Top of the Pops

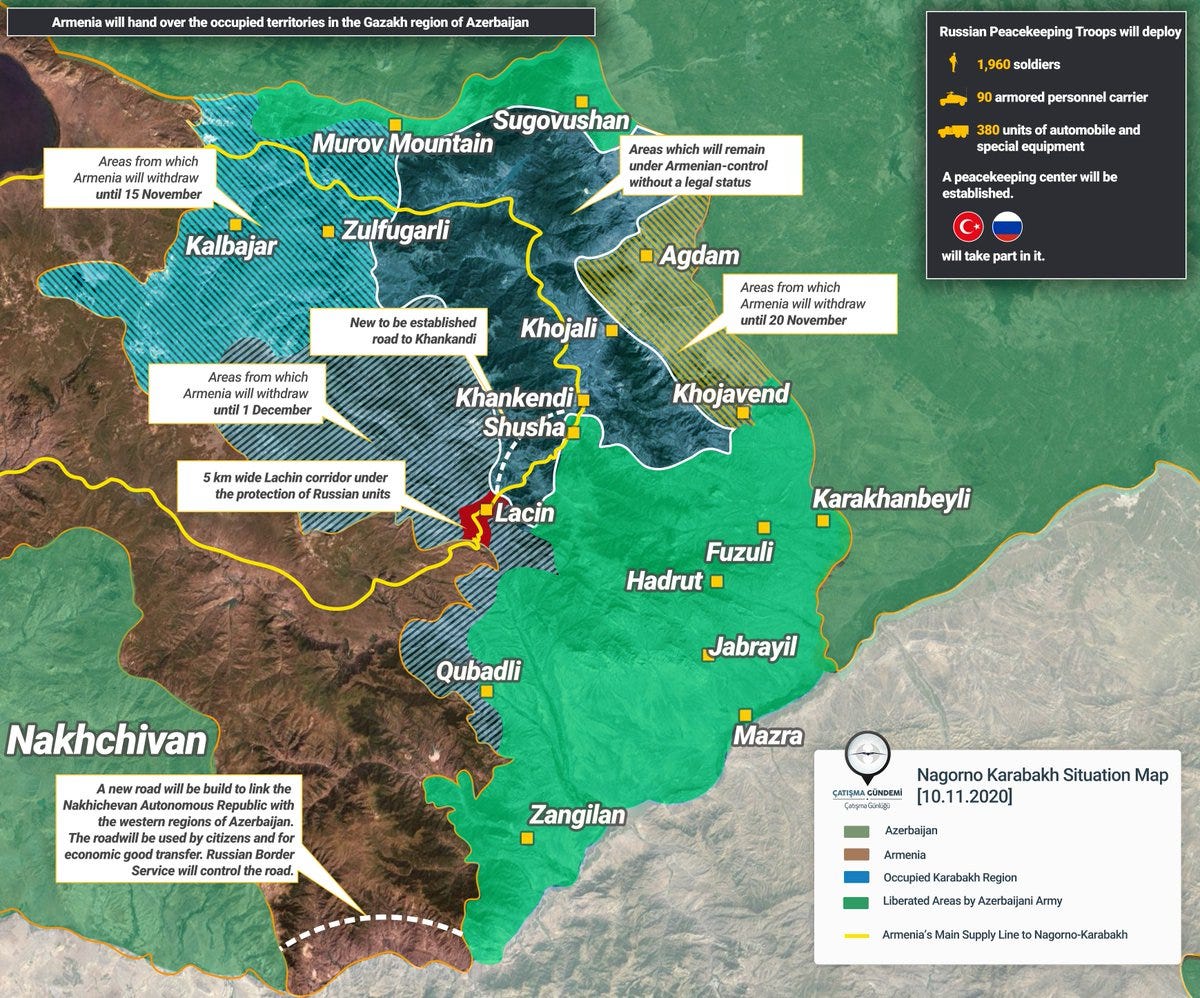

So the early reports yesterday leaked only through MiddleEastEye bore out in the end. My bad. There’s a peace deal in Nagorno-Karabakh. The following map (thanks to Max Hess for pulling it) shows that Azerbaijan will be handed about 80% of Artsakh, with the an enclave kept in the middle around Stepanakert with a land corridor to Armenia and an agreed land corridor for Azerbaijan to Nakhchivan:

Initially it was just Russian peacekeepers deployed to the red bubble here, as well as the land corridors that were reported, but president Aliyev then announced that Turkish peacekeeping forces would also be deployed. Putin’s statement last night made no mention of this and Yerevan denies such is the case.

More further down today’s newsletter on what I think it means. Pashinyan has said that fighting hasn’t completely stopped and he hopes it does. It doesn’t take much to ignite things again.

What’s going on?

RZhD is launching the tender for power generation capacity meant to support the Eastern Poligon — the Trans-Siberian, and the Baikal-Amur Mainline. The tenders will include a set of projects and upgrades to existing plants worth an estimated 250 billion rubles ($3.28 billion). A total of 1.4 gigawatts of new power generation capacity are meant to be added so as to further electrify the rail network, further reducing diesel demand for rail freight. The “normative base” for competing bids still has to be decided to launch the tenders on February 3, 2021, which suggests that the “technological neutrality” claimed behind the project — presumably they don’t intend to favor one source of power over another — might end up influenced by Shulginov’s new post heading MinEnergo. since RusHydro’s in the mix.

OIES’ latest oil market report points to just how much the game has changed for price and demand expectations. Per their calculations, it’s going to be several years before demand returns to pre-crisis levels:

Putting Novak in the cabinet was also a political signal to the Gulf — he’s taken point negotiating cuts and they’re here to stay. Japan’s fuel demand — the world’s 4th largest consumer — has nearly normalized, so watch for any green stimulus plans for marginal shifts in the global demand outlook. Brent hit $43 a barrel yesterday, ripping upwards 10% on the good news from Pfizer. That gives the budget more breathing room, but also may end up inspiring more drilling activity in the Permian and related shale plays as a depressed labor market in the US lowers service costs.

Looks like Igor Artyomev is leaving his post as head of the Federal Anti-Monopoly Service (FAS), a role he’s played since the agency’s creation in March 2004. It’s a bad sign for the business community. In 2015, FAS won control over tariff regulations, which have become one of the more contentious policy areas between SOEs and state-run monopolists like Transneft and RZhD as even incremental changes significantly impact profitability and returns given the long distances goods travel. FAS does not always have a coherent policy agenda, but under Artyomev has consistently pushed back against efforts from the country’s biggest businesses either led by or linked to state security services to introduce distortions that undermine competition and market rationalization. Maxim Shashkol’skiy, vice governor of St. Petersburg, appears to be in the lead running for the job.

In October, Russians pulled a net 74 billion rubles ($969 million) out of Sberbank. Falling incomes, increasingly unattractive rates for deposits against inflation, ruble weakness, and the demand stimulus from mortgage and autoloan subsidies all helped. The outflow from banks is now pushing rates on deposits upwards as they try to maintain reserves. The underlying message is that if the current wave of the virus further erodes consumer confidence or weakens the ruble, the withdrawals will go from covering accelerated spending activity boosted by subsidized credits to actual mattress-stuffing, at which point one might begin to see shadow inflation through the cost of unsecured loans, shadow lenders, and related economic activity not strictly within the formal economy.

COVID Status Report

Siberia’s in trouble now for number of confirmed cases:

As winter arrives and people are stuck indoors, we now see very clear evidence that the virus is not being contained across the full breadth of the regions responsible for Russia’s current account surplus and the regime’s political coalition. To be fair, it’s quite difficult to assess what impact infections would have on output without much more detailed analysis, but with the peak of the virus still a month away per the optimistic early projections out of Moscow, this is Capital B Bad. Daily new cases reported are now just shy of 21,000, and that’s probably understating it. The worse it gets outside the metropolitan cores of European Russia (excluding the south) by comparison, the worse it looks as a center vs. periphery problem.

War in pieces

The current ceasefire agreement — not to be confused with an actual political settlement of the conflict — is good news. Russia’s commitment to station 2,000 peacekeepers on the ground in Nagorno-Karabakh ensures that Azerbaijani forces won’t finish the job in Stepanakert and force yet more civilians to flee. But the dueling words over what exactly happened portends a situation that is far from resolved. The common sense comparison to draw is that Russia and Turkey have learned from each other’s experiences in Libya and Syria and effectively recreated an agreement that mirrors the uneasy regime in Idlib. That captures the outline of the deal that Pashinyan and Aliyev accepted, but probably misleads slightly when considering the longer-term ramifications or else the “Who’s up? Who’s down?” punditry that 30,000 ft. view expertise experts like to use when gauging these things for media hits and their brand.

Armenian president Armen Sarkissian has publicly stated he wasn’t consulted on the deal, aligning himself with the many protesters furious at what’s seen as a capitulation:

Officials in Artsakh are being diplomatic in trying to restrain anyone from acting before they take next steps. The agreement is meant to restore Azerbaijani sovereignty over enclaves as well as create economic corridors. It’s hard to imagine that’s going to stick given the public mood on both sides and the fact that Aliyev pulled out the mother of all trolls against Pashinyan in claiming victory. If this situation is akin to Idlib, then we’d expect troops sent as peacekeepers to eventually come under fire. Armenia has rejected any role for Turkey and Russia’s own stance states publicly that Ankara sees a military solution for the conflict, but not Moscow. No one seems to know what the facts on the ground will actually dictate and Turkey could, in theory, unilaterally place its troops in positions with Baku’s blessing but that would spark a a massive crisis since Russia now owns the peacekeeping mission alone.

It’s easy to snark that those talking about Russia’s diminishing influence in the South Caucasus were proven wrong by the deployment of Russian peacekeepers, but their deployment is proof positive that Russia can’t control events, only react to them. It can’t control the fallout from the massive backlash against Pashinyan now underway. It can’t stop Erdogan and Aliyev from pushing for yet more. And it has not decisively curtailed the escalation risk implicit in an agreement leaving Stepanakert on an island, surrounded, and no clear legal resolution as to the fate of those Armenians who were living on territory that’s been returned to Azerbaijan. Syria should be a lesson about the limits of Russian influence even when it deploys force, but that’s all gone out the window with those looking to affirm their priors. That said, the current deal is clearly one that puts Russia in the driver’s seat relatively speaking. There aren’t joint patrols or operations, which effectively sidelines Turkey from the nitty-gritty of enforcing the peace. That alone signifies a different situation than in Syria. I still think Turkey’s a big winner.

Mark Galeotti argues that Turkey delivered this victory for Azerbaijan despite Russia negotiating the ceasefire, and I agree wholeheartedly. You’d miss the forest for the trees if you obsess too much over the deal itself, which could still fall apart leaving Moscow in the uncomfortable position of leaving troops in territory that is not legally recognized as Armenia while claiming to protect an ally. Russia is no longer deciding things. It is reacting to others dictating the political terrain and doing an able job winning the peace to mask what it lost in conflict. Where exactly is Russia in Syria now, five years on? What has it gained? Virtually nothing. It’s managed to keep what it had. Any “gains” are a result of western strategic myopia and navel-gazing, not reality on the ground. This deal in Nagorno-Karabakh doesn’t even maintain a status quo. It reflects that it’s been altered for good. That doesn't leave Russia defenseless or in the lurch, but it’s past time to argue that somehow it still “wins.”

True as this may be, I’ve never met an official who prefers having to balance against powers with a vested interest in making constant trouble than dominance…

Armenia convinced itself that Baku was bluffing about war and inflated its own ability to win. It paid the price and Moscow could do next to nothing about it. I’m sure someone will cite anecdotal evidence that Russia’s gained the trust of x leaders across the Middle East while the US retreats (a fantastic lie upon which careers are being built), but if Russia can’t even deliver for its friends, what’s that really worth? I wager very little. Welcome to multipolarity. It’s a school of hard knocks and “what have you done for me lately?” You’ve balanced to serve your own interests isn’t the strongest sales pitch.

Jolly Green Giants

In the race to green the economy, institutional capital is going to play a leading role in shaping market preferences, expectations, and movements of capital. It’s also a chance to revisit why a statist capitalist model in Russia is, largely, devoid of structural economic power globally compared to that of, say, China. IRENA is always bullish — after all, their racket is green energy — but their latest report on green energy and institutional capital is worth a look:

As you can see, institutional capital has played a minuscule role in % terms for the energy transition. That’s bonkers, but is going to change. Pension plans alone had over $44 trillion in assets under management last year, and usually aim to generate returns in the range of 6-7% on an annualized basis. A great study from Imperial College London and the IEA earlier in the year tested out hypothetical renewable vs. fossil fuel portfolios to assess returns. I pulled the US cause it lags the other markets, has the least in the way of subsidies, and a strong fossil fuel sector given its natural resource endowments and oil & gas sector strengths:

Returns in Germany, France, and the UK are stronger, but none of those markets has the pull of the US when it comes to building a large equity portfolio intended to generate returns. Germany and France are particularly nuts, though:

Though US fossil fuels have outperformed historically, COVID has flipped the script and now that Biden has won the presidency, it’s reasonable to expect further executive actions designed to improve those returns on top of international players in the industry reacting to their home markets and making plays into green energy on the US market as well.

So why does this interest me? Emerging markets are typically where you sink your savings into equity or bonds with an eye on higher-risk, higher-reward outlooks. Here’s a snapshot from the MSCI Indices which cover emerging markets and 85% of Russia’s free float-adjusted market cap:

Since 2010, Russia has lagged other emerging markets (though China also undoubtedly skews the financial results). As institutional investors get into the renewable energy space and begin to view them as utilities investments — lower marginal return, but more stable — or as significant growth stories as investments ramp up, the relative draw of emerging markets who business cycles and financial returns track considerably with oil & gas markets will diminish. That doesn’t mean Russian equities are dead. MOEX just launched two new ETFs and the number of individual investors holding brokerage accounts on MOEX is now hitting record highs (over 7.5 million). But when your annual inflation target is 4%, it’s a big deal that Russia’s average pension fund returns range from just under 7% to about 9.5%. That 2% difference in inflation is massive for savings over time compared to developed economies where inflation rarely, if ever, breaks 2% annually and returns are still realized at 7% regularly. The energy transition may end up disrupting traditional assumptions about the role of emerging market stocks and bonds for savings investment. Russia might want to get in on that action as fast as possible, lest its own capital outflow from the rich starts going into green energy instruments and funds realizing better inflation-adjusted returns that accelerate its own economic malaise.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).