Top of the Pops

The IEA’s new demand recovery estimate for 2021 shows demand shooting up 5.4 million barrels per day back to 96.4 million barrels consumed daily. The overall impression is that the OPEC+ cuts have finally brought the market close to balance based on stock drawdowns vs. ongoing demand needs. OPEC is holding out for a 6 million bpd demand increase this year ignoring the likely effects of the current COVID wave in India:

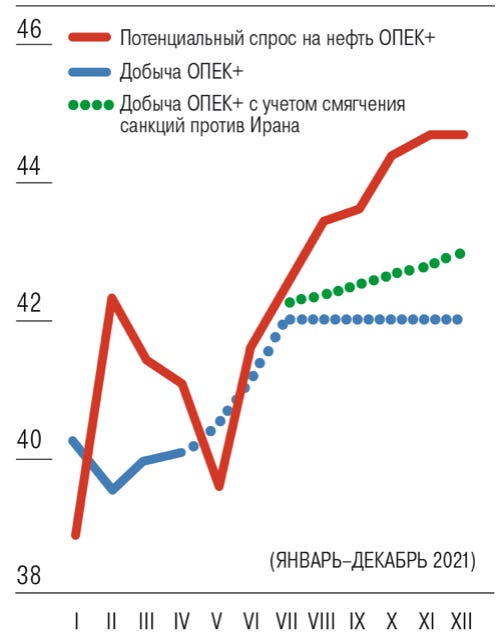

Red = potential demand for OPEC+ production Blue = OPEC+ production Green = OPEC+ output including an easing of Iran sanctions

The overall story is that we’re fast approaching a noticeable gap between potential demand and real output levels, which lines up with OPEC+’s plans to ease the the cuts back into July. That should provide a slight tailwind for the Russian economy at an opportune moment for the regime. Physical export volumes were down 22.6% in monetary terms for Jan.-March vs. 1Q in 2020. Rising production will also help offset some of the strain on domestic fuel prices. MinEnergo and the state opted not to enforce an export ban on benzine as a price control measure. A fair share of the price increase is down to the refinery turnarounds for maintenance that are just now peaking. By June, that specific source of supply bottlenecks should ease.

What’s going on?

On cue, retailers are reacting to Mishustin’s harsh rhetoric about greed driving inflation. Lenta is now asking suppliers not to raise prices for socially significant products until the end of September. In a letter it sent to various producers and wholesalers, it cited the concerns of state agencies and organs as well as the social responsibility of the business. The state’s contract with firms is clearly changing — Lenta is reportedly capping price increases to cut its own (thin) margins down and asking suppliers to follow suit. By the looks of it, Lenta’s trying to use its stronger market position to force others to play ball, but chains owned by the X5 Retail Group, Magnit, Auchan, and Metro aren’t publicly commenting cause they’re annoyed that Lenta doesn’t distinguish between incremental 1-2% price increases and 10% price increases. Really, it’s just trying to see if it can bleed the smaller competitors and move on their turf while making the state happy. Suppliers, though, can’t cut their margins so easily since their inputs keep rising in price and if any of them own productive capacity making things, well, they need the money to invest into more capacity. Lenta’s play is basically to try and jawbone suppliers from raising prices further. Even Kommersant’s coverage includes a reference to price increases being “objective” i.e. these efforts can only delay increases if they’re “really” happening. I wasn’t aware the Kremlin was so opposed to intersubjectivity on markets, but here we are.

The USDA is forecasting that Russia will harvest 85 million tons of wheat this year, with any fall in output per hectare offset by an increase in the total area under cultivation. That matches last year’s harvest and still excludes the 1 million tons expected to be harvested in Crimea. Russian forecasts from from IKAR, Sovekon, and Rusagrotrans forecast the harvest will be 76.8-78.7 million tons on a less optimistic note. An easier winter has helped things, all the more important since export levels are crucial this year to keep the sector on a growth trajectory. The following tracks the overall grain exports in mlns tons since 2010:

In the longer run, incentives are the problem for Russian agriculture. The surge in production and exports correlated to an expansion of subsidies and efforts to increase the total area under cultivation. But the most productive land is already worked for the most part, which makes additional capacity expansions less productive in relative terms compared to the subsidy support for domestic manufacturers supplying the sector as well as firms themselves. Further, the quality of a large share of Russia’s grain exports are often lower than competitors. Long story short, this year will be a little loopy statistically because of export bans and the changes to tariffs as well as seasonal differences and differences/gaps in the underlying data. Prices per ton in the Black Sea basin are up around $70 a ton compared to last year, and that’s going to be a huge draw as producers try to manage the government’s expectations about domestic price increases.

MinFin’s moving forward with more bond issuances as geopolitical risks have calmed down and doing it with the tried and true approach from last year — get Sber and VTB to buy most of it. It was the first set of auctions post-holiday pause. The first round saw investors demand a 6 basis point premium due to geopolitical risks and MinFin couldn’t place about one-third of the declared volume of bonds. At the second round, those two state banks bought 80% of the issuance, a strategy intended to calm domestic investors so they feel free to pile in on future auctions without so much concern for political risk. The state banks’ share of domestic auctions, to my mind, suggests that they’re playing a large part sustaining the return of non-resident investors. There isn’t really much choice otherwise for Moscow to maintain the appearance of financial calm. MinFin is continuing to lean on floating-rate bond issuances, a practice it adopted during the large debt expansion driven by the COVID crisis. But these floating-rate notes are ultimately held by state banks, allowing a greater degree of control over rate movements and auction targets. This is the new normal. Despite the largely cosmetic effect of the most recent sanctions announcements from Washington, non-residents don’t want to be caught out holding Russian bonds unless they have a very, very high risk appetite and can’t find what they’re looking for on other emerging markets with stronger growth outlooks and decent sovereign finances.

The Center for Macroeconomic and Short-term Forecasting is warning of a potential liquidity deficit later this year as the monetary base in the economy has increased, but more weakly than broad money. Their contention is that last year, excess liquidity remaining in the banking system was run down (as were savings), which multiplied the credit multiplication of money. This is in fitting with the support measures taken since they leaned on an expansion of loans to avoid more fiscal policy intervention. But this year, that excess liquidity has been used up — set aside the foreign currency liquidity crunch from 3-4Q — and MinFin has returned to fiscal consolidation, reducing the scale of money creation. Consider the expansion of broad money in Russia last year — 13.5% — compared to its expansion in the US and EU — 52% and 56% respectively. Obviously one has to account for differentiated levels of ‘monetary sovereignty’ since the ruble is a much weaker currency, not really internationalized, and has a much weaker hand less financialized home market not integrated into the dollar system. The problem is that last year, what kept things afloat were concessional loans — loans made at state-directed terms more generous than market rates. Those loans are drying up since the creditworthiness of borrowers has worsened and interest rates are rising again due to monetary policy. So any tightening of monetary policy risks creating more liquidity shortages in the future, shortages that are now worrisome because of the increased level of inflation. But it’s higher inflation that’s driving interest rate hikes in the first place. My own sense is that these concerns are probably exaggerated since the current account has recovered due to rising commodity price levels for exports, bringing in more foreign currency reserves. They’re still worrisome and go to show the problem with Russia’s approach to recovery. It provides ‘stability’ initially only to threaten sustained demand recovery.

COVID Status Report

8,380 new cases and 392 deaths were reported for yesterday. Things are getting weirder when it comes to policy debates — Mishustin had to shut down a nutty LDPR proposal to reintroduce exit visas for Russians to try and force them to travel more domestically in support of the tourism sector out of the inconvenience and restriction of freedom of movement. The first recorded case of the Indian variant of COVID was found among Indian students in Ulyanovsk — that’s sure to panic Rospotrebnadzor given it’s more infectious, even if vaccines are still effective at fighting it. Pharma firm P-Farm is set to start producing AstraZeneca for export. Too bad Russians won’t take AZ domestically given just how deep and broad vaccine skepticism appears to be. Since infection figures are so consistent on a daily basis, there’s significant evidence that the data has to fit a political narrative coming out of the May holiday. Piter continues to be one of the only places running real daily updates to fret about — week-on-week infections were up 34.63% yesterday (1,213 or 14.5% of national cases officially). If the upward trend continues, hard to imagine you wouldn’t see some evidence elsewhere of similar outcomes from the end of the holiday period.

Out Cold

Qatari authorities are reportedly in talks with Chinese firms to take equity stakes in the North Field expansion, a $28.7 billion LNG project that will lift LNG production capacity from about 78 mtpa to 110 mtpa. The announcement isn’t yet a hard deal so we should exercise the usual caution lest we fall into the trap of taking every MoU as the gospel truth. But even a 5% stake is a big deal for the “equity diplomacy” that Gulf exporters and external powers play when trying to secure supplies and influence in the Middle East. Despite Rosneft’s creative dealmaking with the Qatar Investment Authority, Russian firms are effectively shut out of these types of acquisitions now due to sanctions pressures. The North Field expansion is the world’s largest LNG project and the cost basis — $4 per mbtu — is on par with low cost projects in the Russian Arctic. But it’s a better play logistically — it’s easier to swap cargoes and redirect supplies from Qatar depending on needs since LNG volumes can be re-exported and spot trades for LNG cargoes rise with demand declines in Japan.

The hunt to lock in cheap LNG is a critical component to the next stage of the energy transition, one Qatar is exploiting because of its low cost feedstock and advantageous geographic positioning for export markets. Before COVID-19, there was already a glut of LNG supply on the market compared to demand levels. We’ve seen some price swings because of colder weather in winter, but the overall view was that lower average LNG price levels would persist for a few years before demand pushed them up sometime in 2023 and hit a zone of uncertainty mid-decade:

This was borne out by a wave of LNG projects in the planning phases by 2019 waiting for clarity to take investment decisions, many of which were delayed or canceled by COVID. Qatar’s ploy with North Field is to smash through that ‘zone of uncertainty’ mid-decade with a huge low-cost capacity expansion to capture marginal demand growth while other projects wait. Australian production has plateaued just above 100 bcm. Despite Russia’s LNG gains led by Novatek, it’ll remain a peripheral player unless it can break through like Qatar on an increasingly uncertain market — OECD energy policies are likelier to accelerate a transition away from natural gas than pre-COVID when the industry could still hold out hope that it was a ‘transition’ fuel. The following is in bcm from BP’s statistical review. The shades came out funky but the top shaded area is the rest of the world and India is the second from bottom:

Qatar retains a huge edge over Russia and while Novatek will proceed with Arctic-2 LNG, Northfield will maintain that edge. There’s another factor at play — Qatar’s energy sector isn’t divided between so many competing interest groups. Novatek’s supply expansion plans were boosted by gaining more upstream assets a few weeks ago thanks to an intervention from Putin on Mikhelson’s behalf, but there’s a huge question mark as to how exactly the state intends to monetize the reserves on the Yamal peninsula. They’re expected to announce whatever compromise Andrei Belousov is able to strike sometime in early June. Qatar’s play for Chinese investment seizes on the continued worsening of trade relations between Australia and China — Australia supplies roughly 40% of China’s LNG imports and small importers have been instructed not to buy further volumes of Australian LNG. Large, state importers account for 90% of sales and received no such instructions, which implies a healthy awareness that they need to secure alternatives before pursuing a further “divorce” given Australia’s still a prime resource exporter well positioned for the Chinese market.

Gazprom’s hopeful that China’s demand for Russian gas supplies will grow 50% by 2030, leaving plenty of space for both Novatek and Gazprom to increase supplies as China eventually starts shutting down its coal plants. But Russian firms suffer from the regulatory drag of institutional in-fighting in Moscow and the inflation of domestic project costs worsened by the limited scope for western partners who are normally forced to impose some discipline by their shareholders. Fortunately Arctic-2 LNG is pretty much in the bag and investments into the project are planned to rise 50% to each $6 billion this year. But that rare bit of certainty thanks to political support aside, European carbon pricing schema are going to force Gazprom to redirect more volumes eastwards over time and affect investment rationales. OIES has a great overview of the state of carbon pricing in Europe I recommend flipping through if you’re interested. The stark lack of regulatory unity — despite having a shared emissions trading system, carbon pricing systems are still highly national in Europe and worsened by the UK’s exit — makes calculations about relative carbon tax burdens quite difficult. But we can see the trend from 2018 data cited by the European Commission that would only have picked up now that European carbon prices have hit record highs and will keep rising. Tax takes will follow suit in countries that haven’t reduced their dependence on emissions-intensive energy:

Prices yesterday hit 55 euros a ton, a figure high enough to pose serious downside risks to industry during the recovery period and prompting assurances from German authorities that price increases would moderate as investor confidence in the system stabilizes. Political and market pressures are still pushing them up.

MinEnergo and deputy minister Novak need to revise their priors if they sincerely believe Russia has a shot at producing 140 million tons of LNG annually by 2035 and take 20% of the global market. China is their most promising market and Chinese firms can move faster with more capital to access supplies elsewhere without fear of secondary sanctions exposure. And that’s before the slowdown in Chinese demand growth factors in. The role that energy efficiency gains will play in the next 10-15 years are frequently overlooked in favor of the ‘sexier’ conversation about decarbonization. Improved efficiency will have a much larger impact on demand for natural gas than fuel substitution since it’s still the logical replacement for coal on countries that need to avoid intermittency of supply as much as possible. China’s more focused on efficiency and targeted green energy expansions based off its spending plans for recovery:

Watch the Qatari announcement in the weeks ahead. Moscow’s biggest liability is its inability to decentralize major investment decisions. The regime has to guarantee everything with major foreign partners. Trust deficits buildup into investment deficits over time against the goals set out in the national energy strategy, while Gulf rivals with more centralized elites and control over resources, lower costs, and no political problems with Washington and Brussels have an easier time.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).