Roll Up Da Dro

Lead the game on a hydrogen note, flow opera

Top of the Pops

Confusion reigns in Bishkek. President Zheenbekov has signaled he is willing to resign as president. He dismissed prime minister Kubatbek Boronov this morning, and with him, the cabinet though they remain acting in their respective roles for the time-being. The military’s chief of staff Raimberdi Dushambaev was also dismissed. The Central Election Commission says that by law, new elections are to be held a month from the date of the original election if no conclusive result occurred. In short, chaos.

The Armenian and Azerbaijani governments have reportedly agreed to consultative talks lead by Putin and Russia’s foreign policy establishment in Moscow. Armenian president Armen Sarkissian has accused Turkey of ‘creating another Syria’ in the Caucasus. Though Moscow’s entreaty to talk is welcome for hopes of deescalation, Turkey’s fundamentally changed the negotiating calculus for both governments. There’s little reason to believe that the conflict is going to ebb quickly at this point, but that could change in the coming week.

New COVID cases have hit a daily record high in Russia while the Kremlin refuses to push for harsh lockdown measures at the national level. The RBK chart captures how bad it looks:

The important stuff: Salmon = new recorded cases of infection Black = deaths

After telling governors he didn’t want another tough lockdown, Putin 2 days ago asserted that the government was ready for “any development” with the coronavirus. A new round of lockdowns could prove fatal for the country’s struggling SMEs, and the bankruptcies would ripple out into the banking sector. As always, their struggles are a policy choice, and one will fast prove disastrous if infection rates aren’t brought under control. As of this morning, the mayor of Moscow is now considering closing restaurants and bars.

PM Mishustin has tasked the cabinet and government with working out a contract mechanism with MinEkonomiki that will guarantee investors there will no be changes to the conditions under which a long-term investment is being realized from the initial expenditure of capital onward. Nothing screams confidence in a business climate like saying they need help. The scheme calls for guaranteeing investment terms for investments worth 10 billion rubles ($129.7 million) or more for up to 20 years, investments of 5 billion to 10 billion ($64.9-129.7 million) for 15 years, and anything less for 6 years.

Aeroflot raised 50 billion rubles ($648.5 million), including 9.1 billion rubles ($118 million) by open subscription. Money from the National Welfare Fund did the heavy lifting, with retail investors taking on a relatively small share of the action. Foreign investors grabbed 40% of the open subscription issuance, raising some quick money from abroad (take that, America!) while the state was able to hold onto a majority share of the airline of 51.17%.

State banks bailed out MinFin by buying a whopping 700 billion rubles’ ($9 billion) worth OFZ issuances in September. The Bank of Russia took part in by borrowing credits from the CBR and then buying bonds, dodging legal requirements that it not directly provide credit for the budget. The trouble is that while the banks' have plugged the hole left by a lack of domestic and foreign investor interest, the debt raise has little effect on the economy without more fiscal action. It’s the same problem plaguing the US recovery at the moment. Fiscal plans can save the real economy, not just easing or debt raises.

Future’s So Bright, You Gotta Buy Shades

I stumbled across this story today in Kommersant briefly summarizing the state of patent issuances in Russia. Needless to say that Russia’s R&D has lagged for decades, not not been discernibly improved by the growth that oil & gas rents fueled. Moscow’s Higher School of Economics compiled a statistical overview of patent registrations:

Title: Dynamics for registrations of orders transferring exclusive rights (to a patent)

Green = transfer orders by agreement on the provision of usage rights Orange/Yellow = transfer orders denying usage rights Purple = transfer orders by different agreements. Black Line = patents for inventions, useful models, and industrial designs

Russia’s slowly producing more patents, but the transfer orders for the use of patents aren’t keeping pace. In other words, patents aren’t entering circulation and use in the economy at an effective rate. That’s a glaring problem for the next decades of growth, not only because of a loss of access to some imports for the O&G sector and higher import costs due to the depreciation of the ruble since 2014. Per a snapshot from the OECD on % GDP spending on R&D:

We’re missing a 2019 datapoint, but the picture is clear. The US and Germany are way ahead in real and GDP adjusted terms, and China’s pulling away. Traditionally, the focus on R&D differentials in Moscow would concern defense exports. Since 2000, China has steadily stolen and adapted a widening range of Russian military designs, whose export would raise billions more in foreign currency earnings otherwise and help lower the costs of Russian defense procurement plans by using markups on foreign markets. It’s become a glaring drag on growth since 2013-14, and a growing problem for the energy sector. Using the above graph, I quickly calqued data in Current US$ terms from the World Bank to give a snapshot of total nominal R&D spending in the Russian economy, most of which is really defense spending linked to the defense budget and very little of which is Russian energy firms spending internally since they prefer to import foreign production or else form JVs where the heavy-lifting for the IP is taken from abroad:

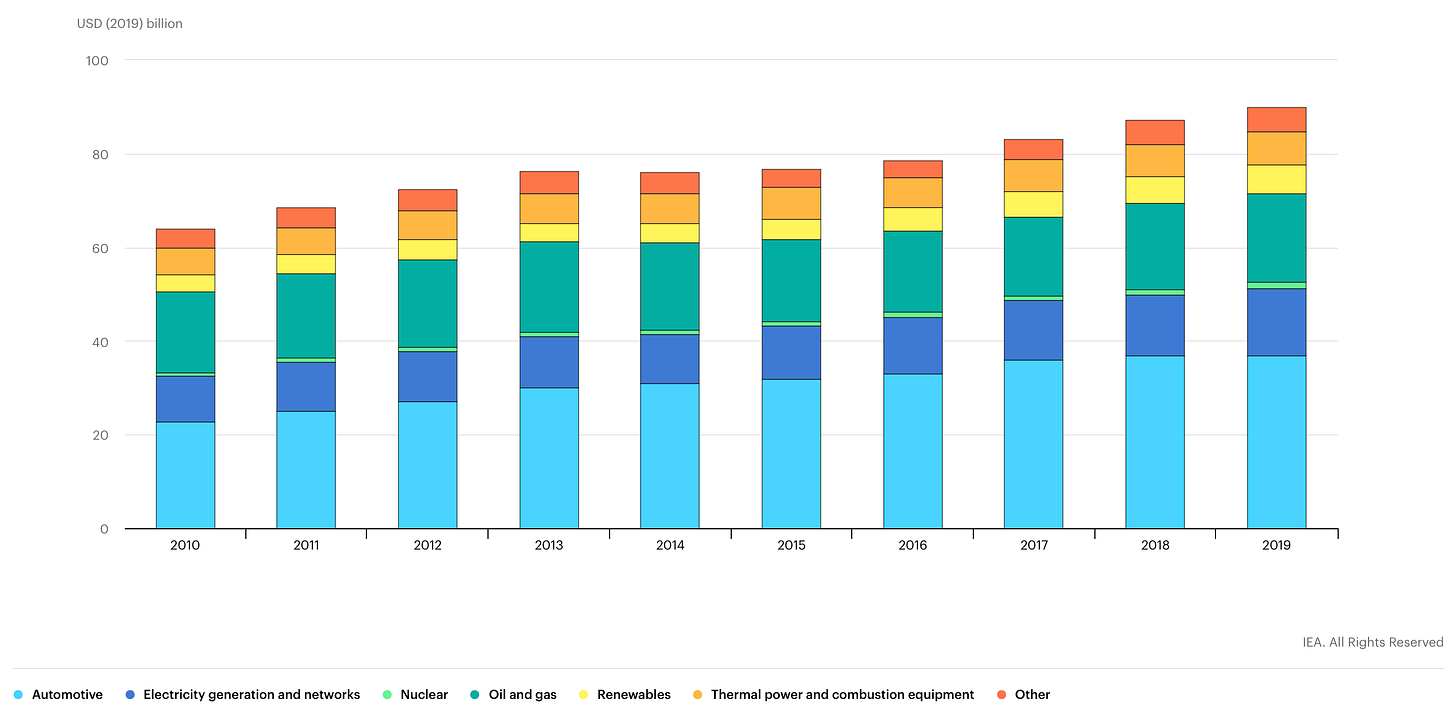

By comparison, the IEA estimates that total corporate R&D spending in the energy sector globally now sits around $90 billion:

Note that these figures are likely about to receive a kick thanks to government stimulus plans and crowding in effects, particularly in Europe where the EU, lacking dynamism in many economic sectors, is going to try to push large European MNCs to go all in on the green deal. Future global growth requires a new normal for research and development investments. Steps like canceling tax amortization of corporate R&D in the US are on the table as a first step.

In Russia, the biggest innovations driven by investment come from firms like Sber pushing ahead with the digitalization and streamlining of services. The problem is that while many of these innovations are great for firm returns, they actually don’t entail large research spending commitments and are, just as often, leveraging existing tech to lower marginal costs to deliver services. It’s a bit like FinTech. A lot of it is “innovative,” but it’s really just recreating existing services in a new medium with lower overhead and, one hopes, more user-friendly and customer-friendly functionality with the added bonus of monetizing your data. The result is a two-speed state in Digital/Innovative Russia: some corporates and specific Russian agencies, namely the Tax Service, have proven very, very good at implementing digital services and new technologies to improve service quality, but they’re much better at offering what they already do without substantial IP investments than in creating the new products of tomorrow with risky investments of capital. It turns out that the chronic short-termism of the Russian economy, ostensibly tamed by low inflation, is a systemic risk for a post-pandemic recovery. Protections for patents and planning horizons have to improve. It’s a damning sign that innovation already taking place even within existing constraints isn’t being tapped effectively.

Peek-a-boo Oil

OPEC quietly admitted defeat in its World Oil Outlook yesterday, now citing an oil demand peak in 2040. But the increase in demand through 2040 they forecast is just about 9.2 million barrels per day higher than in 2019, when it was about 100 million bpd. That’s an average annual increase of 460,000 bpd, less than half the rate of growth pre-COVID and that’s again before factoring in that they have little clarity on economic policies, rates of tech adoption, future trade scenarios, R&D budgets, and more. The very fact of admitting that a peak is 20 years off is itself important, as is the decline in marginal demand increases they forecast. The report can be downloaded freely, I need more time to go through it all but this is a clear assumption about why demand is sticky:

In the big scope, China’s share of global GDP ends up basically equivalent to the US and EU combined. One wonders, however, how exactly they square with the issue of inequality and, notably, how China’s supply side stimulus response is worsening it. From an LSE blog post last year comparing the US and China in terms of income share for the top 1% vs. the bottom 50% through 2015:

Add in the insanity of the equity bubbles created through market panic, central bank policies, and the boom in the e-commerce economy sustained through lockdowns this year. Billionaire wealth in China has grown faster than anywhere else per this PWC report that just dropped:

The explosion of inequality decreases the validity of average income and per capita statistics often used to forecast forward demand as a baseline measure. It’s a classic models fall into treating each unit of national income as equivalent when looking at consumption, yet as Keynes and countless others well-established, there’s a point you get so rich, you simply aren’t consuming much more in the way of physical goods. There are 24 hours in a day. There’s only so many restaurants and theaters and fishing trips and the like we can all take. Ironically, decreasing inequality could be a net benefit for future demand growth, but only with a status quo energy plan.

While there’s a slow change of consciousness in OPEC, MinEnergo is still managing expectations. Alexander Novak has done the usual song and dance about how hydrocarbons aren’t going anywhere, but made sure to highlight intentions to sign a memorandum with German partners to research hydrogen power’s potential. The broader move now is for anyone looking for a piece of Gazprom’s action in Russia to get in while the getting’s good and prepare since there’ll be more dual-use tech for hydrogen that can be built out of infrastructure used for gas. Igor Sechin jumped at the chance to sell Putin on Rosneft’s willingness to build Far East LNG in Primorskiy if the “fiscal conditions” provide stable returns. He wants tax breaks.

Now that hydrogen is creeping into the conversation, Rosatom and Novatek are angling to compete with Gazprom for that future market. But the same recurrent problem arises with attempts to supply the European market - effectively the first mover for hydrogen (at least so far, barring a massive change in US and/or Chinese policy) - that other sectors face. Hydrogen has to be produced, separated, and refined to supply energy, which means it takes a fair bit of energy to make it. Per the IEA’s cost estimates for hydrogen production by power source in 2018:

These costs are going to change, but if the EU commits to its carbon border adjustment mechanism, Russia’s relative producing advantage - subsidized energy prices on the domestic market and a glut of domestic supply of hydrocarbons - will be less competitive against projects to produce hydrogen in Europe proper or elsewhere depending on electricity costs and sources, taxation, and the netback differential after shipping.

The shift among oil market players to accept that demand reality is changing faster than they had hoped before COVID has structural consequences means that natural gas will be the hot topic for Russian majors. And natural gas lends itself better to diversification into hydrogen depending on how the next phases of R&D into its production and use go. Russian firms are going to lose their competitive edge depending on how the EU implements its own policy preferences, and any loss of customers in Europe will drive down prices trying to sell to China in many instances. Russia needs a green energy plan.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).