Top of the Pops

This report from the International Energy Analysis Department of Berkeley Lab dropped a few days ago covering the electrification of regional and long-haul trucks and it offers some serious food for thought. The topline takeaway is that with battery pack prices where they are now, a Class 8 Electric Truck with a 375 mile range operating 300 miles a day offers a 13% lower cost of ownership compared to a diesel truck with a mere 3% payload capacity reduction — this reduction would really only affect trucks operating at full load, and ignores continued battery improvements. Over 15 years, the owner of the electric truck would save $200,000. The issue of higher initial capital costs are the big issue (and perversely, expected future declines in battery costs can delay decisions to electrify in some cases). The following illustration of just how bad we are at forecasting is instructive:

On the left, the purple and green were moderate and aggressive price reduction scenarios for batteries as of 2010. The blue line is what actually happened. The rate of cost reduction is insanely fast compared to what the industry was banking on for oil demand a decade ago when prices were back to their $100 a barrel highs and should have supported faster fuel switching anyway. The right hand graphic shows the total cost of ownership for an electric truck as of 2010 vs. the decline in costs of ownership now. As we can see, the costs really are all front loaded, after which it’s a much better deal than diesel and not subject to the same variability of fuel costs. Once this trend takes off, diesel demand will tank globally, further shifting the refining slate and affecting spreads on dirtier crudes including the declining quality of Russia’s Urals blend as West Siberian field depletion affects its composition. Further price drops lie ahead and even the surge in commodity input prices for stuff like nickel already worrying some EV manufacturers won’t massively change the economics, and will probably accelerate research efforts into substitutes. But even with the current price level, the initial costs for an EV truck are 75% higher than a diesel one. The solutions to these problems are predominantly a matter of fiscal policy with some role for regulations — governments need to reduce the risk for firms making the switch while also accelerating investment into the infrastructure needed to sustain charging stations, including installing independent sources of power for them, as well as mandating ICE vehicle retirements. Markets, like history, need a push sometimes. Marginal price takers on the oil market banking on sustained road fuel demand may find they’re in for trouble, especially in Europe where the density of transport corridors makes shorter-haul freight routes more feasible.

What’s going on?

Talk of using money from the National Welfare Fund to invest into infrastructure is moving fast, with the possibility that spending start as soon as the next few months. Since the NWF holds liquid assets worth more than 7% of GDP, as per the rules inspired by Kudrin’s consensus-built approach to oil revenue sterilization, Siluanov is happy to open the taps ahead of the elections. What’s funnier to see is how they’re trying to stretch the money: the NWF contribution isn’t to exceed 25% of the worth of the project and 40% of the money spent on it. The ploy gets a bit hazy since the 2021-2023 GDP forecast has to be adjusted in the law alongside the law governing spending from the NWF in case since in the current 2021-2023 budget, the liquid funds available = 7.1% of GDP and are projected to fall to 6.76% next year and then rise back to 6.97% in 2023. Oddly, there’d been talk of doing this back in 2019 but they held off — presumably a mix of political uncertainty over US elections and a misreading of the investment cycle were mostly to blame. As of now, the fund has 8.7 trillion rubles ($118.14 billion) to spend, a huge sum lying around but remember they’re only talking about using 1 trillion rubles ($13.58 billion) of that. The idea that no more than 40% of the money for any given project comes from the NWF is a clumsy way of trying to crowd-in investment from the private sector since in many cases, if they spent at a higher rate but took the full burden in the state’s hands, the ensuing investment after developing infrastructure over several years would probably be worth more. In this scenario, they’re going to harangue friends of the regime to invest alongside the NWF and hand out pork barrel spending at the regional level. I’d expect United Russia to campaign on some of these projects.

Levada polling on national attitudes regarding Russia’s place in the world — is Russia “European”? — and how Russians relate to the West offer some interesting food for thought:

Dark Blue = European country Lighter Blue = Non-European country Light Blue = hard to answer

Despite the ostensible polling gains we’ve seen since the worst of the Crimea fever regarding attitudes towards the West, fewer and fewer people see Russia as being European. The question, of course, is what their answers actually mean. Do they wish it was European? Does European denote a specific idea of what a state is i.e. having a stronger social safety net? None of that is laid out here. My own wager is actually the latter. ‘European’ probably denotes a level of socioeconomic development and the longer that economic misery continues unabated and the state opts to spend less, the less ‘European’ Russian society looks like. I struggle with the idea that this just cultural given how much more internationally-facing the online information space is, particularly since the polling shows that the younger you are, the less likely you are to believe Russia is European. This gets slightly more complicated when adding the survey question “do you consider yourself European?”

Dark Blue = Strong/leaning yes Lighter Blue = Strong/leaning no Light Blue = hard to say

Less than a quarter of those under 40 feel they’re European. I again don’t think this is necessarily evidence of a cultural division or successful promotion of a ‘Russian’ sonderweig or Eurasianism, but rather the identification of not living in the EU, which has become largely synonymous with Europe, and of losing any claim to being a part of the community implied by the EU. This is my own stab in the dark, but I think it’s an interesting fissure point for the regime for younger Russians while older Russians who are more secure economically probably see no problem in not being European or else see things as stably European in some respects. There are undoubtedly going to be some cultural considerations, but it seems logical that there’d be a significant link between a rising level of political repression and falling belief in the country’s “Europeanness”. There are of course hundreds of ways to take the question and it’s not particularly material to daily life. Still, in a climate where people are at least cognizant of political tensions with the West because of the Kremlin’s obsessive spin machine probably contributes a fair bit to this dynamic as shown by the age breakdown.

Liberal Democrats Sergei Katasonov and Dmitry Pyanykh are making waves by proposing a bill that would extend and expand tax breaks for small and medium-sized businesses since the two reps argue that this year, SMEs will cut their staffs by 20% and pay by 18% due to economic conditions. One of the bill’s main aims is to expand the use of the patent tax system to make up for fact that the previous preferential tax system — the unified tax on imputed income — ceased to operate last year amid the hubbub about emergency measures ‘helping business.’ The bill targets firms with 15-50 employees earning 60-150 million rubles. They also want to hold the corporate tax rate on SMEs for 2021 at 4% for those doing fine and 0% for those in the hardest hit sectors to help drive recovery. The problem with these proposals, aside from only really helping the worst off firms, is that preferential tax schemes in Russia invariably create new means for businesses to dodge taxation via fragmentation i.e. dividing up different functions into different firms owned by the same individual or enterprise so as to reduce their tax obligations. Further, the types of changes to the tax code would reduce regional revenues. The only way to offset this is would be an increase in federal transfers, and we all know how MinFin looks at spending any money it doesn’t have to. The proposal is worth considering not so much for policy implications, but the politics — the longer the economic crisis drags on, the more policy entrepreneurship we should expect.

The Federation Council is preparing to introduce a bill on March 31 that would establish a ‘damping’ mechanism akin to that seen for refiners but in this case used to regulate exports of sugar. Initial proposals aim to start talks between EAEU members to set a floating system of import and export duties on white sugar and raw sugar based on domestic sugar prices. The relevant committee at the Duma has already taken part in discussions on the matter, with the Union of Sugar Producers of Russia protesting vigorously as one might expect. Producers warn the measure would be a catastrophe since the sector is already voluntarily following price-fixing agreements with the government and the new duties would do significant harm to profit margins, production levels, and investment into production since firms would find more profit elsewhere rather than refine beet sugar. Of course, the Association of Industrial Confectionary Enterprises thinks the policy is great since it’d keep their feedstock prices lower (in theory). There are rumblings per VTimes reporting that there’ll be deficits of sugar by summer, which will surely lead to price increases. The problems are only escalating and the policy instruments and proposals leaders are scrambling to propose are all myopically terrible attempts to reconstruct a more closed economy divorced from international price levels, now making use of the EAEU to that effect.

COVID Status Report

9,803 new cases were reported against 460 deaths. The decline seems to have hit a bit of a plateau, but it’ll take another week to become a ‘mini-trend.’ The map of total infections isn’t significantly changed, but we can see most of European Russia save the south around Krasnodar has improved a fair bit in the last 6 weeks:

The Russian government refused to move on domestic COVID passports, but appears to have acquiesced on the international front and is now putting together a certification for travelers who’ve been vaccinated in Russia to use abroad. It’s part of international efforts, led by Europe in this instance, to work out a system to try and save long-suffering tourism sectors worst hit by the pandemic. There’s also lingering risks for resurgence because of Russia’s approach — St. Peterburg saw a 45% increase week-on-week in COVID hospitalizations in the last 24 hours. Nezavisimaya Gazeta notes that post-COVID health complications could affect workforce participation for millions of Americans in the wake of the pandemic, with the acknowledgement that the same problem will be true for Russia given its excess mortality rate since the pandemic started implies 400,000 Russians have died directly or indirectly from the pandemic. As these cases come to light during the economic recovery, the regime better hope it’s not stuck explaining itself to the public. So far it has no answer, nor any plan for how to address these problems that can be discerned from its policy announcements.

Dysfunctional Finance

With Biden’s line that Putin’s a killer soaking up inordinate coverage — media outlets and markets are trapped covering political events through the filter of Trump i.e. obsessively weighing every word or phrase — Anton Siluanov is doing his job and working out how to avoid sanctions pressures in the event that the Biden administration really does escalate things. “We’ll find an answer, we’ll find a solution for how to act in this situation so that we fully finance all priority spending.” As always, the fear has arisen that deficits have to be avoided to dodge borrowing, which creates sanctions risks — this is strictly true given foreign investors still hold OFZs but last year’s net expansion was domestically borrowed. Worth briefly checking bank sector liquidity (year end numbers) against the budget deficit and inflation rates since 2017 — the bank sector data isn’t available further back through the CBR portal:

Key takeaways: there isn’t a strong or clear relationship between inflation and the budget deficit, budget surpluses have coincided with liquidity deficits in the banking sector i.e. more operations for the CBR to backstop it because of lending expansions often financing consumption making up for lost income worsened via the budget surplus, and the sector ended 2020 with a slight surplus after SOEs were forced to hand over foreign currency reserves and withdrawals from banks were stanched somewhat in 3-4Q. To put it simply, there isn’t any direct link between the injection of reserves from the CBR into the banking system and levels of inflation in the economy, now the biggest fear among policymakers. But Siluanov’s policy premise is that they have to get rid of budget deficits to ensure stability in the event of further sanctions. No doubt US sanctions on sovereign debt would be incredibly disruptive and create massive risk premium movements for asset prices as well as concern and capital flight for non-resident investors holding Russian bonds, but it’s not clear Siluanov’s fears — and the approach now adopted — correspond well to reality in the Russian economy. For one, the CBR’s review of financial sector risks shows that Russia holds the vast majority of its sovereign debt now:

Descending list: Russa, UK, US, Belgium, Singapore, France, China, Luxembourg, Germany, Cayman Islands, others

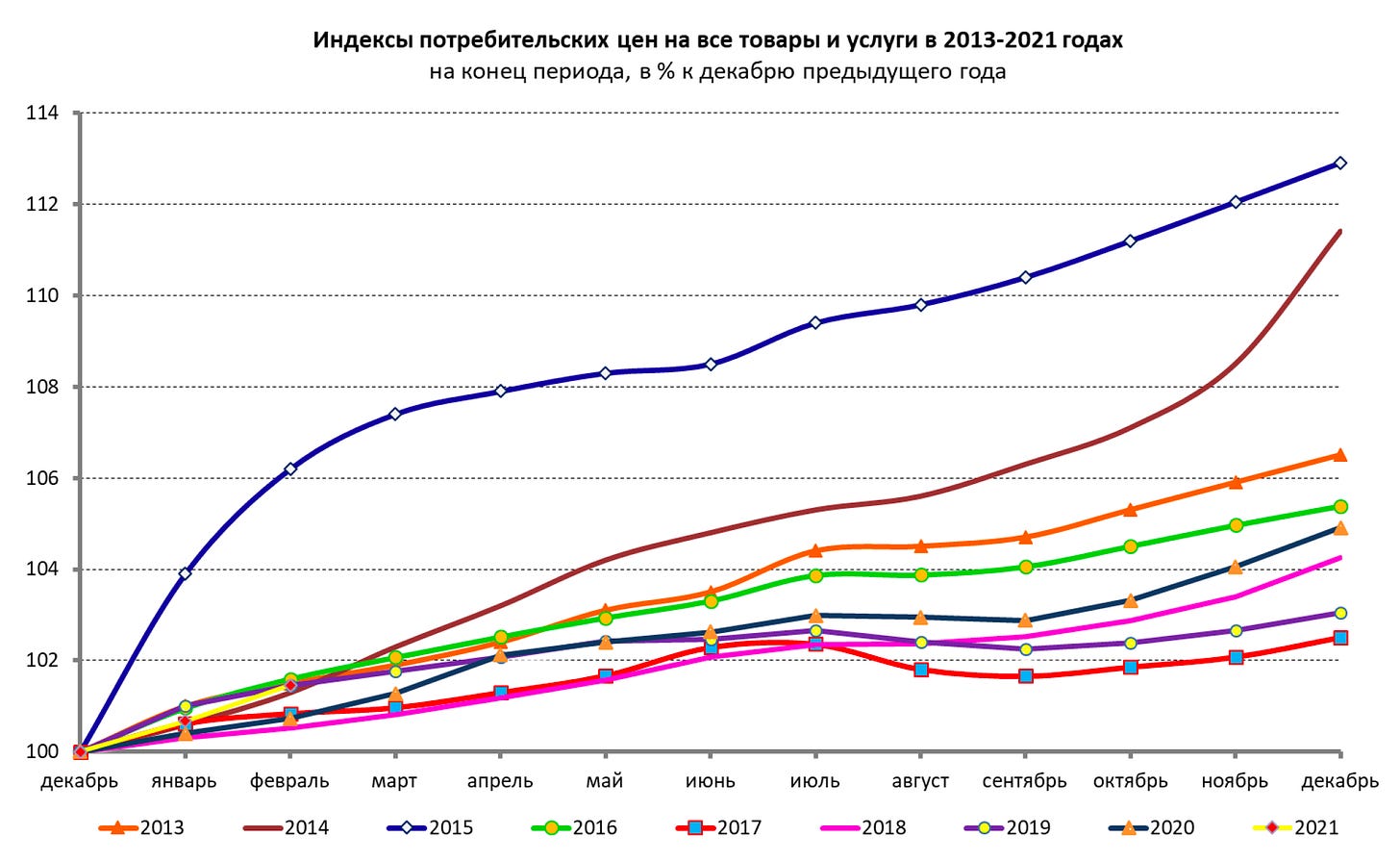

Note here that China is a completely insignificant player for Russia’s sovereign borrowing, which I’ll return to since that may contribute to Siluanov’s concerns. But Russia holds over three-quarters of its own debt. If debt was targeted — that’s a huge if given that the US Treasury compromised as far as it was willing to back in 2019 with limited action against non-ruble sovereign debt issuances — the effects would be relatively concentrated in terms of which foreigners are holding the debt so there would be an initial run of considerable magnitude. However, there are plenty of reserves in the National Welfare Fund, the non-budgetary pension fund vehicles, or else held directly by the Central Bank available to plug significant funding gaps. Further, Sber and other state-backed banks have been doing their patriotic duty and buying up OFZ with longer-term maturities to underwrite future spending. Bank pre-tax earnings were nearly 2 trillion rubles ($27 billion) last year with a terrible 2Q, thanks partially to the state-backed expansion of lending in 3-4Q. If MinFin wants to make sure it can finance borrowing, an increase in state investment into the economy could actually spur more demand for OFZs on balance sheets. The lingering issue is inflation, which threatens to drive up yields the higher it rises without higher inflation levels reflecting strong growth. So if they want to bring down inflation levels, they need to increase spending so the economy produces closer to capacity. The problem is all the more obvious when comparing annual inflation pathways for goods followed by services since 2013 when structural stagnation set in:

Goods are getting more expensive than services in relative terms because demand for them is far stronger given that the lower one’s income falls, the greater the proportion of one’s consumption is taken up by goods rather than services. China’s reticence to buy Russian sovereign debt may give Siluanov pause, especially since he probably hoped that increasing the yuan's role in Russia’s reserves would win brownie points and better tie the stability of returns on ruble-denominated bonds to the state of the Chinese economy and yuan exchange rates. Given recent history, Beijing remains cautious about entangling its relationship with Moscow with its tiffs with the US unless politically useful. Higher inflation fears, however, will drive down investor interest unless yields trend higher, making deficits more expensive. The inflation crisis is also a matter of macroeconomic balance for Fortress Russia’s semi-permanent deflation and corporate borrowing as well. Notice the splurge of oil & gas borrowing (light blue) in November just after companies were forced to hand over their foreign currency reserves (lhs = blns rubles):

The Central Bank and MinFin are out of ammunition if their solution is simply to return to budget balance and drive up private sector borrowing while inflation rises. Increases in real rates starting to take effect will eventually sap the recovery of its momentum, and are better handled through a surge of capacity utilization and state-led investment/income support than stagflation. At least then they’d get productivity gains and more growth. Fortress Russia’s looking weaker than ever having despite so much in hand to head off external shocks and it’s all by choice.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).