Top of the Pops

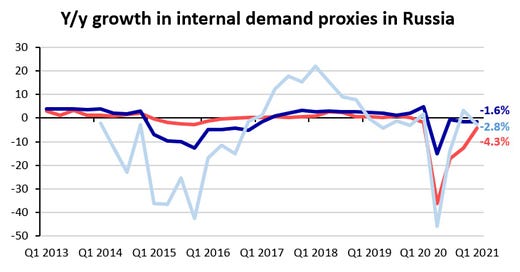

Oil’s still trading around or above $70 a barrel now that demand on developed markets looks stronger, but there isn’t a clear link between the price recovery and demand levels domestically in Russia. Some of that can be explained by persistent production cuts restraining inter-sectoral demand, but more broadly the narrative that an oil market recovery will ‘right’ the Russian economy doesn't really make much sense:

Even in 2018-2019 when oil prices were steady and, at one point, as high as about $85 a barrel for Brent crude, demand was quite weak. Further, big ticket purchases like cars more often involve consumer debt. Mind you, last week’s Shell and Exxon boardroom and courtroom decisions point to a massive increase in the pressure on international oil firms to cut emissions and change their business models, which should give OPEC and Russia more market share and power to influence prices. That could produce a small bump in domestic investment in Russia into production, spilling over into other sectors and eventually filtering into household consumption. I wouldn’t bank on that, however, since we’re beginning to reach the point where oil prices above $80 a barrel pose more significant fuel substitution risks for consumers than in the past and western economies are becoming the marginal buyer for commodities. That amplifies the impact of their policy choices on prices and demand. Oil can’t power domestic demand in Russia anymore, nor can other export sectors.

What’s going on?

AKRA has updated its growth forecast through 2025 and now predicts a steady growth slowdown after 2021 — 3.5-3.7% falling to 3% in 2022 to 2% for 2024-2025. It’s a more optimistic forecast than MinEkon for this year, one worth considering the implications for given the surrounding macro data we have in hand. Unsecured borrowing for consumption has hit record highs with households now paying a record 11.9% of still stagnant or falling incomes to cover debts. This is just one region but Chuvashia has seen its incomes fall 23% for 1Q vs. 4Q in 2020. In Kurgan region, that was 5%. Even if we’re only talking about 2-3% declines, people are borrowing more to buy less with the high levels of price inflation for basic goods without any further stimulus plans in motion despite the lack of a monetary basis for inflation. That means that positive growth outlooks, even the relatively stagnant ones, are all hinging on exports — resource exports at that. In other words, higher growth rates reflect higher external demand due to more aggressive fiscal policies in the US and, to a significantly lesser extent, Europe. Developing markets are now likelier to lead commodities demand in the years ahead, not in volume, but in relative growth as China struggles with domestic adjustment. If Russia can’t fix its income problem, it can only rely on exports and the more those exports financially support import substitution, the more economic policy will increase relative inflation levels domestically and hurt incomes more.

By the looks of it, the industrial recovery is now caught between rising prices and forward-looking demand uncertainty. May data shows output increases aren’t picking up growth pace after April data that, seasonally-adjusted, showed a stop in growth. Only TsMAKL — the Duma’s preferred analytic arm — is showing positive dynamic indicators vs. the same time in 2019. Seasonality here is accounted for:

Blue = TsMAKL Orange = Rosstat Black = HSE

Bottlenecks are the problem. Inventory of finished production is quite low, which increases the upward pressure on prices as firms scramble to fulfill orders as deficits emerge. It’s a trap that Moscow’s setup for itself — deficits of goods creates inflation, inflation weakens domestic demand, and improves corporate profits only if they can slash margins against rising input price levels and see enough sustained demand to increase investment into productivity capacity. If they assume that the “growth” ahead ends at the close of 2021, why expand capacity when you’re just meeting backlogs? Car manufacturer AvtoVAZ has had to halt production and look for new suppliers due to a shortage of imported car components due to the global semiconductor squeeze, now worsened by a combined year-long drought and resurgent COVID caseload in Taiwan. Long story short — we might see a new wave of industrial producer price inflation without much investment despite the nominal increase in corporate turnover because businesses can’t rely on future demand without more fiscal support for consumption.

The latest announcement of plans to extract an additional 100 billion rubles ($1.36 billion) as punishment for the global commodity price upswing they’re now profiting off of. First vice minister Andrei Belousov laid out the logic clearly when the policy idea dropped — you’re profiting handsomely off of higher domestic prices, so the budget should see some of that money. Corporate profits aren’t meant for corporations to invest freely. They serve the state when needed. That’s not new, but it’s far more urgent and extreme given Russia’s constructed an economic system incapable of handling a major inflationary shock effectively. Belousov admits that the government didn’t expect the inflationary wave at the end of 2020, which tells you just how clueless they are. They spent the entirety of the crisis framing COVID as a supply shock and supply-side problem, which would naturally assume that bottlenecks and shortages would lead to inflationary pressures globally. As a reminder:

Interesting figure from @dhneilson showing inventory changes over the past year. Makes clear that the initial economic impact of the pandemic was a fall in demand, no supply -- something that for some reason was controversial at the time. neilson.substack.com/p/two-price

Interesting figure from @dhneilson showing inventory changes over the past year. Makes clear that the initial economic impact of the pandemic was a fall in demand, no supply -- something that for some reason was controversial at the time. neilson.substack.com/p/two-price

Further, the commodity price cycle wasn’t just a matter of the US and Europe or China borrowing and printing money. Investment into output across numerous commodity classes had been down for years — the 2014-2015 oil crash fit into the broader ebb and flow of commodity prices after they peaked around the last global financial crisis. If the idea is to skim rising profits for the state, that’s fine if they intend to actually deploy that capital productively. But there’s no evidence they do, nor is the current deficit a long-run financial problem as long as the economy gets growing.

Mishustin’s government is doubling down on import substitution measures, an agenda all the more urgent now that the Audit Chamber has identified Russia’s import dependence on a wide range of strategic metals crucial to the energy transition and future tech. 50% of copper needs, 66% of bauxite needs, 100% of iodine needs, and others with very high % are accounted for by imports. The current inflation episode appears to be pushing economic policy to find new ways of managing domestic price levels, preferably by reducing imports. But not only is the approach foolish, it just worsens the problem domestically. Analysts and market participants openly question the logic of agricultural counter-sanctions at a time when food prices keep rising and pose such a heavy burden for Russian consumers. The problem is that Russia can’t recreate the “dual circulation” strategy China’s hoping will rebalance its export-led sectors with domestic demand or the US approach of an “iceberg economy” where the domestic market can meet most needs with a more active industrial policy intended to alter the balance of import dependence in the long run. Without adequate domestic consumer demand, it’s Russia’s exporters that stand that most to gain from investing into production, the same exporters likeliest to face structural challenges like carbon levies. Based on Belousov’s interview with RBK, Mishustin does want to tweak what’s been done. Hopefully the announcements around the 50 or so initiatives he wants to push out the door late this month will provide some clarity. The additional 1 trillion rubles ($13.6 billion) being spent on import substitution is likely to undermine competition and raise costs so long as tenders aren’t competitive, key sectors face restricted import competition, and the personalities profiting off the policies ‘can’t’ fail.

COVID Status Report

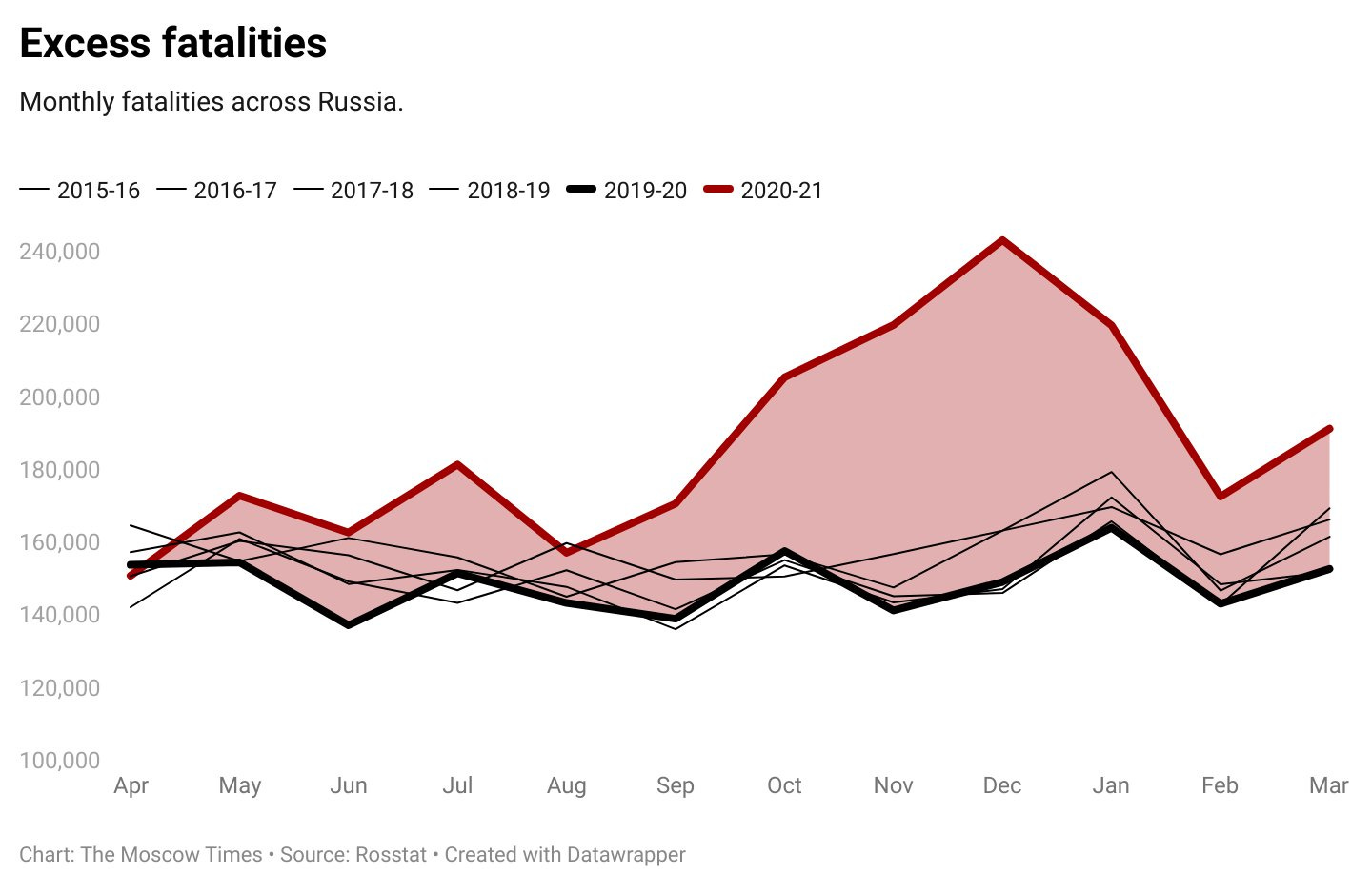

Yesterday, 9,500 new cases were officially recorded alongside 372 deaths. Cases are slightly higher than April-May, but don’t show much upward momentum. Yesterday’s data showed that in Piter, the number of active cases of COVID patients getting treatment was up 10.49% week-on-week — 18,076 as of Sunday. Moscow mayor Sergei Sobyanin notes that the uptick in May cases was likely linked to people going to their dachas or taking time off over the paid holiday and not wanting to go to the doctor. That Piter seems to be one of the only cities (relatively) open about the real state of things draws more attention to the excess mortality data that Jake Cordell and the Moscow Times have done a fantastic job highlighting:

Excess mortality levels were rising in March despite the doldrum for caseloads. Presumably that trend will continue through April and May given the acknowledgement of risks of a 3rd wave. Based on the resumption of anti-COVID measures in the regions — here’s a link on Buryatia as an example and another from Khabarovsk for increasing COVID-specific hospital bed availability — the official data, stated causes of death, and possibly even hospitalization of patients in some cases don’t well correspond to what we know.

OhPEC+

The obstacles to a new Iran deal are immense, between the hawks in Washington eager to spike any attempt at diplomacy, the ongoing uncertainty of Israeli policy as a new and unwieldy coalition ousts Netanyahu, and Iran’s upcoming elections featuring the fallout from the Trump administration’s approach that empowered Iran’s hardliners. There was a brief glimmer of urgency to sign an agreement before the June 18 elections in order to tie the hands of any hardliner president but that tentative deadline has been kicked back to August so that Rouhani might sign an agreement before leaving office achieving the same effect. The US just imported volumes of Iranian crude for just the second time since 1991, though this came from Iranian crude volumes seized at sea off the UAE and resold since the US can’t buy direct by law. With so much in motion, it’s worth considering what the impact would be given the state of the oil market and Russia’s long-running cooperation with Saudi Arabia on the oil market to manage its budget, balance of payments, and political needs in the Middle East.

Iranian oil minister Bijan Zanganeh — leaving office after the vote on June 18 — has called boosting output to 6.5 million barrels per day the “highest priority.” The differential political and economic effects of the energy transition and pressure on international firms make that an interesting prospect. Since the initial declines in investment activity and output from IOCs benefit OPEC, Iranian policymakers want to make sure it doesn’t lose out on its window to increase its relative power on the oil market as well as secure more export earnings. The thing is that if Iran can lift output by millions of barrels a day, that’ll pose considerable challenges for Russian firms — namely Rosneft — obsessed with preserving and expanding Russia’s market share. Its fiscal system, geology, and geography make it exceedingly difficult to ramp up output significantly. As OPEC’s May market report notes, investment into non-OPEC output has never recovered anywhere near 2014 levels, though this has been largely offset by cost deflation, and non-OPEC output increases may never show the same kind of pre-crisis arc so long as publicly-traded IOCs dominate:

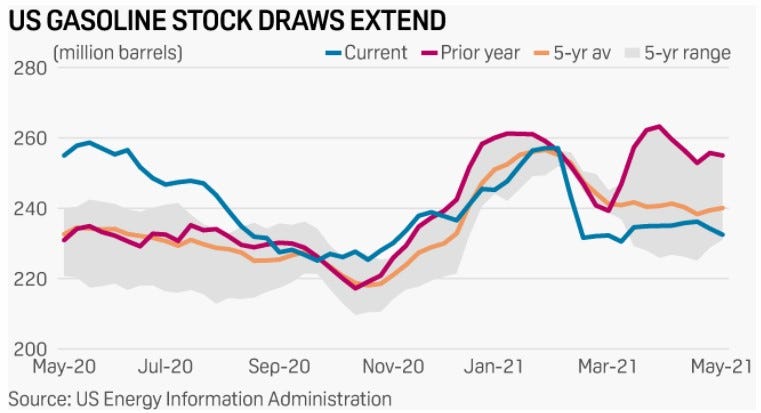

We can see the price squeeze now emerging as demand surges led by the United States’ recovery, China’s demand levels are close to trend, and the EU vaccination campaign now lifts demand prospects as well:

OPEC’s not expecting Russia to lift output much this year in its current forecast. The trouble for Russia’s oil sector lies in the extent to which it “cheated” after the OPEC+ agreement came together. Output kept rising but the sector couldn’t undertake larger, riskier investments that would significantly alter output levels. Just like the West, we can see that cost deflation was achieved. Real investment levels implied by the annual % change data from Rosstat also reveal a big problem for this year — oil & gas investment went up in 2020 despite the brutal cuts imposed by OPEC+, though some of this gap can be explained by differences between oil and natural gas. LHS is billions of rubles and RHS is %:

Whereas Russian firms could have benefited from a relaxation of oil sanctions in 2015-2016 under the JCPOA, the expansion of sanctions or else the power to sanction as determined by congressional legislation and the authority delegated to the US Treasury would seriously disrupt Russian firms attempting to do so now. It’s easier to imagine that the major shift would be a change in Iranian firms access to financing rather than a flood of foreign capital into the sector, particularly since the ‘geopolitical window’ to exploit future underinvestment into non-OPEC oil is relatively narrow and the state will want to centralize control for revenues and likely offer limited concessions to foreign owners. Iranian production is much lower cost on the whole than Russian greenfield projects, putting all the more pressure on Russian firms to try and find new ways to influence South Asian markets to improve the ‘value-add’ proposition of partnering with Iranian firms. Gazprom may have secured a contract to build a pipeline in Pakistan for an LNG project, but it just lost operatorship. That’s been a long-shot angle to build infrastructure linking Pakistan and, ideally, India to Iranian gas fields but it’s an example of Russia Inc.’s loss of leverage as sanctions pressures and market trends give partners more room to demand more. If Moscow wants to hold onto its influence within OPEC+, it needs the US sanctions to remain in place. If they go, it’ll get that much harder to turn oil output into political leverage at a time where, ironically, the energy transition gives Russia an opening to do so for short-term gain. Iranian exports have been higher than official data, so the rebound in output will probably be exaggerated, but for now, it looks like it’s coming. Oil prices will take a hit as well once the market realizes how far from over the pandemic is across most of the world’s future demand growth markets.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).