recipient of FDI from Cyprus for the first time in its post-Soviet history. In 2020, Russia received a net $1.5 billion of investment from the offshore hub. In the last 5 years, Russia sent between $9-20 billion annually to Cyprus. We have to caveat the figure. Central Bank data defines FDI here as the difference between the purchase and sale of financial assets without looking at the structure of said investment — we don’t know what share is dividends, fixed assets, and so on. Vedomosti and state officials are keen to talk up the long-suffering process of de-offshorization intended to attract Russian capital back into the country, where the state can then monitor and seize it as needed as well as minimize capital outflows so as to maintain a larger pool of private savings and assets with which it can back crucial investments. For a long time, Cyprus has been ideal for Russian businesses and individuals trying to optimize their taxes. MinFin estimates 1.4 trillion rubles was transferred to Cyprus in 2018 and 1.9 trillion rubles in 2019. MinFin’s recent campaign to renegotiate tax rates in its double-taxation treaties with other offshores — think the Netherlands too! — has raised the effective rate from 0-5% to 15% on the capital stashed away. That’s obviously encouraged a lot of money to come back into Russia. I’m curious as well how much money from Cyprus has been used to buy Russia’s sovereign debt. Given that state banks have clearly coordinated with Russian investors over the last 16 months to cover the deficit and prevent a total collapse in the non-residents’ share of debt purchases, I imagine that might also explain a bit of the shift on top of changing taxes as well as greater liquidity needs. If someone suddenly wanted to pay down debts or had lots of expenses stack up thanks to COVID, they might have also drawn on assets from abroad in some cases.

COVID Status Report

21,042 new cases and yet another record 669 deaths were recorded in the last day. Regional cases keep climbing while Moscow’s leveled off lower than its peaks. Putin finally revealed today he got the Sputnik V vaccine, but then also made a big fuss about protecting the legal rights of those who aren’t getting vaccinated because of medical concerns being able to work or else enter public places without proof of vaccination so as to avoid an infringement on their rights. The incoherence drags on. Yesterday, PM Mishustin announced 6 billion rubles ($82 million) would be spent on 'in-depth’ examinations of patients who got over COVID — they’d get them free of charge — and an additional 8.5 billion rubles ($116.15 million) for doctors, nurses, and medical workers as compensation for not using days off or taking vacations. They’re tossing scraps to the public without also talking too much directly about long COVID. Now that the Kremlin has made clear vaccinating Russians is the highest priority, Sputnik V importers may follow Guatemala’s lead and demand refunds for failure to deliver contractually agreed loads (h/t Pjotr Sauer and Sarah Rainsford). Public health officials like Oksana Stanevich in Piter are really stressing that it’s impossible to predict any individual’s ability to handle the virus and its lethality so everyone should get vaccinated, hoping that the surge in deaths will make the risks more apparent. Now you’ve got fights over hospitals trying to stick to just treating COVID patients or those confirmed to have COVID in order to manage public health risks and direct capacity. Still no sign the Kremlin wants to take a more active role managing the situation.

Some Don’t Like It Hot

The heatwave’s continuing so I figured I’d reflect a bit more on it, particularly since it’s taken on a global character. Scrolling this morning, I came upon this point raised by the IEA’s Ali Al-Safar by way of Adam Tooze concerning just how bad power-generating infrastructure in Iraq is vs. the needs of its population to avoid heatstroke and other adverse effects from insane heat:

Needless to say building anything expensive in Iraq entails huge risks and problems. You have to physically secure things because of possible attacks or sabotage, you have to funnel huge sums of money to either the government in Baghdad or to the right people in Erbil up north, and then you have to figure out who benefits from building and owning it. Centralized grids reliant on fossil fuel make for convenient vehicles to distribute favor and rents. Building solar panels on the roofs of single-family homes or apartment blocks undercuts that system and shifts its pressure points. Suddenly your focus has to be on the import of the goods, tech, and know-how, the ability to recreate at least some of it locally, and find reliable external partners who don’t mind taking risks. The terrible state of infrastructure in Iraq leads to exorbitant power costs that would actually make renewables more competitive on a cost basis insofar as they’d be preferable to having a mint condition and perfect power system still burning oil or coal.

NASA’s satellite data now shows that the world’s oceans are rising 3.4 millimeters a year:

As the NASA Climate handle on Twitter put it, that level of global sea rise is equivalent to covering the US in 6 inches of water annually. And these changes are continuing without pause as the heatwave that’s struck Canada and the US Pacific Northwest continues. Canada’s set a cracy new heat record — 49.6 degrees Celsius or for us normal people that understand 0 is cold and 100 is hot, 121 degrees Fahrenheit. It’s considered a once in 1,000 year event. Earlier this year, it was discovered that the 2018 and 2019 droughts in Central Europe were once in 2,000 year events. Iraq, where I started, has seen temperatures hit 52 degrees Celsius in the last day and cities have begun cutting working hours to protect lives. And topping all this off, I ran into a piece today talking up a new study that shows 9 square meters of land becomes desert every minute in Uzbekistan, which may lead to massive shortfalls of arable land outside of Tashkent and its many valleys in the next 20 years.

I checked to see if there were parallel stories elsewhere in Central Asia. There weren’t any good recent leads, though the UN is doing its job sounding the alarm that drought and desertification threaten roughly half the population of the planet. I think it’s safe to assume that Turkmenistan isn’t doing a great job managing its land. A UN scoping report from 2012 on Tajikistan found that over 97% of all of its agricultural land suffered from erosion (will look for more recent stuff, but ran out of time). Over 47% of Kyrgyzstan’s land suffers from erosion (as of 2020), with other factors contributing to rising levels of salinity and land degradation/misuse. Though it hasn’t completely taken off, just over 75% of its land is at risk of desertification. Where is Russia in all of this? Over half of its agricultural land faces erosion risks. And all of these underlying problems are then exacerbated by extreme weather, namely extreme heat and lower levels of rainfall or extreme outbursts of rain.

One of the sad realities of reading about the state of the climate globally, for those who don’t focus on its ecological components every day, myself included, is that everything is so much worse than we want to believe. But this specific set of problems from a political economy perspective raise a lot of important questions for Russia and the haphazard integration of former Soviet Eurasia. The more Central Asian land struggles to sustain the region’s growing population, the more pressure for migrants to go to Kazakhstan or Russia to find work. The more migrant labor moves into those countries as a result of structural factors worsening the region’s economic stagnation as well, the more pressure on economic and political systems that were built around the extraction of hydrocarbons and value from the ownership of assets whose frequent underperformance for returns are ‘de-risked’ by the state. These same factors are also bound to affect Russia’s security posture in the Middle East, too frequently analyzed as though it isn’t a logical extension of the country’s domestic political economy. Even a passing observation of European and Middle Eastern politics in the last decade shows the immense psychological power and tumult caused by mass dislocations of people, the strain it places on the bordering states forced to host huge groups of refugees, and the radicalizing impact said flows of people can have in Europe for a wide range of political reasons. These are the reasons why I increasingly see the future of ‘power politics’ through the prism of domestic political economy and the power to drive sustainable development.

Russia has no stake in the politics of development. It lacks the heft in multilateral development institutions, its own mirror institutions were designed to provide a common pool of resources to reduce the budgetary strain of rent-seeking for other Eurasian states, and its investors have learned to survive in a business environment conducive to the extraction of value over the long-run demands of sustainable growth and development. Heading off ecologically-driven security crises will quickly become one of the central objects of security policies for the obvious reason that an ounce of prevention is way cheaper than a pound of cure, of which there isn’t really one at this point. The question is when Russia’s security elites realize that guys like Anatoly Chubais, for all their flaws, are onto something about the potentially transformative power of taxing carbon for the Russian economy. That transformation requires a great deal more than just a tax, but at least the seeds have now been planted.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).