Nothing to lose but your supply chains

An Odd Lots podcast helped me square bottleneck issues in Russia

Top of the Pops

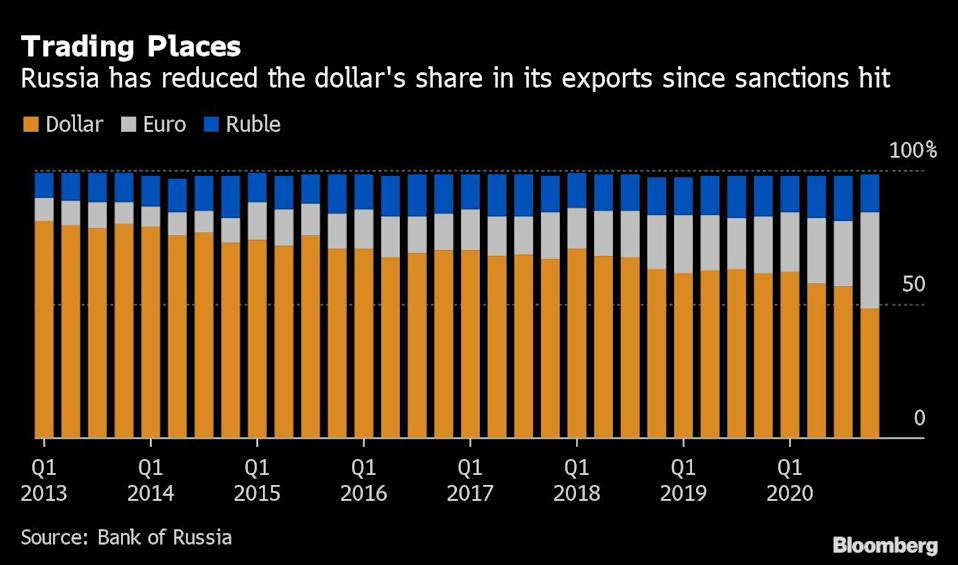

Russia’s ‘success’ de-dollarizing its exports was making the rounds on Twitter from a Blomberg writeup noting that less than 50% of Russian exports were invoiced in dollars for the first time. The political impetus remains clear — de-dollarization is seen to insulate the economy from the unpredictability of the US and is painted as an initiative to support foreign policy aims as well:

As we can see, the export differential is entirely due to the expanded use of the Euro, led by trade with China. No one wants to trade in rubles if they aren’t already receiving large inflows of them via remittances or existing trade finance and investment arrangements. Switching to the Euro with exports does precious little to effectively ‘de-dollarize’ insofar as the Euro is, for now, not a substantive challenger to the US dollar and ultimately circumscribed into the dollar system given the economic structure of Russia’s biggest partner in Europe — Germany — and its role shaping the Eurozone’s current account and internal capital flows. One of the unstated realities of Russia’s ‘multipolar’ economic diplomacy is that the two biggest targets it’s pursued — Germany in Europe and China in Asia — have broadly run trade surpluses that correspond to suppressed household incomes and a dependence on US dollars (and Euros) to invoice trade. It’s not just a challenge because of the incentive to use stable currencies with minimal risks like the USD or Euro, but also because the US dollar dominates non-EU trade:

It takes a few years for data collection to really catch up, but I’d wager the % share of world trade ticked up a bit during the worst of COVID given liquidity concerns and the Fed’s response. Regardless, de-dollarization is a dead-end policy shaped by security concerns that the US will take steps it’s very, very unlikely to countenance for the obvious reason that Russia is not Iran and that despite the hawkish consensus, the only thing worse for US interests than a belligerently opportunistic Russia is one that might politically collapse. The latter isn’t a sure thing if you cut SWIFT, but it becomes a lot more likely to emerge as a viable concern. Since the USD dominates non-OECD trade, Russia’s attempts to diversify its economic relationships run against the security imperative to de-dollarize.

What’s going on?

The government has decided to pass a law that bans foreign-owned auditors from performing audits on banks, some insurance firms and depositors, credit institutions, non-state pension funds, investment management firms, and even micro lenders and clearinghouses. Auditor restrictions have been a policy topic for several years now, but the chief impact of making this change now is to further hinder Russian firms’ ability to attract foreign investors and capital. By mandating that Russian-owned firms perform auditing operations, they’re threatening the Big 4’s portfolios in Moscow and hurting auditors that are indirectly foreign-owned through intermediary entities registered abroad. There is, however, a loophole that would allow firms that are part of an international group to restructure to avoid the worst of it. Without the participation of major international auditors, it’s going to be near impossible to convince foreign capital markets to trust counterparties when they try to access loans, raise money through an issuance, and so on. Work ongoing for this year is safe and it’ll take effect next year, with the expectation that most of the Big 4 auditors’ work will find a way to go ahead and Russian firms will search for some compromise to approximate the role of financial audits in their operations — Vedomosti quotes an expert citing the idea of an ‘independent business review’ that’s legally distinct, comparable, but more expensive than an audit. Seems like yet another case of import substitution and protection measures raising domestic costs without improving anything, worse still because it’s impossible to readily apply sovereignty to concepts like trust in global finance when you aren’t a first-mover setting the rules.

Inflation expectations are shooting up through the roof to 4-year highs. No one yet has a clear handle on whether the current inflationary wave is transitory or part of a longer spiral and the observed inflation by the population is 2.6 times higher than that registered by Rosstat. The Russian case, I think, likely differs from the same observed rise in inflation in the US and advanced economies that are approaching normalization from COVID:

LHS = % Blue = expected inflation Red = observed inflation Gray = annual inflation

Some will claim that the current inflationary wave is a result of resurgent demand, but that’s a flat out lie given the underlying data. Only 19% of Russians are planning to spend more vs. 18% spending less and 63% spending the same. Consumer demand is structurally unchanged save the downward trend from falling incomes — for a majority Russians, the ‘average’ wage at 51,000 rubles a month is aspirational and not reality. MinEkonomiki has revised down its expected real income growth for 2021 to 2% — that’ll still be down about 1.6% from pre-COVID 2019 levels, which of course were themselves significantly down against 2012-2013. In the US, demand isn’t really constrained, nor is credit, and any supply bottlenecks will likely be addressed via additional capacity investments as businesses adjust to the new fiscal policy approach to the economy or absorbed more readily since incomes seem set to recover or rise since workers are now demanding higher pay from businesses thanks to the safety net provided by stimulus. Some inflation might persist, but the bulk of it is transitory and tied to the global commodity market. In Russia’s case, those transitory price pressures are much more structurally worrisome because of the way businesses and the state try to control costs, access to credit, focus investment in industries that are highly exposed to commodity cycles, and do nothing to support consumer demand. Costs are going up without demand improving significantly or any fiscal support for spending, like in the US. The risk of expectations becoming reality is far greater on a market where monetary policy has been rendered less effective through state price interventions, a large informal economy, commodity dependence, and unreliable regulatory, political, and market institutions.

According to TsIAN, the mortgage subsidy program for new-builds has been exhausted in 38% of cities with 500,000 people or more. The repayments owed are up year-on-year in a wide range of cities following housing prices. In Perm’, Moscow, St. Petersburg, Kazan’, and Krasnodar, housing price increases have erased any of the benefits from the program, an expected consequence given the notable lack of a large fiscal boost to construction. In St. Petersburg, you save a whopping 1% on repayment with the subsidy program vs. normal mortgage costs now. The % of apartments available with a minimum principal contribution has fallen from 91% to 84% while the average share of family income spent on subsidized mortgages has risen from 26% to 28%. These may not seem extreme, but in practical terms, they reveal that the program’s effect on prices has outstripped the net positive effect it’s had while worsening the housing squeeze because of its timing — this isn’t specific to Russia given the stories you see in the US, for example, but the market’s struggling because the average 22% price increase for housing year-on-year wasn’t accompanied by an expansive program of income support. If the subsidies are lifted, however, then the principal owed in repayment will shoot up to better match prices. The increase if one took out a mortgage at the market rate of 8.2% amounts to a 38% increase over 20 years. Developers are moving now to expand construction and make use of more land, which should ease pricing pressures as the program winds down later in the year. The cumulative effect, however, will be a surge in housing costs for homeowners and likely more pressure pushing Russians who lacked savings or else had lower incomes to begin with into the rental market.

Wood Mackenzie’s 2050 forecast for oil prices now predicts that in a scenario where the Paris targets are met, oil will cost $10-18 a barrel by 2050. Setting aside my own bias as someone who worked with the firm for a bit, it’s nice to see them come around to what a political economist would have probably spotted pre-COVID based on underlying structural trends/factors. The fear, however, is that new extractive capacity will cease to see investment post-2030, handing more and more market power to the lowest cost producers able to use state fiscal and financial market support to avoid problems with shortfalls. Oil demand would fall to around 30 million barrels a day in their Paris scenario, which effectively means OPEC alone — should it be able to maintain production levels — could provide the world’s oil needs. Should that come to pass, we’d see an increase in the salience of security rationale for intervention in the region. But most importantly, Russian crude has no place in the brave, new world of ‘minimal’ demand given rising lifting costs, depleting Soviet legacy reserves, and the fiscal incentives to extract as much rent from the sector for as long as possible. For now, OPEC+ seems more confident. They just revised upward the expected deficit on the market this year despite the COVID catastrophe in India now dragging down demand expectations. Lukoil head Vagit Alekperov sees the perpetual extension of cuts as a real possibility going forward, a shift from his pre-COVID position that cuts were unnecessary once oil settled above $60 a barrel. The oil market’s old stalwarts like WoodMac are finally coming round to modeling a world with rapidly falling demand. That’ll start to affect the consultations on project investment, infrastructure deals, financials asking for research support when providing financing, and more.

COVID Status Report

8,053 new cases and 392 deaths were reported for yesterday. According to Tatiana Golikova, new strains of COVID were discovered in 54 regions and lightly chided regions for not following advice prioritizing at-risk individuals for vaccination and following federal recommendations for the lifting of restrictions. Apparently the supply of refrigeration units for the vaccines hasn’t met targets thus far though production of vaccines has largely been on track. There’s more evidence of the scale of the problem from last year. MinZdrav just confirmed that mortality rates rose 17.9% in 2020. Consider that the US saw a 15.9% increase. What sets Russia apart somewhat, however, is the demographic profile of the effects. In an interview with Kommersant, demographer Evgeniy Andreev responded to the fact that the average lifespan in Russia dropped 1.8 years last year by pointing out that the mortality rates in Russia for those who contracted COVID rose to a much greater degree for those starting at age 45 rather than the Europe average of 60-65, evidence of poor public health — mostly heart conditions, diabetes, and the like — on top of the poor public health response, lack of medical care capacity, and disorder since the federal government kicked responsibility to the regions. These problems appear in the data for plenty of wealthier countries, but the extent in Russia is still worse than you’d expect and quite bad comparatively. The regional governments might be doing enough to head off the worst of any potential 3rd wave. Waiting for more hospitalization data.

Stagflation, an Odd Lots Podcast, and Post-Soviet Monetarism Walk into a Bar…

I finally got around to listening to the latest Odd Lots podcast on the structure of the lumber market, why lumber futures and spot prices have shot up in price in the US lately, and how the mechanics of bottlenecks and logistical challenges for the lumber market affect supply and pricing pressures. At first blush, you’d think it’s a separate story from Russia. Even given the different contexts, there are some really useful lessons buried in it about the peculiarities of the Russian economy in response to the macro orthodoxy that has effectively set policy since 1999 and fostered a deepening structural crisis since 2013. I think the dynamics laid out in the lumber market offer insights into how inflation really works in the Russian economy and why the political system makes it so difficult to manage properly now.

One of the biggest lessons drawn from the podcast is that economic crises and the successes and failures of state responses to them have a lasting effect on the assumptions and worldview of market participants. The result is changes to business behavior that can create a self-reinforcing disequilibrium of underinvestment and a lack of spending vs. demand adapted to a crisis environment that makes less sense when things ostensibly recover, or else creates a potential supply bottleneck that is only exposed during a large shift in the policy environment, in this case due to a massive exogenous shock. To simplify the podcast’s initial points (you really should listen!), the lumber market’s broken up into several steps of the supply chain: you’ve got the sawmills turning logs into lumber that tend to have substantial pricing power since the largest customers buy direct while small firms have to go through intermediaries, big lumberyards selling lumber they’ve bought from sawmills or else vertically-integrated as the distribution channel for a producer, the retailers buying large piles of lumber they break down into component parts like ‘housing packages’ they sell to builders and consumers, or else you’ve got midstream firms that buy railcars and trucks of lumber before they reach any lumberyard or downstream distributor and try to then resell them as fast as possible. The most important takeaway here is that if you’re trying to buy lumber for construction or else to resell it, there’s usually a huge period of time where your money is at risk without having the product in hand because of the time to transport it, handle it into your own facilities or stores, and then time to market it. We’re talking about about a month, 6 weeks, 2 months, sometimes more in which you’re just taking a loss on the real input you’ve acquired.

The Global Financial Crisis decimated the sector for the obvious reason that housing was at the center of the pandemonium. The massive hit to housing demand as a result of the bubble bursting and the weak, unequal recovery in the US meant that housing starts never reached their pre-crisis highs again and any firms that survived the turmoil were incredibly conservative. Going forward, their instincts were broadly to spend less, hire less, and hold as little lumber in inventory as possible in case of another crisis despite a self-evident housing shortage across the US economy. The result was that when mortgage rates dropped last year to record lows and there was a massive surge in home renovations and interest in buying bigger homes given changing work habits among those who had money, the market was not structured to handle the surge of demand because of how much slack the businesses maintained to ensure their own solvency. They were so terrified of a downturn that they weren’t logistically prepared for booming demand.

Think of this in the Russian context. I’m wary of using something just pulled from Trading Economics citing federal data, but when I pulled up the industrial capacity utilization index on Rosstat, it’s initially broken out by product and I didn’t want to spend too long digging around to make sure all the data was like-with-like. The RHS is % utilization of economic capacity. I’m not confident of the exact figure, but think it tells the basic story well:

The years of 10-15% inflation period from 2000-2008 was brought on with the windfall of oil revenues allowing firms to make use of existing Soviet capacity. But capacity utilization effectively peaks in 2008 around 65%, which it only briefly breaks in 2017-2018. That means that the Russian economy is running with 35% of its effective capacity idled in some way. Compare this to the US:

The US economy has had way too much slack for decades now, fostering low inflation rates and declining labor power, but its own “floor” is still 10+% higher than Russia’s effective ceiling. Russian firms have been operating in a fiscal and institutional policy policy environment since the 2008-2009 Financial Crisis that has systematically destroyed domestic demand when demand was precisely the impulse needed to push firms to invest into new plant, replace Soviet-era plant, and increase capacity utilization. The effect of corruption, terrible fiscal and regulatory policy approaches, and Putin’s steady retreat from deciding economic policy fights has fostered a business climate where firms need to be conservative, minimize risk, and setting aside specific markets, can reasonably expect consumer spending power to keep falling. In short, they have little reason to hold onto extra inventory to address surges of demand, are slow to react to increases in demand given expectations it won’t last, and want to make sure they keep money in hand to ride out downturns or else handle the additional overhead costs imposed by weak legal institutions, property protections, and raiding behavior from the state or private competitors. The lumber industry in the US ended up consolidating given that cost-cutting and risk management were the main means to grow on a market that was suppressing its spending levels despite strong housing demand. The same thing has broadly occurred in the Russian economy since the lack of market growth makes market share more of a zero-sum proposition in many cases.

The default to monetarist macroeconomic policy has therefore created a framework in which businesses are incentivized to preserve slack across the economy, particularly since higher inflation is a political risk and the institutional framework for policy is intended to resist it when possible. There’s a massive contradiction here, though. I’ve written before about the deflationary basis of macro creating pent-up inflationary pressures, but I didn’t fully understand the capacity problem. When you have these markets for physical inputs that are relatively illiquid — you can’t replace a shipment of lumber that didn’t arrive with something else or pull a financial instrument out of a hat to make it appear — pricing bottlenecks are quick to develop whenever demand for transport capacity or the product itself changes quickly because of the underinvestment in capacity and inventory. In a normal situation, these bottlenecks resolve because high prices eventually kill demand and, ideally, firms can capture some additional margin for their profits and invest more along the way. In the Russian case, this tends to fall short because the economy can’t be run hot. Ever. Full employment generates inflation, which then encourages a tightening of monetary policy and tighter fiscal policy in the current framework despite creating more non-oil & gas fiscal revenues. This tweet captures the failure of policy imagination quite perfectly:

Easy monetary policy isn’t the problem. Inflation began to pick up last year with food prices — costs completely divorced from money supply considerations since it was global demand driving it up — and housing prices — a matter of providing what was effectively a monetary stimulus to support the housing sector without adequate fiscal stimulus to support incomes. That it’s continuing now might well reflect the demand shock effect of a sudden recovery as things normalize, but take houses. More can be built using fiscal policy to drive down prices. Take construction. Cheaper loans can support more expansive investment into logistical and production capacity for construction inputs, including logging. It looks more insane juxtaposing investment levels in current prices vs. the relative level of investment in constant prices from 1999:

2020 investment levels were, in constant terms, on par with 1999. The idea that monetary expansion is producing rising levels of inflation may seem to be solid given the state of demand, but inflation shouldn’t be such an existential problem based on relative levels of investment and demand. Russia’s best economic hope is forcing the economy to run closer to capacity to smash the bottlenecks sustained by underinvestment. Monetary policy isn’t the problem. The political need for economic slack is.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).