Top of the Pops

Armenian prime minister Nikol Pashinyan stated on his Facebook yesterday that he does not believe a diplomatic resolution to the current fighting in Nagorno-Karabakh is possible. In short, diplomatic efforts now in motion are frippish theater. Talks in the US are largely window-dressing and it’s clear that NATO is not going to take sides given that neither warring party is a member and, more importantly, Azerbaijan is NATO’s landing strip between European bases and Afghanistan since they lack access to Russian airspace and other bases in Central Asia. Karabakh is becoming a Donbas-style conflict - Azerbaijan is set to bleed Armenia until it can’t afford the economic and political costs any longer. Unlike Russia, however, it’s in better position to do so. There is no way of knowing whether it works, but suffice to say that peace is off the table unless Russia’s willing to risk a direct confrontation with Turkey, a NATO member, after its deployed troops in response to Moscow expanding its security commitment to Nagorno-Karabakh.

In totally unrelated news, check out the latest word on Tesla’s lithium battery R&D. No matter how impractical scaling up production is for now, the prospect of lithium batteries with 2 million mile lifetimes is huge for future EV car parc turnover and shifts in consumer preferences for vehicle retirements and materials use.

What’s going on?

Sergei Naryshkin is reportedly visiting Minsk to meet with Belarusian president Aleksandr Lukashenka. I’d keep an eye on it with the latest wave of speculation that Foreign Minister Sergei Lavrov is finally on his way out. Mark Galeotti’s analysis provides helpful context and Naryshkin, head of the SVR, is a logical choice to fill the seat at MID in line with the heavy securitization of all of Russia’s foreign policymaking and implementing institutions in place of proper diplomacy. I’d only add that Dmitry Kozak makes very little sense to me as a replacement because of his ubiquitous role handling business interests for domestic agendas Putin clearly has little time for or interest handling.

The folks from “Osoboye Mneniye” (Distinct/Special Opinion) are warning Russia’s systemic political parties that ideological views and sympathies are increasingly unimportant as voters are unsatisfied with their quality of life. Resolving social problems has to be the main priority ahead of next year’s elections in order to maintain a favorable electoral balance without losing public face. While that’s pretty obvious to even a casual observer, it’s worth noting the flare fired off by pushing out this report in Vedomosti to prod people along. From this year’s electoral results:

Title: Average result for parties in 2020 elections, %

Parties in descending order: United Russia, Communist Party, Liberal Democrats, A Just Russia, Party of Pensioners for Fairness

Middle column = regional level Right column = in administrative capitals

MinFin’s looking at a record OFZ issuance as it’s registered 361 billion rubles’ worth of demand for 8-year maturities since Oct. 18 against the planned issuance of 309.6 billion rubles and demand for 5-year maturities hit 40.2 billion rubles against the planned issuance of 30.4 billion rubles. In total, it’s managed to place 1 trillion rubles ($12.97. billion) in three auction days. Looks like concerns that the domestic market couldn’t absorb the volumes have been disproven for now, though it’s also important to check where the resident vs. non-resident share of purchases stands later on in 4Q. It’s also telling who’s borrowing on the bond market:

A clear dominance of public borrowing on the Russian domestic bond market amid rising budget financing needs. Something not seen in the crisis of 2014-2015 when interest rates were in a double-digit territory.

A clear dominance of public borrowing on the Russian domestic bond market amid rising budget financing needs. Something not seen in the crisis of 2014-2015 when interest rates were in a double-digit territory.

Corporates sitting on large currency reserves aren’t keen overall for 2020, but note that this doesn’t seem to include Rosneft’s impending issuance which will match the height of that light blue bar at the end. I’m less convinced that dominance is going to hold (at least at these levels) especially for SOEs that benefit from Russia’s sovereign rating, and will come back to this later. Discounts only hit 0.48% for the latest batch of sovereign issuances.

RZhD head Oleg Belozerov is reportedly asking deputy prime minister Yuri Borisov to intercede with the coal sector and reduce coal haulage from the Kuzbas along the Baikaul-Amur Mainline (BAM) so that it can be used instead for coal production from Eastern Siberia and the Far East. Kuzbas coal loads via BAM have reached 55 million tons, quite a bit more than the 39 million originally planned whereas shipments from Eastern Siberia and the Far East only reached 33 million tons instead of the hoped-for 65 million ton target. At heart, this is a regional fight with market rates playing a role. Kuzbas coalers want better market rates while Yakutia in particular struggles given coal prices have been hit by COVID.

COVID Status Report

The latest from RBK on the spread of COVID-19 isn’t great:

Key: Number of confirmed cases of infection

Based on rolling averages for infections per 1,000 people over the last 30 days, the Republic of Altai, Magadan Oblast, and Kalmykia are all ahead of Moscow for worst hit. Andrei Kolesnikov’s minutes from Putin’s meeting with the Russian Union of Industrialists and Entrepreneurs has strong “these are not the droids you’re looking for energy” except that the stormtroopers, suddenly “convinced” that they aren’t, are really just playing along for the benefit of an old man of stature with the power to make their life hell. Andrei Belousov believes that unemployment figures aren’t so dramatically bad and Putin seems convinced that if people simply follow medical advice, there’s no need for real restrictions. How much of that is managing up and how much of that is managing down I don’t know, but instead of Jesus, it seems the Sputnik-V vaccine has taken the wheel.

Ever the Engie-nue

Politico ran a good piece on how the French government has delayed a $7 billion LNG deal cut between Engie and NextDecade for future exports from its planned Rio Grande LNG terminal in Brownsville, Texas over concerns about methane emissions standards. A little bit of inside baseball here from my brief time in consulting: French banks and investors have already been looking at US methane emissions regulatory standards for shale in an attempt to score them in terms of compliance with the IEA’s best practices, industry groups, and the Paris Agreement goals. This specific case is an interesting one given that it arose from the Trump administration’s attempts to roll back regulatory standards, something that oil majors have actually opposed but has been supported by state-level chambers of commerce and small and medium-sized producers. Scott Pruitt’s tenure at the Environmental Protection Agency was a masterclass in handouts to friends from back home - in his case, that was Oklahoma, a significant player for shale gas production in the US.

Pulled from my Twitter feed last night, thanks to Phillip Heimberger:

We’re already back to net emissions growth for 2020. Companies in the US are also facing the brave new world of open-source intelligence gathering and constantly improving data collection capabilities:

No one can fudge facts anymore. The larger point is that France is taking a stand on a US project for political purposes as much as environmental concerns, hedging so that if Trump wins re-election, the Texas oil & gas lobby will start demanding tighter emissions standards to remain competitive. It also signals a clear shift in willingness to factor in emissions into trade as a political tool. Per IEA methane estimates, one wouldn’t expect US LNG projects to be much affected by recent EU commitments to formalize methane emission legislation in 2021:

NextDecade even formally committed to reduce its output before the French government made its announcement. It’s obvious that as the issue moves towards formal legislation, Russian natural gas production is at risk of losing much of its competitive edge without significant investments into emissions capture and mitigation. Yesterday, France’s Total delivered its first-ever carbon neutral LNG shipment to China’s CNOOC - carbon neutral here meaning that emissions have been offset at every stage of the value chain. Given the company’s stakes in Yamal LNG and Arctic-2 LNG with Novatek and CNOOC and the growing climate scrutiny for lenders financing these projects, Novatek seems the best positioned to make the leap win Russia.

French corporates fit into a more comfortably statist economic ecosystem than their counterparts in the United States or UK. Even for a center-right reformer with imperialist dreams of civilizational struggle like Macron, dirigisme has its uses. European capitals are getting ready to pressure US policy no matter who wins the election and that’s going to matter in Moscow eventually.

Murder He Quota

Looks like Rosneft CEO Igor Sechin has been trying to convince Putin to push for a change to the OPEC+ cuts regime since the spring after the price war ended up being an Epic Fail. But rather than breaking with cuts, Sechin’s idea is a bit more novel: introduce what is effectively a cap and trade system with the oil production quotas so that companies can “buy” excess production from other companies cutting back so that the total adherence to the cut is maintained but Rosneft allowed to keep drilling for new fields. In effect, Sechin wants to buy out independent operators to seize even greater relative control over the country’s production. MinEnergo is strictly against it, especially if Rosneft were to somehow become the “operator” managing the quota system.

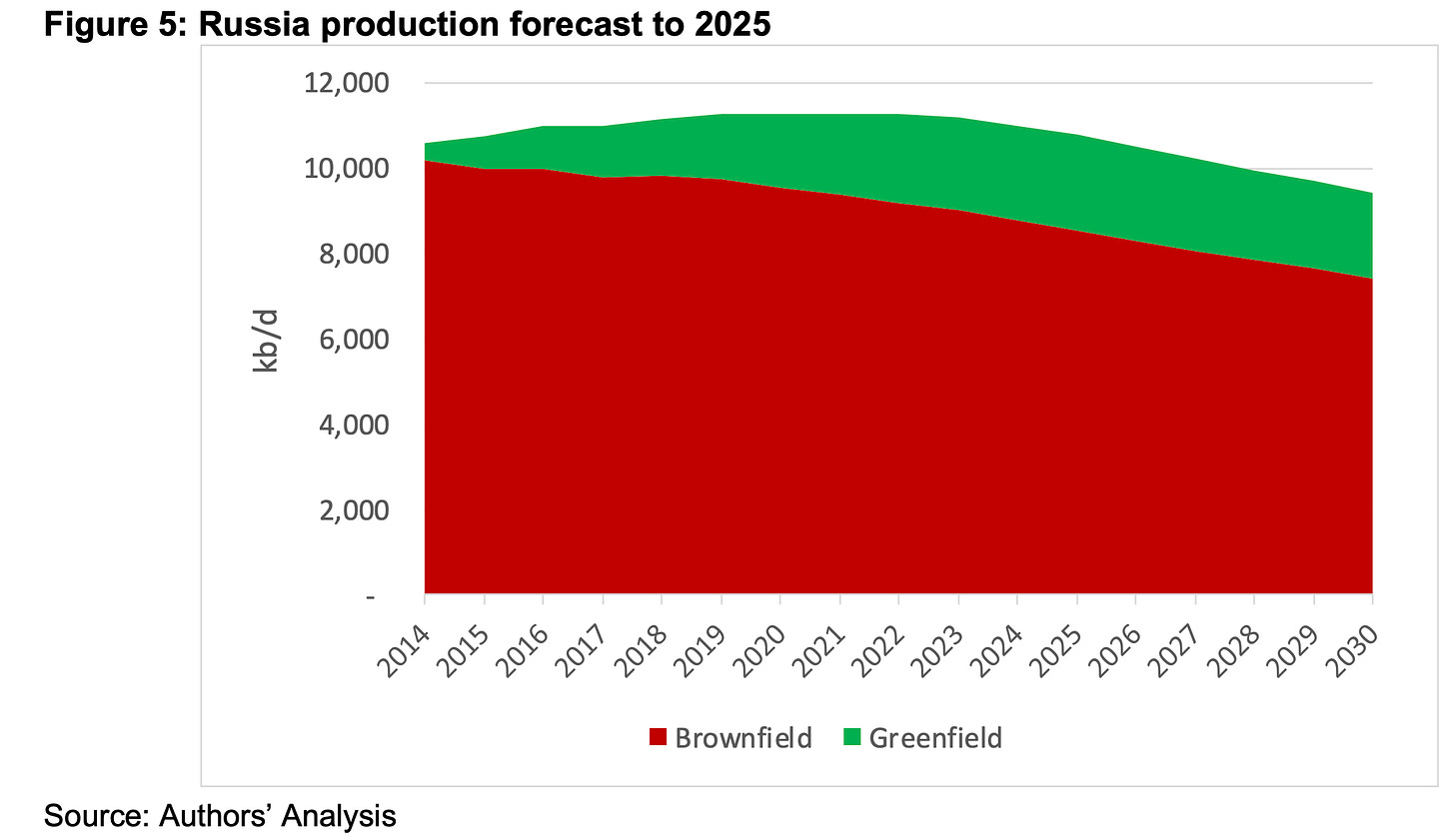

It’s a blatantly self-serving idea, but one that could make more sense in a world where production and reserve management become increasingly important due to downward price pressures for oil. What’s odd, though, is that even Finance Minister Anton Siluanov backed breaking with OPEC+ back in March-April. He was convinced that Russia’s budget and economy could survive at $30 a barrel. Not only was he spectacularly wrong, but he hasn’t shown any signs of learning more about economics and political economy since. Without some kind of pressure valve to distribute additional output gains negotiated within OPEC+, there’s going to be an inevitable conflict within the sector next year over who can invest into greenfield projects. Prior to the COVID shock, the balance between brownfield and greenfield production was a key concern for projections over future output in Russia. Per this Oxford Energy analysis:

The oil market has a collective action problem once demand stops growing: who cuts production to maintain prices? That’s always a sore subject, but becomes much more worrisome when future demand can no longer smooth out returns on conventional oilfields with a planning horizon of decades. Sechin’s proposal is designed to make him the permanent kingmaker in the oil sector, the hall monitor who gets to bully the smaller kids into handing over their lunches and emptying their pockets with permission from above. As far as I can tell, he realizes that breaking the cuts again will lead to tragedy but he can’t invest into new production without more slack. If I owned an independent operator and prices fall again on a global double-dip recession (thank China and the US congress), I’d be worried. There aren’t any Bashnefts left to draw Sauron’s gaze.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).