Top of the Pops

Vedomosti ran with a retelling of coverage from FT that Swedish metallurgical firm LKAB is aiming for a net zero emissions target by 2045. It’s expected to call for $47 billion of investment over the next 15-20 years. The functional details — recycling inputs, developing cleaner production processes for steel, moving beyond the current model of carbon offsets — aren’t as interesting as the scale of the investments needed LKAB’s 2019 earnings were around $3.64 billion. The scale of the financial challenge to reach that 2045 target is immense, and highlights that in political terms, ultra-low, zero, and negative real interests rates are here to stay if these companies and policy initiatives funded by sovereign governments have any shot of working. That means that, for Russian firms, it’s quite possible — and likely — that even with risk premiums, borrowing in foreign currencies on foreign capital markets or, in some instances, from foreign banks will be more attractive on a rate basis so long as they can secure the loan or, in the case of a bond or hybrid bond issuance, be confident they’ll evade further sanctions restrictions. Put another way, it’s a dynamic that could make the USD more powerful in some respects so long as the Euro is saddled with the escalating risks of a weakening banking sector in the EU and the lack of a unified capital market. Easing sanctions risks, therefore, would be central to any Russian policy actively engaging with the energy transition. As Aleksandr Novak establishes his own mini-power vertical from his new cabinet post in the energy sector, I’m curious to see how he approaches trying to get MinFin and the Siloviki to get comfortable financing the massive overhauls that are going to be needed to keep pace with change.

What’s going on?

MinFin is planning for an incoming Biden administration and reviewing the possibility of new sanctions on Russia’s ability to issue sovereign debt. Petr Kazakevich, director of the department of state debt and financial assets, made clear that they don’t think such sanctions are a likely possibility (since they know full well the US Treasury’s internal debates think sanctioning sovereign debt further would be stupidly counter-productive for the US’ position internationally). Declines for foreign investors’ share of debt held aren’t a concern because of the strength of domestic demand for it. The bigger shift since mid-year has been the over 3 trillion rubles ($39.7 billion) in floating-rate bonds issued. On the whole, it’s clear that MinFin isn’t worried about trouble financing state spending or left field sanctions proposed by Biden’s team.

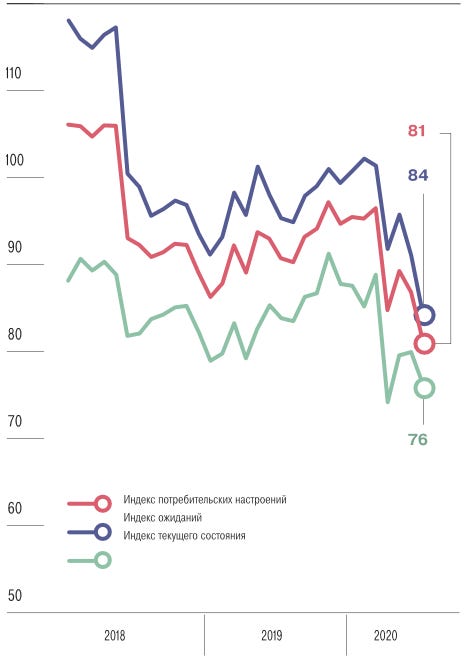

Consumer sentiment in Russia is plunging per the latest assessment put out by the Central Bank. It seems that while Russian consumers are experiencing inflation during the current crisis, most still seem convinced it’s a temporary phenomenon:

Red = index of consumer sentiment Blue = index of expectations Green = index of current conditions

The CBR is much more concerned about the collapse in sentiment and expectations than short-run inflation for obvious reasons. Ask indicators now point to large deflationary risks if demand doesn’t recover. 2018-2019 were already a drop-off and some stagnation for Russian consumers — a reminder that even when the oil market returns to “normalcy” around $60 a barrel, consumption and expectations only lift a little bit. Savings rates are also declining now, which means people are burning through their savings. The CBR is promising easy monetary policy and to keep rates lower, but Turkey’s experience has probably scared off any thoughts of lowering the key rate below inflation as it would likely trigger massive capital flight. Still, Nabiullina is telling the market “we have room to cut” in hopes of inspiring calm.

Rosneft is launching a $2.2 billion metallurgical project meant to produce 1.5 million tons of steel and turbines for the Zvezda shipyard in the Far East. The problem? The plant will produce 4 times what Zvezda consumes annually and no one at MinPromTorg can make sense of why Sechin wants the project at that scale. South Korean steel has displaced Russian steel for most output because of the large distances to ship steel domestically for the shipyard’s purposes as well as limited available capacity. There’s no conceivable way the Far East generates enough demand to absorb the excess capacity, so best guess is that Sechin is trying to kick contracts to Chinese counterparts and friends. It’s a good case study for how SOEs and large firms in Russia have the potential to massively distort regional imbalances and multiply inefficiencies between regions with their power to lobby.

For the first time in 5 years, Russian food retailers are seeing a rise in sales of bread, with expectations sales will increase about 2.9% in monetary terms to 552.7 billion rubles ($7.3 billion). This is a story about rising hardship. With real incomes declining 8.7% year-on-year in 3Q, spending growth is clustered on low-cost items and staples. Bread production declined 5.4% since 2015 and under current conditions, flour prices have risen 18-21%. Retailers selling these goods operate with slim profit margins — 2-3% in Russia per ROSPiK — so increases in input costs on that scale have to be passed onto consumers. This dynamic goes to show how supply constraints and demand constraints generated by Russia’s bevy of state interventions into key markets and macroeconomic policy is generating differential inflation in a manner that’s going to hurt next year. Jacking up property values at the same time bread is getting more expensive without income support is a recipe for disaster. It’s clear that push-pull factors on prices for bread are driving inflation, and the velocity of money going into purchases of such goods, not monetary expansion.

COVID Status Report

Last 24 hours saw the caseload at 25,487 with the dip made up almost entirely by Moscow as usual with a record death toll of 524. The regional map is back and slightly reset based on the spread by number of confirmed cases:

On the whole, key export-producing regions still seem harder it and while travel will undoubtedly be reduced this winter, everyone’s now getting stuck indoors at last. When asked for comment on how long Russians would have to scrimp and save, Putin’s spokesman Dmitry Peskov replied “We have no idea, because [no one] has any idea how long the epidemic will last.” Irkutsk just received 700 medical suits for those caring for COVID patients from South Korea in a gesture of support. I’d be curious to see what else they and Japan have offered compared to China as I’d expect the virus to linger in Siberia and the Far East for longer than Moscow and European Russia even once they launch a national vaccination regime.

Goldie Yawn

Earlier this year, it seemed, if for a relatively brief moment, that Russia was betting on gold bugs having their day. Due to the colossal price crash on European natural gas markets (and earlier losses from China’s lockdown), Russia earned more off its gold exports than piped gas exports for April-June. In late April, Moscow pushed through a regulatory change to provide gold miners perpetual export licenses instead of one-off rights to sell abroad. It was a crisis measure, for sure, and meant to support Russia’s current account since in April, global markets had a newfound desire to acquire gold. The Bank of International Settlements has a new report on the role of gold in sovereign financial asset portfolios worth reading, and it helps explain what presumably Russian policymakers were thinking since gold is an odd duck of an asset — it does not represent a financial claim and has no corresponding liability:

The upticks since 2000 correspond to financial shocks, while gold’s declining share is easily explained by the massive expansion of sovereign liabilities and claims backed only by central banks (and less directly by fiscal policies). Emerging markets with current account surpluses would generally be able to rely on reserve accumulation of USD, Euros, and Pounds Sterling while buying gold as a hedge. Gold would, in theory, be a bit more salient for emerging markets with current account deficits trying to prevent significant currency volatility. Russia was trying to make use of its roughly 330 million tons of annual production to sell to other central banks that were hedging in support of the current account. It was also an indirect means to sustain investment plans in the Arctic and Far East. Shaded darker gray are Russia’s gold-producing regions:

MinPrirody is now pushing gold as one of the most attractive resources to mine in the Arctic, which fits with the need to generate foreign currency earnings to support long-run budget subsidies and spending. The shift towards gold tracks with post-2014 efforts by the CBR to pursue some degree of de-dollarization to the detriment of actual stability since the rise in Euro reserves is now heavily exposed to European deflation risks:

Gold, in practice, is often bought as a hedge against the US dollar. The market still supports this view. A weaker dollar tends to correlate to a higher gold price as gold is useful to hold against USD inflation. In effect, Russia’s bet against the dollar, which certainly befits the bizarre soundbites that occasionally come out of the Kremlin or agencies in Moscow about the risks to the US dollar’s hegemonic role, or else the pablum that Sputnik and RT push. The irony, of course, is that if buying gold is central to “de-dollarizing,” it just reifies the relationship with the USD. After all, the Central Bank has to estimate the value of its gold reserves in US dollars without being able to directly exchange it for any other currency (in most cases). At the same time, gold’s increasingly what’s backing the expansion of the money supply in Russia — note that the Central Bank is diligent in keeping monetary expansion steady given its inflation-targeting mandate comes first. All 2020 figures are Jan.-Nov. so the full year figures by year end will differ some, particularly given likelier continued money supply expansion though the slowdown in borrowing will crimp that. M2 is used for the money supply data, so that includes liquid assets easily converted into cash:

Private banks create money too, so they may have their own reserve balance sheets that look different, but it’s interesting to note that Russia’s increased gold hoarding coupled with a relatively flat money supply growth profile imply that the CBR is using a relatively illiquid asset subject to price fluctuations that strongly react to US macroeconomic policy so as to back future money supply expansion. Further, the purchase of CNY for currency reserves (not broken out here, need better fine-grained data) also hints at lower levels of liquidity for a key asset since China has to maintain significant capital controls to prevent financial contagion from rippling through the economy. Then add the dollar being replaced with the Euro — now appreciating due to deflationary pressure and slightly less liquid than the dollar, especially given rising European banking sector risks — and Russia’s potentially playing itself.

Many expect gold to keep rallying in 2021 on the assumption that the distribution of vaccines, this year’s monetary expansions, and stimulus plans will create significant inflationary pressures against which investors, businesses, and central banks will want to hedge. That’s going to increase the value of the ruble in exchange should something in the range of an 11% appreciation from levels around $1,800 per troy ounce take place per big banks. If the gold stock keeps rising, that dynamic matters more. But in this case, a stronger ruble risks creating deflationary pressures in the Russian economy. Implied lower liquidity with foreign currency in relative terms via Central Bank operations is not great for banks, but manageable and not a huge problem. The. bigger issue is that if the ruble strengthens and makes imports more affordable without any substantive improvement in the current account i.e. other key commodity exports that generate foreign currency earnings, what’s really happening is that exporters earning in foreign currency are seeing their relative income decline and with it, the value of the foreign currency that filters into the banking sector to sustain this year’s credit expansion.

I’m not suggesting a calamitous effect, but it is curious to see how disinterested Russian policymakers seem to be to the implicitly deflationary bias of their policy prescriptions. That gold is taking on a greater role to backstop the ruble is part of those calculations. Any economic stimulus to remote eastern regions in Russia will be limited. Gold mines don’t generate rents like oil & gas, let alone provide a viable backbone for further economic diversification. They do, however, provide a cost advantage for inputs on tech supply chains that require the stuff. Gold’s a great conductor, so conceivably Russian firms could take advantage on cost savings to export in some instances depending on other input costs and trade barriers. Stocking up on gold seems almost antiquated. Then again, they are planning to ride out the worst in the event of even stricter US sanctions and perhaps it was the best option they had. The price of gold is going to have a stronger effect on Russia’s balance of payments and the health of its banking sector the greater the reserves grow. It’s a throwback to a much older time.

Keeping the peace

Despite appearances, I’m skeptical that Russia’s faced with mission creep in Nagorno-Karabakh. Peskov’s clarification yesterday that Moscow was simply setting up centers to coordinate humanitarian efforts pushed back against some claims I stumbled across on social media hinting that Russia’s peacekeeping mission was expanding. It’s difficult to imagine that MoD and Shoigu are keen to tie up more resources than necessary to do the job, especially when there’s so little upside for Russia. Still, with more emergency services personnel arriving in Stepanakert now, they may well be in for a long deployment. As what’s left of Armenian Karabakh struggles to recover economically, Moscow is going to have to foot more of the bill if it wants its presence to deliver a durable peace for further negotiations. As of now, the humanitarian mission is estimated to only cost a few billion rubles a year.

The French senate decided to ruffle feathers without any gameplan, a not entirely surprising decision taken in Paris given Macron has pivoted to forge a new consensus as Europe’s George W. Bush. In passing a resolution urging the government to recognize the independence of Nagorno-Karabakh, the senate effectively called a bluff. If France is to lead a Europe built on its ideals, then surely it must have a role in mediating Nagorno-Karabakh? It turns out that reality is far more complicated. The Azerbaijani parliament is now calling for France to be excluded from the mediation process since its resolution de facto renders France unable to impartially play a role. They even called for France to lose its chair of the Minsk Group, but that’s just spite. Ironically, Russia’s job would be much simpler if the EU or European nations individually had a definitive approach to providing humanitarian aid and redevelopment assistance to Nagorno-Karabakh. The money has to come from somewhere. Now that Paris has infuriated Baku, it’s all the more difficult to create any space for Europe to play a constructive role in the months and year ahead.

Armenia is already haggling in the aftermath. The military is reportedly threatening to end purchases of Russian radio-electronic systems that failed in combat against Turkish drones. It’s clear they want better systems at a heavy discount for the trouble of losing. There are reports that Russia’s already deployed higher-end gear precisely to respond to drones in order to deter Azerbaijan and Turkey from using them again to make incremental gains. The peacekeeping mission is now an extension of Armenia’s defense posture. There’s no way around that. And the risks only rise when one aggrieved party thinks it has cover from a much more powerful friend to act, knowing full well even Turkey would have limits using its NATO-status as a sort of human shield for Baku. Violence appears to have subsided, but it’s early days to keep this peace together and it’s likely going to cost more than Moscow initially intended.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).