Top of the Pops

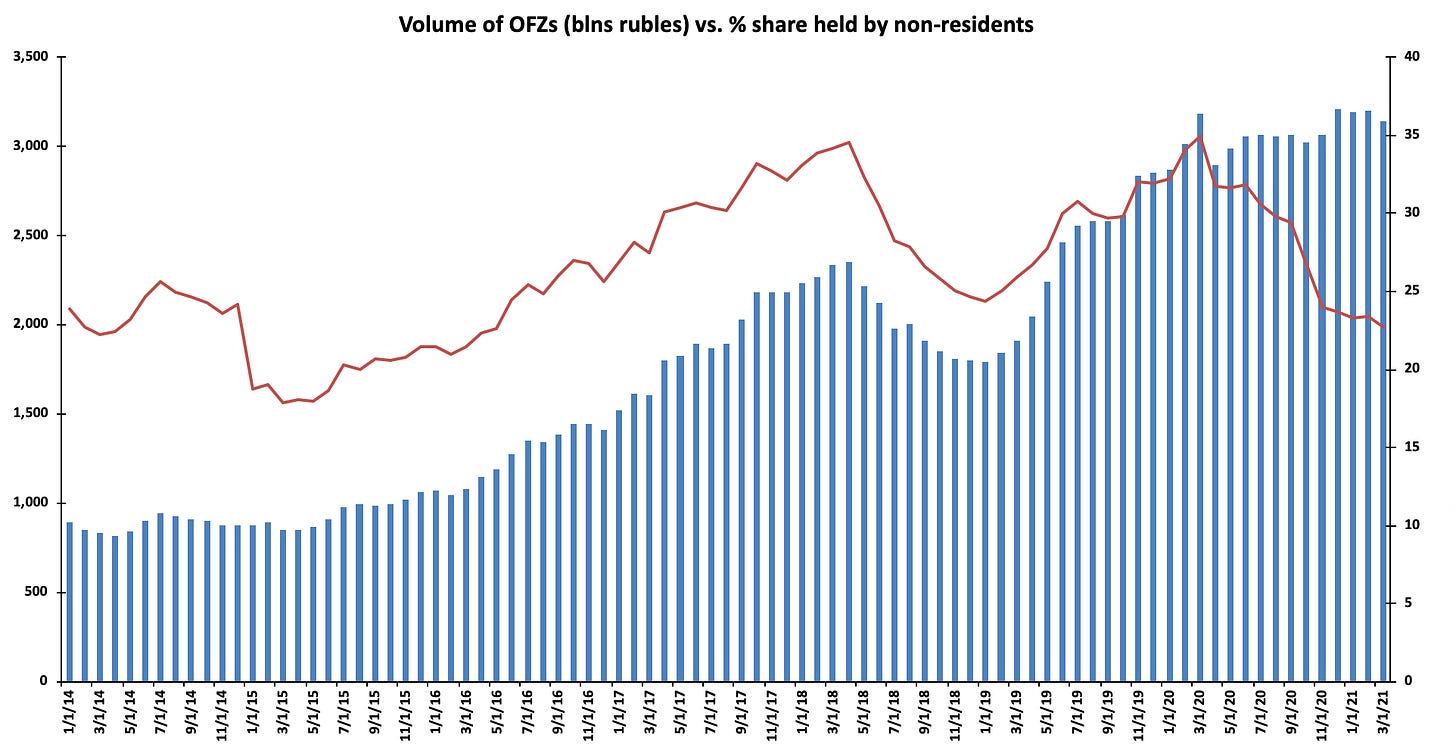

Non-resident holders of Russian bonds appear to be getting out of the game due to sanctions fears. The military buildup on the border with Ukraine — itself a response of Ukraine’s targeted escalation of deployments — has created political grounds for Washington to find a new excuse to levy sanctions. The non-resident share of OFZs has dropped to a 6-year low on the latest flare up of concerns, dropping just under 20% as of early April. It’s still worth noting that even with the possibility of full on direct sovereign debt sanctions and sanctions on secondary trading of sovereign bonds that near 20% of OFZs are still held by non-residents. The following excludes April from the data but you can tell it’s a large sell-off given the % drop:

The point is not to dismiss fears, but equally if one holds that markets are often wrong about the ‘lack’ of sanctions risks, then markets are equally wrong about how severe the measures will turn out to be. The buildup on the border is quite worrying and you have two competing problems of perception: Ukraine may have moved forces into position, but has no clear established policy intention of using a new escalation of force to reclaim territory given the force disparity and a Russian response that is still most likely about intimidation, but could be more. It’s not crazy to imagine that the more hawkish members of the Biden administration are trying to use the current events to push for yet more punitive action without a strategy. Given that the US and Russian governments are in high-level contact over the situation, I’m inclined to assume that a major announcement on sovereign debt will have to be telegraphed significantly in advance, but won’t weigh heavily on Russian decision-making because physical security and geopolitical aims come first, not the economy which can absorb the financial shock, though at some initially heavy cost with long-term political ramifications. At the same time you see a move out of Russian bonds, the ruble has outperformed other emerging market currencies, in part, thanks to the Ministry of Finance’s efforts to reduce dollar holdings and exposure to US monetary policy:

The ruble is smack in the middle with only a small drop in that time. Oil prices rising also explains a fair portion of that story, but it’s worth remembering that the move out of EM bonds as US treasury yields rise is part of the story for investors. If they can net a 2+% return on long-term US debt with reasonable expectations that inflation will remain relatively low since 2.5-3% is “overshooting” and could easily be reined in with a rate hike from a very, very low base, then holding OFZs yielding 6.5-7+% with annual inflation rising towards 6% on top of political risks looks a lot different for non-resident investors. And CBR rate hikes can’t ameliorate the political risks involved. Long story short, the sanctions are a big part of the current market movement, but they’re also happening in a changing inflation context within Russia and in the US altering investor incentives. Markets are stupid about tomorrow, but much less so how to conceivably make money today (even if it’s a long-term bet). Zelensky’s gambling big on a NATO MAP announcement for future membership, membership that realistically can’t materialize so long as Ukraine’s territorial integrity is violated mimicking the trap Georgia fell into. Let’s see if Moscow spills its beer.

What’s going on?

The largest two participating banks — Sberbank and Rossel’khozbank — have reportedly stopped issuing subsidized mortgages capped at 3% annual rates for rural residents because the subsidies for the program have run out. They’re promising to resume once the program’s topped up again, but won’t commit to more details about the terms for the maturity of the loans. MinFin is looking to change them given imbalances of the supply and demand between rural Russians and the banks as banks tell clients and customers that lending via the subsidy is being halted. But the subsidy program unleashed voracious, constantly growing demand — thus far, MinSel’khoz has received 307,400 applications for 652 billion rubles’ ($8.53 billion) worth of loans of which 130.5 billion rubles ($1.71 billion) has been given to 68,700 families. It’s part of a ongoing effort to support rural home ownership and increase family wealth, one that likely works in parallel with other efforts from MinSel’khoz to increase agricultural output wherever feasible. But the program’s apparently only been a whopping 1.2 billion rubles in total thus far out of the federal budget. It’s being drawn from regional budgets and other sources then handed over to the ministry, which augurs a tough year ahead even with a plan to raise the federal subsidy slightly. Just as with other similar subsidies, the program has fostered a mix of pricing pressures, pent-up demand, and future misery without income support or else rising incomes. The worst part is that city residents/workers living in near suburbs can exploit it to acquire rural properties too. In short, it seems to be an ineffective program and one that may end up baking in more inequalities than it undoes.

According to surveys from Headhunter, Russians appear to be less worried about being laid off in 2021 than in 2020. The finding lends psychological credence to the observations in labor market data that show levels of unemployment decreasing as the recovery (supposedly) begins in earnest:

Title: Sense of stability at work — evaluation of the threat of dismissal

Light Blue = very real Orange = More a threat than not Light Green = less a threat Purple = really not worried Grey = hard to say

The working assumption from TsMAKL is that the fall in the unemployment rate isn’t just people returning to work after the worst of COVID passed — an assumption that will be tested by a third wave if it hits — but also by people working in the informal sector shifting their work into the formal one. What sticks out from their report building on Kommersant’s writeup is that government jobs seem to offset a fair part of the surges in vacancies for other sectors between February and June last year. But if that’s the case, then people who are suddenly employed by the state are likely to leave the new posts only if they can find better pay elsewhere, which is hard to conceive given that government salaries were more immune to market gyrations last year anyway. The result should, in theory, lead to private sector wage hikes to attract labor at the same time Mishustin has laid out targets to reduce the total size of the government payroll — a backdoor jobs boost for the private sector that would counteract a probably small portion of upwards wage pressures. Headhunter shows people are optimistic about jobs. If that’s truly the case, then one wonders how many of those jobs are government-based or export-facing cause domestic demand has a long, long way to go.

MinSel’khoz appears to have broken the logjam over sugar and sunflower oil prices by reaching new subsidy agreements with producers, whereby the subsidies are allocated to regional governments by their region’s respective share of national production. The existing agreements still stipulate that retail chains buy at fixed prices, and the new agreements will extend the fixed-price regime through September (shockingly) in order to get through the electoral cycle. The beauty of the fix is that it’s up to regional governments to figure out how to actually distribute the subsidies between producers. It’s classic can-kicking behavior. The current agreement structure is such that producers have to sign direct supply agreements with retailers and cut out wholesale middlemen entirely, a choice that I wager will have significant political ramifications in the future. By removing the middleman, the state’s preserving a market structure that makes it easier to intervene again if need be. This is capacity building on the fly. When wholesalers are able to procure large volumes of production at lower prices by buying in bulk and then taking on some of the logistical costs to re-sell to retailers in salable volumes at a markup, they add a layer to the formation of market prices and, when they act efficiently, a means of absorbing overhead that would otherwise fall to the factory and the retailer in managing distribution channels as well as bearing risk by owning title to or directly owning the goods being transported. But with pricing agreements cut direct between store and producer, the distribution channels and pricing mechanisms have a little bit more in common with the way goods were distributed in the Soviet system i.e. shortages at the producer level can’t be absorbed by wholesalers who are flexible in responding to shifts in output and demand and may be able to trade between themselves to maintain supply contracts and reduce interruptions. This system was already the norm for many regional chains since wholesalers can’t play that role effectively in areas that are more remote or sparsely populated, but now federal chains are shifting into it. I’d watch to see if the federal chains move back to their older model post-elections.

The Duma has just passed a law on 2nd reading that allows individuals included on the registry of foreign agents to run for office, but imposes legal requirements for their campaign materials and campaign efforts intended to tar them and make it exceedingly difficult to win. No less than 15% of what’s included in campaign materials has to address the candidate’s status as a foreign agent and candidates will have to include their status as a foreign agent after their patronymic when gathering signatures needed to run in the first place. The Duma bill has created two new legal categories for candidates — candidates fulfilling the functions of a foreign entity and candidates who are physically a foreign agent themselves. The former covers candidates who worked at least 2 years before the elections for NGOs or media outlets registered as foreign agents and the latter covers those directly included on the foreign agent registry. It’s an obvious means of cutting Navalny supporters and other non-systemic opposition with similar ties to NGOs and media outlets at the knees should they try and run this September without explicitly banning them and making them martyrs. The other effect will inevitably be that any such candidates in the future will have to do a lot more fundraising to retain legal counsel and services whenever the authorities act, especially when trying to make use of administrative resources or resorting to physical intimidation. Even if Navalny’s hunger strike garners more public sympathy, the label of foreign agent will end up hindering attempts to gather support from otherwise apathetic voters.

COVID Status Report

There were 8,238 new cases reported alongside 389 deaths. It’s safe to say that caseloads aren’t declining much anymore, and the longer that continues without a ramp up in vaccination rates, the riskier the outlook becomes for mutations. The week-on-week rate of decline was just 3% for the last week:

Jake Cordell continues to dig up gold, writing today on how trials show the Sputnik vaccine is significantly less effective against the South African variant of the virus. That’s troubling given the likelihood of a new wave in the weeks to come. Rospotrebnadzor’s Anna Popova has laid out her approach to lifting restrictions at the regional level — if your region is performing better than the national average, it’s a green light. If not, it’s a red light. One wonders what happens if regions with decent vaccination rates compared to the national average have to keep applying restrictions, however weakly, given political pressure to normalize. Belts keep tightening. Meat consumption in 2020 was down 3.4% to 1.94 million tons for the year, a 10-year low. That situation’s only gotten worse this year, even with things reopening. Yet some regions are on a decent trend for vaccinations. Tula’s now vaccinated 15% of its population, for instance. It’s going to be a messy, regional patchwork of a recovery at this rate.

Token of My Depreciation

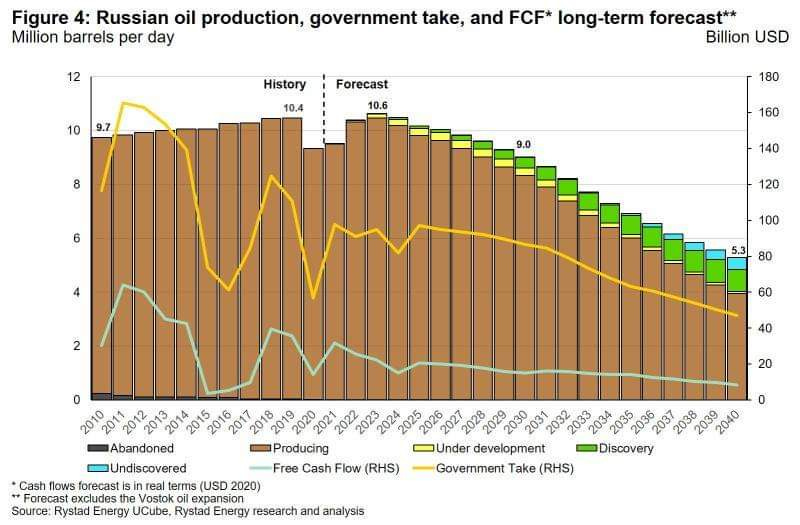

3 days ago, Rosnedr head Evgeniy Kisilev gave an interview with Rossiyskaya Gazeta in which he warned that while Russia has 58 years’ worth of oil reserves left, it only has 19 years’ worth of profitable reserves based on current holdings. Rosnedr is an oft ignored agency that handles the direct auction of the country’s natural resources and is ensconced in the small network of resource ministries headed by MinPrirody and joined by SOEs like Rosgeo that handle the grittier side of who wins which assets and pushes forward exploration for more reserves. It’s always important to take these prognostications with a grain of salt since the state-owned or backed firms and ministries responsible for exploration are chronically under-resourced, a legacy of the compromise struck with oil firms back during Putin’s 2001 oil tax reform that set a highly progressive tax rate on production as prices rose in exchange for assurances that the state would fund more of the costs of exploration to reduce the risk borne by oil firms. The latter part of the deal never quite panned out as promised. But his estimate jives with a new one put out by Rystad Energy on the future of Russian output. Thanks to Maria Shagina for catching it and posting it by way of Tatiana Mitrova:

This forecast notably excludes Vostok Oil, but the economics get messy there since the assumption for the project is $70 a barrel to be profitable, but that $70 a barrel figure includes billions of nominal dollars of support for infrastructure investment and, based on some reporting, initially preferential tax schema. Kisilev’s contention is that if the EU really achieves net zero by 2050, then Russia’s got till 2040 to profit off its reserves. Some will undoubtedly point out that China’s demand has accounted for a rising share of Russian exports, but we’re still talking about a roughly 60-40 or 65-35 split in the immediate term (that may look worse now because of renewed lockdowns in Europe). There’ll also be a bit of noise and rising demand for specific types of petroleum products that are integral to infrastructure construction in developed economies in the years to come. And while 2020 was exceptional because of the price crash, we can still see that oil drives the current account balance and any significant decline in external demand poses a problem for Russia because of the rising costs of newer deposits. The following is in billions of rubles from 2020 annualized data from the Bank of Russia:

If you subtract crude oil and products exports, Russia was a net importer last year. The figures can get funny cause higher oil prices also tend to drive up import levels such that the 2019 current account surplus was actually nearly 40% lower than in 2020. That also means that it’s conceivable you could see higher oil prices encourage more imports but the differential geography of demand would diminish Russia’s ability to maintain export levels competitively against lower cost producers, especially if carbon costs are internalized to export prices. One of the biggest problems now is just how much oil that’s ‘getable’ is left to find. Admittedly this stat reflects a massive hit to exploration budgets, but for the first half of 2020, only 11 new oilfields containing an estimated 30 million tons of oil — roughly 1/9th of national output — were discovered. That’s heinously bad when you factor in that a large portion of the oil discovered at any field can’t be recovered and that Russian firms’ recovery rates onshore for what exploitable reserves lag competitors in the Gulf, the US, even Norway’s offshore by a considerable margin. It’s a twin blow in the making — when prices are high(er), European crude and refined product imports with natural gas helping account for basically the entirety of Russia’s current account surplus. Once demand falls on those markets, it has to find other consumers to maintain said surplus, but China’s demand has to grow a massive amount to match European import levels given Russia’s market share. Further, the market dependence on China and Asian demand is only intensifying post-COVID — the IEA expects it to account for 90% of demand growth through 2025 — and it’s growth will slow as well without domestic structural adjustment.

Russia Inc.’s equity problem is potentially immense, underreported, and difficult to fully grasp. Last year, the Audit Chamber found that oil & gas companies were claiming “fake” deposit finds to maintain the appearance of adequate reserve replacement ratios against current production on their balance sheets. Most of oil companies’ new finds are extensions of old fields and per the AC calculations, between 2015-2019, only 25% of existing resource losses were replaced by new finds despite the rosy figures provided. In Russia, oil prices can have a significant impact on equity markets. Just look at the relationship between oil output, prices, domestic intermediate demand between sectors, consumer demand, and import levels affected by firms earning foreign currency. The equity risks stemming Russian oil companies overstating their new finds at the same time there’s huge uncertainty for future demand and price levels and the national trade surplus is accounted for by European demand are immense. There’s far more spillover than you’d see in a more diversified economy. On top of these pressures, the effect of lower prices and the need to strip away costs and improve efficiency is driving private operators abroad to look much more intensely at automating key functions, particularly drilling operations. Rystad estimates as much as 20% of jobs in drilling, operational support, and maintenance could be automated in the next 10 years and Russia’s far behind the curve against western competitors on that front:

If US drillers move more aggressively, then costs for output drop. Russian firms have to embrace the possibility of higher unemployment to stay competitive. It’s a perfect storm reminiscent of the late Soviet oil crisis, though not as dire: rising investment needs for output, rising capital needs for automation to stay competitive on prices, the potential for carbon price-induced losses, overstated reserve valuations, and incoming equity volatility as investors realize that the returns on Russian firms may struggle to keep up. The best way through the clinch is to massively raise investment levels and support domestic import substitution by exposing firms to external competition and supporting domestic demand. European demand can bring the sector’s hopes tumbling down with it.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).