Top of the Pops

I’ll cover Lukashenko’s meeting tomorrow, as a heads up.

After pumping more liquidity into the financial sector, China’s decision to impose import duties on light cycle oil (LCO), mixed aromatics (MA), and diluted bitumen is finally having an effect on crude and oil products markets. State-owned refiners lobbied for the duties since they’d lost market share to teapot refiners dodging taxes using imports. The inclusion of diluted bitumen is also quite significant because bitumen blends have been used to disguise crude oil imports from sanctioned countries, particularly Venezuela whose chief export blend to the Chinese market — Merey — is very heavy and yields a lot of products like bitumen from the bottom of the barrel. China will be importing less crude and exporting fewer products as these tax changes take effect, but they also serve as a useful reminder of some of the limits facing OPEC+ if it has to adjust output upwards to demand levels higher than in 2019. The following cover Chinese crude imports in mbpd per official states and then based on tanker tracking stats (TT):

A lot of Iranian and Venezuelan crude has been marketed as Malaysian using tricks with transfers at sea, reclassifying crude using product blend labels, and other chicanery. Russia’s chief negotiator for nuclear talks Mikhail Ulyanov stressed yesterday he believes that Iran talks are about 90% of the way to an agreement. Clearly Moscow senses a diplomatic opening and is keen to return to the deal. But if that does happen, OPEC+ has a new problem — Russian firms are going to want to invest into upstream projects that’ll yield better returns than most of the greenfield projects available in Russia, save those part of already established oilfield “clusters.” Further, Tehran has every reason to try and get as much investment in the door as possible. As Nikolay Kozhanov writes, incoming president Ebrahim Raisi may be a conservative but the weight of domestic needs — high inflation, lower growth, and financial pressures — will keep the economy at the top of the policy agenda. Even lifting sanctions, however, won’t lead to an investment boom, nor are sanctions on Venezuela going anywhere. OPEC+ is finally acknowledging that some members can’t produce the baselines set by pre-crisis output levels going back to 2017-2018 anymore, nor has Russia produced near its baseline thus far. The effect is two-fold: the UAE may get the market share it wants by default and there’s actually more rigidity in the excess capacity available once demand returns to 2019 levels. If it doesn’t, which will only be possible if air travel is depressed for long enough to see the beginnings of demand decline for other petroleum fuels, then OPEC+ will be forced to hang together instead of hanging separately. If it does, then it’s hard to see how there won’t be a renewed scramble for market share trying to head off both US shale drillers and an increase in non-OPEC+ conventional and offshore output elsewhere from new finds.

What’s going on?

The pandemic has had a big impact on consumer preferences for data plans — 1 in 4 Russians living in a city of a million people or more now pay for limitless data, double the number who did pre-COVID. Operators are trying to limit the expansion of limitless plans because they’re overloading networks and offer limited profit upside since users can draw huge amounts of data past the cutoff from a paid “ration” plan without any change in cost. 69% of respondents to a TelecomDaily poll say that limitless plans should cost no more than 500 rubles ($6.77) a month in May. The stratification of plan usage is a direct result of working from home or wanting to escape town. Users either rely on WiFi more for their phones or want limitless data to make up for being out of the city in areas where coverage is worse and WiFi not always a given. There was a particularly strong increase in demand for special limitless plans to be applied to notebooks as people were self-isolating and taking other precautionary measures for work. If you look at monthly turnover for telecoms as a sector, it’s risen steadily since 2018. But now that the security establishment is trying to force telecoms companies to invest into more expensive and less efficient bandwidths for 5G and COVID’s stepping up pressure on existing infrastructure, there probably needs to be a considerable increase in investment hampered by the limited space to raise tariff rates without losing customers or else facing political pushback. It’s ultimately a problem of use — half of the subscribers paying for limitless data use as much data as the rest combined. That’s a large loss for companies and a decent indicator of where the future politics of data are headed as it becomes an increasingly vital public utility in a political system that has sought to generate data rents where possible to offset the declining value of rents elsewhere while strengthening the domestic telecoms sector.

Russia’s balance of payments is posting a solid recovery against 2020 with the Jan.-June figures showing a $43.1 billion surplus vs. a $25.1 billion surplus for the same time last year. Capital outflows dropped by about $3 billion year-on-year to $28.2 billion. The former shows what the price rise for most non-oil & gas commodities can do and the latter how negligible said commodity crunch has been to convince people to hold more capital in Russia proper despite what was billed as the start of a strong recovery with MinEkonomiki now forecasting nominal wage growth to hit 9.1% this year, ahead of inflation (for now). The LHS is % year-on-year growth and RHS is US$ blns:

Blue = goods imports Orange = non-oil exports Light Blue = services imports Grey Blue = current account

As we can see here, the value (and volume) of goods imports directly tracks with non-oil exports since 2016 — this intuitively makes sense since oil rents stopped creating shared income growth by 2013 and the ruble devaluation and real income decline have affected spending power for imports. Services imports are covered by oil & gas exports, and also often serve those industries or other extractive industries while Russia’s service exports primarily go to CIS markets. Now that more aggressive key rate hikes are on the way, the Ministry of Finance is defiantly setting a course towards a budget surplus, and there’s uncertainty about nominal wage growth matching inflation with labor shortages and supply chain pressures, the recovery of imports is probably going to be matched by exports since there isn’t enough domestically-driven growth to sustain an import expansion and readjustment of the balance of payments. Put another way, demand is weak, the outlook poor for most Russian businesses, household indebtedness at record highs, and the budget exiting deficit so higher import levels can’t be financed without more domestic growth. Rather the value now probably tracks rising prices for strained supply chains. Think cars, some consumer electronics, and similar goods.

Authorities and Central Bank have been in talks to allow banks to issue adjustable rate loans, including for mortgages, but limited to high-income Russians who are aware of the risks. By Thursday, the Central Bank is supposed to issue guidance on how to reduce risk for floating rate loans — these are the kinds of loans linked to broader market rates or indexed to an indicator or indicators in some fashion. For those who recall the subprime crisis in the United States, adjustable rate mortgages (ARM) played a central role because initially low rates would adjust upwards after having convinced people to buy at a lower rate than a standard 30-year mortgage. What caught so many people out was the upwards adjustment from the margin on top of the initial rate, which then dovetailed with worsening credit conditions. For ARM, the monthly payments change with interest rates and that’s implicitly the instrument discussed based on the Vedomosti writeup. As an example given, an interest increase from 7% to 9% on a 15-year maturity loan increases your monthly payments by 13% and total overpayment for the loan by 34%. By the looks of it, the government wants to set limits on the size of loans given such that adjustable rate loans must exceed a certain threshold in size to be determined by regional income levels. They’re only giving the richest Russians able to hedge interest rate risks access to these loans, but it’s unclear why they need this financial innovation at this stage, particularly since adjustable rates introduce more risk. On the whole, it’s a positive development insofar as Russian financial markets and banks need to do more to develop these types of offerings. That so few will have access to it suggests there are serious concerns about the quality of consumer debt portfolios and the need to manage the “debt comedown” whenever we can really say a “post-COVID” recovery begins in Russia.

Rosstat updated its data on oil & gas sectors’ share of GDP and found that it fell from 19.2% in 2019 to 15.2% during the COVID crisis in 2020. Perhaps indirectly, the data release reveals how empty the regime’s economic narratives post-Crimea proved to be of much content. Use World Bank data as a comparison — in 2019, oil rents accounted for less than 9.5% of GDP per its own calculations having peaked in 2000. While natural gas subsidies to other sectors can produce large figures, they probably can’t make up the rest of that % gap (though to be clear, they aren’t necessarily measuring the same thing). What it means, however, is that pre-crisis the oil & gas sector were still driving about 1/5th of economic activity with a higher proportion of tax revenues and leading role maintaining domestic investment levels as consumer spending power has fallen since 2014. Rosstat just admitted indirectly that the diversification process was held up by its own contradictions — a then suffering oil & gas sector had to provide wealth transfers to other sectors in desperate need of development via taxation or price subsidy, but ended up taking up a greater share of GDP since relative investment levels into oil & gas have risen compared to value-added production since 2014. The % share of the economy follows the oil price, reflecting stagnation:

Dark Green = % share GDP Light Green = % share revenues in federal budget Grey = % share of goods exports Black = avg. price for Brent crude, US$/bbl

In the absence of growth, the relative importance of the oil & gas sector has ironically grown in some respects while creating a constant problem for resource allocation: the best returns are probably still in those sectors, but they now face supply constraints (cheap greenfields for oil/OPEC+) and political pressures to create enough incentives to expand investment elsewhere.

COVID Status Report

24,702 new cases and another record 780 deaths were recorded in the last day. Mandatory vaccinations are just now beginning to have an effect on labor markets in the regions, though small thus far — only 11% of respondents from a SuperJobs survey said they’d been denied work because they weren’t vaccinated. The growth rate in the official data has come down significantly to just 8% week-on-week, which may then support the original thesis that cases could peak by mid to late July, though I remain skeptical that the official data is capturing the spread given what I’ve heard from unvaccinated 20somethings working in the services industry in the UK:

As we can see from the last wave, there’s plenty of scope for it to hover up and down for awhile to come, enough to warrant considering caseloads north of 30k are still quite possible. Lung transplants are effectively on hold across the nation as hospitals try to manage patient risks, health measures are still limited, and public health officials have failed miserably in their duty to enable the continued import of necessary medications or else the proper registration and production of Russian-made equivalents necessary to undertake these operations. MinZdrav has yet to authorize hospitals to use these medications in lung transplant operations after they’ve been legally acquired privately either. Rospotrebnadzor is making sure that no region holds events with 1,000 or more people. It’s something. The declining rate data is a bit skewed by falling cases in Moscow vs. everywhere else. 71% of Moscow government officials and bureaucrats are now vaccinated.

Club “Fed Up”

Meeting with G-20 finance ministers in Venice, Anton Siluanov warned that the continuation of anti-crisis measures threatened to worsen imbalances in the global economy. In Siluanov’s account, budget stimulus measures have triggered excessive inflation that threatens to runaway out of hand. To quote MinFin’s press release:

“The following normalization or even tightening of policy will lead to the necessity to react to changes on currency, financial, and commodity markets. All these factors will create additional volatility on markets and will likely contribute negatively to global economic growth.”

On the one hand, Siluanov is pointing to a clear and present danger for Russia’s economy and a challenge for others. Inflation levels have risen significantly with commodity prices, supply chain disruptions, surges in consumer demand, and labor market dislocations. Vaccine politics have left a massive gap between developed markets and developing ones, a gap further exacerbated by the much greater room for fiscal policy afforded to the United States, Eurozone or EU members, China, and Japan than most other markets, especially those dependent on foreign lenders and investors and resource or goods exports invoiced in US dollars or Euros. It’s also rather telling that he points to the volatility risk posed by tightening monetary and fiscal policy. Yet his actual complaint, going back to his quip about the ‘childish diseases’ of leftism run amok in the OECD, is that the countries driving global recovery aren’t tightening fast enough. Compare Siluanov’s concerns and criticism to what US Treasury Secretary Janet Yellen said to her European peers while visiting Brussels just after hitting up Venice:

“Going forward, it is important that member states seriously consider additional fiscal measures to ensure a robust domestic and global recovery . . . An essential part of a durable recovery is creating an EU fiscal framework with sufficient flexibility to allow countries to respond forcefully to crises.”

Siluanov wants stimulus to ease while Yellen, rightly, is calling for Europe to get its act together and actually spend instead of free riding off of its safety nets and the spillover of US stimulus on European exports and domestic demand. The Ministry of Finance’s view on the state of the recovery is completely at odds with how US Treasuries markets are pricing in global growth expectations, and with that inflationary pressures. 10-year yields are trending downwards, signaling bets on the “reflation trade” for strong growth and higher inflation are easing and ‘team transitory’ — those on Econ and IPE twitter who see current inflation levels as a transitory phenomenon — are being vindicated:

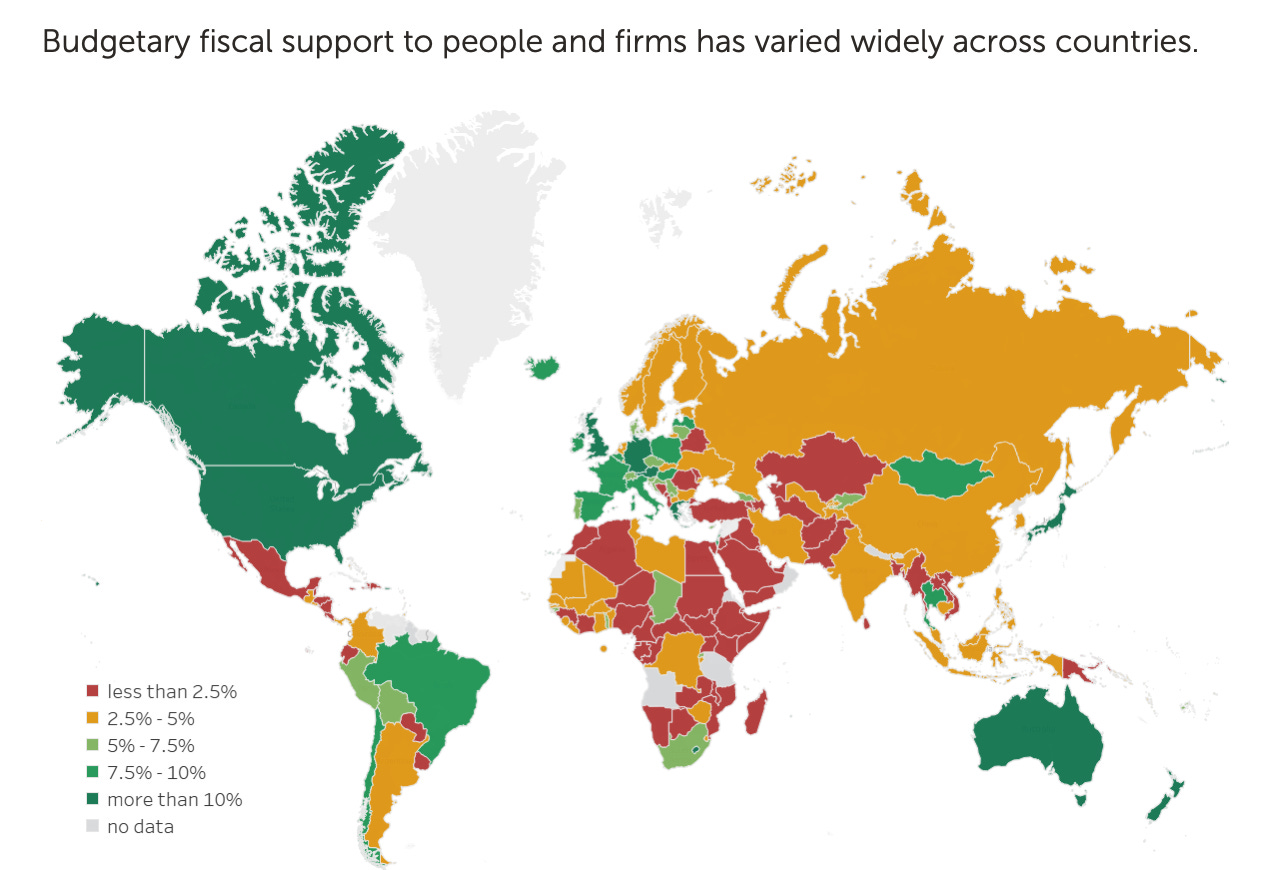

If Siluanov is so worried about about persistently high inflation from excessive stimulus, he has to contend with the logically fallacious constructs of Russian macroeconomic policy. First, monetary expansion of the kind undertaken during and after the Global Financial Crisis in 2008-2010 has no clear direct relationship with commodity prices. The commodity price cycle fell from its peak post-2008 despite a massive expansion in the money supply alongside inadequate levels of fiscal spending. Second, investors now expect inflation levels to fall because current stimulus plans are actually seen to be too small to create long-run inflation risks. The question then becomes inflation for whom as well as how it can be addressed. When it comes to commodities, investment into output is the only way forward or else a reduction of consumption as needed. It’s easier to invest into output when the cost of credit is lower and demand assured thanks to fiscal stimulus coming out of a crisis. It’s hilarious that Siluanov can say this with a straight face given MinFin can’t get state banks to buy OFZs precisely because of Russia’s miserly response. According to the Ministry view, Russia launched one of the largest budgetary stimulus programs in the G-20 worth a whopping 6.3% of GDP. The IMF’s analysis of fiscal responses in % GDP terms quickly reveals Siluanov is, to be polite, making **** up:

It wasn’t a G-20 leader overall, and his own count exceeds that of most independent observations and comes after repeated attempts on his part to use existing budget spending as ‘stimulus’ and probably factor in credit subsidy measures on par with budgetary spending, a practice other analyses generally distinguish from fiscal expenditure.

Siluanov’s G-20 comments come at the same time the National Security Council has been talking up Western attempts to foster an economic crisis in Russia. In direct terms, the tightening of oversight over dual use technologies coordinated between Washington and European capitals in the last weeks is an obvious culprit. Harder to swallow for Sovbez, however, is the reality of Russia’s position in global value chains, level of development, and what they entail for the differential experiences of higher inflation at the national level. From what I can glean, Siluanov’s complaints are really just an extension of the ever-expanding obsession among the securitocrats in Moscow to contextualize domestic policy failures and struggles in light of the West’s sanctions policy and anti-Russianness. We’ve reached the point where large stimulus spending backed by easy monetary policy intended to pursue near full or full employment in the United States is somehow a political technology being exploited by American elites to impoverish Russian citizens and strain the state’s financial resources to their limits.

Not only is this view childish and irrational, it belies an intellectual rear guard action to justify the long-standing Russian reception of the last financial crisis as an inflection point for Anglo-American capitalism. Blame speculators, easy money, the profligacy of governments unwilling to level with their own people about the costs of budget deficits and instead try to foist them onto challengers like Russia rather than govern prudently. 2008-2010 failed to give rise to a multipolar moment as intended by Moscow because, for all the American fiscal state’s shortcomings, the Federal Reserve saved the day while a US administration tried to reorient the country’s foreign commitments and reduce their relative burden more effectively. COVID has similarly failed to fracture the global distribution of power despite the pervasive pessimism last year as a result of the stunning failure of the American public health response under Trump. After beating expectations last year in GDP terms while botching the health response, Moscow is clinging to the illusion that it did a better job than its competitors or else only failed to do a better one because of their perfidy. The disconnect between where macroeconomic discourse has gone in the United States and Europe vs. Russia has never been this extreme from what I can tell. The closing of Russia’s “economic mind” is total. That doesn’t mean all economic ministries or ministers are now part of the security establishment, nor even that every decision has been truly securitized. But the dream is now to divorce the Russian economy from global forces entirely while sinking further into a model that will only enhance the national economy’s exposure to them. Control without planning, command without control, and all following a tired and disproven script written by Austrian school economists and the American offspring they inspired. Even Milton Friedman admitted that low interest rates may reflect a weak economy rather than loose monetary policy, a reality of the immense slack existing in the United States and other developed economies like Germany that have depended on trade surpluses maintained by suppressing domestic consumption. You’d think the Ministry of Finance would revisit that problem now that it’s tasked with deciding how to best structure the economic pain it plans to impose on households in the year ahead.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).