Murder he Rotenberg

The Kremlin's got a serious public narrative problem spinning out of control

Top of the Pops

BP just sold a third of its net stake in Oman’s natural gas project Block 61 to Thailand’s PTTEP — 20% of the projects equity — for $2.6. billion, yet another move intended to raise capital to be redeployed elsewhere into more sustainable investments. Block 61 is the largest tight gas — think fracking — development currently under way in the Middle East. The sale is worth flagging cause it points to a divergence between IOCs now trying to figure out what part of the market they occupy as demand projections shift. In a bid to chase headlines, the story (re)emerged that Exxon and Chevron reportedly considered pursuing a merger last year in the depths of the initial COVID crisis. That would have created the world’s second largest oil company and oil producer after Saudi Aramco and, more importantly, created a behemoth of an oil company relatively disinterested in responding to climate change or investor concerns about the long-term viability of businesses dominated by oil extraction and refining. Its plans are vague, but even Saudi Aramco is making a big deal of eliminating all oil burned for power generation, achieving 50% renewable electricity generation by 2030 with the other half from natural gas, and is working how exactly it intends to announce a net-zero target at the moment.

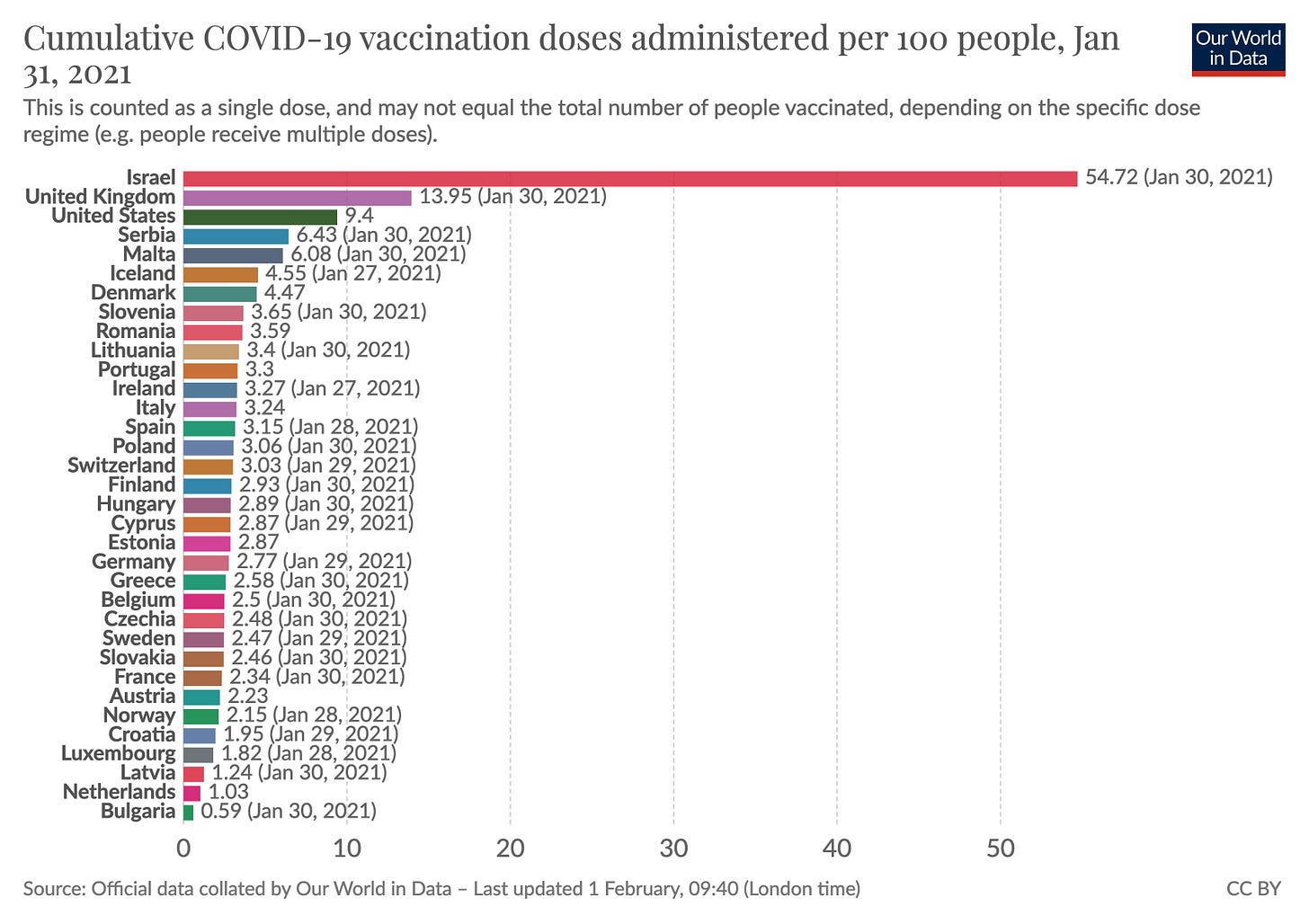

Russian firms are falling further and further behind the longer they delay naming plans to go after these objectives, even if they’re assured a slice of the market that IOCs like BP will struggle to maintain. But the current race to ‘greenwashing’ or else actual greening of firm operations is fundamentally different than your usual cycles of upstream investment activity because projects accelerating EV adoption, supporting natural gas substitution, or else backstopping research that may reduce refined products end use from competitors are destroying the underlying equity value and long-term profit margin of the assets firms failing to do so now hold. It’s an equity arms race. Norway’s Oil Fund has diversified away from any companies that extract oil for the simple reason that it’s no longer an attractive long-term investment. Even with a more bullish near-term outlook from US stimulus plans, Biden’s federal permit ban, and broader hopes that vaccine rollouts will accelerate, the long-term equity case just isn’t there. The US and UK are currently lapping the field for rollout among bigger economies, and both are ultimately likelier to nudge forward demand destruction than not with spending bills, as are most of those in Europe.

GM has now committed to manufacturing only EVs by 2035 since the explosion of EV sales in Europe and China threatens its competitiveness, a huge psychological pivot for Detroit and the policy landscape in the US. Automakers face the same depreciation pressures. The boulder’s rolling, it’s just a question of how fast it hits as investment needs for electricity and energy efficiency likely skyrocket to keep pace.

What’s going on?

Looks like the export of Russian-made farming equipment — tractors et al — reached record levels in 2020 raking in 15.9 billion rubles ($210.5 million). That’s a 30% increase year-on-year. But that’s small potatoes and a relatively weak showing for a sector that has received hundreds of billions of rubles in subsidies over the last 5-6 years alongside import protections, though it does mark progress. Export growth was a record 40% in 2018. We’re seeing a low base effect at play here. But the growth was aided as well by higher food commodity prices and the ruble’s further devaluation. More notably, domestic production rose 29.6% in monetary terms to ($1.97 billion) and now accounts for 58% of domestic purchases for gear. That’s proof of successful import substitution, but still reflects lower value-added production and limited export competitiveness.

The balance of customs revenues raised by the Customs Service and Federal Tax Service on imports and exports shifted some last year as the data out now shows a 19% net decline in customs revenues against 2019. Export duties only accounted for 24.2% of all revenues against 72.5% collected fro VAT, excise taxes, and duties on imports:

Blue = fees collected, trlns rubles Red = Ural blend price, $/bbl

Much of the structural decline pre-COVID reflects the oil tax maneuver, not just the fall in oil prices. You’d expect that the ruble’s devaluation in late 2014-2015 would have offset some of the losses (assuming they didn’t set this in constant terms), but since they launched the gradual phase out of export duties to be replaced by higher Mineral Extraction Taxes (MET), exports’ share of revenues would fall significantly. I suspect that last year’s figures beat out 2017 primarily cause of the initial COVID-ruble devaluation and rising prices on wheat and other commodities that have some similar tax structures in place. 4.75 trillion rubles ($63 billion) is a lot of money to raise off trade, equivalent to nearly 10% of all revenues in 2019 and, most likely, 2020 as well. Most of that now comes from reducing Russians’ consumption power and raising costs without much domestic production increases. For comparison, the US raised something like $71 billion on trade in 2019, and that’s entirely because of the irrational tariff policy Trump’s trade team pursued.

Though 2020 saw bank profits drop by about 16% year-on-year and a further decline is expected in 2021 — since bank profits broadly correspond to interest collected, there’s a lagging effect from interest rate cuts and state subsidy programs — the Central Bank appears confident that a pullback of COVID stability measures would not lead to banking sector instability. January saw positive movement of money back into deposits, which likely reflects a mix of cautious optimism from declining COVID rates and the vaccine rollout as well as an easing of last year’s rush to stash cash under the mattress for emergency purposes. That’s good news for a recovery insofar as the damage done to the current account by lower oil prices was contained and now seems (relatively) immaterial to the next steps to take. There’s probably still concerns about the effects of the mortgage bubble, though it’s not particularly securitized so the fallout of any drop in home values and weaker than expected wage and job recovery wouldn’t cascade into banks’ investment operations and need to draw on liquidity. On the whole, business appears to be running as usual as the consensus around the vaccination-first strategy holds.

A trio of two academics and a reporter from RAN have put forward a report calculating that the human losses suffered from COVID-19 in the mortality data for 2020 push up economic losses to 4.8% of GDP, considerably higher than the rosier 3.5% Putin touted at the end-of-year press conference. They go on to criticize the current budget planning cycle for not factoring in these losses into its calculations and call for a doubling of spending on anti-crisis measures to expand unemployment and social benefits and a packet of stimulus approaches, including capping commercial lending rates to consumers to twice that of the key rate set by the CBR. Their key contention is that the country urgently needs to increase wages’ share of GDP to boost consumption, reduce the impact of price fluctuations for basic goods on the poorest, and boost consumption. The authors, however, promise a 3-4% GDP growth rate annually with these reforms. That’s too optimistic without related structural changes, such as exposing more of Russia’s firms now profiting off of market imperfections from import substitution policies to actual import competition in order to weed out the week and refine competitive advantages so as to better target subsidy money or else spend more of it on infrastructure and social policy. Russia’s economic experts are clearly fed up with the regime’s planning process and economic thinking and throwing everything against a wall in the hope that something sticks.

COVID Status Report

Yesterday’s cases came in at 17,648 with reported deaths at 437. It seems that the infection growth rate is tipping heavily into negative territory on a sustainable trajectory so long as vaccine supply holds up. Growth rates came out to -9.1% for Jan. 18-25 and -13.3% for Jan. 26 through Feb. 1:

Prior declines were primarily from people staying put more over the holidays than usual, it would seem. The government portal to register for your vaccination has now launched after 2 weeks of working out the kinks with regional governments, a rare display of competence amid the current wave of protest activity that undoubtedly became a serious source of stress internally. Interestingly, Dmitry Medvedev cracked open the door to registering foreign vaccines for use in Russia in an interview, so long as they passed Russian safety requirements. It’s just one statement, but it could suggest that some in Moscow are at least thinking about procuring additional vaccines to reach vaccination targets as a last resort.

Navalny vs. the Dvorniki

This weekend’s protest activity led to over 5,000 Russians being detained as the regime has prepared to repress protests as needed. Reactions are mixed. Some are hardened by repressive tactics, others fear for their own well-being lacking other options if there isn’t some sort of ‘end-game’ for the protest movement. Polling from a protest in St. Petersburg paints an interesting picture of how these protests seem fundamentally different than prior ones, and the serious problem the Kremlin has this year in managing protest activity. 3/4 of protesters were 35 or younger. The whole thread is linked here, but I grabbed the education figures:

21% of those attending were currently in higher ed, with 57% having completed higher ed (and of course the 2.5% of those lonely PhD students who made it out). Demographically, it is the precisely those people who are most educated and prepared for higher-productivity jobs and professional lifestyles sustained by Russia’s (relatively) resilient human capital despite its systemic underinvestment and informal and formal censorship within its educational system that want something to change. There was the brief flirtation back in 2018-2019 with Generation Putin pointing to the emergent crop of 18ish year olds who’d only known life under him and were just fine with it. These protests don’t destroy the story behind that sociological phenomenon, but they do stress that at least in St. Petersburg, the demographics are who we’d expect to see protesting, and frankly who the regime has accepted it ‘lost’ back in 2011-2012: urban young professionals. It’s unclear how many of them are directly affected by related social policy changes coming into effect, such as the inflation indexation for social benefits from last year that starts as of Feb. 1. The question is how durable the broader coalition that appears to have come together this time actually is outside of Moscow or SPB.

I don’t have any special insight on that front. It’s incredibly difficult to follow from afar and I have few people I reach out to who are actually involved instead of just waiting to see it go away. The international angle is one that I’m more curious about since 2020 signaled a clear shift in priorities for most of the public, but also the problem of the Kremlin’s past success. Looking at polling from YouGov on national attitudes about the UN, WHO, and other political matters offers an interesting juxtaposition. 76% of Russians feel that Russia is respected — surely evidence that the Kremlin’s obsession with national respect has paid off — but 78% of respondents thought Russia should focus more on human rights and 73% thought it should focus more on relations with its neighbors. Other topics similarly drew responses that the state should focus more:

Red = agree Purple = not sure Seafoam = our country should focus less

Take these with a grain of salt, but the basic impression you get from the data is that Moscow has been very successful at stoking faith that Russia is now respected, but it seems that Russians want more from the government to deliver on that respect. This dynamic is one I’m really not sure how to think about going forward. Levada’s data from late 2020 shows that the US has a net negative perception with the public while the EU maintains a net positive one. First chart is the US, second is the EU:

You have to wonder how the current calls led by the US and then followed by EU members regarding the release of Navalny and proper treatment of protesters are being received, if at all, by Russian audiences. The most telling shift geopolitically has ultimately been within the EU between Germany and France. Merkel’s looming exit and decision to pick Armin Laschet as her successor lined up a change in position from Paris on Nord Stream 2. As of today, the French government is now calling on Germany to cancel the project in what is, in a weird way, somewhat of an unintentional vindication of Trump’s and the US Congress’ approach to NS2. Paris is using Navalny as its excuse to make the shift in what appears to be a ploy to curry more favor with the Biden administration given the mounting challenges facing the Eurozone in the year ahead and need to feel out what his administration intends to do for US policy in Europe. Biden himself called NS2 a ‘fundamentally bad deal’ for Europe back in 2016 and his position doesn’t appear to have changed. It also works out that France is more aggressive about setting decarbonization targets for its power grid than Germany.

The European Parliament has already passed a resolution calling on the suspension of NS2. Navalny’s success in making himself an international story and rallying point for geopolitical decision making, not just domestic politics in Russia, is about to be put to the test. His team’s call for western sanctions on leading regime figures/cronies, including the likes of Igor Sechin and Roman Abramovich, has landed Navalny’s team at FBK on the Foreign Agent list for NGOs intended to make it as difficult as possible for them to function. The question now is who do the protesters trust more. The polling from SPB showed that over 80% of protesters completely or more or less trusted Navalny, and if that figure among those 35 and under is repeated elsewhere and holds relatively true for older demographics, it’ll be much, much harder for the Kremlin to spin any sanctions response as an unfair retaliation from the West seeking to advance its own interests and undermine Russia. This is basically the dividing line ironically now set by the regime’s success in simultaneously selling the public narrative that Russia was respected once more and constantly being insulted, mocked, and disrespected. If non-systemic figures are trusted by the segment of the public worst affected by the failures of Russian economic policy since 2012, many now entering mid-career and parenthood, it’ll be harder to claim the benefits of Great Power-dom without showing the public Russia’s working more proactively to improve relations as a reliable stakeholder the larger the share of the population is that remembers the opportunities they thought there were going to have wrecked by Russian policy.

We shouldn't overstate Navalny’s support, but the last polling data showing only 20% of the public approved of him will most likely look different because of the reach of his exposé on Putin’s palace. The genius of the current push for protests is that people don’t have to support him. They just have to be angry at the state. Arkady Rotenberg’s move to take the public hit by claiming ownership of the palace is a classic mess-cleaning move for the Kremlin. Always find a fall guy to keep Putin’s ratings intact. The impulse is to find a dvornik — a janitor minding the palace grounds in this case — to clean up the mess on the street and take the blame. Unfortunately, there’s a whole lot of mess and ‘personal responsibility’ doesn’t fix anyone’s problems.

For that reason, it’s hard to imagine that working this time, especially since the internet is so much more dominant an information medium now than it was in 2011-2012. The state, while successful in some respects, doesn’t have nearly the same control over the information space there as it does in legacy media. If, and this is a big if, the public reacts positively to sanctions threats and calls for Navalny’s release and better treatment of the public from Washington and European capitals, then the line between domestic and foreign policy will have been blurred enough to existentially challenge a great chunk of the geopolitical narrative the Kremlin has cultivated since Crimea creating huge pressure on domestic fiscal, industrial, trade, and investment policies. If not, then it’s much harder to see the current protests changing the status quo, but they are creating a larger, more integrated public space expressing political discontent. Either of those outcomes are bad for the Kremlin and the coercive power and mystique holding the political system as it is currently constituted together. And to think that its foundations lie in two failures of Russian economic policy: the loss of Ukraine from the EAEU and utter failure to diversify adequately to reduce the impact of a negative oil market shock and the oil price and sector on the broader economy.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).