Top of the Pops

Yesterday afternoon, OPEC+ reached a production deal that honored Russia and Kazakhstan’s wishes — Russian output rises 65,000 barrels per day come February, Kazakhstan’s does by 10,000 barrels, the Saudis took the brunt of the pain to keep the market stable making voluntary cuts (under duress, of course). Brent crude settled above $53 a barrel in response and West Texas Intermediate jumped north of $50 a barrel for the first time since last February. There are two orthodox explanations: the Wall Street view (which I agree with) holds that Riyadh knows oil demand recovery is going to weaken on the latest COVID and vaccine news. The second is political. If Saudi didn't take it on the chin, no one else would and the current price recovery would be used as cause to increase output against any agreement to sustain existing cuts and while Saudi Aramco can win any pricing war, another round of oil prices below $40 a barrel would be a massive risk for the stability of Iraq, Russian oil producers have little business reason to cut output until oil falls below $35 a barrel due to their tax regime, and the Saudi budget — running a whopping $79.4 billion deficit for 2020 — has already been cut by nearly 7% for 2021. A funny thing is happening with US shale, however:

This is from Argus from Dec. 21, and capex from US shale firms is dropping to the lowest point we’ve seen in recent years, but the current price recovery also means that just as firms double down on cost cutting and caution with their investments, the survivors from this downturn are holding onto more free cash flow than they ever have. With the spread between Brent and WTI within the $3 dollar per barrel range instead of $7-12, that means that while US output may fall further (I’m somewhat skeptical mostly due to the its resilience the last 6 years), there’ll be more money in hand to finance investment into new production just when Wall Street may start getting reckless again during the recovery period so long as the cost of borrowing and leveraging investments remains relatively low. OPEC+ will have to uphold a price floor at the same time the ceiling may come crashing down later in the year.

What’s going on?

Polling from Gallup shows that an index of Russians’ economic hopes fell in 2020 to levels not seen since 1998 — -41, one of the lowest ratings ever recorded in the last 23 years the polling has been run. 47% of respondents expect economic problems. From the 2014-2015 oil and sanctions shock until the Russian economy ‘stabilized’ in 2018-2019 along with oil prices, the common wisdom politically in the West was that the regime was able to avoid suffering as a result of prolonged economic pain because of its foreign policy successes and ability to project the image of Russia as a leading international power. COVID is a different shock, and it puts paid to the idea that there aren’t political consequences for Russia’s increasingly rent dependent, growth-deprived economic model. VTsIOM polling shows 70% of Russians believe they have to scrimp and save now to save for the future and 77% as of the last polling before 2020 ended felt it was a bad time to take on debt. Yet housing price inflation from subsidized mortgages was bad enough, Putin had to demand an intervention to stop “baseless” price inflation from happening. These are idiotic, considerable domestic policy failures that carry a price, especially if United Russia expects to win a governing majority of the Duma in September while only being supported by about a third of the public when polled. Russians are saving and incomes are falling. Foreign policy can’t magic that away.

This is from Dec. 30, but Aleksandr Shirov’s column for Vedomosti on Russia’s economic woes captures the problems the country faces in 2021 very well, even if he’s spinning a bit. When your default policy response to the problems for global trade and regionalization is to make better use of the potential of the Eurasian Economic Union, you’re in trouble. The battle between inflation control and incomes is the real story, though:

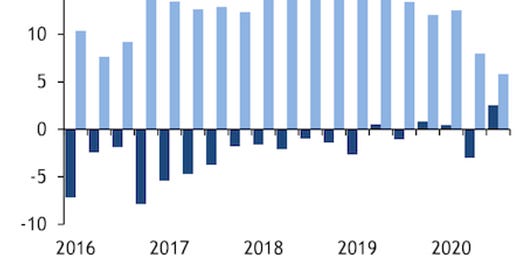

Title: Standard of Living, rate of growth in year-on-year % terms

Left: real money incomes Middle: real average wages Right: real average pensions

Inflation for 2020 came out to 4.9%, with much of that concentrated in housing and, by 4Q, the cost of consumer staples. In short, Russian policy best served pensioners and did very little for the rest despite saving employment. Though wages are back to growth, the value lost to inflation will outstrip any material gains without price control policies working and a rise in investment activity across the economy, not aided by the stinginess of this year’s budget. Living standards will take a sustained hit without some sort of policy breakthrough.

Writing for VTimes, Nikolai Kul’bak makes the point that even a considerable increase in Russia’s R&D expenditure (about 1% of GDP) would not fix the country’s problems with innovation. For one, the uncompetitive and highly politicized nature of internal competition for research resources in the Soviet period informed how research institutions functioned in the post-Soviet period. The result is a highly competitive system fighting over limited ‘spoils’ from the state budget with little trust from state officials, vested interests in seizing control of what’s available, and the support of otherwise uncompetitive research projects to further political leverage. Rosatom is a prime example. It’s possibly the best run SOE in Russia and has internalized supply chains for all sorts of relevant technologies and parts, but it’s business model is not very profitable and it sucks resources away from purely civilian applications into the weird gray area between defense and security spending and civilian nuclear power generation that takes precedence over supporting competitive economic activity that is not controlled by the state. The current political climate cannibalizing research in service of the distribution of rents and consolidation of monopoly or quasi-monopoly power (think Sber’s push into AI, for example) is destroying the country’s competitiveness in the longer-term when it comes to R&D.

Mishustin just signed into law the formation of two ‘special economic zones,’ one in Omsk oblast’ and the other in Krasnoyarsk’ oblast. The specifics aren’t that relevant to the larger problem they reflect. Desperation to create jobs and hand out favors, particularly in the 2nd and 3rd tier cities across Russia’s regions that have become crucial sources of support for the regime since Putin’s 2011-2012 election cycle to return to the presidency, encourages the use of instruments like SEZ. But using these zones that carry tax benefits or exemptions, state financial support, and similar mechanisms to encourage investment are used in place of broader structural fixes that would apply at the national level. In effect, these zones, over time, worsen the general lack of systematicity in the formation of Russian economic policy and also create a pressure point for elite bargaining. Is it Moscow money getting the benefit from these SEZ or can local business leaders and administrations use them to claw back more influence with the center?

COVID Status Report

The total case load hit 24,217 for the last 24 hours with 445 recorded deaths. The total caseload appears to have spiked upwards largely due to an increase in Moscow. Numbers in the regions are still slowly declining, though I do wonder how reliable the data available is from the last few weeks, especially with tomorrow being Christmas and people traveling home or else gathering to mark it in some way. Based on cases per 100,000 people, there’s a growing gap from the regional leaders observable in the data RBK puts out by way of the Operational Staff:

St. Petersburg is in real trouble, which is why Putin used his pulpit to pressure Moscow mayor Sergei Sobyanin to share the city’s resources with other cities and regions. Karelia is in close pursuit to St. Petersburg, which makes sense given its proximity, after which the spread of regions, mostly across European Russia, shows a steady, if slow, decline in case loads per 100,000 people that just haven’t quite hit in the leading hotspots yet. Unfortunately for the country, Moscow is such a key hub for transit routes — anyone flying domestic has, at some point, had to catch a completely unnecessary connecting flight out of Moscow from a regional city — that the newer variant of COVID would be a serious problem for transmission. Overall, things look to be slowly improving. Some academic specialists are trying to push the idea of COVID passports for those who have been vaccinated or recovered from the virus. That no one in Moscow has noted it publicly suggests it’s not on their radar, but that could change.

The Devil Went Down to Georgia

Rev. Raphael Warnock is projected the winner in his senate race against Kelly Loeffler and Jon Ossoff holds a razor-thin lead over David Perdue with the rest of the ballots coming in primarily hailing from Democratic strongholds in the state and is expected to win. It turns out that Trump’s verbal incontinence and inability to provide a coherent message or else just stay back and avoid activating Democratic turnout post-election hurt the Republican Party in the State. It should still be a warning that these margins were this tight in a high-turnout race. Nevertheless, we now have the prospect of Democratic control of the White House, the House, and the Senate to scrutinize for its various policy implications.

Biden himself stumped in the closing days on $2,000 checks going “out the door” once he’s inaugurated if the Democrats won control of the Senate. Presumably that means that even the more conservative members of the party are onboard, and that another stimulus bill would quickly pass, ideally with a combination of hundreds of billions in state and local aid on top of direct cash relief. It’s anyone’s guess whether or not the Democratic leadership pulls the trigger on eliminating the filibuster, but my sense is that the party is moving in that direction. Harris would certainly support it, Biden’s presidency may fail in many respects without the move, and even Obama urged that it be eliminated during the campaign season. Given the growing gap between the popular vote and electoral vote, it’d be hard to justify not doing it with much of the party’s constituency, even though I think doing so poses massive risks unless the party takes rural voters more seriously.

Assuming a new stimulus package emerges quickly, we’d expect to see the US grow much more than its European counterparts through the rest of the year regardless of the current travails with vaccine rollouts. A stimulus would also bolster oil prices and the expected commodity bull market, a short-term benefit for Russia, Saudi Arabia, and other key oil & gas exporters. The good news for Russia on the economic front, however, would likely be fairly short-lived, at least as concerns challenging US power. And after all, 2018-2019 showed that even when oil is above $60 a barrel for an extended period of time, it provides limited growth for the Russian economy (really in the range of only around 1ish% a year, with gains weakened through inefficient and cumbersome cross-subsidization between sectors, wasteful use of state spending, and a limited fiscal multiplier for rubles spent in terms of economic activity generated).

The CBO was unduly influenced by the Trump Administration to produce insanely rosy views of future growth, and their July 2020 10-year forecast reflects that:

No one I know of reasonably expects US GDP growth to average around 4% on an annualized basis over the next decade, but the new congress and Federal Reserve give us food for thought. For one, Jerome Powell has setup the Fed to accept higher price inflation past the traditional 2% target before thinking about hiking interest rates. He’s in effect committed the Fed to supporting the ease of state borrowing to provide stimulus for the economy in various forms until inflation’s out of the bag. As we’ve learned the last 3 decades, consumer price inflation has often been offset by global value chains and mobile capital — cheaper labor, more efficient energy usage, productivity gains from technological applications, etc. mean that it truly is push-pull factors for any given good determining most of the inflation taking place rather than the expansion of the money supply. However, this latter point is also largely the case because the expanding money supply has gone into financial assets, massively inflating their value. Overall, the shift at the Fed points to a willingness to run the economy hot at all costs.

In the case of congress, stimulus like cash relief is a one-off measure. We can’t predict any long-term growth gains from it. But other areas get more interesting. If, for example, the Biden administration changes standing legal protections for many gig workers who, it will be argued, have been misclassified as independent contractors, the cost of the gig economy is going to rise because of the relevant legal protections and benefits that those jobs will then require over time. That’s undoubtedly going to generate some inflation and potentially limit some job creation, but on the whole, will improve labor bargaining power and raise spending power assuming that things like healthcare plans are built into more gig jobs. Similarly, Biden’s green agenda — namely to build a zero-emissions national grid system by 2035 — per his campaign commitments entails spending plans to funnel $2 trillion into the green energy/greening sector in just one term (though much of this is backstopping loans and the like rather than direct spending). It’s ultimately good politics as well. Before. 2020, Pew showed that two-thirds of Americans think the government isn’t doing enough to combat climate change, an issue obviously submerged by COVID, the George Floyd protests, and countless other issues and distractions:

Given that green spending is a jobs bill, the administration will use executive action to tighten some worker protections, and Democrats as a party will have to spend big to secure both houses for 2022 and setup 2024, there’s every reason to believe that US GDP growth may well run hotter than it has in the last decade, particularly if this spending sustains industrial jobs in the United States. I’m waiting to see more specifics, but I do think that for all his flaws, Biden sincerely wants to remedy that problem to the extent possible. That’s an important trend to follow longer-term given the general structure of the balance of payments between leading economies. I just pulled the US, China, Germany, and Russia here as a reference point:

The US has reduced its relative current account deficit compared to GDP post-global financial crisis, even with Trump’s stupid trade policies (though 2020 data will look much worse due to the initial COVID shock). The reason to flag this is that as China opens up financially and the CNY continues to appreciate in value against the dollar, it’s losing its export competitiveness and importing more at the same time that demand is stagnant in Europe and the existing stimulus framework within the EU is completely inadequate to generate substantial growth, though it’s successfully maintained employment and avoided the same disaster that befell the US labor market. Add onto this that the CBO’s 4% growth target isn’t actually that far off from China’s potentially reduced 5% GDP growth target through 2025 and suddenly the raise for growth looks different. Higher inflation appetites in the US support growth in a way they do not in Europe because the US economy is much less exposed to trade than Europe. A Democratic congress is much likelier to be proactive in trying to not just create jobs, but pivot federal investment into the types of infrastructure the US is lagging on at the federal level: green energy, R&D, inter-city transport, airports, etc.

The point here is that while we still have to see how the caucus acts and tilts on policy i.e. how much power will conservative democrats vs. more liberal ones have to shape what passes, there’s a renewed impetus to generate more growth that’s more broadly shared. This is undoubtedly going to be inflected with debates about the US-China rivalry, and it’s going to involve trying to accelerate the energy transition, which serves multiple US policy objectives including reducing its longer-term security commitments in the Middle East and undermining the power of competitors like Russia to compete. I’m not that confident the Democrats are going to swoop in and get it right, but I do believe that structurally, the early good news about a less belligerent US, more open trade policy, and weaker dollar and related commodity market strength will look different in 12-18 months for those in Moscow who bet everything on Trump. It was a bad bet in 2015-2016, one that will cost Russia now more than it has the last 4 years.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).