Top of the Pops

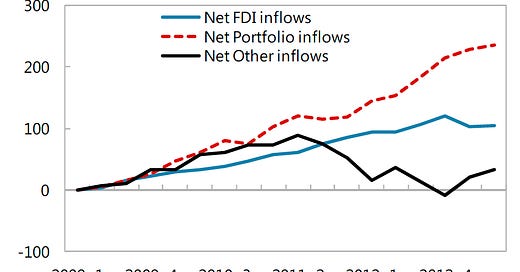

There’s an argument going on between the old guard fighting the last war and today’s circumstances. There are those still afraid from the infamous ‘Taper Tantrum’ that struck emerging markets in 2013 when the Federal Reserve announced it would taper its quantitative easing program, thus spiking US bond yields and triggering a bout of volatility and falling asset prices and currency values felt mostly by emerging markets. And there are those who I think are much closer to being right that the present rise in US bond yields isn’t due to anything like 2013, but rather signs of growth expectations and an expansion of bank lending. The stagnation Russia entered in 2013 was most mostly domestic and structurally of its own making, but it still came amid a larger shift for investment patterns into emerging European economies (read: Eastern Europe):

Foreign real economy investments dried up somewhat, Russia was praying it could get FDI into Arctic oil & gas projects with prices still high, but by and large, most of the inflows were portfolio investments — people and institutions looking for financial assets to hold onto for return. The volatility that broadly struck emerging markets in 2013, however, did have a net negative pull on the oil market by the next year as the relative growth rates for developing countries slowed. For all its economic sovereignty, Russia can’t escape the pull of US monetary policy so long as it depends on external demand. This time is different. US Treasuries are only rising for longer-term maturities, not the 2-year bills, and the rise tracks with rising growth expectations thanks to US stimulus and vaccination efforts:

Market movements of capital out of indices for emerging market bonds, for instance, aren’t anywhere near touching what happened in 2013 yet, nor have currencies devalued as much. The current pressures for inflation are idiosyncratic — supply chain disruptions, clearing backlogs of orders, specific commodity price increase linked to cyclical underinvestment in production or resilient and rising demand for food. They aren’t long-run (yet), and it takes time for commodity input prices to register as broader inflation outside of markets that don’t work effectively/efficiently, like Russia’s or else for food since demand is constant and mostly unchanging. The Taper Tantrum did end up contributing to Russia’s economic woes in 2014-2015. This tantrum, so far at least, is largely in the minds of specialists and analysts not yet comfortable with the idea that central banks have the power to control yield curves for bonds at all times. Oil’s biggest problem remains the virus, any long-run economic impacts or changes in behavior and preference from it, and policy changes associated with the COVID shock.

What’s going on?

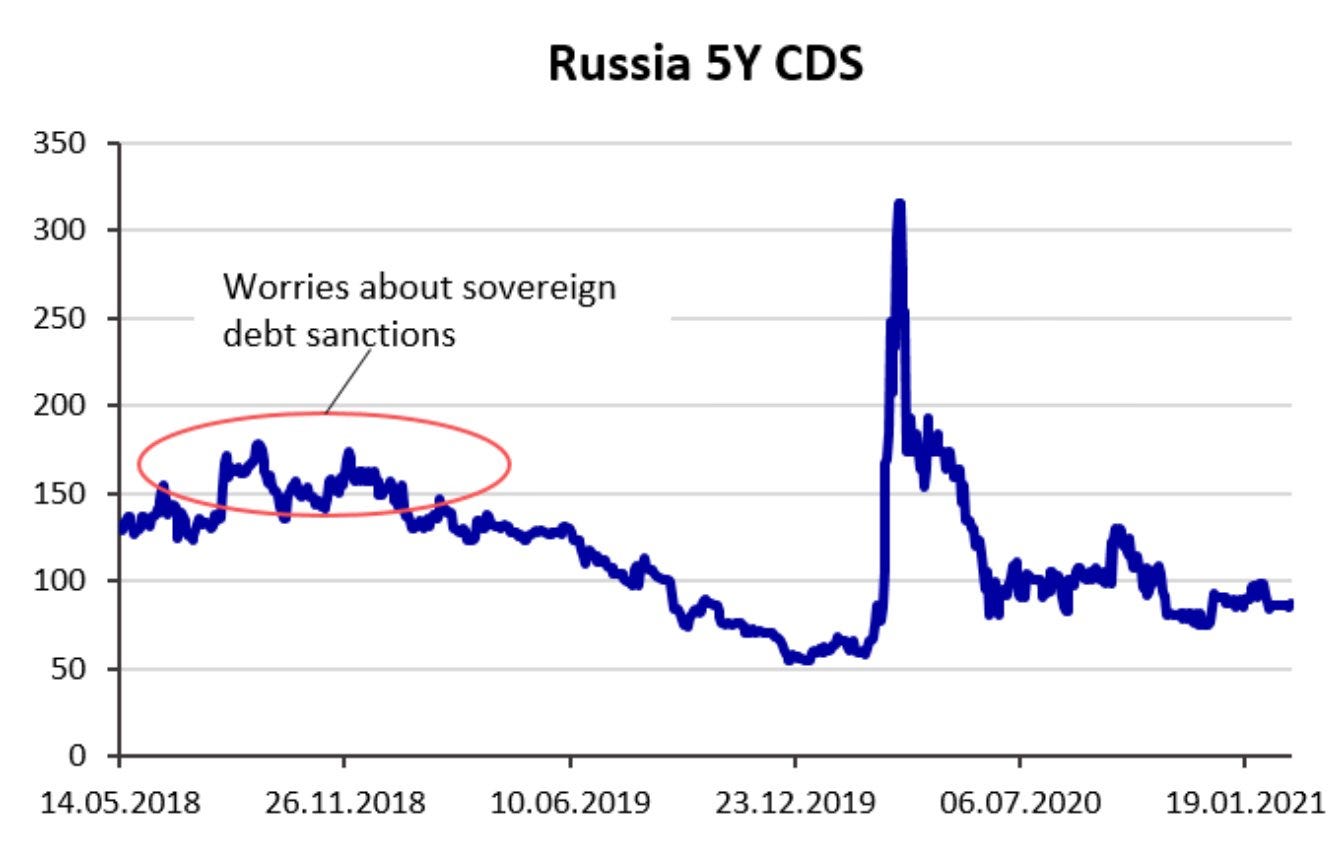

From tomorrow through April 6, MinFin is nearly tripling its foreign currency purchases to a total of 148.1 billion rubles ($2 billion), 2 billion of which will be in USD — that’s the equivalent of a planned $91 million currency purchase vs. the current $32 million level for the same time period. It’s a response to the budget rule since the adjusted base price for oil at which point it kicks in is $43.25 a barrel for 2021. These purchases are expressly to support the ruble, such that I’d expect to see some ruble strengthening the longer oil holds above $60 a barrel. Oil & gas revenues are also beating expectations so far, which augurs well for expanded spending plans — the ad hoc break with the normal budget rule means that all deficit spending made with oil at or above about $45 a barrel is debt-financed. But no one’s sure why these purchases are being made since the ruble’s been fine, what with the better than expected performance last year. The country risk premium frequently cited as a related cause for greater ruble weakness than fundamentals suggest isn’t reflected in rates for credit default swaps on Russian debt:

MinFin doesn’t seem to trust the ruble’s stability and is siphoning off money that could be released and spent elsewhere. It’s good to make policy more predictable and less reactive to oil prices, but the flip side is that the additional $60ish million on a monthly basis could go a lot farther if it provided liquidity for productive investments or, gasp, was used to strengthen domestic demand given MinFin loves to withhold unspent budgetary outlays that would do so and park them into non-budgetary vehicles where no one else in the government can touch them.

In a surprise, Rosstat’s data for capital investments across the economy showed just a 1.4% decline for 2020 vs. the expect 3.3-4.3% decline from the Central Bank and MinEkonomiki. It mostly comes down to post-September growth linked with the usual 4Q budget spending splurge, but the data also leaves out a fair bit of SME investment not directly captured by stats. The following are % share of total capital investments by category:

Descending: private, federal, regional gov’ts, joint Russia/foreign, foreign, mixed Russian, municipal, state corporations’ property

The fact that capital investments barely fell suggests two things: the business climate is truly terrible and supply side measures served their intended function of maintaining investment levels. Even the mortgage subsidy — nominally a demand side policy — functions to bolster supply side measures because of credit scarcity during a crisis for most Russians and, most crucially, the fact that it has probably done more to allow constrained demand from falling incomes onto the market and we still don’t have good data on who’s actually done the buying. Affecting the supply of credit in the Russian economy is about the supply of money for a specific type of consumption here, not more direct demand measures via income support etc. As one might expect, healthcare and social service investment rose a dramatic 54.3% in response to COVID (which maybe says more should have been invested earlier…) but what’s most telling about the odd crunch in the data is that construction investment rose 10.5% while investment in real estate dropped 17% despite there being an evident housing bubble emerging late year. Basically, attempts to control the supply side without more demand support are likelier to distort the recovery than support it, much as in China though with a very different structural logic and political economy underlying the approach.

The imposition of additional export quota controls and tariffs has led to surprising changes in trade patterns as partners adjust to the decreased competitiveness of Russian grains sold after the quotas are filled. Georgia has become the 4th largest importer of grains from Russia and the largest buyer for Russian corn. For January alone, the data shows Georgia importing 350,000 tons. But there’s no way this corresponds to longer-run demand in Georgia proper and it’s much likelier that volumes are being bought for re-export since prices are higher and that some importers from elsewhere are dodging restrictions by buying in Georgia for re-export themselves. Georgia’s annual imports per USDA data are usually around 600,000 tons. This is obviously a trade distortion that Russia’s ill-conceived price control measures have fostered. Georgian importers were just scrambling to buy before higher tariff rates hit to then re-sell and benefit from the arbitrage with a later transaction. There’s another, funnier explanation based on oddities in trade data elsewhere on the Russian side: Russian firms are reclassifying what they’re selling on declaration forms to keep existing contracts in place without price fluctuations. It’s going to be a fun year tracking the data it looks like.

The Ministry for the Environment has reported introduced a proposed law to the cabinet that would legally bar industrial companies from paying out their full dividends if they own ecologically dangerous assets that aren’t operating in a clean manner per regulations. The ‘haircut’ to the dividend would correspond to the scale of pollution and ecological degradation. Once any ecological damage/incident is declared, it would immediately apply to the dividend scheme rather than incurring some sort of administrative delay, the result of which would be much more volatile equity valuations for companies refusing to invest at adequate levels to protect the environment. As part of this scheme, companies have to report their own financial activities to meet ecological standards using bank or independent guarantees, insurance agreements, or reserve funds while payments for negative impacts on the environment will be accumulated and then distributed as necessary to remove or replace assets causing said damage. What’s more interesting is that the proposal was reportedly ordered by Putin and vice minister Victoria Abramchenko jointly in response to the Norilsk Nickel spill, suggesting a lot of pressure to get moving on this. I think it’s actually a decent step given the limits of state capacity to achieve much of anything as well as the regime’s political economy. But it’s gong to require a step change in domestic investment levels for industry, which either requires stronger demand for their goods and services or else a large fiscal commitment from the state to directly allocate capital. That last part is where the fighting will start.

COVID Status Report

There were 11,835 new cases and 475 deaths reported. While there’s clearly growing confidence because of the lower infection rates and Sputnik rollout, the head of the Federal Biomedical Agency (FMBR) Veronica Skortsova is warning that a new wave of infections is unavoidable unless they can vaccinate at least 25% of the population in the next two months. Some of that is probably trying to scare people to action, but it’s quite worrisome since the 7-day rolling average of doses given per 100 people hasn’t really budged since vaccinations began. I wanted the EU as well, but there wasn’t aggregated data available per the portal:

If anything, it’s declined slightly from an already unimpressive figure. The FMBR has made progress testing its own vaccine as it becomes apparent that other options might be needed to increase take-up (though how they would do so is a mystery given how hard it is for the regime to convince the public). Kirill Dmitriev at the RDIF is publicly expressing his confidence that EU members will be cleared to import Sputnik-V within a month while the Kremlin attempts to backtrack on its own sputtering vaccine diplomacy in Africa by explaining that vaccine supplies “aren’t humanitarian aid.” The miserable vaccination rate in Russia is sure to lead to an excess stock of vaccines, especially as more come to market and take-up seems to only be getting worse, so it makes perfect sense that Moscow would focus on financial gains over free aid at the moment. It also helps keep the research infrastructure responsible for the breakthrough financially secure without additional funding. Think of it like applying the defense sector’s export model to finance some of the armaments program to other sectors.

In the Room

Vedomosti ran a piece today that caught my eye about the Duma’s staffing machine changing slightly. It seems that Andrei Zhorin, former member of the presidential administration, will be joining Tatiana Voronova's staff as a deputy. Zhorin’s been tasked with handling public affairs and communication with the public. Specifically, he’s acting on a proposal from Duma speaker Vyacheslav Volodin to strengthen the legal obligations that elected officials have before the voters. In short, there’s a realization that as much as control over the levers of power of the country’s political institutions are being tightened once more to prevent Navalny or any other outsider from mobilizing a coalition to challenge the regime’s monopoly on political power, the Duma has to become a forum that more adroitly reacts to and addresses the public’s needs and interests. Zhorin’s just the guy to do it given his background in the security services and decade spent handling internal politics within United Russia from 2003-2012.

I generally shy away from personal analyses because I’m much more interested in material structures and how they shape the “ideas lying around” to find solutions or else the ability of any given individual to act within a political context. This announcement isn’t earth-shattering, but I think it’s an interesting development for the September electoral cycle because of the structural implications of what I understand to be the regime’s strategy so far and this new spin on ‘personal responsibility’ that permeates the government. Volodin’s own statement backing up his proposal made the following point:

"We see that during each convocation there are examples when promises made are forgotten, justifying it with populist statements. If we find a solution to fix citizens' appeals to deputies, this will do a lot to bind us."

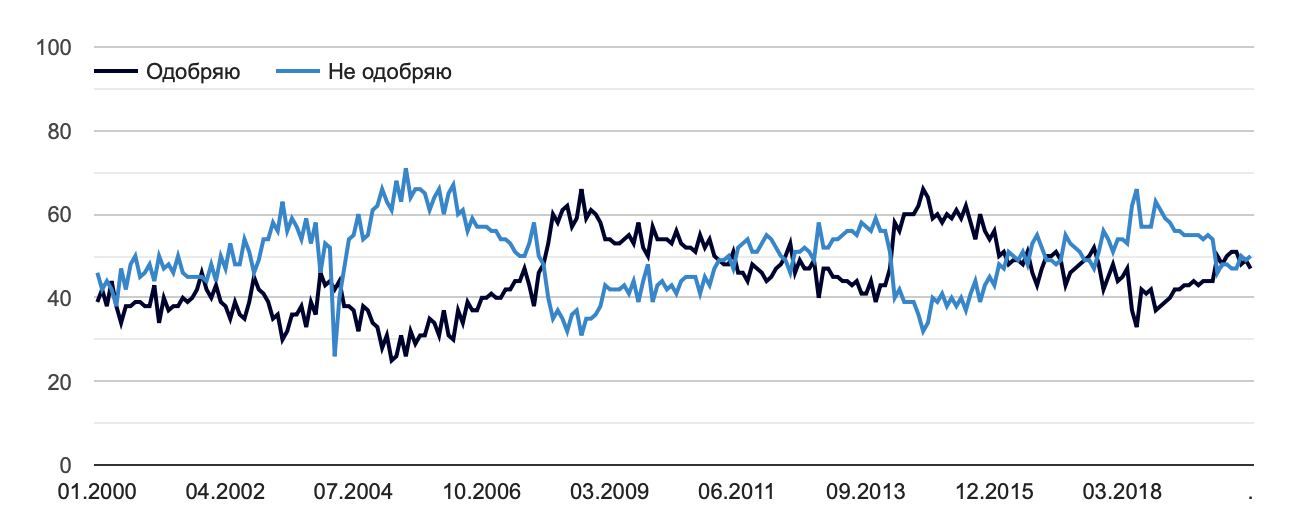

It sounds a lot like they need new instruments of accountability to combat the populist statements made elsewhere. The escalating crackdown on non-systemic opposition organizers and anyone connected to Navalny can stifle the organizational capabilities of outsiders trying to urge people to use smart voting to disrupt elections for United Russia in particular. What it can’t do is anything about the underlying causes of discontent, which continue to go unaddressed at a time when the presidential administration needs the Duma to improve its public image to avoid dragging down trust in the cabinet and government. Consider the following from Levada, first that more Russians don’t approve of the Duma’s activity than approve and then that support for the government is almost evenly split despite the notable lack of further stimulus yet announced:

The longer that the economy suffers and lacks significant evidence of strong recovery — I ignore business optimism surveys for now because they’re operating off a low base and optimism isn’t the same as physical orders or spending — the more pressure there is on institutions outside the presidential administration and presidency to be able to react to public needs. Zhorin’s promotion is predicated on the idea that more of the non-systemic opposition’s energy and furor can be channeled into systemic political parties, ideally United Russia, by creating a legalistic justification for political competition to take place on the basis of actually doing things once in office. The problem, of course, is that any such competition can only be useful if legislators can substantively shape fiscal policy without a permanent veto from the Ministry of Finance and the Kremlin before public debate has even begun. This gets more complicated still since the usual tactic is to portray Putin as negotiating the face-saving deal whenever a difficult announcement such as the pension reforms is made. But growing discontent over him staying in power indefinitely, even if that doesn’t signal a desire to replace him with someone else, makes these proposed changes an important extension of past innovations for the regime’s political system.

Russians seem to like their governors a lot more than their Duma reps, which is probably because governors actually resolve things locally. They wield executive power and can offer favors. However, that power is quite limited in the matter of things like price inflation without considerable help from the federal center. The federal center has to spend to be able to offer that help at a meaningful level. And further, the hoped-for governmental renaissance led by Mishustin as he pushes for greater efficiency and quality of governance while reducing staff sizes will look like more window-dressing if he doesn’t get the current inflation situation under control. The spending consensus — and the power of the Duma to actually direct spending alongside governors — would have to evolve in this case, especially because there’s no way Russian investors are going to open up their wallets and push investment levels as % of GDP higher unless their money is crowded in via subsidies or direct spending. Every marginal addition of legal responsibility within electoral institutions, including the Duma, acts as a salve for the public mood today. But once you allow the public to demand more things of elected officials, you’ve further opened the door to political competition with considerable risks no matter the bounds you’ve place on it. Governors have proven more effective at managing this dynamic also because of the Kremlin’s active management of personnel and rollout of KPIs to create some sort of accountability framework that is not entirely opaque to the public.

Expanding these types of frameworks into elected institutions at the federal level will probably filter down to regional and local elections with the politicians most Russians have far more exposure to. And the more accountability matters at the local level, the more engaged Russians trying to fix issues from roadwork to school repair to municipal waste have to engage with the manner in which the federal center denies them the resources they need to do so. None of this deterministically leads to political crisis for the regime. I’d rather argue that they reflect a crisis of structure. Putin’s absence from domestic policymaking unless when absolutely necessary makes it all the more important to control institutional outcomes such as a United Russia majority come September so that they can fill the gaps in governance he has preferred to ignore and farm out for most of the last decade. Yet the ability to secure that majority is compromised by the regime’s preference to pursue macroeconomic stability in such a manner as to actually render the country less stable in many respects, creating permanent push-pull tug of wars over inflation and supply vs. demand for basic goods, the housing stock, and more while, more recently, inflating a housing bubble to create a new store of wealth that would be threatened if housing supply levels increased at a faster pace.

Trying to control political competition without actually fixing the economy is a foolish endeavor for the simple reason that if they intend to bind systemic politicians to make good on their promises, they amplify the potential for systemic political figures to actually agitate for change. These aren’t new trends, but these problems are more salient because of the depth of Russia’s economic stagnation and, increasingly, appearance of relative economic decline. Trying to push non-systemic political activity into the systemic sphere may well end up creating a series of policy Trojan horses in the long run. Russians are mostly content that their country now has a voice on the international stage. They don’t care about great power politics. Almost half the country thought the economy was in a bad place late last year and nothing the regime’s done so far in 2021 is helping the economy that much. The question, as ever, is how long that long run actually is for these pressures to materialize. Structurally, at least, they already are.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).