What’s going on?

The World Bank has warned that current support programs are inadequate to save Russia’s small and medium-sized businesses from mass closures given ongoing business losses, risks from a second wave of infection, and depressed demand. It’s a particularly significant risk for job creation since new firms tend to create more jobs more quickly than large corporations and SOEs. If the state ends up dominating more of the economy as a result of the current recession, it’s hard to see strong job creation rates ahead.

The ecological damage from whatever occurred in Avacha Bay on the Kamchatka Peninsula, which has killed as much as 95% of all life in the bay. Stats from Rosgidromet show that the discharge of sulfates and petroleum products into the bay increased between 240-280% between 2018-2019. Crucially, the episode has forced regional governor Vladimir Solodov to take charge of managing the fallout and the first time that the party Green Alternative, formed in March and actually winning 10% of the vote in Komi and 5.4% of the vote in Chelyabinsk, has a national event to tie itself to. Trouble with waste disposal and management wasn’t quite the ticket for them, it seems.

Today in self-fulfilling prophecies, the combined weakening of the ruble and consumer inflation expectations for 4Q have triggered a burst of borrowing to buy cars among Russian consumers. Lower rates trickling down from the CBR’s cuts earlier this year undoubtedly are spurring some demand. In August, the average car loan was worth 852,600 rubles ($10,913), a 9.9% increase year-on-year over last August.

Consumer sentiment has recovered from its 2Q bottom, per data from Rosstat. But it’s not evidence of optimism. Rather the easing of lockdowns coincided with ongoing support measures for businesses. Since they’re starting to roll back help for SMEs and unemployment is much worse than official statistics show, take this picture with a huge grain of salt. Improvement doesn’t yet equal confidence in a recovery. It’s notable that the younger you are, the more certain you seem to be.

Title: Index of Consumer Certainty by Age Group (%)

Russia’s 9th Arbitration Appellate Court has ruled that decisions reached by the courts on non-urgent matters during quarantine in the absence of the parties and without their agreement are invalid. It’s an interesting development because it ostensibly limits the fallout from the inevitable asset raiding and legal fights that have emerged this year since COVID hit. It’s also the rare decision that actually strengthens the private sector’s legal rights, though winning a case once you make an appearance is, of course, a different matter entirely. The relevant case involved Pride Line, a medical equipment provider.

Not One Step Back

President Trump called off stimulus negotiations with the Democrats, informing us all in tweets:

Nancy Pelosi is asking for $2.4 Trillion Dollars to bailout poorly run, high crime, Democrat States, money that is in no way related to COVID-19. We made a very generous offer of $1.6 Trillion Dollars and, as usual, she is not negotiating in good faith. I am rejecting their...

Nancy Pelosi is asking for $2.4 Trillion Dollars to bailout poorly run, high crime, Democrat States, money that is in no way related to COVID-19. We made a very generous offer of $1.6 Trillion Dollars and, as usual, she is not negotiating in good faith. I am rejecting their... ...request, and looking to the future of our Country. I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business. I have asked...

...request, and looking to the future of our Country. I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business. I have asked...It’s clear that his electoral strategy in the wake of getting infected with COVID-19 is to scorch the earth. There’s little light when it comes to the polls (though I frankly would love it if the 538 and the Economist stopped duking it out for the least qualitatively engaged and most ridiculously certain that turnout can be modeled in the middle of a mismanaged pandemic). Note the 538 averages in Pennsylvania and Florida, the two most important swing states based on potential paths to victory for Trump:

Underlying trends post-debate aren’t good, so the bigger question becomes what happens institutionally if Trump loses, though there’s still literally potential for more mayhem in the next month. The problem for Moscow is that US stimulus is necessary to hold oil prices higher in the short-term and improve business sentiment in Europe, providing a knock-on effect. The connection is straightforward based on the US trade deficit:

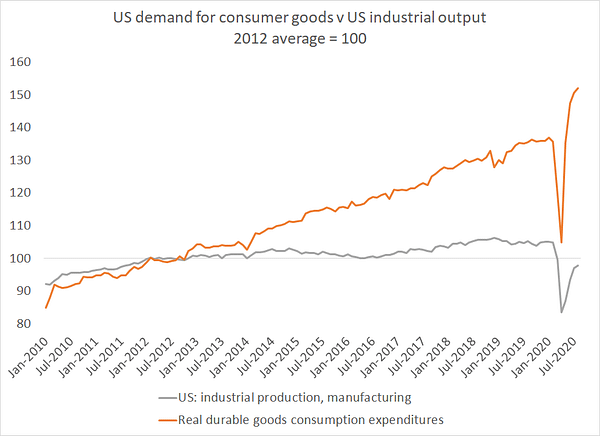

The surge in household demand for "durable" goods has pushed goods demand above pre-pandemic levels. But the U.S. doesn't make a ton of these goods at home (it makes capital goods such as aircraft) that increase in demand hasn't translated into higher ind production

The surge in household demand for "durable" goods has pushed goods demand above pre-pandemic levels. But the U.S. doesn't make a ton of these goods at home (it makes capital goods such as aircraft) that increase in demand hasn't translated into higher ind production

Without consumer spending power, supported by unemployment insurance, direct cash payments, industries bailouts, etc. it’s hard to see who else could take excess production from China given its supply-side stimulus. The US still functions as the consumer of last resort (thanks dollar hegemony!) and trade imbalances risk weighing negatively on any recovery. Europe’s in trouble without a US deal. Eurozone inflation has ticked into negative territory. The economy’s contracting, and since exports account for 48% of the Eurozone’s GDP, other people have to start buying imports. The oil market was banking on a stimulus deal to uplift demand and US inventories are a big signal on the direction of travel:

The ill-fated market share war that Igor Sechin convinced the Kremlin to launch against OPEC in March is still haunting them because of how it juiced inventory builds by several millions of barrels for a month. Worse, demand tends to fall in the winter and if US consumers are struggling to get by or have to prioritize their spending on rent, mortgages, and the like, the oil price is going to struggle to break out of its box from the high $30s per barrel to $45 per barrel. The Central Bank has been planning for that since July. It’s MinEnergo and the oil sector that haven’t accepted reality when it comes to macro. One thing is clear from the last 4 years. Trump has not proven a strategic masterstroke for Russian foreign policy. Chaos, it turns out, is terrible for business, especially when thousands are dying each day from a virus we’re struggling to get ahead of.

Set Phasers to Shift

The bad news, however, for Russia is that a potential Biden victory is likely to change the structure of US stimulus plans to recover from the current economic crisis. Short-term consumer spending wouldn’t change the longer-term risks for demand. So far, the division of green labor around the globe is clear:

Europe is far ahead in committing spending on green stimulus. British PM Boris Johnson is now bumbling around the aim of making the UK “the Saudi Arabia of wind” and quadrupling wind power generation capacity by 2030. A Biden administration spending plan would likely nudge more investors like Bill Gross to bet big on renewables and, most importantly, take advantage of the biggest strength the US has over Europe in accelerating the energy transition - the size of its capital markets, access to financing, and risk-taking with VCs:

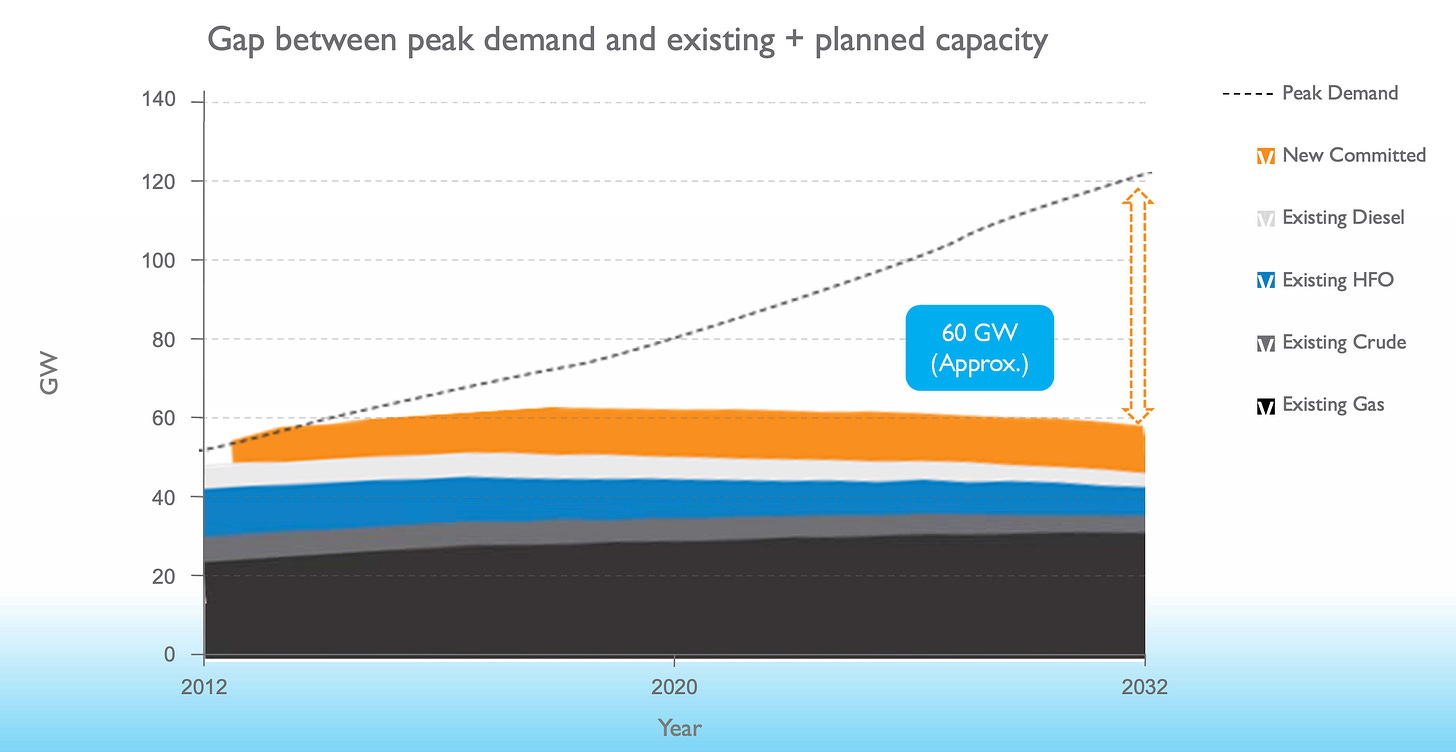

Investment into electric vehicle and broader infrastructure, gains in energy efficiency for existing domestic US natural gas consumption, and the flow of capital looking for value would all accelerate (assuming that Democrats control the senate and the a bill passes). In so doing, it’d make it that much easier for the. US to countenance including green energy requirements and emissions regulations in trade deals, building on the position that Europe has tried to carve out and, paradoxically, freeing up more natural gas for LNG export depending on what a final plan looks like. These shifts aren’t just a concern for Russia to maintain its oil and gas market share or budget targets. Renewables are a core concern for sustaining oil exports from the Gulf. If Saudi Arabia wants to meet its energy needs, it’s going to have to build out new sources of energy, reduce its reliance on crude for power generation, and seek to build up supply chains to serve related sectors to reduce its reliance on imports. Here’s the Saudi demand growth outlook from IRENA:

It’s important to remember that renewables actually sustain oil exports for exporting nations and until electric vehicles are viable everywhere in terms of infrastructure, affordable, and address their own energy use during extraction processes for key inputs and production, they won’t put too massive a dent into demand (just demand growth). After all, even the dashboard of your car is made using oil. The energy transition isn’t just about changing what we consume to power things or make things. It’s also about changes in the market and corporate structures and strategies that underpin the energy sector.

The oil majors leading the charge to move into renewables - BP, Shell, Total - are now creating an interesting space for new types of vertical integration that Russian energy firms may not be able to keep pace with. It’s widely noted that the $110 billion in assets that oil majors want to unload or move aren’t the easiest sell given the market uncertainty, but with the right plan, it’s a buyer’s market. A few deals caught my eye that might hint at things to come.

Caterpillar bought Weir Oil & Gas in a $405 million cash deal and BHP bought Hess’ 28% stake in the Shenzi field in the Gulf of Mexico for $505 million. The Caterpillar acquisition is, on its face, pretty pedestrian. It’s basically about synergy and snapping up a firm that specializes in O&G services equipment that complements Caterpillar’s portfolio. Well, with customers struggling, I’d expect a rise in consolidation (with a 1-2 year lag based on firms’ balance sheets going into 2020 and access to credit) where larger industrials that don’t live and die by the oil price can realize significant profits by making buys on the cheap and incorporating them into existing services they offer customers.

BHP is a bit more interesting. For one, it’s important to note that they probably had their eye on the asset before everything went pear-shaped. Hess has spun the sale as a way to raise capital to develop finds off the coast of Guyana (and developed in partnership with Exxon, the only oil major with the balls to decide to keep increasing emissions as a business plan given the market). But BHP isn’t an industrial like Caterpillar. It’s an extraction company with a diversified portfolio across metals and minerals, many of which are bound to be very valuable thanks to the energy transition. That means, like Caterpillar, it can hedge against losses on its oil & gas assets and build them into a business portfolio in a fundamentally different way than, say, Chevron or BP. The sector is too diversified to allow for cartels like oil did back in the day, but I’d be interested to see if “Big Extraction” becomes a business model as companies look for acquisitions, whether to placate investors and boards or else identifying growth opportunities. We can talk about Russian mercenaries in Africa till we’re blue in the face. The corporate innovation in the extractives sector to profit off of the energy transition is taking shape elsewhere and Russian firms are mostly absent.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).