Top of the Pops

First off, I’m taking tomorrow off as I’ve got a doctor’s appointment late morning that will probably run long given both the distance I’ve got to travel and logistics around COVID so don’t panic (as I’m sure many of you will) when you don’t see a brief in your inbox.

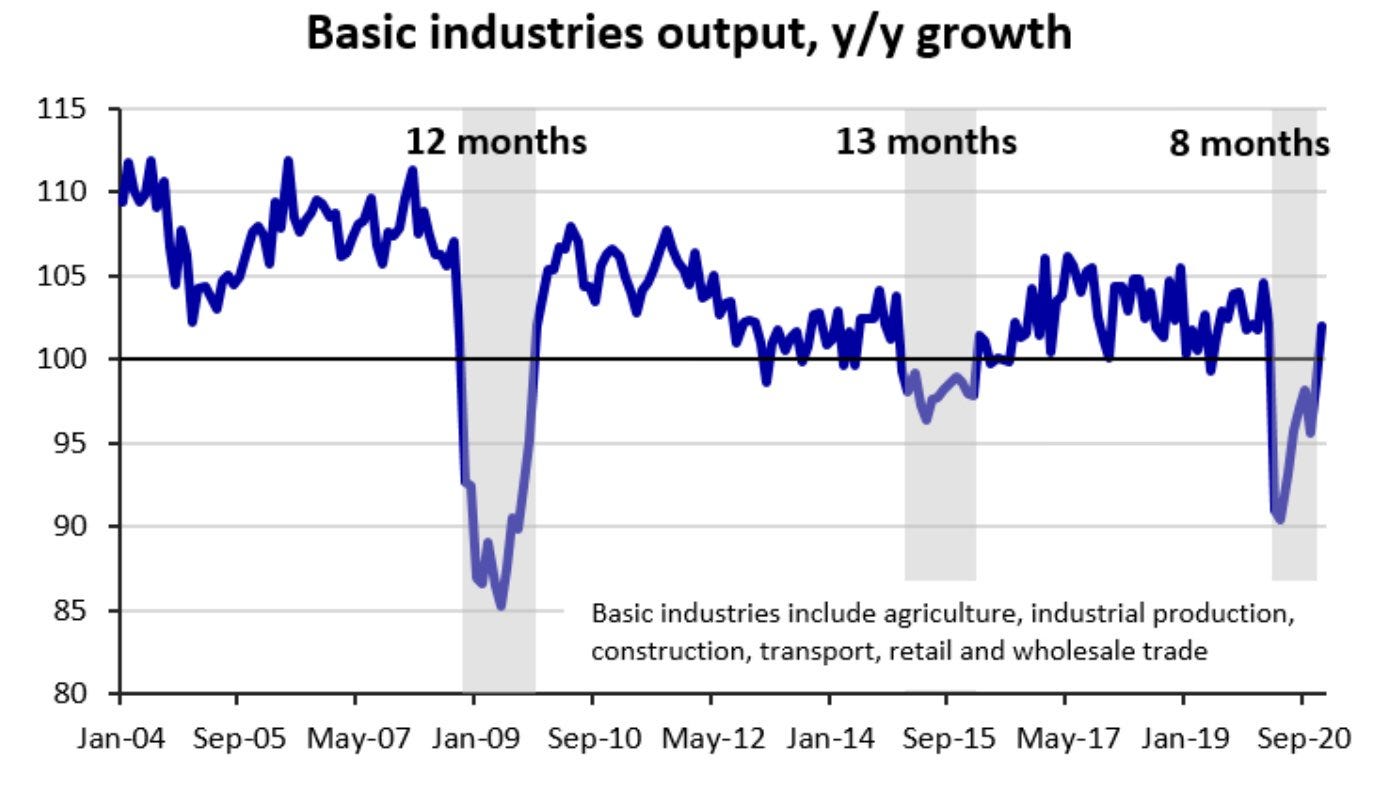

Norway rocked the boat a bit by putting a Transmashholding acquisition of a Rolls-Royce factory on hold due to security concerns. The plant supplies engines to the Norwegian navy. The firm — Bergen Engines — was going to be acquired by TMH for the princely sum of $178 million, allowing it to use the acquisition to import back some of the knowledge/technical gains from the plant while also inserting itself into Norway’s defense supply chain. It’s the latest example of how Russian foreign policy has blown up its ability to more ably diversify its economy as potential European partners have every reason to apply more scrutiny to deals, a trend that ironically owes more to China’s corporate behavior in Europe than Russia’s in many respects. And China’s role in digging Europe out of recession may look quite different this time than the last global financial crisis because of its lopsided recovery. The US is now in the driver’s seat after China held things up last year:

US stimulus is expected to add 1% to global GDP this year, higher than its contribution to China, the Eurozone, Japan, or the UK. That means it’s benefiting most domestically, but also that much of the stimulus will affect other emerging markets. The trouble there is the bond market tantrum misreading rising long-term rates as evidence of inflationary fears rather than, you know, actual growth happening led to currency losses for EMs that will prove costlier the longer OPEC+ holds down output increases. The sell-off for EM currencies against the US dollar yesterday was a high since last March:

I’m pretty confident it’ll balance out fine in the end. The narrative for growth coming in this year has shifted significantly from the worst fears about China’s inexorable rise last year vs. the United States. Ironic, then, that with the Ministry of Finance’s shift to increase the yuan and yen share of the reserve basket as well as the pivot in Russian trade towards China is that it’s increasingly dependent on the rising power whose economic model now faces serious growth challenges while the US seems closer to unshackling itself from its own limitations (excepting reality that the costs of US dollar hegemony remain in place).

What’s going on?

The move to make Kuntsev municipal deputy Denis Shenderovich an example for supporting protest actions against Navalny’s arrest and imprisonment has moved ahead today. The administrative code covering unsanctioned protests was used to levy either a 10 day detainment or 30,000 ruble fine. Other independent municipal deputies able to win seats independently without systemic party support are clearly at risk if they displease local authorities anywhere in the country. The main threat is legal retaliation for anything posted on social media, transparently an attempt to aim right at what gives grassroots civil society actors in Russia the most space to organize given the state’s weaker control over the internet as an information space. This also builds on the current fight between the government and Twitter over its failure to delete banned posts. But it’s also likely that municipal deputies could be hit with violations of public health protections for their part in January protests. Marina Litvinovitch, a rights defender who’s been too honest about the show trial directed against opposition Lyubov’ Sobol’, has received support in an open letter from colleagues on Moscow’s Public Monitoring Commission (ONK) that tracks the treatment of prisoners and detainees and related questions of rights as a proto-guardrail against the worst abuses of the system. Administrative resources of all kinds are being brought to bear to try and snuff out any organizational capabilities ahead of September as expected given inflation keeps rising, now at 5.7% YoY, a record high since November 2016. There’s a growing possibility of a small key rate hike from the Central Bank in late April:

The data in hand from the insurance market shows that the pandemic not only failed to dent demand growth for policies, but saw a notable rise in payments out by 4Q. Net premium payments for 2020 reached 1.5 trillion rubles ($20.2 billion), equivalent to roughly 1.2% of GDP last year:

Lhs = blns rubls Rhs = % growth Light Blue = premiums Darker Blue = payouts Yellow = premium growth % Purple = payout growth %

What’s important to track here is that 3-year life insurance investment vehicles are currently offering a % rate of about 4.7%, just hovering above the key rate but more popular among consumers because it just beats out bank deposit rates. Excess mortality in a low rate environment is the pretty clear main driver for overall insurance market growth the last year — the market recorded a 48.5% increase in life insurance payouts to 158.3 billion rubles ($2.14 billion). The pool of insurance fund money out there keeps growing amid stagnation, offering those with some savings to invest alternative means of bringing in passive income and planning for life events such as major illnesses, deaths, or car accidents. It also means the pot of domestic money looking to buy OFZs and long-term financial instruments is growing steadily, even if in absolute terms it’s dwarfed by MinFin’s issuance needs when it has to cover deficits. If the growth path continues post-pandemic from more cautious consumers making every kopek go as far as they can, Russia’s ability to weather any additional sanctions will only strengthen.

Producers and retailers have agreed to an effective price freeze for poultry the next 3 weeks to be supplied at levels no lower than a year ago — there’s a surge of demand for broiled poultry (chicken), it seems. But the lack of poultry meat might end up hitting producers of cheap sausages that mix meats when making them. Shortages in one industry inevitably bleed into intermediate demand, a problem the current policy framework is terrible at addressing. The agreement as it stands is informal and not a legally binding agreement or even written down anywhere per the Kommersant reporting. Poultry prices rose nearly 13% between Feb. 2020 and Feb. 2021, more than twice the rate of topline inflation, and it’s top of the mind for the government since it’s now officially constantly monitoring prices. Demand for broiled and gutted carcasses seems to have risen 10-20% year-on-year according to retail chains, while production of poultry meat fell 6.4% in January. It’s obvious consumers are trying to stretch their money as far as it can possibly go while producers might be forced to buy more expensive pork to replace the poultry lost for sausages by the new deal mandating more production go direct to consumers instead of other industries, inevitably filtering into consumer prices elsewhere. The increasingly ad hoc system of price controls is worsening, particularly if it’s now the government’s job to reach to every price change as it happens and clamp down. The Federal Anti-Monopoly Service and MinPromTorg are oddly silent on the matter and MinSel’khoz says it didn’t receive any information about the agreement. Sectors are probably starting to bargain without concern for state policy when state policy fails, and the response always seems to be to then expand the formal authority and responsibility of the state to react.

Russia and the US have reportedly restarted bilateral talks for cooperation on climate change issues. Russian Edel’geriev — godfather of the Sakhalin cap and trade scheme — has met with John Kerry, Biden’s climate point man. Climate change could be a useful way to get some sort of dialogue and traction going for future talks, though I highly doubt too much progress can be made. Even Edel’geriev isn’t dumb enough to push a carbon tax, for instance, knowing domestic political limits and the compromises he had to make to launch cap and trade as a policy agenda. Ironically, Trump’s victory killed momentum to work with the Obama administration on climate matters since they were geopolitically neutral at the time, yet another unintended consequence of Moscow’s foolish info op gamble on Trump. Further talks are planned at Glasgow for COP26 later this year as well as sidebars at the G-7 in October. This parallels Germany’s entreaty to the EU to use climate issues as a diplomatic opportunity with Moscow. There’s not much information to work with about what’s actually being discussed, but it’s an important avenue for the bilateral relationship to explore in the months and year ahead, especially if Democrats actually manage to pass a large infrastructure bill that embeds decarbonization efforts across a wide swathe of the US economy.

COVID Status Report

Finally under 10,000! — 9,445 new cases 36 deaths were reported for the last day. The trend resumed its downward arc, particularly in Moscow. There’s more evidence that Sputnik-V has been expressly politicized by the state despite its terrible track record encouraging take-up domestically. Reports have dropped that Russian cyberattacks targeted information concerning where Pfizer deliveries were headed from the European Monitoring Agency back in December (along with Chinese efforts to hack it as well). Most of the public briefing on when things truly stabilize with COVID continues to point to summer, which implies both that the current data isn’t seen as real stabilization and that while rates have declined dramatically, there’s still a lot of noise and datapoints excluded from official releases to make things look better. The newer non-Sputnik vaccines are also finally being rolled out to regions that can procure supplies, which should hopefully presage an increase in vaccination rates. Peskov has reiterated the Kremlin is skeptical of COVID passports for travelers in practice despite the likely lingering infection rates that won’t be captured well by data so long as the vaccine rollout drags behind. But since the EU appears to moving towards creating an infrastructure for something like a COVID passport — all the more important during the initial phase of re-openings for countries dependent on tourism revenues in Europe — the question now is whether Russians will be able to travel to Europe without a parallel system in place domestically. Particularly given the economic pain of the last year, the demographic group that can afford to travel to Europe has undoubtedly shrunk and is mostly clustered in the largest cities. It’ll be interesting to see who complains if Russians lose out on travel as a result.

Autarky! at the Disco

The near mindless pursuit of economic autarky is creating potential for a cascade of dumb policy proposals in the months ahead. Price regulation isn’t just about food for consumers or housing. It’s also now about inputs, particularly the fertilizer consumed by the agricultural sector. MinSel’khoz and MinPromTorg are reportedly in talks to set fertilizer prices (read: also mineral input costs for fertilizer) for the spring sowing season by reaching a price fixing agreement with domestic fertilizer producers analogous to that used for sunflower oil and sugar. The main idea being batted around MinSel’khoz now is to use 2019 average prices and inflation as a reference point:

2021 prices going forwards = avg. 2019 price + annualized inflation

Producers and MinPromTorg want a system that looks more like this (inferred from Vedomosti’s brief description):

2021 prices going forward = current high price levels but fixed with some sort of compensatory instrument or debt-financing to cover losses if they impede investment

It’s the type of pricing compromise endemic to lots of other parts of the economy. For instance, Transneft — the oil pipeline monopolist — regularly debates tariff rates with the oil companies using its infrastructure and Russian Railways to index returns to inflation with some artificially chosen adjustment to sustain capital investments and rents while balancing business between the rail network and pipelines as needed. What’s striking about the fertilizer news is that it comes just after the government announced it was coordinating and monitoring prices on a constant basis across the government. Price increases appear to be accelerating despite expanding policy intervention. United Russia rep Anatoly Vyborny — let us reflect briefly on the perfection that is his familial name — is getting in on the action putting forward a bill that would threaten anyone manipulating market prices with “unreliable information” up to 3 years in prison. This builds on a proposed amendment to existing legislation imposing fines for said market manipulation of 200-500,000 rubles ($2,704-6,760) for individuals caught in violation (and the loss of freedom for up to 3 years) or a fine of 800,000 rubles ($10,816) for legal entities caught in violation. The Duma is trying to make panic buying by wholesalers illegal and creating legal space for the state to decide what economic information is actually true. We might start seeing price fixing arrangements more like this:

2021 prices going forward = politically determined level of ‘real’ inflation + wholesaler spot price determined by informal agreements and legal pressures + politically determined surcharge to finance investment

The latest episode of price regulation troubles highlights how Russian economic policy has consciously aped Soviet-era approaches: the current agreements are focused on supply levels, not prices, as a means of eventually stabilizing said prices and the agreement most likely does little to address the fact that while retail prices are frozen to avoid passing on cost increases, wholesale prices are subject to much more volatility. This (eventually) encourages retailers to ask for state support if shifts in demand undermine supply and price stability. They’ve basically reconstructed a quasi-late Soviet planning mechanism that uses prices to absorb the volatility that enterprises with no incentives to use capital efficiently and soft budget constraints couldn’t, forcing them to get more efficient or cut informal agreements to keep the system going since investment levels track most with consumer demand rather than Gosplan. The result is madness since the underlying demand base is shrinking. Put another way, Russia’s economic growth, wherever it takes place, is basically BS. It’s like the growth the Soviets claimed, but reversed from over-investment into the wrong sectors, projects, or goods to under-investment in everything except the military and specific “pockets of competence” as Vladimir Gel’man puts it. And instead of engineering results from the budget and state planning, they’ve begun to destroy the efficacy of market price signals by challenging their legitimacy whenever the effects aren’t to their liking. This is an unmistakeable callback to the late Soviet crisis: long-running stagnation that appeared (wrongly) to be sustainable until it hit an inflection point in 1985-86 when the sudden loss of oil revenues sustaining the fiscal and financial framework of the economy warding off an uncontrollable inflationary spiral (experienced as shortages rather than price increases) exploded amid interest group fights over reform. I don’t think Russia’s going the same route, but history isn’t written in blank verse here.

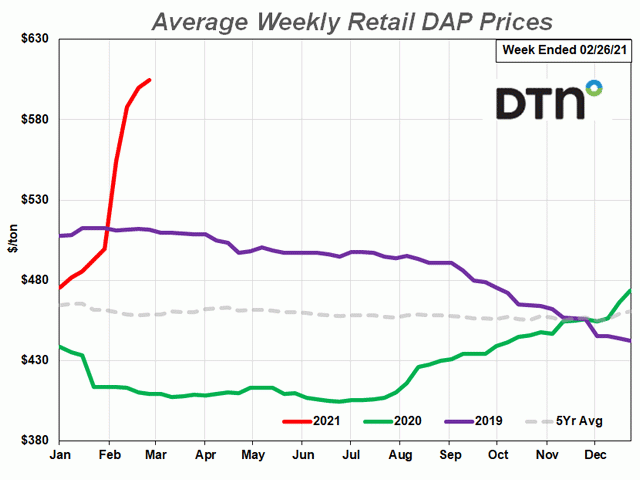

What makes the agricultural story all the more concerning is that it’s a prime example of the bleeding effect between sectors during a commodity super cycle when an exporting country is mostly dependent on one or a few commodities but consumes a great deal more in other areas. The net effects of sustained and rising food demand last year with the broader recovery in oil prices, rising production input prices, and lower producer capacity utilization have led to a huge price spike for fertilizer to start the year:

So now Mishustin and the government need to get this roughly 25% increase under control before it feeds through to higher food prices the rest of the year. But if you try to cap fertilizer prices and impose either losses on production and sale or else reduce profit margins, you then have to look at the underlying production costs for the resources and finished goods consumed by the fertilizer producers. Suddenly you’re looking at an expanding array of interconnected sources of demand and price signaling that have to be managed through administrative measures by a state that is much more integrated into global trade compared to its Soviet predecessor and also much less able to centrally administer or maintain these types of controls. If inflationary pressure sticks higher for longer, there’s then more pressure for the Central Bank to hike the key rate and pull back economic activity. The only way out of this spiral at this point is a slowdown in demand. Manufacturing activity might be a good proxy for GDP (h/t to Tatiana Evdokimova), but it’s a mixed story given the pricing mayhem:

GDP might be recovering, but the new price control schema are setting a precedent for supply-side management that’ll end in tears. Agriculture is a big consumer of domestic industrial production, and once its orders are affected by profit margins, then suddenly factories have to find ways to cut costs or ask for help from the state. What’s really happening is that the list of businesses in need of state help is lengthening the longer these control measures are normalized and risk expanding marginally into sectors that supply intermediate demand for others responsible for most price inflation so far. The more they have to coordinate prices, the worse their margins. The worse their margins, the lower the level of investment activity into production. The lower the level of productive investment, the greater the inflationary risks from deficits in the economy. The greater the deficit, the more that state money has to cover the difference, whether through price subsidies, direct industrial subsidies, procurement orders, or risk-free credit.

The market gains made under Putinism aren’t vanishing, but they are structurally being rolled back in a thus far limited, but dangerous manner that risks strengthening the statist tendencies of the existing political and economic system. That’s terrible news give the state’s now trapped in permanent austerity because of its ideological preferences and its foreign policy choices. September elections should be (relatively) safe for the regime given its command of administrative resource and other means to guarantee results. Inadequate economic governance and state capacity to achieve the regime’s desired ends, however, are much more difficult to overcome. In killing ‘objective’ truth in the economy, the regime’s weakening the feedback systems via markets that have kept the system together, if stagnant, for this long. I’d be much more worried about 2024 if I were on Team Mishustin than this year’s inflationary burst and even then, inflation risks are rising the more state policy weakens the power of pricing signals to affect the allocation of capital and other resources. It’s not the fall that kills you, it’s the landing. When the only way out of an inflationary burst like this is yet more deflation after a lost decade for incomes, how do you imagine voters will react?

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).