Top of the Pops

The fault lines are more clearly emerging now among investment banks, squawking heads, and (wannabe) politicos as to how we can make sense of the current commodity price rally, and why a new cycle is so different than the 2000s cycle. Oil bulls keep banking on US shale driller restraint and ignore the structural problem that alongside upstream cost deflation, OPEC+ still has the excess capacity needed to meet demand as it normalizes and air travel is going to take a lot longer to get back to 2019 than every other derived consumption of crude oil. What’s more important in my view is the distribution of marginal demand changes as the correlation between classic macro factors and commodities shifts:

We’re already seeing a visible shift from Russian policy — transport subsidies for commodity exports are now being cut to make it less competitive against domestic consumption and try to rein in domestic prices. Metallurgical export and fertilizer subsidies are being completely axed, while other products that have risen in price are on the chopping block as well. Commodity bears rightly point to rising COVID infection rates and China’s GDP growth is slowing faster than expected on top of some concerns about the People’s Bank of China’s decision to cut capital reserve requirements for banks and pump ¥1 trillion of liquidity into the economy. That’s where US infrastructure talks come in. Developed markets are now in the driver’s seat for future marginal demand gains, and that’s why so much hinges on how much Washington spends this year as well as whether Europe’s never-ending austerity politics make way for much more expansive shared spending commitments. The bear/bull story is now about politics. Even when infection rates rise, most of the remaining consumption under lockdowns or even with falling incomes remains commodity intensive. This is why oil’s in such a weird place. China and the developing Asia-Pacific followed by Middle Eastern consumers have lifted oil demand since 2000 while it remained stagnant in developed markets. If the former slowdown now while developed markets commit money to reduce said oil consumption, it’s the rest of the energy, transport, and infrastructure commodity basket that benefits while oil nears its ceiling.

What’s going on?

Moldovan president Maia Sandu and her Party of Action and Solidarity (PAS) have won the parliamentary elections with just over 52% of the vote and 63 of 101 seats. Now the fun really begins with an explicitly pro-EU reformist party in power and a host of structural problems the political system has been completely incapable of making even marginal progress on over the last decade. In the next 5 years alone, it’s estimated that the population (2.63 million) will decline by 270,00 people despite expectations the economy will keep growing at or just above 4% annually. The only reason inflation hasn’t proven as ruinous since the COVID crisis began is that remittances accounted for about 15% of GDP as of 2020 and a majority of the remitted earnings are coming from the EU, in Euros when possible, and therefore offsetting potential losses in spending power using leu. No one should kid themselves that Chisinau is at the top of any priority list in major European capitals. Still, Sandu’s visit to Berlin a month ago and meeting with German president Frank-Walter Steinmeier — admittedly a generally ceremonial figure — were still important signs that her government will keep at it diplomatically with the EU. External aid and investment will be essential to any further reform process. The decision to lower the pension age last December repealing a past reform attempt only increases the pressure on the budget while also being quite popular give the large, aging political constituency dependent on fixed-incomes to survive as young Moldovans go to Romania and onwards elsewhere within the EU to find better opportunities where they can. These are the types of ready-made wedge issues that’ll come up quickly as the opposition, as disorganized as it often is, starts throwing post-election flaming darts at PAS.

State procurements are up year-on-year over 2020 in number as well as average cost as inflation begins to affect price assessments for tenders, with SOE procurements and costs rising faster than state procurements cost. Straight state orders are up 18% in volume and 8% in average cost vs. a 22% rise in volume for SOEs and 16% rise in costs. LHS is in 000s while RHS is in millions of rubles:

Pink = state orders Red = avg. state tender cost Blue = SOE orders Black = avg. SOE cost

First, we can see clearly that SOE procurement costs are, on average, way higher. That makes a lot of intuitive sense since SOEs tend to build elaborate preferential supply chains to enrich the right people or generate intermediate demand between each other and subsidiaries, whereas state procurements for smaller goods/services would be cheaper and entail arm’s length transactions more often. What’s more interesting is that February-March are generally the peak procurement months after a big drop-off in January from December. That means that the effect of state consumption on demand is strongest in those two months based on the usual budget cycle. Fitch has maintained Russia’s sovereign rating at BBB with a stable outlook, a rating that might have improved perversely had Russia spent more as noted in prior newsletters, but the timing within the year is important to consider too. MinEkonomiki’s improved economic growth forecast comes after the peak of the short-run boost to growth from budget procurements — admittedly SOEs spend more overall, but that also gets to the problem of fiscal stimulus for Moscow. If SOEs are the primary channel for stimulus measures, then spending has to be justified at the business level rather than, say, a step-change in infrastructure investment or healthcare spending that increases households’ relative spending power and lowers business transaction costs while employing more people (who at the moment, the labor market is short on).

MinEkonmiki rewrote its roadmap plan to improve energy efficiency across the Russian economy to include decarbonization in the latest sign that Moscow’s political institutions finally grasped they had to act before Europe, the US, and China wrong-footed them in turn as national and regional policy approaches develop. There aren’t any hard targets as the ministry intends to publish them after the 2050 Net Zero strategy is adopted by the government. So far, the focus seems to fall on industrial production, power generation and transmission, and utilities systems — there isn’t a grand electrification plan for electric vehicles buried in here or some new national urban and regional infrastructure initiative either. It’s the stuff that affects household expenses and Russia’s industrial exporters and it’s mostly about rewriting existing rules to create political tools to pressure firms to make investments with targeted state help that won’t generate a large increase in state investment. That includes upping fines for failure to lower emissions and strengthening energy efficiency planning requirements for any construction. In other words, it’s a Goldilocks approach not dissimilar from the new initiative to combine wealthier with poorer regions to transfer more resources out of the wealthier urban centers where voters already dislike or outright hate the regime or else are just keeping their heads down to help rural areas, smaller, poorer towns, and propping up the voting base the Kremlin has relied on since 2012. It serves a logical policy purpose and makes economic sense, but only comes together because it’s politically convenient.

SOE dividends will only pay out about 290 billion rubles ($3.89 billion) to the budget this year according to the head of Rosimushchestvo Vadim Yakovenko. Last year, they paid out 639.5 billion rubles ($8.58 billion). One has to hope that the reduced payments aren’t indicative of large losses on margin, and otherwise would correspond to a net increase in investment. One of the biggest problem with this specific aspect of Russia’s state capitalist model is that SOEs still need profits to pay out dividends. While most SOEs either serve state needs i.e. security and defense, strategic sectors like logistics, or are export-facing, they have a crucial impact leading some trends or forces on labor markets. According to new polling from Grant Thornton, only 27% of businesses are optimistic about the national economy in the year ahead and more importantly, only 7% are willing to raise wages faster than inflation and only 30% are willing to invest in IT. Baumol’s cost disease reason these factors come together — salaries in industries that have seen no real productivity gains tend to have to rise in response to salaries in industries that have to retain talent because labor costs are linked across labor markets. The fact that state officials saw their salaries frequently increase above inflation since the crisis began is a reverse case — there probably wasn’t a productivity increase for most public services — and SOEs have taken part in that dynamic at different points. Other businesses can’t raise wages without having adequate demand to be confident in their earnings, whereas SOEs sit on the most attractive market rents and have more flexibility to do so. It creates a tug of war dynamic that imposes additional costs to SMEs and newer firms in the long-run because working for state firms looks that much better when people know their salaries are likelier to keep pace or else beat inflation in a crisis. Not paying out dividends suggests something’s up with SOE plans this year, and it builds on the lack of confidence in the recovery now evident after the oddly euphoric takes from April-May confusing a low-base effect for success. Now that the National Welfare Fund is being used to dish out 1.6 trillion rubles ($21.44 billion) for civilian aircraft production and procurement, we’ll see how the new civilian aviation push handles cost increases for labor and falling consumer spending power over that timeline as businesses see gloomy days ahead.

COVID Status Report

25,150 new cases and 710 deaths were recorded in the last day. The rate of increase in regional cases is just slightly flattening but at a slower rate than the last wave. That should be a massive red flag — non-Moscow cases peaked at 21,750 on December 19, 2020 and they’re currently at 19,737. The rate of vaccine take-up has accelerated significantly and we’re now past 20% of the population with one dose inferred from the July 10 data:

After the initial moves last week to allow foreign vaccines to launch, we’re now seeing Moscow and Beijing setup potential joint vaccine recognition at the Eastern Economic Forum. That’s almost 2 months away but still a big deal. The CoviVac vaccine has surged in popularity, because of the hope that one shot will be enough for one’s immunity instead of 2 and a variety of bizarre fears about GMOs, other scientific memes, and distrust of Sputnik propaganda. Doctors and medical authorities are moving to be as strict as possible for those seeking vaccination exemptions, basically saying that only allergies or hypersensitivity are acceptable and most long-term conditions won’t be considered. Things are looking up for vaccines for now. The question is what happens when the vaccination wall of skeptics hits and how long it’ll take before vaccinations bring down rates enough to be visibly improving things at the national level.

Need for Weed

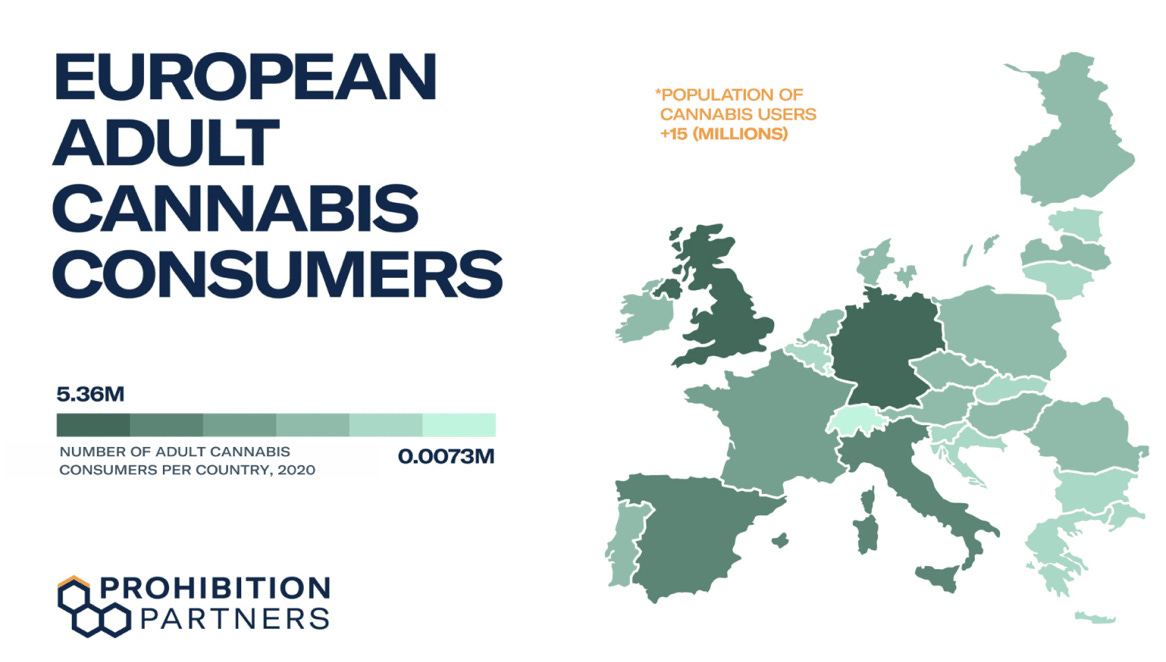

It’s not every day you see the president of a former Soviet state push for weed legalization, even if it’s initially for medical purposes. Ukrainian president Volodymyr Zelensky is pushing the Rada to pass a bill that would legalize medical cannabis in Ukraine while also taking up issues like reforming defense industrial enterprises. A poll late last year Zelensky ordered found just under 65% of respondents supported legalization. I can’t speak to the accuracy of the particular poll, but that offered enough ammunition to put it on the agenda since January. If the proposal passes, it’ll make a big difference for the Ukrainian economy and draw in a lot more westerners. Even if it’s for medical purposes, we know full well that there’ll be a multitude of ways around limits imposed and that drug laws will be enforced differentially, especially if large inflows of tourists are partaking. Consider the distribution of consumers in Europe based on admittedly high level polling from Prohibition Partners that would bet a bit of an outlier since it’s 2020 data:

These markets matter a great deal and can create decent sources of localized revenues. The world’s consumer of last resort, the United States, spent $17.5 billion last year on legal sales. It’s far more difficult to assess the value of the market in the EU, but it’s much less developed — enthusiastic growth projections have legal sales at just €3.2 billion by 2025 with an annual compound growth rate of over 60%. There’s clearly huge demand out there not being met and anyone looking for an excuse to bag some more tourists to spend money on your country’s hospitality sector and services while building up more public awareness of what your country has to offer in Europe can spot that. Zelensky needs a larger political constituency to help it build upon the reform gains its making now, particularly since the de-oligarchization process he’s launched has historically provided cover to simply replace one constellation of patronage networks with another.

US Secretary of State Tony Blinken set a clear checklist of reform priorities at the videoconference for the International Conference on Questions of Reform in Ukraine that the marijuana bill might indirectly ease politically:

Reform the Higher Council of Justice and Qualifications for Commissions of Judges

Make the nomination of the leadership for the National Anti-Corruption Bureau and Anti-Corruption Prosecutor’s Office transparent

Align corporate governance standards with the OECD

The demilitarization and depoliticization of the SBU

Actually prosecute corrupt officials

Corporate governance is by far the most important in practical terms. The OECD found that 86% of all 3,300 SOEs in Ukraine were still operating as state unitary enterprises instead of converted into state-owned shareholding structures that promote greater transparency. The result is that ministries and state organs exercise direct control and ownership over firms without any institutional separation creating hosts of conflicting interests. When it comes down to it, being able to assess who owns what, their legal responsibilities, their obligations to boards and shareholders, and the ability to safely transfer property without political interference are core to any sustainable reform coalition. The issue is sequencing and it takes years and years to carve away at entrenched interests, especially in a country like Ukraine where institutional weaknesses are amplified by a more regionally-centered elite system wherein the center lacks the same kind of veto power and dominance over decision-making as in Russia. There isn’t a power vertical one can build and maintain in the same manner.

Weed clearly wasn’t on Blinken’s mind since his boss isn’t exactly a sterling progressive voice on the matter. He may have instructed the Federal government to stop contracting with private prisons, but that isn’t an abolition of the institutions that managed to turn the mass incarceration of non-violent drug offenders into a rentier’s dream. In the case of Ukraine, it’s a smart way to generate local revenues and reduce the scope for extractive behavior from policing institutions — the application of drug laws is often selective and smuggling and growing operations, when they exist, have to pay people to make the cops go away. If you create a legal channel for growing and distribution, even one that’ll encourage others to follow the letter of the law rather than its spirit, those types of problems and sources of graft become less prevalent. Roughly 1/10th of all Ukrainian prisoners are sentenced for drug possession. It may not be a huge number of people, but that is quite visible an issue. Combine that with poor public health services for addicts and it’s a big drain on public resources that skews lots of other institutional and personal incentives for the worse. Doing so creates that much more political capacity to address bigger problems. Blinken and the EU reps all made clear that judicial reform is the foundation upon which everything else must be built, but as a matter of practicality, one has to reshape interest groups and economic blocs to be able to pursue a systemic overhaul. You also need to create new groups if possible. 6 years ago, you even had a Vox op-ed talking up legalization as a means of reducing homicide, assault rates, and turning people off of harder drugs by making soft ones more accessible and managed. What makes this proposal important to flag is that its constituency is ultimately the voters, not a specific business or interest bloc, but it can become the latter over time as well.

It was a radically different context and unsuccessful, but Anatoly Chubais’ efforts to create a nation of shareholders in Russia were premised on being able smash the system of vested institutional interests by doing so. Pair this proposal with the first stages of the land reform and you can see that logically, smallholders and entrepreneurs might well try to get into the business quickly if the marginal returns are better than what they’re currently growing or else restrained from growing thanks to quota setting and other political decisions they can’t influence. Existing laws allow farmers to grow hemp for industrial purposes, but has massively hindered planting because quotas to grow more have rarely been approved. The lack of direct ownership of land impeded the institutional efforts needed to allow people to take risks with their own property for profit, within the reasonable limits one would expect from matters such as shared water supplies and properly managing waste runoff. It also has the added benefit of allowing smallholders to move up the value-chain and diversify business before land sales would be opened up to large investors in a few years’ time, marketing various CBD products and related services to consumers or other growers if the current quota system adapts to private ownership effectively. Even if it’s just medical legalization, one can see laws being managed to allow more growing for export. Once you have an export lobby, suddenly you have more businesses invested in improving ties with the EU — Russia isn’t legalizing anytime soon — and locals living in agricultural producing areas see the benefits of land privatization directly. I’m conjecturing a fair bit on how the laws shake out, but just think it’s refreshing to see political decisions being taken that escape the usual bounds of intra-elite political settlements that dominate in non-EU former Soviet states. Ukraine’s still stuck in a political halfway house, but at least they may soon soothe the pain with some decent bud to go with a dark beer and dinner while European tourists realize their money goes farther and there are avenues to find supply while taking in the sites.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).