What’s going on?

Yuri Borisov - tasked with sorting out what revisions to non-market markups for energy prices - now has till March 31, 2021 to make a move. MinEnergo has suggested calculating energy’s share of large firms’ export earnings and proposed that MinEkonomiki study regional gross product across the country and its dependence on energy prices. Markups are most concerning for Rusal - energy prices eat up 21% of its revenues given the energy intensity of the company’s refining and production base.

Rossel’xoznadzor was notified by Chinese authorities that imports of fish from Russia would face restrictions due to the discovery of COVID in packaging from some deliveries. Russian exporter Norebo, implicated by the communiques, is at a loss since the inspection at port before being shipped off showed no sign of infection. China sucks up over 60% of Russia’s seafood exports, providing $3.27 billion in earnings in 2019. Far East fishermen are going to hurt. Given infections in Russia have risen past 9,000 for the last daily count, expect more pain for exporters in the Asia-Pacific without a better public health response.

The moratorium on bankruptcies has been extended by three months to January 7, 2021, when inevitably the exact same policy debate over how many people it’s acceptable to hurt will be held again. About 500,000 legal entities and 1.6 million individual entrepreneurs were covered by the policy when implemented in April, but notably it mandates that no dividends be paid out. Only 855 legal entities have thus far left the moratorium per its conditions to be able to pay dividends again, which really goes to show just how much this crisis is going to entrench and expand the power of the country’s largest firms by virtue of their access to capital, lower borrowing costs, and ability to keep investors onside.

Sovkomflot is launching an IPO, but don’t expect fireworks. The company’s profits benefited significantly in H1 2020 from the massive oil supply overhang after Russia broke with the OPEC+ cuts and the cumulative demand reductions that reached their worst in Q2, which sent every operator and trader from Ypsilanti to Timbuktu trying to find spare floating storage capacity. It won’t last, but the company’s world-leading ice-capable capacity will benefit from global warming, particularly if Vostok Oil enters development and uses an export outlet on the Northern Sea Route. The company’s got a lot of debt and will be slowly paying it off.

Title: “Sovcomflot” in comparison with analog companies

Left: Price/Earnings Ratio for 2019 Right: Return on Equity, %

The Dearth of Pipeline Politics

Since Navalny’s poisoning and evacuation, it’s been interesting to see the proliferation of hot takes waxing geopolitic about how Merkel faced considerable pressure to try and scuttle Nord Stream 2 at the last possible moment with construction something like 96% complete. Not only was it premature (I too indulged in the mania for about a week), but it missed a larger change for natural gas markets, both stemming from COVID in the short-term and structural factors in the longer-term.

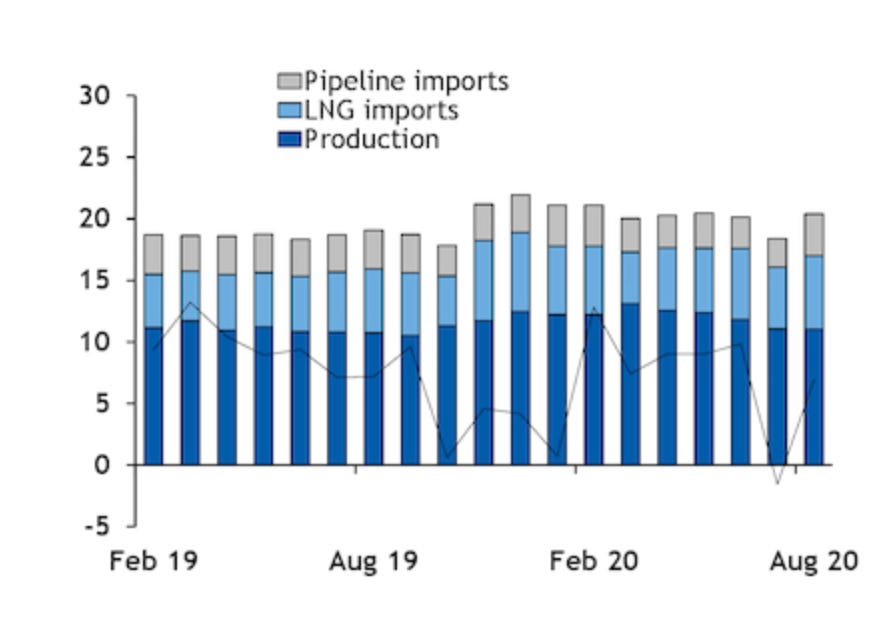

To translate: OPE represents natural gas pricing schemes indexed to the price of oil (Brent presumably), GOG traded represents volumes of gas whose prices are set and traded against other volumes of gas via longer-term contacts, GOG spot is the same but traded on the spot the day of sale, and the right axis and line is the % of the market priced by spot volumes of LNG. Gazprom’s preferred MO was always oil-indexed pricing, but it lost the power to leverage said prices from a combination of the 2014 oil supply shock, antitrust action by the European Commission to compel it to accept market prices, and European markets pricing increasingly determined by a mix of GOG traded, GOG spot, and LNG spot volumes. The real value of Azerbaijan’s Southern Gas Corridor was never a large amount of supply for Southeastern Europe. Rather it was a useful pretext to expand interconnections between markets that were divvied up and dominated by single suppliers and, crucially, change the pricing contract structure to make it more competitive. Then we get to word that Gazprom has ordered pipes for the Power of Siberia 2 and work will “project work” will start next year. Aside from the fact that it seems like a convenient means of stimulating demand now while bigging up better things to come - Miller is a horrendous hype man - Gazprom lost the pricing battle in China from the start. They were negotiating oil-indexation in 2013, China waffled, then the oil shock hits and China says “yes please” while using Turkmen volumes to undercut Gazprom’s price leverage. It has no power to price. Check here from Argus’ blog (no paywall!) on the structure of China’s consumption.

LNG spot prices and domestic sourcing set the price - volumes of gas traded against each other. This dynamic feeds into Uzbekistan’s turn away from gas exports. The gamble is simple: use the feedstock domestically to create value-added products and support the country’s industrial base instead of shipping volumes off to Kazakhstan or China where the earnings are low. It matters less for gas, of course, but the trouble there is that said industrial capacity to produce plastics and more is only going to bring real, sustained wage growth if exports rise. That in turn requires demand in Central Asian economies lacking said capacity to pick up and the structure of regional economies leaves demand and real incomes frequently exposed to oil price swings. COVID-19 posed a sharp shock to demand for gas, but nothing like the shock for oil because of its end-uses. Watch as prices tick up due to lost capacity in the Permian basin from shale’s continued misery. But at the end of the day, we now live in a world where, at least for Russia, pipeline politics no longer carry real power aside from the palms greased along the way. To paraphrase Vadim Kozlov, leader of the Slavic Federation in Civilization: Beyond Earth: market share is good. Pricing power is better.

Vanilla ICE

Anyone watching the stocks or even casually perusing business this year has heard, pray tell, of the madness of the Nasdaq and bets that we’re reaching the beginning of the end for internal combustion engines (ICE). Tesla exemplified the mania of retail traders and investors over the summer as people went long banking on Elon Musk’s EV revolution. From our friends at Robinhood stealing from the poor and giving to the rich(er):

The visuals are small, but the important bit is the trend. Given that EV batteries rely on lithium anodes, one would expect market expectations for future sales and deployments of EVs to correlate strongly with mining stocks heavily exposed or else focused on lithium as well as battery manufacturers. Here’s the Global X ETF for lithium and battery-makers Robinhood allows you to trade:

The market’s probably a bit ahead of itself there, but these are just two data points. What’s clear, however, is that the mania isn’t really breaking. Even Tesla’s sudden options sell-off didn’t erase most of its gains, and if Biden wins the US election, I’d guess we’d see another surge for EV stocks banking on him trying to shove through a bill to help Detroit make the pivot. Despite Rosneft and co.’s belligerent commitment to the Exxon model of denying reality, some Russian companies realize that Bismarck’s dictum was right: if there is to be revolution, we would rather make it, than suffer it. Alas, unless battery-makers emerge, it’s really a half-compromise - selling the raw material input: lithium.

Rosatom announced plans last week to provide 3.5% of the world’s lithium supplies by 2025, with the aim of starting extraction next year and marketing it by 2023. What’s fascinating about the announcement is just how much of damp squib it is. Despite the lack of clarity that raises questions, in the last few months, Tesla has patented a lithium metal/anode-free battery cell and secured rights to mine lithium in Nevada. It accounted for 28% of global EV sales in H1, though the space is about to get a lot more crowded. You have to imagine that Rogozin and others pushed for this since Musk intends to keep playing the role of an idiot savant wannabe John Galt: vaguely brilliant, elusively ever-present yet absent, and a really flat character for someone so much ostensibly hinges upon.

Ignoring the current policy scenario, look at the IEA’s sustainable development scenario for EV adoption:

That’s a breathtaking rate of adoption that probably can’t be reached, but there’s definitely going to be policy movement towards it as publics across the planet see the increasingly evident damage caused by climate change. The scramble for lithium is bound to create its own variations of “resource nationalism” as supply chains are securitized with the likely continued escalation of tensions between the United States and key western partners (dominantly the 5 Eyes) and China. The European Commission has launched the EU Raw Materials Alliance to increase production within the EU and to partner with safe third countries. I need to dig more but there really is just the one announcement readily in hand concerning Rosatom’s lithium production plans. All of the noise made about R&D is focused on nuclear energy, with company head Alexei Likachev mentioning that he “hoped” to announce a research program for it through 2024 in September. There’s more out there and I’ll definitely be digging for it in the weeks to come.

But if this is to fit the Russian model of development, they’re probably assuming that the heaps of cash they have lying around can be used to pay for imports of foreign technology to close the production gap and get into the lithium battery business. The problem, of course, is that money can’t buy IP if that IP isn’t protected, and that IP is going to be facing more scrutiny and export controls than ever before. Without a large increase in R&D spending and an escape from the self-defeating obsession with one-off special investment contracts, Rosatom may become the next Russian SOE to be eating Musk’s dust. You hate to see it.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).