Russia Inc. needs more ink

Reinventing the analytical wheel doesn't shed much light on how Russia works

Top of the Pops

Monday will be Eurasia now, there was enough news today to focus on Russia and that way, buys a little more time to curate given the size of the region. Will most likely focus on Afghanistan and events around it for the long column.

The IEA has done great work in a recent report that catalogs the physical demands of the energy transition regarding metals & minerals. The VTimes ran a piece by Mikhail Overchenko reacting to its implications and I think it’s really, really important to wrap our heads around the investment needs into new supply. It can’t be stressed enough, especially if countries like the US, UK, and others with chronic housing shortages actually move to address them, further increasing construction materials demand. These don’t cover the full gamut of resources but captures the overall dynamic showing the X increase expected for demand from 2020-2040:

Left to Right: lithium, graphite, cobalt, nickel, and rare earth metals

Systemic increases in metals & mineral production require a huge increase in investment, though the relative cost of mining operations are generally a lot lower than, say, developing an offshore or most onshore oil deposits — you can infer it from the relative size of M&A deals in the space at the project level. Add in how many of Russia’s reserve deposits are remote and higher-cost due to climate and it’s clear that current investment levels into the mining sector likely won’t keep pace with rising demand, but could more easily do so with the right support and policy choices in Moscow. Elite fights over resources and assets undermine making the investment pivot and they’re already underway. Igor Sechin just acquired about 20% of the Chelyabinsk Zinc Plant exploiting managerial conflicts within the company, the type of which will only proliferate in the metallurgical sector thanks to rising demand. CZP was partially owned by the Uralskaya-Gorno Metallurgicheskaya Kompaniya (UMMC) and the dismissal of CZP’s general director led to a scramble to make sure the right guy got the job. No one really knows what Sechin’s role was, but even if he played no direct part, his ownership tends to breed conflict down the road. Owning valuable assets is much better than risking building them in Russia when you can manage it. About a month ago, work on a state-of-the-art steel plant in Nizhnenovgorod oblast’ launched aiming to build a plant with 1.8 million tons of annual capacity utilizing direct-reduced iron. The project belongs to the United Metallurgical Company headed by Anatoliy Sedykh. I’m not forecasting a corporate raid anytime soon, but these assets are rising in value relative to oil & gas and the declining equity value and cashflows from the oil & gas sector are going to create push-pull fights over newer metallurgical assets that will begin to account for a larger share of the current account surplus and, depending on what Andrei Belousov manages in the next year or two, a higher share of state revenues bestowing a greater degree of political influence in Moscow over policy.

What’s going on?

After Mishustin’s performative castigation of greed, MinPromTorg is now requesting that producers and retailers report and explain the causes of price increases for meat. The Federal Anti-Monopoly Service (FAS) joined in on the action, jointly requesting this information for monitoring purposes from Lenta — remember that Lenta’s leading the way trying to force other retailers to freeze prices — as well as the National Meat Association. This time, the proximate cause is panic among officials who noticed a surge in wholesale prices for meat at the start of the May holiday. It’s not that surprising. You give people a bunch of time off when the weather’s nicer and they want to invite friends round and grill, plus Post ended so anyone observing dietary restrictions could eat meat again. Going off of the charges of greed, the problem now is how state agencies can ascertain an “objective” picture regarding price increases. MinPromTorg and FAS are planning on using receipts from retailers who buy meat wholesale, which is a pretty stupid way of getting at the data. Different cuts of meat and parts of the animal are in different demand at different times, which makes it more difficult to derive an ‘objective’ price level that’s shared broadly and also is a bit like playing whack-a-mole with inflation. Say prime cuts for beef and pork get too pricey, people shift their consumption into lower cost cuts if they don’t cut net meat consumption which then just drives up those prices. Commodity inputs are the other aspect this approach can’t capture well given the proliferation of price controls — grain gets more expensive, then feed for livestock gets more expensive and so on. The receipts will obviously capture prices being passed on, but its gets harder and harder to ascertain ‘objective’ inflation vs. greed the more the state does to cap price increases between sectors. Thankfully, more pork production is expected to come onstream later this year and meat price increases pre-COVID were in line with overall inflation. Attempts to downplay the pricing pressures, however, reflect the obvious decline in incomes continuing to take place.

AKRA has taken the forecasts from 2017-2021 and painted a useful picture of how different economic institutions’ own views have deviated from the consensus forecast. Those deviations quite logically reflect their own position and needs, and go to show where the more positive takes among business coverage of Russia since the 2014-2015 shock subsided come from. The red lines reflect levels needed for high degrees of optimism (upper) or pessimism (lower) based on the % deviations from the consensus:

Blue = investment firms Grey = commercial banks Dark Blue = research institutes and ratings agencies Left to Right = GDP growth rate, ruble/USD, annual inflation, key rate, budget balance

Investment firms are wildly up on growth and the budget balance and happy with the key rate. Commercial banks and researchers dealing with the actual economy i.e. having to lend to profitable activity or assessing it are very pessimistic about growth and happier about a weaker ruble, which makes sense given it can benefit exporters earning foreign currency. Commercial banks are the most optimistic on inflation, which probably reflects the high rates they can demand and they’re ok with the budget balance. It’s the researchers and raters, however, who tend to be most pessimistic. The lesson’s pretty clear. People trading bonds, securities, and hunting for equity deals are the worst ones to ask about the state of the real economy. They live well, deal with finance on a high-risk market, are clustered in Moscow, and are simultaneously positive about growth and the budget policies that have systemically destroyed it and only really fret about inflation as it threatens the value of assets and future cashflows, not the management of real unit costs. According to an FT study, more than a third of the national wealth is now owned by billionaires in Russia. You’d imagine that investment banks are fine with that — an intensifying trend since 2014 — despite what it portends about future returns so long as they can keep managing money.

Missed this yesterday, but Moscow is now talking about creating a state-owned forestry firm with the Russian Direct Investment Fund (RDIF) as one of the ‘founding’ parties. The Ministry of Far East Development is pushing it to solve the problem created by the ban on round timber exports that takes effect starting January 2022 — the loss of foreign currency earnings via exports. We’re seeing the haphazard imposition of state control over a widening array of exports, in this case done so as to grant the state power to increase, decrease, or else halt sales for political purposes and leave domestic firms more reliant on state largesse. If they can’t export raw timber, it has to be consumed domestically. Domestic consumption levels reflect budget, regulatory, and monetary policy within the austerity framework for Russian macro. Basically, the state has to provide demand. Yuri. Trutnev, long the main curator for the Far East trying to guide rent flows where possible, was reportedly ordered to work up the proposal by Putin. It’s estimated that the planned export ban might cost the Far East 34,000 jobs, which Trutnev desperately wants to avoid to keep hitting regional economic targets. It’s a solution simultaneously in search of a problem and created by the state’s policy in the first place — there aren’t any paper and pulp mills in the Far East or other firms utilizing low-grade or pulp wood. The result is that any company ‘refining’ round timber into consumer products has some surplus that it’s forced to hold onto if they can’t export. So the export monopoly would likely affect margins for these companies and also has come about because of the failure of Russian authorities to foster a business environment that could sustain a business as ostensibly simple as a paper and pulp mill to serve the region. Moscow’s tightening control over the current account and sensitive industries, though not in a fashion that suggests an overarching plan (yet).

In an interesting indicator of the state of the recovery across the economy, factoring companies saw a 35% increase year-on-year in the size of their portfolio in 1Q. For those who don’t know — I had to check this to make sure this morning — factoring companies buy outstanding invoices from businesses with slow-paying customers to give them faster access to cash. The basic model is that the factoring company forwards something like 80% of the invoice in one installment, then the rest later after taking out a ‘factoring’ fee from company’s earnings. That way the business gets paid immediately instead of a 30-90 day wait for the invoice to clear at the cost of a relatively stable fee. That market was worth 967 billion rubles ($13.06 billion) at the end of 1Q and may grow to 1.3-1.4 trillion rubles ($17.57-18.92 billion) by year’s end. The biggest impediment to growth will be the worsening creditworthiness of firms and increased cost of credit as a result of central bank key rate increases. Thing is that the 1Q data was actually a 13% fall against the end of 4Q 2020, which makes sense. Economic indicators have looked up and that means less financial stress around cash needs given delayed payments from invoices. If factoring keeps growing, it’s not necessarily a negative sign. It’s healthy for businesses to have to tap cash faster and reduces financial risks for firms. The broader growth in factoring services since 2018 doesn’t just match inflation, it suggests the growing need for services to help firms survive a demand-starved market:

Title: How factoring company portfolio(s) changed (blns rubles)

The companies themselves expect 25-30% growth for the year. My guess is that is this is a positive story about a service sector in Russia that’s benefiting from just how terrible the economic fundamentals are for firms incentivized to work with small inventories and constantly be ready for another downturn or crisis.

COVID Status Report

Russia recorded 9,462 new cases and 393 deaths yesterday. The entirety of the increase from the Operational Staff data came from Moscow, where the caseload was the highest recorded since January 17 — 3,818 cases were reported. City authorities are warning that the situation is tense. We’ll see if the official data rounds out around today’s level or keeps rising. With the specter of a rising caseload and a still sluggish vaccination campaign, only 25% of Russians feel comfortable sharing their healthcare data with private companies, including presumably their vaccination status. Less than 10% of Piter is vaccinated, where hospitalizations have trended up for a few weeks now:

We’re talking a 7-day rolling average of .16 doses per 100 people right now, with Russia cumulatively underperforming Turkey, India, and Brazil over this time period. Looking briefly at the official data portal, it’s clear that today’s caseload is higher than any since April 16. Normally that’d be useless without a trend but given just how consistent the numbers have been, I’m fairly confident that higher caseloads as of Monday-Tuesday would support the thesis that there’s a broad rise happening, though it may be concentrated for now in certain cities.

Russia Inc. and Analytic Myth-making

In a piece for Riddle, Vladislav Inozemtsev argues that the regime Putin has constructed is a corporation, not a state. The rejection of proto-Russian sonderweg lies at the heart of Inozemtsev’s analytic and rhetorical framing. Russia is often cast as an exception to the norm de jure of a policy or historical debate rather than part of a broader continuum of socioeconomic and political developments with plenty of parallels and problems commonplace elsewhere in the world or, if we go back to pre-revolutionary Russia, analogous to other European imperial polities caveated primarily by its size and persistent economic under-development compared to its geopolitical rivals. Inozemtsev’s novel analytic innovation is to distinguish a ‘captured state’ seized by oligarchs and private interests with that of a ‘commercial state’ that is organized and designed to enrich those who maintain control over the levers of power. What appears to be a state formally is more akin to a business. If we commit to Inozemtsev’s account, Putin’s power comes from being able to wield the benefits of formal statehood and state institutions while freely exploiting private corporate resources, possessing an unlimited array of financial resources at his disposal, and otherwise living like the rapacious head of a firm moving fast and breaking things. Over time, this model becomes harder and harder to manage since the strengthening of a bureaucratic apparatus strengthens the formality of the state to the detriment of the benefits of informality the regime relies upon. The regime can’t be ‘defeated,’ it can only be outlived as its business model becomes unprofitable and unmanageable.

Despite rejecting the notion of a “Russian path” that is deviant from the norm at the outset, Inozemtsev’s argument recasts Putinism as a novel innovation in international politics, if one that has analogs in other former Soviet states in Eurasia. I think it’s an unconvincing rhetorical framing and an attempt to demolish an invented myth, sort of like finding an archetype on Twitter to despise who doesn’t really exist. If we are to take the corporate analogy seriously, then the regime has constructed itself like a corporation with a fairly hard budget constraint — it spurns borrowing whenever possible. Despite the points Inozemtsev raises about social spending being frozen in real terms, those constraints are also built around assumptions about the potential risks to Russians’ savings if more is actually spent and done for the public. He overstates his case a bit for the piece rhetorically given that we have some observable metrics for consumption that don’t support his contention of a society in complete stasis since 2000 though I staunchly agreement about the refusal to actually build things or invest properly. What’s unclear is why the spiraling transactions costs needed to maintain the proper allocation of rents go to elites without necessarily reaching contractors or the public necessitates some new formulation of a political entity. What the piece really criticizes is the breakdown of the social contract the regime has relied upon, but that reflects the stagnation of the economy due to structural factors since 2012-2013 and Putin’s return to power. Up until about 2005-2006, there was not necessarily proof it would turn out as it has. I recall even Dmitri Trenin remarking in 2005 that the regime was at the point where things usually go wrong in Russian history.

Take the Gulf States. They’re effectively family-owned businesses endowed with formal state powers trying to enrich themselves to the extent possible without risking a loss of power. Spend a day reading about the UAE’s modernization efforts and you realize that everything is couched in the language of McKinsey and public-private partnerships, sunny sounding commitments to improve gender equality, or else raise social happiness. But the entire system still hinges on certain families’ control of revenues and access to resources, their ability to promote their own within state institutions, the leading banks, or the energy sector, and their ability to buy the support of Emiratis while remaining silent about import wage slave labor and those dependent on the earnings found in the Gulf to remit money back home. The distinction is not that they aren’t a corporatist state — even the ‘formal’ institutions in the Gulf often mirror neoliberal private sector solutions to public sector problems. The distinction is their degree of dependence on oil & gas, relationship with the West, and lack of pretense about challenging the international order since they largely benefit from the US dollar system and US security commitments and simply lack the same material resources to be military players like Russia. If Russia is a corporation as a state, it’s difficult to explain the rationale behind its economic orthodoxy when it could actually do so much more to enrich asset owners. Why isn’t the United States considered more corporatist when you look at key wealth statistics?

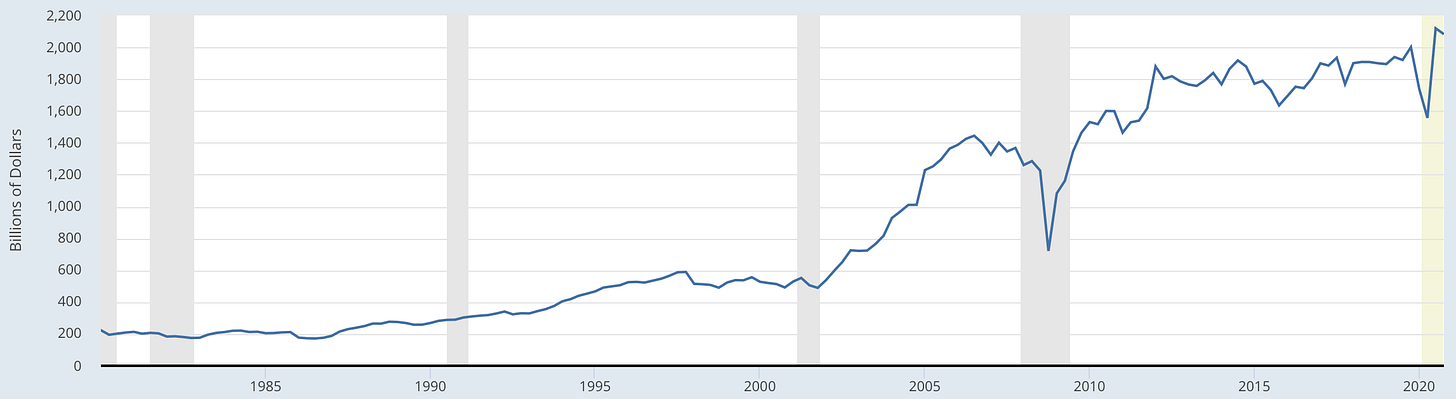

The US corporate landscape has been oligopolistic since the end of the Second World War and the political system and economic orthodoxy that evolved out of the inflationary shock fo the 1970s created a political class of asset owners who’ve benefited alongside corporations from the systematic dismantling of labor bargaining power at the expense of everyone coming of age after the Baby Boomer cohort. The following is corporate profits after tax (without IVA/CCAdj) in billions of USD at seasonally adjusted rates while incomes have massively lagged productivity:

Huge swathes of regulatory power were handed to private interests or else opened up to bidding from the private sector in Washington and at the state level since 1980, doubled by the expansion of contractor services that began under Reagan. The difference is that the system has to deliver wide enough growth to maintain the growing value and returns on assets, not just to a small group. By no means do I mean to suggest that the US system is much like Russia’s. But rather the attempt to use the corporation as a point of analytical distinction due to its attributes in the Russian case seems to me to be another case of demolishing a false idol by erecting another one, in this case by inventing a notional ‘commercial state’ when it’s fine to accept that Russia is still a state that functions like a state in some cases (if badly) that’s been cannibalized by competing interest groups, its own bureaucracy, and need for great power status. One can find these problems in other forms in many, many systems. Vladimir Gel’man very effectively drew comparisons between sub-national authoritarianism as practiced in Chicago — a system I admittedly loved growing up within — and Russia. The spiraling transactions costs Inozemtsev refers to are as much a result of the macroeconomic orthodoxy forged by true-blooded statists like Primakov in 1999 as the corporatization of the state and mobilization of criminality for specific ends. For instance, painting Wagner mercenaries as somehow a novel innovation is truly bizarre. The United States has actively armed, financed, or else coordinated military and intelligence activity with Latin American paramilitaries for decades in a manner expressly designed to minimize the culpability of the state. The distinction is that this was activity authorized by a state firmly in control of itself and its resources. Policy entrepreneurship doesn’t beget the same kinds of rents, though even this distinction gets cloudier when you consider what PMCs and defense contractors are constantly doing in the Washington D.C. metro area. Even the OSINT phenomenon now celebrated by many is a symptom of rent-seeking attempts by private-sector actors looking for state money to exploit the securitization of all policy. These practices then filtered into the private sector, much the same way that political risk analysts started out as “bond vigilantes” offering their two cents about sovereign debt defaults or to help oil traders manage the security risks of the Middle East during the 70s and 80s.

These same problems dog the latest release from Chatham House lining up experts to address myths and misconceptions about Russia. Some pieces are great, some are not. Most of them traffic in the problem they claim to fight against, a point raised by Mike Kofman and Sergei Radchenko. The sanctions piece footnotes several security articles to support the case that sanctions stopped the 2014 advance on Mariupol, but something tells me no author has actually interviewed anyone who was there on the Russian side as to what happened operationally to be able to reasonably infer that sanctions were the actual cause. The piece on the West never promising Russia NATO wouldn’t expand confounds a formal guarantee with the verbal assurances made by H.W. Bush’s team that were tossed out because Clinton’s foreign policy team lacked the same restraint figures like Baker observed. Criticism of the EAEU as incapable of driving integration in Eurasia is only strictly true as a result of Russian macroeconomic policy i.e. it’s obsession with maintaining a current account surplus to then support domestic industries at the expense of more efficient imports, though it’s correct that the EAEU isn’t analogous to the EU at all. Philip Hanson’s argument that deeper shock therapy could have worked better for Russia — setting aside the lack of an opportunity to integrate with Europe vs. Poland — is a massive stretch that seems to consciously ignore the political economy of the crash after 91’. The Central Bank can be blamed for printing money to keep industries afloat that might otherwise have gone under with a harder budget constraint, but the structures most capable of surviving would have been the military and security services. Shockingly, those are the institutions that benefited form self-imposed stagnation and limits on investment since Putin came to power. Russia needs to be accepted as part of an international continuum of political economy that utilizes what we see elsewhere, not just what we see in Russia. One of the biggest problems with Russia analysis is how self-referential and closed it can become, also a result of the self-serving political discourse around Russia-related policies that leaves the newer generation(s) of Russia experts constantly on the defensive trying to justify research funding and their relevance. I’m guilty of that as well. I just wish more attention was paid to the structures that fit into broader discussions applicable elsewhere instead of finding ways to say “well, you just don’t understand the place” over and over again.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).