Top of the Pops

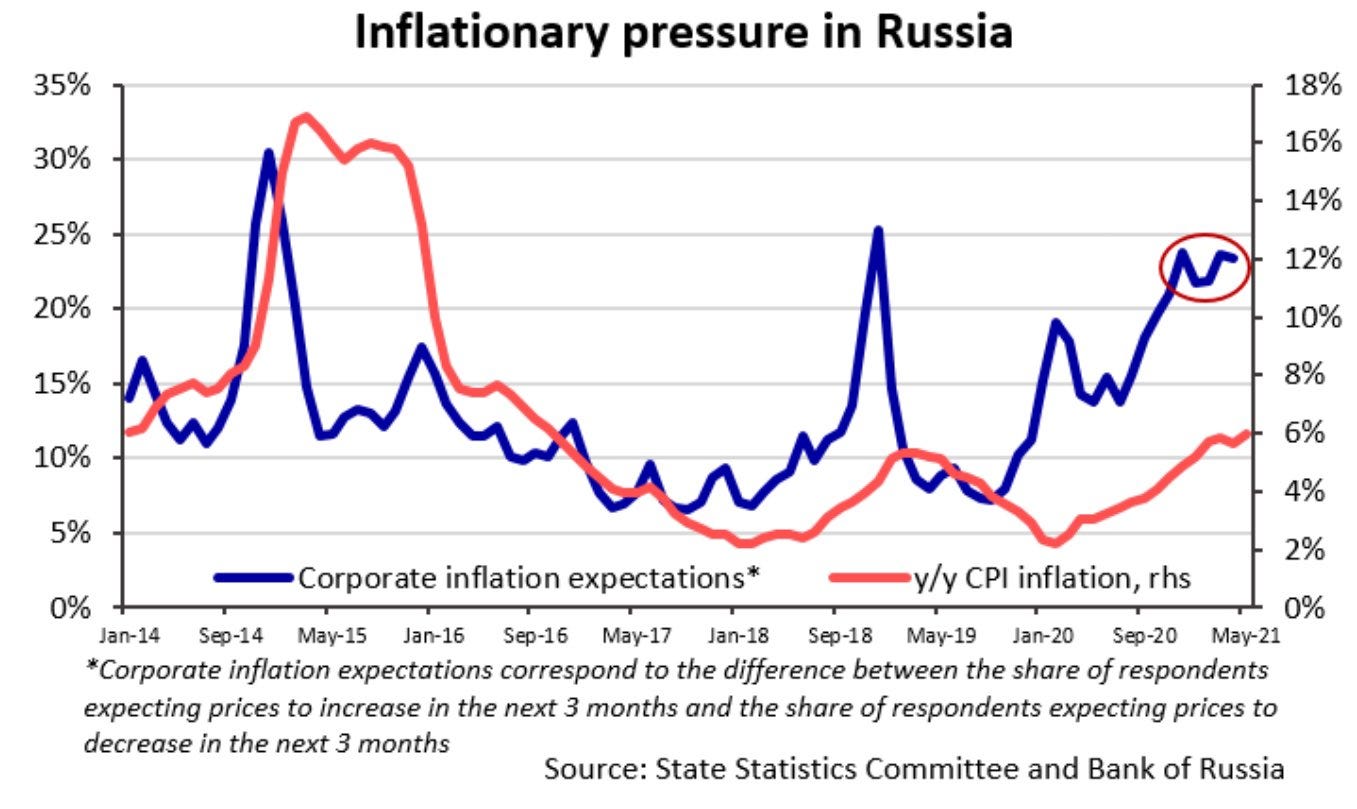

The cat’s out of the bag. Annualized inflation has reached higher than 6% (6.02% to be exact) for the first time since 2016. In other words, it’s accelerating for all the basic goods that are most important to a growing number of Russian consumers. For examples, bread is now up 8.26%, meat and chicken 19.85%, fish 12.56%, and sugar a whopping 41.54% year-on-year. Utilities that are fairly strictly regulated in price are up 4.03% and public transport costs are up 3.12%. Corporate inflation expectations appear to have leveled off, but that’s probably more to do with expectations of aggressive rate hikes from the Central Bank than a positive indicator about prices:

First, as much as I hate saying I told you so as much as the next guy, the continued pace of inflation was predictable and the earlier arguments from the CBR and MinFin that it would peak in April reflected political pressures around Putin’s address more than reality. Second, there is a fair bit of capacity utilization and surges in pricing due to domestic activity — retailers’ inflation expectations are now at levels not seen since 2003 at the start of the 2000s commodity boom. Third, that surge is pretty clearly linked to debt. 3 trillion rubles ($41.19 billion) in consumer credits have been issued since the start of the year, with more to come at higher interest rates. Finally, there’s going to be some serious supply pressures if the consumer recovery lasts longer than I expect — for instance, 20% of retail developers have gone under since the COVID crisis started, which means we should expect more consolidation, larger developers, and labor that lost jobs shuffling into new firms trying to meet a surge in demand from companies that now have to figure out just how long demand will last. In other words, if you want to build, you’ll have less power negotiating for costs and the same time there might not be enough demand for long enough to sustain the sector (or commercial expansions). At some point, the uncertainty kicks in and limits the demand upside. If it doesn’t, then debt-financed consumption driving demand through a wall of inflation the regime really doesn’t want right now.

What’s going on?

New estimates from Vygon Consulting show that the imposition of EU carbon adjustments on imported production will cost Russia’s fuel and power sector €1.2 billion a year. But if the same carbon pricing mechanisms now in place in the EU were applied in full on Russian power markets, it’d cost firms a whopping €18 billion annually, 74-90% of which would be paid out by the firms that own power generation infrastructure at precisely the moment they need a considerable boost to capex for modernization needs. This raises a really interesting problem. The cost of regulatory alignment with the EU far exceeds the cost of taking the hit on exports, at least for now. Given support for the initial carbon pricing schema in Sakhalin and Kaliningrad, Putin’s desire to appear to be doing something, as well as renewed business pressure on the regime to negotiate with the EU, the new rush to raise taxes on profits as an investment stimulus is all the more confusing. Taxing carbon and methane externalities would be a much more direct ‘stimulus’ since firms would have an immediate incentive to invest to reduce their tax burden and would benefit reducing external export costs. The risk, of course, is that taxing corporate profits doesn’t directly increase consumer prices whereas internalizing externalities would for electricity consumption. They can’t risk passing on decarbonization costs to households, which makes the issue of income transfers all the more acute. The longer they drag their feet conceptualizing a new approach — redistributing carbon tax revenues to households, providing concessional loans for decarbonization investment, or else directly assigning resource rents to transfer akin to basic income or other forms of targeted income support — the harder it will be to reconcile the relatively light cost of dragging their feet. Decarbonization and carbon taxes can be used to increase investment levels, more pressing for metallurgists, cement manufacturers, and agricultural firms for whom about €20 billion in exports are affected by the adjustment mechanism per current proposals. For now, though, the inflation risks are too high. Maybe the conversation will evolve after the September elections.

With all the wacky base effects at play, China’s imports for May grew a record 51.1% year-on-year after showing 43.1% growth for April. Exports were up 27.9% as China’s consumption recovery is now picking up a bit more despite still lagging its export recovery. The export slowdown is also a symptom of bottlenecks for chips and other electronic components with import values also reflecting rising commodity prices, so there’s still a structural imbalance to the recovery at play though it’s normalizing. What’s perhaps more important now to track for Russia, however, is the effect of rising capital inflows into China (along with the burst of export gains) on the value of the CNY against the US dollar and other currencies:

The PBoC has raised the forex reserve requirements for banks from 5% to 7%, taking more money off the market and supporting the assumption that they intend to intervene to prevent excessive swings in the exchange rate as it now climbs against the dollar to levels last seen in 2018. Sino-Russian trade turnover reached hit $50.65 billion for January-May — a positive sign that bilateral trade will likely continue to grow and break past $100 billion. Buried in that otherwise good story for Moscow is the fact that Russia ran a cumulative $4.8 billion bilateral trade deficit in that time with China, now likely to be a persistent reality for longer and a development that increases the effects of a stronger CNY on price levels for certain goods and services in Russia over time if Moscow can’t further diversify its export basket.

The administrations of Krasnodar and Stavropol’ krai are expressing concerns about rising fertilizer costs to MinSel’khoz as inflation keeps ticking up. Regional agricultural ministries are also writing the Federal Anti-Monopoly Service (FAS) about pricing pressures, presumably trying to enlist its help in negotiating a solution. Quotes from Stavropol’ agriculture minister Vladimir Sitnikov cite a doubling of ammophos (phosphate fertilizer) prices in the last year, 38% higher for urea prices, and a 96% increase in sulfoammphos prices. Those are huge changes in input costs — 52,590 rubles per ton of ammophos for instance. In May alone, ammophos prices in Volgograd oblast’ rose 27% and 16% in Chelyabinsk oblast’. These are hefty price squeezes for phosphate fertilizers as the spring planting season winds down and summer picks up. The pricier fertilizer gets, the likelier producers have to cut back on the amount they use. That then means 2022 crop harvests are likely to have a lower share of quality grains for both domestic consumption and export, which may end up prolonging some of the current inflationary pressures on food prices and, more importantly, reducing the competitiveness of Russian grain exports next year. One source cited said that fertilizer costs accounted for 34.3% of his firm’s direct expenditures, so this is a big story to follow. Export restrictions are now hurting firms forced to spend more and more on fertilizer for production without realizing export prices. This dynamic’s getting worse and it’s already harming planning for the next year.

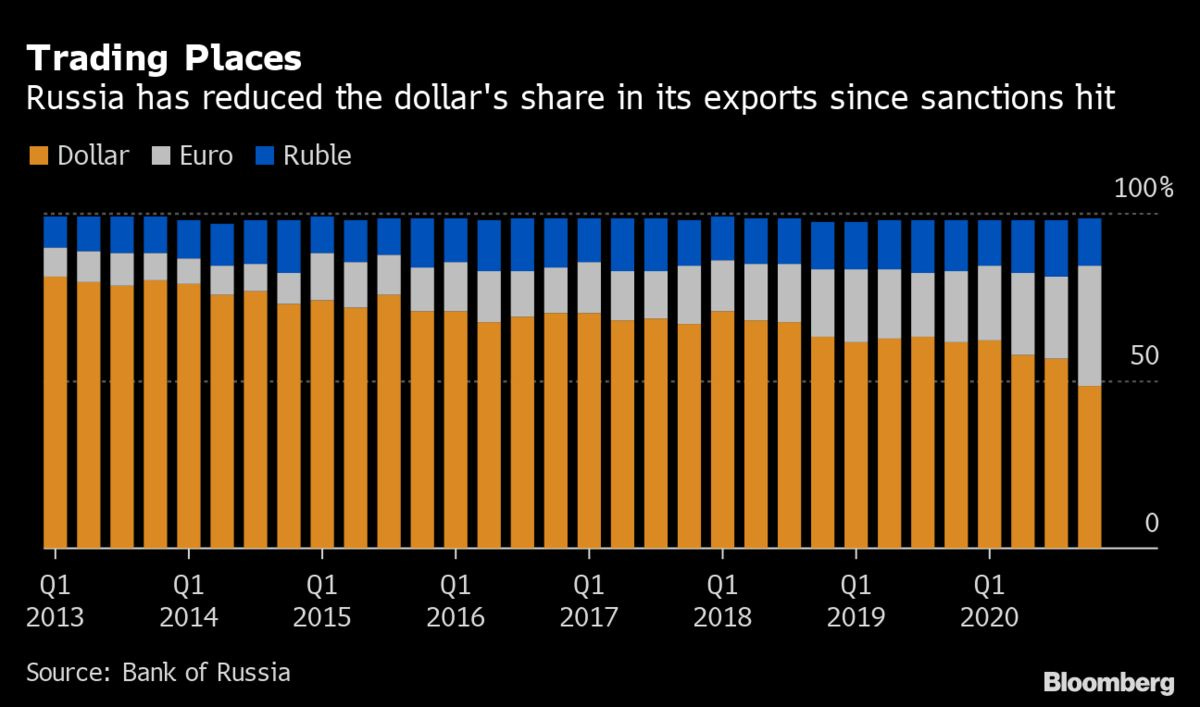

Dmitry Timofeev, head of MinFin’s Department of Control of External Restrictions (capital controls), testified in the Duma yesterday that the Ministry intends to support the use of the Euro across the economy to replace the dollar as form of stimulus and in support of de-dollarization. Bloomberg’s writeup covers the crucial external trend, which is that the share of exports denominated in USD fell below 50% last year for the first time ever:

Ultimately the decision to think through stimuli — Timofeev offered nothing concrete, but the lowest hanging fruit will be getting SOEs to make the transition — is a self-defeating one. Russia’s just reducing the supply of dollars it’s earning, and thus creating new transaction costs when firms or banks inevitably have to change Euros back into dollars. Further, it increases Moscow’s exposure to the monetary effects of Eurozone fiscal and monetary policies without providing real material benefit. Presumably this would also mean that pressure will be exerted on Russian corporates to borrow externally in Euros and forego the dollar entirely, something that’s pretty feasible but also creates a self-fulfilling logic whereby Russian firms will need Europe more than ever at a time when Moscow has shattered most of whatever goodwill it’s had left. There is no plan here. Only improvisation.

COVID Status Report

9,977 new cases and 379 deaths were recorded, the first time the case load has almost hit 10,000 since March. Far from being ‘conclusive’, it’s still official evidence of an underlying up trend that the Operational Staff is almost certainly under-counting or else unable to accurately assess due to capacity constraints and institutional incentives around data reporting. It’s reflected by rising case fatality rates, though these might also reflect the likelihood that younger Russians who weren’t affected by restrictions or cared also got infected at a higher rate throughout:

Excess mortality data may show considerable normalization of late so it isn’t evidence that things are suddenly out of control, but it does reinforce that the pandemic continues to take a heavy toll. Though it’s still got to be peer-reviewed, this academic data set tracking global excess mortality figures has Russia at about 480,000 excess deaths since March 2020, a 27% increase above trend that did not yet show evidence of slowing down this year from the most recently available data. 9.52% of the population is now fully vaccinated, and I haven’t seen any good data breaking down vaccinations demographically but need to spend more time looking. These are outliers most likely, but Tambov oblast’, for instance, has recorded roughly a doubling in cases. Despite MinZdrav’s projected confidence everything’s getting better, the underlying data doesn’t support the view that Russia’s getting over COVID very well.

Up and Atom

Rosatom is prepping a development plan through 2030 to present to Mishustin and the government worth an estimated 506 billion rubles ($6.96 billion), of which 150 billion rubles ($2.06 billion) would come from the budget. The SOE aims to control 20% of the global market share for modular reactor designs — a hot topic for nuclear enthusiasts looking to incorporate it into a less centralized, more flexible grid supporting renewables — and 24% of the nuclear fuel market. What’s buried in the export story is the extent to which the company is really banking on domestic contracts intended to finance the creation of the production capacity needed for export. The Kommersant writeup notes the deployment of these smaller designs, with the potential application of modular nuclear power to support gold extraction in Yakutia a particularly salient example. We’re probably moving towards seeing domestic carbon trading, but without a hard tax component for externalities, but the easier way for Moscow to dodge costs for its national champions is to create more cross-subsidies and opportunities for Rosatom to build nuclear power to backstop Russia’s resource exports and thus dodge losses of competitiveness from carbon adjustment mechanisms.

That’s going to be vital for Russia’s current account surplus — the primary political and economic means by which the regime balances its fiscal system and sustains rents — because the domestic economics of oil are shifting pretty quickly. Russian firms don’t just need oil at $70 a barrel to sustain the shrinking base of viable greenfield investments available, but to explore for more oil profitably. The IMF has realized what I and anyone tracking oil closely without much of a vested interest in its success could have told you even before COVID: the current price “supercycle” is probably oil’s last. Even with strengthening demand expectations, oil keeps testing $70 a barrel and then trending back down while the global economic recovery will diverge heavily by region and level of development. The following breakdown is marred by the lack of good data in countless developing countries but tells the basic story (including the concentration of deaths in countries that export the natural resources necessary for the energy transition). Weekly deaths with regions by color — Africa (green), Americas (lighter blue), yellow-green (Asia), dark blue (Europe), and Oceania (cyan):

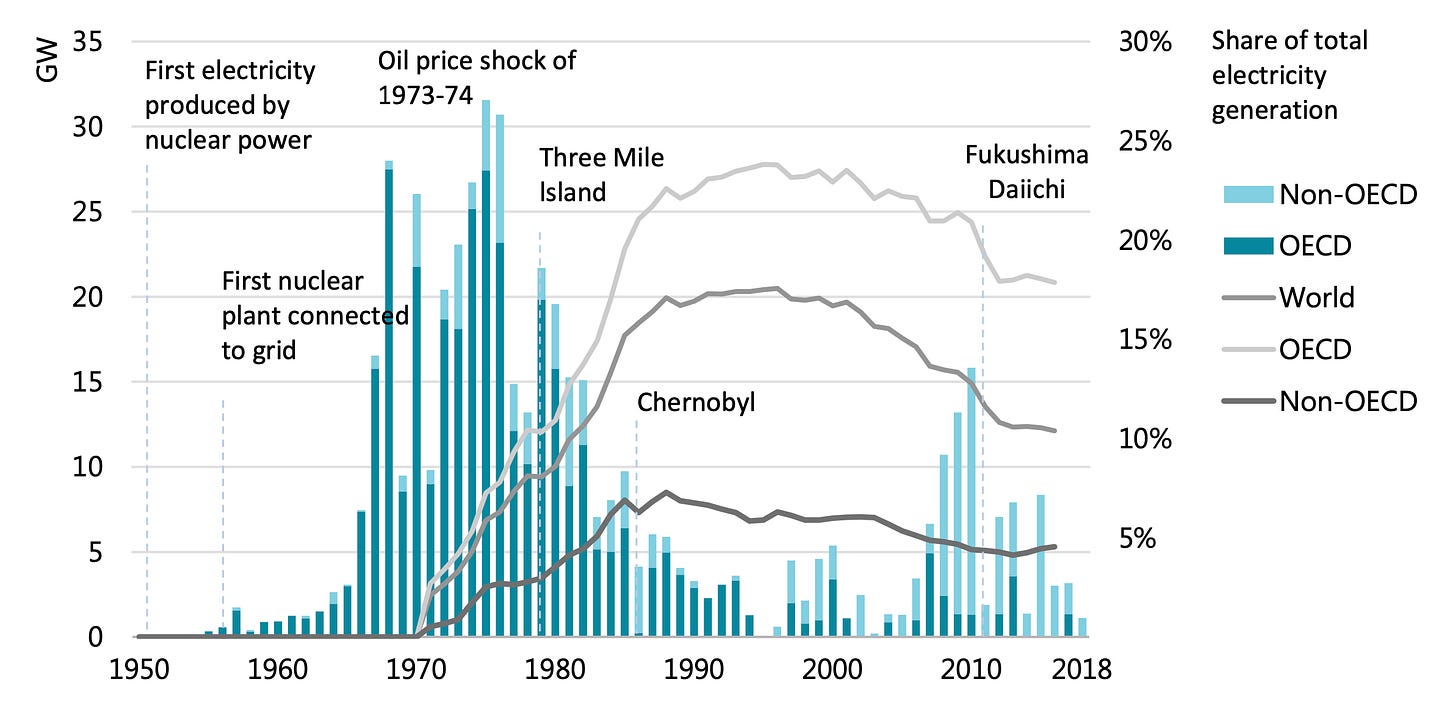

Rosatom’s gambit is to try to get in the door supporting the adoption of other forms of power generation and extraction wherever possible as oil takes the hit. There’s a broader conversation that needs to be had globally about the viability of green energy plans without a significant expansion of nuclear power capacity, though that would also strain the global supply of uranium that’s in need of further exploration investments. It seems unlikely, however, that Rosatom and other nuclear firms globally can roll back the structural shift in the energy mix since 2000:

It’s that underlying non-OECD trend that Rosatom’s most interested in, and where the most space for potential innovation and weirdness lies. Rather than focus on the technical needs — Rosatom is better managed than other SOEs and has great stock of human capital, expertise, and technical capabilities — I think the politics of finance around Russian SOEs trying to expand onto these markets now struggling with the COVID recovery is more interesting. And not from the perspective of vaccine diplomacy, but rather sanctions risks and payments. At a Duma hearing, officials floated the idea of experimenting with cryptocurrencies or alternative methods to settle accounts for imports of equipment and other transactions like Iran. Despite their general failure to make any significant difference for Iran in economic terms, it seems Moscow’s psychologically adapting to the idea that sanctions “are forever” — there’ll be no change in Russian foreign policy or that of the West. These are particularly important for Rosatom’s efforts because of its use of concessional loans to allow developing countries to afford joint ventures and nuclear investments. As of October 1, 2020, foreign governments and firms owed Russia a collective $39.6 billion making Russia the 5th largest state creditor globally. The energy transition is going to entail a considerable expansion of borrowing and lending to finance energy investments. But if Moscow insists on using loan agreements as a geopolitical tool whether that be writing off older debts as a ‘favor’ or else to support individual projects rather than getting really serious about development lending, then the financial relationships used to back these projects will always be politicized. After all, Rosatom is going to use state banks under sanctions to structure deals since the state wants to “keep it in the family” when signing off on major exports of strategic significance.

That matters because there’s also a structural shift in the relative power of nationally-owned companies to dictate the course of energy markets as the transition creates more space for privately-owned actors, often from the West, to increase their investment share globally. This goes back before COVID hit too:

This is where relative costs of credit and the mechanics of on vs. offshore corporate financing and sanctions and sanctions anxieties are going to make a huge structural difference over time. The Bank of International Settlements just released a great breakdown of corporate debt issuances including trends — USD’s going strong, folks! — and it points to an interesting dynamic for Russian firms that rely primarily on Luxembourg to borrow abroad with net borrowing volumes generally tracking pretty closely with oil prices. LHS is US$ blns vs. RHS %:

Russian firms’ reliance on offshore debt issuances never stopped with sanctions and has actually intensified during COVID. Rosatom’s development strategy is a set of leapfrogs built off of domestic no-bid tenders it has locked down for dirty industries and purposes it can use to sustain capacity to sell abroad using state-backed loans. But the over-concentration of capabilities for these purposes in SOE hands means Russian firms won’t be able to make ready use of international financial markets to support these ambitions while its dependence on Europe and a few other offshore centers to borrow has only deepened.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).