Top of the Pops

Mike Pompeo’s completely BS announcement yesterday that Iran has become the primary staging ground for Al Qaeda completes what’s been a 4 year campaign by him, hawks at or linked to the CIA, and most of Trump’s foreign policy team to find a way to link the standing AUMF passed after 9/11 to justify military action against Iran, thus bypassing congressional oversight for war powers. It’s a scary thought that something would happen as Trump leaves, but it’s as much, if not more, about Iran’s domestic audiences. Hardliners benefit from American bellicosity, and should they win the presidency or else become more visibly powerful in setting policy, it gets harder and harder for supporters of the JCPOA to argue for an attempted renegotiation or re-entry into the deal.

On top of that, news that Israel had launched more than 18 air attacks on targets near the Syria-Iraq border, including the urban center of Deir ez Zor with the intent of hitting Iranian troops and supplies is just the latest provocation from the Israeli Air Force aimed at escalating tensions and fighting in Syria. That it comes with Trump now heading out the door and staring down the barrel of an increasingly likely impeachment as Republicans abandon him is all the more worrying since both Netanyahu and Mohammed bin Salman are well aware that no matter what they do, Biden is going to be skeptical of moving to the use of military force as quick as they’d prefer should they believe the situation warrants active engagement with Iranian military forces across the Middle East. It should be a big red flag that AP has reported the attacks were carried out using US intelligence and that Pompeo appears to the be the one managing US involvement in whatever it is Israel is doing.

This continues to be a political risk that the oil market has decided it has no interest in because of the psychological bias to assume that if a conflict hasn’t broken out yet, it won’t in the future. Lebanon is moving to file a formal complaint with the UN over escalating violations of its airspace by the Israeli military as well carrying out mock raids in the country’s borders, presumably to plan for expected military and intelligence operations. These activities are largely in support of Israeli action in Syria and a stick in the eye for Hezbollah, one of the ‘tripwire’ groups the US has identified as a means of linking every possible attack or eventuality to Iran. Saying there’ll be war tomorrow is a mug’s game, but the risks that this blows up are very real, persistent, structural, and can’t be undone by Biden’s incoming defense and foreign policy team despite their own commitments to the original Iran deal and avoiding unnecessary military conflicts with no defined objective or victory that do not materially enhance the security of the homeland. Russian officials seem conspicuously silent, which either means they’re calling everyone on the ground now to figure out what’s going on, or else they have no idea what to do. Both are probably at play.

What’s going on?

Mishustin and the economic block in the cabinet and at the ministries are now working out which regions should have their debts written off and absorbed by the federal center in order to maintain adequate investment and development levels across the country using regional budget money. As of now, the bottom line is that project has to be worth more than 50 million rubles ($677,000) and applications for write-offs will be assessed individually. Regional governments have already applied for help citing 200 projects worth a combined total of more 1 trillion rubles ($13.5 billion), twice the amount of federal financial support for restructuring currently on the table. As of now, the aim is to negotiate the potential restructuring of debt in exchange for investment, a proposition seems fair on its face but runs against the more limited power of regional governments to raise revenues, particularly if the economic recovery continues to be weak. There’s evident skepticism that this approach will work, especially because it hinges on the use of investment contracts to attract private capital. Sometimes federal governments have to spend money to make money. If only Moscow understood that.

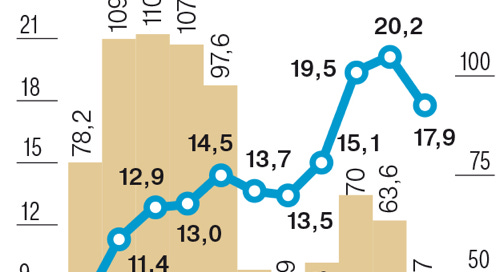

MinFin’s tallied up the annual stats for 2020 and with average oil prices down about a third from 2019, the budget’s budget revenues fell about 15.5% in inflation-adjusted terms (excluding exchange rate fluctuations) to 17.9 trillion rubles ($242.48 billion):

Blue = budget revenues Gold = Urals blend cost ($/bbl)

This chart somewhat understates the long-run shift in revenue streams and problems given the effect of inflation. Adjusting for it, net revenues in 2019 were actually comparable (again in purely inflation-adjusted terms without concern for exchange rate exposure) to 2012 when oil prices were over $110 a barrel. That’s no shock given the extensive mix of austerity/fiscal consolidation post-2014 to reduce the budget’s exposure to price fluctuations, but the inflationary factor is something to watch in the years to come. If oil settles around $55 for an extended period, the relative tax earnings will be higher because of a higher tax burden on the sector — this will hurt investment into production if anyone in Moscow still believes a big price recovery lies ahead, but offsets the relative spending power lost over time to inflation. Cumulative inflation between 2012 and 2020 was in the realm of 66% based on the CPI. Russian fiscal policy has accomplished a great deal in diversifying revenue streams (and increasing the overall tax burden while trying to limit spending commitments), but the expansion of Russia’s fiscal firepower post-2014 may be a bit overstated when comparing the effects of inflation to net economic growth over the last 8 years (newsflash: it’s been anemically terrible).

The Ministry of Finance has relaunched currency purchase operations — reportedly about $1.4 billion of them — to take place from Jan. 15 through Feb. 4 after a 9 month pause due to the pandemic and economic crisis. Over the last 9 months, MinFin had sold 947 billion rubles ($12.8. billion) from currency reserves to finance fiscal operations as needed in line with existing budget rules. It signals two things — confidence that oil is sticking north of $50 a barrel, which gives the budget a fair bit of breathing room and a clear upside for the ruble’s exchange value as the oil market stabilizes at a higher price and vaccinations proceed in Russia. I’m not sold on the latter quite yet since market experts aren’t public health officials and the new strain of COVID will change things rapidly. The risk of new sanctions and aggressive action from the Biden administration is, I think, reasonable muted by the scale of the problems it’s facing at home. Fiscal consolidation worked quickly. The question now is whether anyone in Moscow has the stomach to really push for pro-growth policies since the status quo being stabilized in Russia isn’t stable or working for enough people and sectors.

The end of the moratorium on bankruptcy proceedings put in place effective from January 7, 2020 is going to be an interesting test case for how much the political rhetoric and pressure to define the impact of COVID-19 affects legal judgments and business owners struggling to get by. The Supreme Court effectively ruled that if creditors can prove that their debtors weren’t affected by COVID-19, they can collect their debts in bankruptcy proceedings. Normally, that would be fine in legal principle. But since the government refused to use extensive lockdown measures for most of the 2nd wave of the virus’ course and there’s been quite limited federal action, that could get complicated quite quickly. It’s the type of conundrum that faced British businesses because of the structure of business relief programs. The longer the country used the tier system without a decision in Westminster and local councils who couldn’t afford tier 3 restrictions held out against applying them, the longer businesses and employees suffered without legal recourse to some aid. This is not a high-profile story to most observers, and I don’t think the Russian legal system is going to throw businesses overboard en masse. Still, if the economic damage stems from lockdowns and not the virus itself per policymakers’ orthodoxy, then they’re signing death warrants for SMEs struggling to make it through this crisis if legal judgements reflect those assumptions.

COVID Status Report

Infections held below 23,000, but deaths rose to 566 yesterday. Rospotrebnadzor is communicating that the situation has ‘stabilized’ across the country, which is borne out in the data but a fair number of question marks remain:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

Novaya Gazeta’s pass at infection data — they attempted to reconstruct where infections were taking place and get a sense of what impact “super-spreaders” we’re having on infection rates — confirmed my own suspicions. Industrial regions have tended to show spreading infections from factories and related sites since this crisis hasn’t provoked a supply-side shutdown, so people are at work getting sick. But it’s still hospitals that are the biggest spread risk across the country’s regions. That’s where the rubber meets the road given that continued lack of interest in articulating any new measures in response to new variants of the virus.

The Desolation of Smug

I missed this yesterday, but yesterday, RBK reported that Russia’s gold reserves had overtaken its dollar reserves for the first time in its history per CBR data. It seems that it’s entirely a result of gold’s appreciation last year against a weakening dollar. The value per oz peaked in mid-summer which, given the time series put out by the CBR went up to June 30, suggest it’s fallen significantly since then in valuation terms. However, the magic $1,800/oz price floor remains for now:

The basic problem for gold now is the Biden administration and Eurozone recovery. Inflation expectations for five-year breakeven forward in Europe are at their highest point since January 2020, 1.29%. Inflation expectations in the US are in limbo, but it seems the market is hoping that consumer prices are back on the rise, signaling proof of life for economic recovery as everyone bites their fingernails until Biden and a Democratic senate pass a stimulus bill. As inflation expectations shift, the threat that yields on US treasuries rise is driving investors away from buying gold. That could explain a significant part of the timing of MinFin’s decision to resume foreign currency purchases (gold purchases were halted last March).

The appreciation of gold reserves shored up the ruble’s value and, combined with the halt of purchases of gold, provided a bit of a stabilizer for the ruble’s purchasing power, though this had no appreciable impact on inflation found on any specific market such as the consumer staple woes evident in 3Q-4Q. Take sugar. By December, prices were up 64.5% year-on-year. There’s a fundamental disconnect here between traditional orthodox economic policymaking — the go-to obsession with old school ‘stabilizers’ for the nation’s macroeconomic health — and the root causes of price inflation — supply/demand mismatches, the bargaining power of labor and stickiness of prices vs. wages, the use of non-market supply management mechanisms, etc. The implied inflation from OFZ yields, however, remains under control and is the main concern given policymakers are trying to prevent a ‘too significant’ increase in Russia’s sovereign debt levels with the current, new fiscal consolidation program:

Implied inflation by maturity dates — Red = 2023 Beige = 2023-2028 Blue = 2028-2030

Observed inflation — Red = annual inflation Beige = 2020 forecast Blue = 2021 forecast Silver = 2022 forecast

The increased role that gold plays in the country’s currency reserves should raise questions about what these measurements of inflation are actually capturing when it comes to what’s happening on the street. After all, inflation measurements in developed economies have been at basement lows for decades, yet the relative costs of living measured by rising non-tradable service costs i.e. education and healthcare, rising asset prices for housing and land, and the combination of anemic wage growth with rising indebtedness meant that while inflation was low, things were getting worse for a growing number of people for a very long time. The disinflationary influence of gold doesn’t promote growth just because it tames topline inflation. Look at nominal wage growth from Rosstat data using just the last 3 years in a monthly breakdown:

Set aside that financial salaries are skyrocketing, wages nominally increased 20-60% for a huge swathe of the population — I consciously excluded government jobs, though the budgetary dynamics at play there would make gold more relevant to wage levels — in just 3 years’ time. Yet over that time, we’re led to believe that cumulative net inflation in the Russian economy, per the CBR, was around 13-14% using 2017 as a base. Now, nominal increases also reflect regional wage adjustments mandated by law meant to account for differential costs of living in Russia’s harshest regions, which plays a factor, but the rate of wage increases pared against real income changes for. the same time period suggest that measures of inflation — and the power of a larger pool of gold reserves to serve as a disinflationary buffer — aren’t telling enough of the story. Forgive the annual data points dropped in, but the spreadsheet was acting a little funny and I was pressed for time:

Between 2017 and 2019, real incomes might have cumulatively risen near 4-4.5%, yet nominal wage increases were often 5-9 times that. It lends more credence to the idea that low inflation reflects falling incomes, not a healthy control of the money supply or a growth-positive macroeconomic environment. Even the CBR’s 3Q 2020 review of Microfinance institutions and company borrowing reflected what it spun as declining net debt levels. But properly translated, it just means companies are deleveraging now that their earnings have taken a big hit from the current crisis, which will then correspond to lower levels of investment activity and, shocker, weaker nominal wage growth. The pervasive smugness of the economic establishment in Moscow, having solved the problems of the 1998 default crisis (and 1985-86’ oil shock to the Soviet economy), has largely blinded them to questioning the macroeconomic assumptions driving policymaking now. Kudrin’s calls for structural reforms don’t ultimately challenge any sacred macroeconomic cows. The current inflation targeting regime and corresponding low inflation doesn’t represent just the sound management of the economy by the CBR, but the straitjacket that the CBR, MinFin, and Putin’s closest aides have placed on standards of living, investment levels, and more.

Gold is an attractive reserve asset for Russia primarily because it can produce it in large enough quantities domestically to ensure relative security of supply while then using it as needed, either to raise foreign currency via sales or else to make the ruble seem to be a more valuable store of value. However, the deepened reliance on gold — aside from making little sense for the provision of liquidity or reduction of foreign currency dependence since its value is heavily driven by the dollar and US economy — reflects an increasingly evident problem: the traditional markers of economic stability and successful macroeconomic management in Russia don’t correspond to what actually drives price changes or potential future growth. Milton Friedman didn’t have the last word on inflation, even if I agree that many Keynesians and Neo-Keynesians too readily ignore the structural effect that changes in the money supply and the cost of credit can have on asset price inflation among other things.

I doubt there are plans to increase gold’s share of the country’s reserves much more precisely since gold is not liquid like dollars, Euros, yuan, yen, and other currencies. Even with a slight course correction, though, the deflationary bias built into Russian macro is emblematic of an operating policy framework that reflects many of the worst qualities of the gold standard era. If inflation lifts in developed economies in Europe, the US, Japan, and South Korea, it’ll be fascinating to see how the CBR and other political elites react. Many will say they were right all along about fiscal prudence, avoiding debt, and so on. But they’ll leave out the part that in many cases, OECD economies may see a recovery in real income growth that Russia can only dream of for now. Inflation alone isn’t the enemy. Inflation for inelastic goods that most people need to get ahead without wage growth is.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).