Breaking

As you most likely know, there are now ongoing protests in Kyrgyzstan over the falsification of vote tallies in the national election, which returned 4 status quo parties into power. The rampant use of administrative resources to rig the outcome was evident. Bermet Talant notes:

Amid widespread reports of injuries and clashes in Bishkek, protesters seized the parliamentary White House, offices of the Presidential Administration, and offices of the National Security Council last night. The opposition parties have all aligned to fight the result and the election results have been annulled. I don’t have any idea what to expect next, though this is both surprising and unsurprising given the fractured nature of political power bases in Kyrgyzstan and problems COVID worsened. There’s a commodity market story to tell about this later when I’ve had more time to make to feel confident in any analysis. I highly recommend following Erica Marat (@Ericamarat), Bermet, Colleen Wood (@colleenwood_), Caroline Eden (@edentravels), Bruce Pannier (@BrucePannier), Peter Leonard (@Peter_Leonard), Joanna Lillis (@joannalillis) and others for updates.

What (else) is going on?

The Russian Union of Industrialists and Entrepreneurs (RUIE) is freaking out over a policy proposal that would ban the use of encryption protocols for websites. As constructed, the law would threaten Russian business’ exports by making them less competitive with global standards, which is sort of the opposite thing you want to do when you want to achieve a tech breakthrough and maximize the gains of other efforts for telecommunications and IT linked to 5G, machine learning, and so on. MinTsifry is promising a working group. Oh the logrolling to come.

Current subsidies and direct spending to support the implementation of 5G across Russia are pegged at 24.1 billion rubles ($307.5 million) through 2024. Given that the country has nearly $600 billion in currency reserves and its biggest SOEs hold more cash than the National Welfare Fund, that’s a pittance. Budgets always reveal priorities. Innovation that can’t readily produce rents via the state budget or procurements is simply less valuable in Russia’s business ecosystem, aside from individual cases like Sber and Yandex that, sadly, can’t sustain an innovative ecosystem on their own.

New data in shows that non-payments for rent and communal utilities hit 6.3% for Jan.-June this year, back up to levels last seen in 2016. Nationally, utility providers are owed debts worth 1.5 trillion rubles ($19.1 billion), nearly half of which is held by the public. Though not extreme, that’s bad news given the unemployment rate is closer to 12% than official stats show and it’s estimated that 4.9 million people are ‘secretly’ unemployed i.e. working for free, in the shadow economy, or otherwise experiencing massive wage arrears.

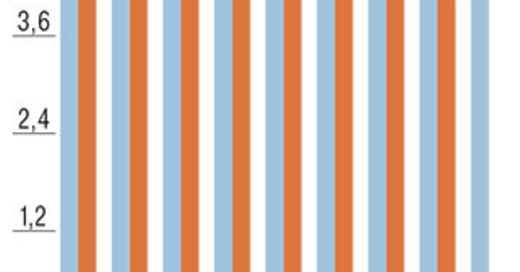

Title: Population’s debts for rent and communal utilities in Russia, % invoiced

Light Blue = Jan.-June Orange = Jan.-Dec.

There’s a growing problem with drug shortages on the Russian market, a phenomenon that has been building up as a structural problem for both inflation and access to medical care since 2014. Attempts to index prices to a 2-6% range around inflation indicators are constraining manufacturers’ investment by minimizing room to adjust to price increases for inputs, now happening for basics like paracetamol. An age old problem reaching back to the Soviet period: fixing and subsidizing prices creates shadow inflation that shows up in the form of shortage and under-production.

Soak and Dagger

Given all the talk about more fiscal consolidation and MinFin’s OFZ woes, I stumbled across a good graph capturing the revenue expectations put forward in the ministry’s 2021-2023 budget bill. Thanks to Tatiana Evdokimova for putting this out on Twitter! Looks like MinFin’s budget bill isn’t banking on significant revenue increases against GDP, but the question becomes what the composition of that GDP is assuming lower oil & gas revenues (and by extension, share of GDP and VAT receipts). Not all GDP is created equal.

Presuming the continuation of lower oil prices, things aren’t looking great for households and the private sector. A year-on-year comparison of the makeup of GDP for 2Q from 2017-2020 published by Kommersant shows how the economy’s structural reliance on state-owned firms and state-led activity (which isn’t by itself a problem, but imposes a drag on growth because of inefficiency, corruption, and underinvestment) is slowly worsening. One should expect that COVID’s effect on small and medium-sized businesses will only accelerate the underlying trend, especially if COVID stimulus support is pared back at the same time that authorities fail to control the virus. (Note that the last daily infection rate passed 11,600 people in a day, nearly the record high from earlier this year)

Title: Structure of the Use of Russia’s GDP, % - from Rosstat

Red = household consumption Green = state consumption Black = Non-profits’ consumption Light Blue = gross return on fixed capital Purple = change in inventories Pink = “Clean exports” (Exports - Imports)

For a snapshot of exports’ share of GDP pre-2017, I used Rosstat data for the current account surplus in USD vs. World Bank GDP figures in 2010 USD constant terms:

As expected, the 2014-2015 supply shock (and EM demand growth slowdown post-2008) slammed Russia’s current account surplus. That matters here because of the phases of Russian growth since 2000. From about 2002-2008, rising oil prices helped push salary and benefits increases, which raised household consumption despite the steady expansion of the state’s role in the economy that visibly began with the dismemberment of Yukos and re-nationalization of Gazprom. Then the return of high prices supported by US and Chinese stimulus in 2008-2009 and capital return to emerging markets in 2010-2013 stabilized incomes while GDP growth began to sputter. Since then, state consumption has been the necessary lever to maintain incomes amid falling oil prices and recession, and clearly COVID, by definition, crimps household consumption and raises the state’s share of it. It’s hard to see that being reversed given budget priorities and the structure of the economy. Stronger current accounts encourage state spending and an expansion of the state which proves more resilient to downturns cause of Russian fiscal policy.

While the tax burden is steadily raised on the non-resource sectors of the economy, marginal fluctuations in Russia’s current account or “clean exports” share of GDP will be more important than ever for incomes. In structural terms, Moscow would be better served focusing on income support to keep SMEs and service businesses alive. If they don’t, the recovery is going to be incredibly lopsided since the anti-inflationary basis of Russian economic policy functions best when export earnings are high to mask other economic problems. Some government officials who act as subject matter experts, work in the courts, and related institutions are seeing their pay rise by 3% as of Oct. 1 while other newswires are saying that regional officials will see pay freezes for 2021-2023, but Siluanov wants to limit inflation indexation for salaries to those saving in the military next year. As the state’s role in the economy is likely to grow as the consumer of last resort, I’d expect a lot more hollering behind closed doors about who takes pay cuts. Belousov talked tough to the mining sector last week cause he was under orders. It won’t be so easy once they can’t blame COVID for weak growth and business prospects.

Altered Carbon Tax

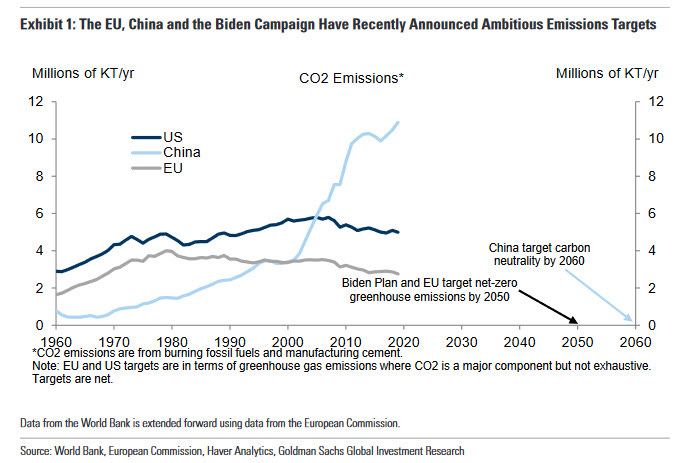

The EU’s push to consider a carbon border adjustment tax - basically a means of penalizing foreign exporters for using carbon-intensive production and consumption practices - is interesting to consider from Russia’s perspective. First, just to reiterate where things stand with annual emissions and that the EU, the smallest emitter of the “troika” is doing the legwork right now:

The EU is wedded to the idea that it can use the size of its market to accelerate regulatory convergence towards its own rules elsewhere. One of the biggest challenges it faces is making a carbon levy on imports compliant with WTO rules and proving it’s not discriminatory - lord knows Beijing will go to court over it. But the European Commission has already gone ahead and announced plans to withdraw free carbon allowances for heavily polluting industries within the EU’s emissions trading systems (ETS). Refiners in Europe have long warned that increases carbon costs would render them uncompetitive with other regions. Given that Europe has a glut of capacity compared to regional demand, it’s a given that COVID is going to lead to permanent refinery closures because the margins are simply too low to survive and will be less competitive for export if they have to place product volumes against refiners unencumbered by environmental regulations. For context from the Argus piece linked above showing the margin for refined gasoline over Brent crude:

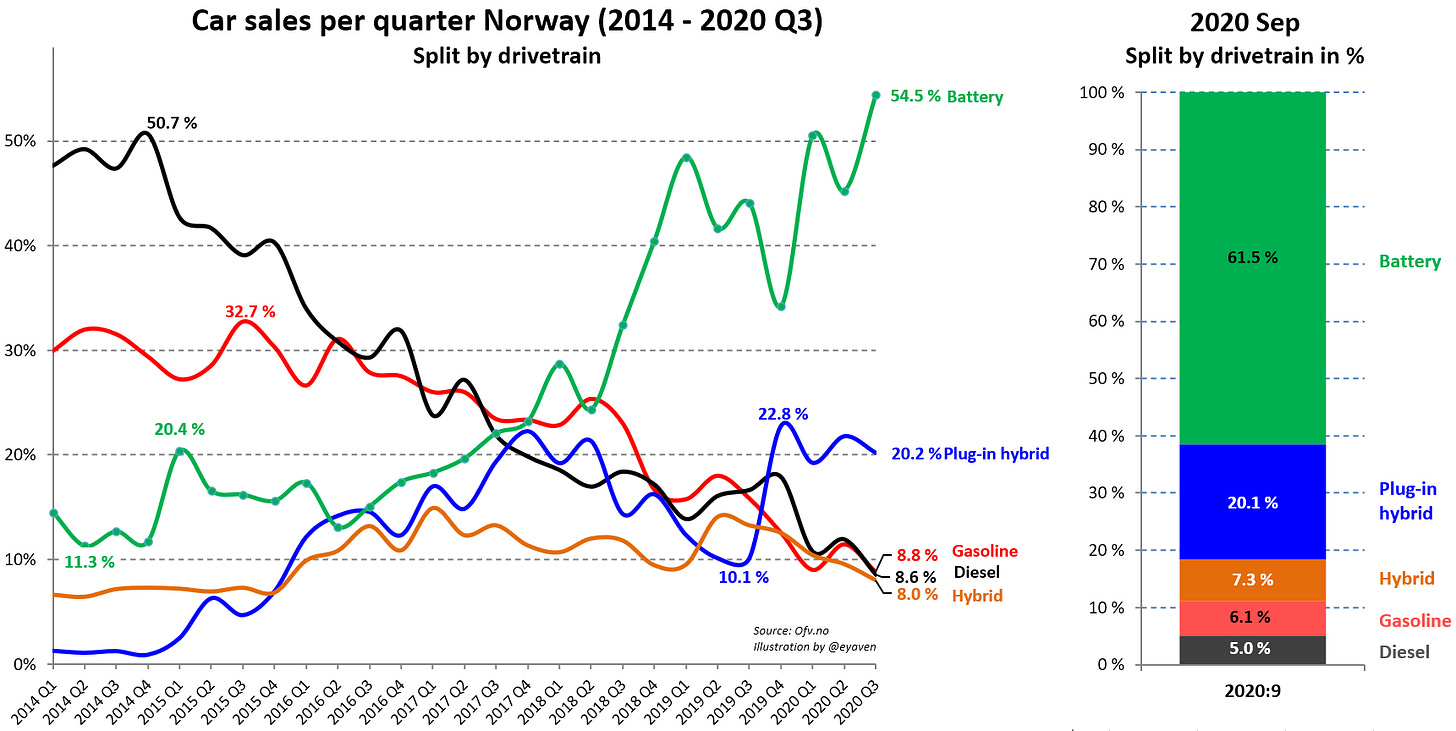

COVID has murdered refiners’ margins for a key road fuel, one that will take a hit as European EV adoption is going to accelerate with state support. Norway is an exceptional case in most respects, but is still instructive in just how fast consumer preferences shift if investments are made into infrastructure and credits or grants used to encourage EV sales:

These trends can have a huge impact on product margins before EVs become the dominant means of road transport on any given market (and long-haul trucking is going to be particularly difficult to shift from diesel for many countries). The adjustment tax is designed to avoid “carbon leakage” - the offshoring of a supply chain to jurisdictions with worse emissions standards. The Commission’s proposal is expected in 1H next year and it’s already begun to rewrite rules on state aid to allow support for companies exposed to international trade losing out to carbon leakage on the condition that they invest into lowering emissions. The UK has been urged to remain within EU carbon trading and pricing schema. The IMF has endorsed putting a carbon price on imports, which goes to show that carbon is on its way to becoming a sticking point for national balances of payments and trade negotiations.

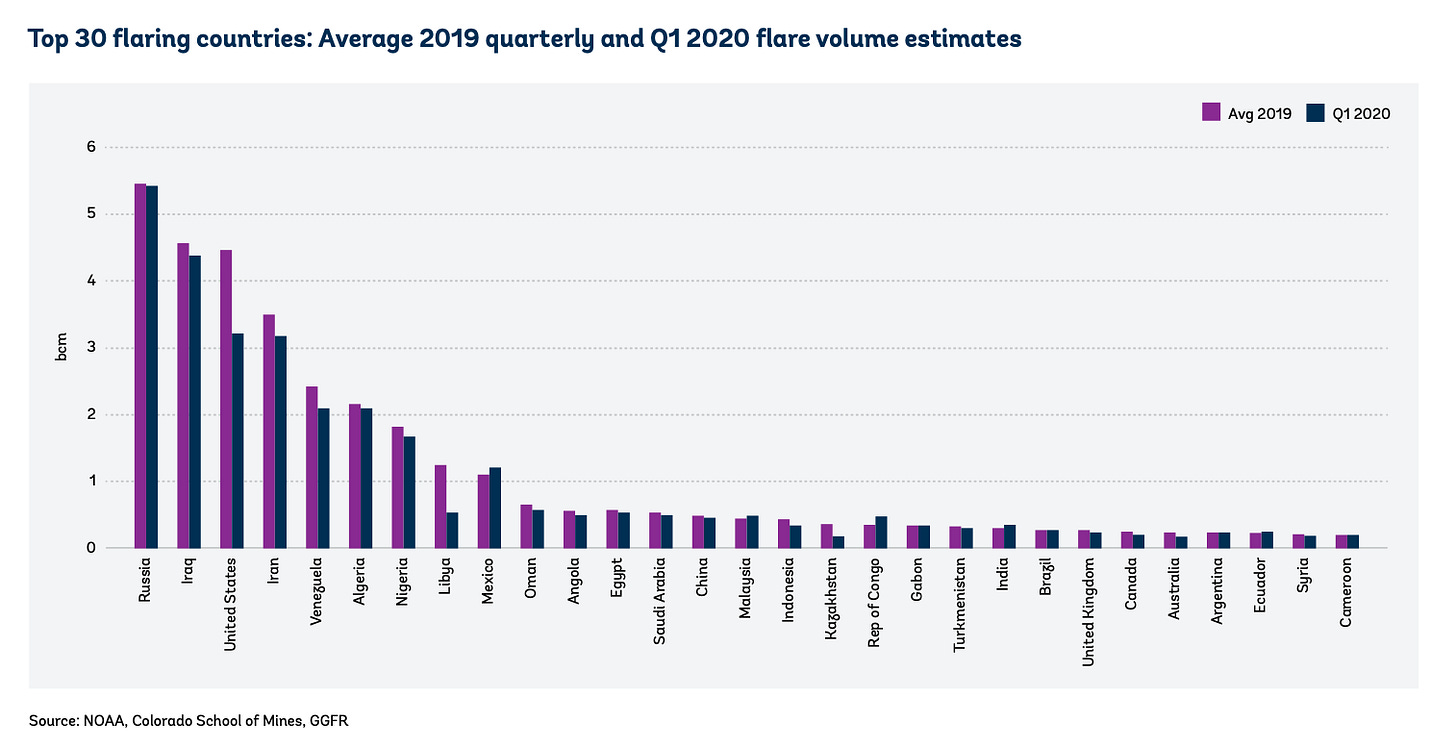

The adjustment tax was discussed by Dmitry Medvedev and a bunch of representatives at a late August meeting of the National Security Council. Clearly some are aware of the implications, but the issue isn’t even just industries losing revenues - KPMG estimated a cost of over €33 billion between 2025-2030. My own gut reaction is that it’d be higher (but I don’t have their model or my own in-hand). The real problem is that it’d actually slam Russia’s O&G sector and make exports less competitive to the European market. Russia is the world’s worst offender for flaring:

The comparative price increase from an import levy on oil - assuming it isn’t exempt in the final proposal, which is a possibility - would force Russian firms to discount crude to compete with Saudi Arabia for market share. Any importer in Asia is going to then try to do what they can to arbitrage discounted flows into Europe if producers can’t adjust, so inevitably Chinese importers will demand price cuts. Taking a few dollars off a barrel adds up bigly for the current account and company bottom line over the course of a year or years. This all has a big trickle-down effect. Ironically, there’s significant potential for Russia to upgrade its own refining complex to improve the array of products it can export if enough European capacity comes offline with declining margins or, in the case of Rosneft and Lukoil, learn how to adapt European standards to Russia by dint of owning refining assets in the EU. It’s early days for the full-on proposal, but this is becoming a reality Russia needs to address, and not just by liberal economists pointing to a carbon tax as a good policy proposal.

I’d wager that if Democrats control the senate and White House in the US, they might fight back on the levy, but would use the opening to build in worker protections for manufacturing in the US into trade deals while trying to make headway. For all his faults, Biden was the candidate who best acknowledged that climate change is a transnational problem that no domestic US policy could fix without a diplomatic offensive. Would be the irony of fate to see combating climate change fundamentally rip apart the political economy of Russian power projection in foreign policy and not all the tough talk on elections and what-not.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).