Give em' enough Europe

Europe's maladies give Biden a lot more leverage than Brussels likes to admit

Top of the Pops

The IEA has once again lowered its 2021 demand forecast due to the effects of renewed lockdowns and newer COVID variants. The current baseline sees demand largely recover to towards the 100 million barrels per day by the end of the year, a demand boundary that has psychologically defined a ‘return to normality’ for most market observers:

On the one hand, OPEC+ is set to reclaim a bunch of the market share that it lost due to US shale and price supporting cuts since 2016. On the other, the IEA has some doom and gloom for us oil market bears: the emissions cuts (and fuel use declines) prompted by rising EV sales in 2020 were offset by people delaying new purchases and, more importantly, a surge in SUVs' share of car sales. They accounted for as much as 50% of the market in the US in 2020 — I really think a lot of this isn’t just cheap gasoline prices, but people getting cabin fever and wanting to feel like they can use them for vacations with jet fuel demand and airline capacity undoubtedly not recovering to full capacity this year given the loss of business travel to come. There may well be an explosion of tourism when vaccinations take root, but that wouldn’t be sustainable as pent up demand from anyone who could afford to deleverage during the last year can only last so long and there are only so many vacation days in a year. The oil demand runway hasn’t materially changed in my view, even with the SUV surge, but it’s still highly exposed to policy choices. Still, until oil market bulls start addressing how global economic imbalances that have been steadily slowing economic growth since 2009-2010 are resolved and what impact a likely burst of commodity and demand-driven inflation is going to do for consumer preferences and spending power at a time when even in Europe, where job support measures have been generous, the scale of under and unemployment will be revealed as policy support measures ease, it’s hard to believe that demand can rise that much more than 2019 levels. Some, for sure. But the 108-110 million bpd target many set for 2028-2030, I think, is unrealistic as OECD demand substitution/destruction accelerates (here’s hoping EV SUVs take off…) compared to a slow growth outlook for the global economy and slowing growth for emerging markets and China.

What’s going on?

The Russian government’s purchase of a controlling stake of Sber last year — worth $33.9 billion — saved Russian M&A activity for the year though it still came in at an 18-year low if you exclude the deal. The trend in the data is fairly obvious and should be a serious concern for the next 5-10 years:

Black Line = number of M&A deals Green Columns = net value (US$ blns)

For the last decade, the economy has steadily centralized in many sectors, a trend that visibly accelerates after the 2014-2015 oil shock triggered a banking sector crisis and austerity measures mixed with state-firms and systemically-important firms benefiting from their privileged access to loans or higher debt ratings, thus lowering interest rates on bond issuances. Without the Sber deal, we’re looking at 2002 levels of activity. That’s pathetic. Some can be attributed to COVID’s impacts on demand, but without the deal, we can see the collapse in the value of M&A for 2017-2019 was just slightly accelerated. There are fewer and fewer firms to merge with or acquire as market consolidation picks up thanks to higher rates of SME failure during the current crisis. Dynamism isn’t coming back until macroeconomic policy stances focused on supporting consumer demand using public deficits instead of private debt burdens that for less political control over sectors are adopted.

The topline industrial data for 4Q 2020 showed a continued, broad recovery in output and demand, which on the face of it ought to be good news. This being Russia, of course, it isn’t so clear. The data shows a huge underlying problem for future growth — and it’s telling that Kommersant opted to use the Gaidar Institute’s more negative figures for demand changes than other research centers:

Title: Average balance of changes in demand, %

Blue = expected Red = actual

Basically, Russia’s lack of integration into global industrial value chains and the massive role that state procurements and state aid to large, systemically-important firms lifted orders while SME manufacturers took the brunt of COVID’s impact on the sector. In practical terms, those two things are terrible. First, the state-backed firms aren’t particularly competitive exporters since they aren’t integrated into global value chains and they’re overly affected by fiscal cycles to maintain demand levels in the economy. Second, the SMEs are the ones likeliest to innovate and improve efficiency, which historically has run counter to the chief aims of Russian economic policymaking for manufacturing since productivity gains entail job losses unless you’re selling abroad and despite the rhetoric, no one takes Russia’s value-added manufacturing export potential particularly seriously, especially since other members of the EAEU are likelier to exploit the trade area to export inputs if possible onto the Russian market. COVID thus will likely strengthen the correlation between demand and fiscal policy — a problem given fiscal policy is now entering austerity 3.0 — and increase dependence on the largest firms.

MinEnergo and MinEkonomiki have agreed to subsidy support for renewable energy worth 306 billion rubles ($3 billion) for 2025-2035, almost 25% less than was initially expected 400 billion rubles in the original joint draft, but 30% less than MinEnergo’s original suggestion and down from a now austerity-adjusted 600 billion rubles meant for the program in the 2019 proposal. Reshetnikov at MinEkonomiki apparently wanted to halve it, but the Shul’ginov, being a RusHydro man, managed to wrangle for more. It’s more evidence of the troubling influence of state ownership and control of the economy. The state is going to have to allocate budget resources to invest into energy sector projects that will undermine the equity and revenue value of existing hydrocarbon projects that themselves receive extensive state support or else frequently are managed through a mixture of market and non-market mechanisms. It’s harder to distribute the negative impact of these changes since Moscow isn’t relying on domestic investor sentiment and preferences driven by shifts in policy to direct capital or other, less centrally distributed means. In a system where state resources are coopted and contested without legally-bound institutional checks and balances, losers lash out. It’s going to be a much bigger problem for the regime as those dates approach when they realize how the systemic impact on energy prices and power distribution — as well as Russians’ standards of living — is going to require real sacrifice on the part of the budget and state rather than asking that they sacrifice for the both, yielding yet worsening stagnation.

Over half of the housing capacity in Russia under construction are apparently single-family homes, frequently outside of cities — that’s 34 million sq. meters under construction out of a total of 64.4 million nationally. Polling cited by Denis Filippov, general director from Dom.RF, at the Gaidar Forum showed that 70% of Russians preferred to live that way now (if possible). The current tempo of purchases is still being propped up by mortgage subsidies, though Putin finally ordered subordinates to address housing price inflation driven by the policy. Anyway, it’s interesting to consider what impacts the mortgage subsidies will have on oil and auto demand. If more people move to the edge of or outside cities, they will have to drive more unless there’s a secret infrastructure spending plan of epic proportions under a rock somewhere. That’s great for existing Russian automakers, but terrible if they don’t deploy EVs since it would end up diminishing the country’s net oil exports and therefore currency earnings used to maintain macroeconomic stability. Remember that Russia’s net exports actually effectively peaked in the late 2000s and that the consumption gains from income growth between 1999-2008 have eaten into net exports since (unless they suddenly raise output significantly again, but they’ve shown themselves both economically incapable on investment grounds with oil prices, tax regimes, and higher costs at newer fields as well as unable politically due to OPEC+).

COVID Status Report

The caseload fell to 21,734 with reported deaths higher at 586. The dip is notable because while Moscow leads the way, it’s directly mirrored by the regions — though always take the Operational Staff data with a big grain of salt:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

Good news in the form of good underlying trends, however, is always welcome. It looks like United Russia’s Dmitry Morozov of the Duma’s health committee is now expanding the push for a “COVID passport” for those who’ve been vaccinated to the federal level. Rospotrebnadzor has put out that the Epivacorona vaccine has proven 100% effective at generating an immune response (not at ensuring those vaccinated don’t get the virus). There’s clearly more federal pressure to accelerate the rollout of non-Sputnik vaccines to meet mass vaccination targets. On the whole, though, it seems the falling case numbers correspond to a diminishing strain on hospitals. Take Tula region, where the rate of incoming patients with COVID fell 24% week-on-week or Pskov, where the number of ‘hotspots’ has fallen to just three. The new variant, however, hasn’t yet been tracked or become more dominant for newer cases so with the likely premature re-opening of activities that oughtn’t be — think school campuses and similar environments returning to in-person instruction or work — the current trend may not make it to late February.

Eurovision 2021

Back in the world of power politics, polling commissioned by the European Council on Foreign Relations offers some food for thought on a trend I noticed while studying at LSE among the Western European students in my IPE cohort: they seemed to believe that the EU (and Eurozone) matter in global power politics. Now, I’m not suggesting that they’re irrelevant or powerless by any stretch, but there is a certain arrogance to the “European project” that is sadly out of touch with the current moment in that it fails to see the ways in which EU successes have been enabled by its position in an international system still dependent on American power. It wasn’t surprising, but rather dispiriting to see just how deep-seated the European preference for neutrality in the face of US-China conflict appears to be:

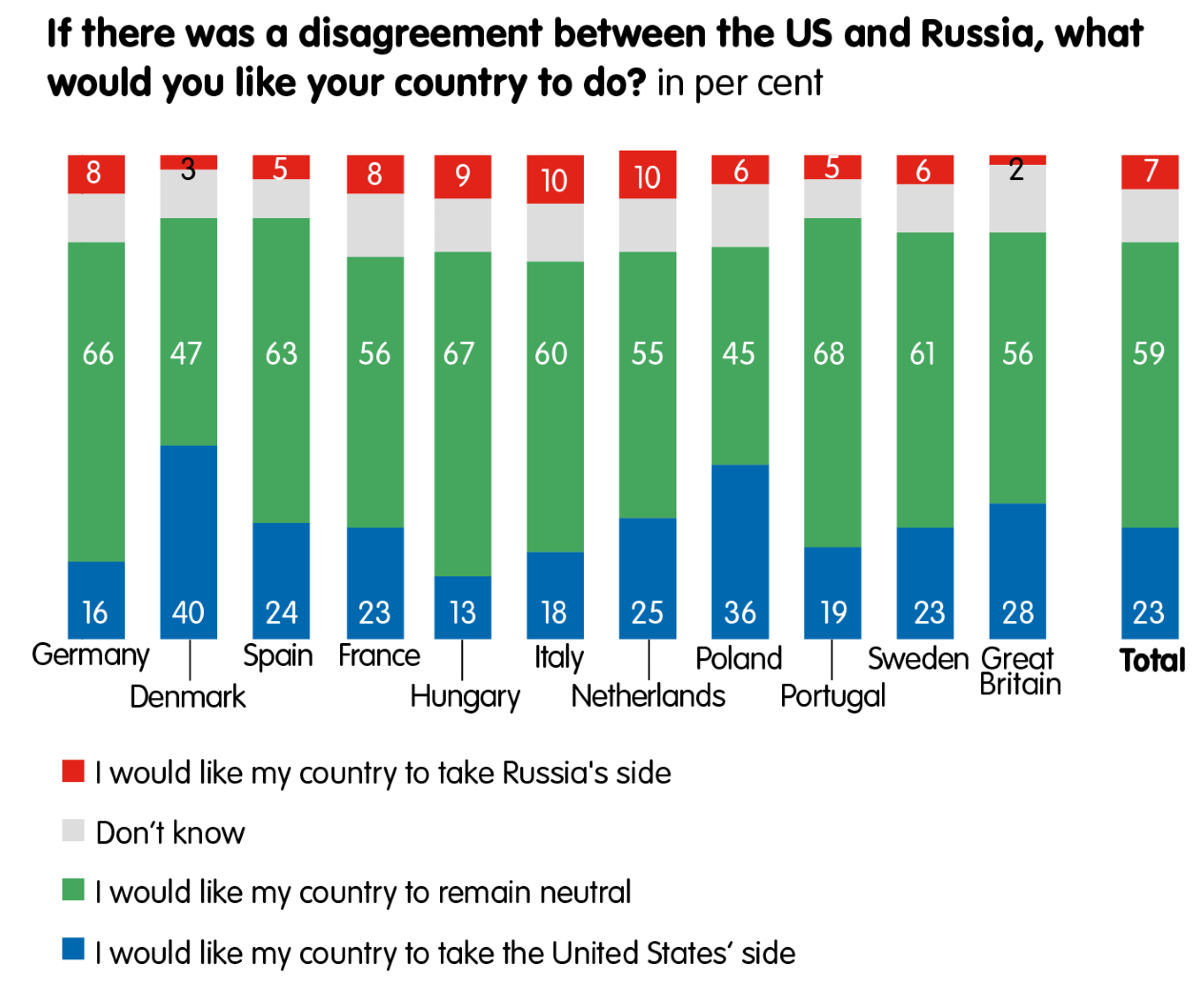

You see a similar aversion to picking sides between the US and Russia:

The polling is, frankly, a bit laughable. Neutrality is an option when a dispute is purely diplomatic or else can be contained to a military conflict in a location of little direct bearing on European security, but in a world where today’s conflicts are really about the distribution of rents and wealth, of how to foster technological innovation, how to (re)create economic growth in a world suffering from excessively constrained demand due to imbalanced financial (and trade) flows, how to ‘securitize’ or else re-shore the manufacture of strategically important goods without destroying international trade arrangements, and how to both accelerate the energy transition as quickly as possible and incorporate the externalities of carbon and methane emissions into all aspects of economic activity including trade. The EU is ahead of the game on the last bit, but is struggling with everything else. There’s good reason to focus on the incoming Biden administration when trying to factor in policy risks for Russia, energy markets, or post-COVID recovery, but the hardest parts assessing said policy risks come from what traditional allies in Europe are doing and want at a time when their relative influence over US policy is declining in structural terms, save on climate issues, and Russia’s leverage in Europe as an energy security provider has become almost irrelevant geopolitically.

First off, the EU’s economic prospects for recovery are far too weak for an economic bloc that has the resources and currency power it ostensibly has to absorb huge deficit expansions at real negative interest rates. No matter what the ECB does, inflation doesn’t rise enough and deflationary risks drive up the value of the Euro, thus undermining the competitiveness of German exports in particular and, eventually, cutting European corporate profits at a time when corporate debt levels are high and Eurozone demand is weak. The Euro’s still hanging at or north of $1.20, with likely further appreciation if the weaker dollar narrative settles in the market, Fed easing, and further stimulus packages pass the US congress. The US is on track to recover much more strongly than Europe:

Credit conditions in Europe for households and firms are slowly but steadily tightening. The ECB is warning that Eurozone banks — the sick men of global finance for a decade now — have often underestimated credit losses from COVID because of payment deferrals, which could further squeeze future profits and worsen further credit conditions for the economy just as recovery becomes a palpable reality, far away it may be. The vaccine rollout has been wanting in Europe broadly, though that will probably improve over the next 6 weeks. There’s now a renewed push by the European Commission to increase the role of the Euro globally to avoid sanctions pressure, reportedly because of Trump’s Iran policy (and perhaps Russia too since even Gazprom is now admitting in a bond prospectus that Nord Stream II may not be completed). Either way, the claim is largely farcical.

The Euro’s share of global transactions and broader use as a currency was strongest prior to the Global Financial Crisis. It then quickly became apparent that European banks, leveraged to the gills on US securities in search of safe yields, needed US dollars to survive because of the inundation of dollars throughout the international financial system. That hasn’t changed, but what has is the role of US banks on European markets after a decade of weak profits for the sector. Five years ago, US investment banks barely trailed their EU counterparts in terms of market share. By 2019, US investment banks held 53% of the revenue pool. European banks used a US pullback during COVID to try and expand their lending activity in market share terms, but with how weak the recovery looks, they’ll just as likely be holding the bag with lower net profits that will again allow US banks to expand their share. Even if the role of the Euro were to expand, US banks control so much of the European market that the US maintains the power to pass extra-territorial legal regimes that would significantly impact European firms’ access to credit. Further, European capitals are broadly worried about Iran’s ballistic missile program and while they now urge caution with attempts to increase uranium enrichment levels so as to encourage diplomacy with Washington, they want Biden to use the existing supposed leverage to include the missile program in a broader deal. That’s very unlikely to be acceptable to Tehran. The appearance otherwise is largely a sham. European powers like to offer humanitarian aid and excoriate Washington when convenient for political gain on policy matters they deem important, but have no intention of carrying out a values-based foreign policy or bearing the military costs of maintaining spheres of influence on the back of US military spending.

Tech’s another area where Europe, even if it manages to overcome the internal contradictions of the Eurozone’s suppression of demand in Germany and its core economies at the expense of the periphery, will be stuck depending on the US. After all, European tech firms that are successful still opt for IPOs in New York, which again exposes them to US regulation through its financial markets. What’s important to remember, then, is where the other risks that affect Biden’s US foreign policy reset — and Russia’s position in the Middle East — lie.

It’s easy to forget that it was actually France that was responsible for the imposition of a no-fly zone in Libya in 2011. Their lobbying efforts initially failed with Obama so they, coordinating with then Secretary of State Hillary Clinton, acted unilaterally in such a manner as to force the US to act so as not to appear as though NATO wasn’t united on the matter. In the case of Syria, France and the UK actively fought to lift the EU’s arms embargo to supply rebels to fight the Assad regime, which can only be described as de facto support for regime change. Europe is very good at parlaying its self-imposed weakness into strength by playing on American anxieties about decline. That’s what should be scrutinized as Biden lines up a foreign policy that will be much more continuity than change in substance. What’s fascinating to consider, then, is that Russia actually has very little to do with dynamics in the transatlantic alliance anymore. It’s effectively a settled matter by dint of its policy choices since Crimea. Navalny’s arrest handed Europe exactly what it needed — a values-based event to get angry over — while waiting for the US to force its hand to act if something is to be done. But Europe can play a strong role in shaping Biden’s climate approach to trade. If that happens, and I certainly count myself among those who hope it does, Moscow should worry. The irony of accelerating the energy transition is that it gives external powers who used to rely on oil imports and worried about oil’s inflationary effects freer rain to do as they please in the Middle East. Without a sound ability to manage the oil market’s supply side by maintaining a role across the region, Russia’s economy is in that much more trouble.

2021 is going to be a very difficult and very interesting year. Biden has a much freer hand to set a policy course than Brussels cares to admit. Whether he does or not depends largely on how successful European capitals are at turning their weakness into carte blanche support from the US on security matters, negotiating trade, and preventing a US-UK trade deal in the shorter-term.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).