Top of the Pops

We’re now in the 4th day of no clear resolution as to who has formed the government of Kygyzstan as protests against the rampant use of administrative resources and electoral manipulation to prevent opposition parties from gaining seats continue unabated. In an extreme move, the Central Bank decoupled the country from SWIFT, effectively stranding capital as well as cutting off Kyrgyz immigrants abroad from being able to readily send remittances - a huge portion of GDP - back home from Russia. Opposition leaders have formed a “People’s Coordination Council” to further organize. KAZ Minerals has suspended operations in the country till this blows over, but Kumtor Mine - responsible for a huge portion of the country’s hard currency earnings - continues to operate while watching developments closely.

What’s going on?

Today marks the third day in a row with new daily recorded cases of COVID above 11,000 in Russia. Infection rates are observed to be rising in 60 regions, yet there is no sign that the Kremlin is rethinking earlier commitments to avoiding strict lockdown measures. This morning, governor Sergei Tsivilyov of the Kuzbas - the heart of Russia’s coal industry - announced that a second wave of infections was happening. Local authorities, including the Moscow city government, are now admitting that they’re starting to run out of hospital beds and intake capacity to handle new infections.

Analysts interviewed by TASS and the Central Bank both deny that a mortgage bubble has formed in the Russian economy despite the fact that in August alone, 392.3 billions rubles’ ($5 billion) worth of mortgages were issued. The argument is simple - mortgages rely heavily on real incomes and broader economic performance. The questions, then, is who is buying these houses, how much do they earn, how much do the houses cost, and how safe are their jobs? It’s unlikely that a full on speculative bubble has emerged since incomes losses are broadly deflationary, but one can see how inequality might be about to worsen based on asset acquisitions by those who are better off weathering COVID-19. Watch to see if the impacts of tax holidays and low rates disproportionately affect real estate in Moscow, St. Petersburg, and other of the largest metro centers. I’d bet they do.

Personal bankruptcy rates for September doubled year-on-year in yet another sign of the mounting toll coronavirus has taken on the Russian economy. A lot of it came down to a change in the law since individuals with debts between 50,000 and 500,000 rubles ($641-$6411) could declare bankruptcy without a full-on court procedure. But it only goes for those without property in order to avoid the exploitation of the law.

According to Rosstat, annualized inflation hit 3.67% in September, creeping up from 3.57% in August. The nature of rising prices for consumer goods and services. suggests two things about inflationary pressures in Russia: mismatches between supply and demand are the most important factors at play and the decline and then stagnation of real wages are deflationary. The spike in inflation post-2014 oil shock/sanctions regime corresponds to a collapse in imports of goods that couldn’t be readily replaced by domestic production.

Title: Annual inflation in the RF and the share of base factors for the change in inflation (%)

Beige = foodstuffs Blue = non-foodstuffs Light blue = services Orange line = CPI (% year-on-year)

Get Carville

James Carville, one of Bill Clinton’s right-hand men, infamously joked that “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” The whole idea hinged on fear of “bond vigilantes,” the market equivalent of cat-stroking villains wearing silk and velvet Mao suits lying in wait to prey on the weakness of sovereign debt. Well, that was all BS, as we’ve learned the last 20 years. Central banks rule when it comes to controlling prices and yields. But it’s interesting to see how the evolution of bond market finance for central banks, private banks, regulators, and investors is going to have an impact on Russia post-COVID, not just because old orthodoxies are being shed in the West, but because Russia’s bond market is underdeveloped compared to its peers in developed economies. This data’s lagging, but a useful snapshot from ACRA from last year:

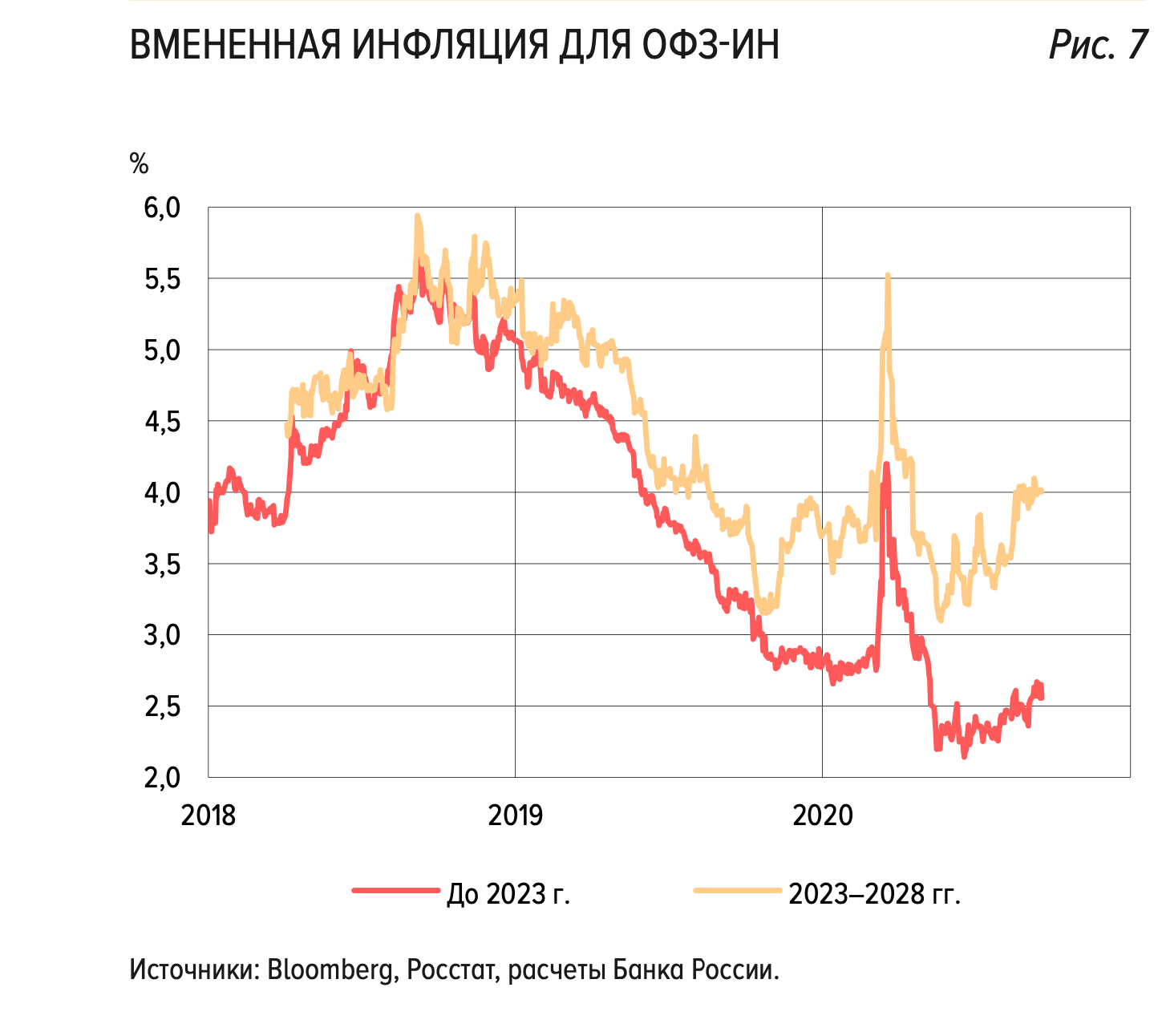

The ratio of Russia’s bond market to GDP is certainly higher now thanks to economic contraction this year, but quite low - the market is really only 2 decades old. But part of the reason why bonds have been slower to grow is higher historical inflation. Ruble-denominated debt is of diminishing use very quickly if the value of any given issuance meant to raise capital depreciates quickly. That puts more pressure to use shorter-term bond maturities. But, perversely, the decline in real incomes since 2014 and relatively tight monetary (less fiscal policy in my view, but that’s for another time) have suppressed demand enough to bring inflation down. Now, per the Central Bank’s September review, yields for OFZ issuances imply inflation at or under 4% through 2028 (as of now):

That encourages longer-term planning horizons using ruble-denominated debt. That’s important. MinFin saw record demand for OFZ issuances in its first 4Q auction, placing over 315 billion rubles ($4 billion) driven by demand from banks. But the sales were discounted at record levels - about 0.94% at weighted average prices on the secondary market and about 1.11% at the cut-off price - way above the usual 0.3-0.55% range. So buyers see the coupons offering returns lower than prevailing interest rates and want a deal to make up for that. The reason this is so interesting now is that MinFin was just admitting that it lacked the domestic resources/demand needed to meet its OFZ issuance targets (though it surely can at the right discount) at the same time that Russian corporates are looking at new bond issuance strategies.

Russian Railways has issued a perpetual ruble-denominated bond that also happens to be a green bond and Gazprom is planning to be the first Russian company to issue a perpetual eurobond. There’s a bit here to consider. One is that RZhD is the first mover creating demand for debt issuance earmarked to finance greening operations for ruble-denominated bonds that, assuming inflation expectations hold steady, are becoming a more attractive means of financing long-term projects. VEB.RF just presented a new methodology to assure foreign investors of the quality of Russian infrastructure projects in Paris, an important thread to follow given that Russian macroeconomic policy is starving the domestic market of financing by failing to crowd-in private investment though deficit spending. The other is that Gazprom has opted for a hybrid bond issuance, which means it takes on some characteristics of equity and therefore acts closer to a capital raise issuing shares with the added benefit of not necessarily contributing to the company’s gearing ratio on its balance sheets.

RZhD is never that profitable. That it stuck its toe into green finance is an interesting development, particularly as its most recent ruble-bond was issued with a target rate around 7.25%. The green bond coincides with a new push from RZhD to deregulate coal tariffs and let the market dictate its (relatively low) profits on coal exports. Something’s afoot there when it comes to competitiveness. For Gazprom, I’m curious to see how the need to tap foreign capital markets plays out in the year ahead. Its las ruble-bond issuance had a target interest rate of 5.9%. But the hot thing in Europe now for bond issuances are *gasp* green bonds. Per the Climate Bond Initiative review of H1 this year, Euro-denominated green bonds see greater spread compression than vanilla bonds and have been oversubscribed by an average of more than 5x:

Tighter compression spreads can signal market euphoria, sure, but at the moment, green bond spreads trade closer to sovereign bonds (which we all know are at record lows). That means that Russian corporates could theoretically borrow in Euros at rates closer to sovereign rates in Europe if they commit to green spending. The pile of money abroad looking for green yield makes Russia’s debt market look like a joke. Green bonds are relatively new, but for 2019, EUR and USD issuances surpassed the entire value of Russia’s corporate bond market by tens of billions of dollars - Russia’s corporate bond pile is worth around $190 billion right now.

The longer that Russian macroeconomic policy starves the domestic economy of demand, and by extension, healthy credit creation via rising incomes and savings to invest into bonds, the more relevant that shifts in investor preferences for eurobonds and green spending stipulations if you’re an O&G firm like Rosneft or Gazprom or Lukoil are going to be. This is a very long-term trend. The global corporate bond market is so insanely vast as to make green bonds a few drops in the bucket. But the longer that inflation targeting in Russia works without generating growth, the likelier that Russian corporates will have to grapple with how foreign capital markets are evolving in response to the energy transition. The private sector is screaming for it. Today in the UK, 30 firms with over £10 trillion under management are calling for the British government to issue green bonds to finance a green COVID-19 recovery. Change tends to look insurmountably difficult and slow until a tipping point is reached, at which point it accelerates precipitously. Russia Inc.’s preference for foreign listings and continued use of Eurobonds - threatened now primarily by exchange rate fluctuations, but most such firms earn most of their revenues in foreign currency anyway - is a pressure point to accelerate green financing at home.

For now, a paltry 24 billion rubles ($309 million) have been earmarked to develop the green finance market in Russia though 2024. Not a single ruble was spent on the support mechanism for green finance already in place for 2019. Safe to say that a sea change is needed.

Iran so far away

As the US presidential race enters the home stretch, word dropped last night that the Trump administration intends to impose new sanctions on Iran’s financial sector. The Washington Post’s reporting makes it fairly clear that the US Treasury Department was opposed given that even with State Department waivers, the move will further limit Iran’s ability to access humanitarian assistance, but Republican lawmakers managed to convince Secretary Mnuchin to get onboard. US policy in the Middle East is, ultimately, of great importance to Moscow and Eurasia writ large. What’s clearly happening (and has already happened) is that the Trump administration is poisoning the well in the event of a Biden victory. Even Democratic Vice Presidential candidate Kamala Harris accepted the premise of the gamble made by hawks within the Trump administration: if you scare Tehran by breaking the Iran Deal, you force their hand to pursue nuclear weapons as a means of ensuring their own security. Once that happens, the litany of warnings about the security risks posed by the Iranian state become true. Facts on the ground change and those opposed can’t argue that it’s the fault of US policy.

It’s important to acknowledge that a Biden administration would be unlikely to change course on Iran because it simply can’t. That requires a willing partner. The potential drawdown in Afghanistan now being negotiated as part of a peace deal with the Taliban is likely to leave open the continued presence of a US contingent and the airbase capacity needed to sustain supply lines and, if need be, launch airstrikes in the country. It’s a mixed bag of a deal, and despite Trump’s tweeting and bleating about withdrawal, few seem to believe it when you parse through DoD statements and details.

US shale had effectively de-risked oil prices to a considerable extent. Risk premiums from potential production outages have declined and, for all intents and purposes, oil markets increasingly reflect risk premiums in daily spot pricing rather than futures contracts, with a structural decline in observed premiums evident prior to 2020. The market opted to focus entirely on supply risks, not demand risks, and reality is that demand risks structurally are generally a downside affair or discount. No major oil importer was expecting a sudden explosion of growth coming into COVID. The trouble now is that the normalization of ties between Israel, the UAE, and Bahrain with reported pressure to get Sudan to normalize ties too undermines any constraints on US policy or those of regional actors, including Israel.

Despite persistent reports that the US is leaving Syria or the region, 100 troops and six Bradley IFVs were deployed to northeastern Syria three weeks ago. The carrier Nimitz is launching airstrikes on Iraqi territory from the Persian Gulf. Secretary of Defense Mark Esper made sure to add a visit to Kuwait recently after the death of Kuwaiti Emir Sheikh Sabah al-Sabah. Arms sales and defense talks continue with regional partners and the US has expanded airbase capacity in Jordan and Qatar since 2018. Reality is that US policy in the region remains highly militarized and a market risk. What's important to watch, then, is where the oil and gas sector’s private investment into the upstream globally flows in the next 6-12 months. There could be a return of a supply risk premium in the right scenario since Biden’s as liable to stumble into something Trump started as to reassure the region, particularly since the Saudi royal family has invested so much into its personal relationship with the Trump family. That requires a lot more than a column to unpack. But in the event, oil prices could rise significantly, if not to soaring highs one might have seen during the 2000s bull market.

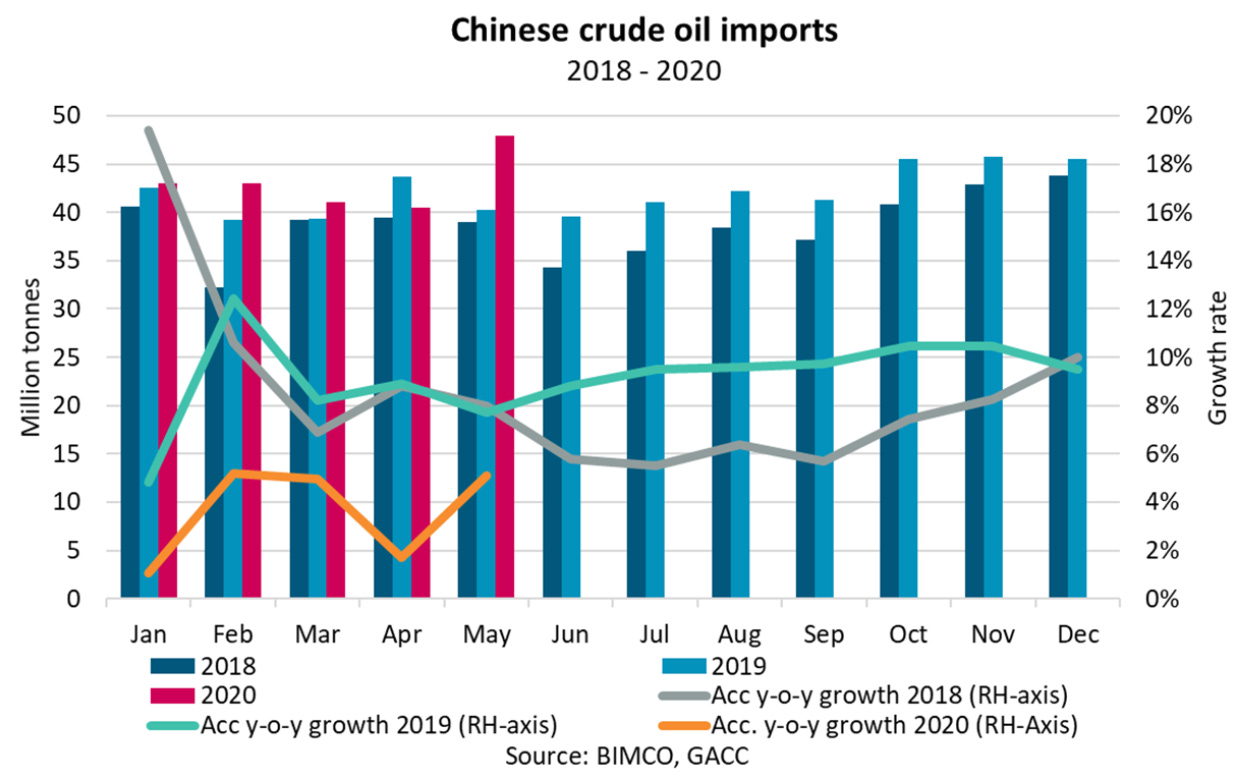

From another angle, I’d expect continued trouble for Uzbekistan being able to source crude to sustain the modernization and expansion of its refining complex. Currently, Tashkent is relying on larger volumes from Kazakhstan to get it done. If peace were ever reached in Afghanistan, it was once hoped that Iran could supply thousands of barrels via the railhead running through Mazar-i-Sharif. Trump’s policy killed that despite trying to enlarge the country’s role as a mediator in the conflict. But Kazakhstan’s MinEnergo has confirmed that oil production capacity increases will go ahead as planned despite the current market conditions. But the pressure to sell to China instead is going to be immense given its import needs:

Even a decelerating growth rate for import demand will pull in marginal barrels. US policy is, bizarrely, a bigger risk for Chinese supply than at any time in its history. So long as shale survives, however, don’t expect the supply risk premium to come roaring back. There’s no way to know till conflict erupts, in practice. But Trump has maneuvered all the chess pieces in place to make it as likely as possible that any Democratic entreaty to calm tensions will fall flat on its face. It used to be that Russia benefited from a chaotic US policy in the region (though I dispute that was ever the true). Imagine how much worse it could be with someone calm and considered at the helm lacking any good options with a lot of targets put in harm’s way.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).