Top of the Pops

The ECB put out its financial stability report for November, and there are some red flags that caught my eye given that European banks don’t actually know when the wave of COVID-related non-performing loans are going to hit because EU stimulus plans were administered to save jobs rather than consumer demand creating a large bow wave of uncertainty. The report noted trouble for European corporates. The left hand side is %, the right hand side is % of value-added:

It’s essential to understand that COVID is not the core problem for economies in Europe, it’s just accelerated the underlying problem. Profit margins have been declining, gross profit growth existed but against worsening margins, which indicates greater need for investment (limited by the EU’s reliance on external demand via trade), and a slowly declining share of retained earnings from value-added. Exceedingly low borrowing costs since 2015-2016 weren’t generating demand growth because of a lack of fiscal spending. The current plans have been massive, but still haven’t fixed this problem and, if anything, it’s just as likely that the EU agreements around the recovery fund will be used as cover to pursue further fiscal consolidation i.e. austerity. European companies were becoming less competitive based on their profit margins pre-COVID so while it’s premature to talk about zombie firms barely surviving on credit, marginal increases in costs associated with debt servicing are going to impose larger drags on future investment if the economy doesn’t snap back strongly in 2021, especially as non-performing loans stress bank balance sheets, return on equity for banks was already declining pre-COVID, and unemployment numbers rise to their real levels reflective of which firms survive as we exit the policy support phase. Russia is going to take a corollary hit when that happens. European banks need to be better provisioned for bad loans. Who knew that crazy low rates reducing the cost of borrowing significantly encourage greater risk-taking for lending?

What’s going on?

It’s a big deal that Ozon’s listing on the Nasdaq led to a 40% upward rip in the price to around $42 per share vs. a 33% rise on the Moscow Exchange to about 3,190 rubles a share. Now capitalized at $7.5 billion, it raised $990 million off of the listing initially. Revenues are up 70% thanks to Russians ordering a lot more online, but losses have been consistent from 2019 since the company’s still burning cash to keep pace with capacity. Ozon has a lot of room to run as a growth stock, but it faces a serious problem after the current Santa rally on the market ends and investors come back to Earth in January: it can grow to dominate the Russian market, but consumer demand is structurally constrained in Russia. Maintaining the positive story for investors is easy for now, but watch what happens if income stagnation worsens on its home market.

The Center for Macroeconomic Analysis and Short-term Forecasting shows that we can see the growth of borrowing, some social support schema, and desperation pushed Russians to spend about as much of their disposable income in % terms as they did in 4Q 2019:

Title: Norms of Russian Consumption (as a % of Disposable Income)

Blue = factual Red = seasonally adjusted

That helps explain why the shock wasn’t worse in 2-3Q, but with real incomes declining in net terms, a failure to rise past the current levels would signal a plateaued drop-off for domestic demand in 2021. And it’s hard to maintain the same levels of disposable income being spent if indebtedness continues to rise past the current environment where important rates are subsidized or else at historic lows (that still require wage growth to be sustainable). The external shock transformed into an internal one via the distribution of the national income. But unlike 2014-2015, there hasn’t been a savings buildup in the same way and Russians are already slowing or stopping their credit growth to only pay for necessities. Unless Moscow intends to spend more than 3% of its GDP on real stimulus, that’s going to sap economic activity in 2021-2022.

Credit stimulus to boost Russians’ assets and investment prospects by subsidizing mortgages seems to have reached its limits in Moscow, where price increases for apartments have already overtaken any reduction in costs associated with lower borrowing costs. The only stimulus left to build up a pool of savings is to get more money into consumers’ hands so they can choose how to spend. Vedomosti is buying the sudden oil market bull run due to vaccine news and pushing the idea that a fast economic recovery driven by vaccine distribution could drive oil to $80 a barrel. That’s the only stimulus plan Moscow has left that could raise incomes and Russian equities, but it would require that any increased earnings accruing to the budget be distributed and the sector not be caught flatfooted by shale production increases in the US.

MinEkonomiki is trying to boost Russia’s flagging patent environment by allowing companies to claim exclusive rights to intellectual property developed in partnership with research centers and universities with a quick fix: allowing them to include IP in their authorized capital, thus increasing the amount of equity they can raise via their capitalization. It’s a simple idea that makes longer-term investment into R&D more attractive, especially for firms that struggle to list, borrow, or else raise capital on foreign capital markets (or else don’t want to). Startups currently get usage rights for IP developed from research centers, but those rights can be easily extended to others which makes any investment using said IP highly risky since the startup could quickly realize losses. Exclusivity, while generating monopoly rents for larger firms, at least allows smaller ones to own an innovative space for a short time before market competition catches up. 60-70% of all research spending in Russia is federal money. This is probably the only decent way to boost the private sector’s spending.

COVID Status Report

For the first time, Russia’s recorded more than 500 deaths for a single day with the total caseload of new infections at 23,675. The numbers continue to fluctuate up and down at a plateau in Moscow while rising steadily across the regions. RBK didn’t even include its regional heat map today, and we’ll see if it’s been cut until the news gets better the next week or two:

Black = Moscow Red = Russia Blue = Russia without Moscow

Znak ran a piece arguing for the introduction of immunity passports, an idea that has circulated since spring and finds voice in the UK under the guise of so-called “freedom passes.” They’re going to be necessary, I think, especially given the sheer size of the country and limits, self-imposed or real, on state capacity to manage rising infection rates. But that’s inevitably going to be exploited by local and regional authorities as well as those in Moscow with personal business and agendas to take care of. Mishustin has put forward an extension of a payment scheme for medical professionals and others working at COVID hospitals offering what amount to large bonuses per shift (depending on the hospital they work in) through the end of 2021. In place of ramping up state medical care capacity, they’re paying those taking the risks to keep to hold the system together and using some of these bonus payments to pay for what the hospitals themselves are short of, I’d wager. It’s a good policy, just one that says loads about the limits of Russian policymaking. Hundreds of millions if not billions rubles will be thrown at it to hide any fall off in incomes, cover for wage arrears, and more.

The Battle of Bull Runs

Reuters has it that Chinese oil imports from Russia were down 4% in October year-on-year to 1.56 million barrels per day and imports from Saudi Arabia were down 29% year-on-year to 1.4 million bpd. Facing potential gluts on the domestic market and across the region, Chinese refiners are slowing down their purchases. Since oil prices finally broke out of the $38-45 box on vaccine euphoria, no one wants to stop and consider just how immense the logistical difficulties distributing vaccines remain, as well as how much of the underlying economic shock at the moment actually preceded the virus structurally. But China’s consistent “over-buying” is being cut short by the lopsided nature of its recovery and, now, by the fact that relative price levels could be less attractive for a few weeks due to the current price rally. In the US, oil stocks are nearing April highs because of the impact of state-level restrictions and the unabated rise in COVID infection rates across the country suppressing demand. China’s replaced the role of the US on the oil market as a sort of “consumer of last resort” during this year’s turbulence. But that’s no longer enough, not necessarily advantageous for Chinese refiners, and important to track against China’s macro. From Platts:

Freight throughput begets oil product demand, whether that’s bunker fuels, gasoil, or diesel for shipping, gasoline or diesel for delivery and pick up of some goods and resources, and other ripple effects. Throughput here doesn’t necessarily indicate higher exports, but consider that Q1 showed China running a current account deficit when throughput levels were down during the COVID shock:

Given that industrial production recovered much more swiftly and strongly than consumer demand until about September-October — the gap in recoveries is still significant — it’s fairly safe to assume that the rise in throughput reflects higher export levels and China running up a current account surplus while other economies struggle. China’s consumer price inflation a few weeks back was at a decade low. That’s terrible news for a sustainable oil bull market given pre-COVID dynamics clashing with COVID-induced shocks:

This is a clumsy depiction, but you can see that the recovery in Russia’s current surplus post-2013 is almost entirely down to suppressed demand and devaluation, Germany’s surplus reflects suppression of domestic demand and intra-EU dynamics, and China’s current account surplus this year will be a result of skewed stimulus plans. These imbalances put a net drag on growth without COVID to think about. And these imbalances will also be hostage, somewhat, to the rate at which vaccines can be deployed. In theory, if China immunizes faster, its imports should recover faster based on improvements in consumer confidence. The same won’t likely hold true for Germany. Success in the US would likely absorb China’s surplus, but the Biden administration will be going hell for leather to help key US exporters too.

The “Rest” category is obviously quite heterogenous economically, but many of the relevant countries are heavily exposed to commodity price cycles and the CIS is going to stagnate with Europe I suspect. As we can see, oil consumption growth is being driven by China and the Asia-Pacific, counties that run current account surpluses and actually, often, suppress domestic demand in relative terms. There is no evidence of rebalancing taking place as of yet, which means that even assuming a best-case vaccine scenario, we’re looking at highly uneven recoveries not lifting demand as much as they could. The oil market bulls are taken with anecdotal evidence and generous readings of demand statistics in China and India in particular. Their thesis tends to simultaneously posit that these economies, adapting to social preferences to avoid public transport and isolate more, use cars more, etc., are proof that demand will come roaring back and, in the same breath, tout vaccines as positive developments for oil demand despite their efficacy presumably bringing people back to stuff like public transport. Setting aside jet fuel demand, there’s nothing coherent about the bull case. For now, take it as a pre-Christmas rally built on hopes for a better tomorrow. Until spring, they’re stumbling in the dark.

Dueling Mandates

OPEC+ has got itself a pretty sticky wicket. There is no way to boost oil prices with restraint and manage to capture more market share during the recovery. The lesson of 2014-2015 was that OPEC alone was inadequate to the task of righting the market from a flood of light, sweet crude from the US, worsened by the Obama administration’s decision to back lifting the export ban in 2015 that reduced the impact of rising US production on foreign markets and world prices. The problem is worsened by Russia’s inability to cut production as flexibly as Saudi Arabia. Were it not for Chinese demand for May-July, Russian firms would have risked spoiling a great deal of wells at fields that comprise the core of the sector’s brownfield and greenfield investment plans to sustain output levels and avoid massive capital expenditures on projects with high sunk costs and little existing infrastructure wherever feasible.

Putin has gone out of his way to publicly sell that everything’s copacetic with Gulf partners and cooperation is strengthening. Now that Novak is in the cabinet, it’s obvious the Kremlin wants to make it clear to Riyadh that the Russian state is in this for long-haul, no matter what the oil sector says. That is a viable strategy if their only concern is trying to keep prices above $40 a barrel, but it suggests that they’re out of options. The oil price has always been Russia’s primary stimulus plan, and while Saudi Arabia is sweating, they’ve sworn off tapping international debt markets again for the rest of the year. Both Russia and Saudi have adapted to the current crisis primarily by using domestic borrowing expansions. But they both know that any “return to normalcy” for the market doesn’t portend them grabbing larger market share.

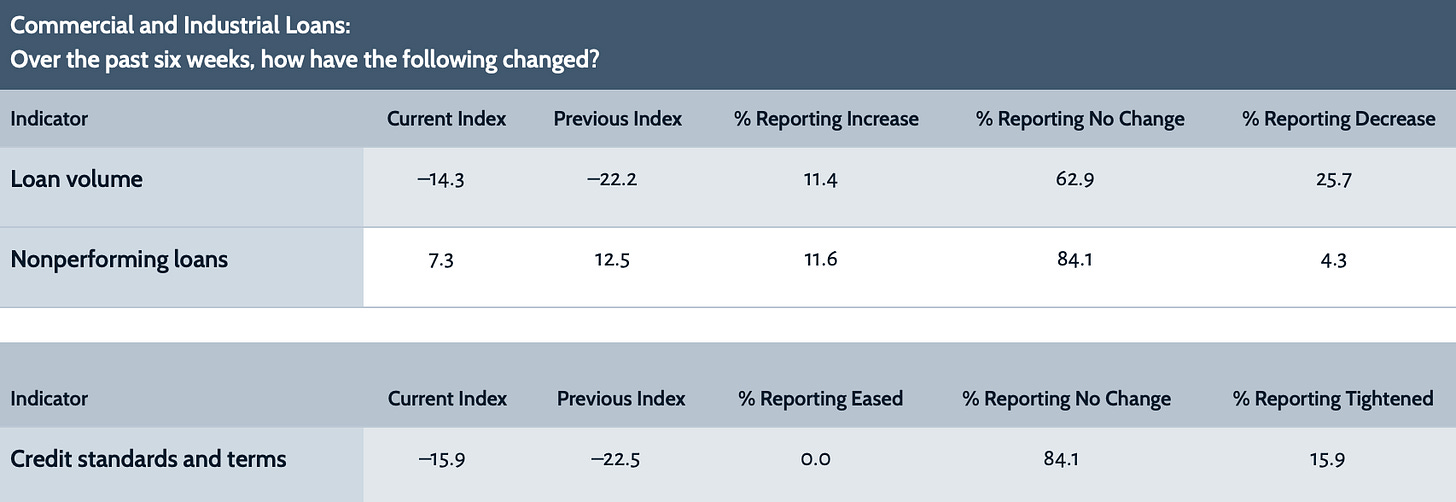

The only good news, buried in the weeds, comes out of the Dallas Fed’s November. banking conditions survey. Energy isn’t broken out, but given its dominant role in Texas for industrial and commercial loans, the following does tell us something:

Credit standards are finally starting to tighten, NPLs are rising, and there’s less borrowing going on. That won’t touch those in the shale patch relying on junk debt issuances and on equity raises, but it does matter for service providers and contractors and for smaller firms. It’s conceivable that while firms see favorable servicing costs now on the market, a lot of the companies providing them are scraping the barrel to stay afloat. That’ll become more difficult if credit conditions continue to tighten in the absence of a stimulus package from congress and a looming eviction cliff in January. Futures will likely reflect that news and you might see further price increases gambling on that going into 1Q 2021.

OPEC+ won’t wait out shale or be able to pull off the dual mandate. In a weird way, you can see some parallels with the dilemma facing central banks now at a crossroads. Mandates to achieve full employment or mandates to rein in inflation? What wins out in this crisis? For the oil market, the choice has clearly been the price mandate over the market share mandate, as has been historically the case. Given the dysfunction of the economies now struggling to recover, however, OPEC+ may have to revise its mandate to just target price stability over everything else till the end of time depending on how quickly fuel substitution takes off. Leaving market share on the back burner isn’t a sustainable option in a world where marginal demand gains have largely evaporated. That’s probably going to force Russia to suppress the ancillary domestic demand generated by the sector for a long, long time to come. If there are defections next year from smaller oil producers that see no value in the stability target over market share, the next price war could do far more damage and trigger a much larger price increase in response to lost investment. The more tech improves, the lower the price ceiling is before consumers and businesses look at other options to reduce overall costs and meet the rising tide of corporate-mandated net zero targets. As usual, that Saudis win on balance from such a condominium.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).